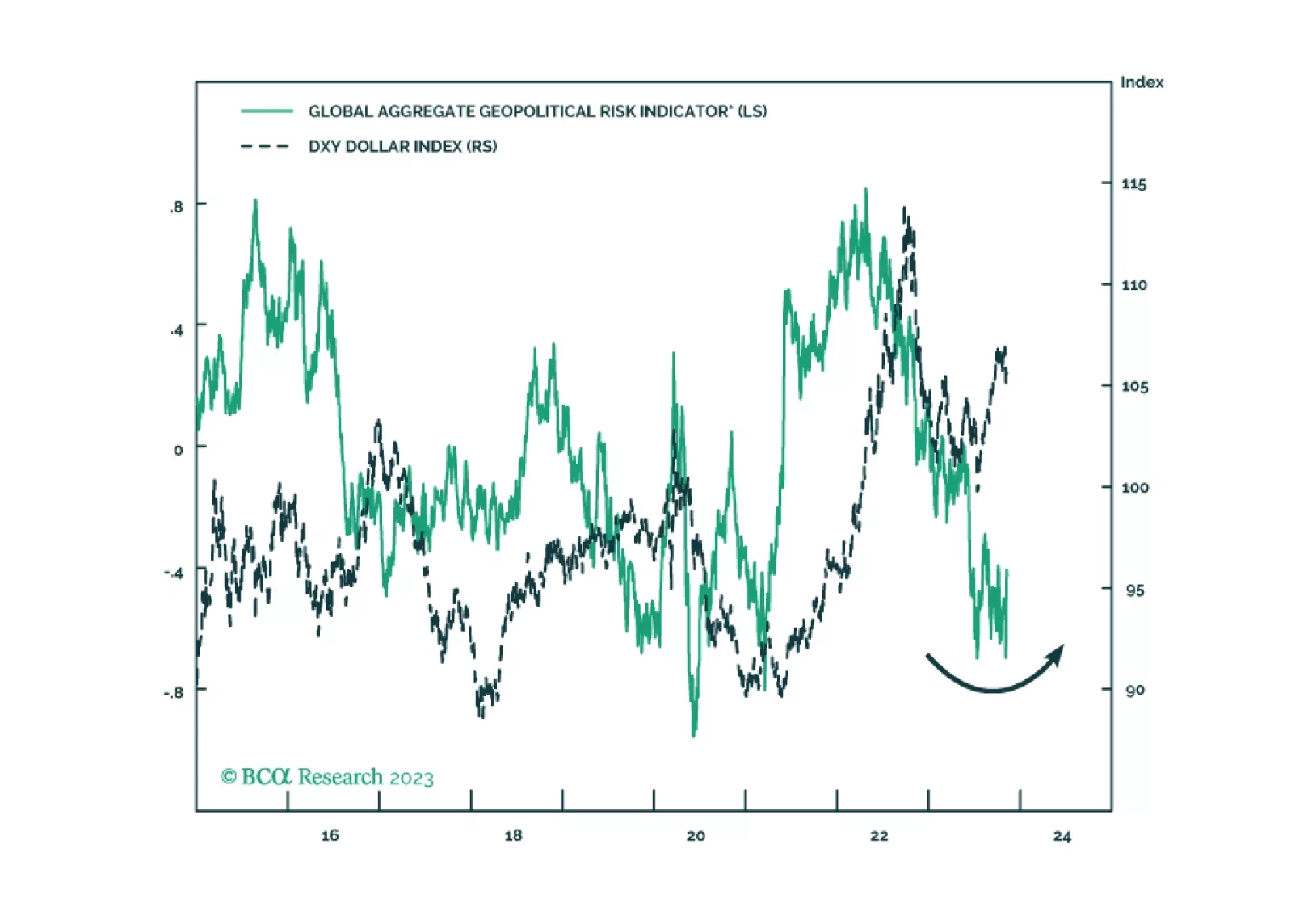

Amid a range of geopolitical narratives, what matters is that the US strategy of economic engagement with its rivals is failing, giving rise to a new strategy of containment that will reinforce the secular rise in geopolitical risk.…

