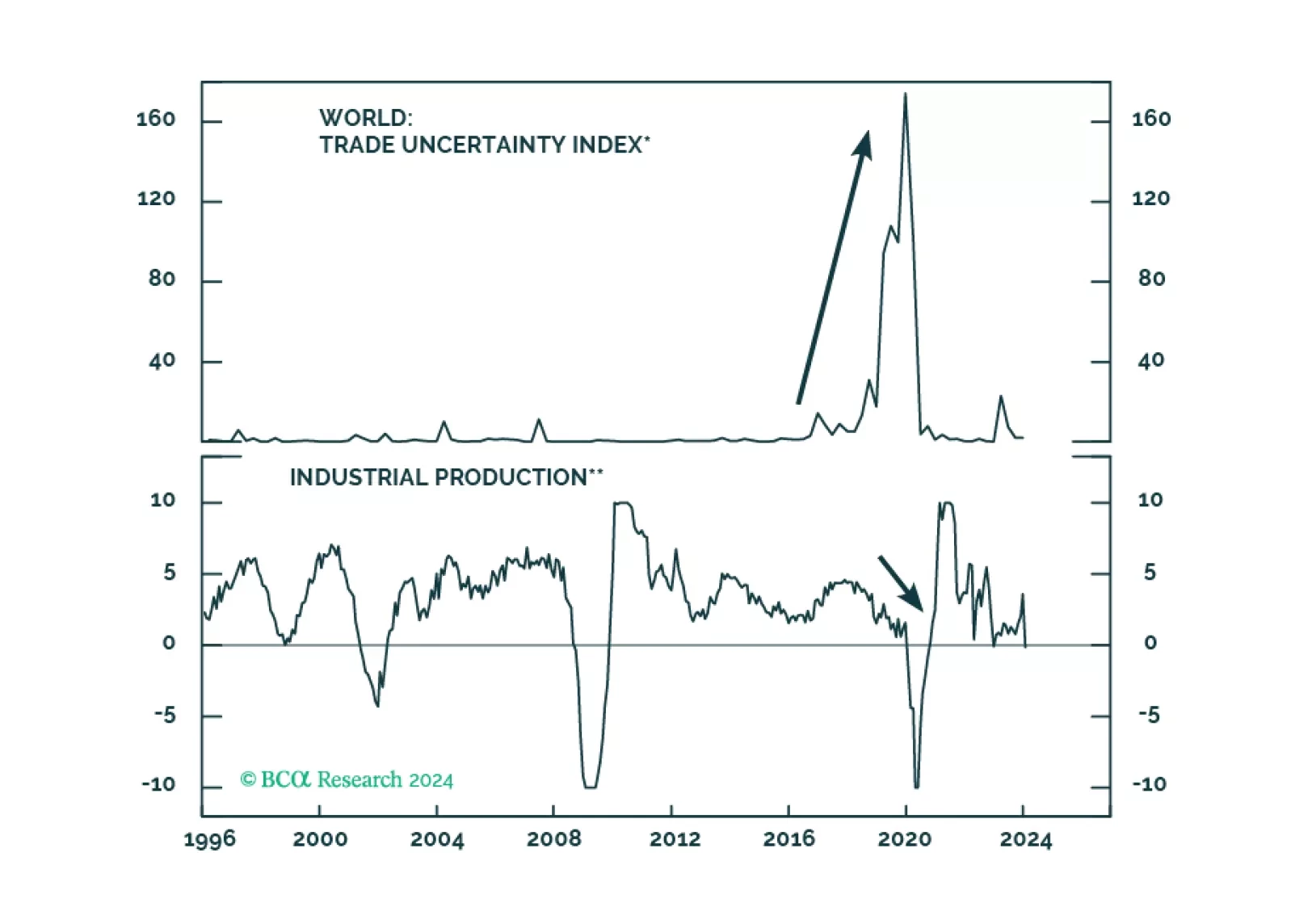

In this Strategy Outlook we examine why, contrary to popular perception, the odds of a global recession over the next 12 months are rising not falling.

