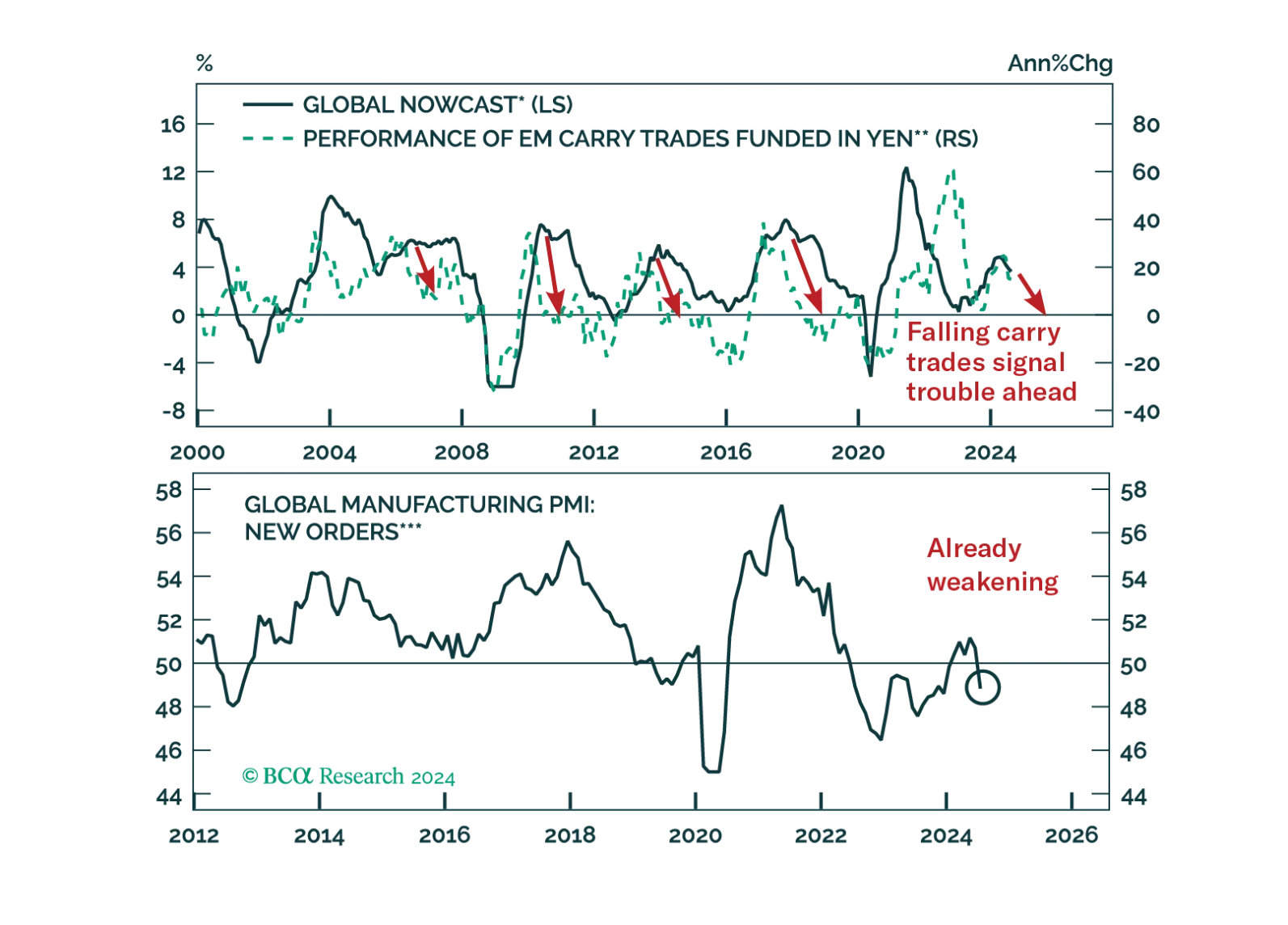

Crucial leading indicators of the global and European economies continue to deteriorate. How should investors position their European portfolios to benefit from these trends?

