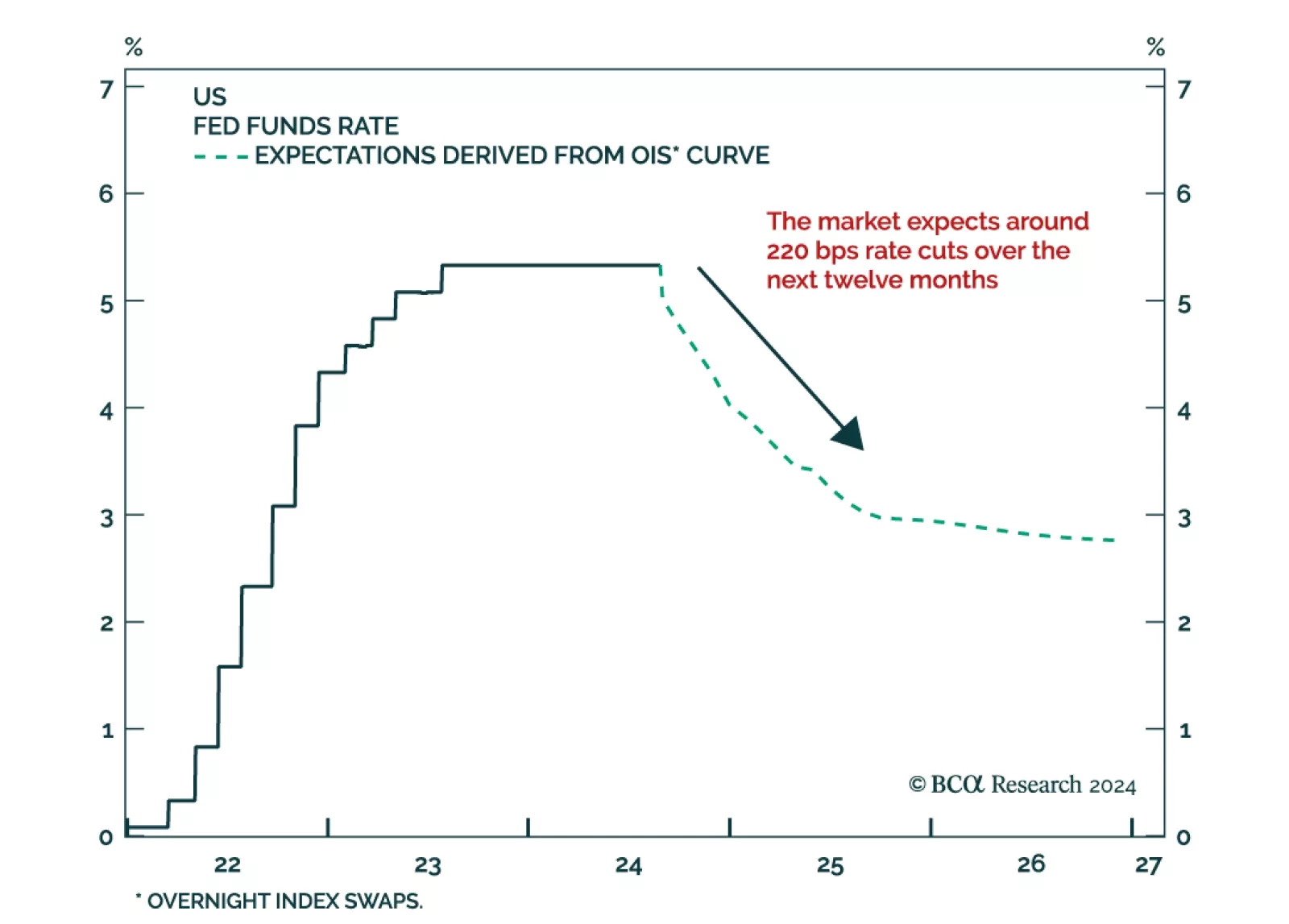

The market is currently expecting the Fed to cut rates by 100 bps over the course of 2024 and by another 120 bps throughout the first eight months of 2025. However, our Global Investment strategists expect the extent of 2024…