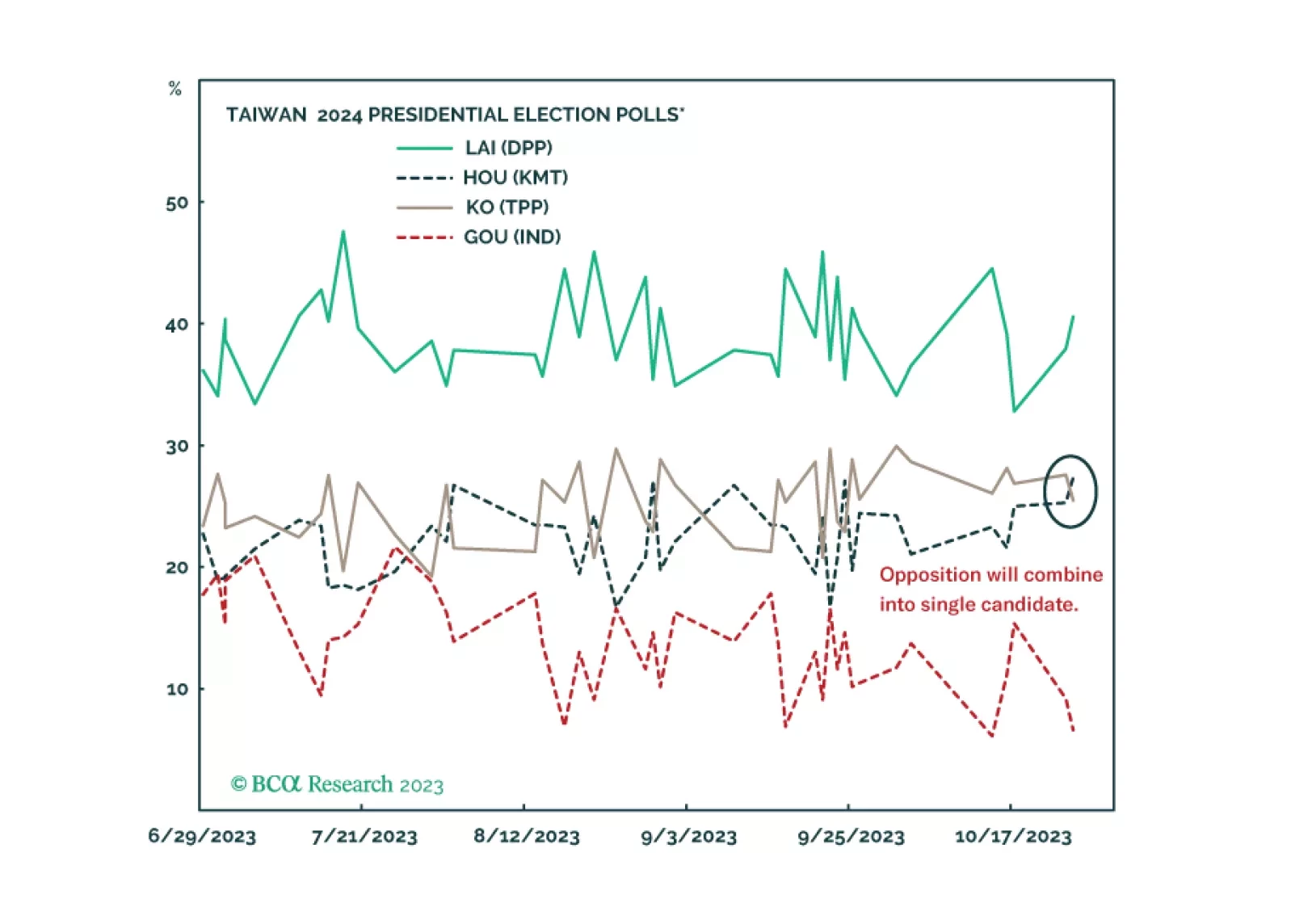

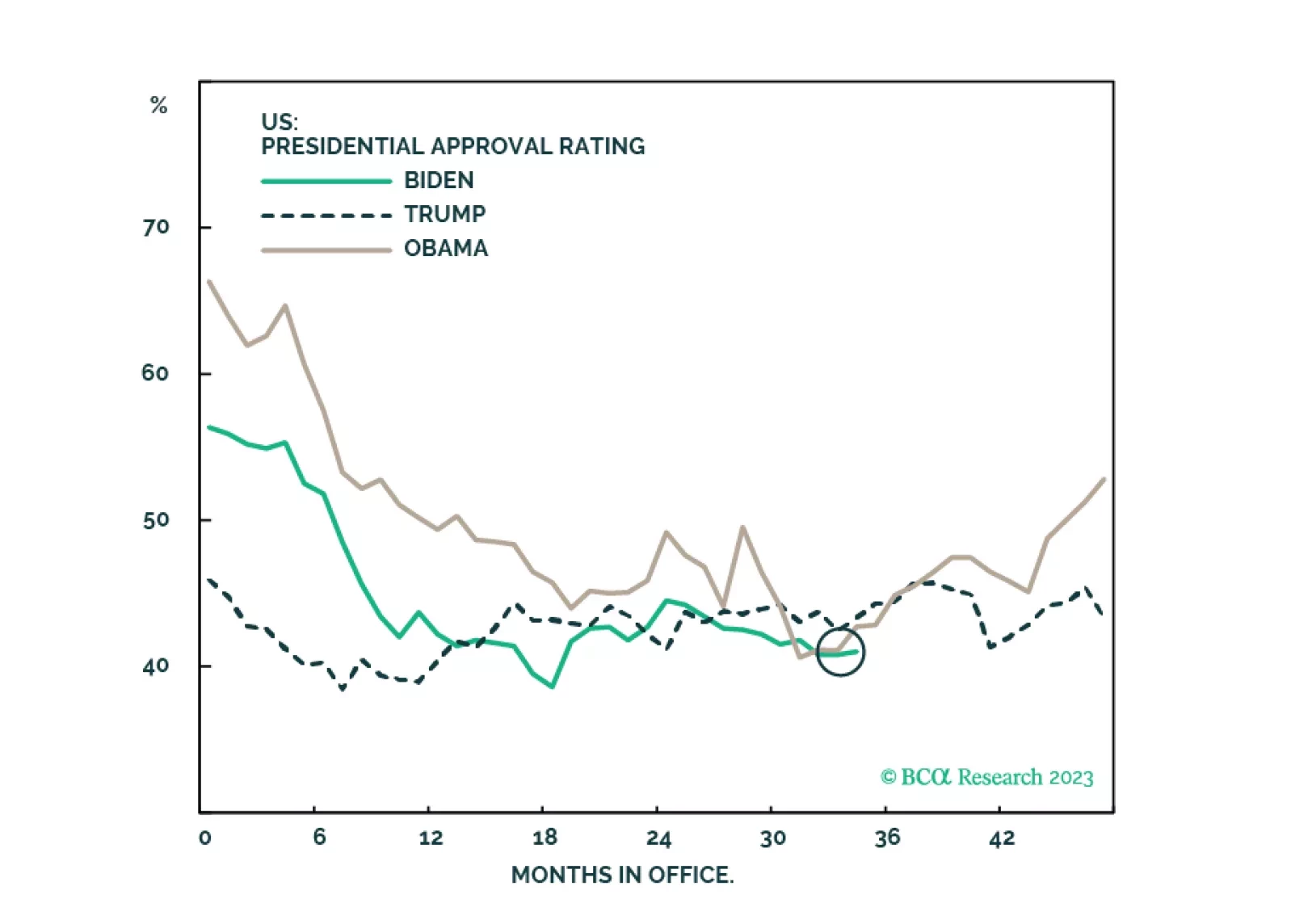

Results from Tuesday’s elections suggest that the Democrats are doing better than what their 2024 polling are showing. While the results are marginally positive for equities, investors should not overrate this off-year election,…