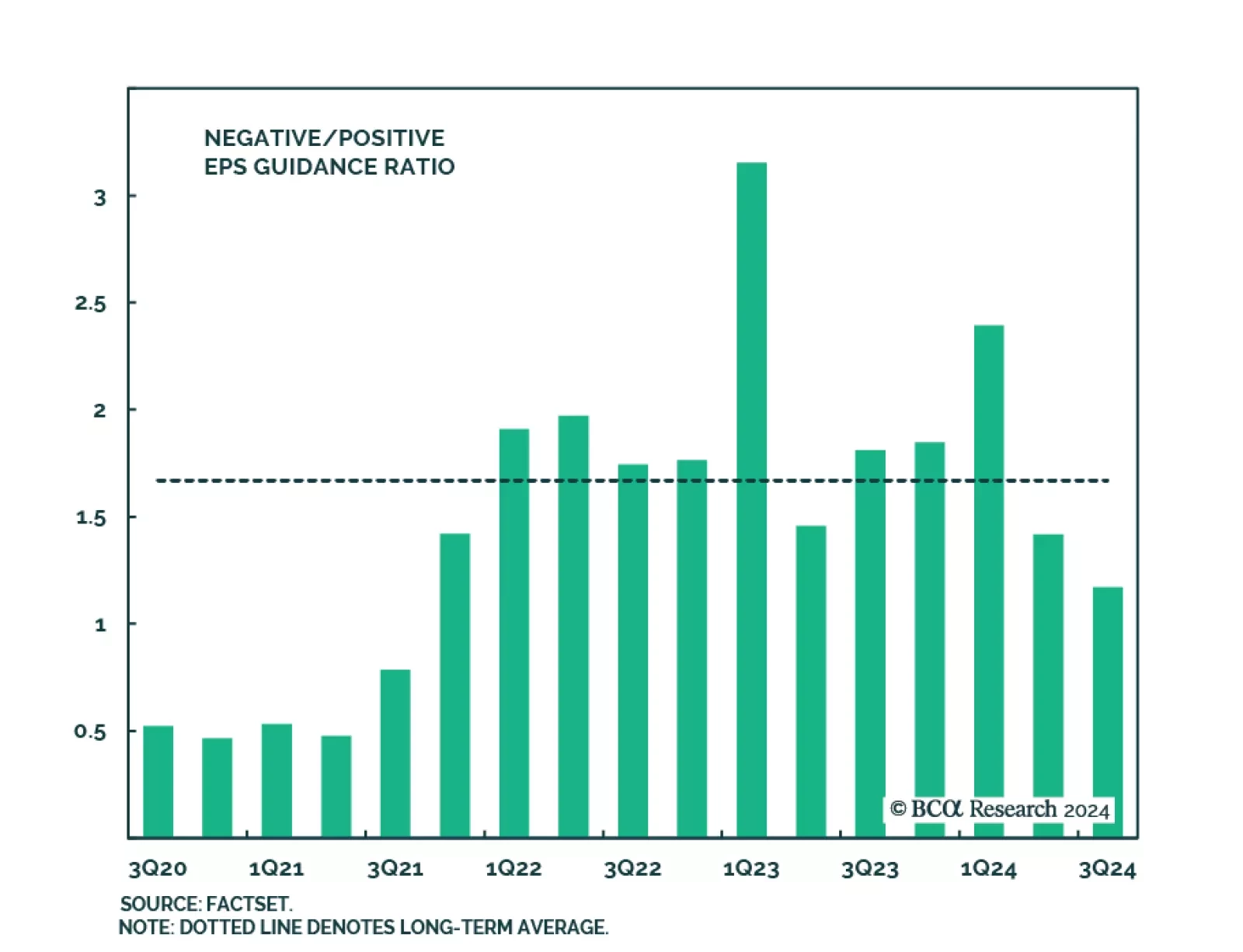

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

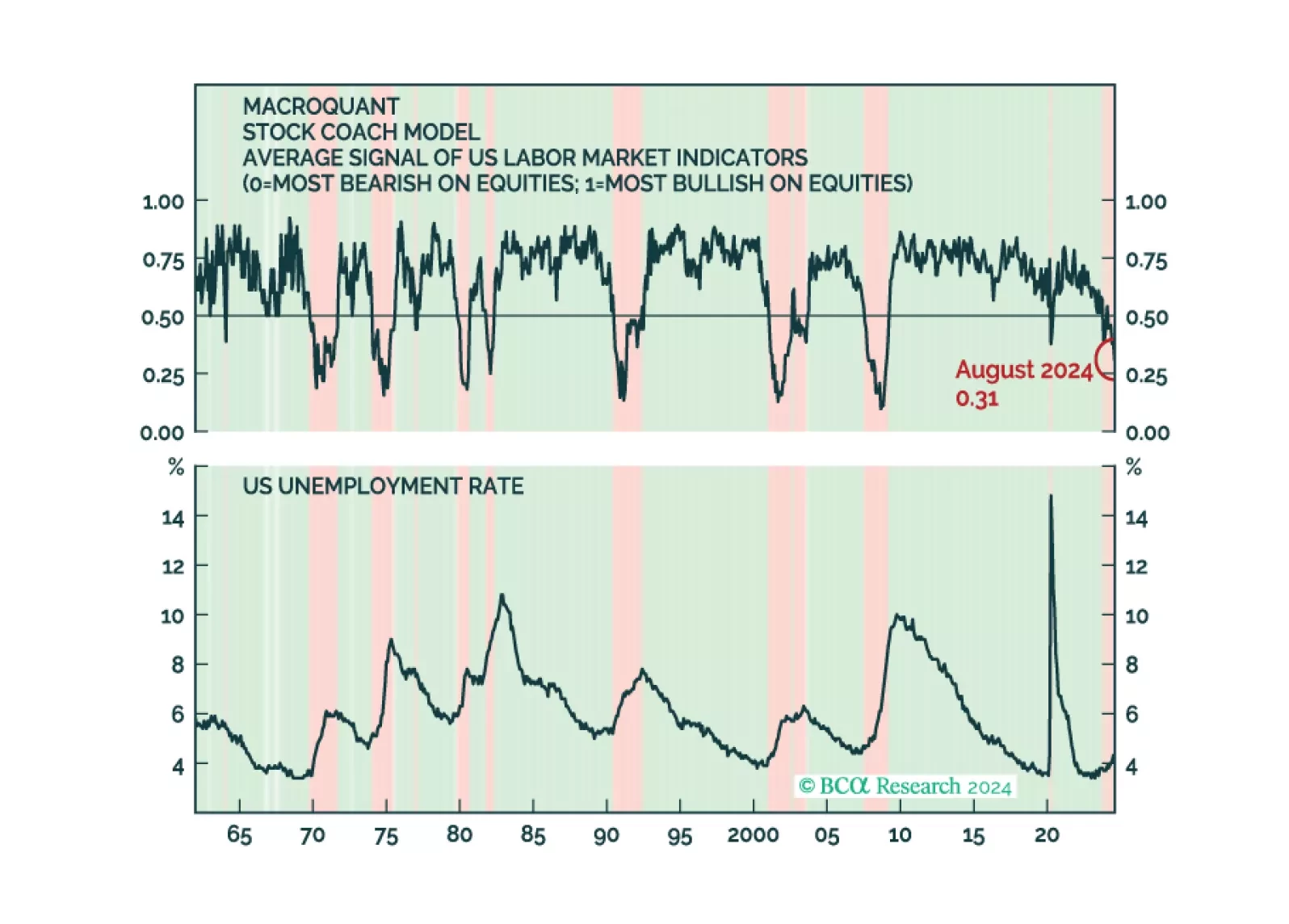

MacroQuant continues to recommend underweighting equities and overweighting bonds. This is consistent with the Global Investment Strategy Team's decision to downgrade global equities to underweight in late June.

