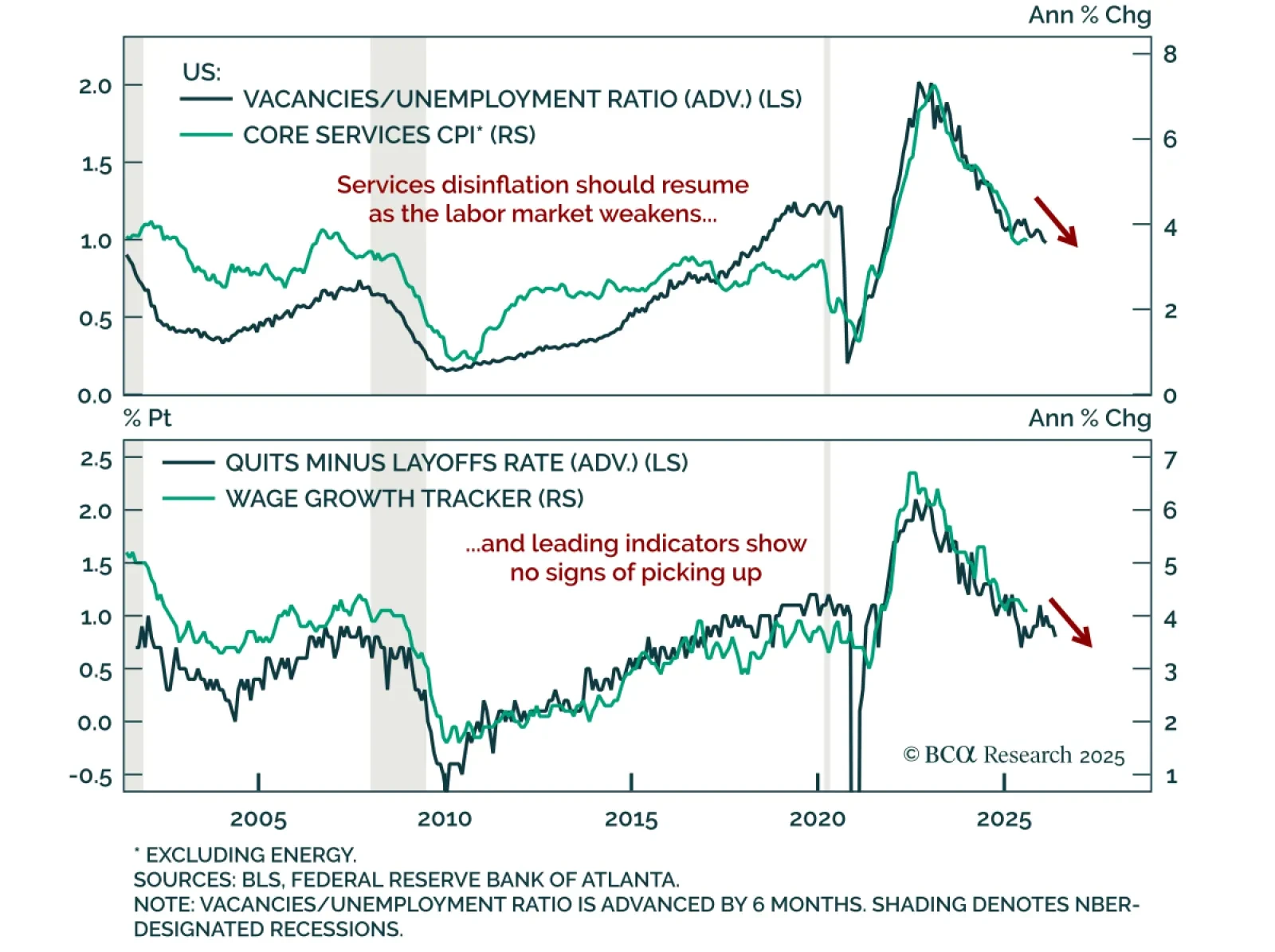

August JOLTS data confirm a loosening labor market, reinforcing a modestly defensive allocation stance. Job openings ticked up to 7.23m from 7.21m, yet gains came from non-cyclical sectors. Quits fell to 3.09m from 3.17m, pushing the…