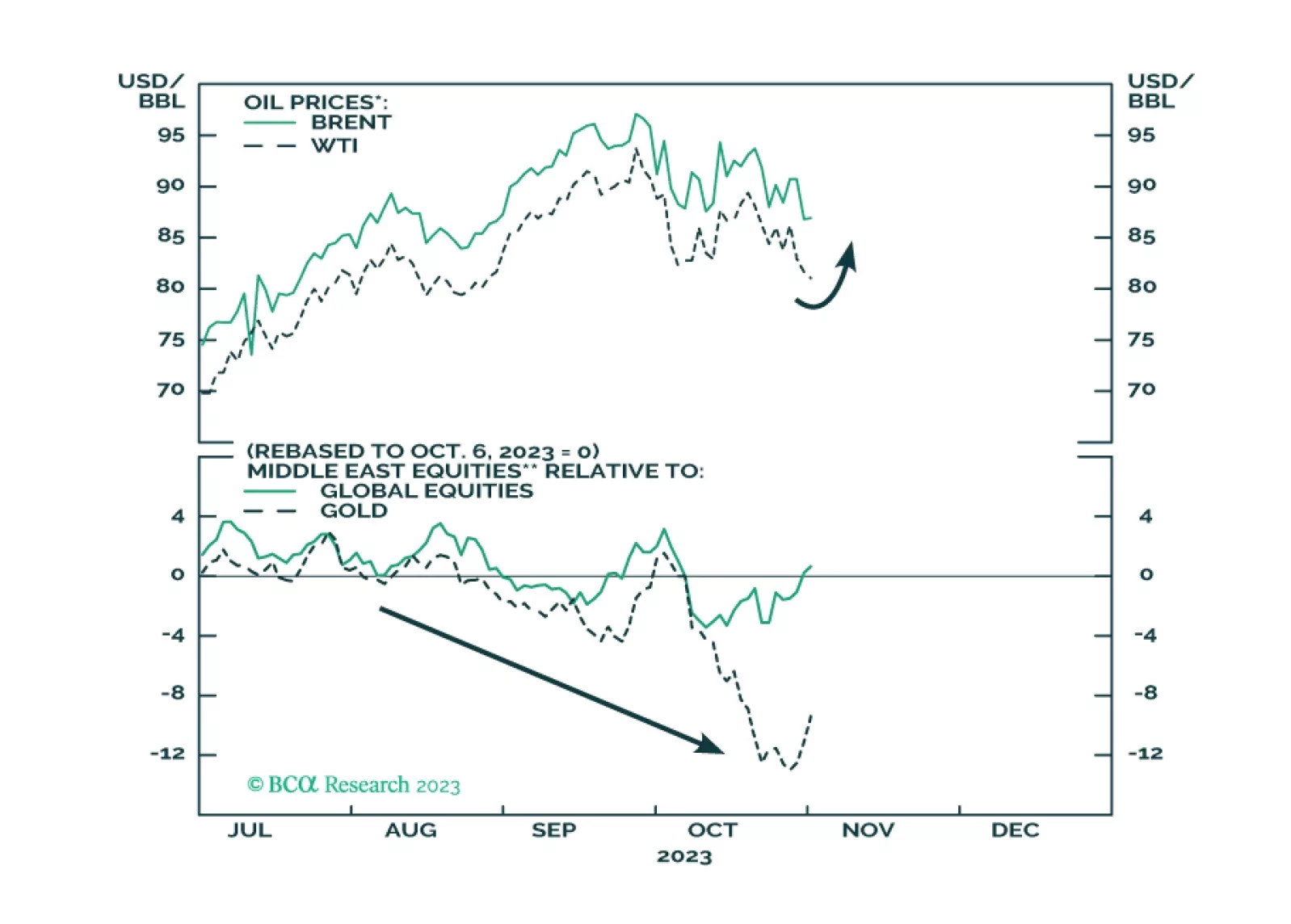

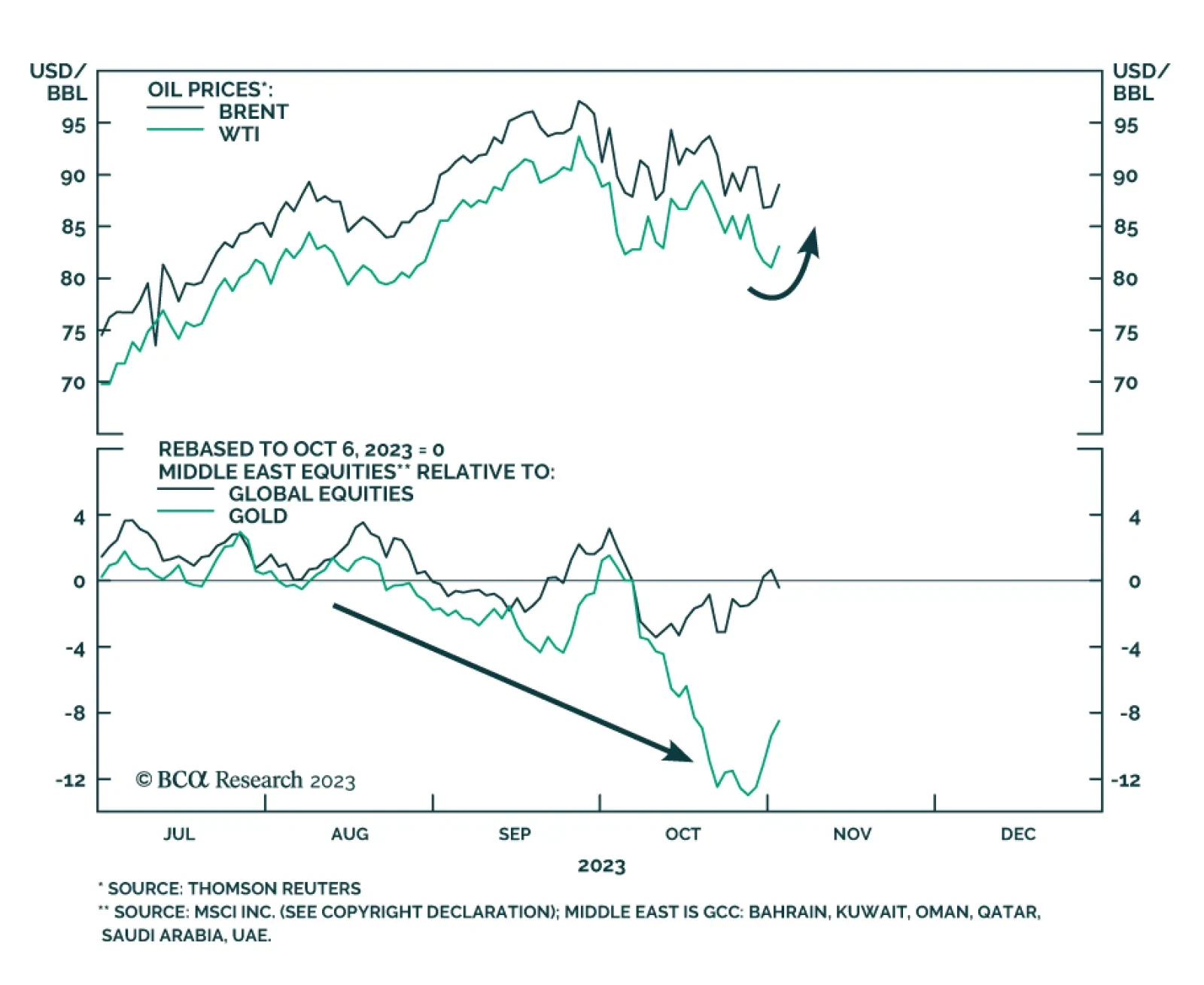

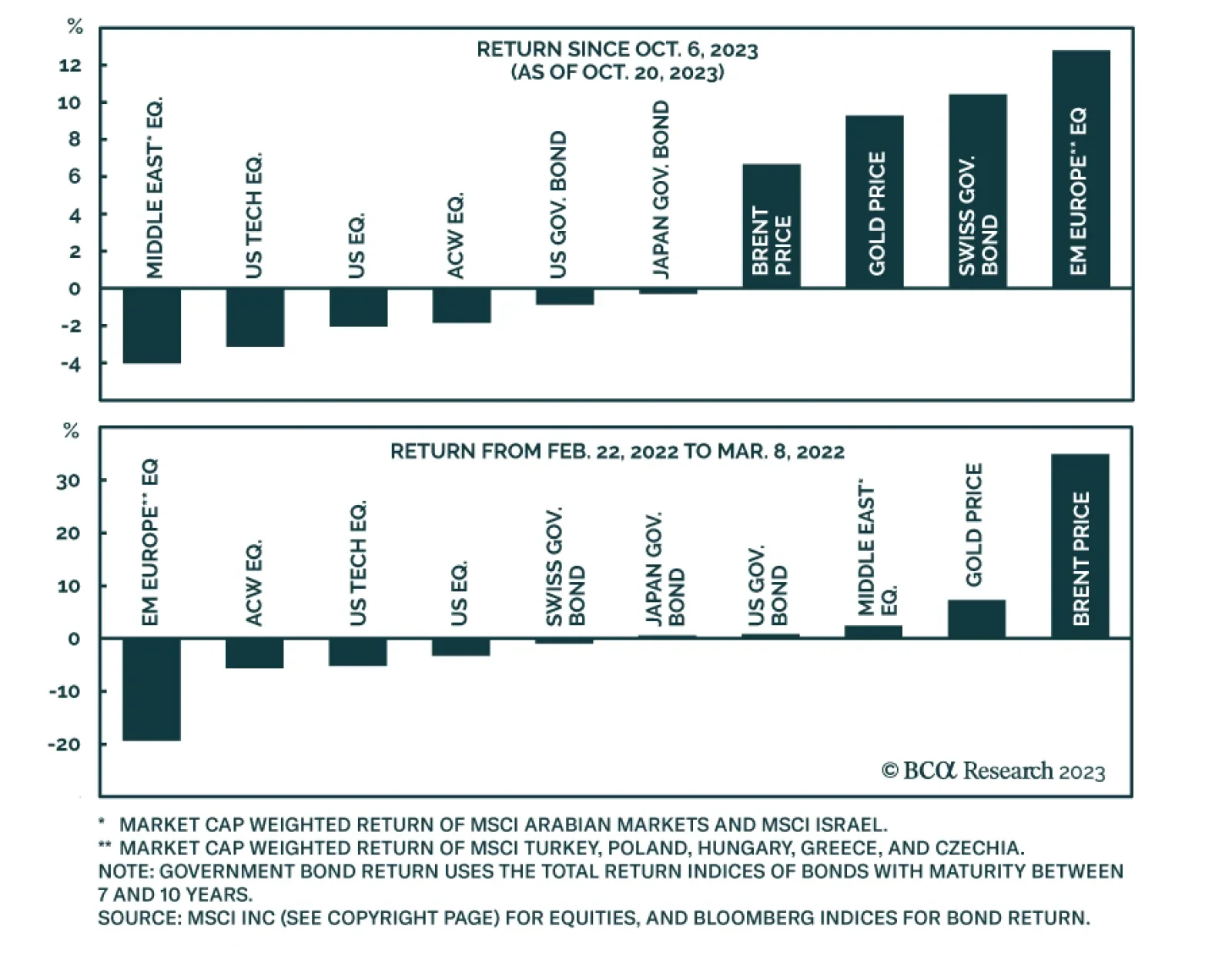

According to BCA Research's Geopolitical Strategy service, investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the…

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.

