Our Portfolio Allocation Summary for August 2025.

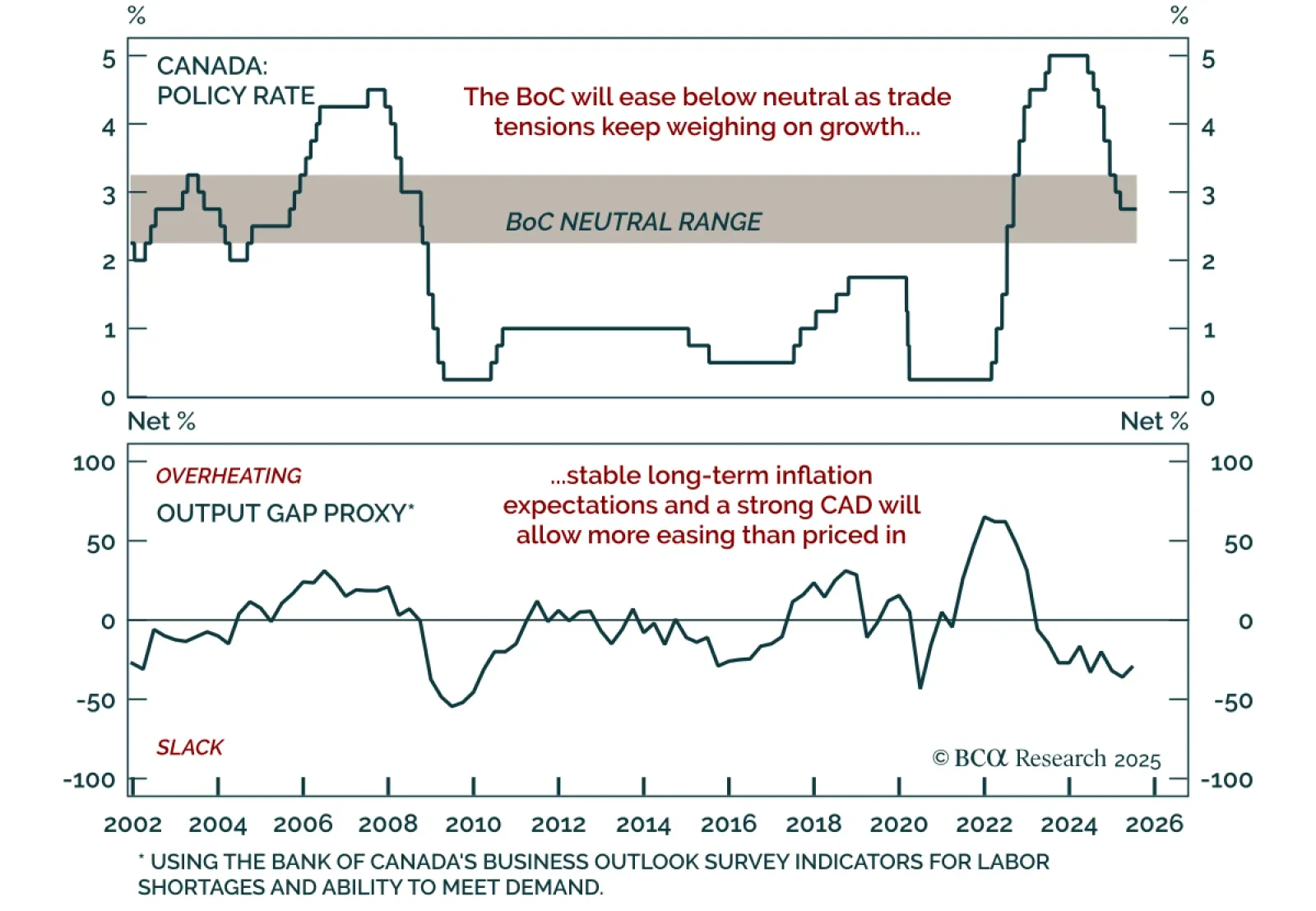

The BoC held rates at 2.75% for a third consecutive meeting, but a weak growth outlook and contained inflation reinforce our overweight in Canadian bonds. With policy within the 2.25%–3.25% neutral range, the BoC remains…

