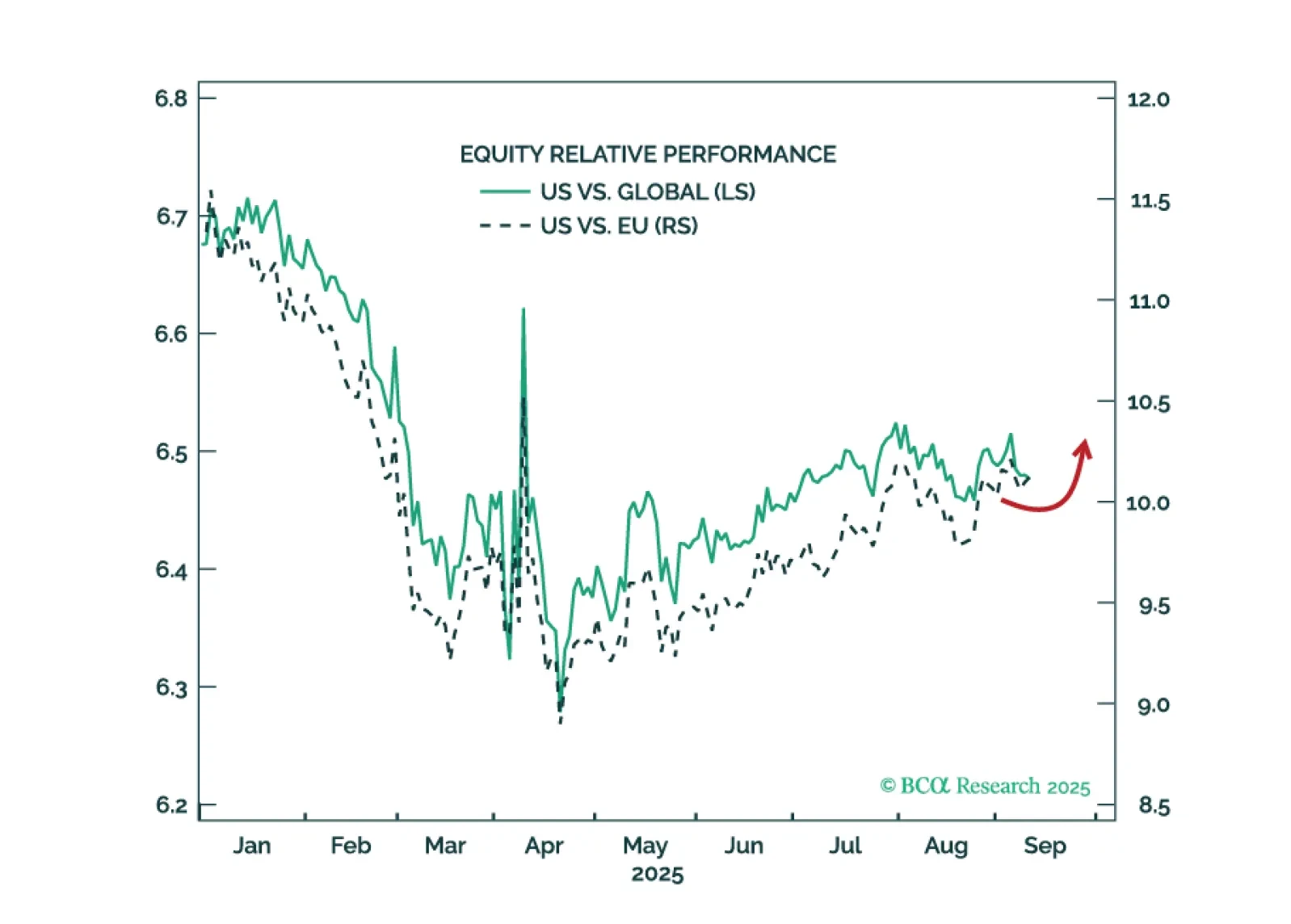

Our top five "Black Swan" risks this year are familiar but all too realistic in the current climate. Investors should stay overweight US equities and EM-ex-China until some hurdles are cleared.

