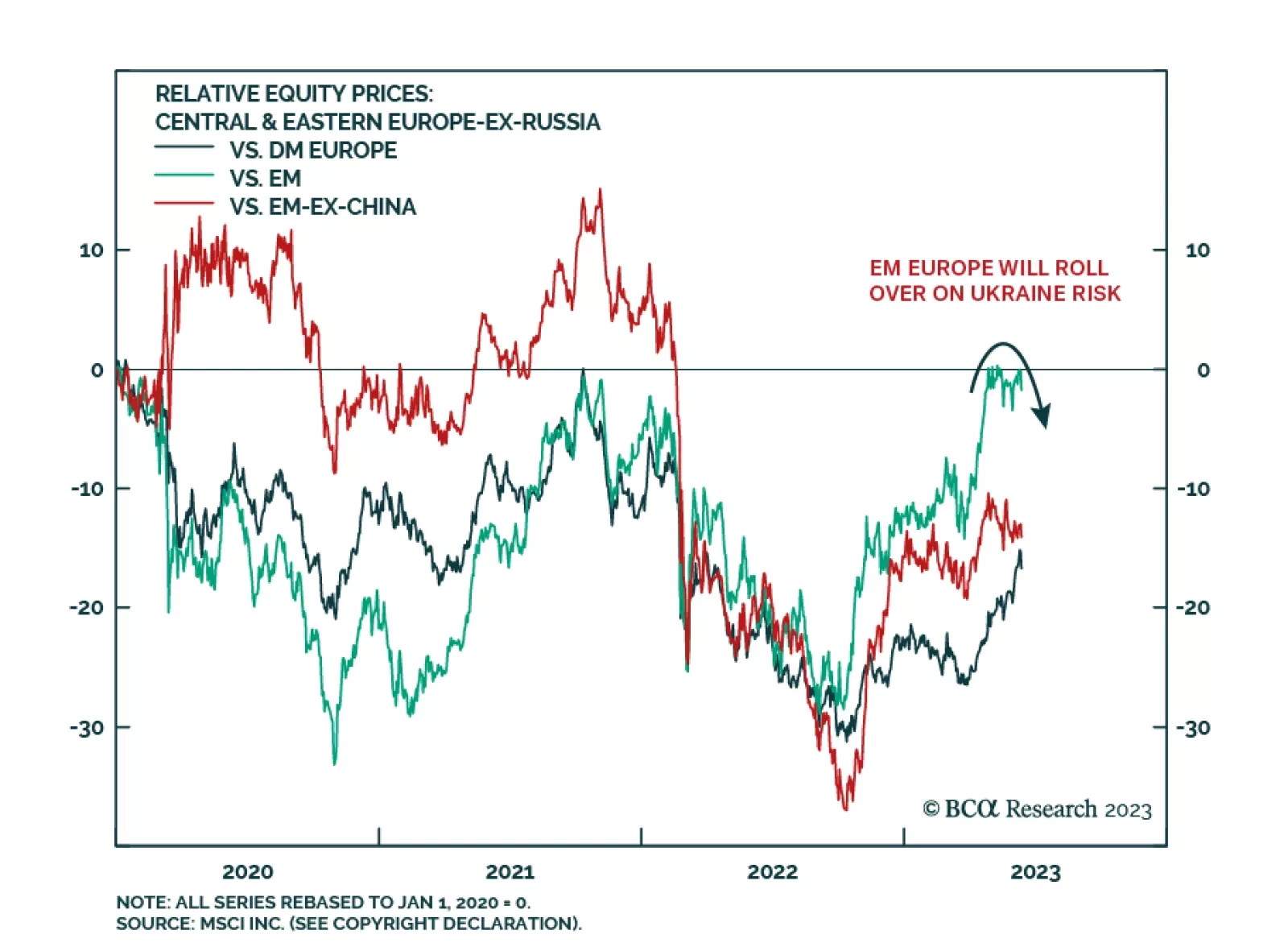

According to BCA Research’s Geopolitical Strategy service, geopolitical risk will rise before the Ukraine war is resolved, punishing eastern European emerging market assets on a relative basis. Ukraine’s…