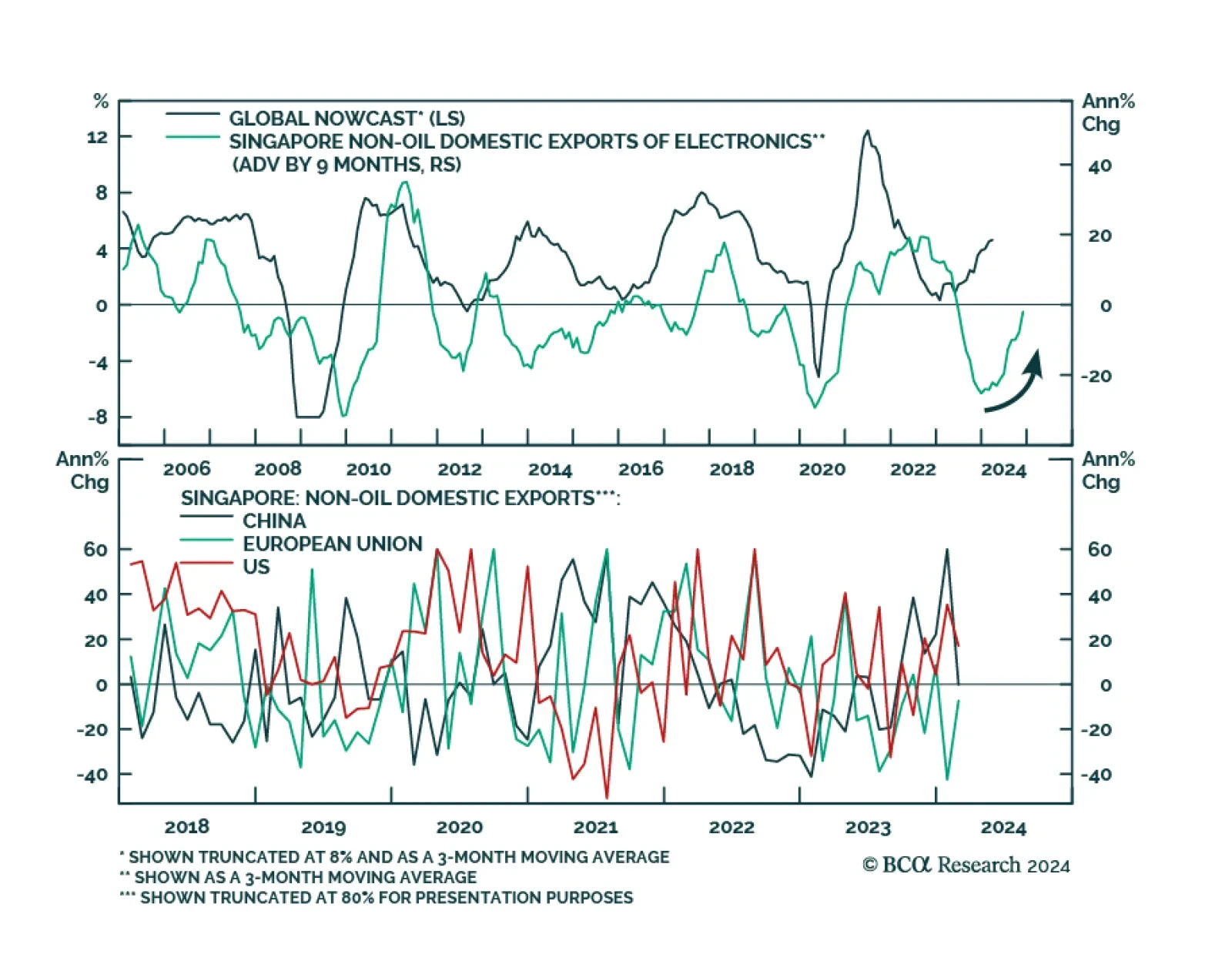

Singapore non-oil exports (NODX) largely disappointed in February, contracting by 4.8% m/m following a 2.3% m/m expansion in January, and falling below expectations of a milder 0.5% m/m decline. In a similar vein, the 0.1% y/y…