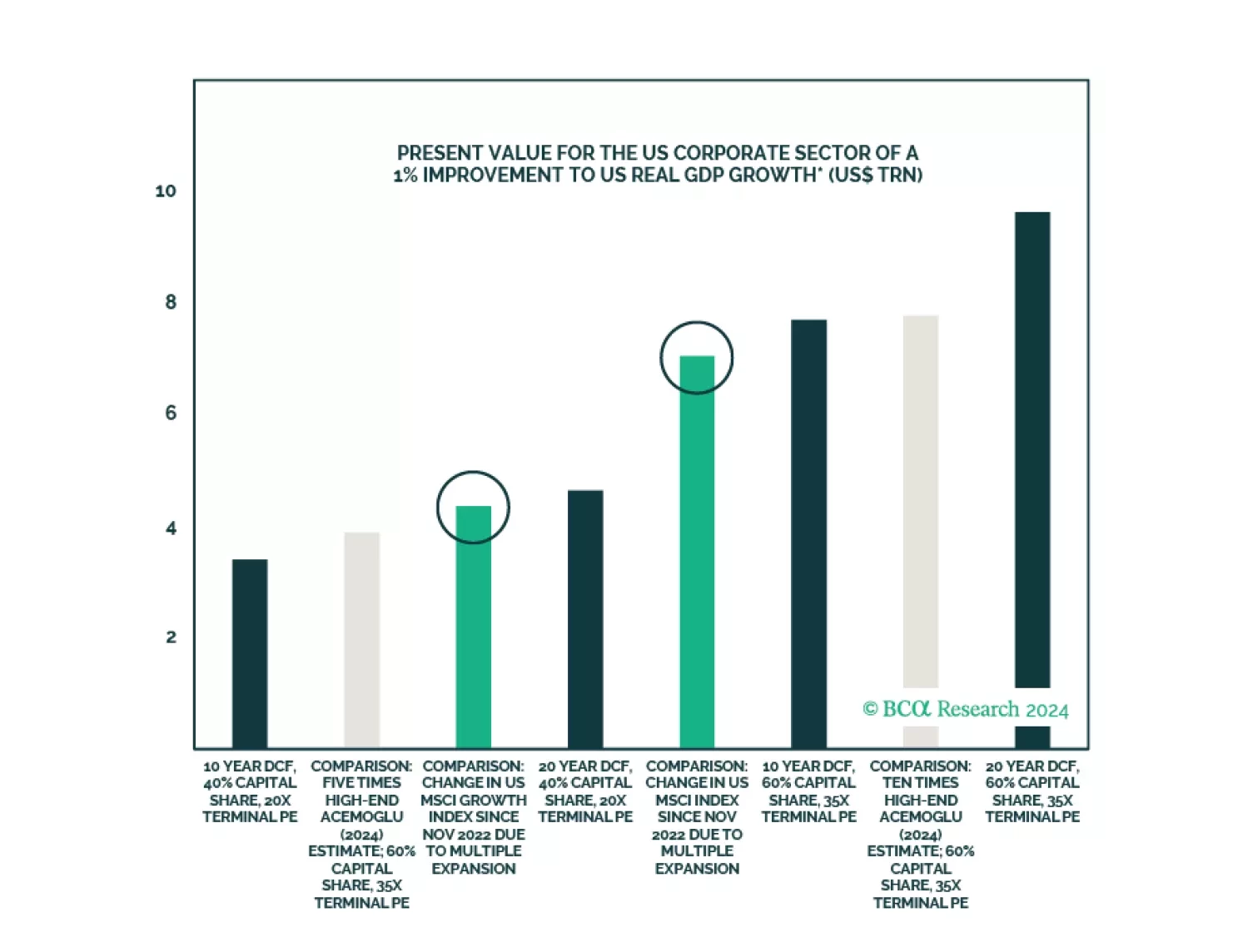

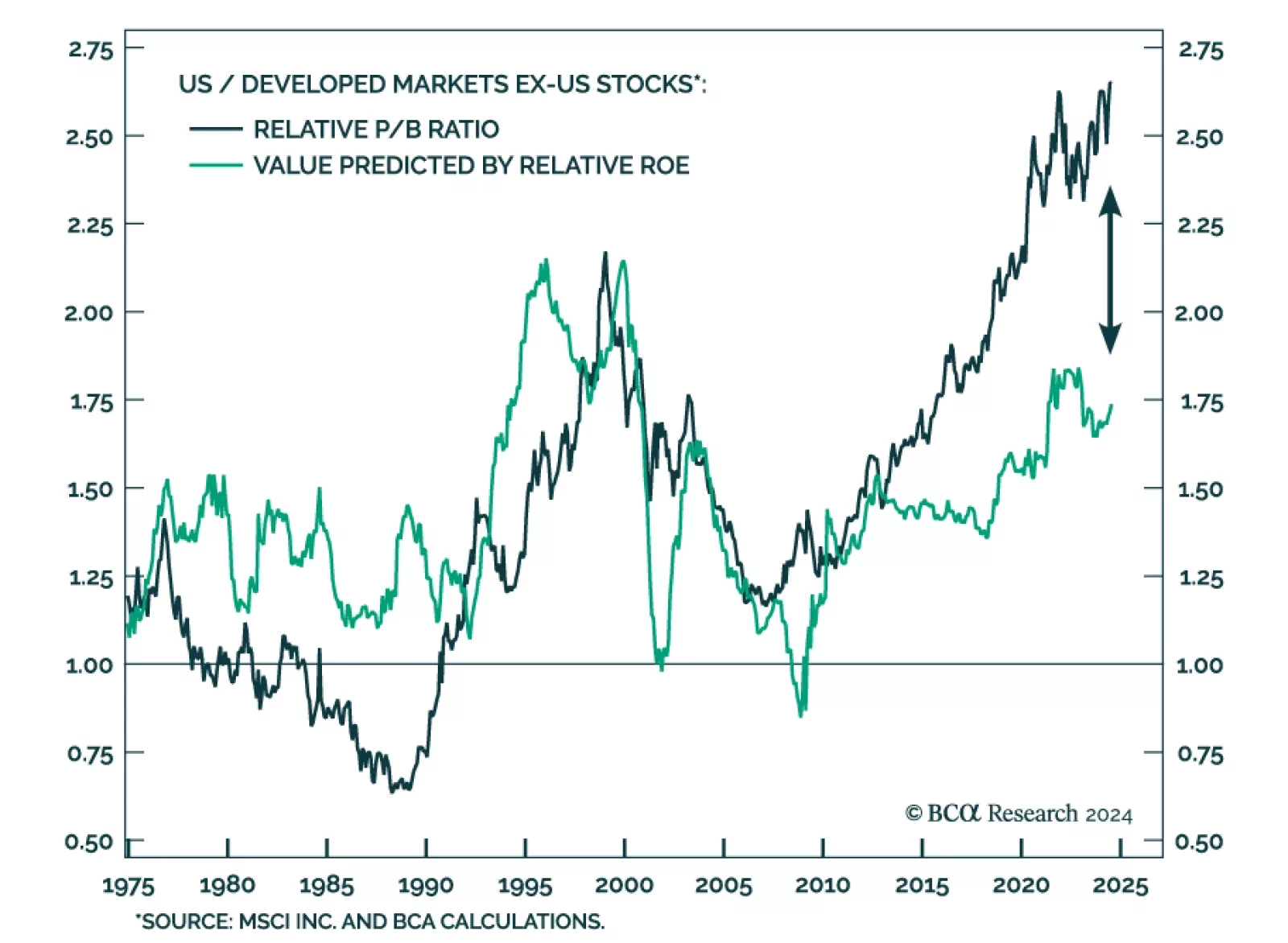

According to our Bank Credit Analyst service, an inflection point in the relative performance of US stocks is not likely to occur over the coming 6-12 months. A recession favors US equities in common currency terms barring…

The unwind of yen carry trades caused violent tremors across the globe. Was this shock a one-off event or the prelude to more troubles?