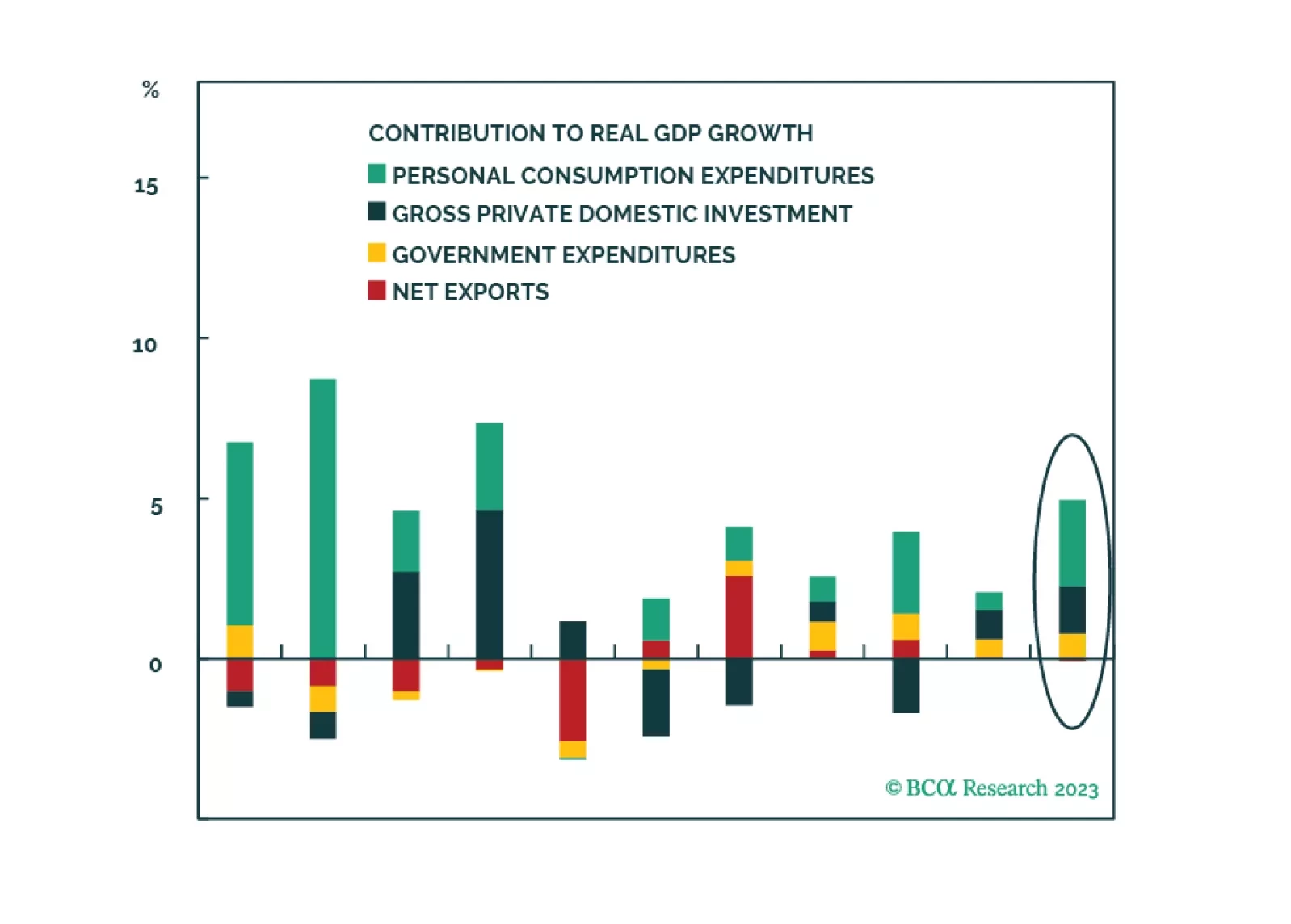

Stronger US growth elicits a response from the House Republicans. But a government shutdown is not devastating to the economy. What is more devastating would be a crisis in the Middle East, Europe, and Asia. Stay long US defense,…