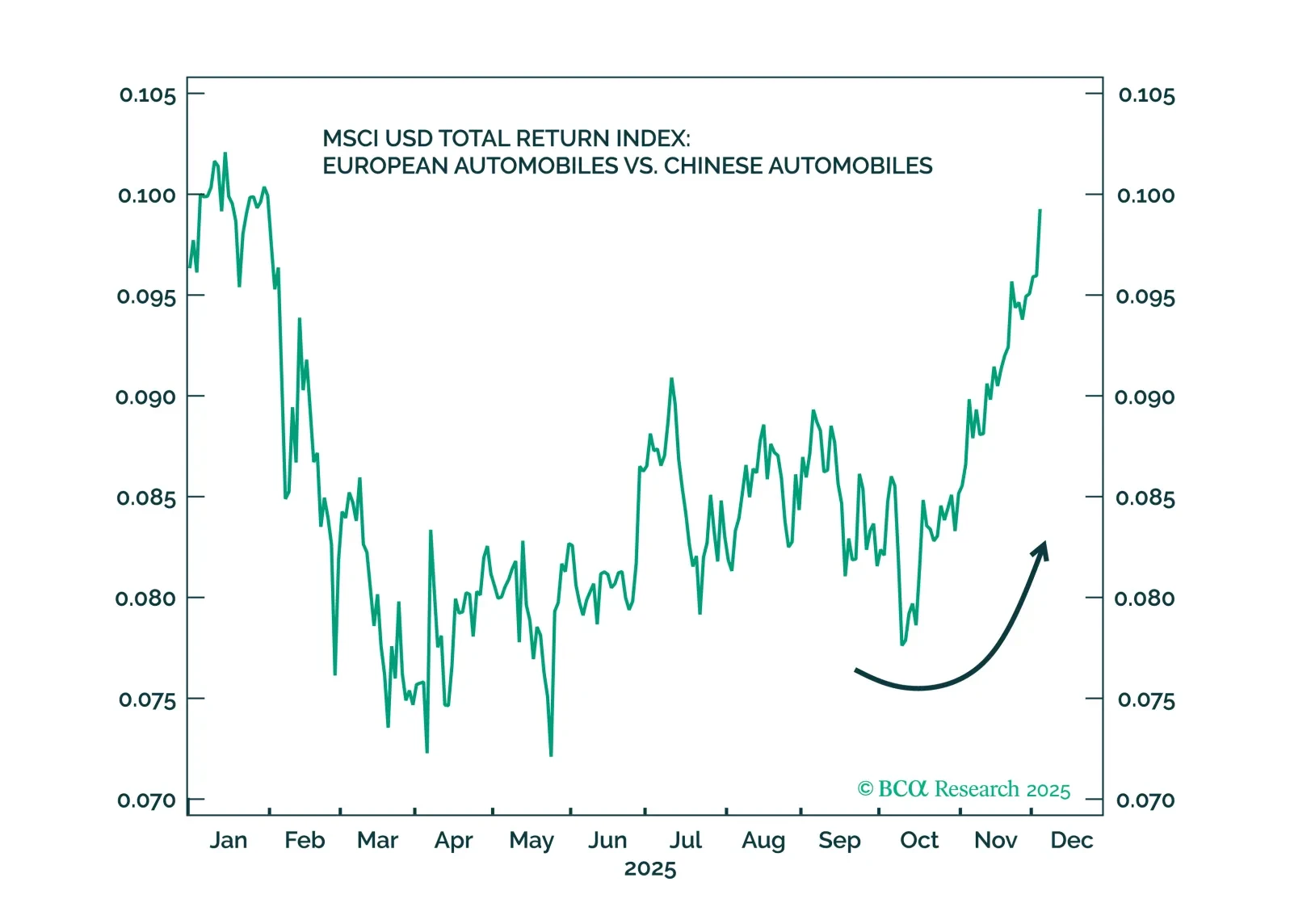

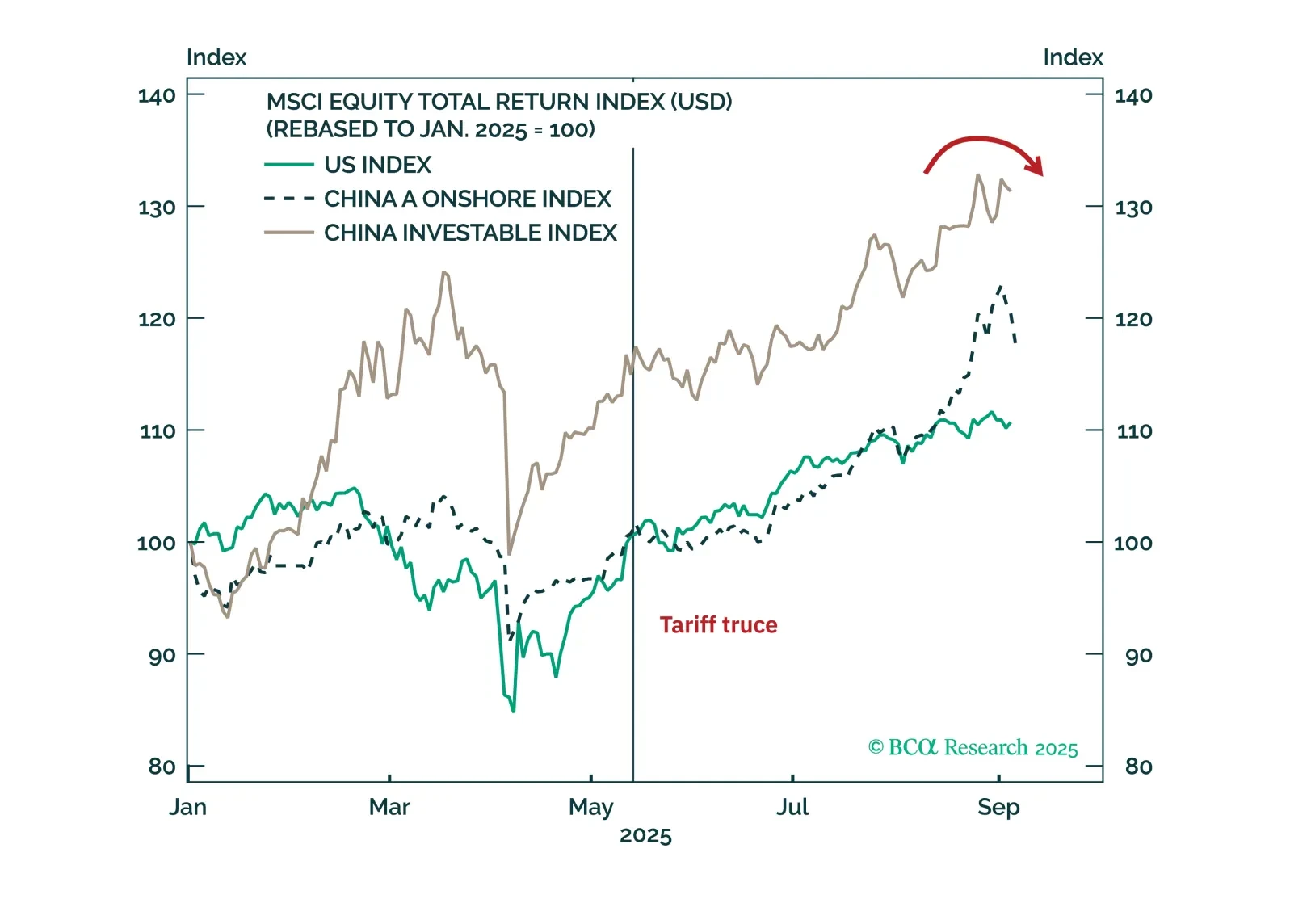

We got Trump's tariff shock and backtracking correct and predicted Israel's attack on Iran. But we missed the China rally — and there is still no Ukraine ceasefire.