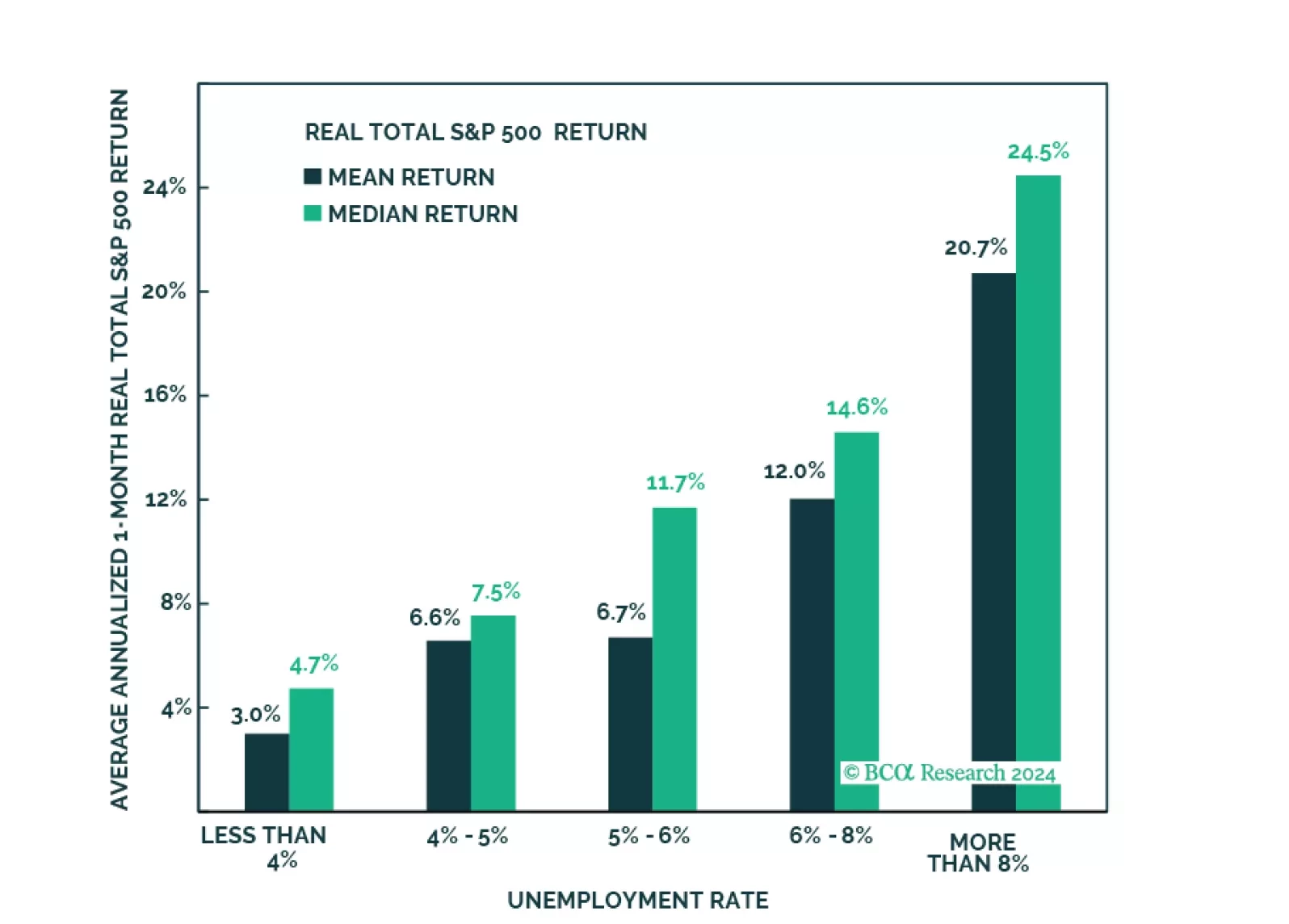

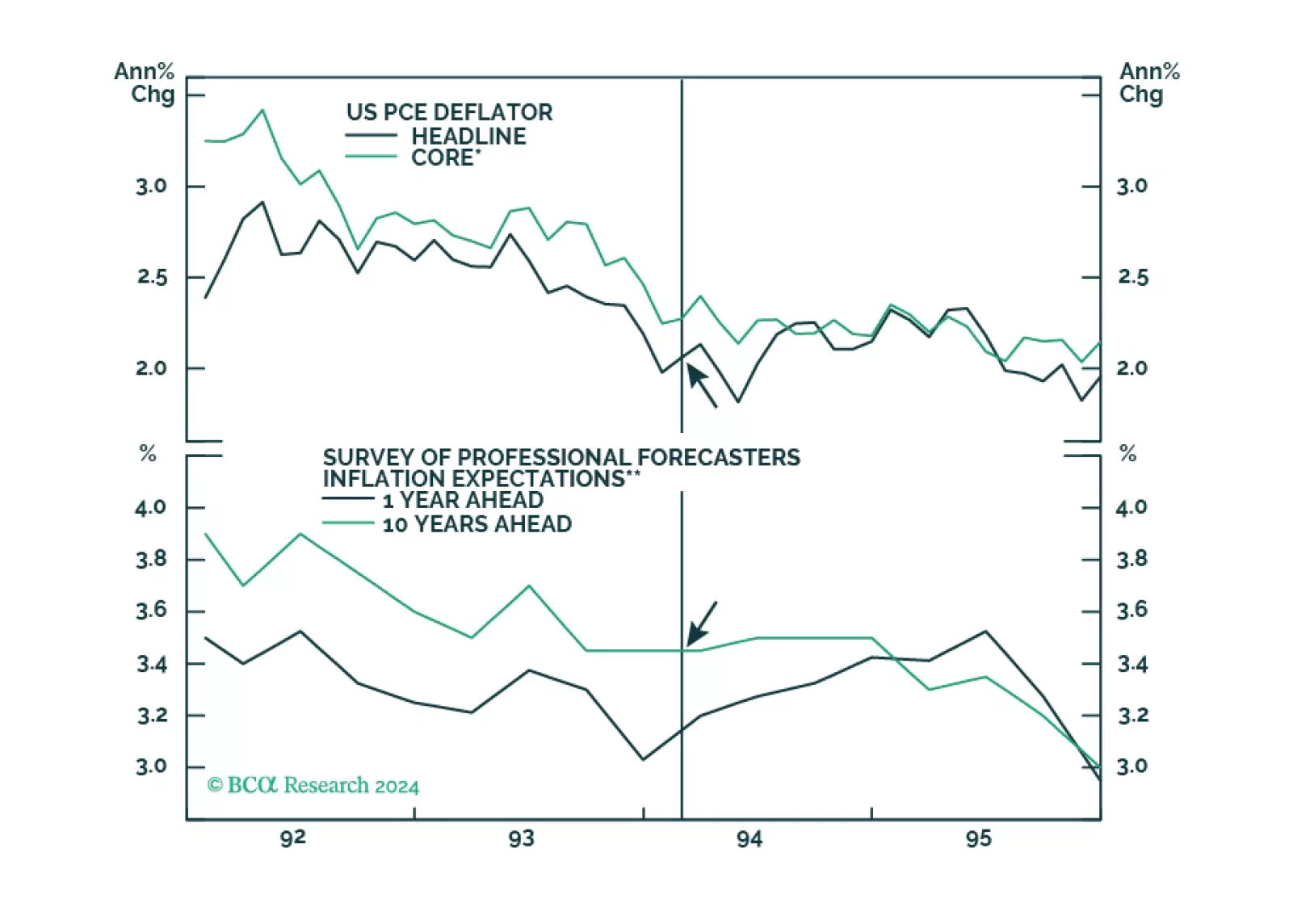

Many investors have cited the 1994 tightening cycle as an example of how the Fed managed to raise rates without triggering a recession. However, the unemployment rate was 6.5% in early 1994, which meant that inflation was less of a…