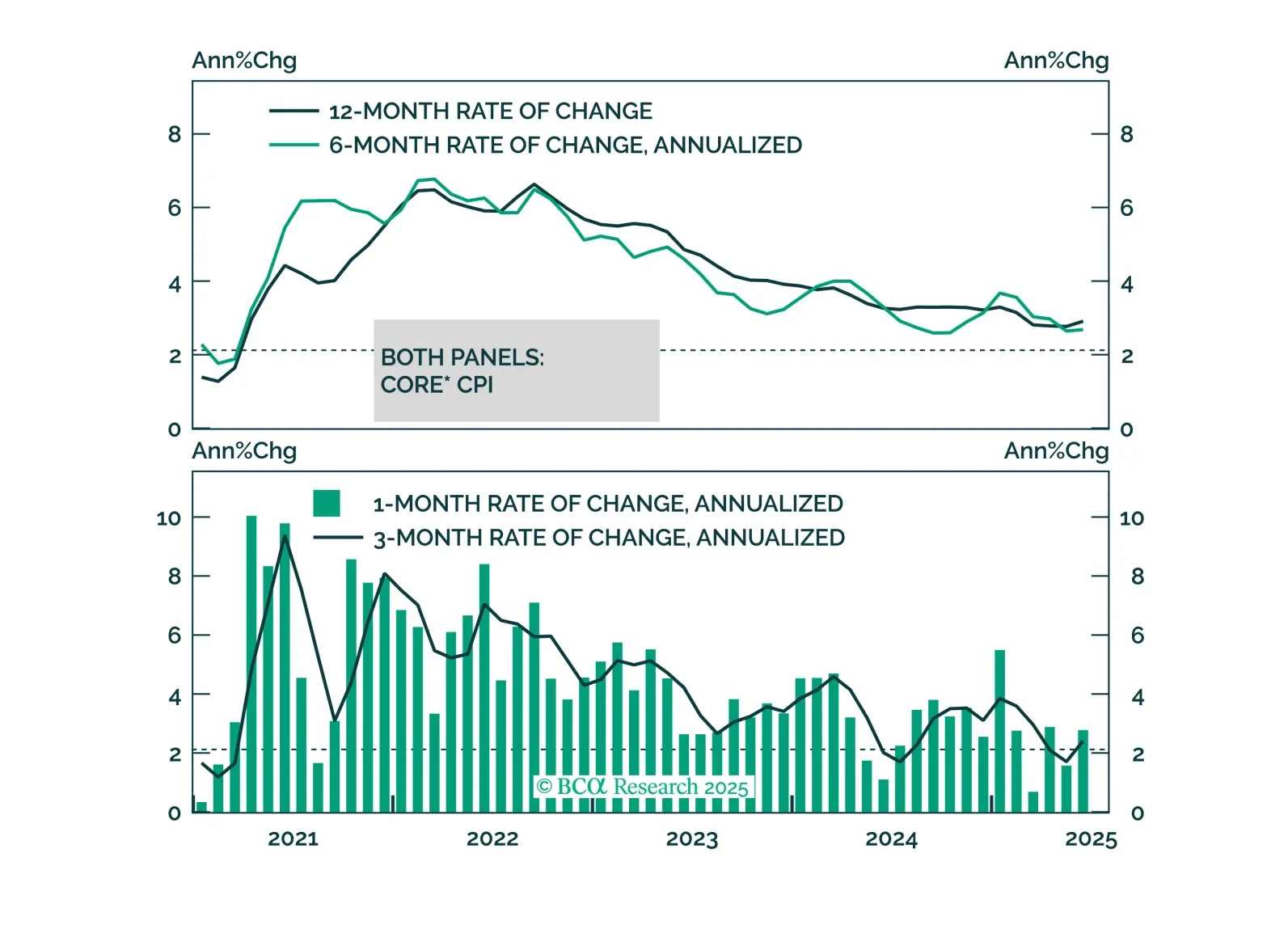

We discuss the implications of this morning’s CPI report and the relative attractiveness of 2/5 Treasury curve steepeners.