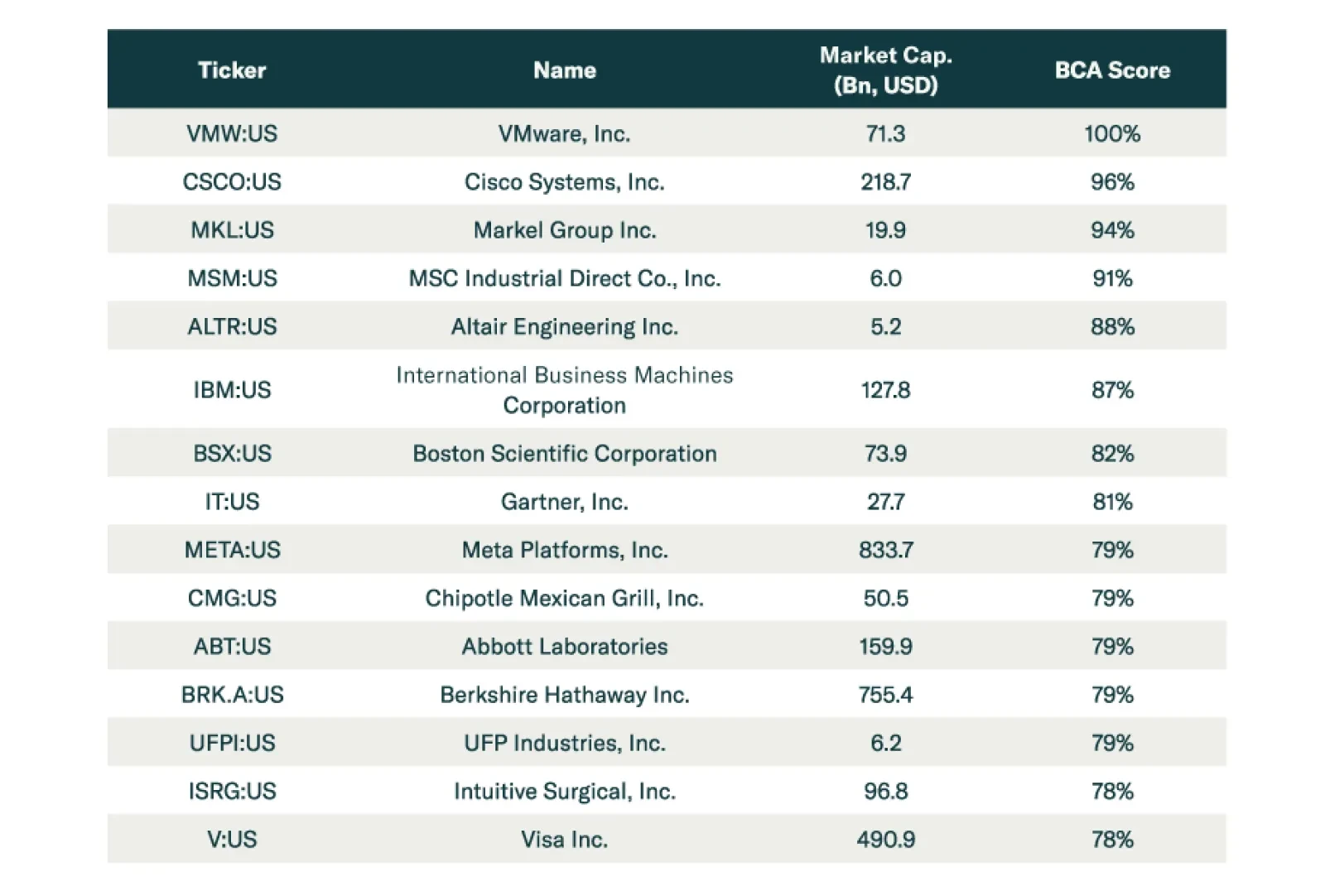

In a recent report, BCA Research’s Equity Analyzer service proposes two strategies to help investors navigate the conflict in the Middle East. The first strategy uses the “Macro Sensitivities” filter on…

