Our Portfolio Allocation Summary for May 2025.

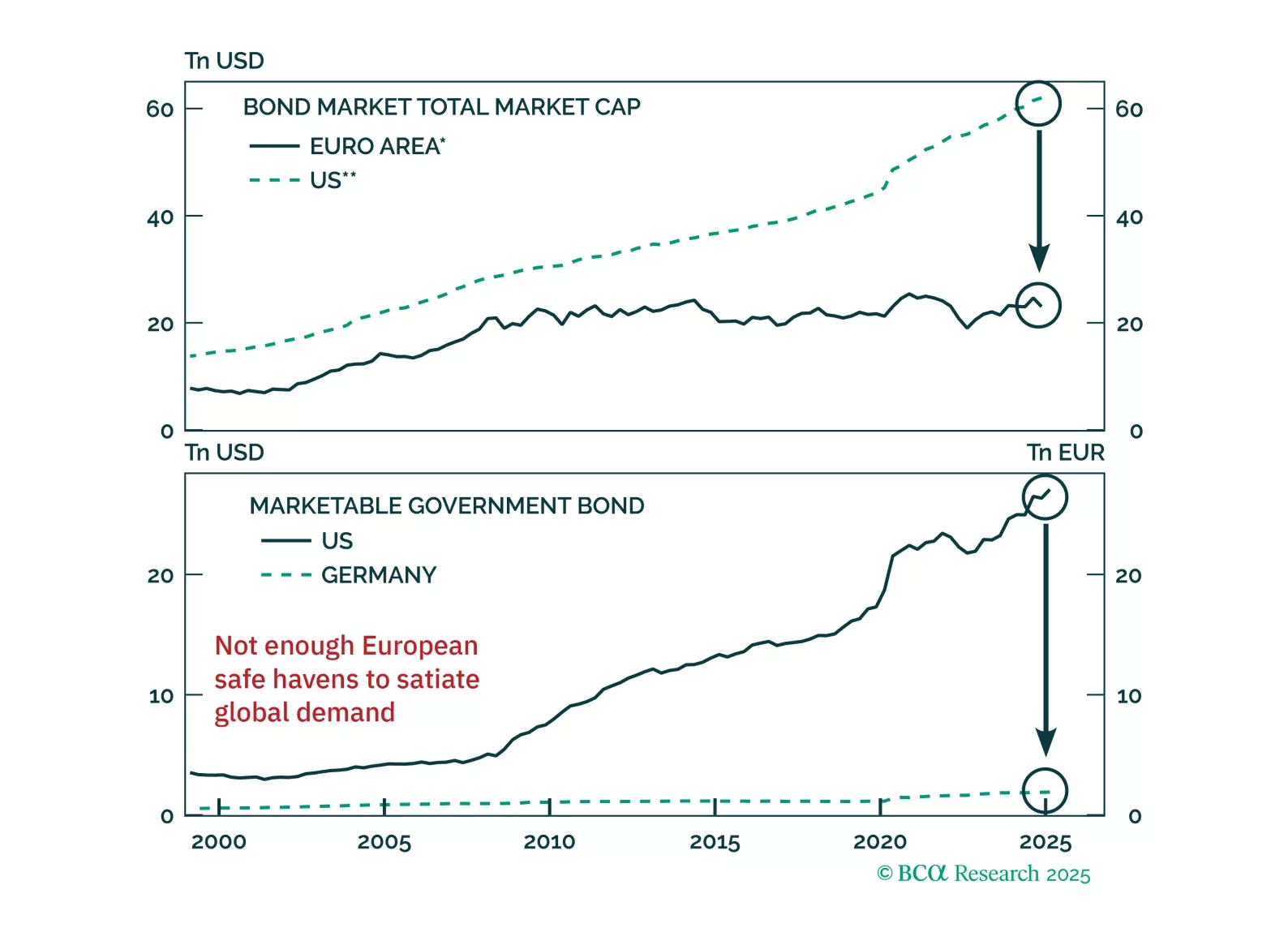

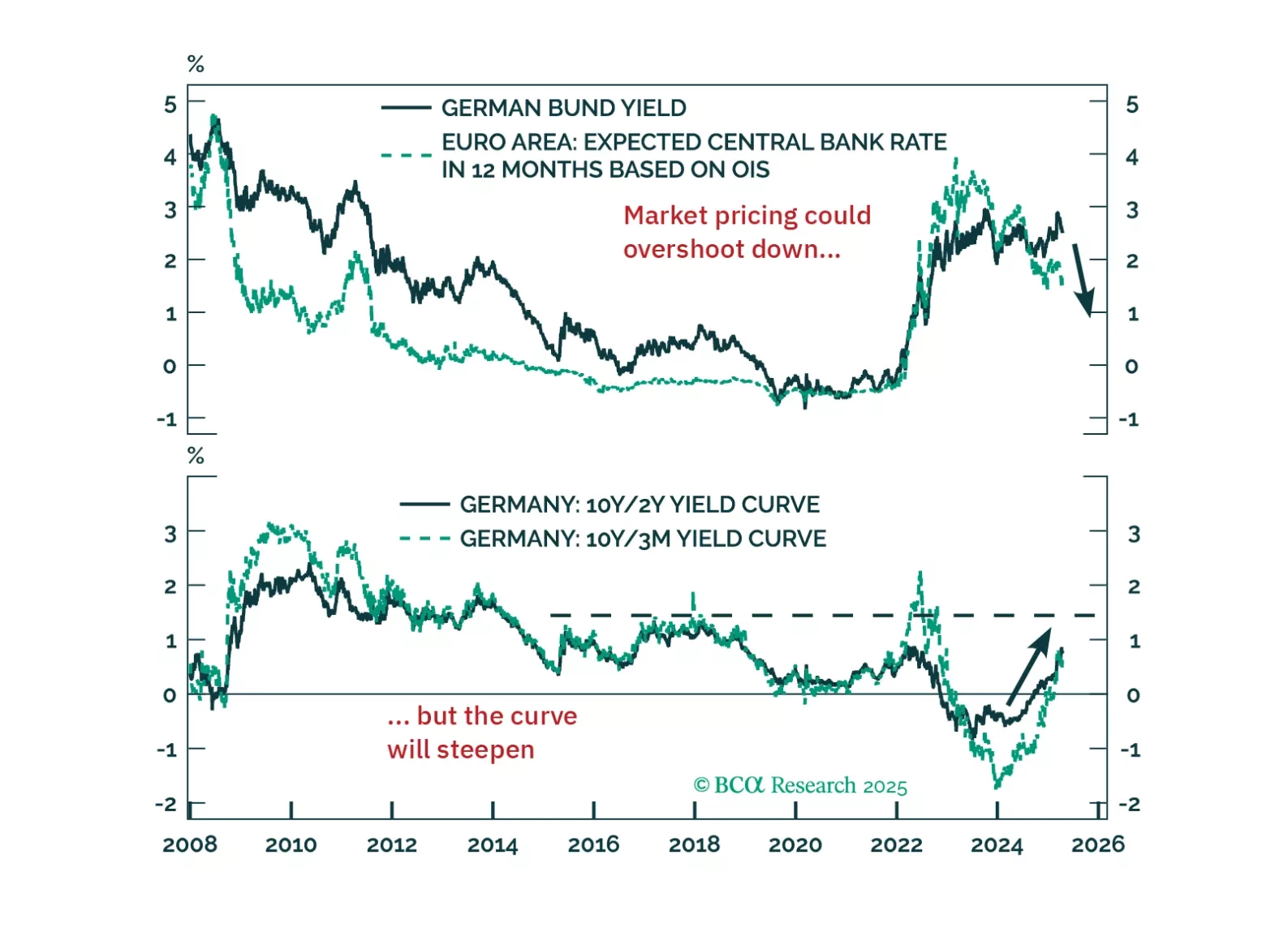

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.

