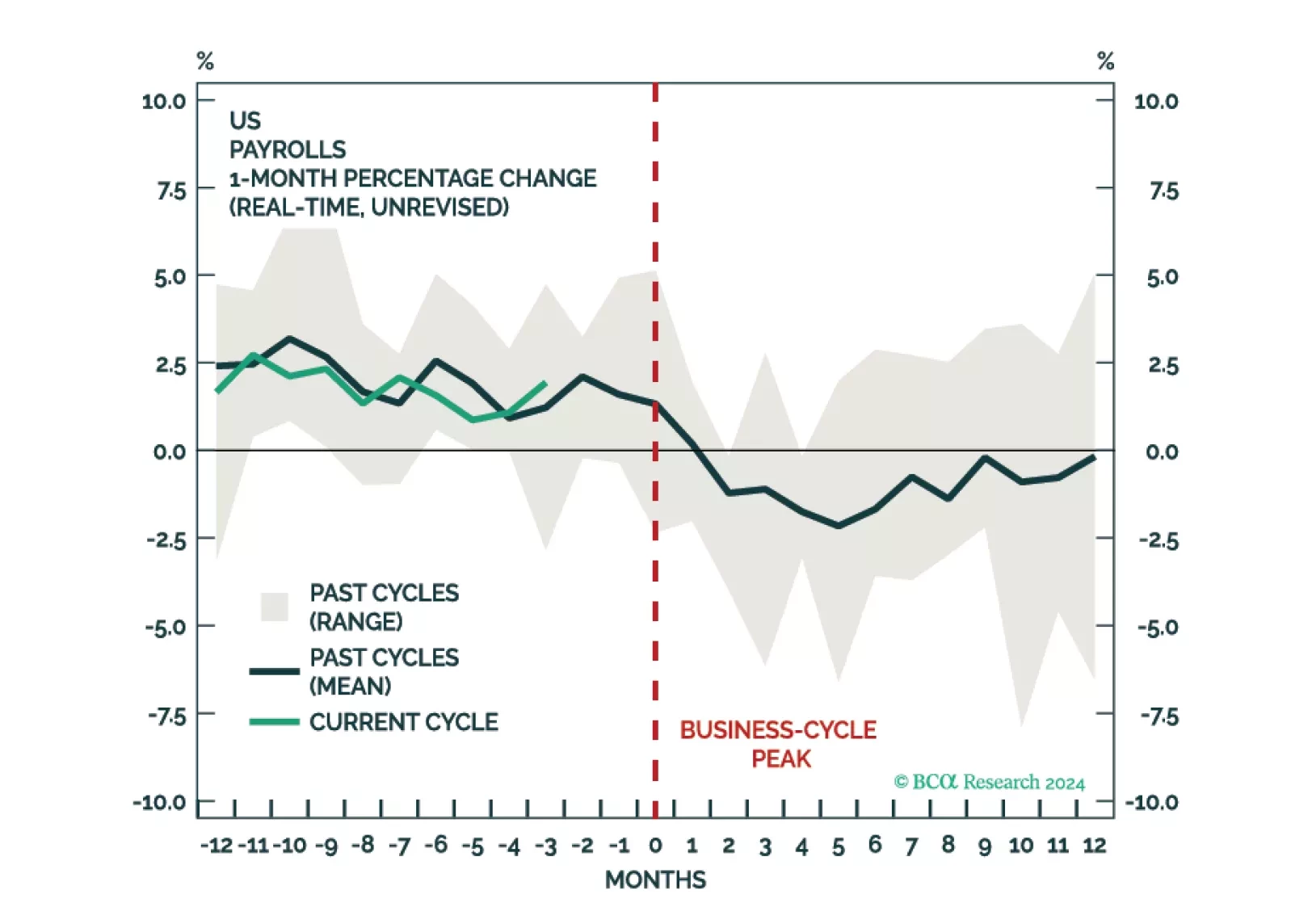

It is too early to say that the US labor market has turned the corner. We assign a 60% chance that the US will enter a recession over the next 12 months, with the downturn likely to begin in the first half of 2025. Accordingly,…