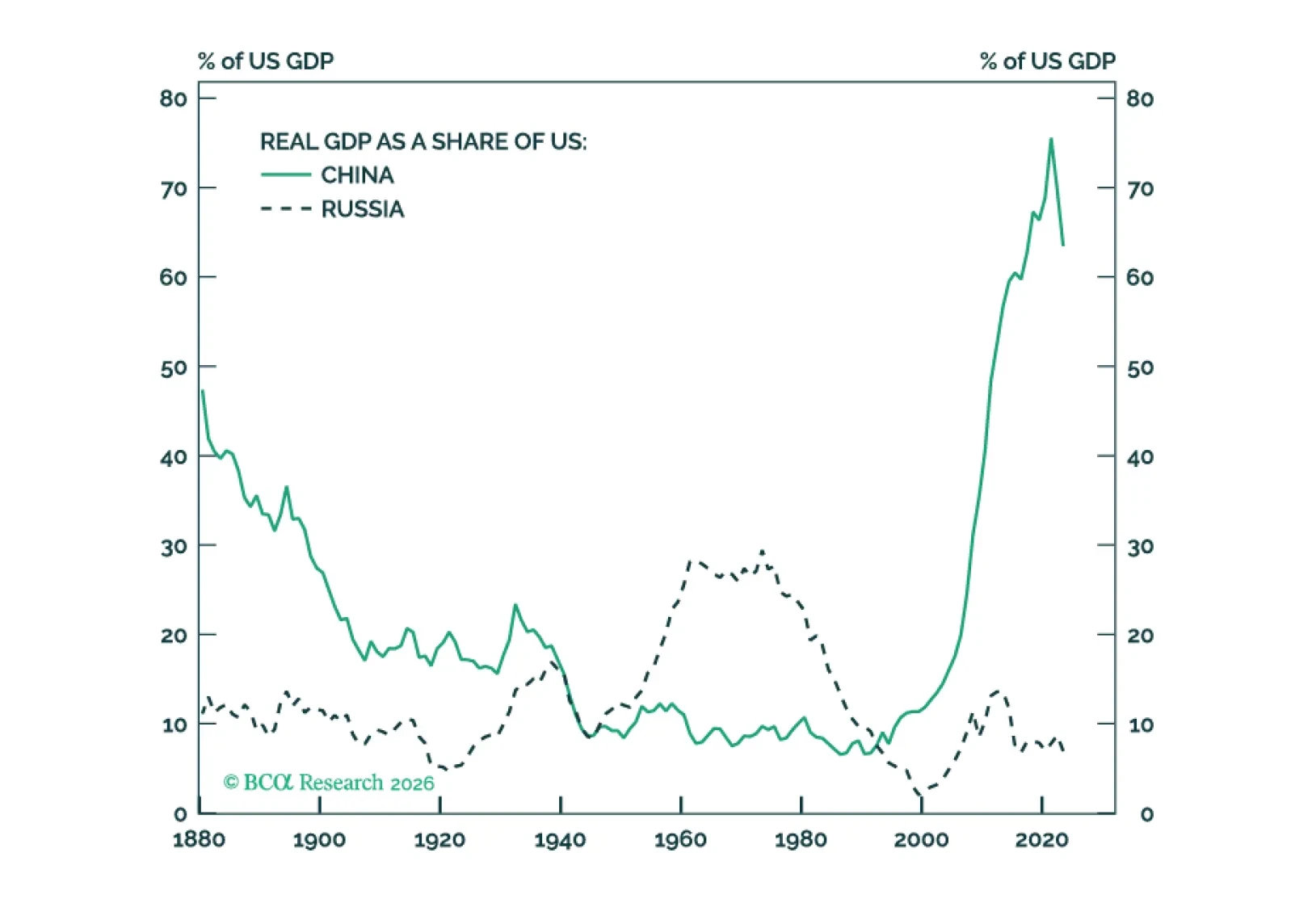

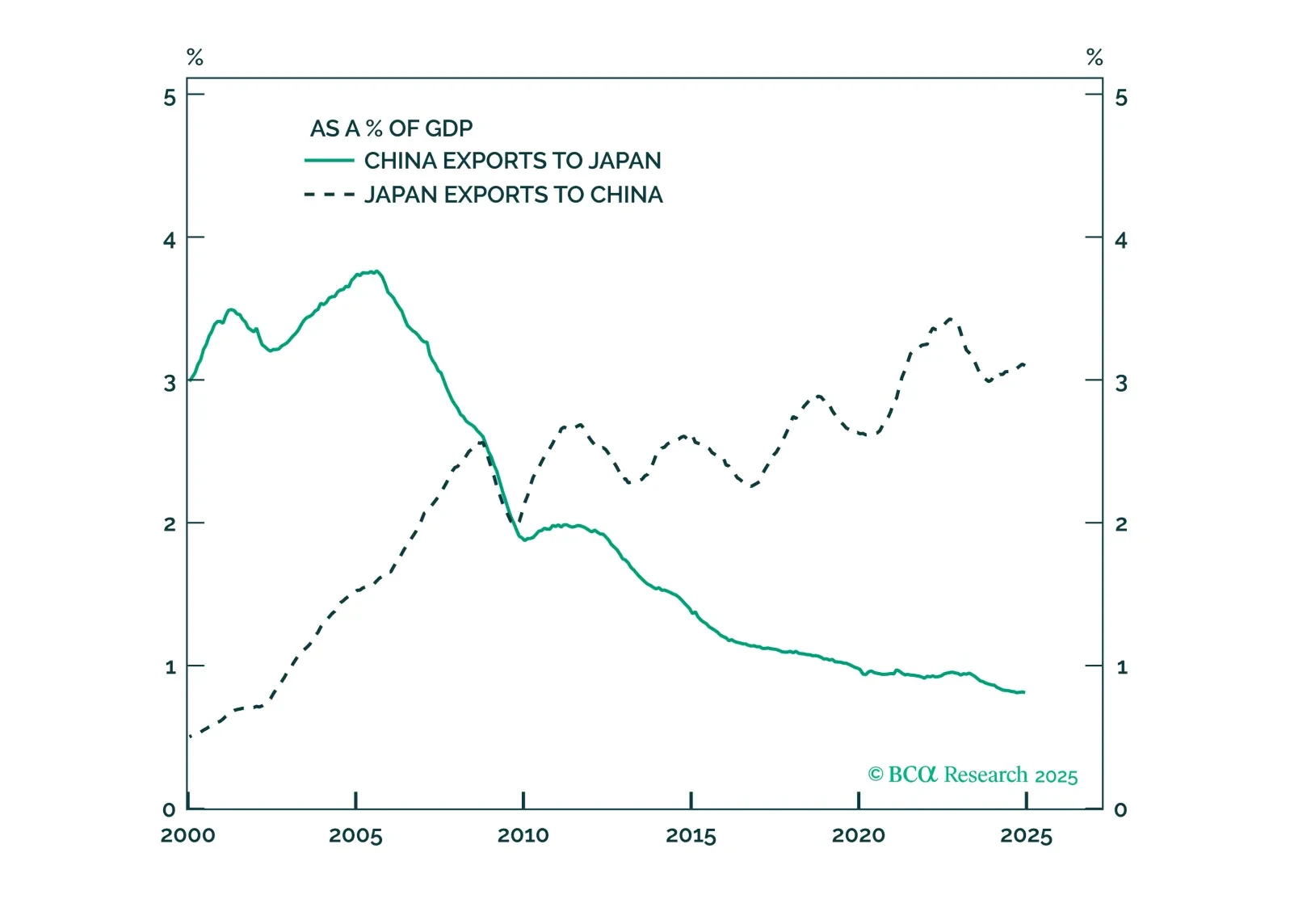

US talks with Russia and China coincide with rising EU-Russia and Japan-China tensions. Stay overweight US assets and long Japanese yen.

