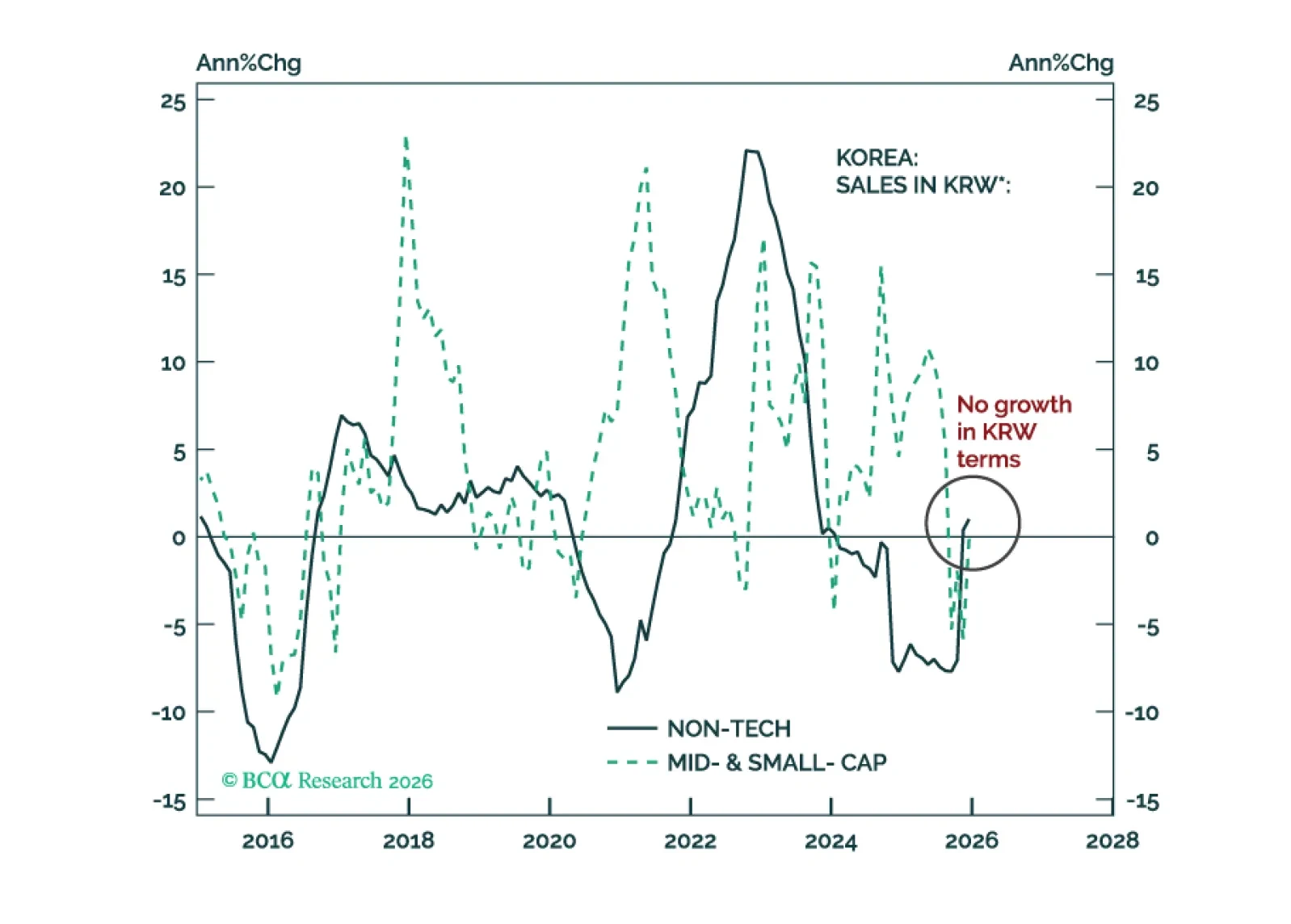

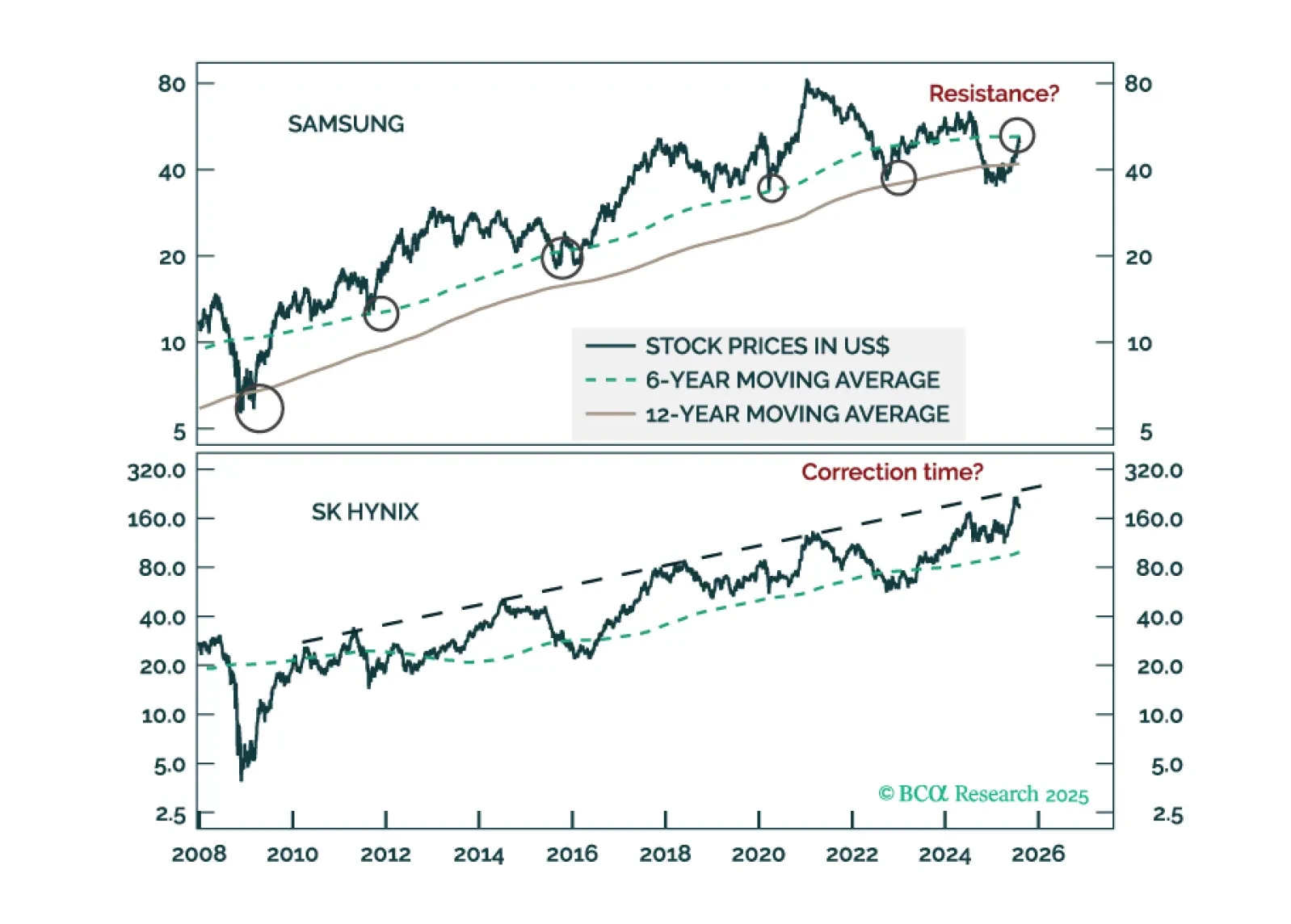

Go long KRW versus USD. Within an EM equity portfolio, overweight Korean tech and stay neutral on Korean non-tech. However, we are not bullish on the Korean bourse's absolute performance.

