In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

We continue to expect a recession by early 2025 but assign non-trivial odds to growth surprising to the upside until then. Our Global Investment Strategy team thus recommends investors adopt a barbell equity strategy as a…

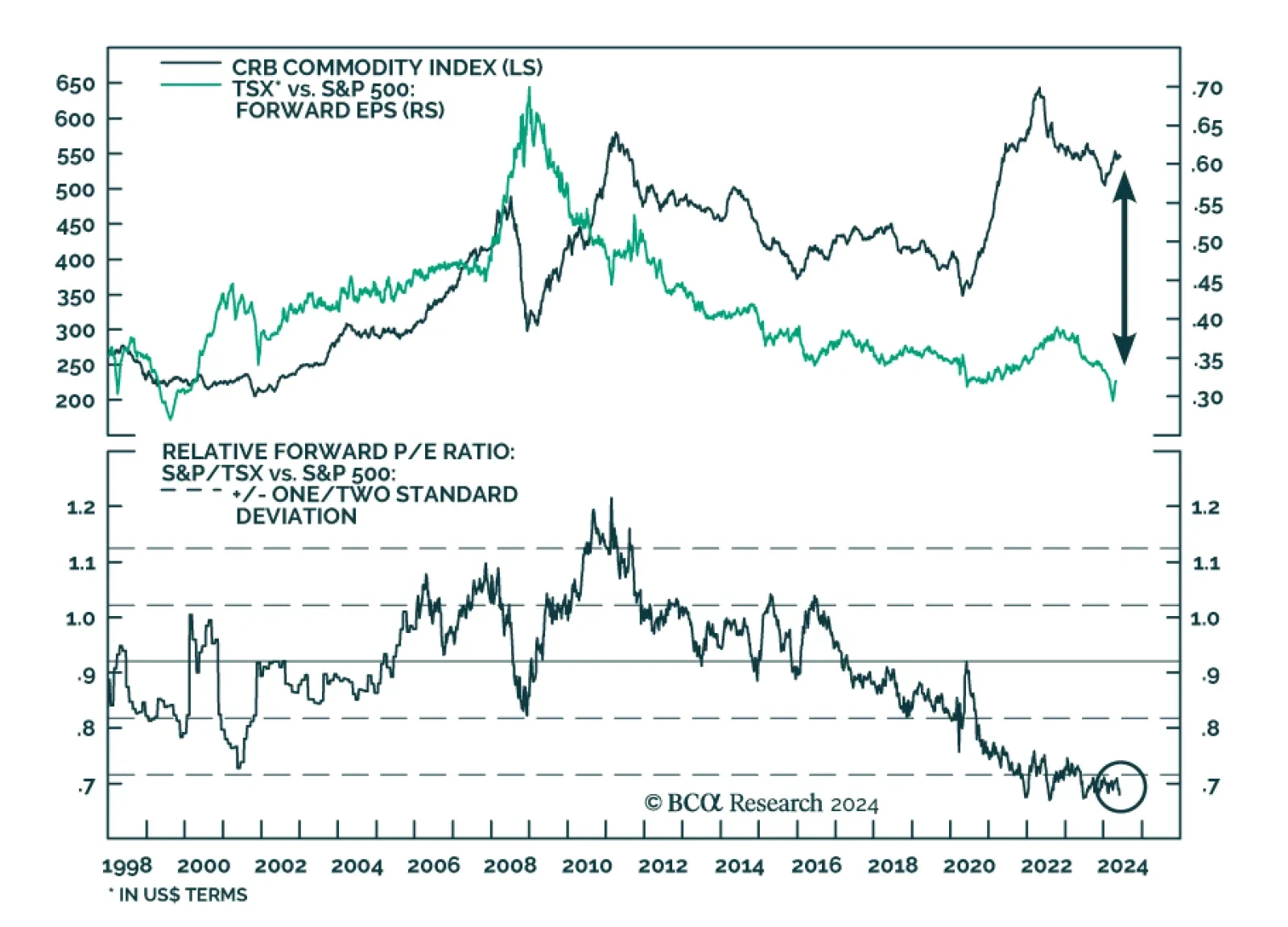

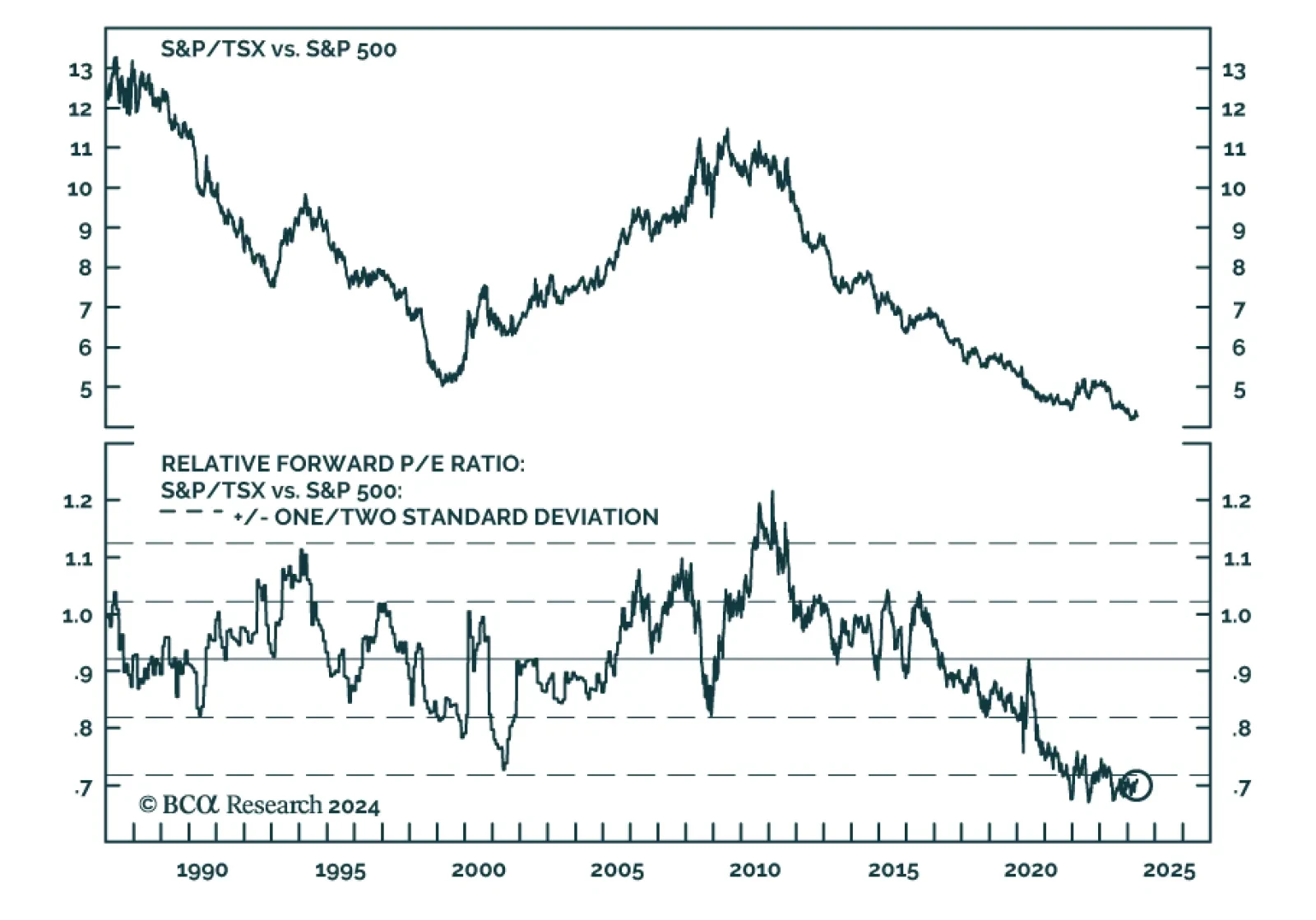

A decade of Canadian equity underperformance has led to a historical discount relative to the S&P 500. Sector composition largely explains this underperformance. Banks and natural resources stocks are overrepresented in the…

