Precious metals, corporate credit, and tech stocks are all showing signs of late-cycle euphoria. We identify various trigger points that investors should monitor to turn more bearish.

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

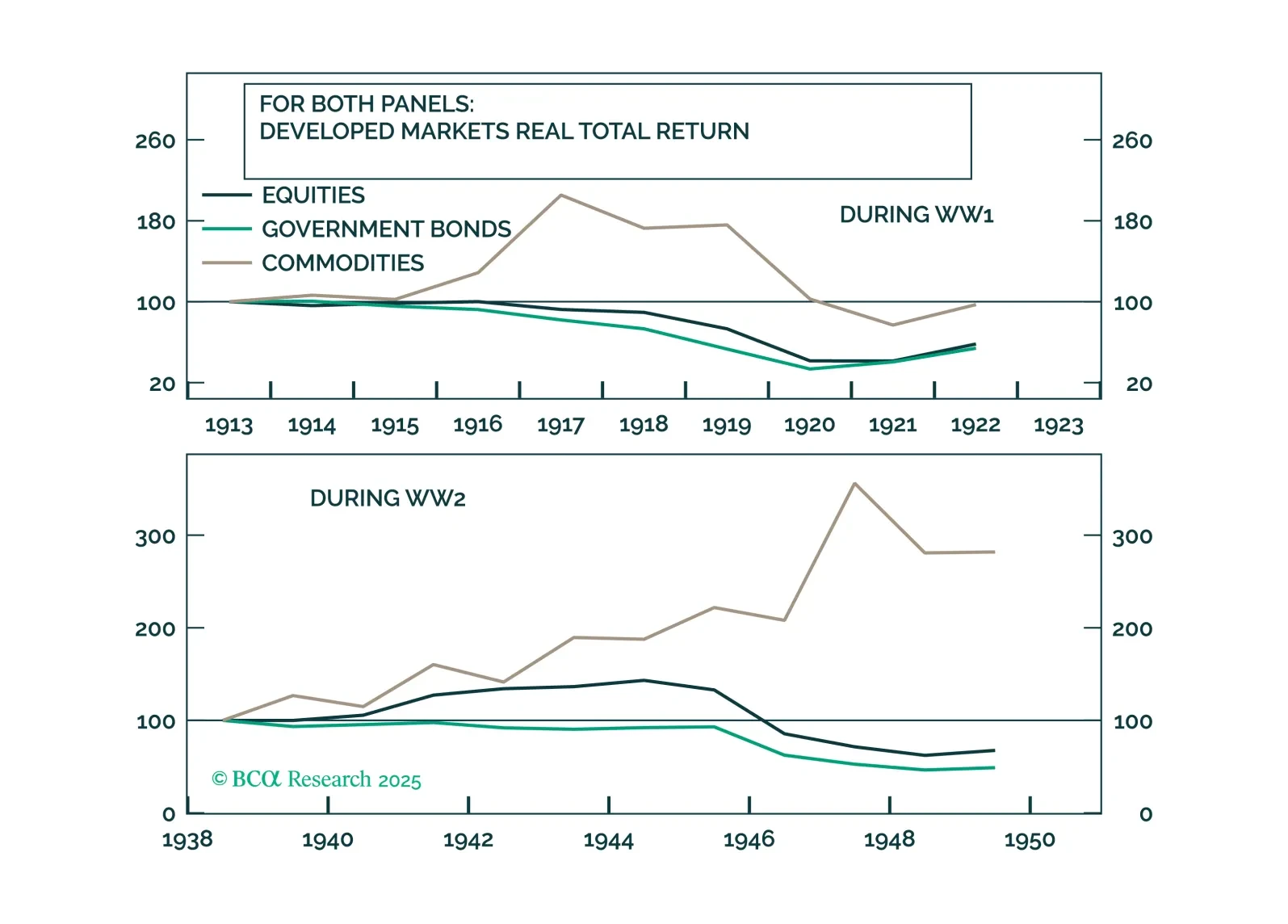

World War III will not happen. But if you disagree, here is our portfolio to hedge it: commodities, neutrals, and crypto.