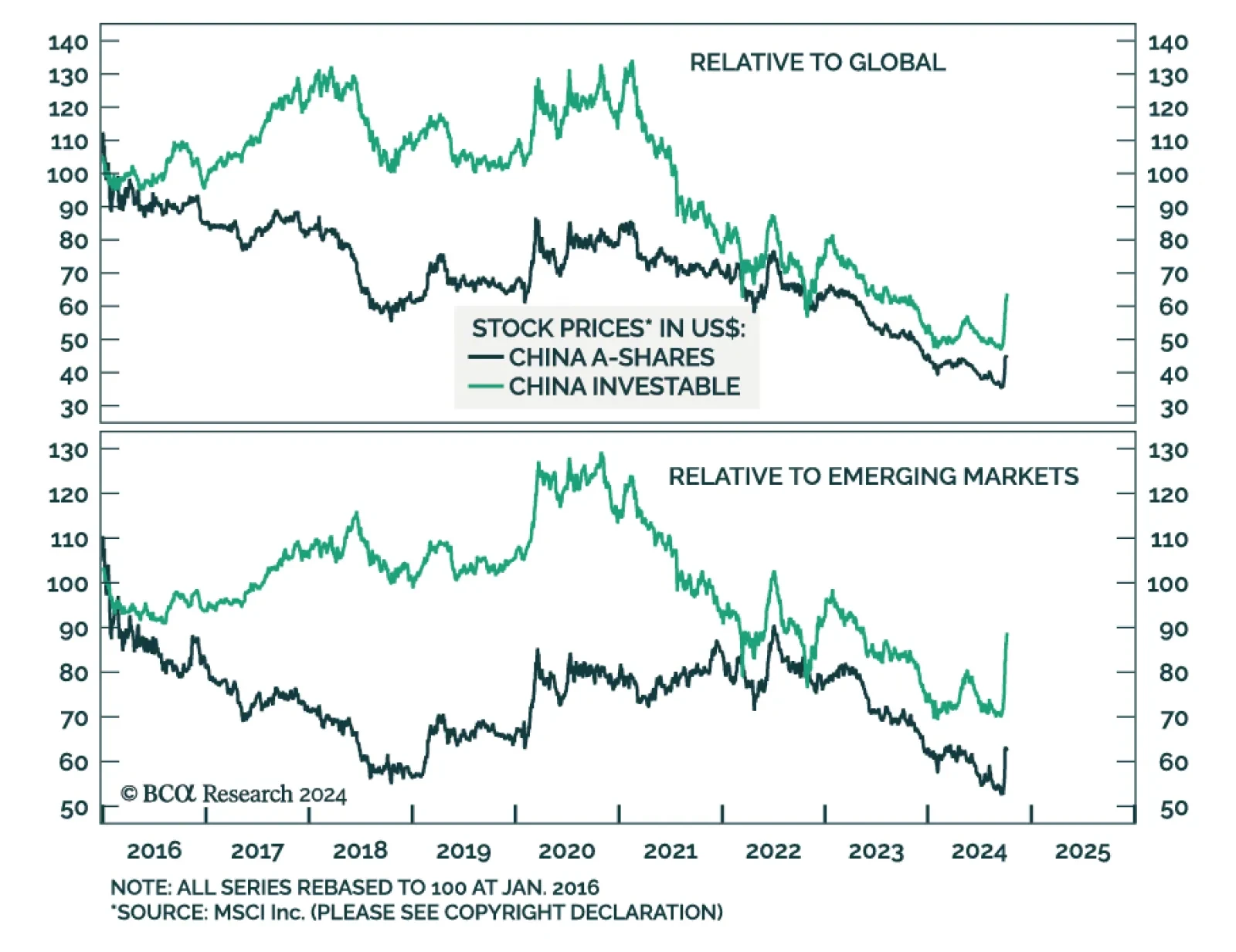

China’s National Development and Reform Commission (NDRC) provided no insights Tuesday on the size or nature of the fiscal stimulus Beijing promised in late September. The key takeaway of the authorities' first briefing…