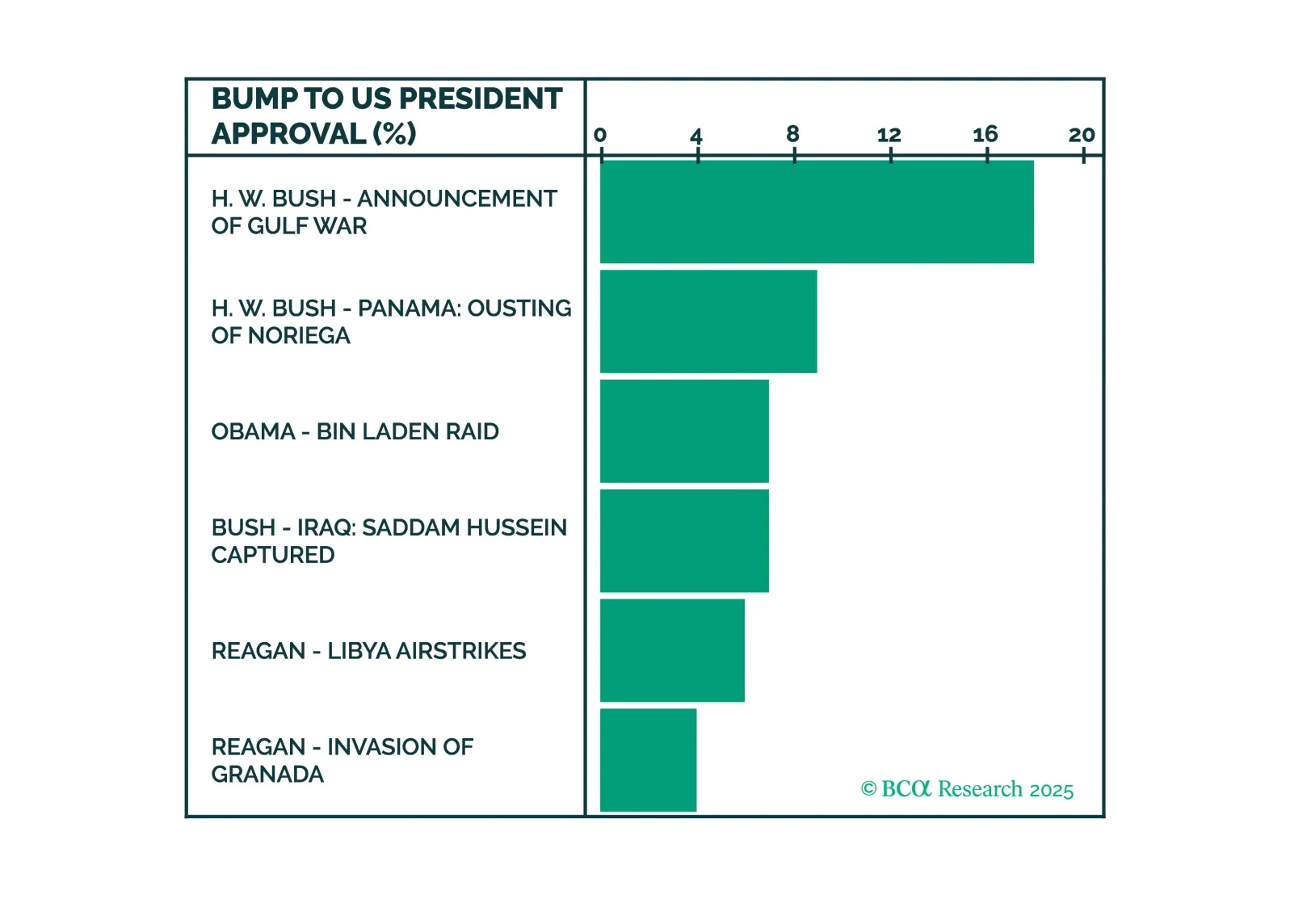

Reduce risk exposure in the very near term as President Trump's ceasefire effort falters, Russia tensions spike, and US-China trade prospects suffer.