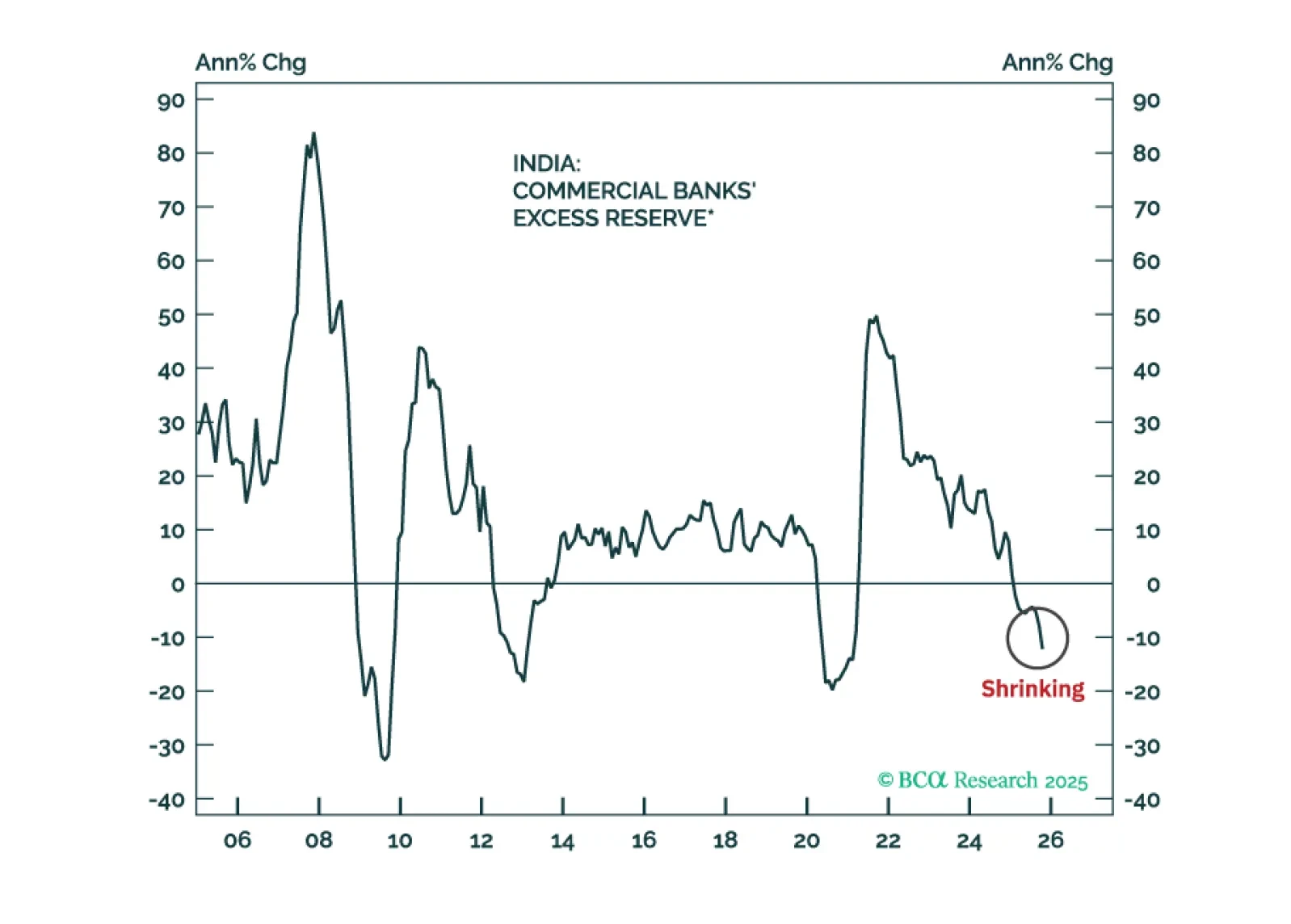

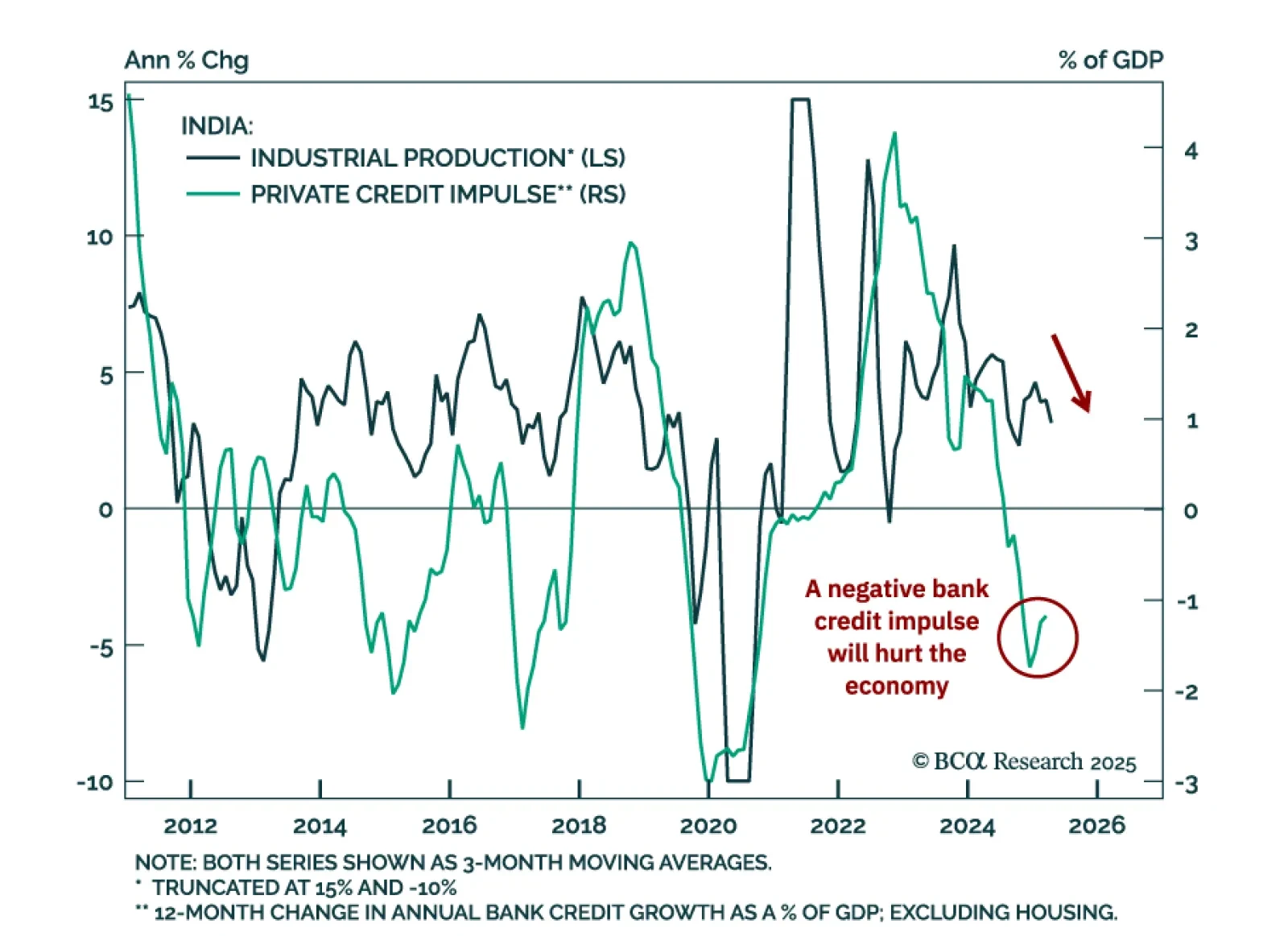

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

