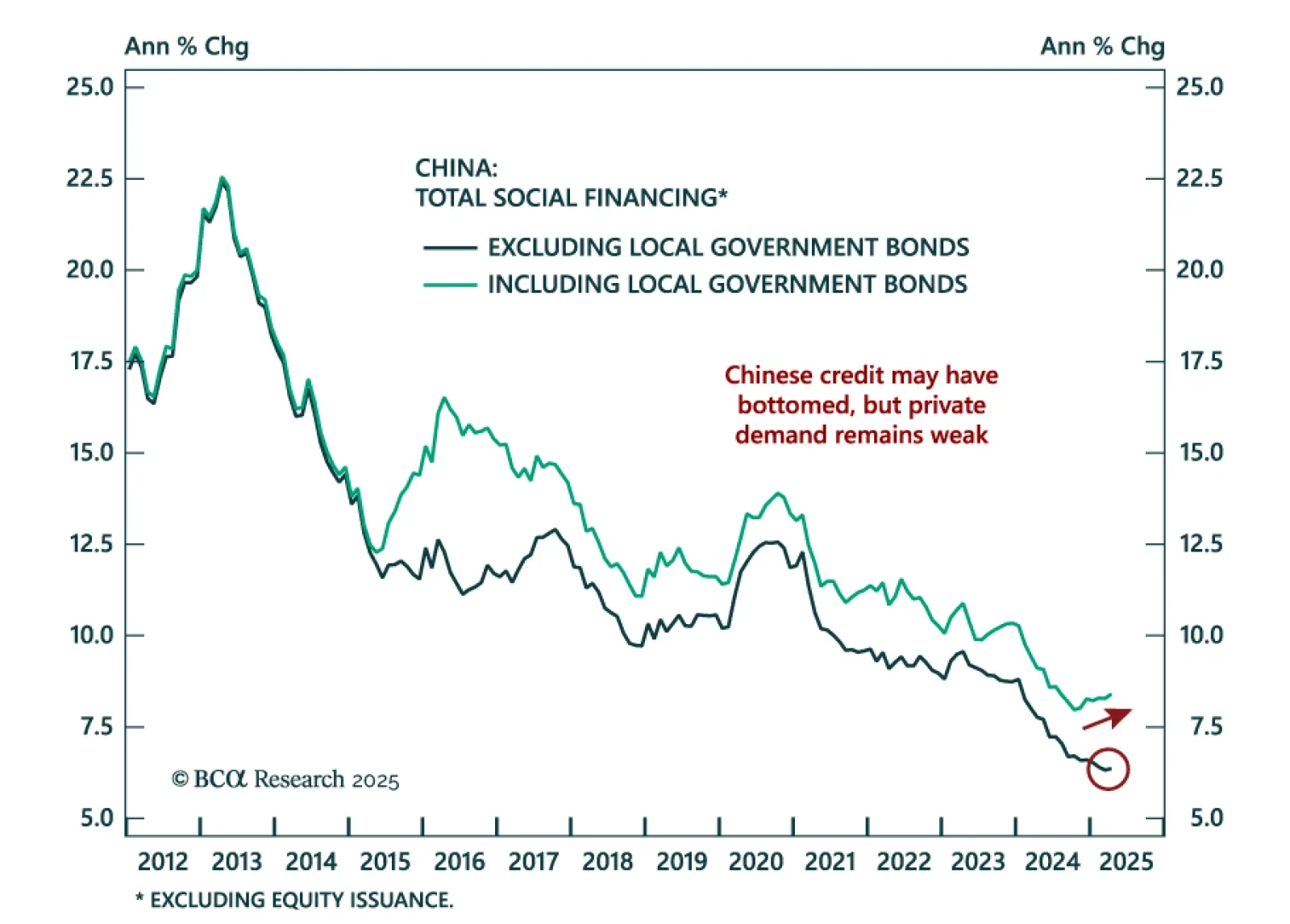

China’s weak April credit data reinforces the case for defensive positioning, with policy aimed at stability, not recovery. New yuan loans and aggregate financing both rose less than expected. While credit growth may have bottomed,…

Our EM strategists see rising odds of a structural regime shift in Emerging Asian currencies. However, they expect a USD rebound and are looking to close short positions in IDR, PHP, and TWD. Severe deflationary shocks will drive…