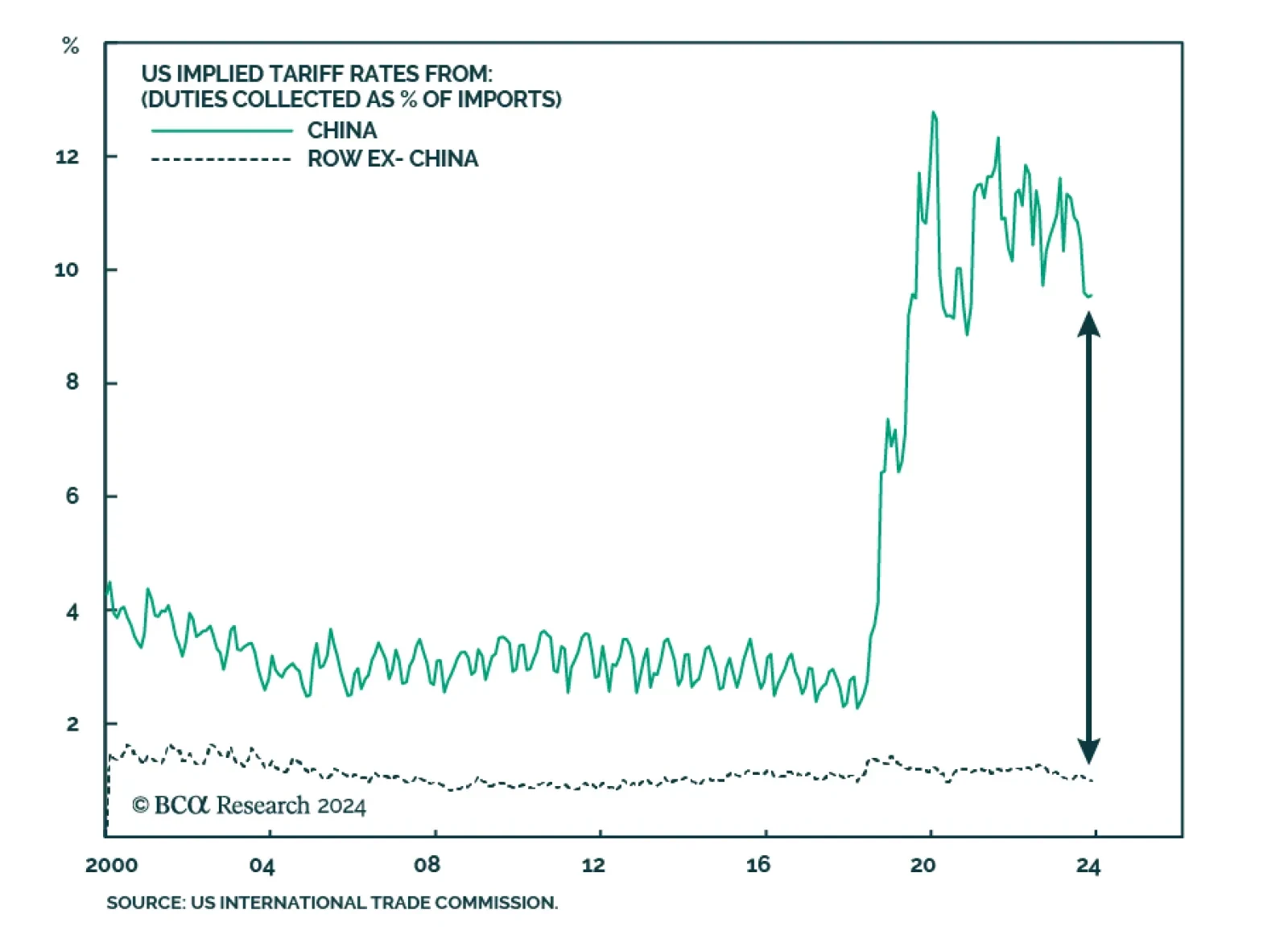

According to BCA Research’s Geopolitical Strategy service, US policy will have an impact on China’s willingness to adopt a preemptively hawkish foreign policy. But the US is in the middle of a chaotic election that…

