Our Emerging Market Strategy team has the following observations. The peso is about 40% below its real effective exchange rate fair value based on consumer and producer prices. Based on past devaluation episodes, there could…

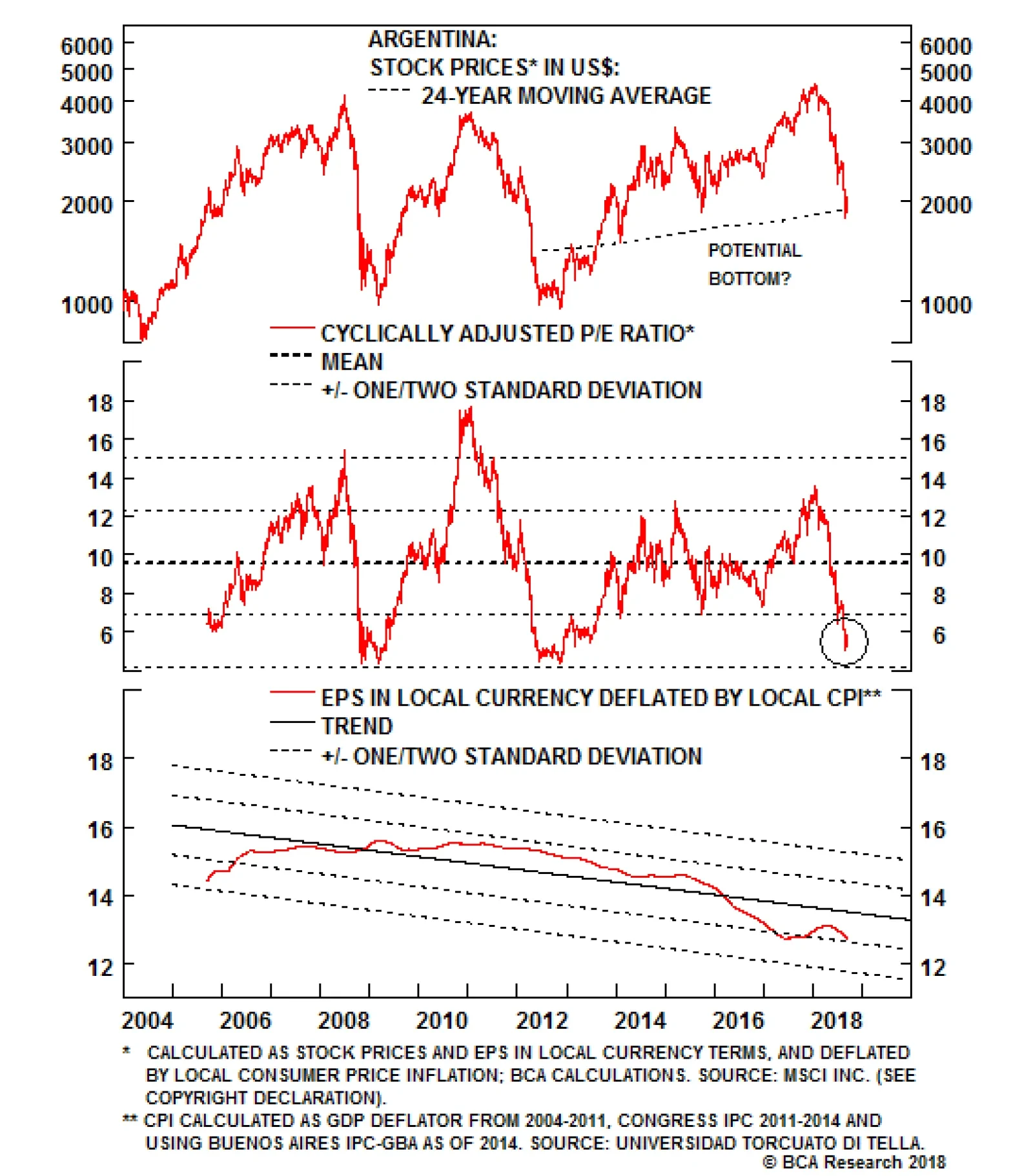

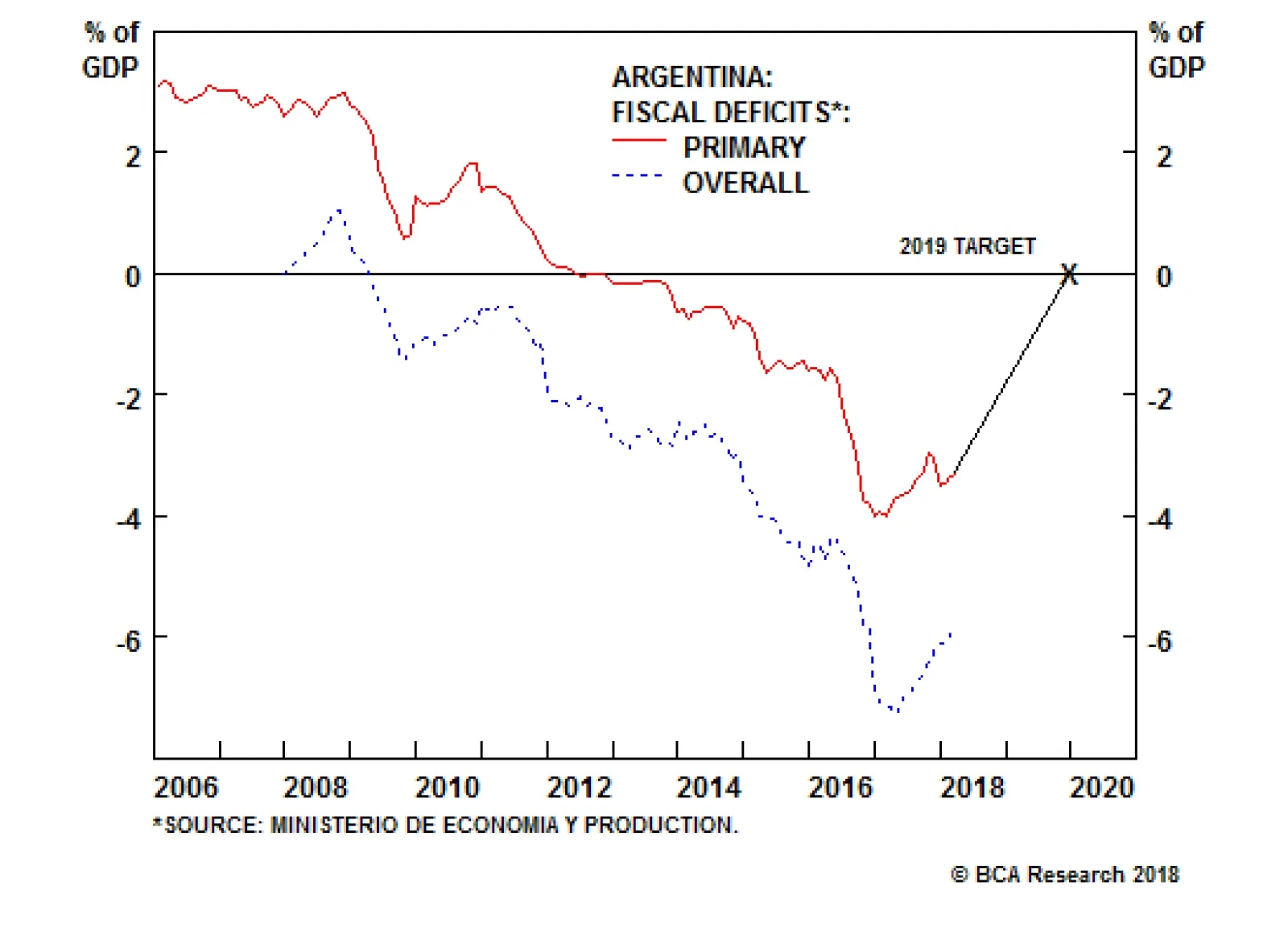

The massive underperformance of Argentine assets in 2018 shows that investors are intensely asking if the country is heading toward another sovereign default. This is a valid question, given that Argentina's foreign currency…

Highlights The U.S. dollar still has meaningful upside versus the majority of currencies. We continue to recommend shorting a basket of the following EM currencies versus the U.S. dollar: TRY, ZAR, BRL, IDR, MYR and KRW. Fixed-income…

Argentine financial markets have been rioting, with the currency plunging by 11% versus the U.S. dollar since the beginning of April. What is the underlying cause of turbulence, and what should investors do? Argentina's…

Argentine financial markets have been rioting, with the currency plunging by 11% versus the U.S. dollar since the beginning of April. What is the underlying cause of turbulence, and what should investors do? Argentina's macro…

Highlights Agricultural markets are informationally efficient for the most part, which is to say that at any given time, prices already reflect most public information available to traders, and a lot of private information as well. Even…

Highlights The main driving force behind EM risk assets this year has been downshifting U.S. interest rates and a weak U.S. dollar. These factors have more than offset the relapse in commodity prices and the deteriorating growth…

Hillary Clinton has a 65% chance of winning the election; she receives 334 electoral college votes according to our model. Trump still requires an exogenous shock to win. Meanwhile, the USD is poised to rally - and leftward-moving…