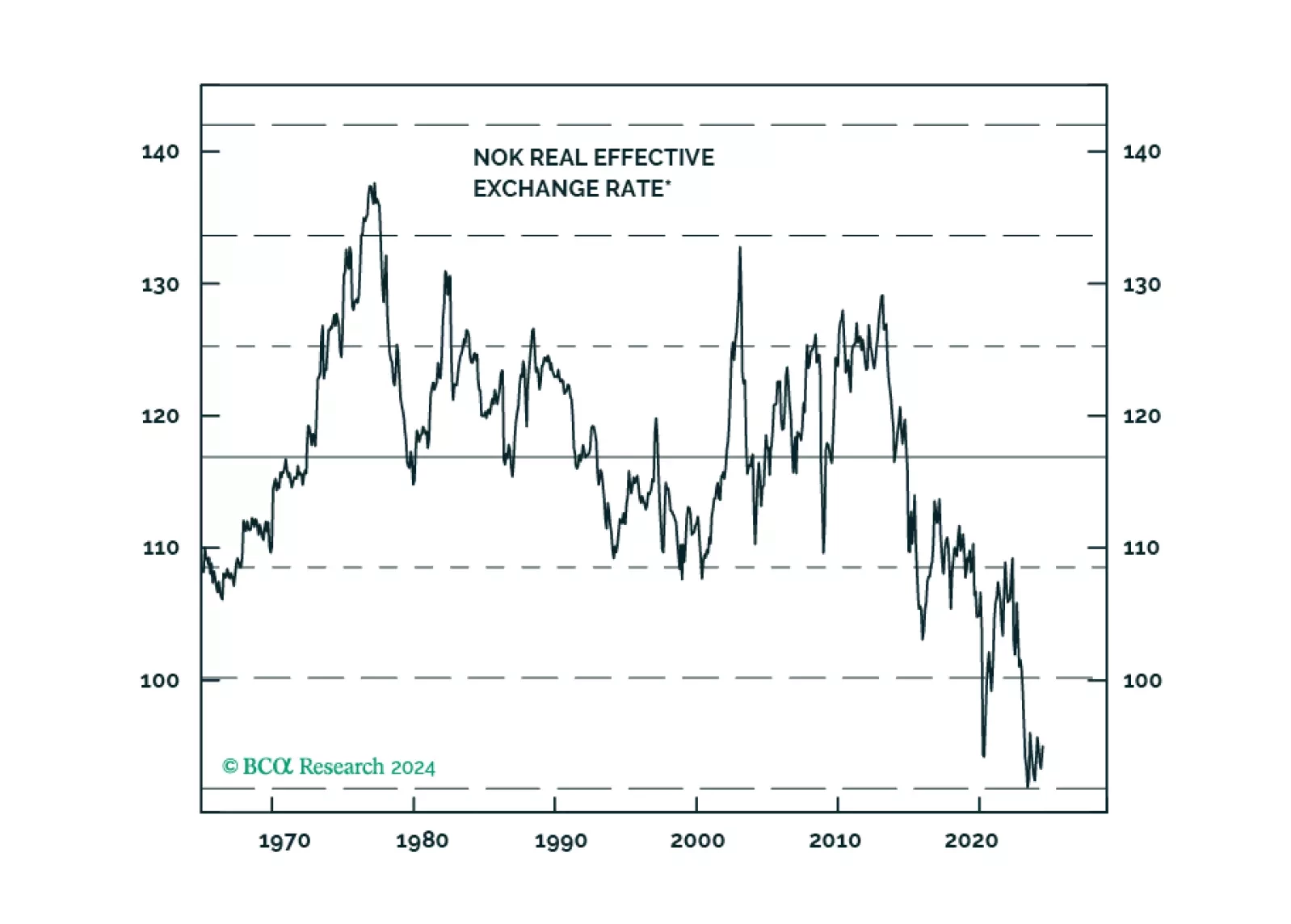

As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