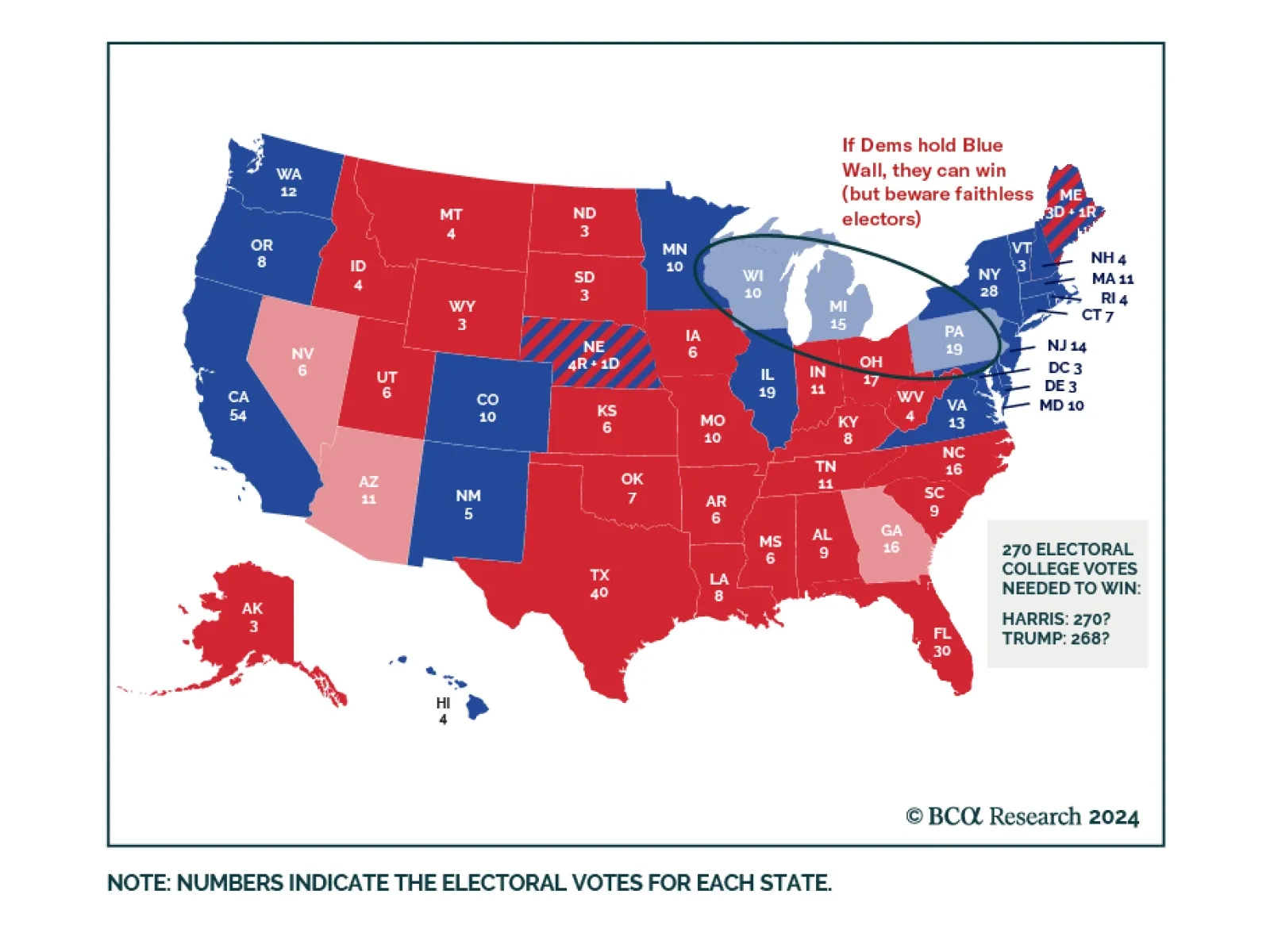

According to BCA Research’s US Political Strategy service, there is a strange quirk about Walz and the state of Nebraska that could have national consequences in the black swan scenario of an electoral college tie. Walz…