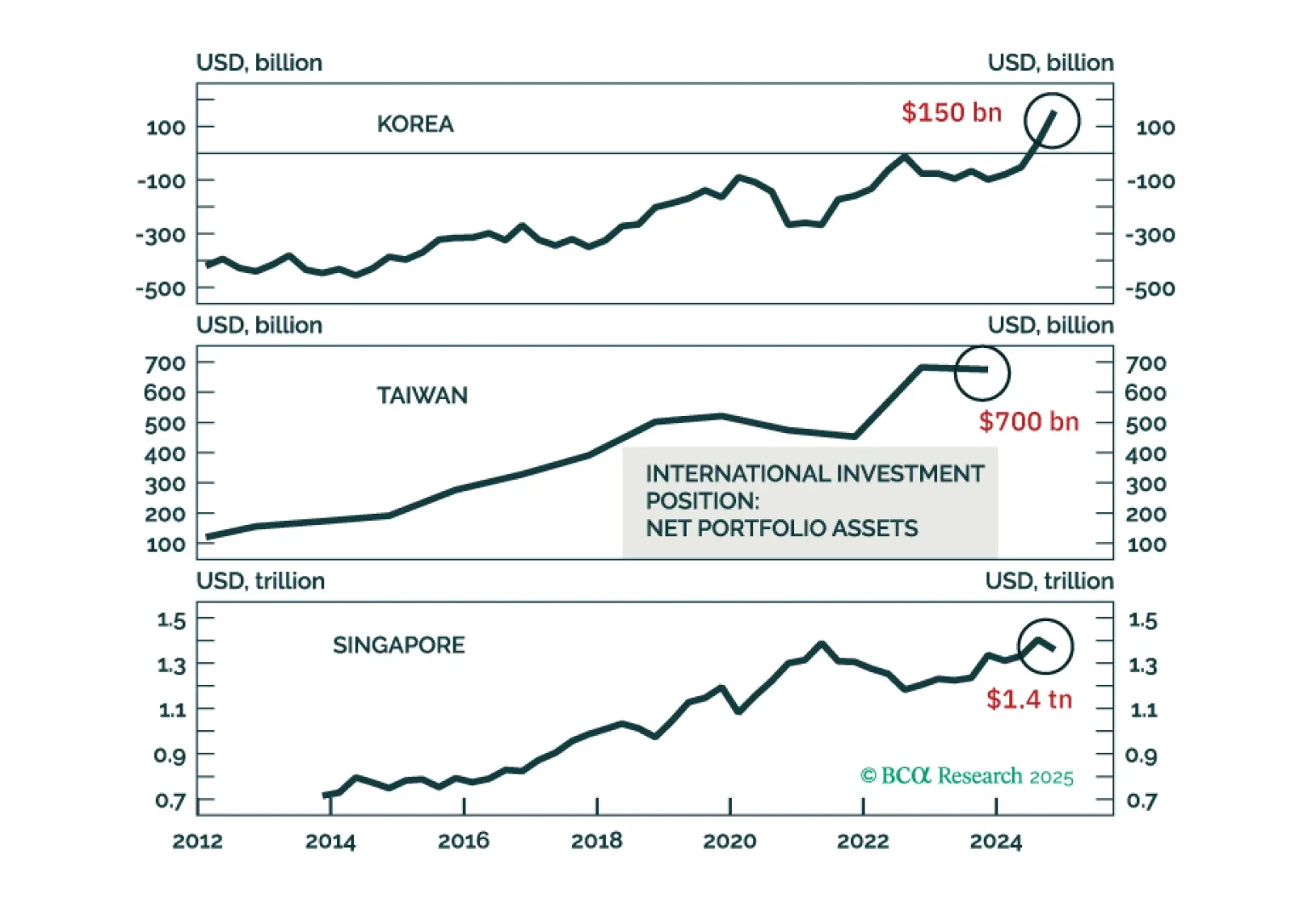

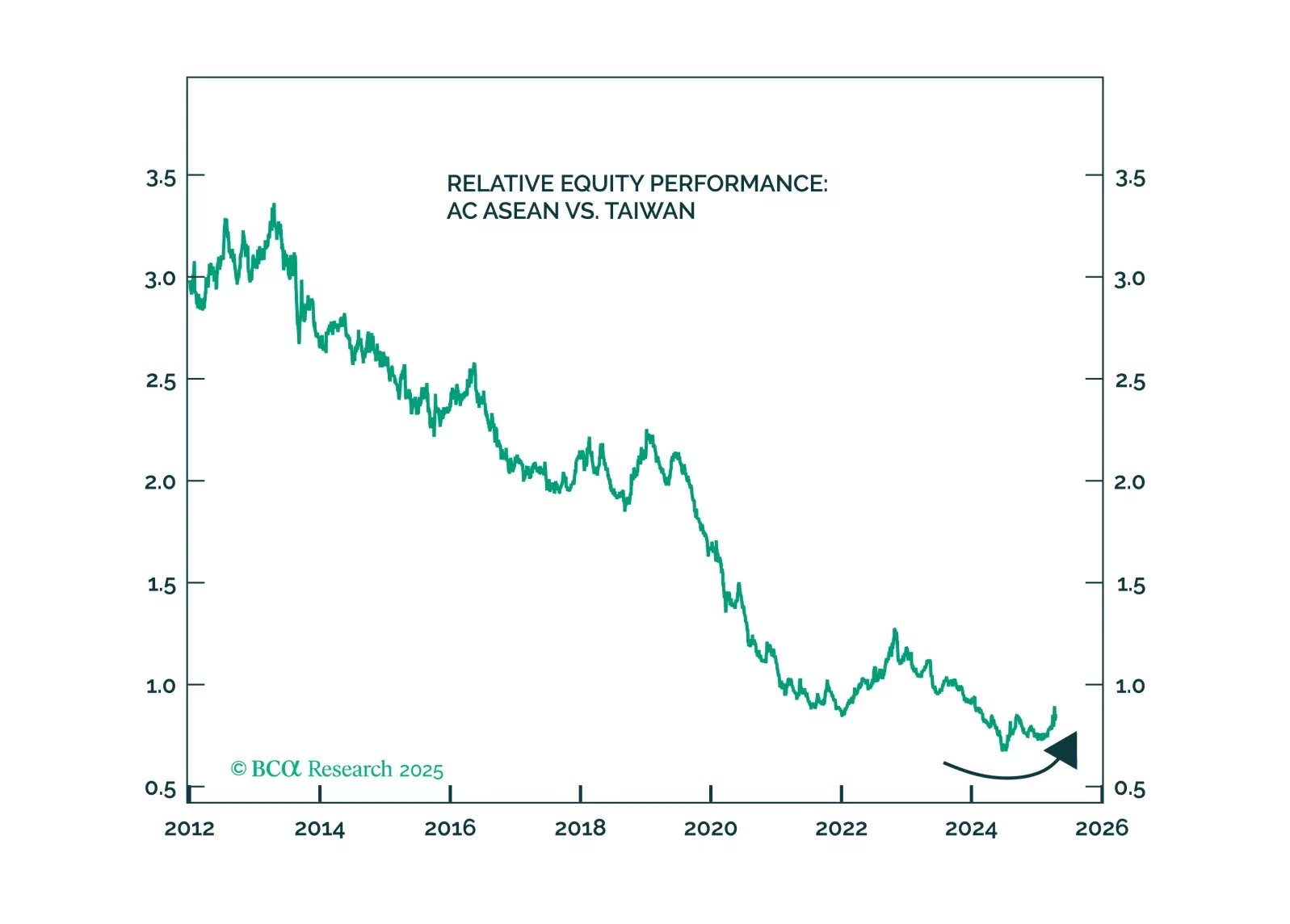

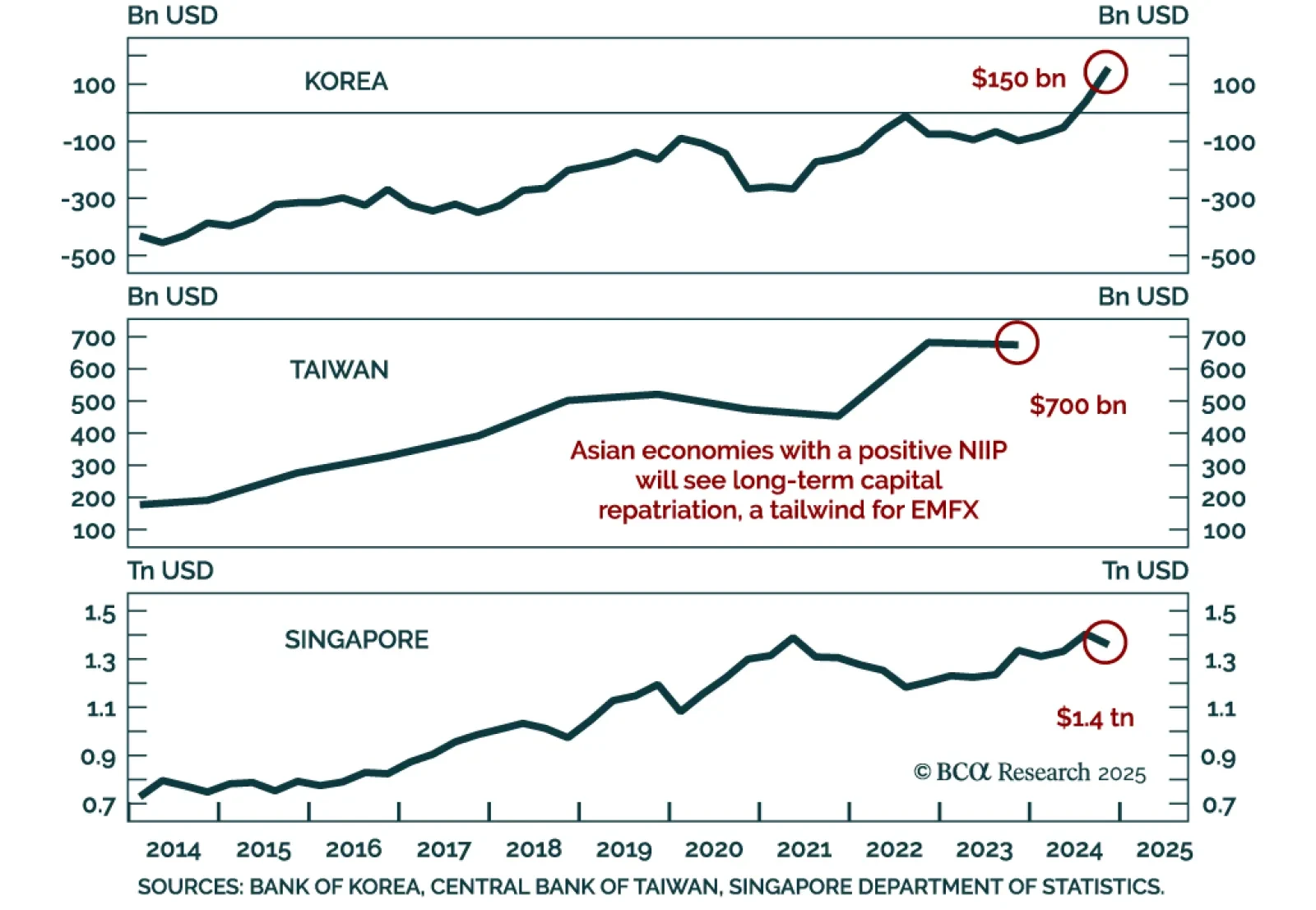

Taiwan, Singapore, and Korea's currencies might appreciate versus the USD, driven by capital repatriation from domestic private investors away from the US. This thesis is less pertinent to India, Indonesia, and the Philippines…