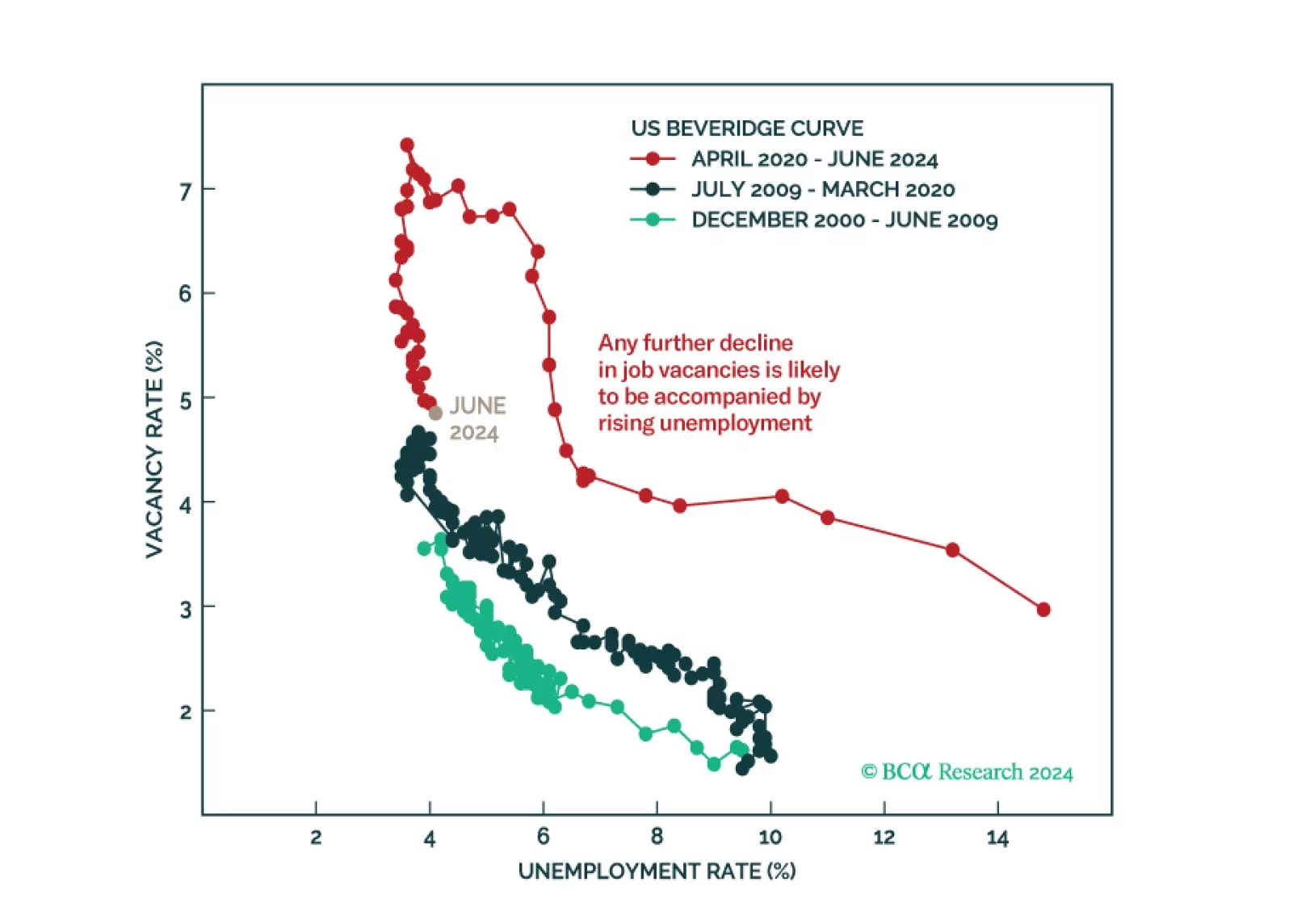

Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.

