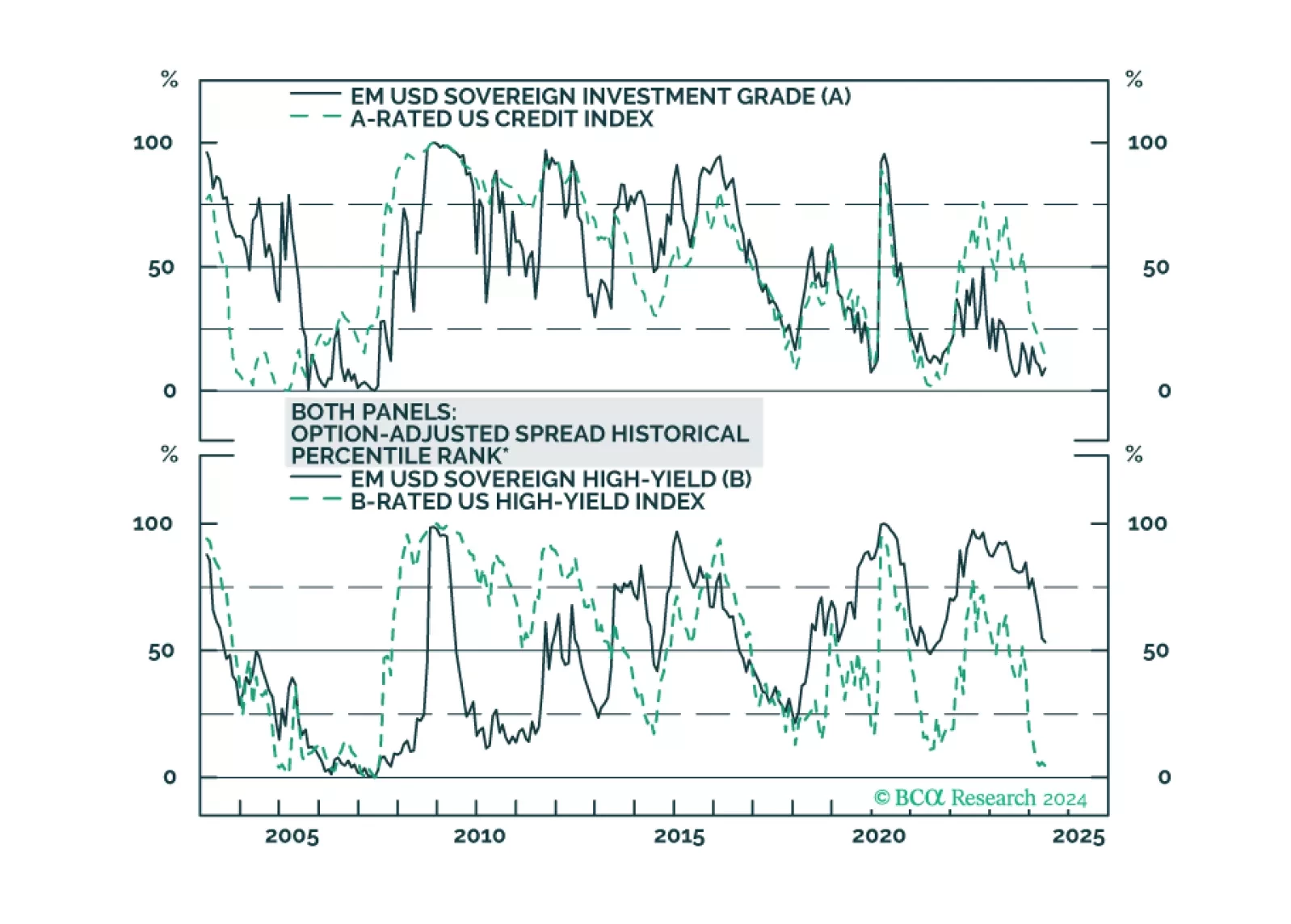

We dig into the USD-denominated Emerging Market Sovereign Index to see which credit tiers and countries offer value relative to US Credit.