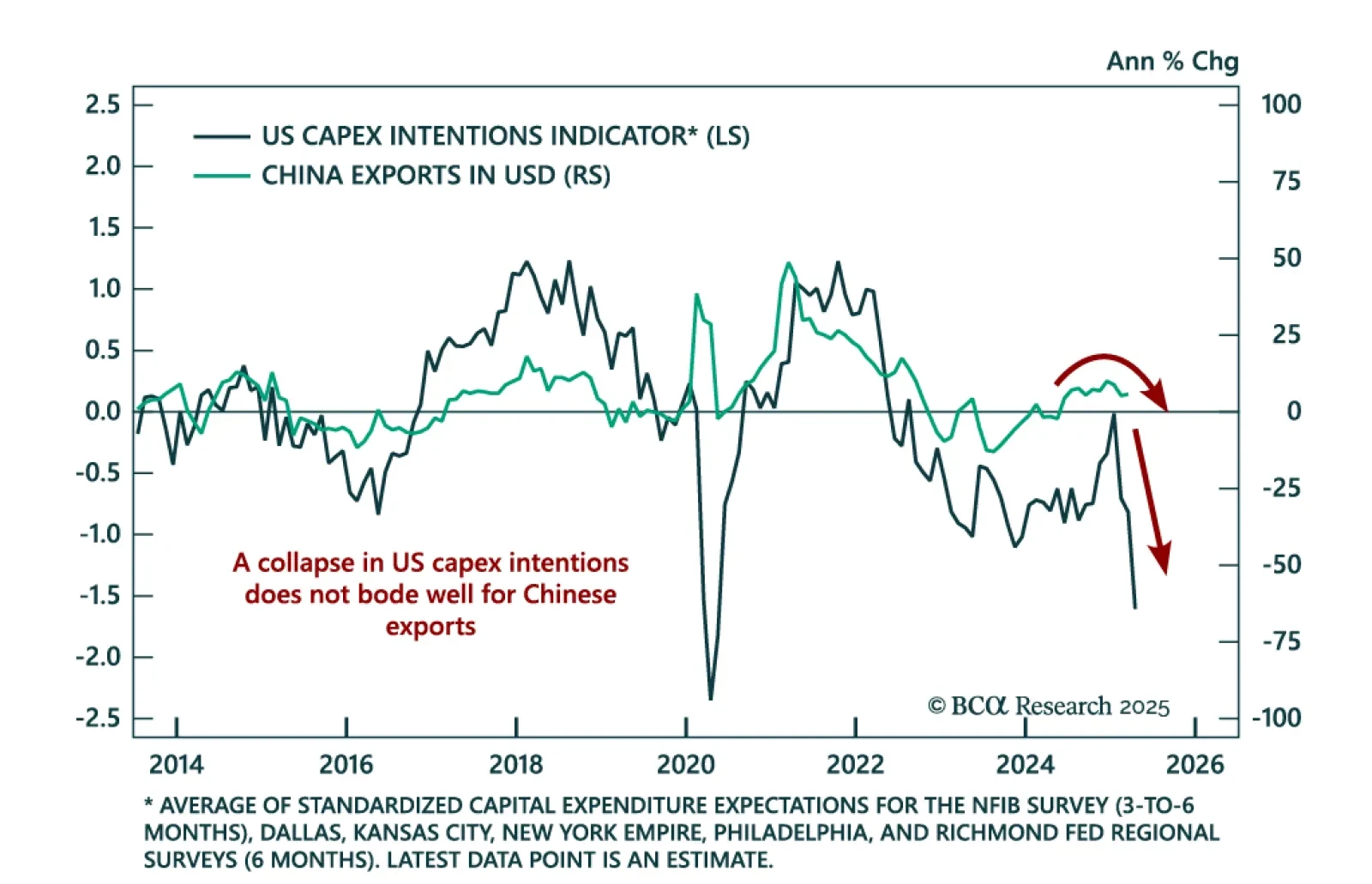

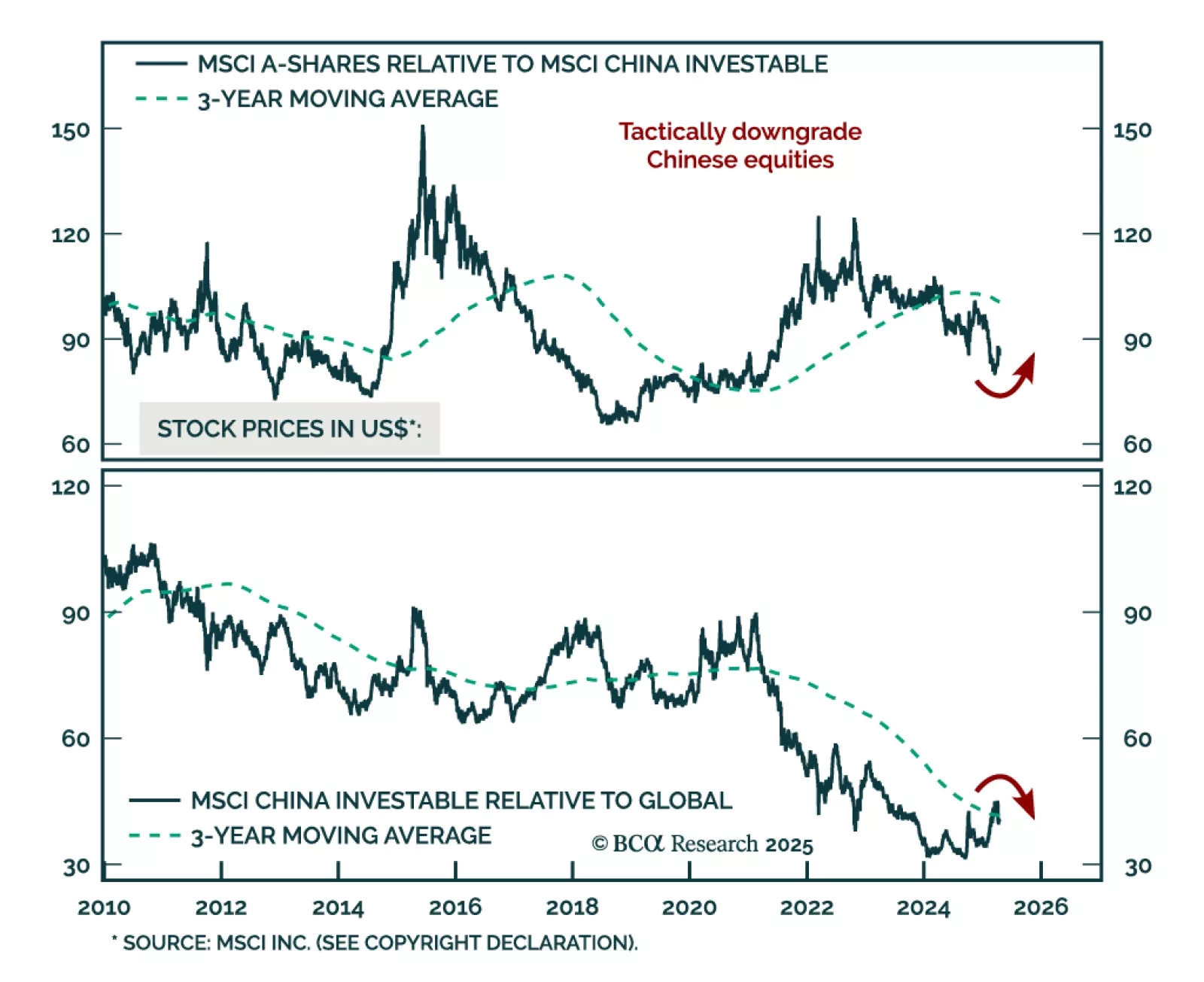

BCA’s China Investment Strategists remain defensive as China’s growth outlook is still weak. Even if some US tariff rates are rolled back, export headwinds and lagging stimulus will continue to weigh on Chinese equities. The…