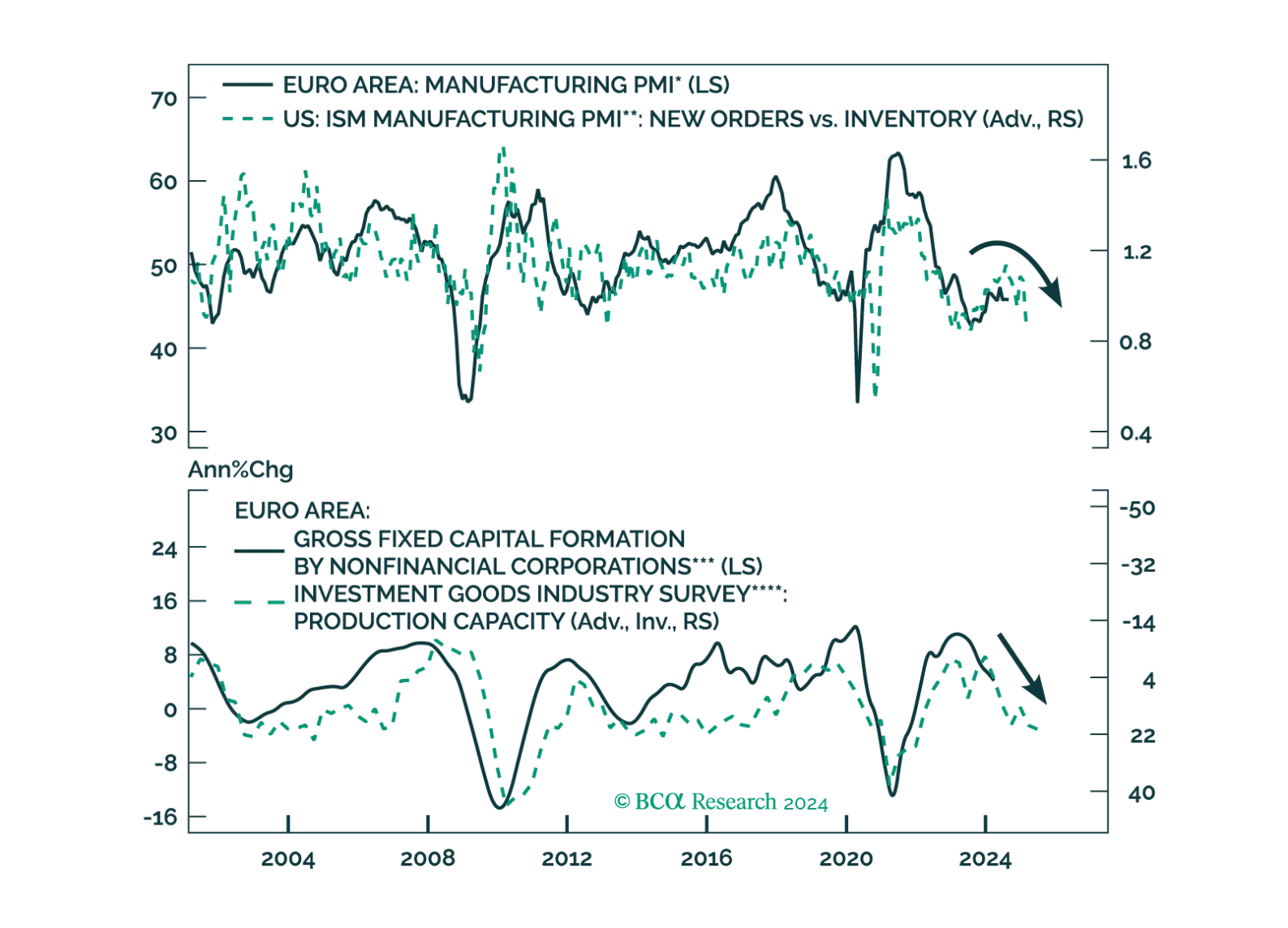

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?