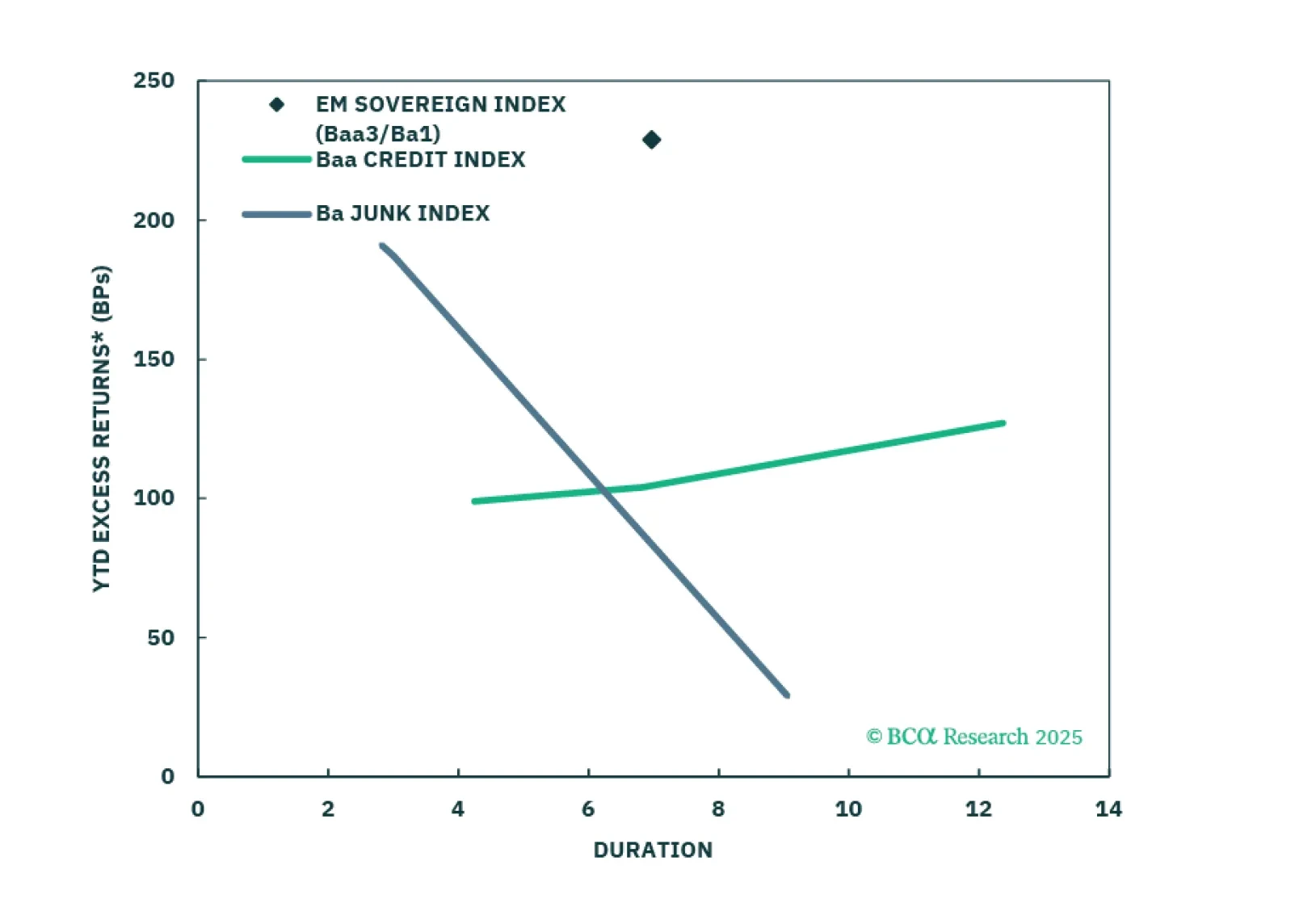

USD-denominated Emerging Market bonds have been outperforming US corporates for the past year. We don’t think the rally is exhausted yet.