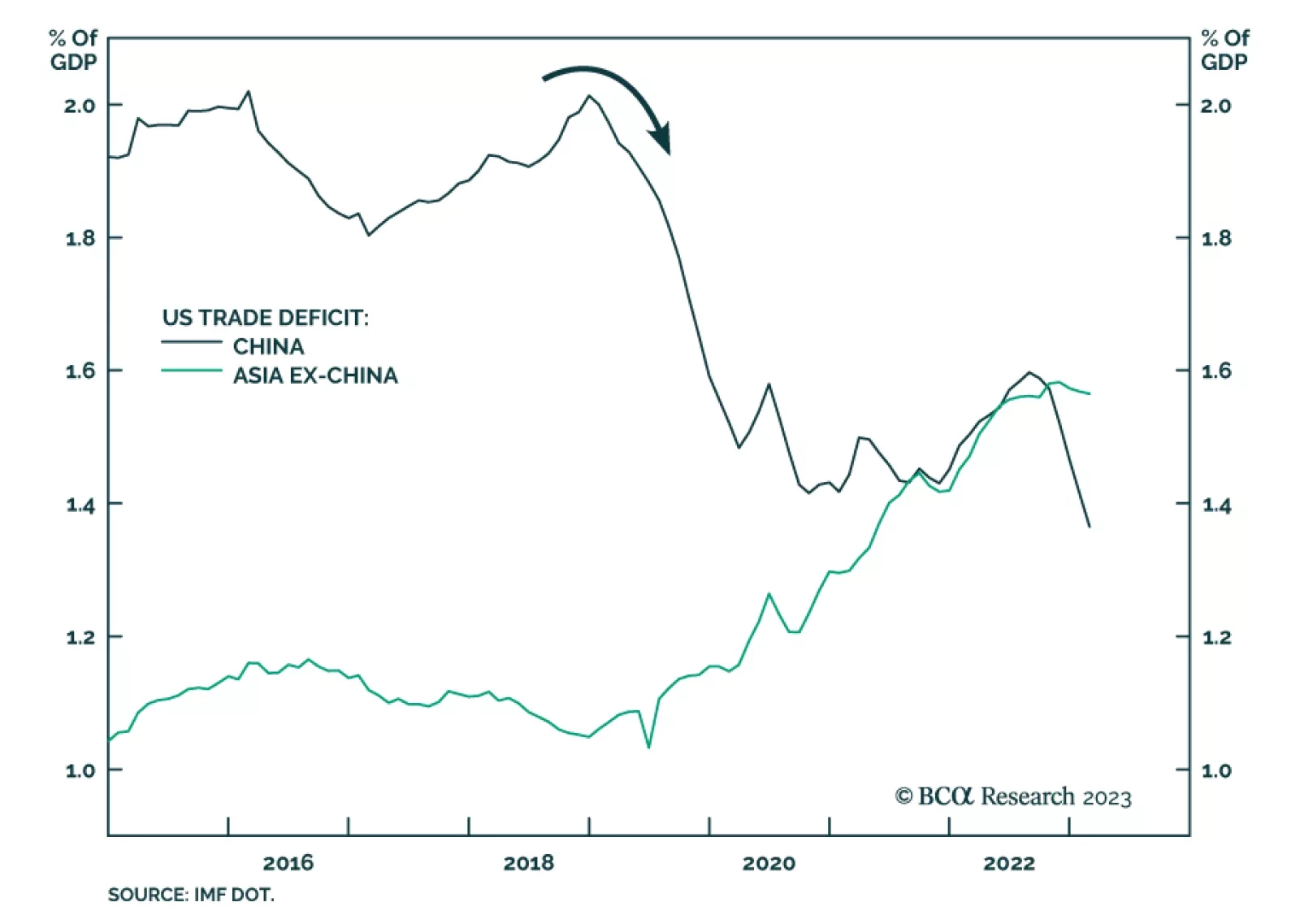

The Biden administration reached out to China to try to reduce tensions over the month of May, attracting interest from the investment community, though our Geopolitical Strategists believe the US and China cannot agree to a…