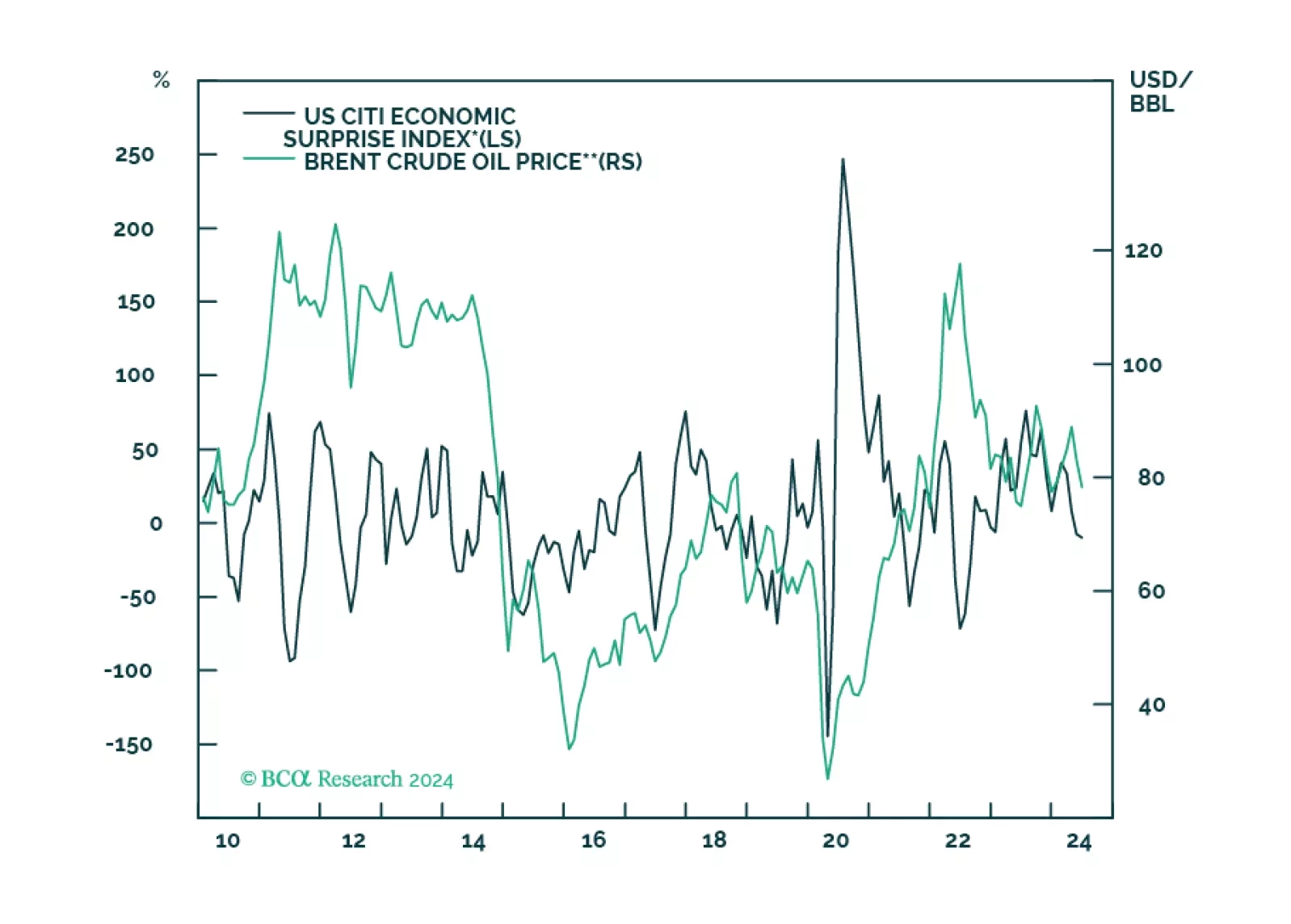

We close our overweights to Energy and Aerospace & Defense. The macroeconomic backdrop is deteriorating for Energy. As for A&D, the good news is already priced in.