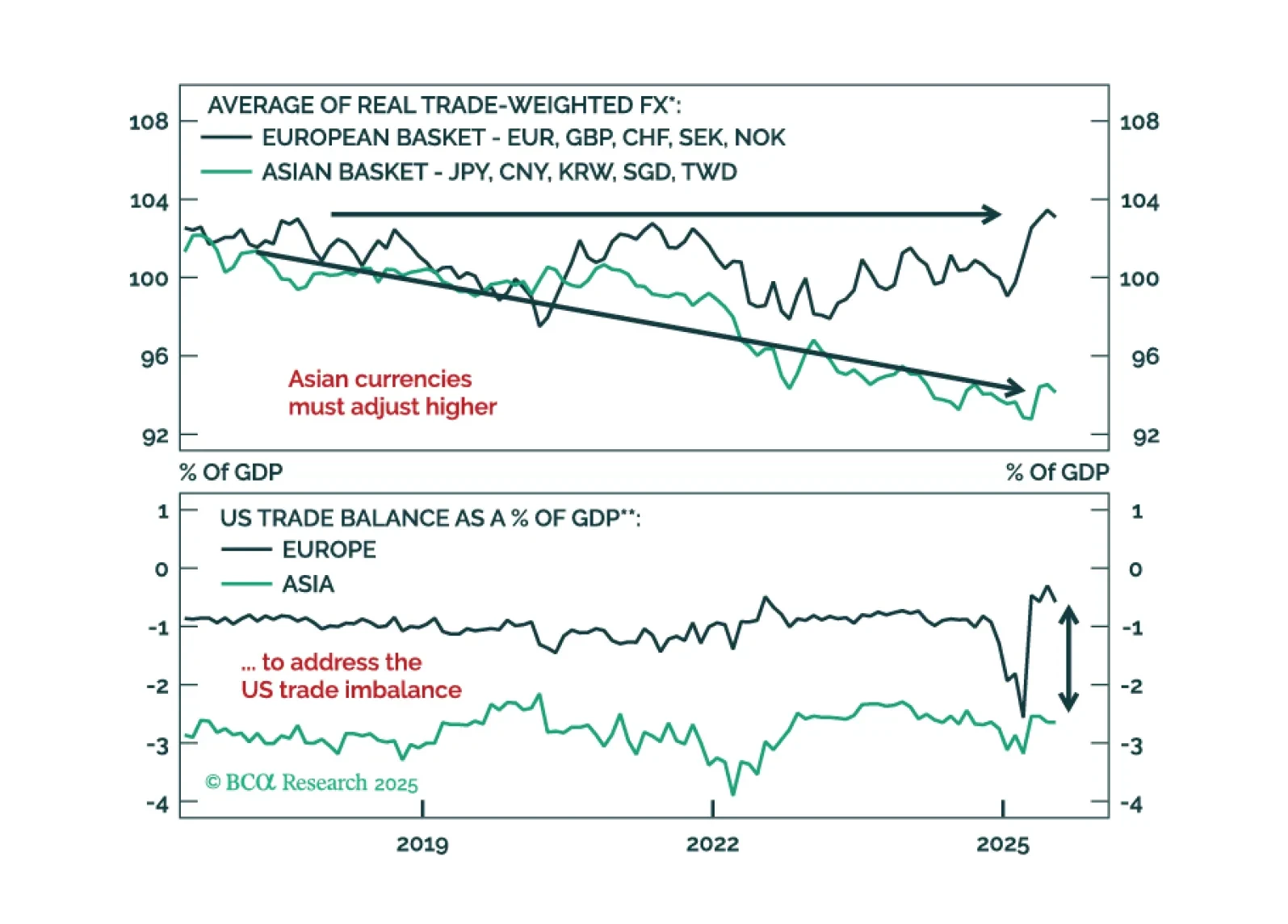

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

A deflationary shock from shrinking exports will ripple throughout the Korean economy. We are downgrading the KOSPI from overweight to neutral and reiterating a long position in 10-year domestic bonds, currency unhedged.