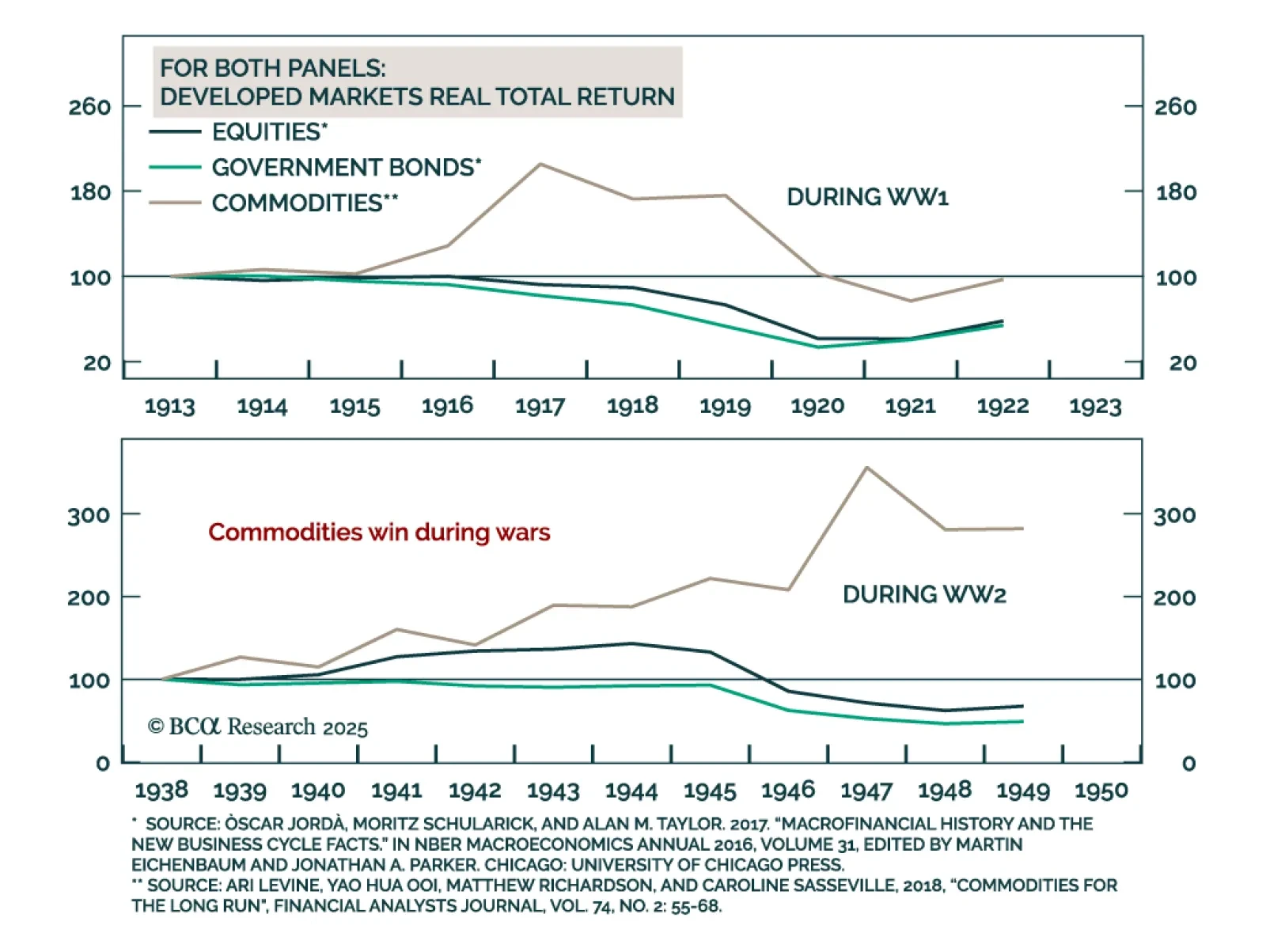

Buy commodities, neutral markets, and crypto to hedge against World War III. In their latest special report BCA’s GeoMacro and Global Asset Allocation strategists outline an asset allocation framework for a deep tail risk scenario: a…