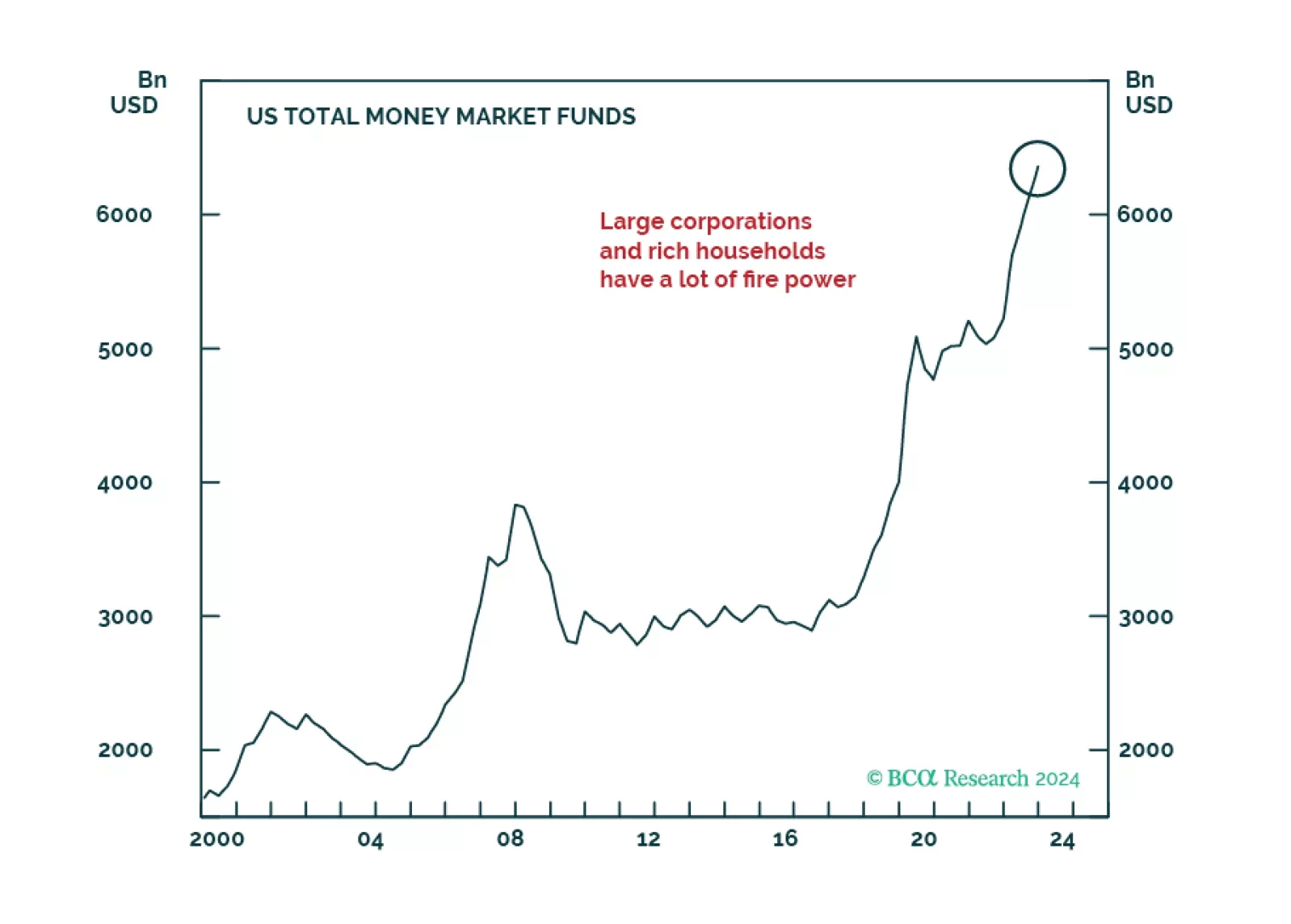

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

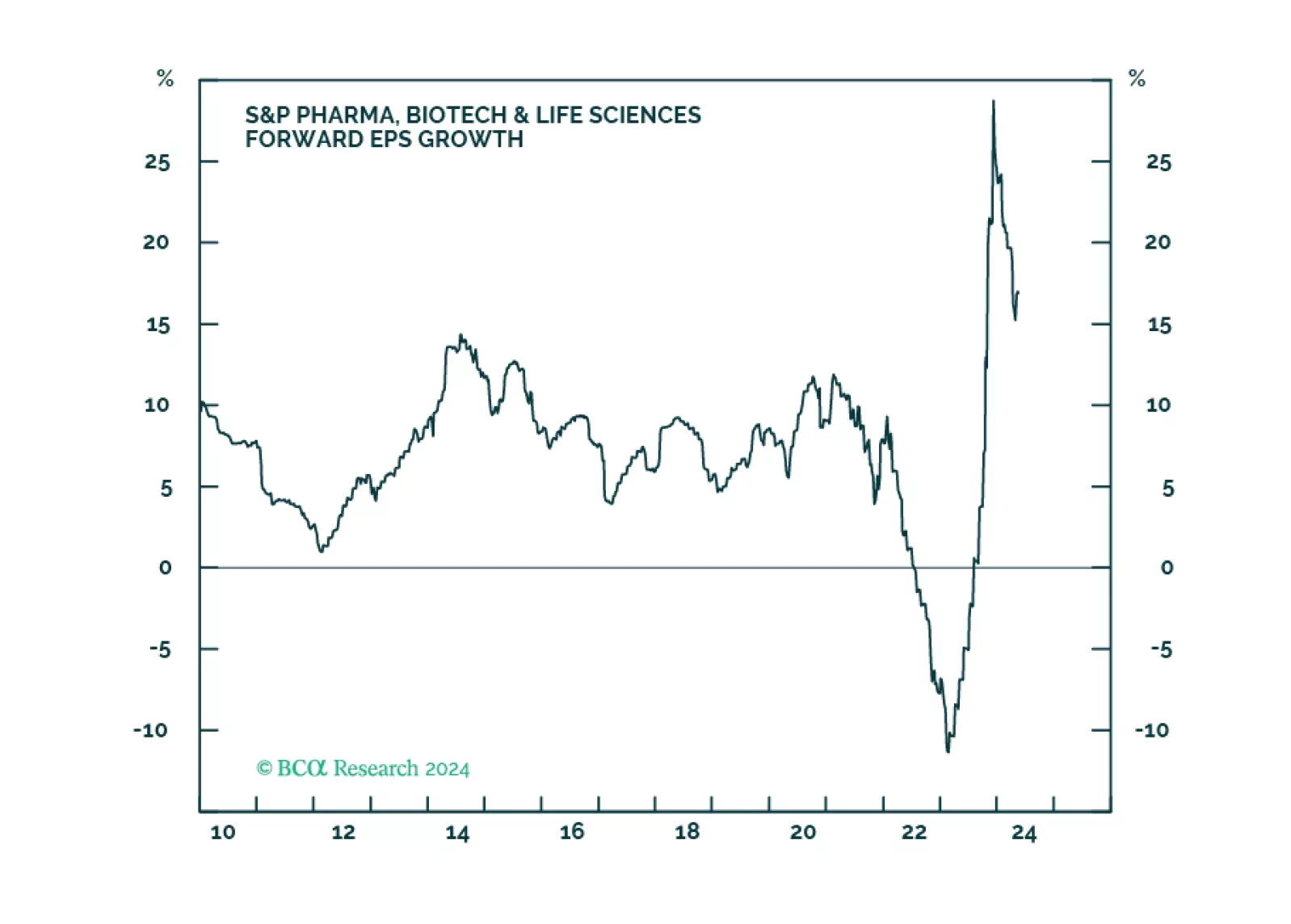

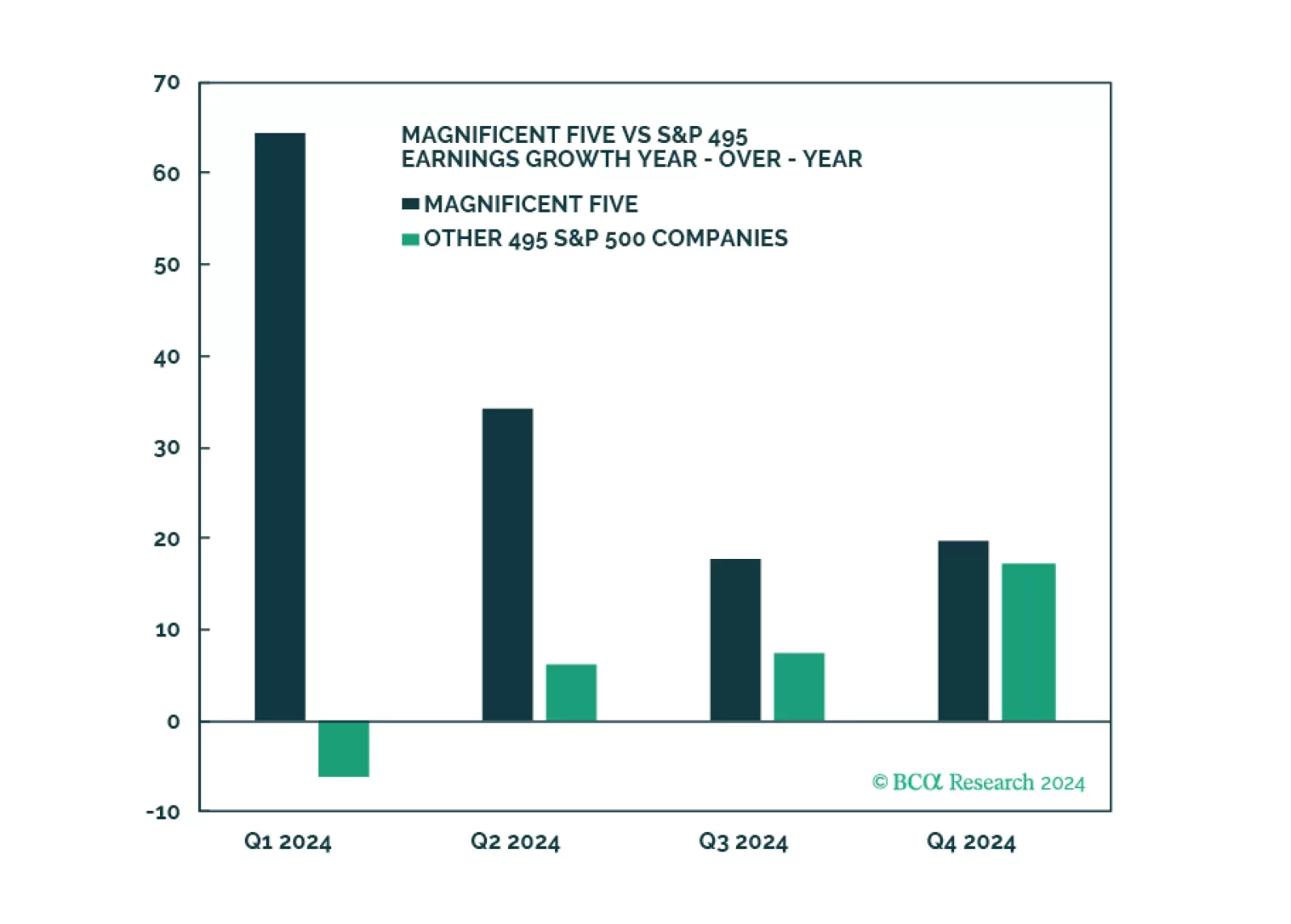