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

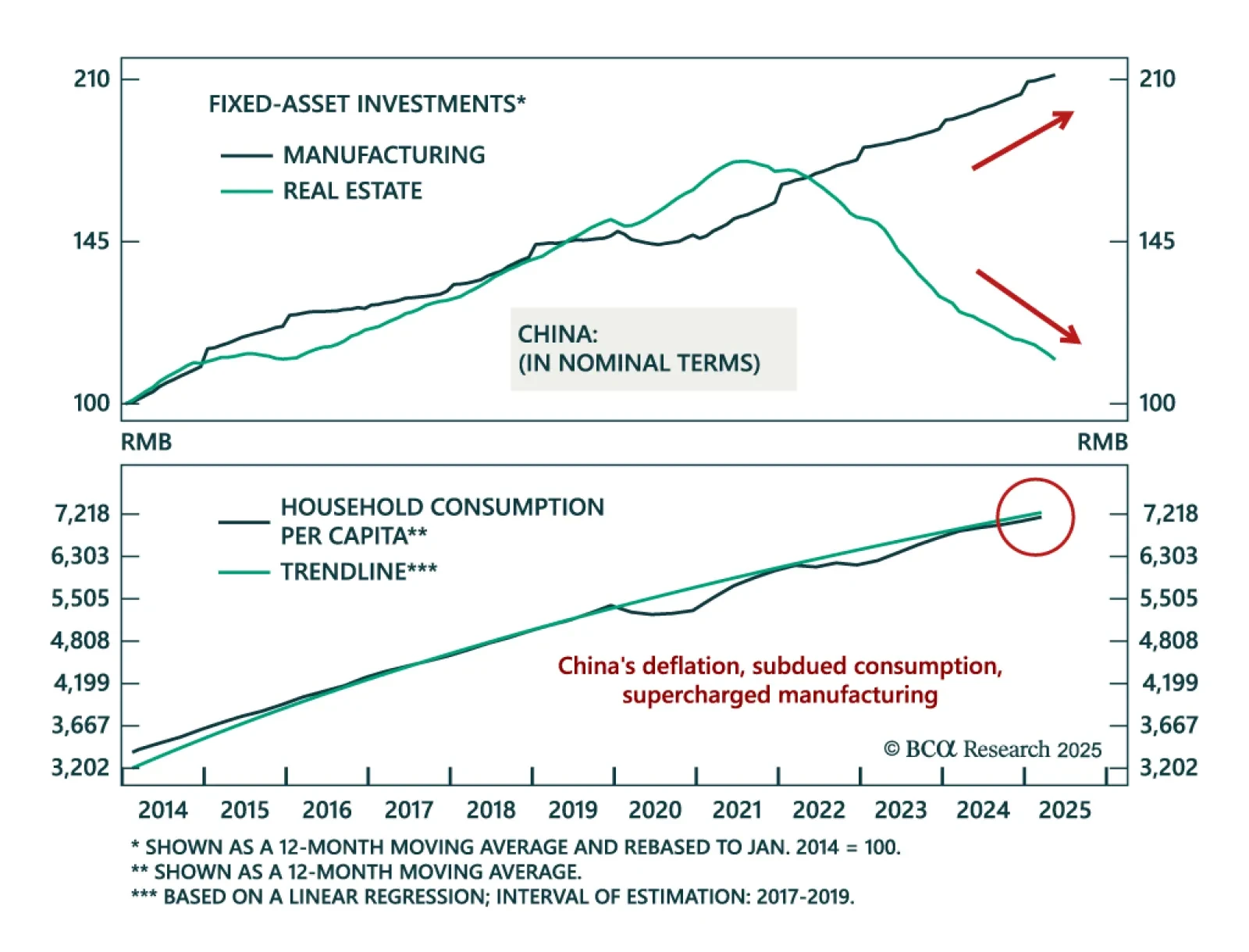

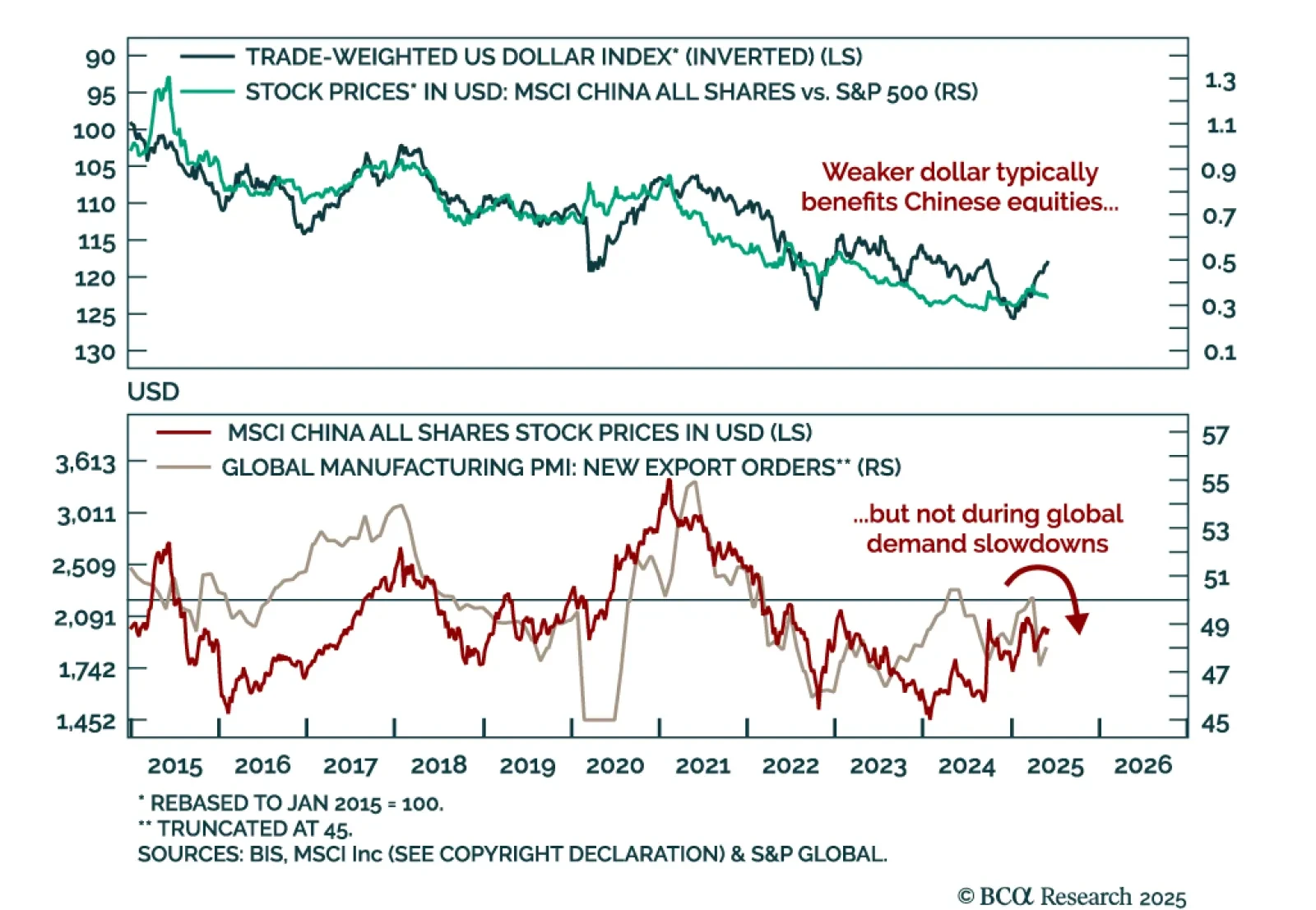

Our China strategists maintain a defensive stance on equities, favoring government bonds and high-dividend sectors as deflation persists. China’s deflationary pressures are supply-driven, with manufacturing capacity expanding faster…