Our Portfolio Allocation Summary for July 2025.

Our Portfolio Allocation Summary for June 2025.

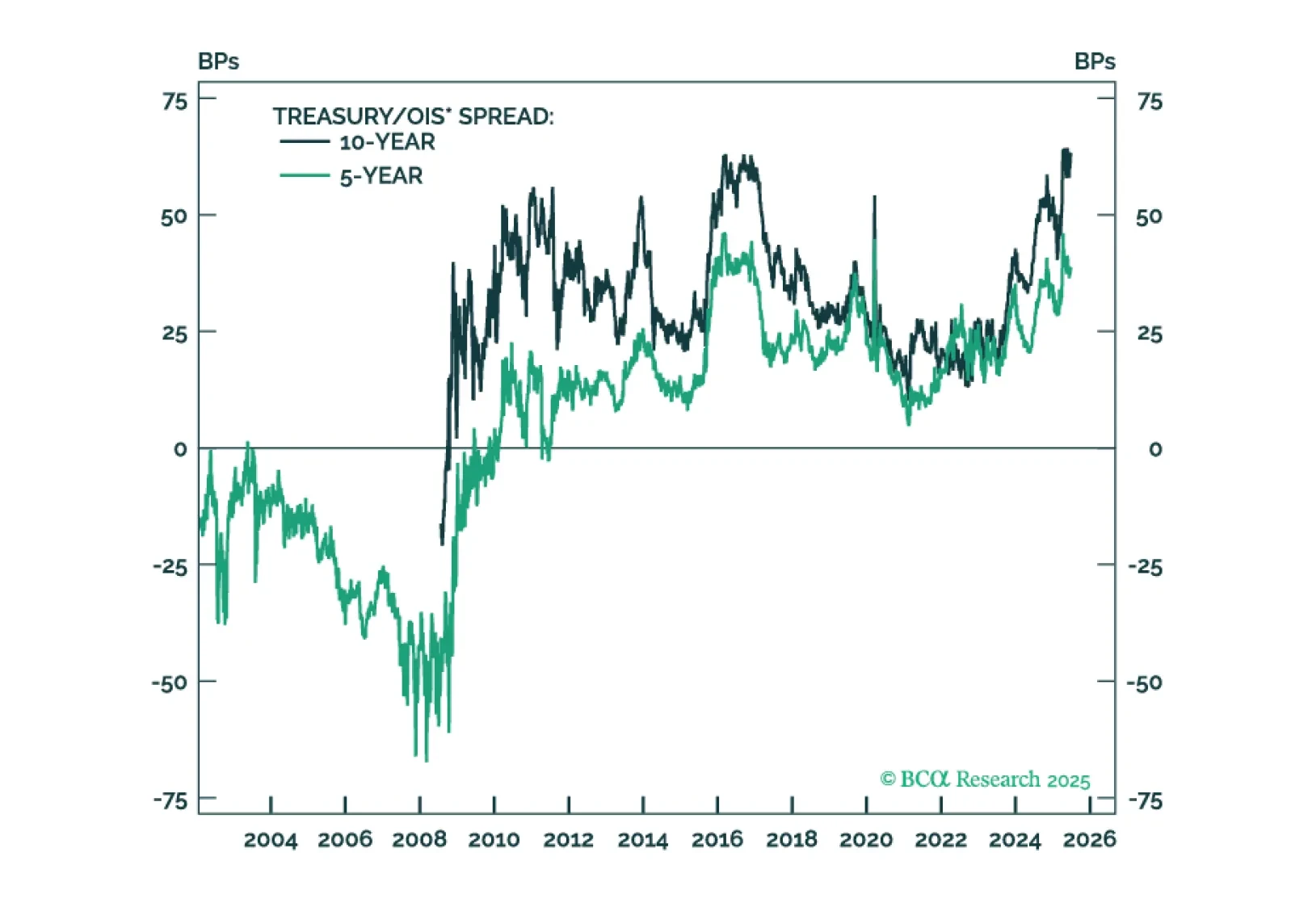