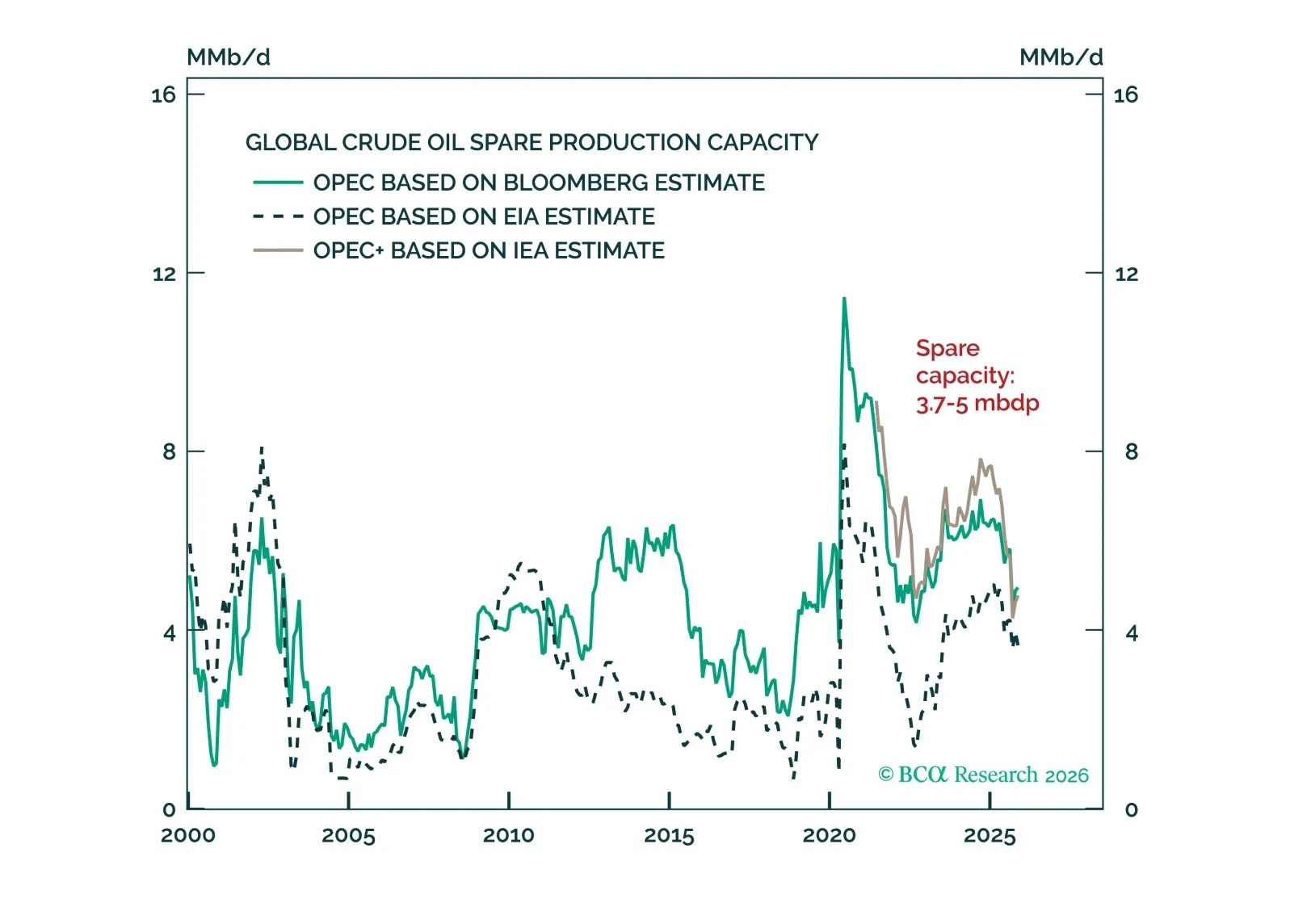

Russia’s recalcitrance will probably trigger a near-term global stock market correction by prompting larger sanctions and derailing US-China talks. But Israel’s actions do not raise our odds of a major oil shock.