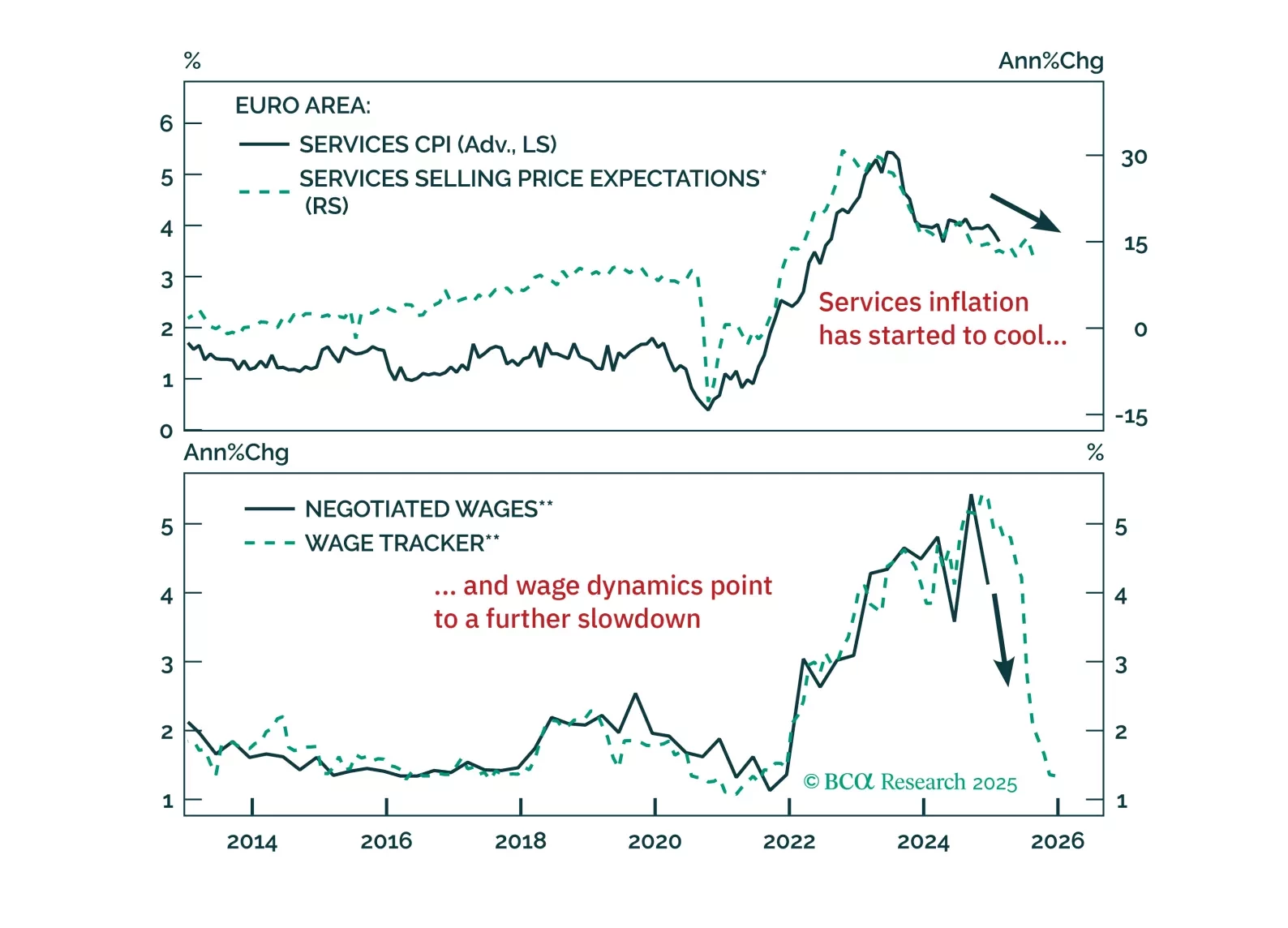

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

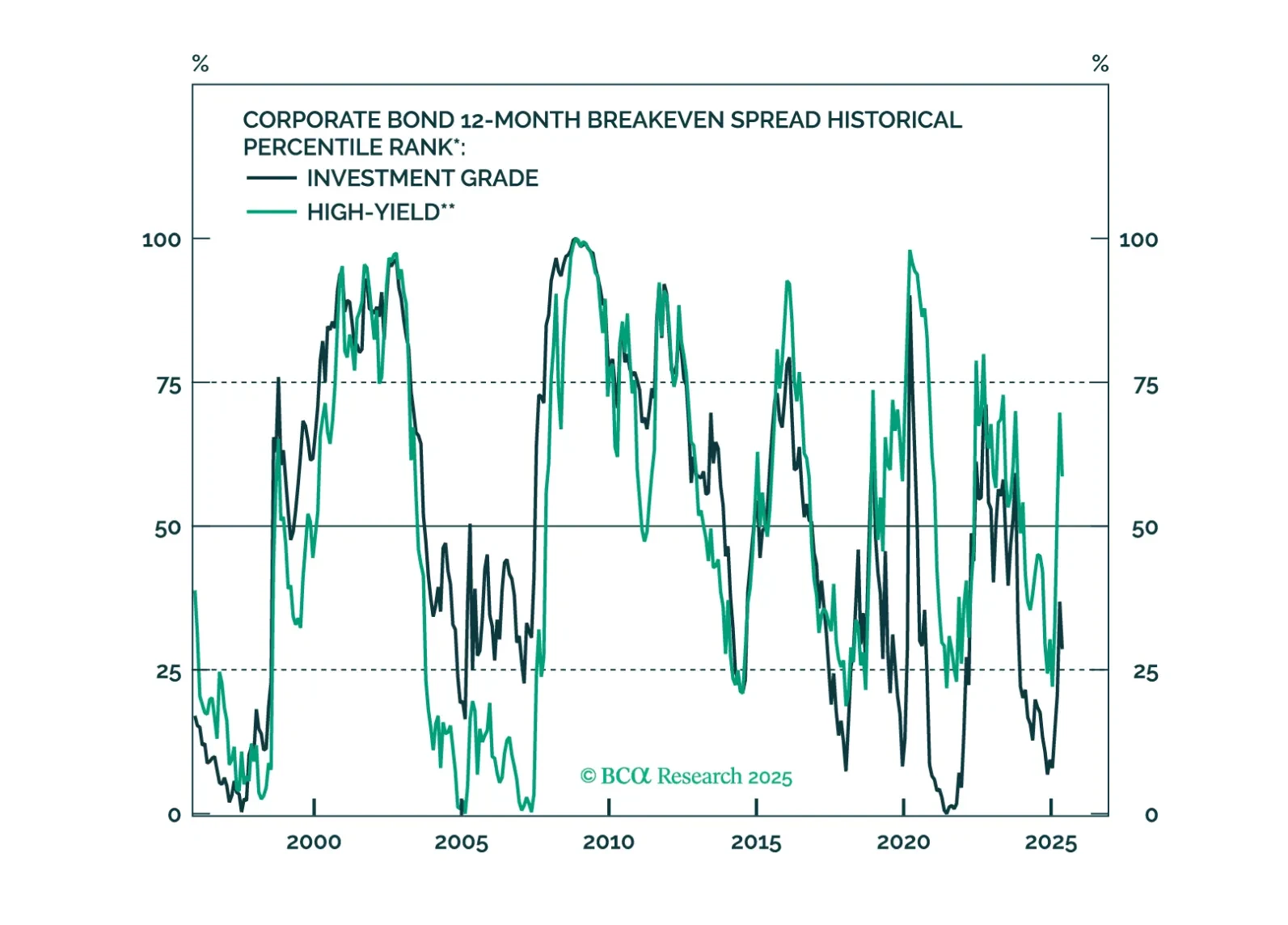