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

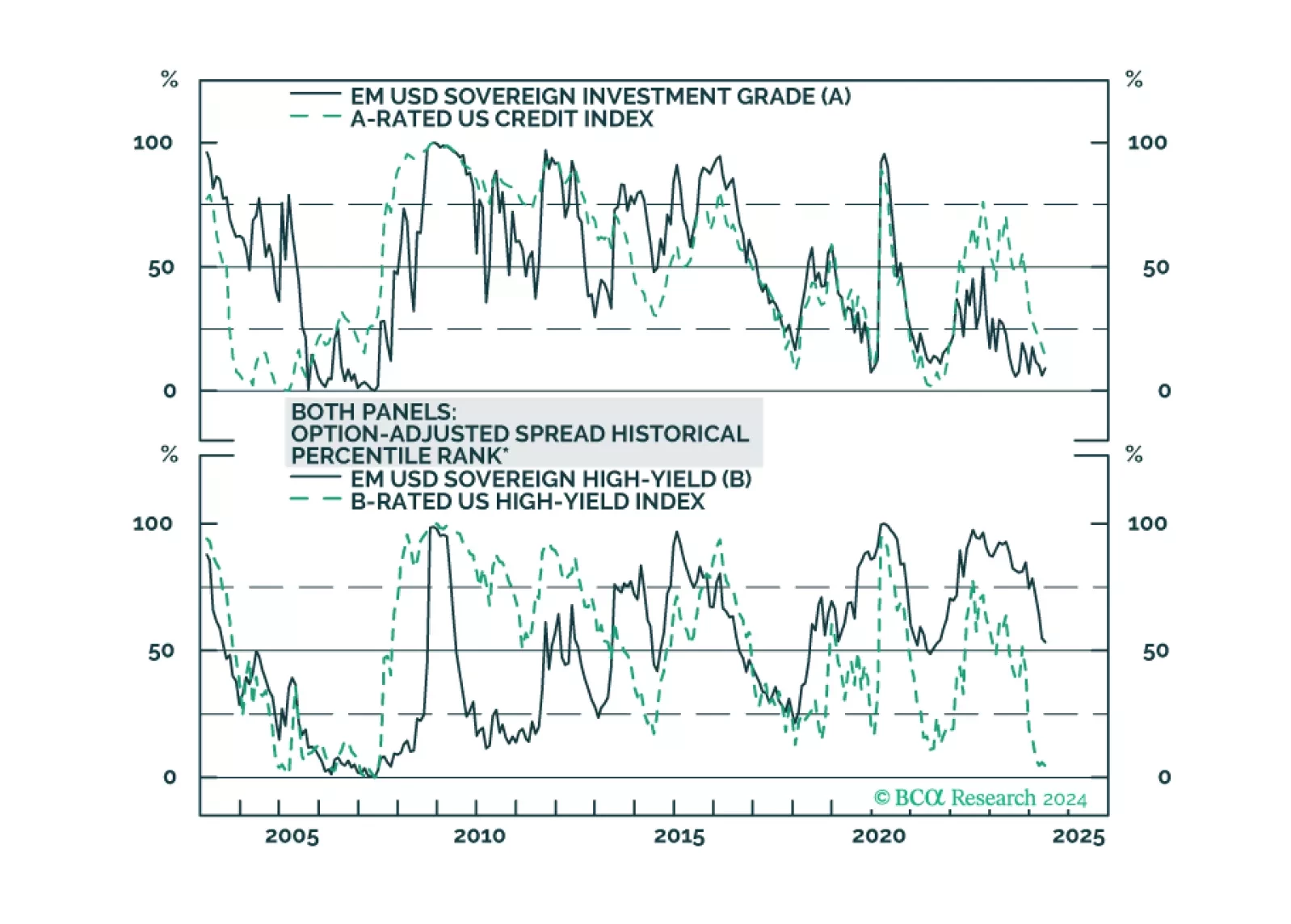

We dig into the USD-denominated Emerging Market Sovereign Index to see which credit tiers and countries offer value relative to US Credit.

Canadian equities have lagged their US counterparts for over a decade. Sector composition largely explains this underperformance. Banks and natural resources stocks are overrepresented in the TSX while the US stock market is…