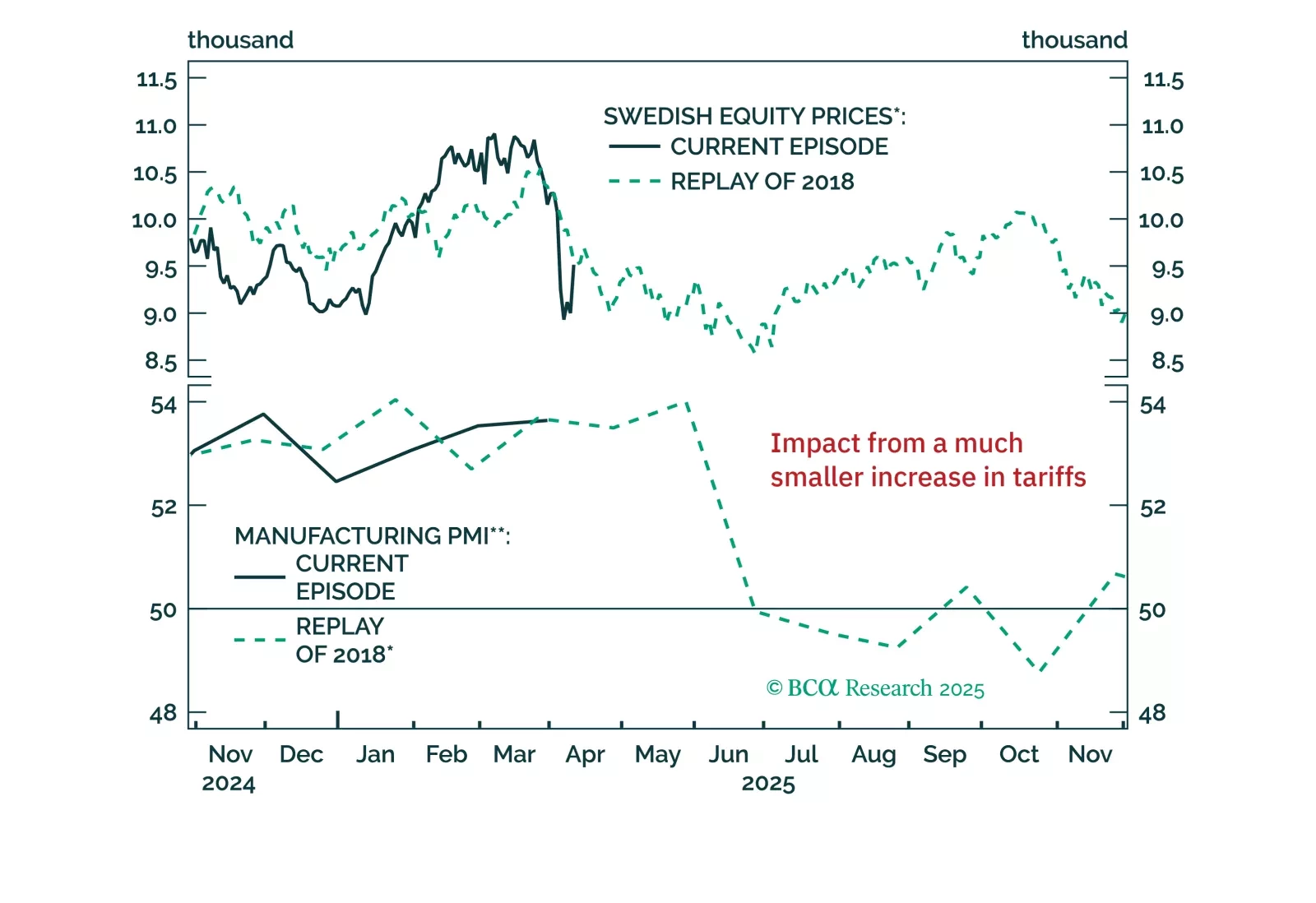

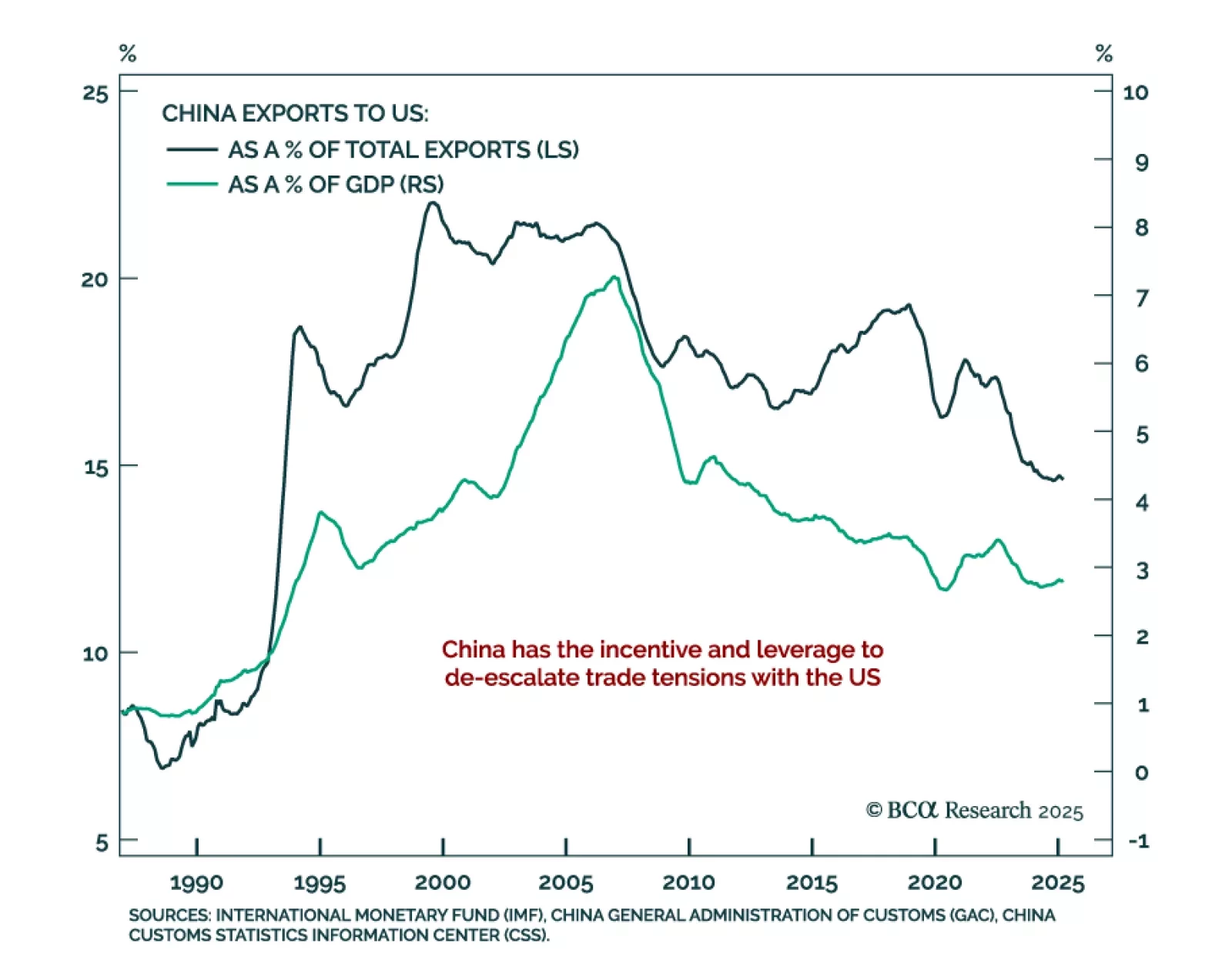

Trade headlines shift too fast to interpret reliably, but cutting through the noise reveals the US is pivoting from escalation to de-escalation. As the equity and bond selloff intensified, the tone from Washington softened,…