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and…

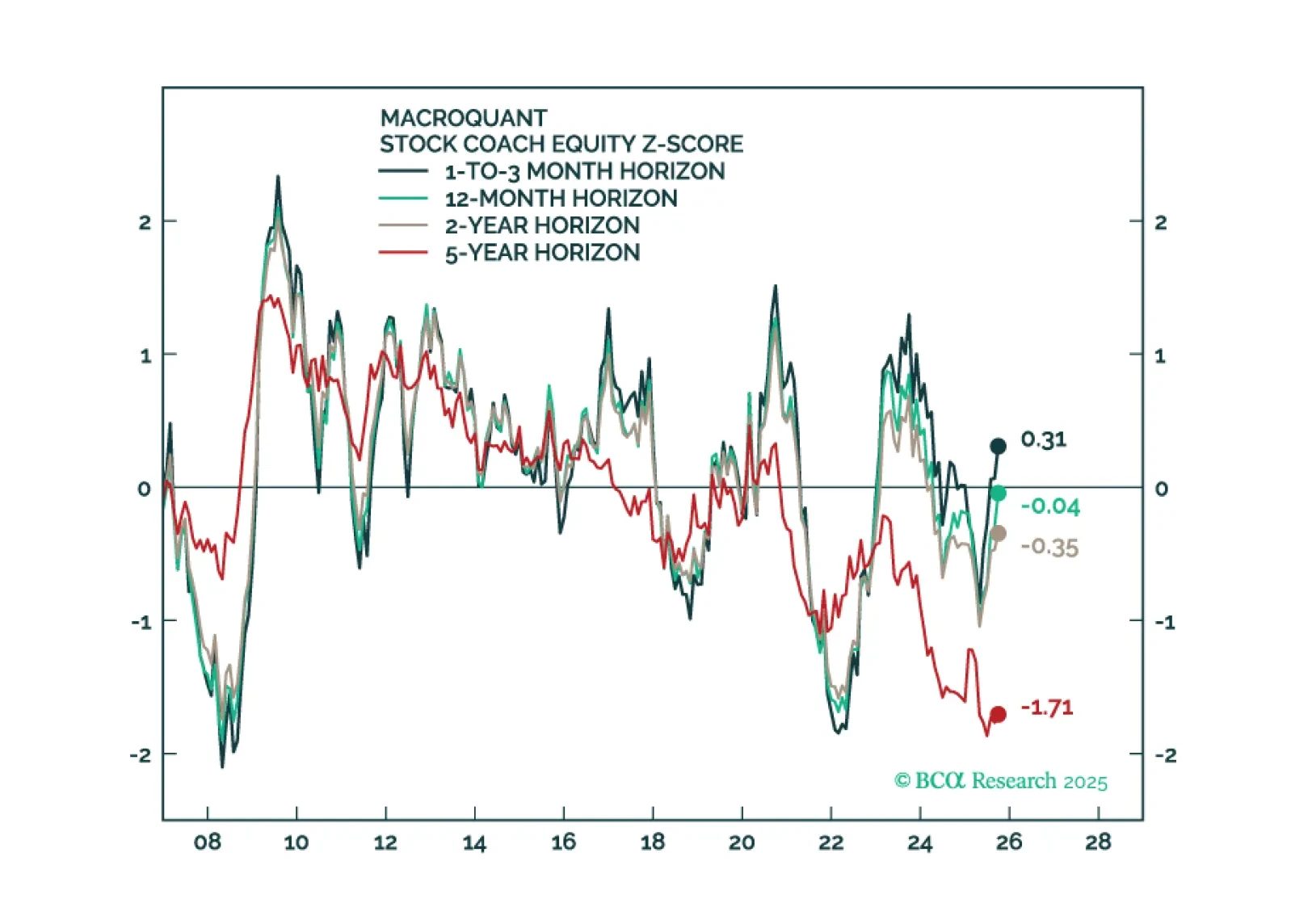

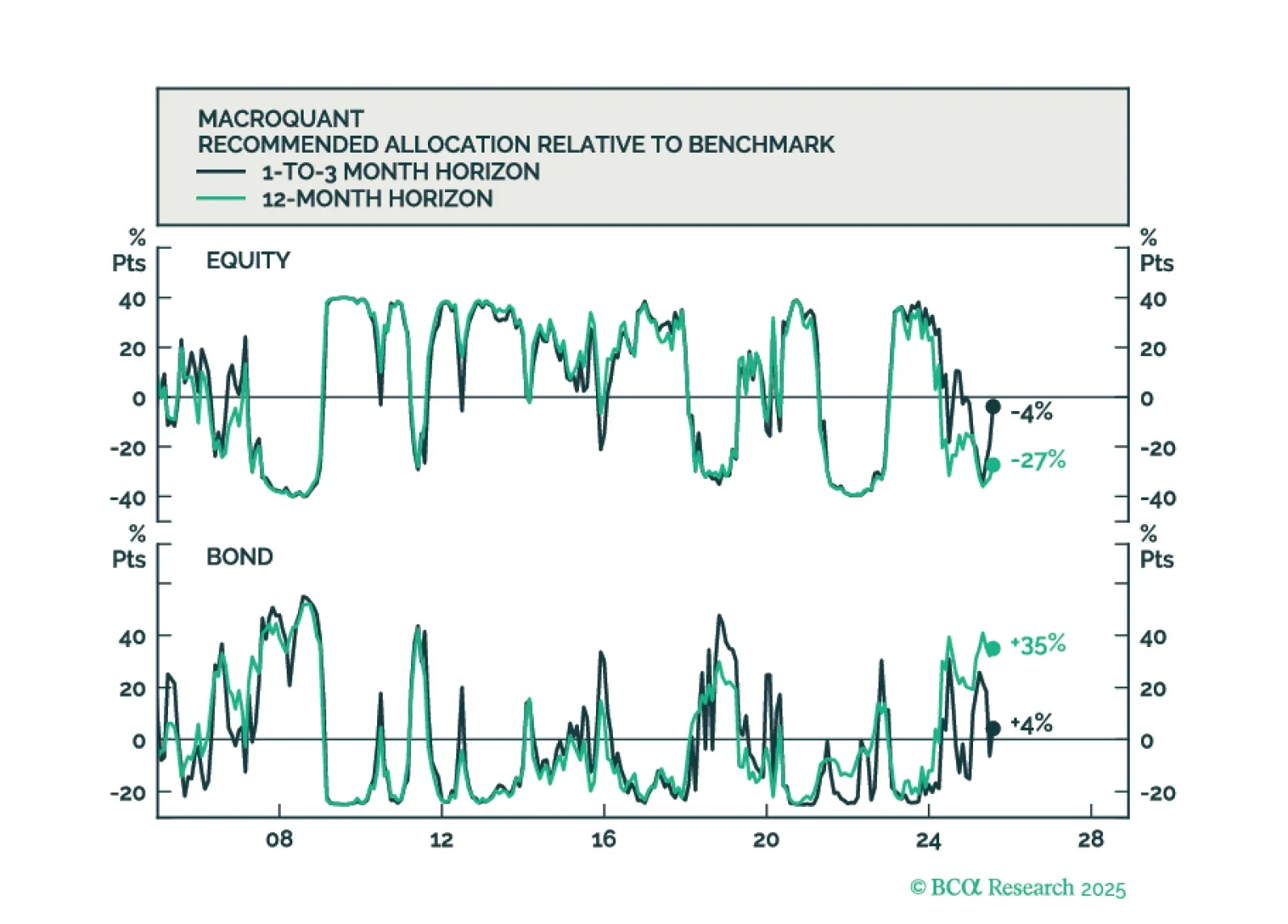