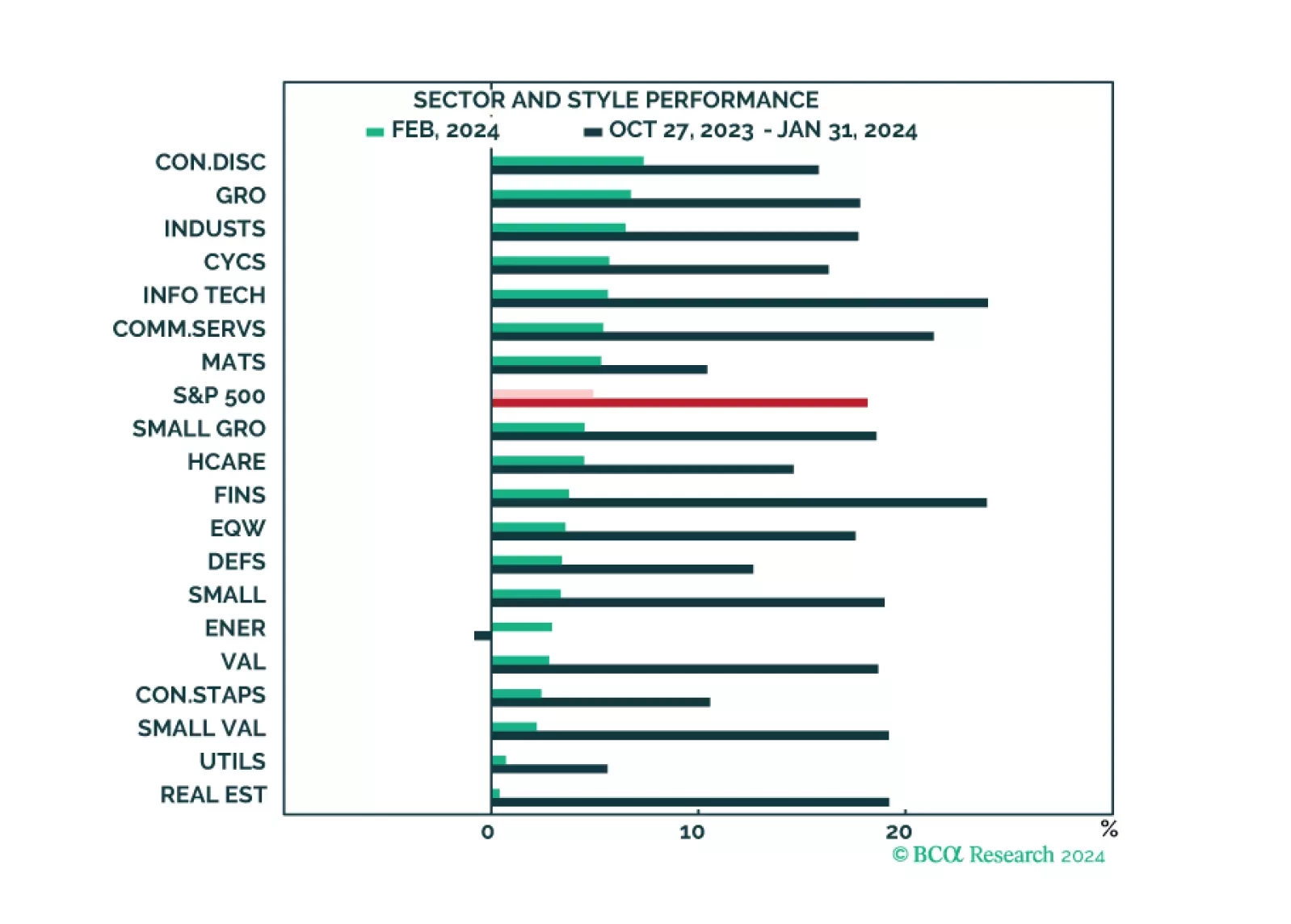

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…

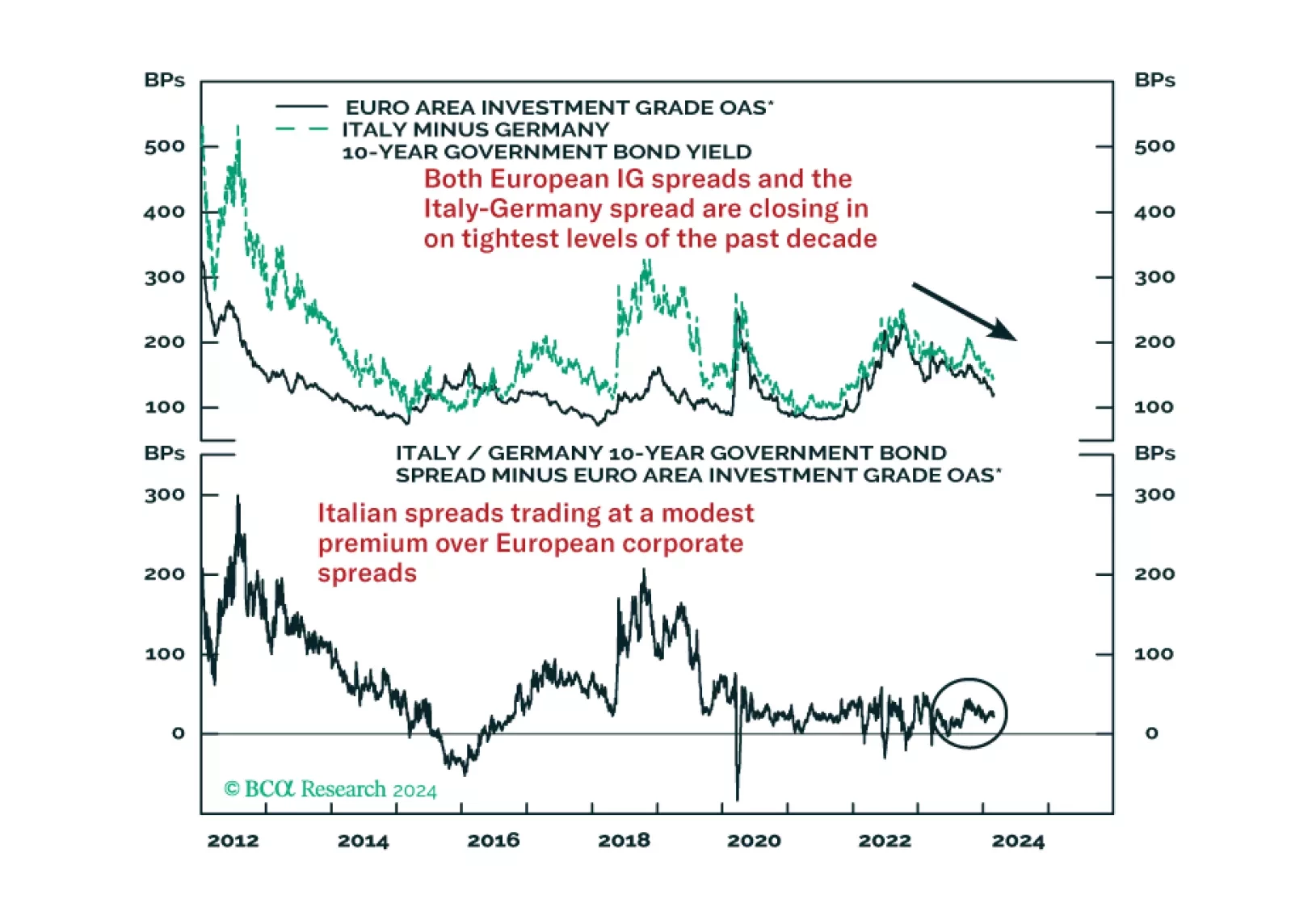

In this Strategy Insight, we take a comparative look at two of the largest spread product sectors in Europe – Italian government bonds and investment grade corporates. We make the case for favoring Italy over investment grade in the…