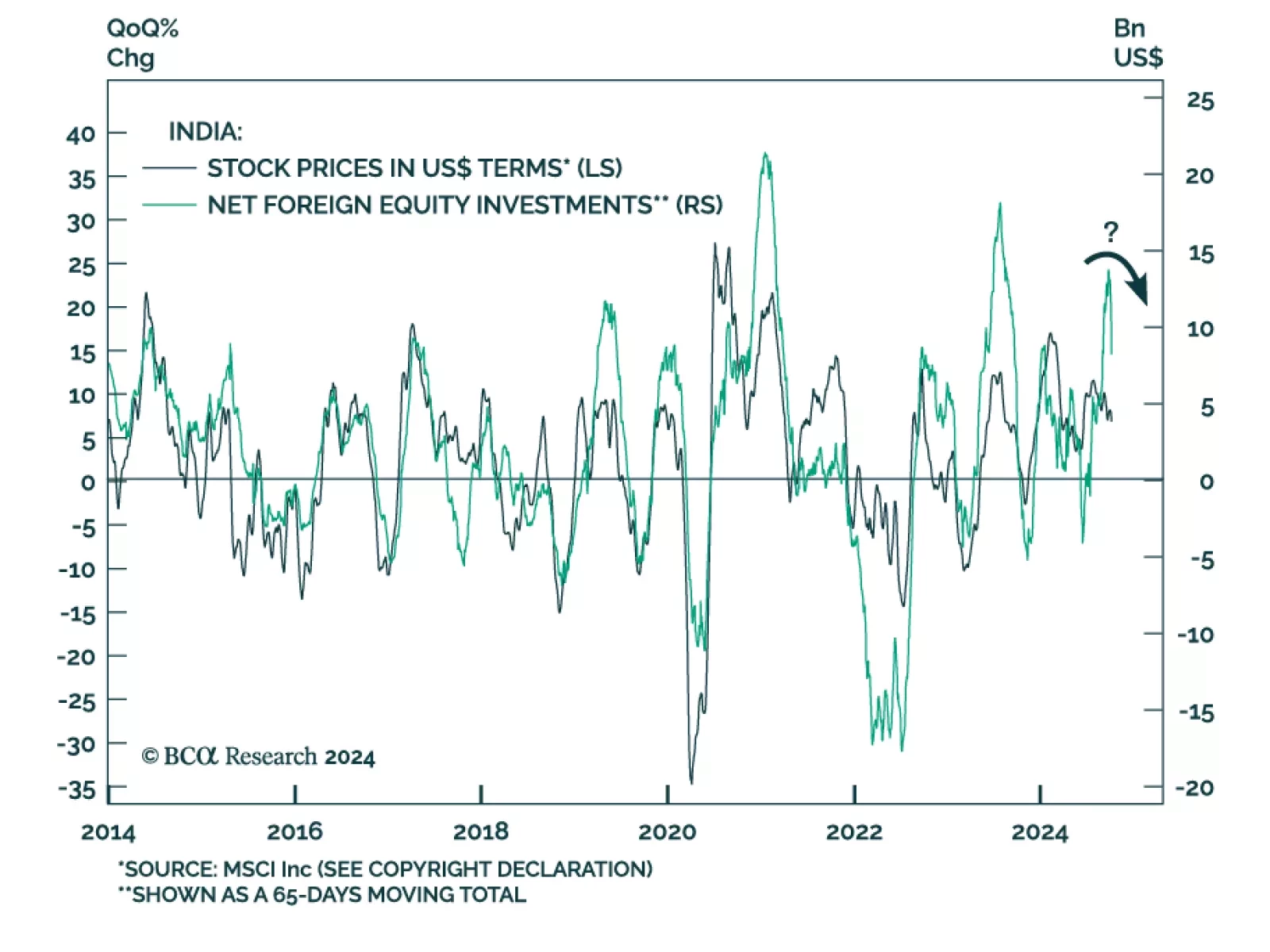

Indian equities reached new highs in late September. Our Emerging Market strategists recommend dedicated EM investors use these gains as an opportunity to reduce Indian equity allocations from neutral to underweight. They expect both…