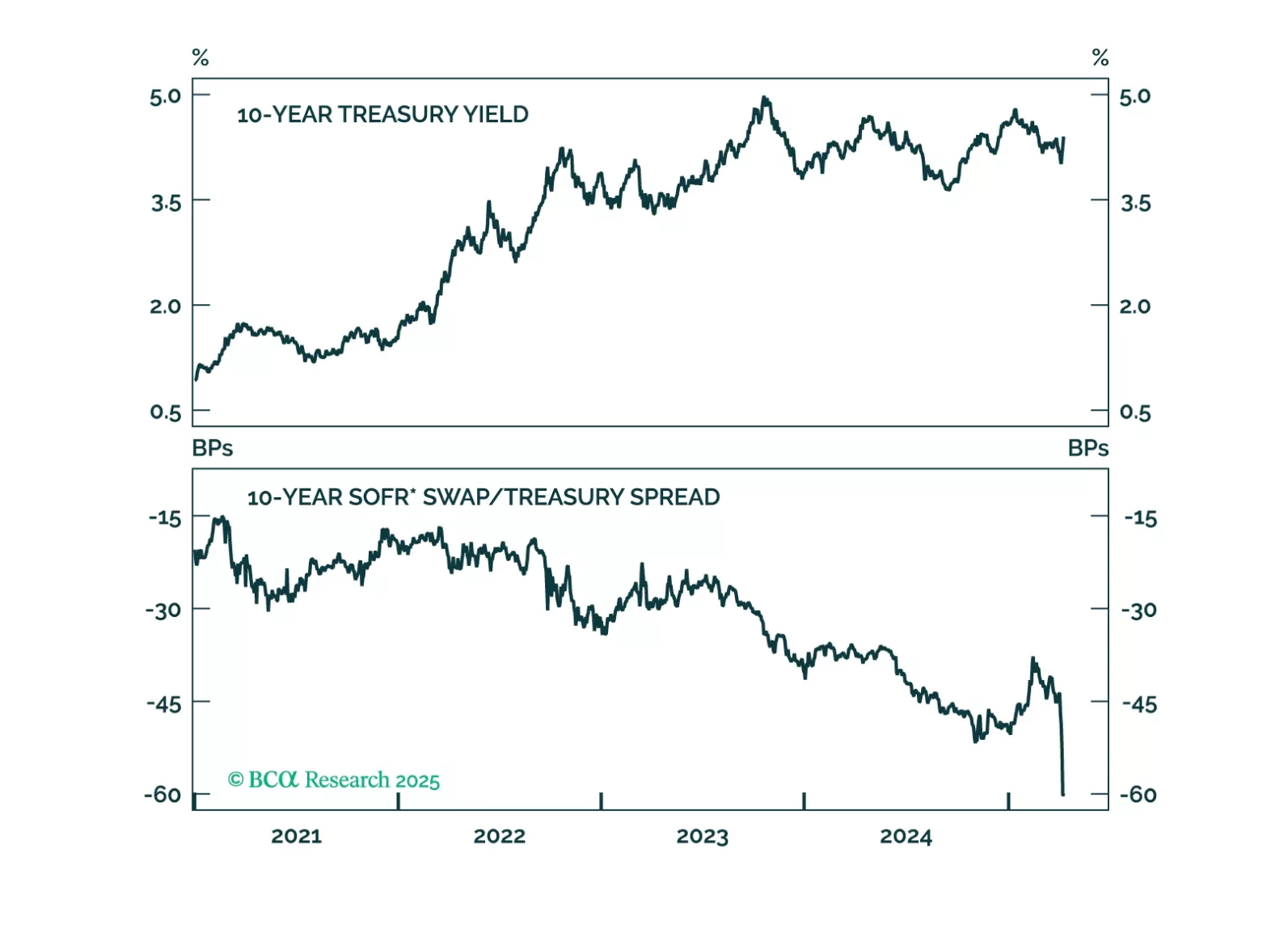

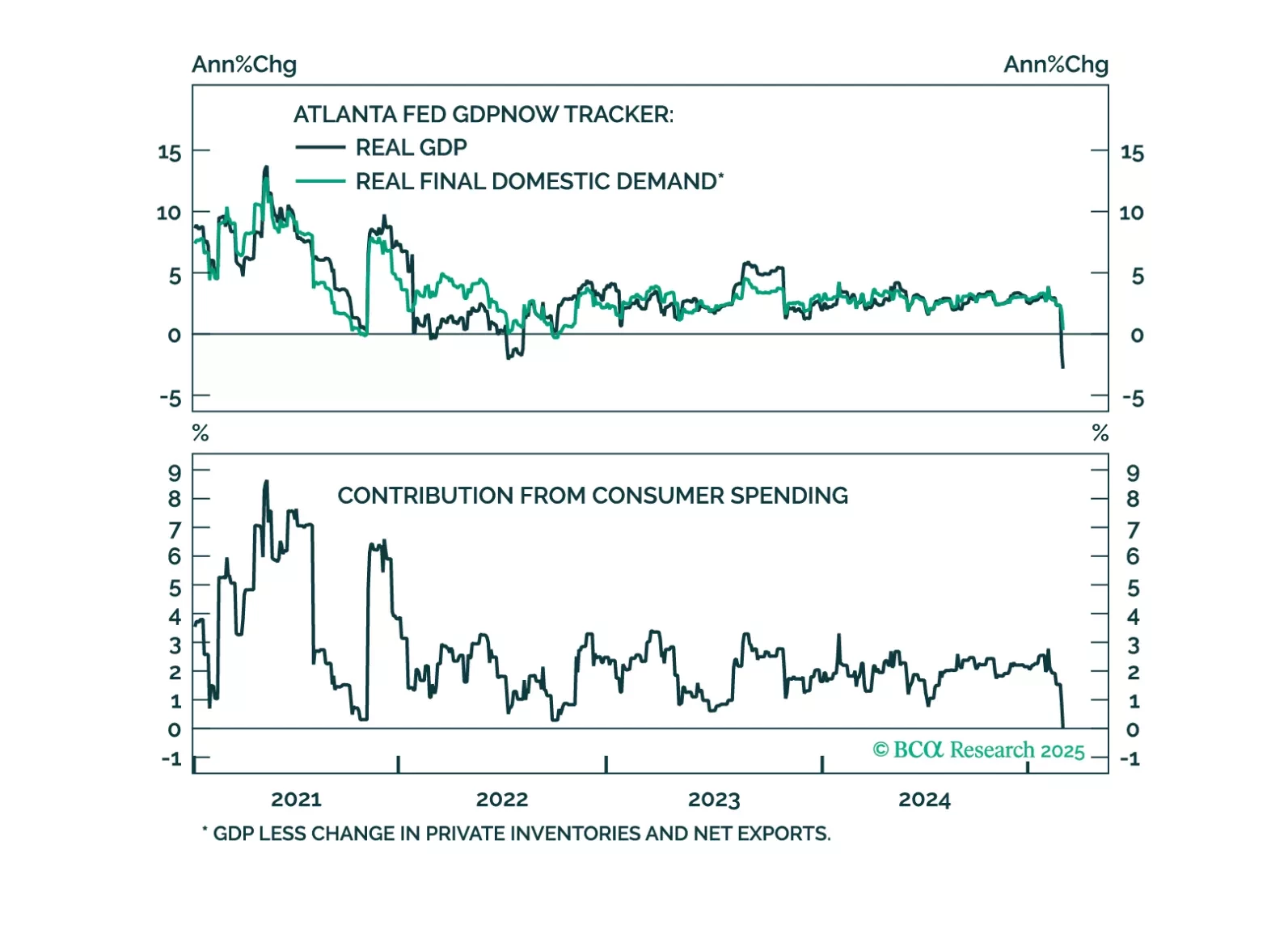

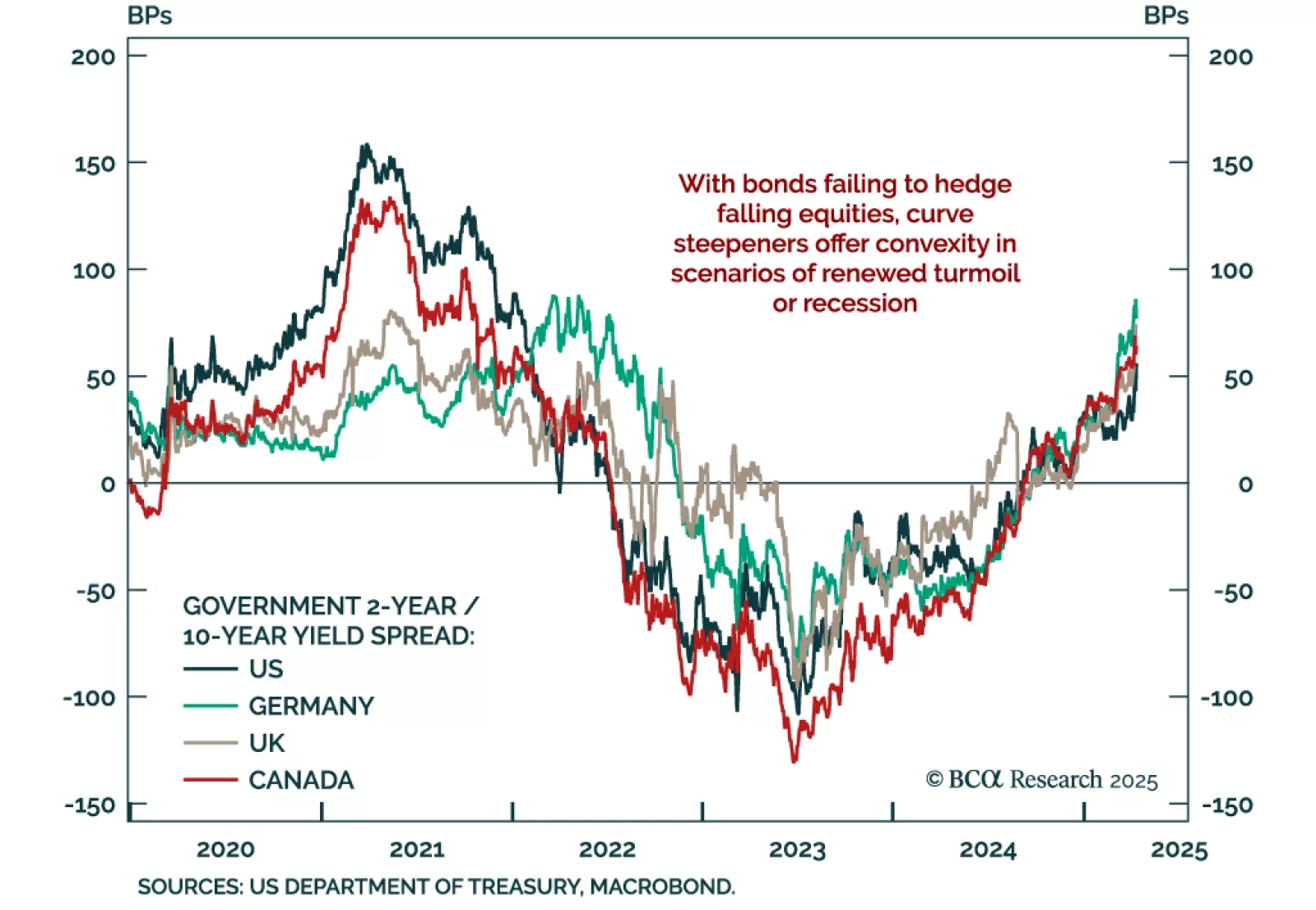

Bonds are failing to deliver defensive convexity; asset allocators should look to tactical curve steepeners for protection. Despite rising growth fears, Treasury yields have risen sharply at the long end. This is a clear break from…

Our Portfolio Allocation Summary for April 2025.