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

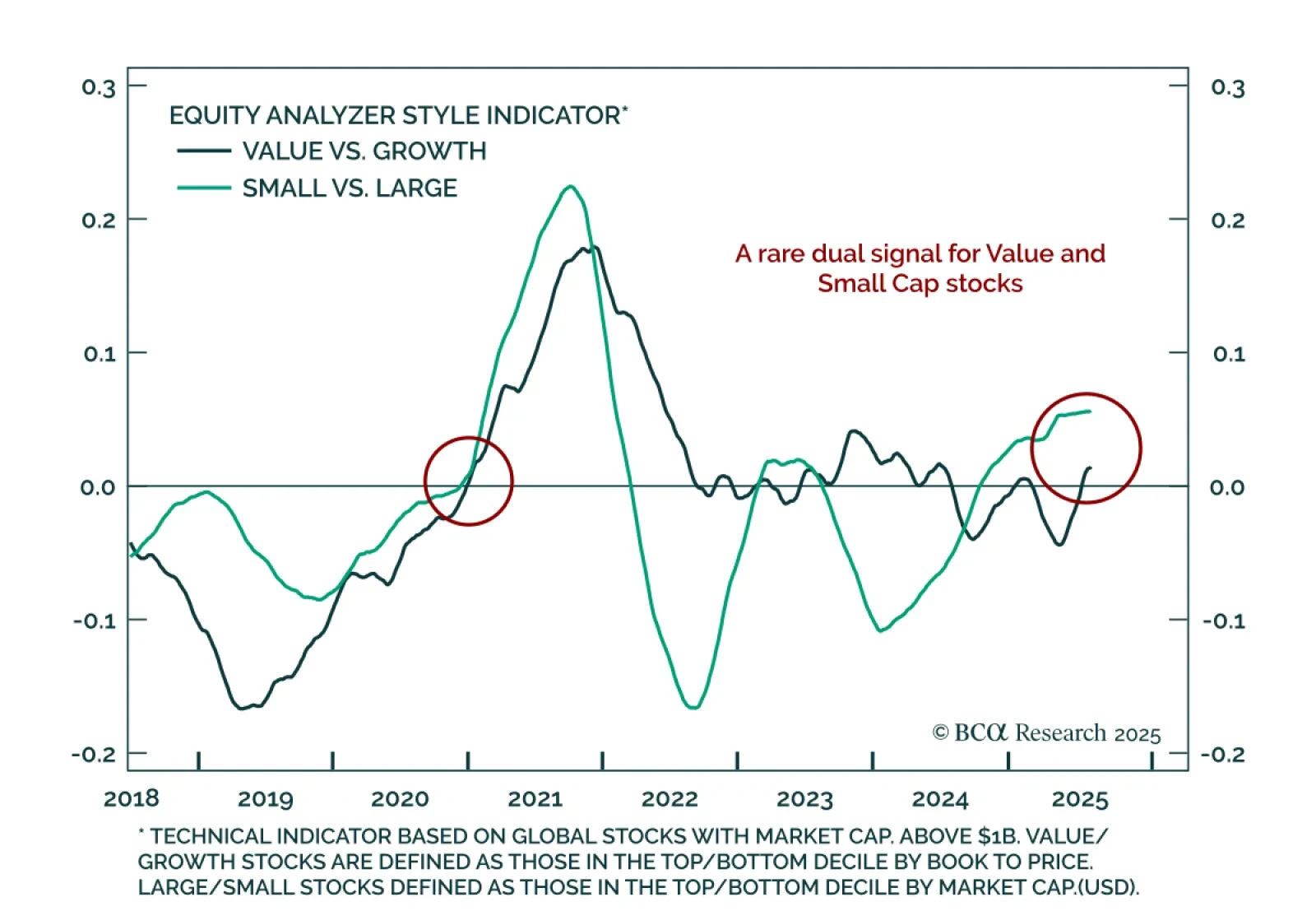

Momentum is building behind small-cap and value stocks, signaling a rare dual tailwind for cyclical styles. Our Chart Of The Week comes from Guy Russell, strategist for Equity Analyzer.While market attention remains focused on the…