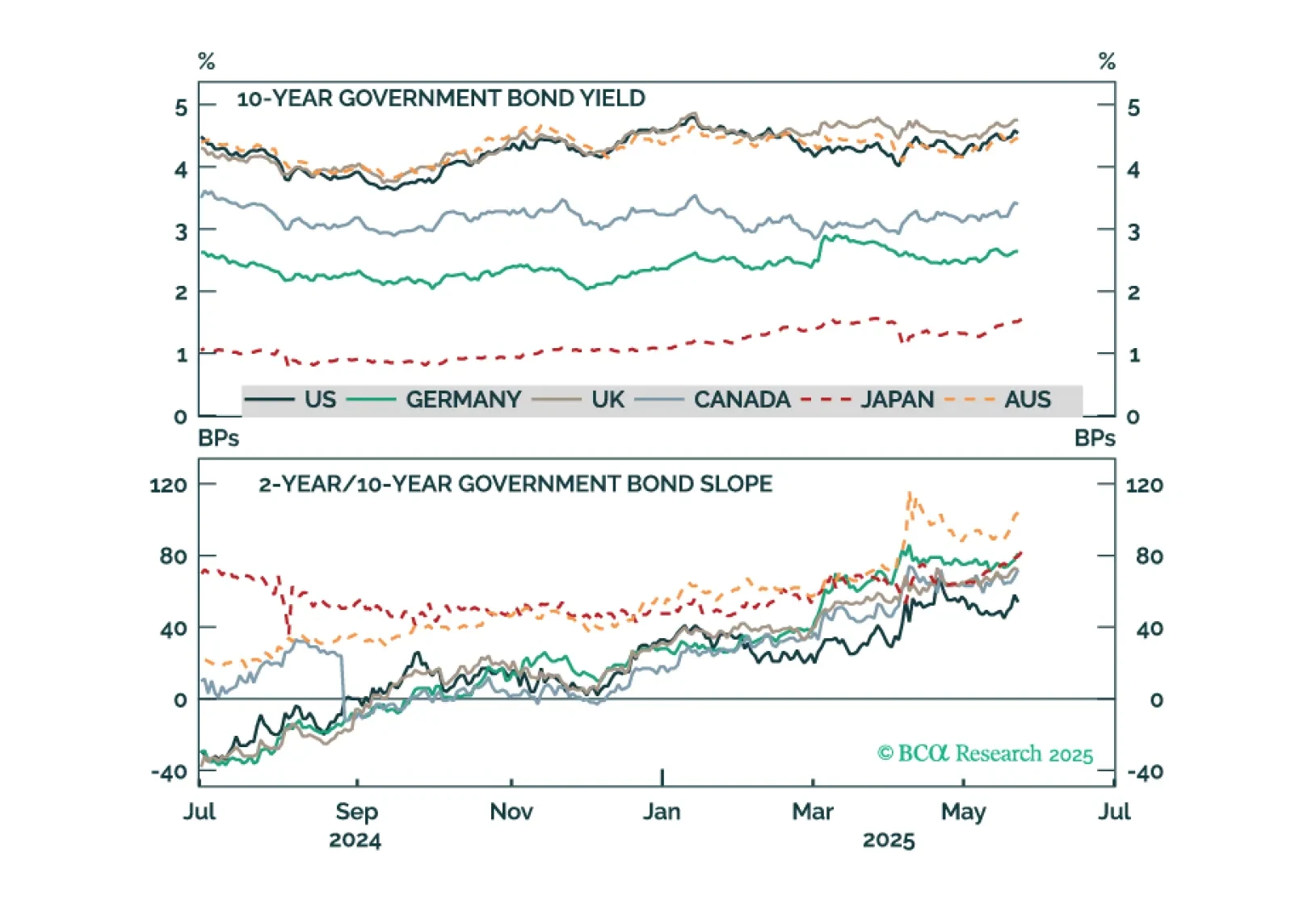

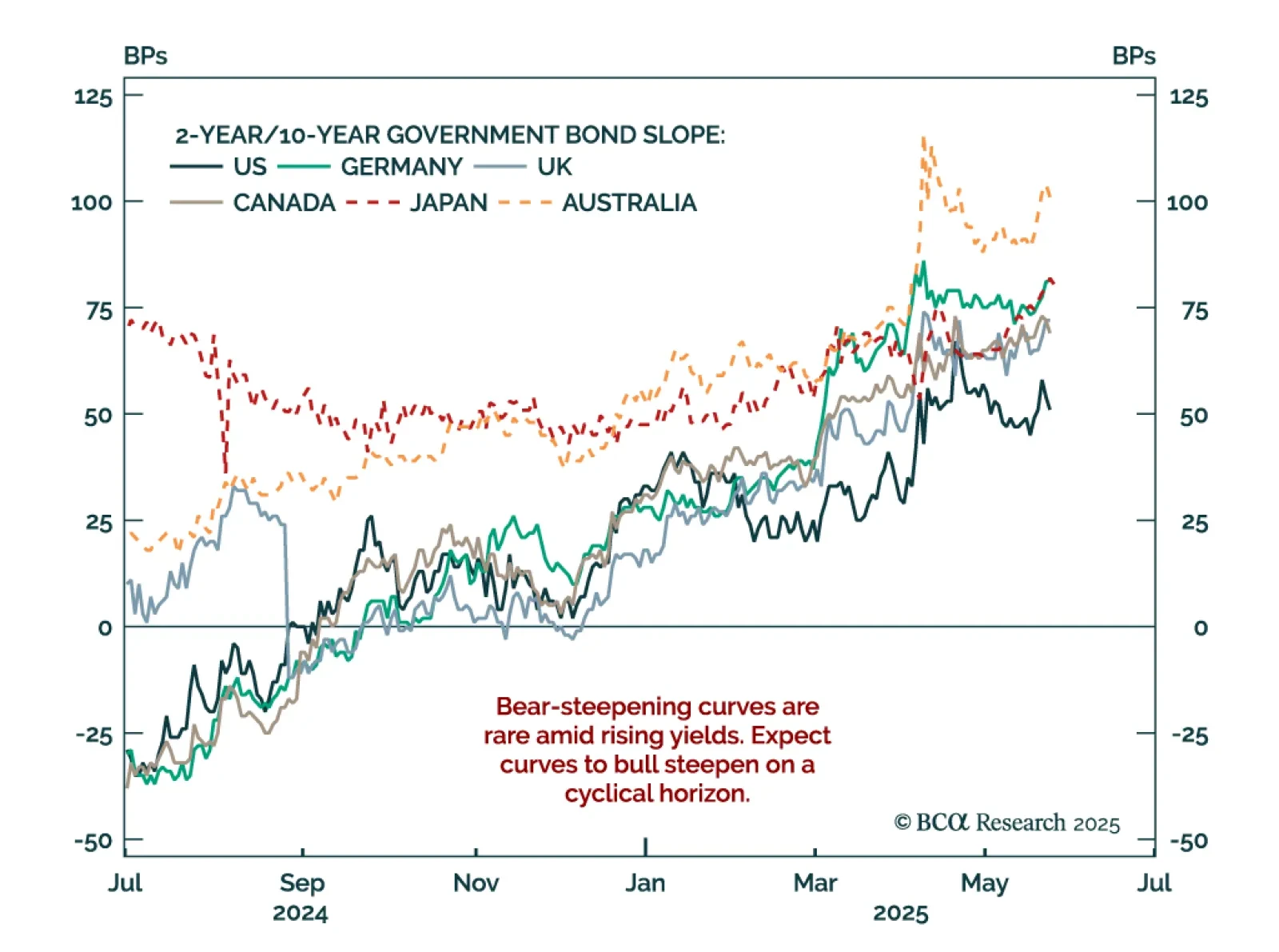

According to our fixed income strategists, the main drivers of rising global yields have been widening bond/OIS spreads and term premiums. Wider government bond/OIS spreads reflect increasing government bond supply (net of…