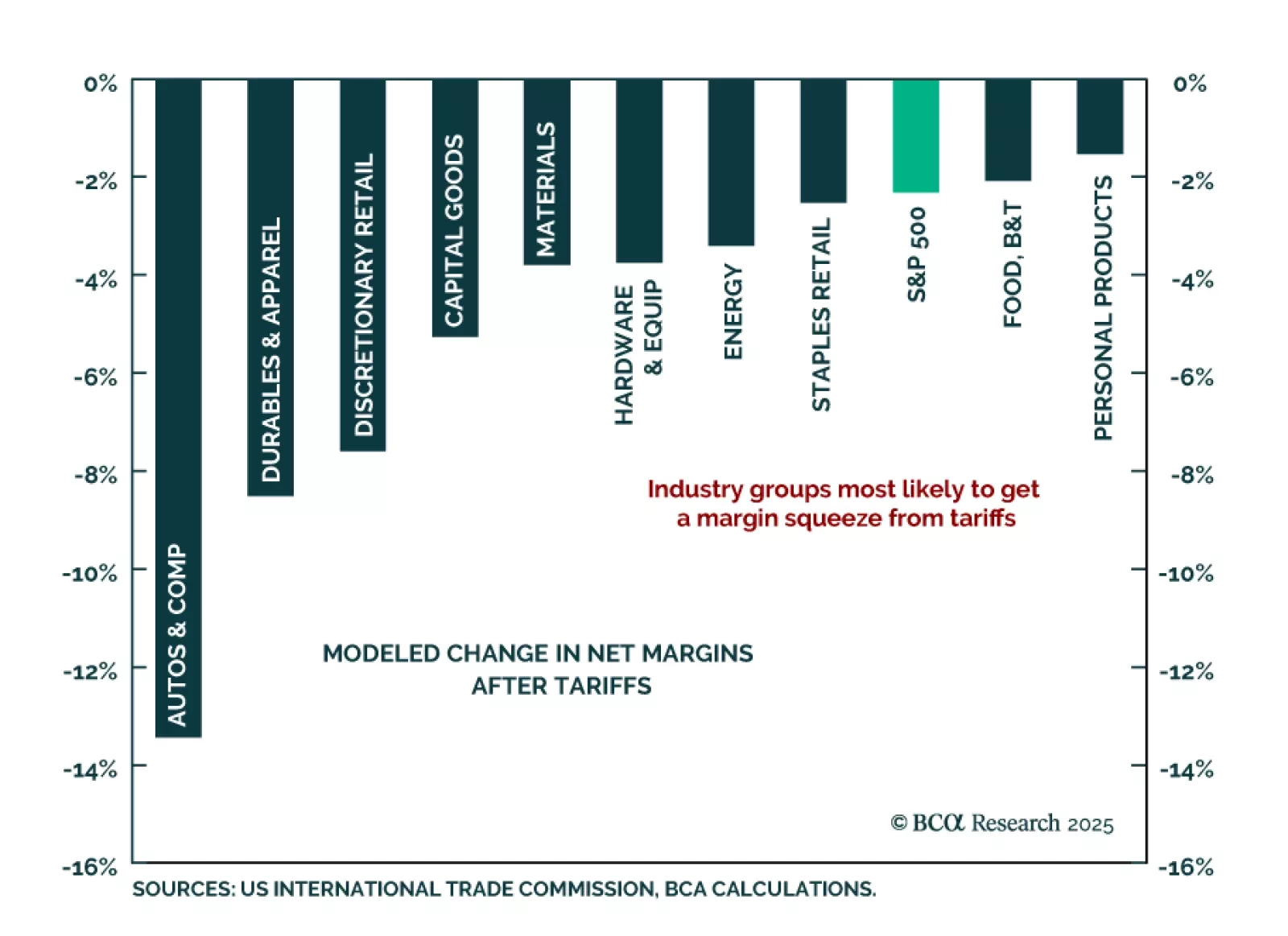

Our US Equity strategists warn that tariffs will meaningfully compress S&P 500 margins, with little pricing power to offset rising input costs. A two-point hit to net margins and falling multiples will drive earnings downgrades…

