Momentum, high cash balances, FOMO, and expectations of soft landing drive the market higher. This rally may continue for a while, but macroeconomic headwinds are intensifying and will eventually derail the rally. It is too early to…

Machine learning has made significant progress in the physical sciences, although it has some ways to go in the social sciences. When asked to make predictions on oil markets, ChatGPT's responses lack in-depth analysis given its…

According to BCA Research’s European Investment Strategy service, the Dutch market will be the main European beneficiary of expanding spending on AI. The crucial factor constraining the deployment and expansion of AI is…

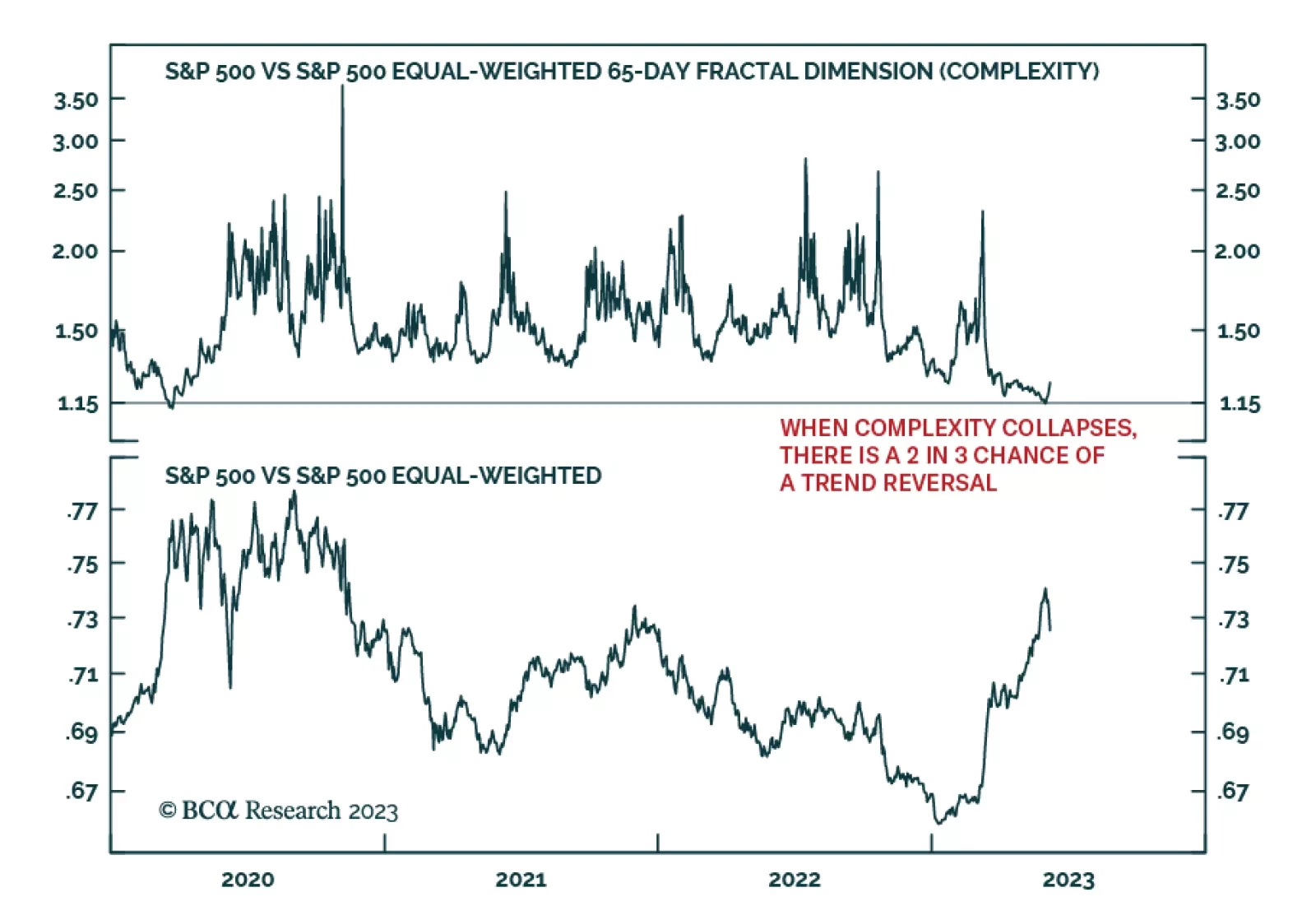

According to BCA Research’s Counterpoint service, an analysis of the AI rally’s complexity suggests that the rally is nearing a potential reversal point. Can the AI euphoria continue to drive the S&P 500 higher…