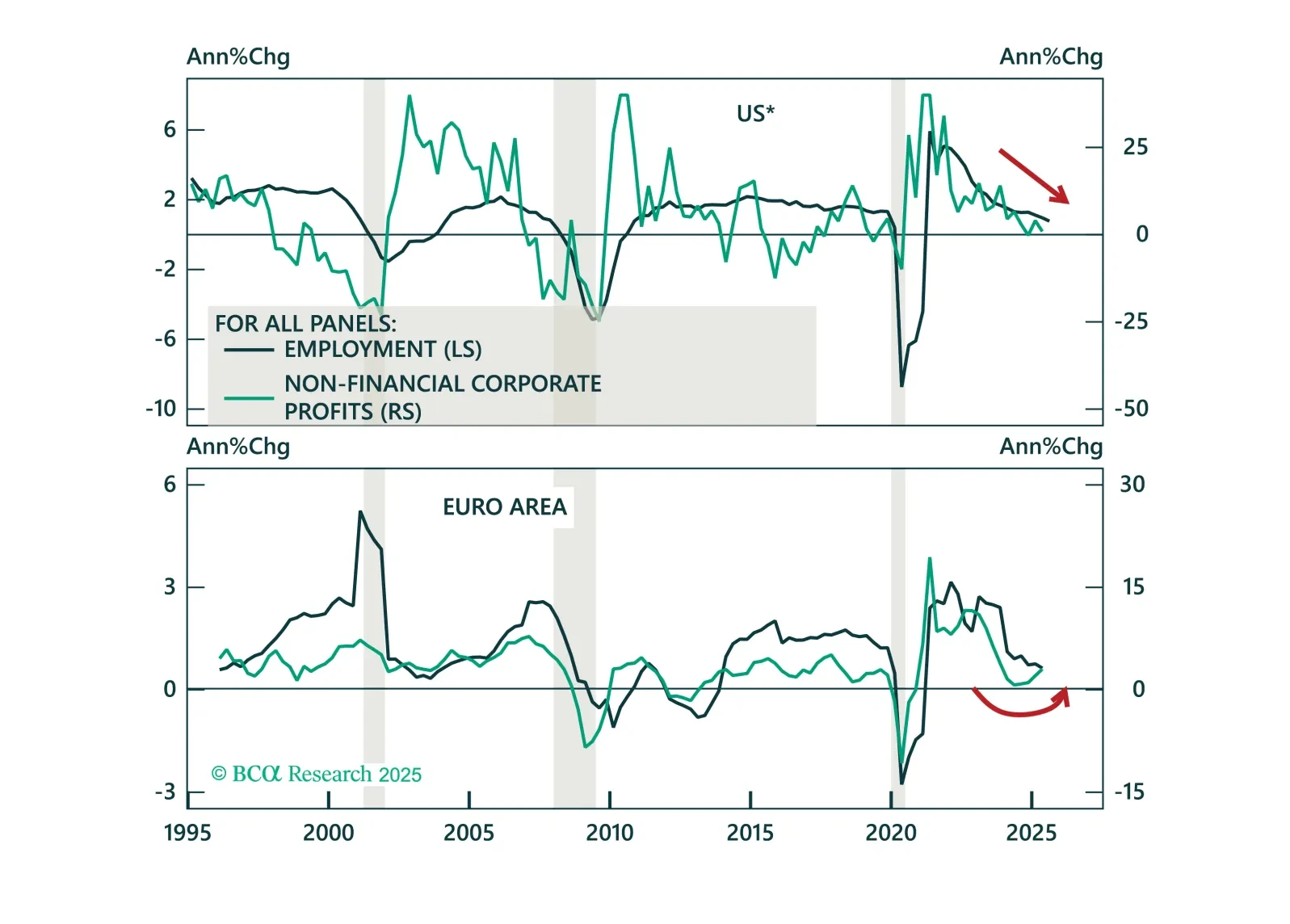

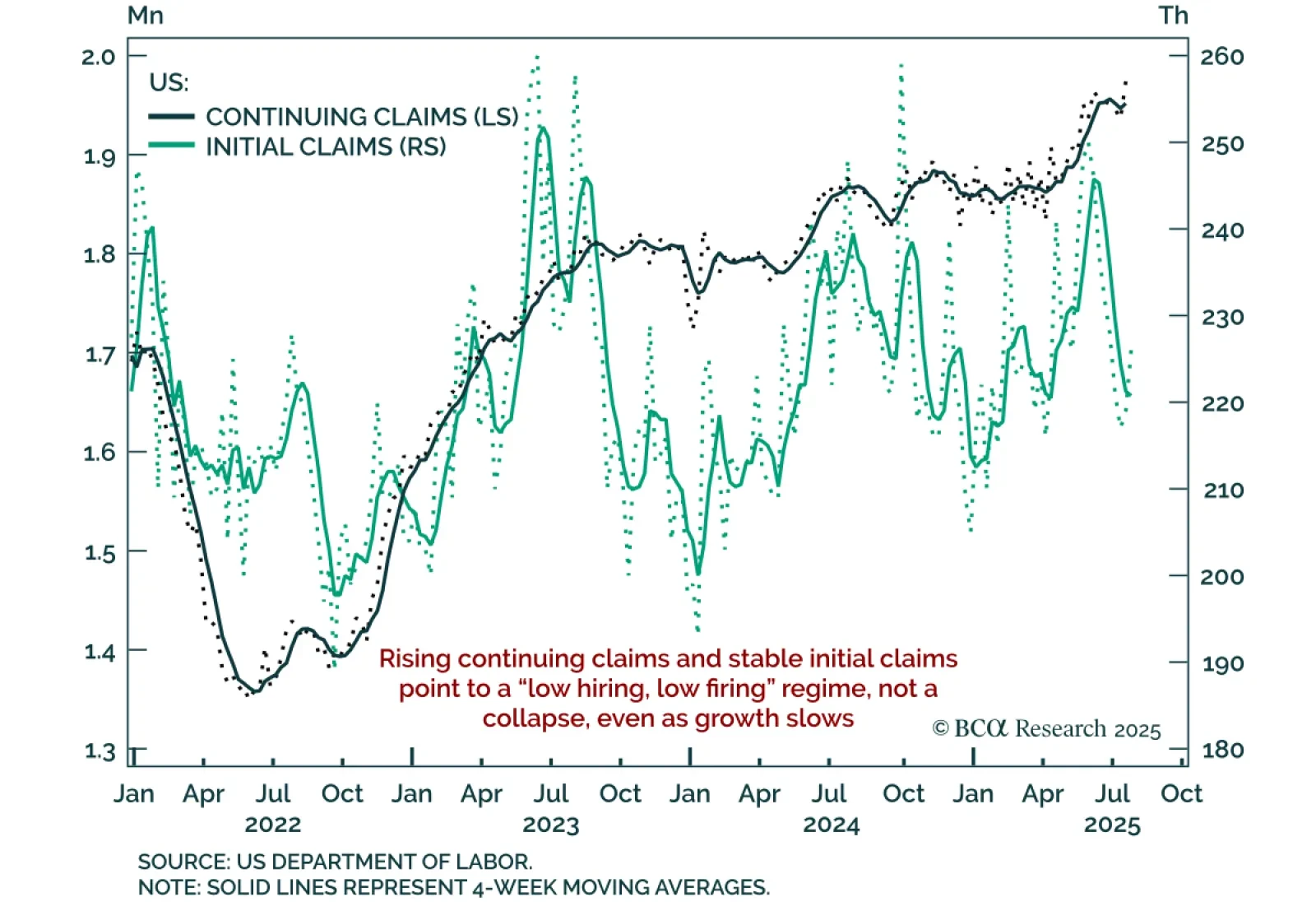

Rising continuing claims and slower job creation reinforce labor market softening, supporting a defensive stance. Continuing claims climbed to a post-COVID high of 1.974m, while initial claims held steady at 226k. Weekly claims…