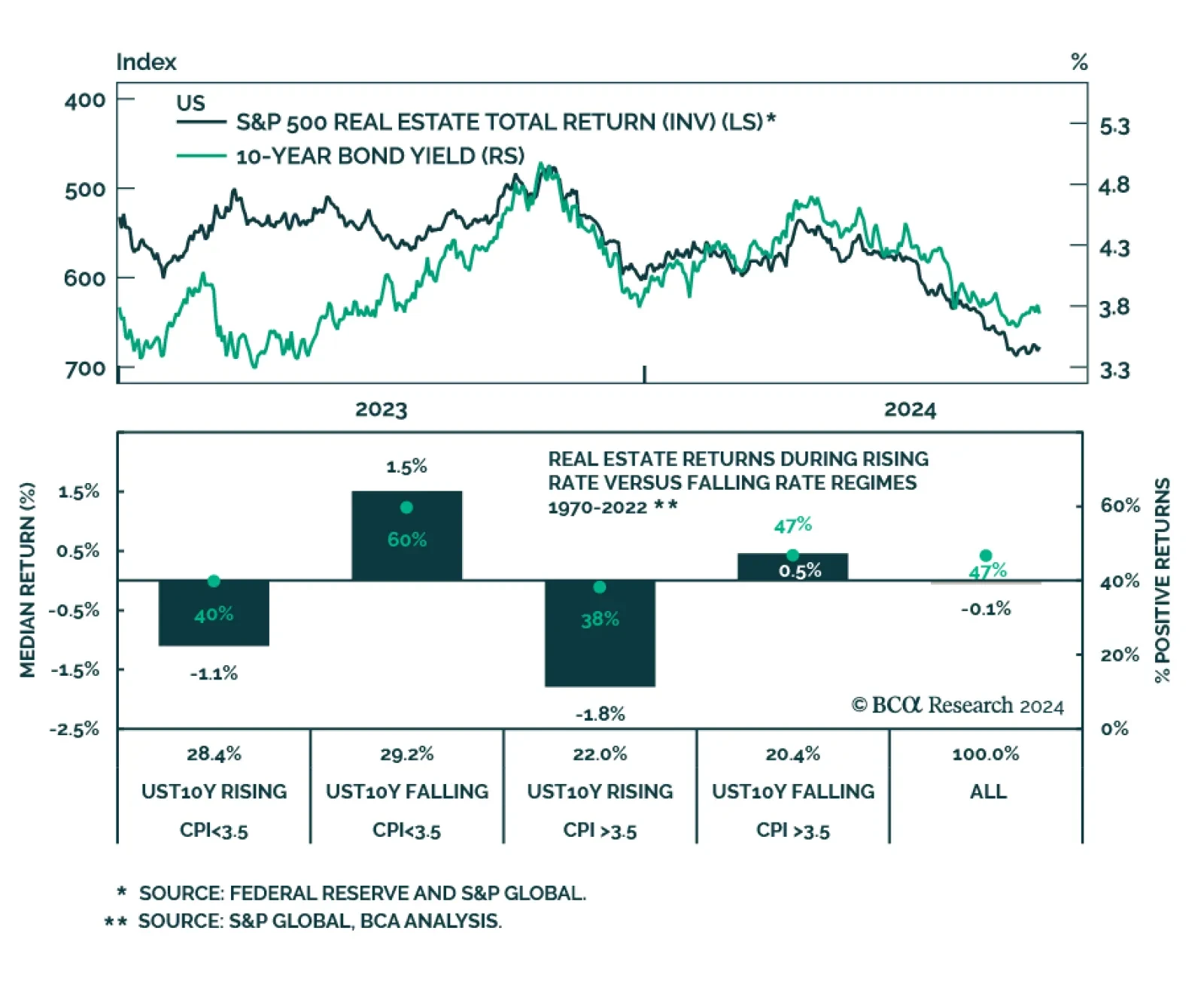

The prospects of Fed rate cuts powered the S&P 500 Real Estate index’s rally. Real estate was the best-performing sector in Q3, outperforming the S&P 500 by nearly 12%. Can this sector pursue its lead now that…