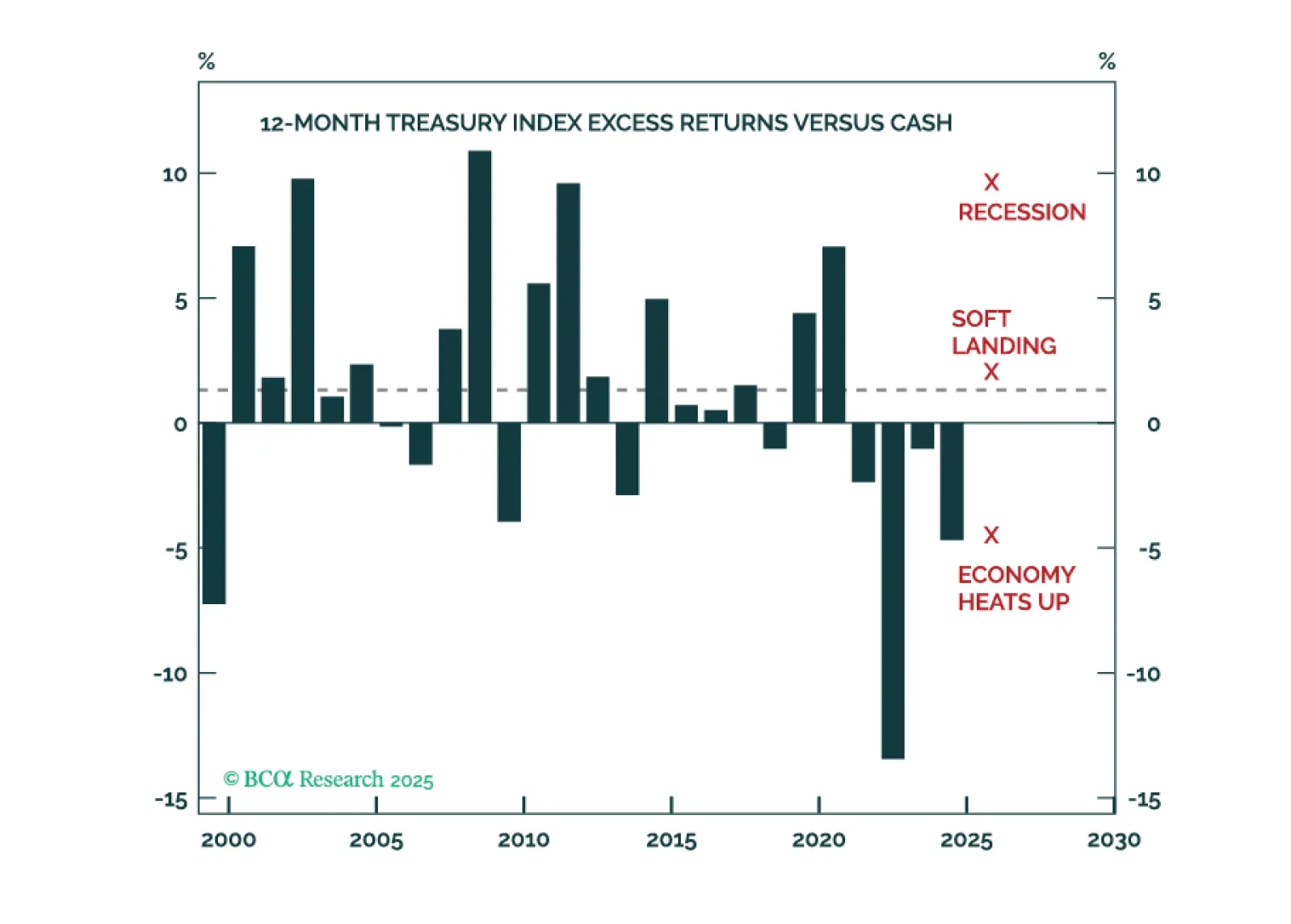

A weakening economy will apply downward pressure to Treasury yields, but the Trump term premium will keep long-dated yields higher than they would otherwise be. This makes Treasury curve steepeners the most attractive trade in US…