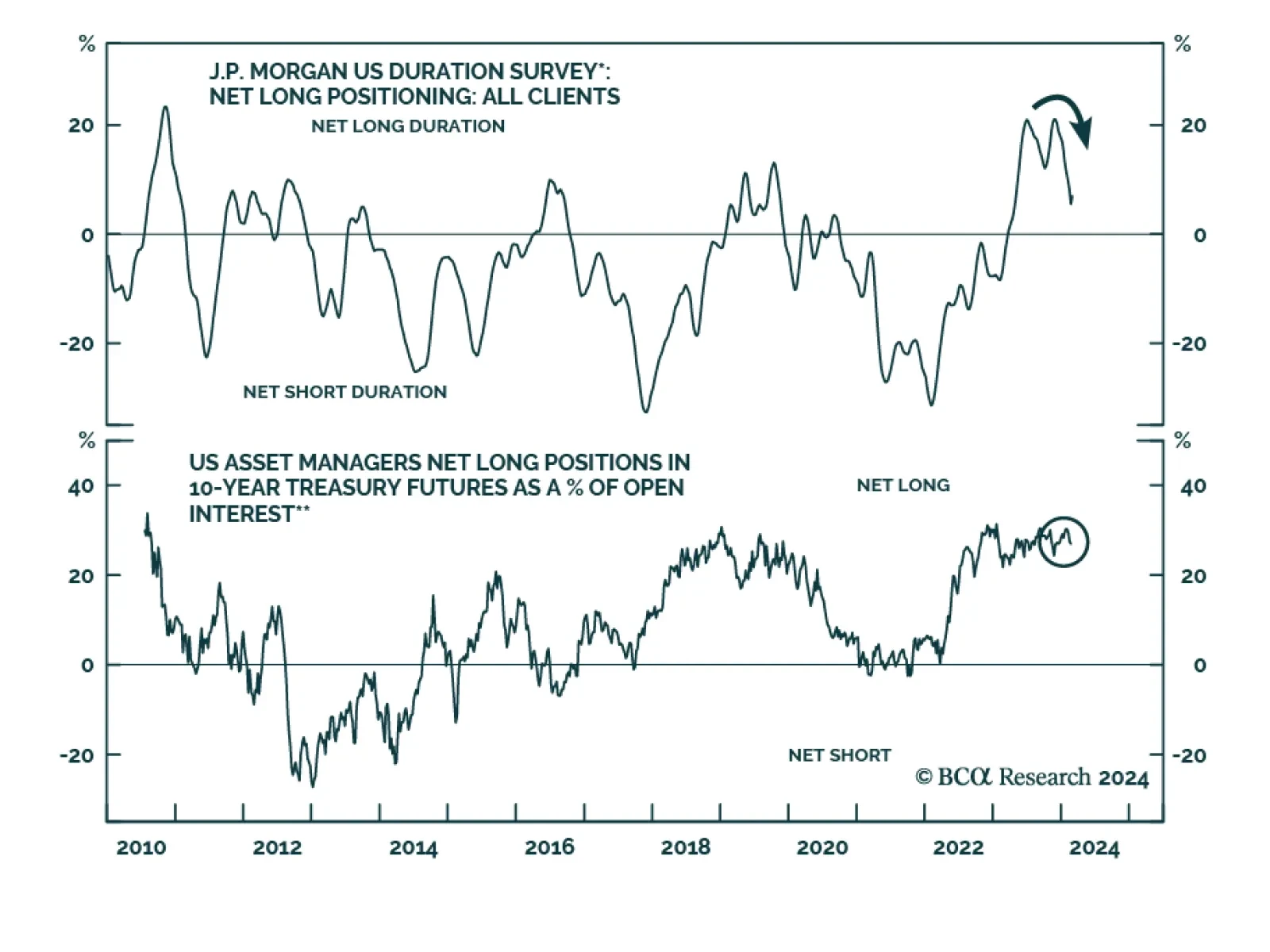

In a recent report, our US Bond strategists argued that while the year-to-date increase in yields has made Treasures more attractive, conditions are not yet in place to extend duration. Instead, they expect that there will be a…