What’s going on? The market-weighted stock market is up. But the equally-weighted stock market is not up. Neither is credit. Neither are industrial metal prices. Neither is the oil price, despite two waves of OPEC output cuts. We…

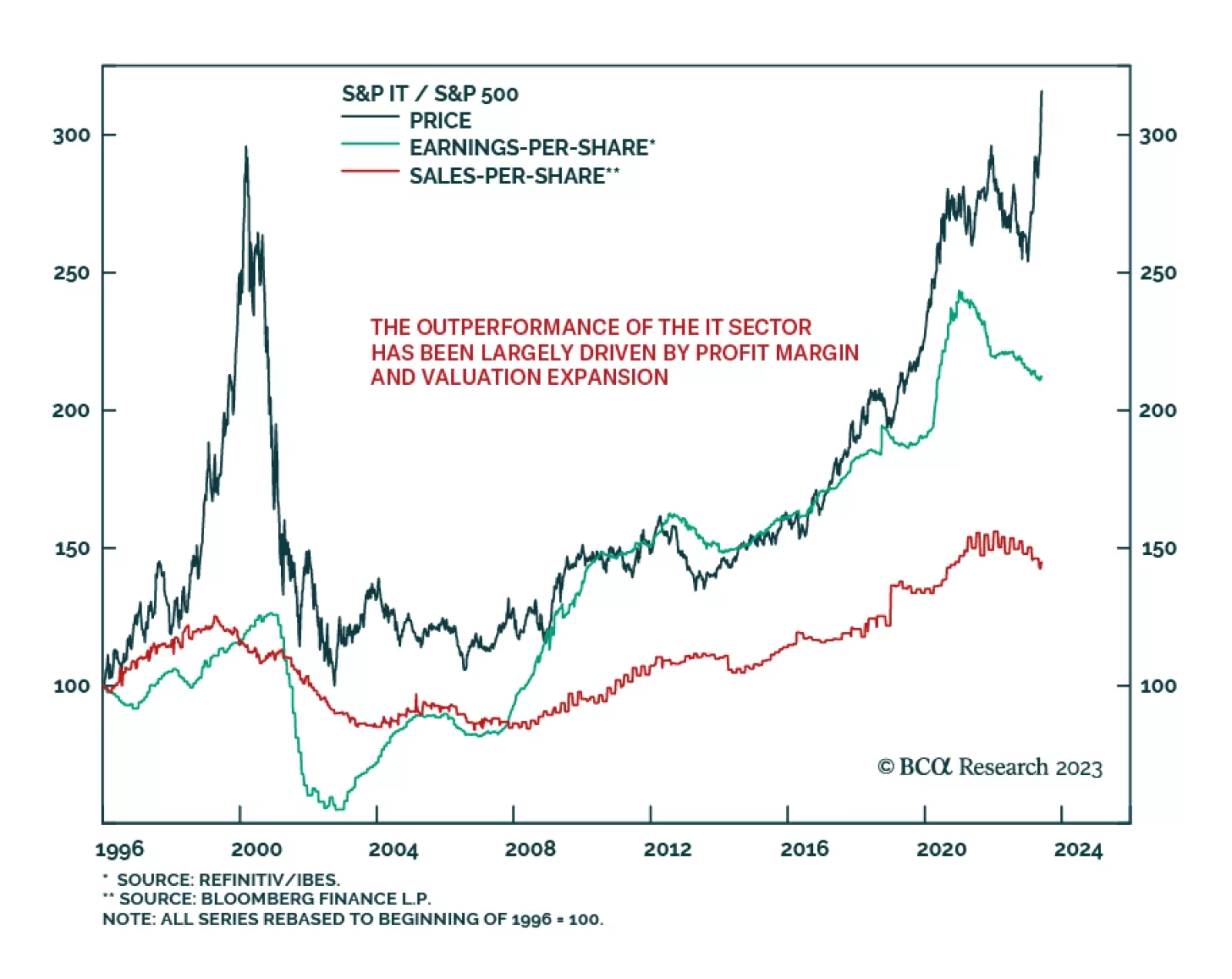

Most of the profits that today’s internet companies earn stem from the quasi-monopoly power that they enjoy. According BCA Research’s Global Investment Strategy service, it is possible that AI will have the…

The AI craze could further lift stock prices, boost capex, and delay the onset of the next recession. Looking further out, reaping the profit windfall from AI may take longer than many investors expect.

Once the debt ceiling soap opera ends, investors will likely turn their attention to some of the tailwinds supporting stocks. These include stronger earnings growth, diminished bank stresses, better housing data, early signs of an…

The Q1-2023 earnings season has surprised as companies’ results point to the end of the earnings recession. However, the good news is already priced in – the market has barely budged over the past six weeks. Earnings rebound may…