According to BCA Research’s Emerging Markets Strategy service, while it may be tempting to bottom fish, the team advises that investors maintain a cautious stance on Argentinian sovereign credit. Even though the election…

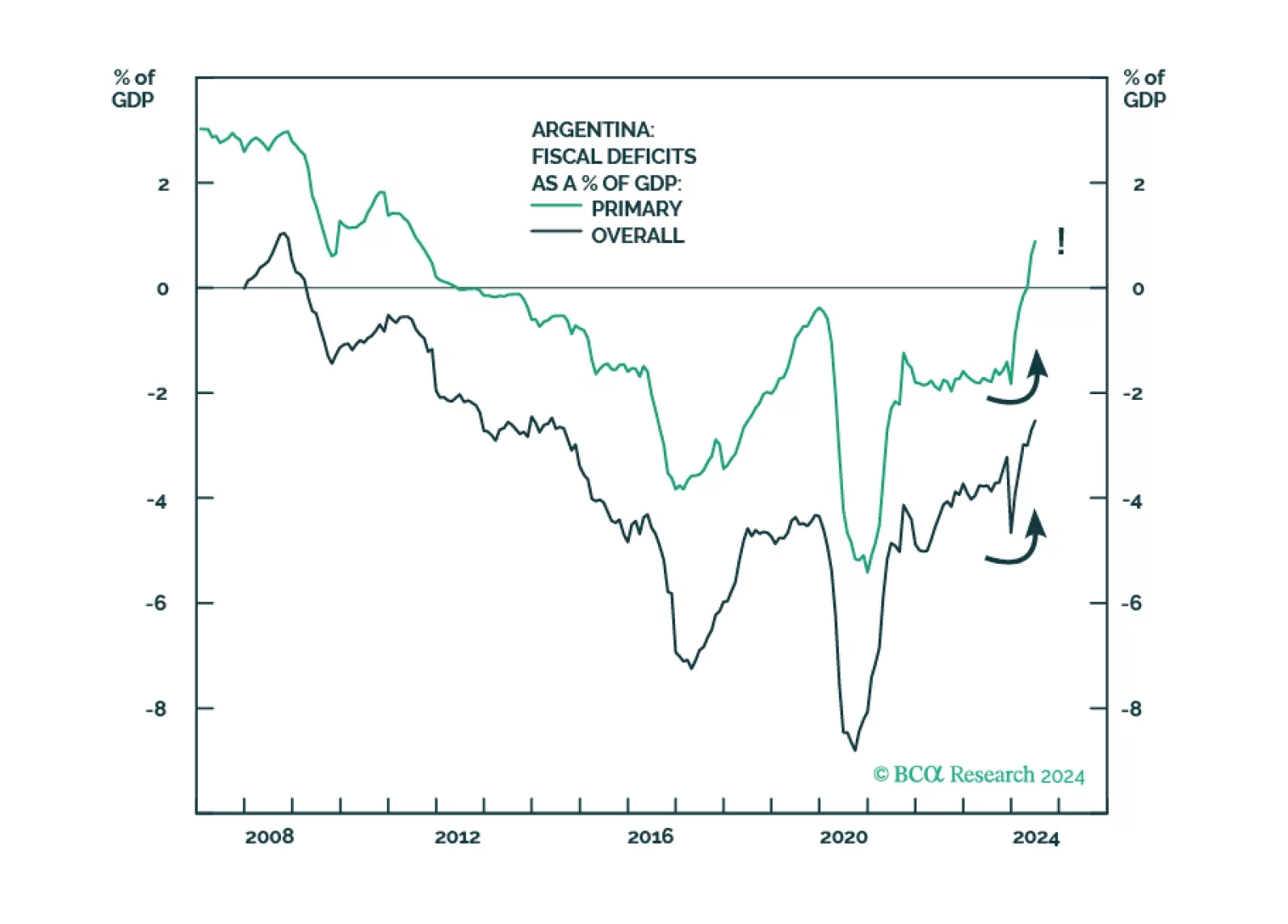

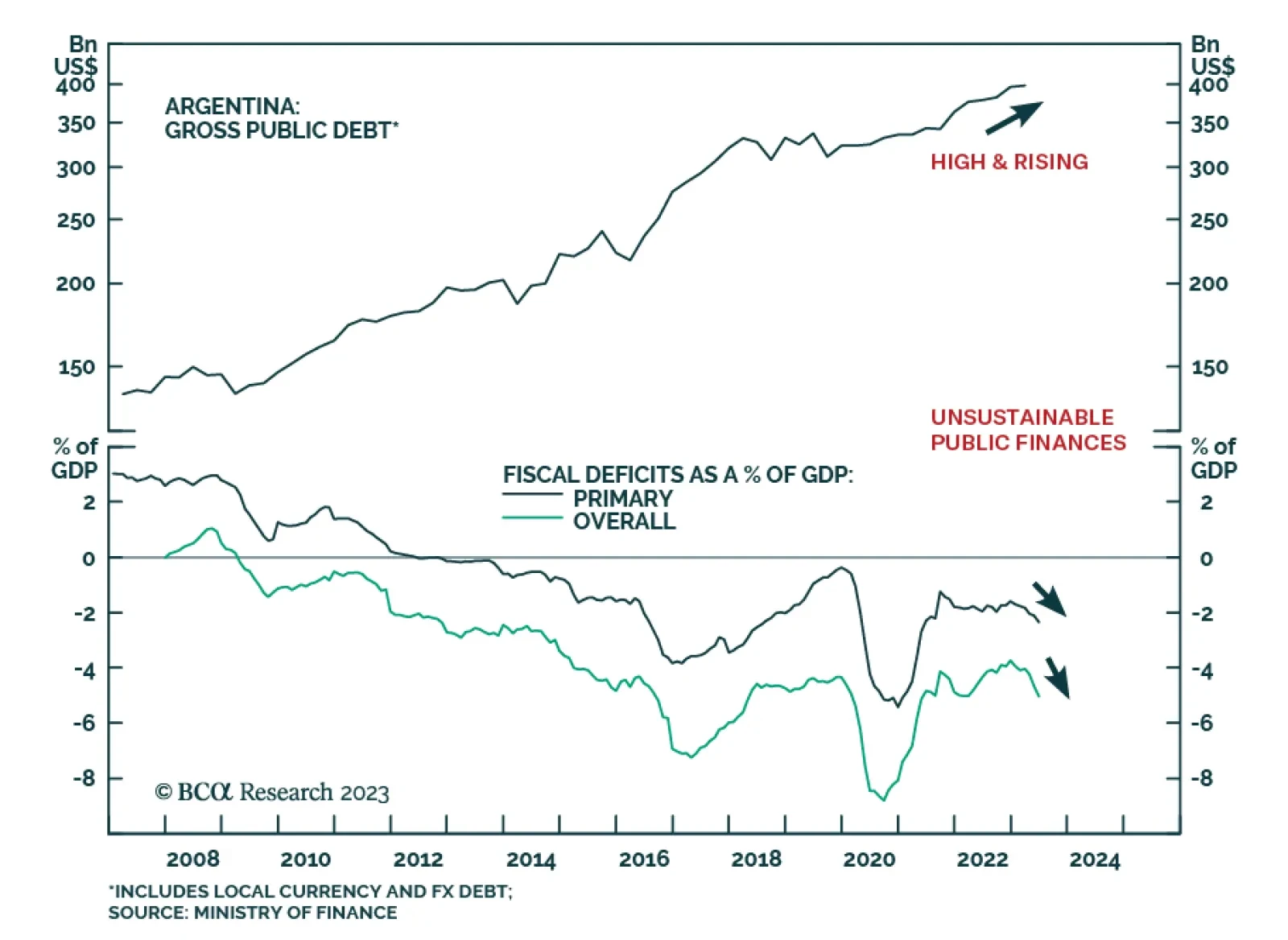

While it may be tempting to bottom fish, we advise that investors maintain a cautious stance on Argentinian sovereign credit. Even though the election of a right-wing candidate in the coming months may boost investor sentiment, the…

Chart III-1Downside Risks to Bond Prices Our view remains that debt negotiations will be drawn-out because the Argentine government is both unwilling and lacks the financial capacity to service public foreign debt. The…

Highlights Analyses on Asian semis, Argentina and Russia are available on pages 7, 12 and 14, respectively. The most likely trajectory for Chinese growth will be as follows: the initial plunge in business activity will be…

Analyses on the Philippines, Colombia and Argentina are available below. Highlights Global growth conditions, especially outside the U.S., remain bond friendly. Nevertheless, U.S. bonds are overbought and technical factors might…

The latest rout in Argentine markets has brought fears of another sovereign debt default or restructuring. Are conditions right for buying Argentine markets? Politics complicate the assessment of a debt restructuring and we do not…

The Argentine peso remains vulnerable due to deficient external funding and public debt sustainability concerns. A lack of external funding and a depreciating peso are causing rising inflation and interest rates. The latter are spurring a…

Analysis on the Philippines and Argentina are below. Highlights Analysis on the Philippines starts on page 9 and Argentina on page 12. Relative return on capital for non-financial corporations points to continuous EM equity…