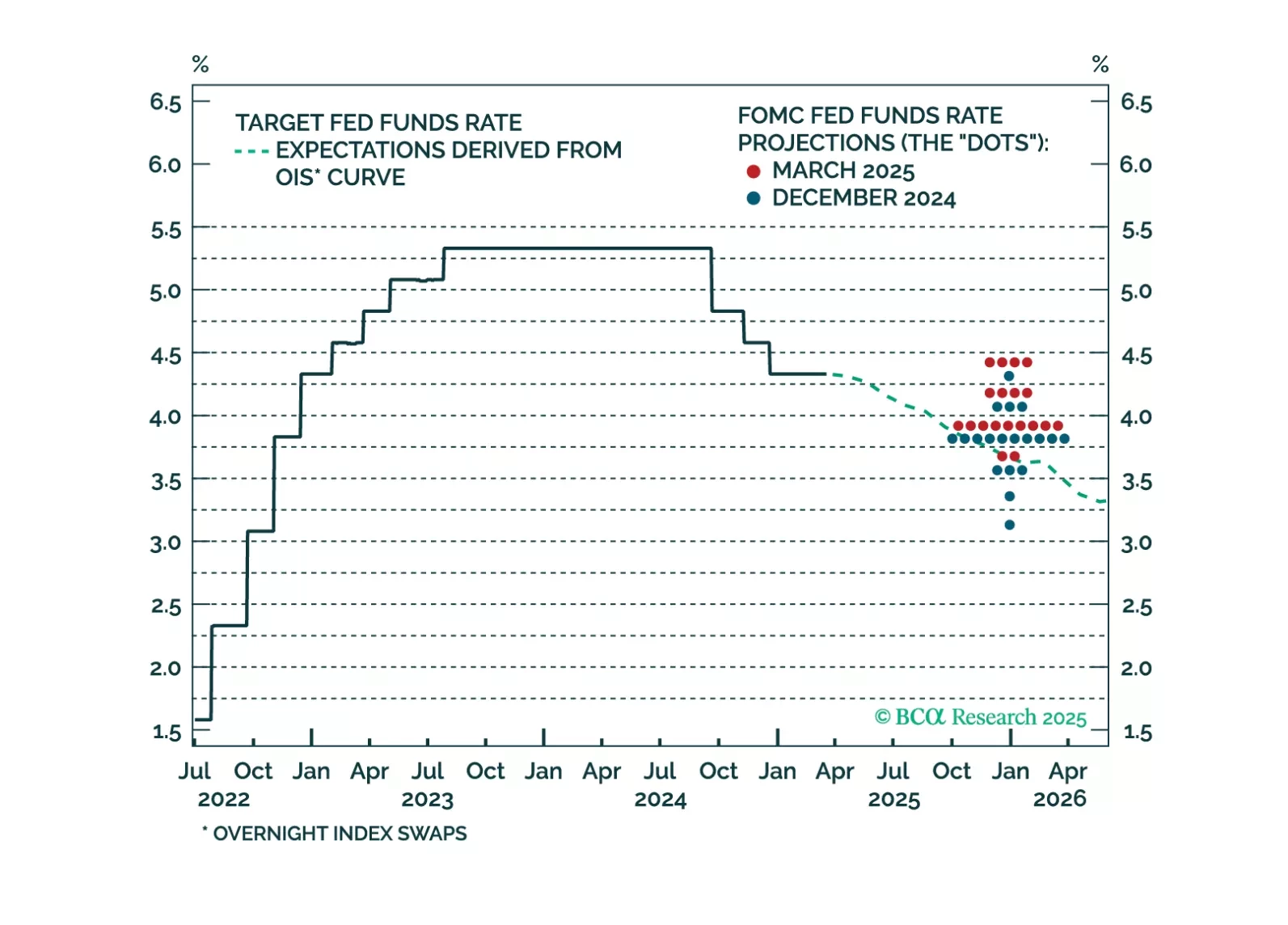

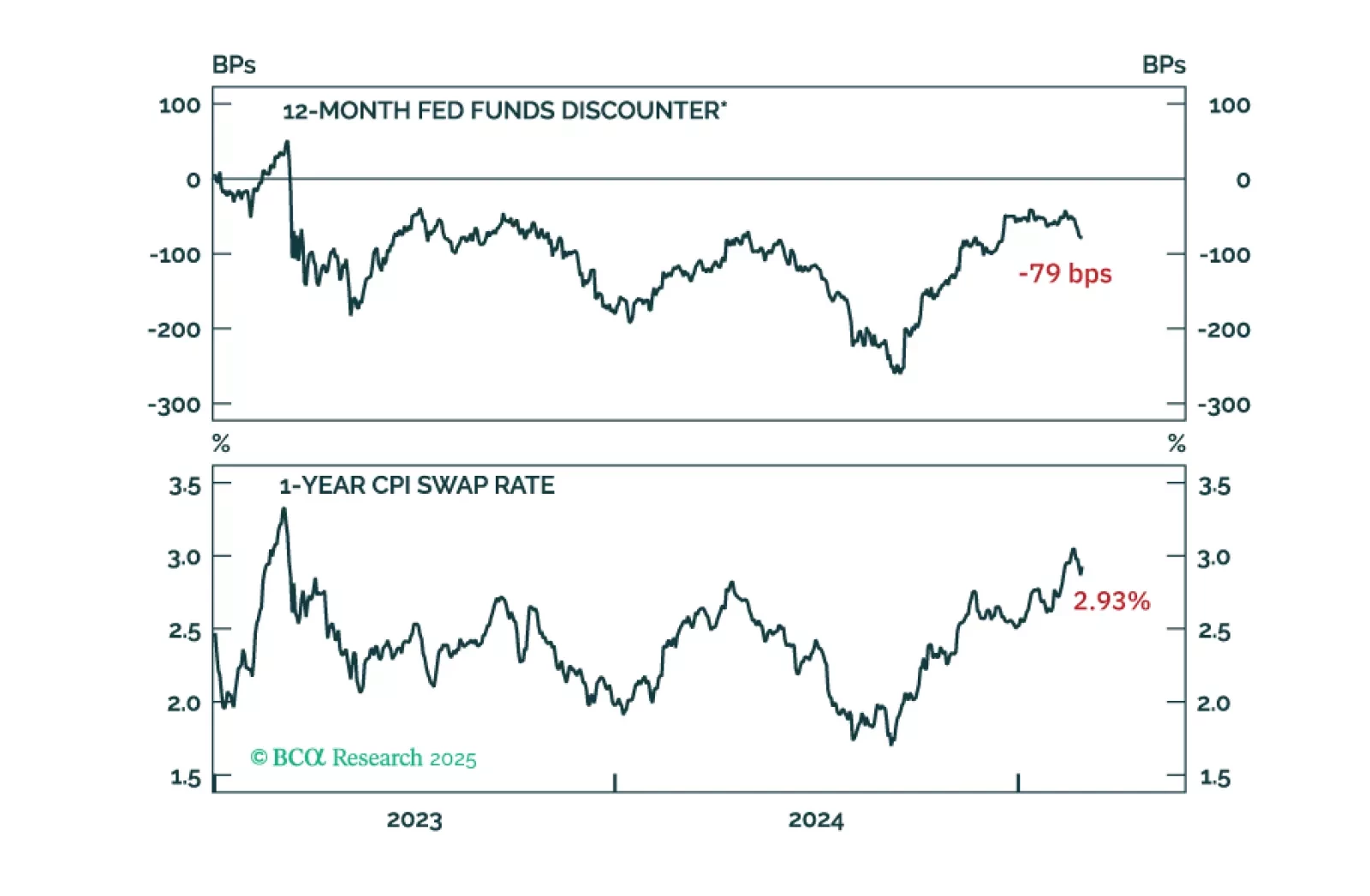

The market reaction to this afternoon’s Fed meeting looks overdone. Investors could be in for a hawkish surprise when it becomes apparent that the Fed won’t ease policy into higher tariff-driven inflation prints.