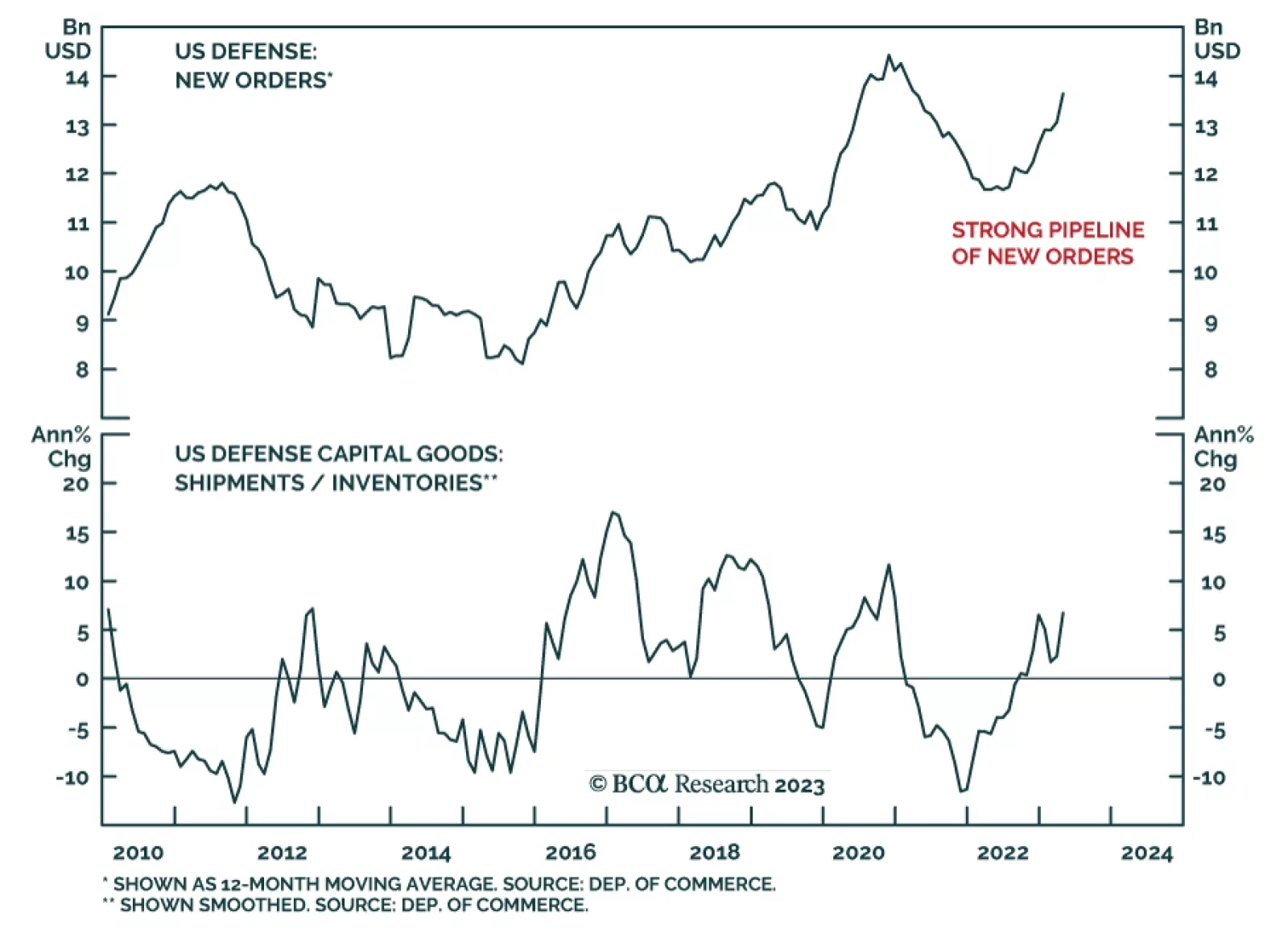

According to BCA Research’s US Equity Strategy service, despite temporary hurdles, the longer-term trends support an overweight in Defense. Global military spending is poised for significant increases as the world system…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

No, the secular rise in geopolitical risk has not peaked. EU-China trade ties underscore the multipolar context, but this multipolarity is unbalanced, as the US has not reached a new equilibrium with its rivals. While the second…

Bullish equity sentiment may persist in the second quarter on the Fed’s pause, but tight monetary policy, financial instability, elevated recession odds, extreme US polarization and policy uncertainty, and still-high geopolitical…

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…

US financial instability reinforces our bearish investment outlook by weighing on economic growth and corporate earnings while also increasing US policy uncertainty and geopolitical risk.