Geopolitical risk is returning to the market after a hiatus for most of 2023. Global investors are now realizing what our geopolitical strategists have argued all year: that the rise in geopolitical risk is a secular trend…

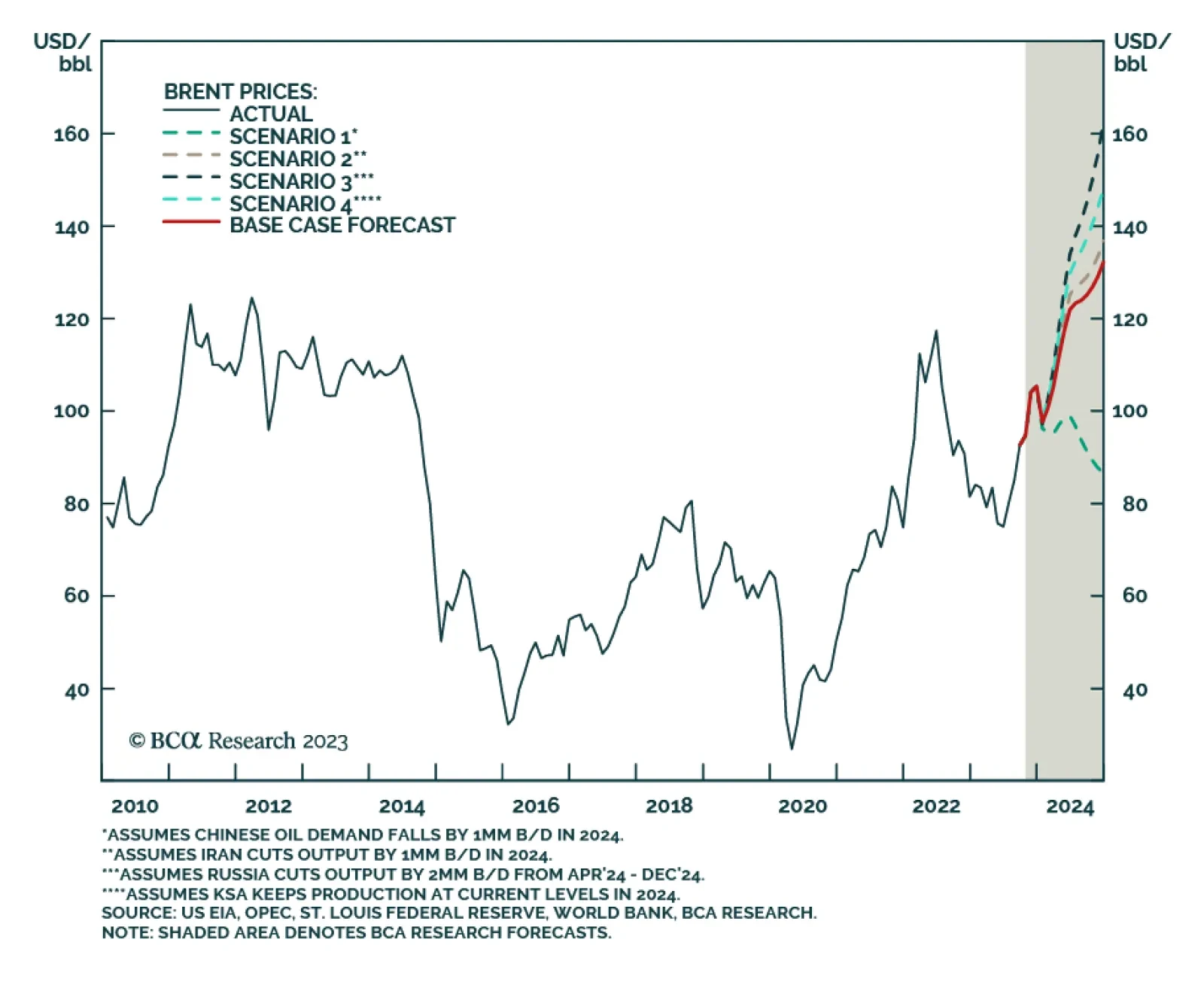

Our Commodity & Energy Strategy colleagues (CES) left their 2024 Brent crude oil price forecast unchanged at $118/bbl. This is not because nothing’s changed in the market. Rather, higher levels of…