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

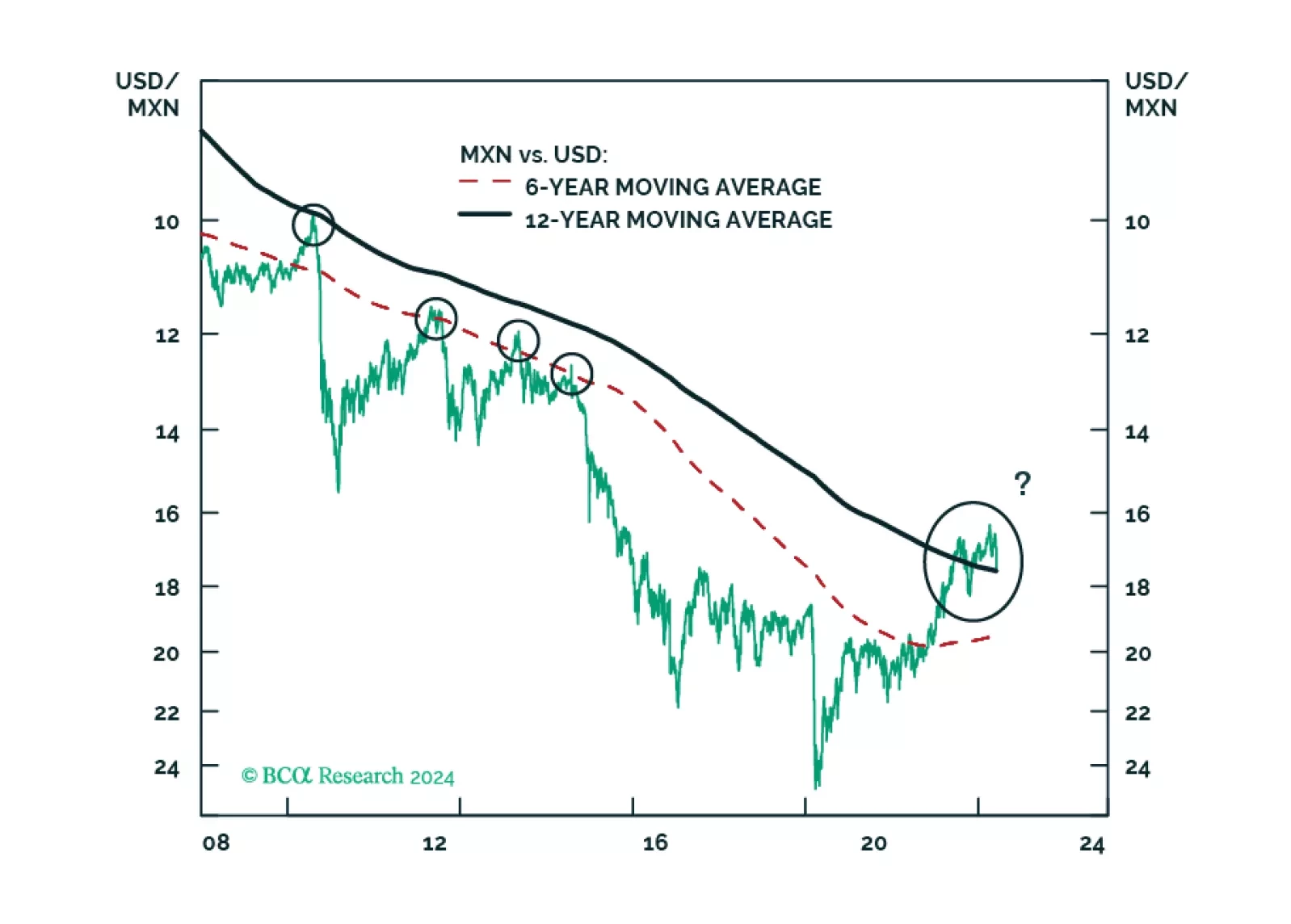

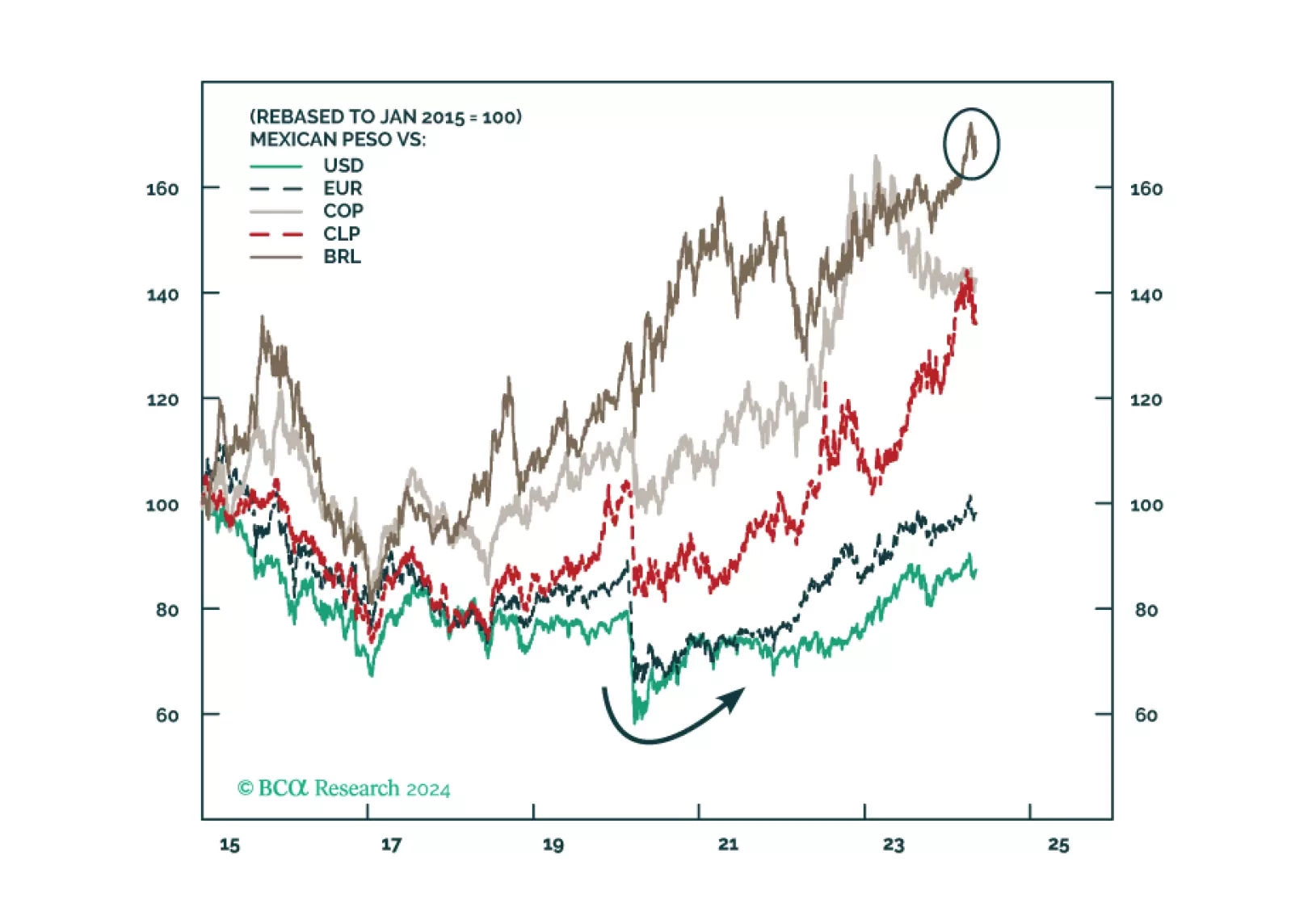

MORENA has once again swept the Mexican election: Claudia Sheinbaum will be president, with little to no constraint in Congress. All in all, Mexican politics will remain stable and overall supportive of markets. In the medium term,…