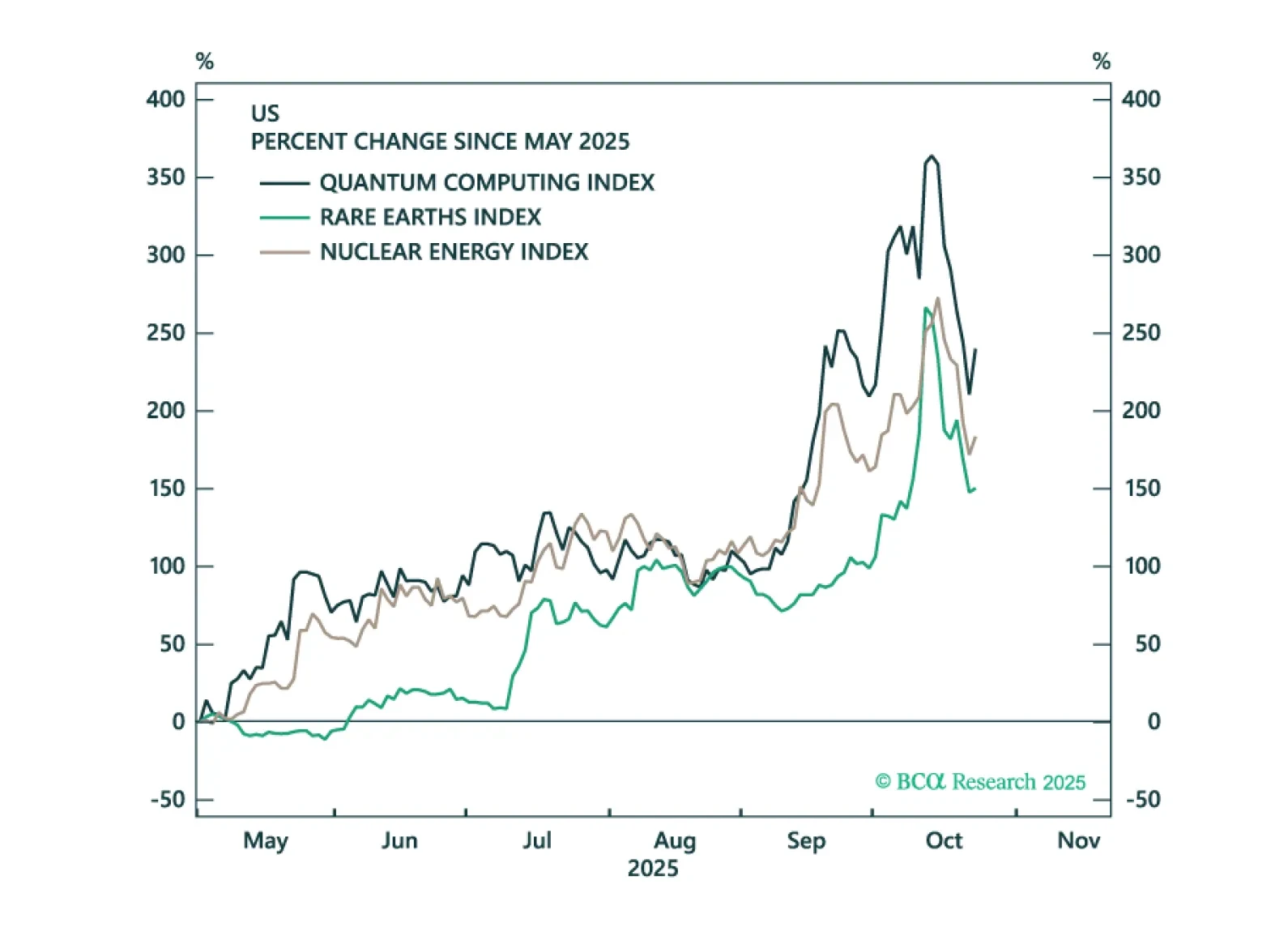

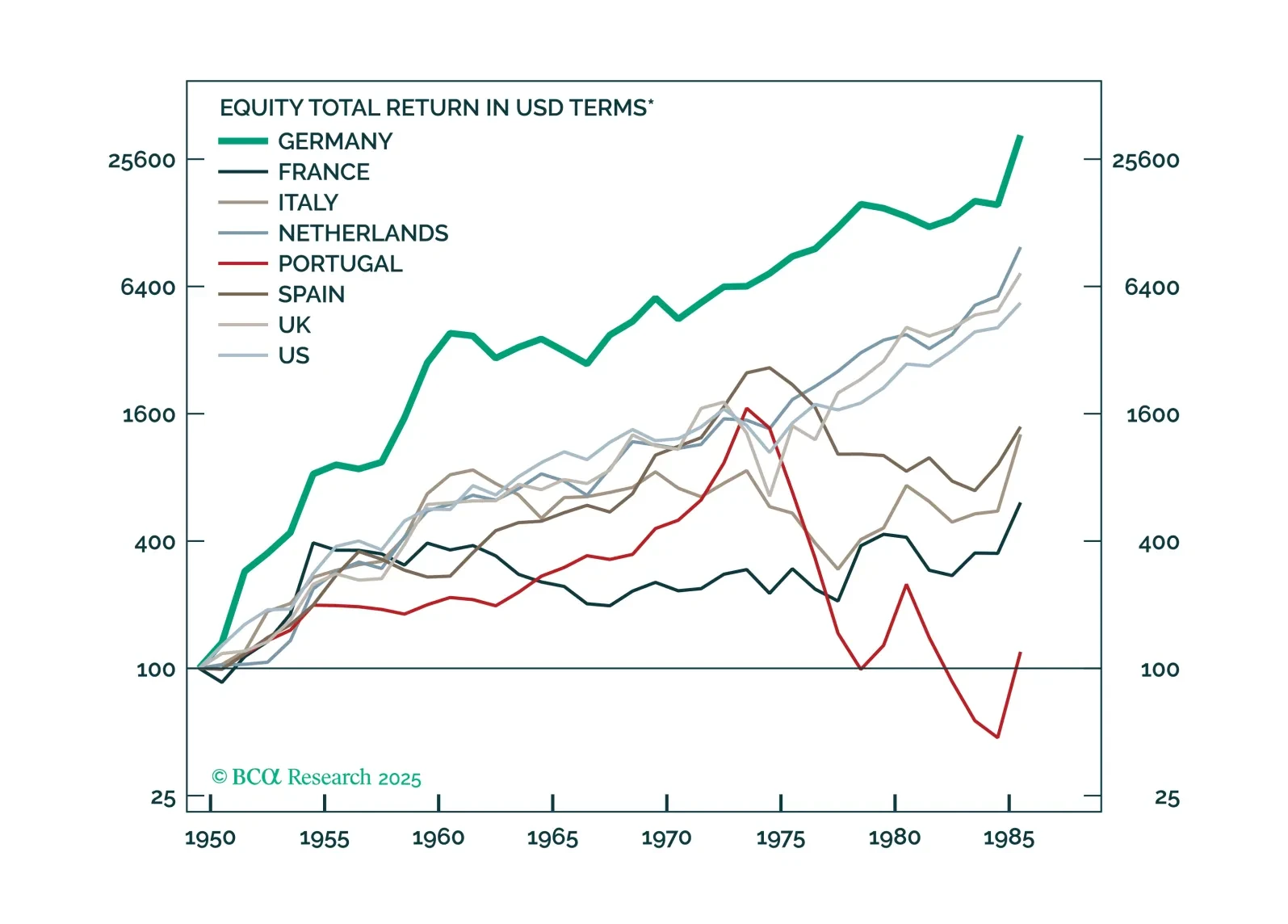

In our Beta report, we introduce a new framework for thinking about long-term investing in a multipolar world: The Garrison State. Investors need to shed their outdated view that geopolitical risks are... a risk. History teaches…