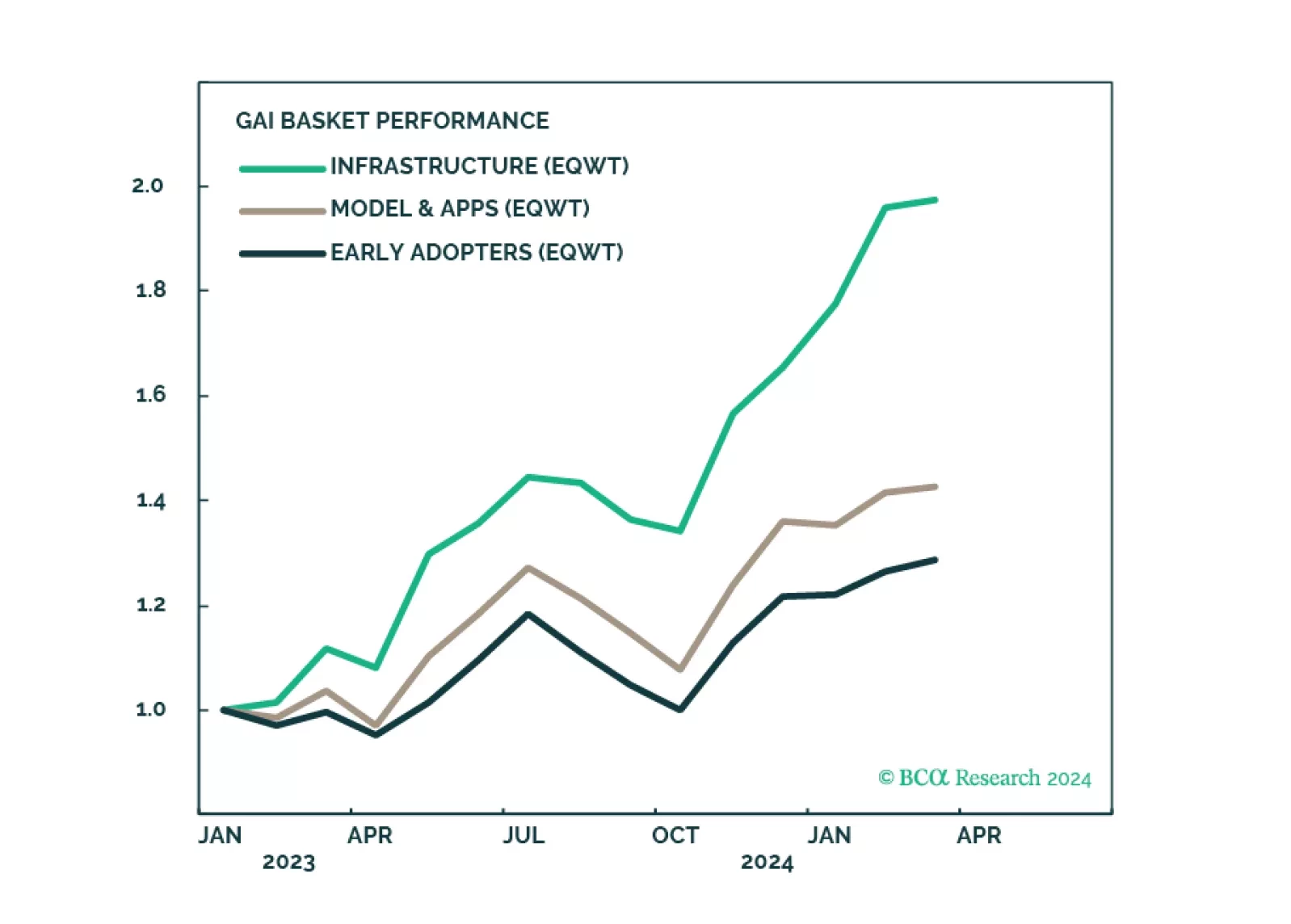

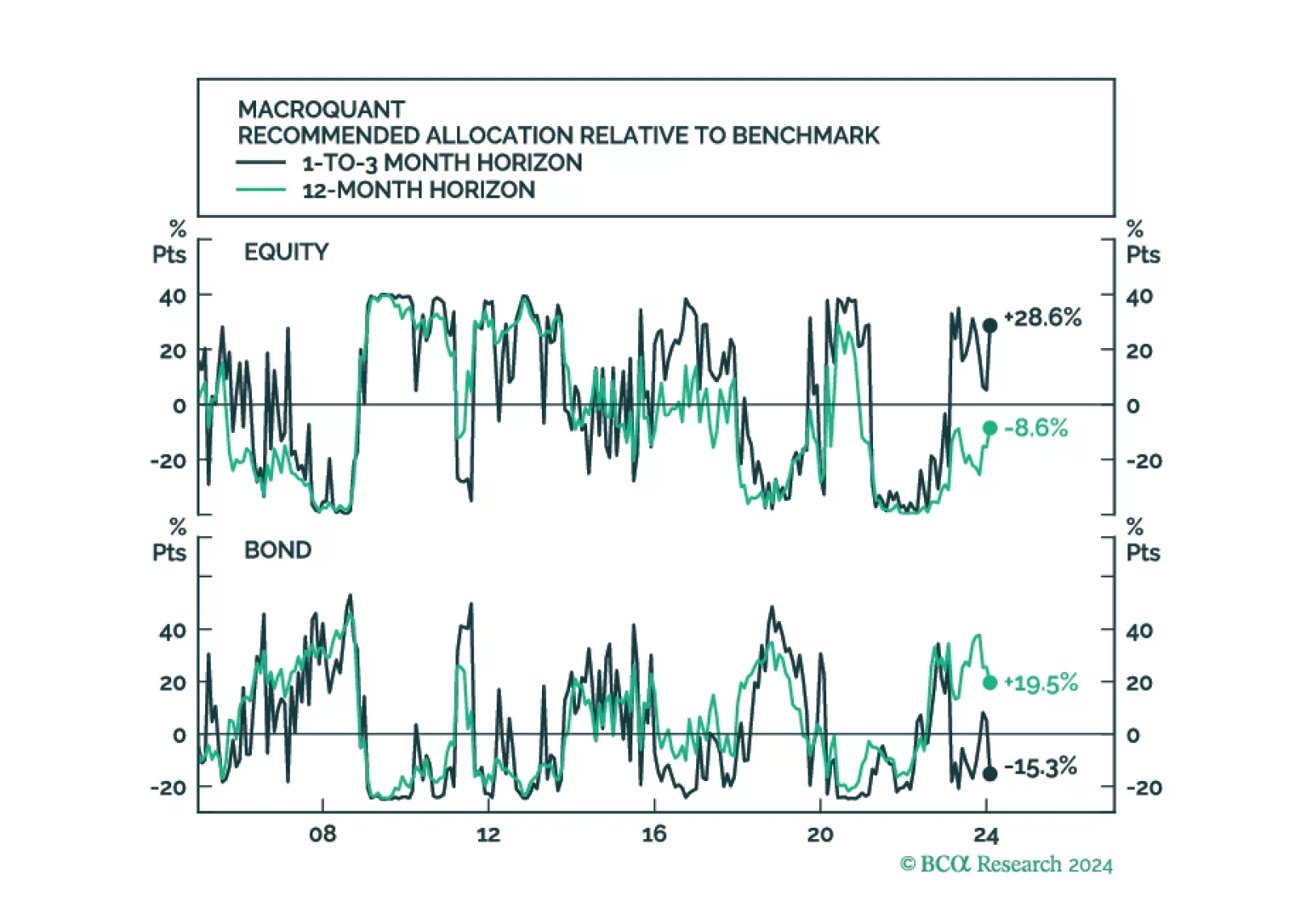

MacroQuant upgraded equities to overweight in February on a tactical short-term (1-to-3 month) horizon, but it continues to see downside risks to stocks on a medium-term (12-month) horizon. Consistent with the model’s relatively…