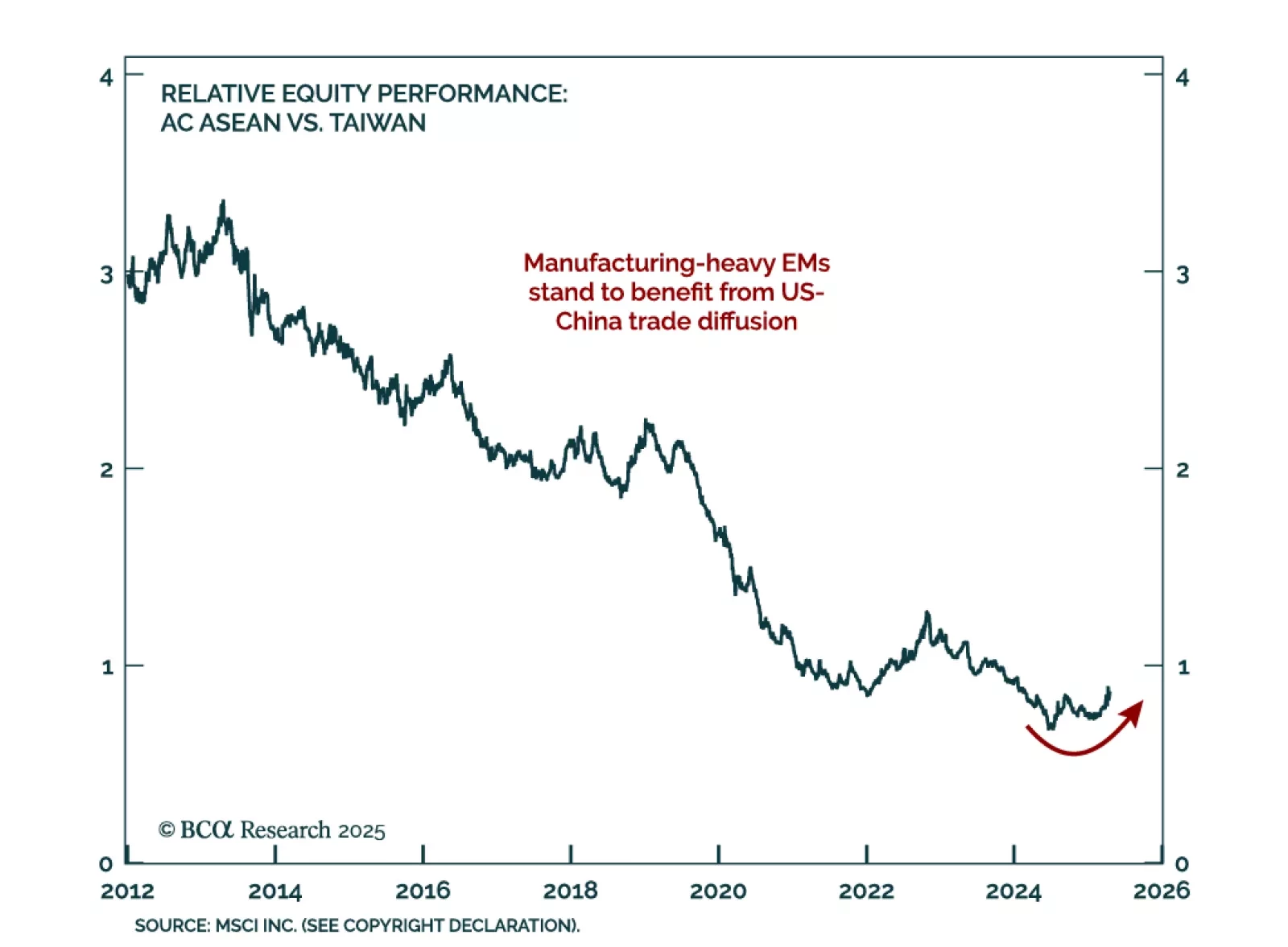

Our Geopolitical and GeoMacro strategists recommend buying tail-risk protection and adding exposure to manufacturing-oriented EMs as the risk of US-China military escalation rises. They now see a 10% chance of full-scale war over…

Our China strategists remain defensive and tactically downgrade MSCI China to underweight, citing escalating US China tariff tensions and subdued domestic demand. Favor government bonds over equities, defensive sectors, and A-Shares…