The ECB cut rates as expected, but rising yields and a stronger euro are tightening financial conditions just as fiscal policy shifts the macro landscape. With more rate cuts ahead and market positioning stretched, we outline the key…

Our Portfolio Allocation Summary for March 2025.

Core PCE inflation was tame this morning, but with large tariffs looming we anticipate loftier inflation readings in the months ahead.

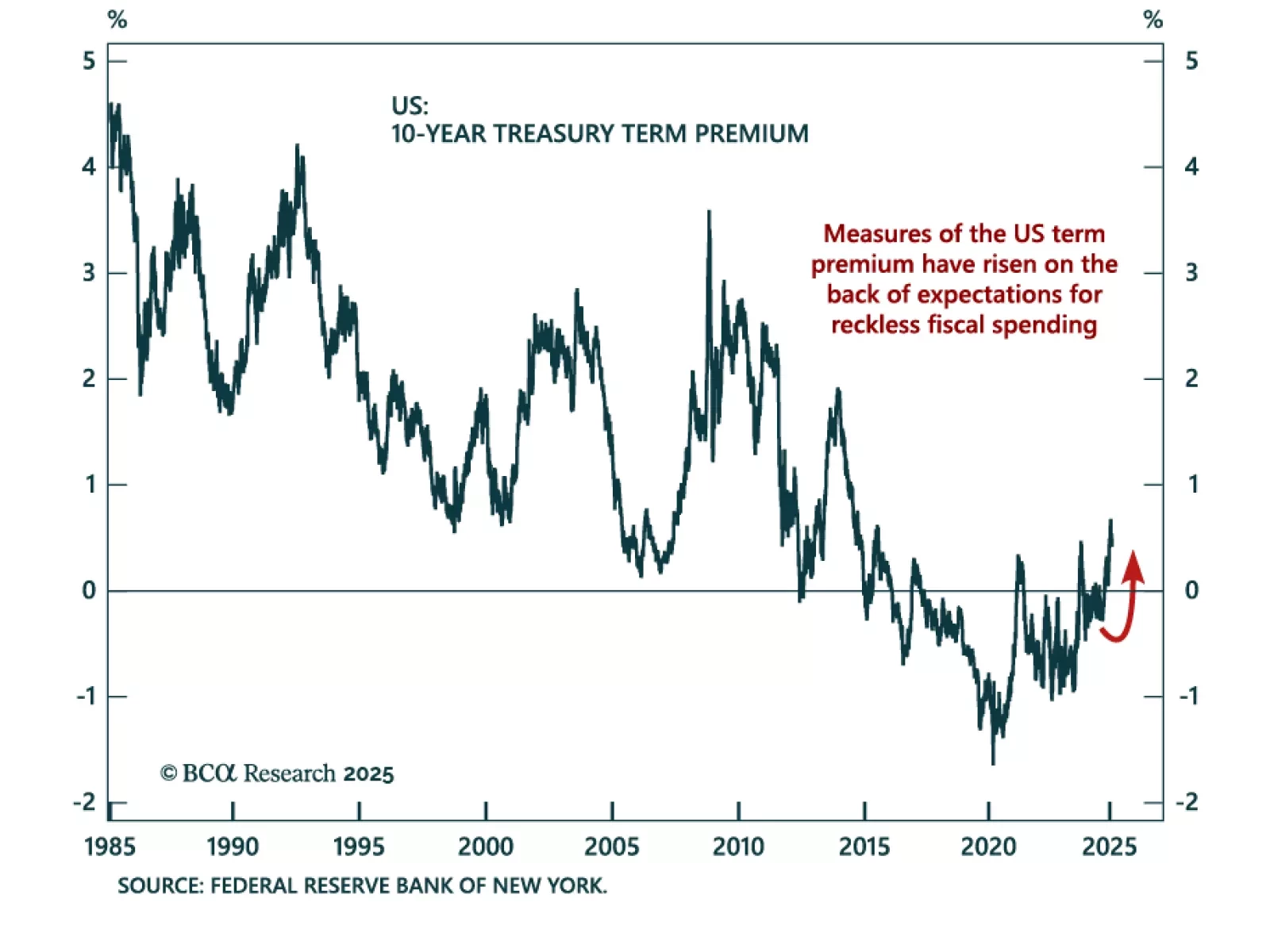

Treasury Secretary Scott Bessent commented that one of the Trump administration’s priority was lowering 10-year bond yields. Bessent’s 3/3/3 plan, boosting growth to 3% from deregulation, increasing US oil production by 3 mmb/d, and…