BCA’s China Investment strategists see limited upside for Chinese equities and favor bonds, as trade tensions ease but domestic headwinds persist. This week’s US-China trade talks in London lowered the risk of near-term escalation or…

Industrial activity in India is deteriorating, which will weigh on a stock market that’s priced for perfection. Indian industrial production slowed to 2.7% year-on-year in April compared to 3.9% in March. The economic…

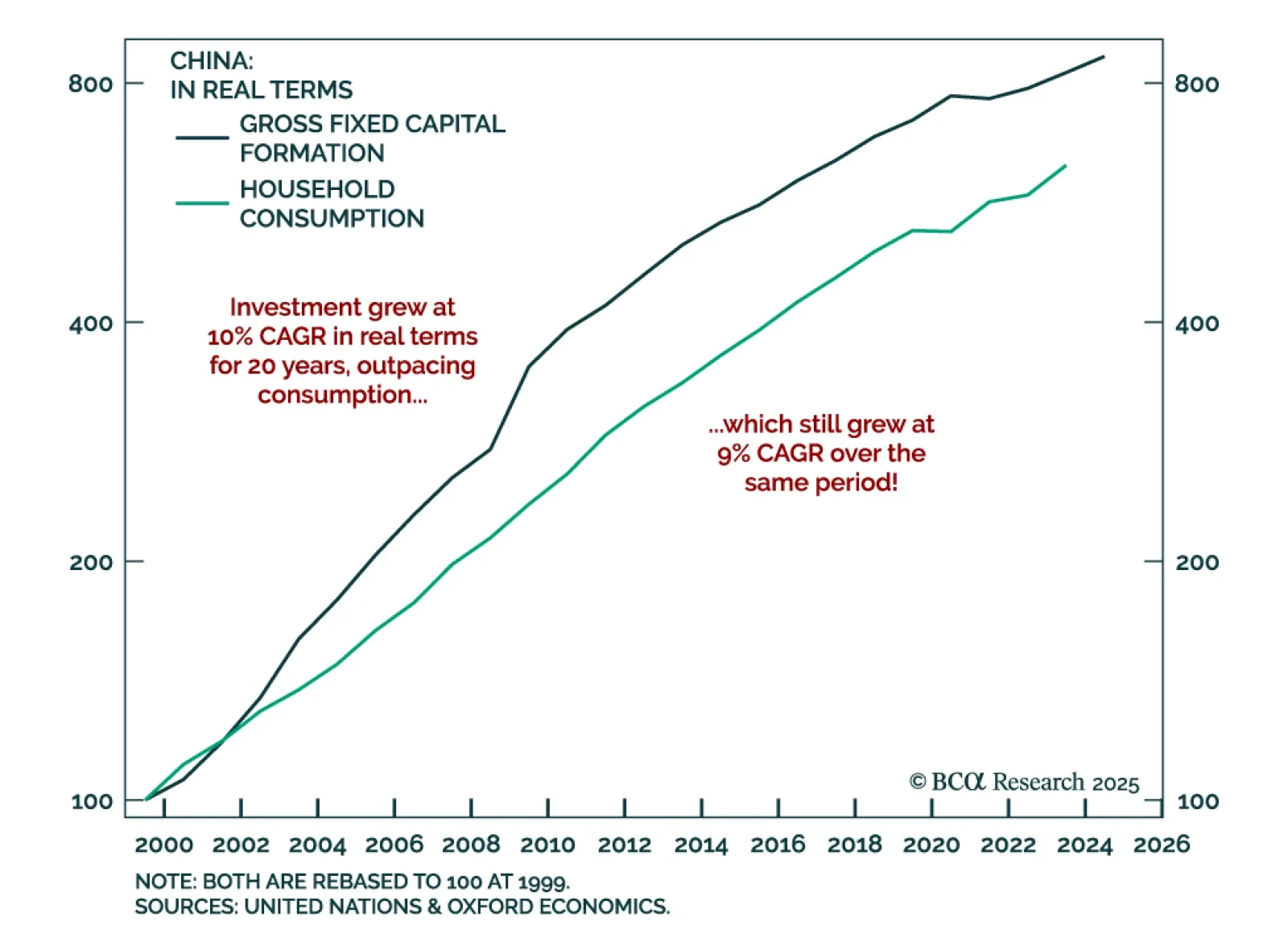

Our EM strategists warn that China’s overinvestment problem has no quick fix, keeping deflationary pressures in place and limiting upside for Chinese equities. Excessive domestic investment, driven by aggressive credit creation, is…