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

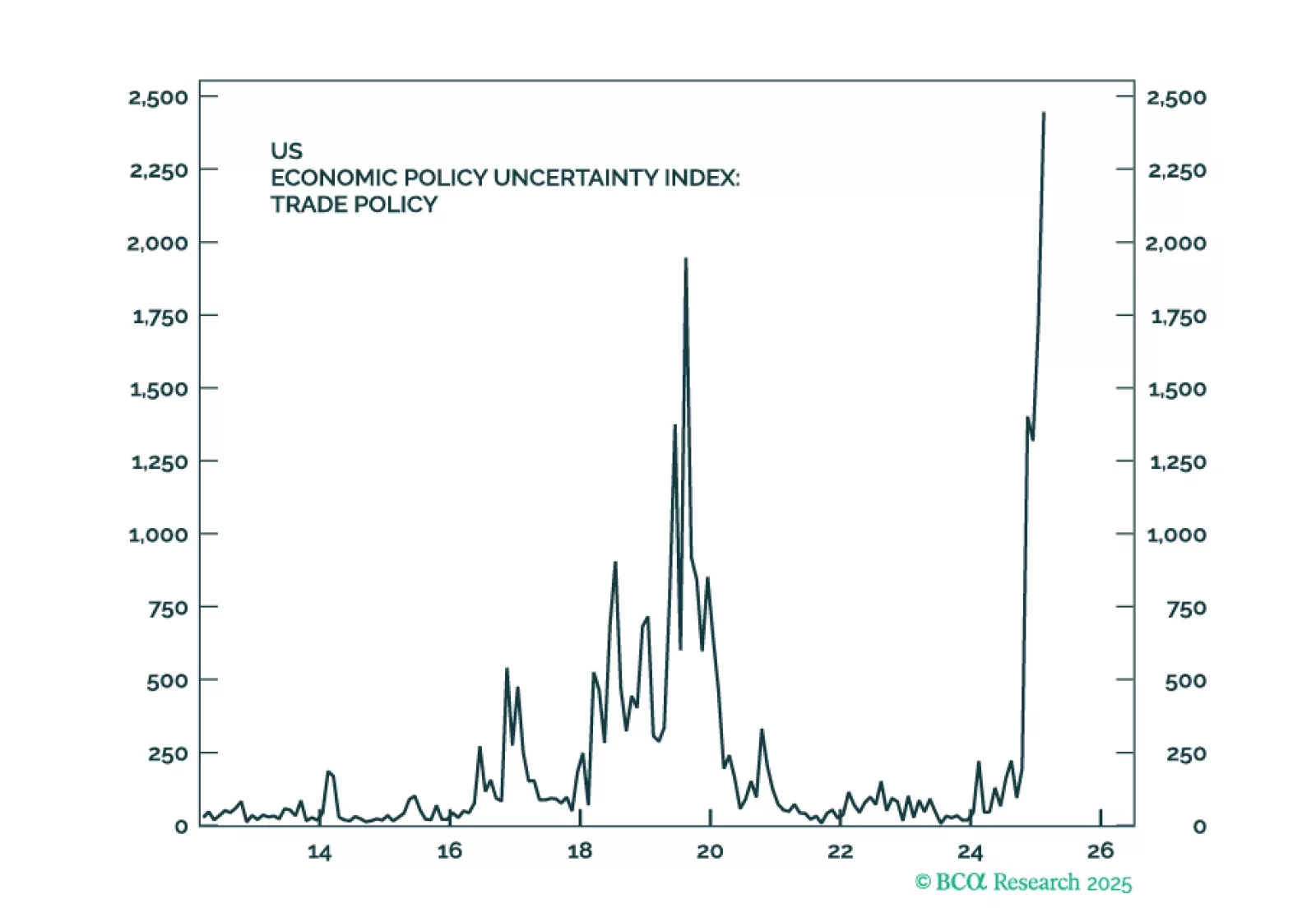

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

The US economy is set to enter a recession within the next few months. Stay underweight equities and overweight cash. Look to increase fixed-income duration exposure over the coming months. The euro is likely to strengthen and…