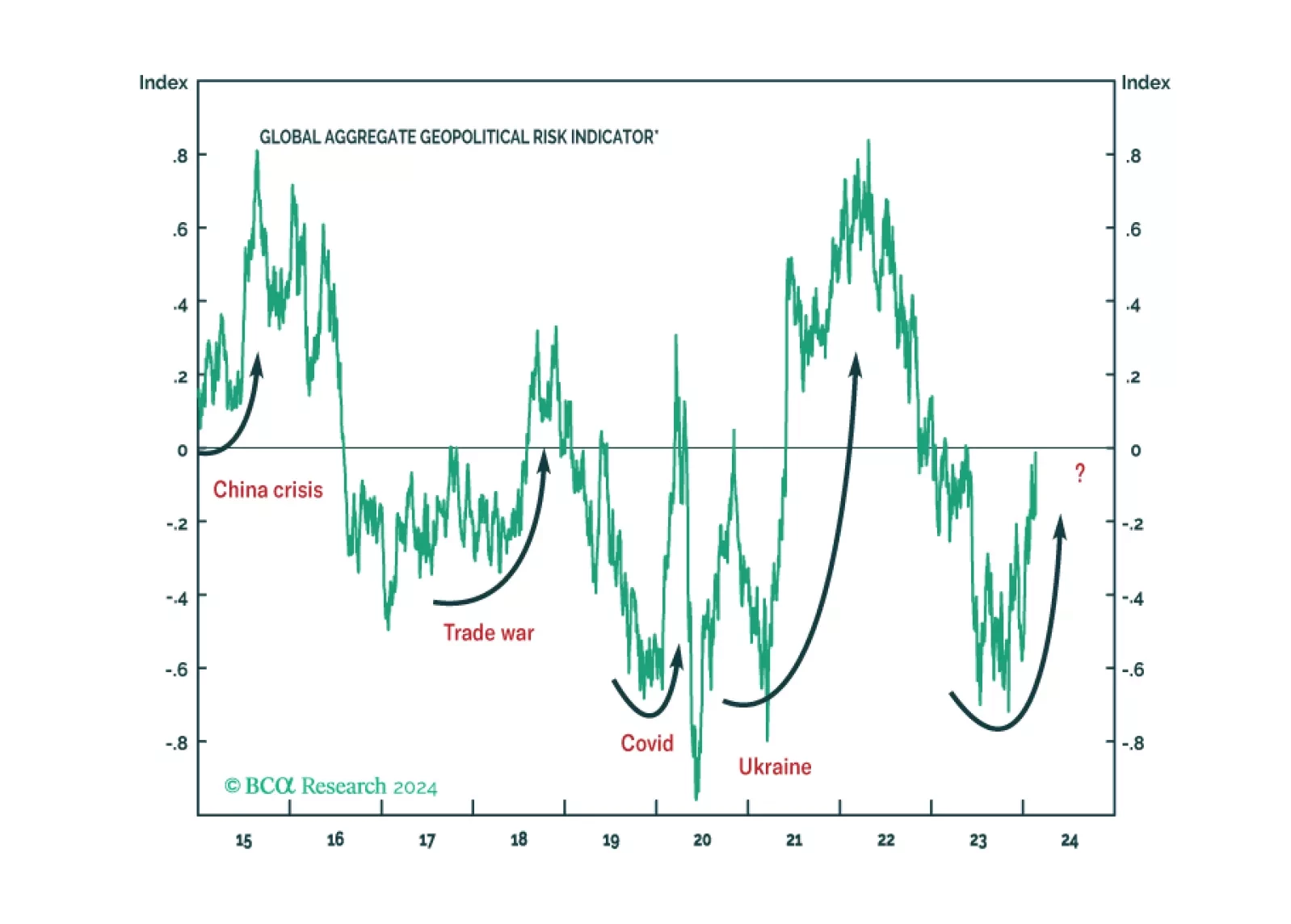

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

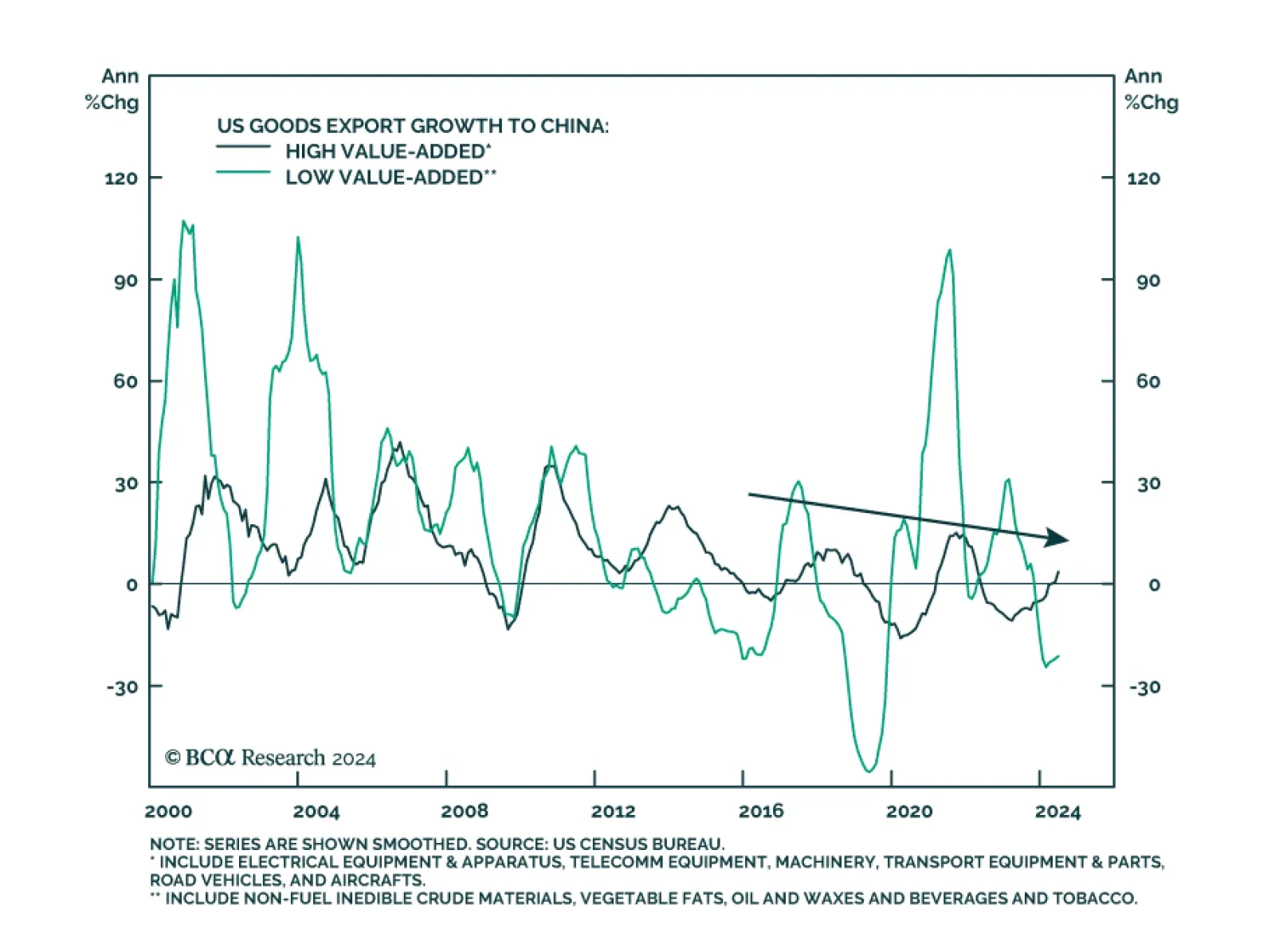

The Chinese economy continues to face deflationary pressures, reducing the odds that any intervention-driven rebound in equities will be sustained. In addition, our Geopolitical strategists have argued that US-China relations…