Investors will be disappointed if they buy into the China rally and then Russia escalates the war in Ukraine.

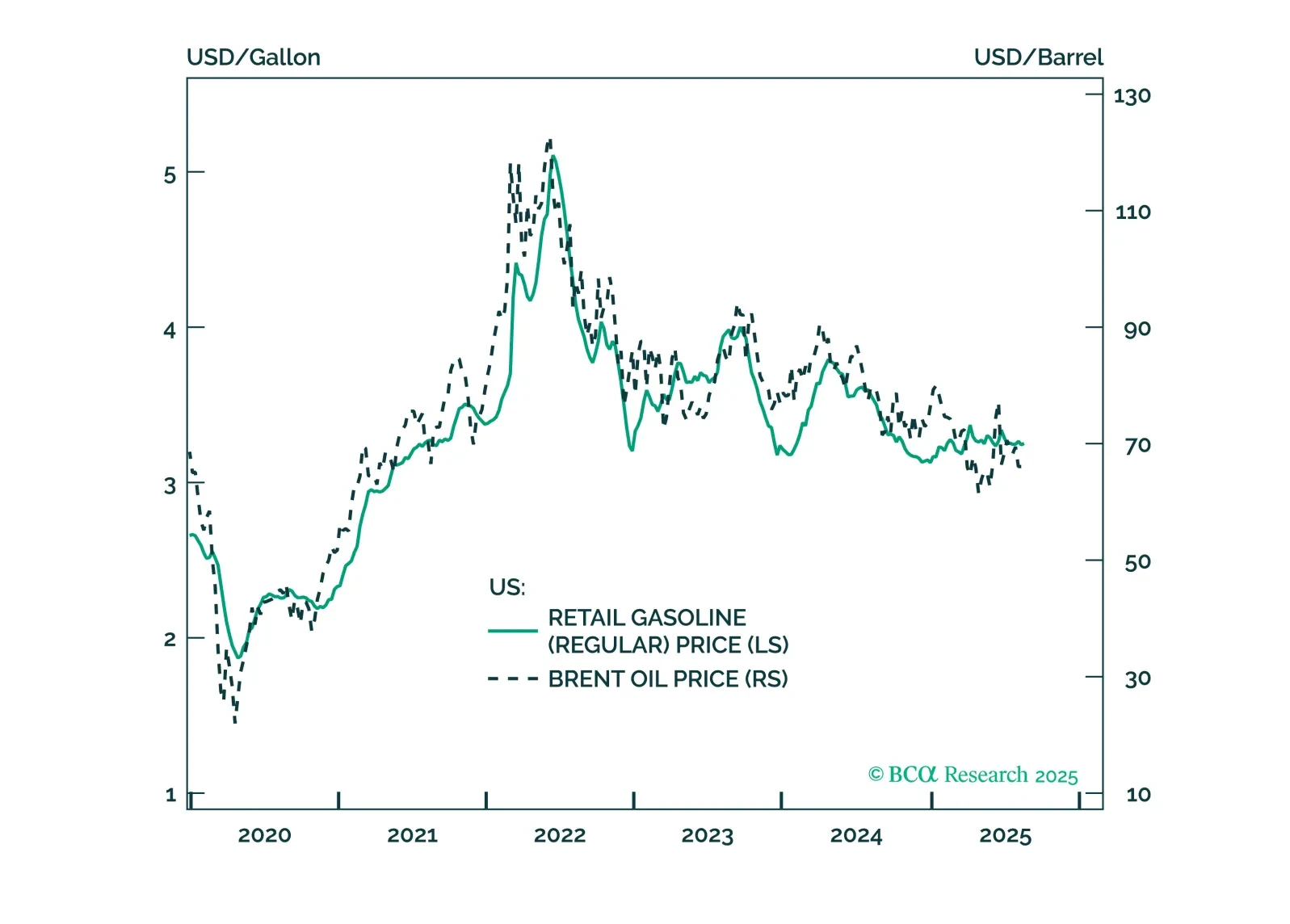

The media is missing the big picture: the war is already contained. The falling oil price confirms that. We fully expect cold feet and volatility incidents in the very near term but there is only a 5% chance of Russia triggering a…