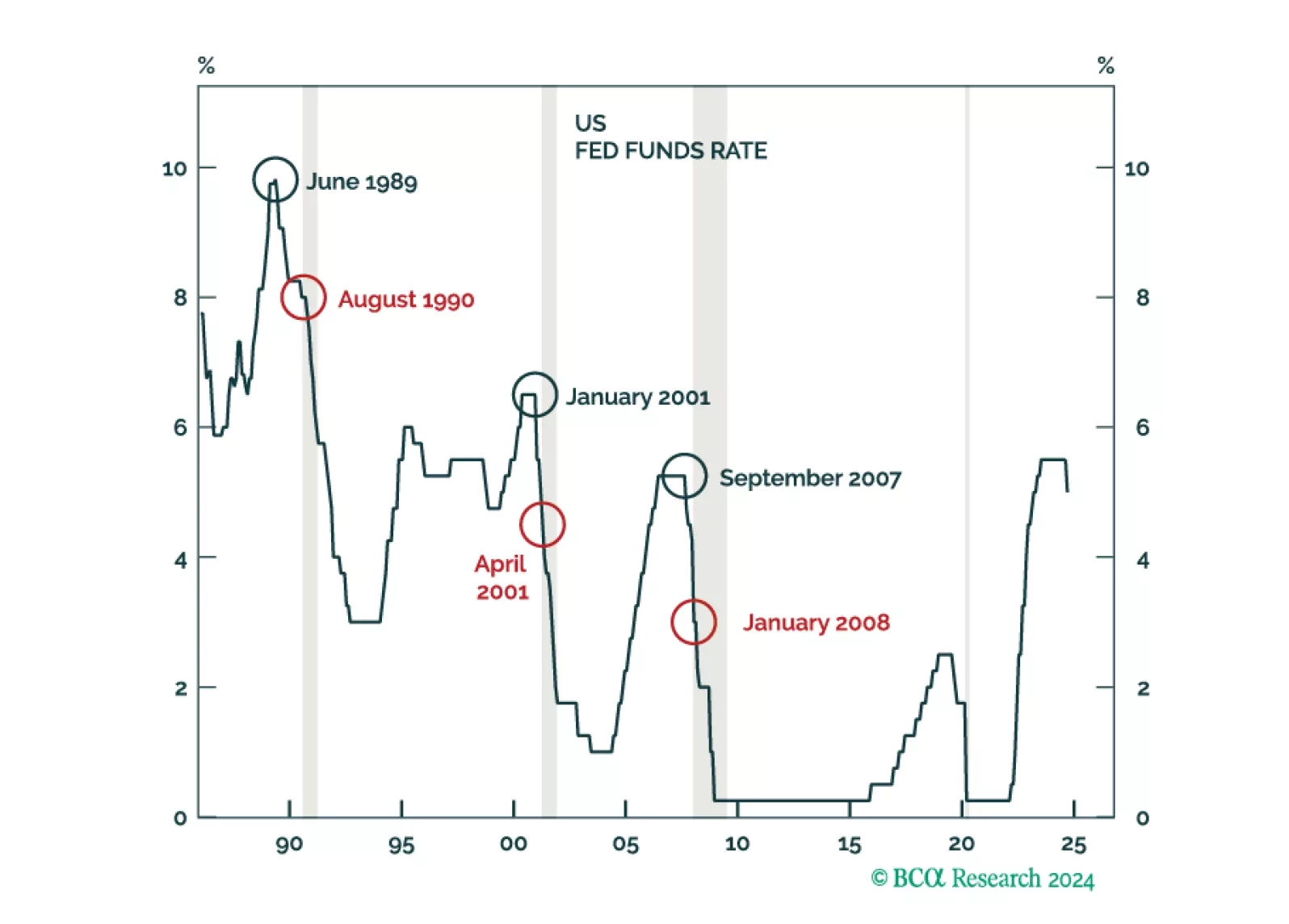

After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

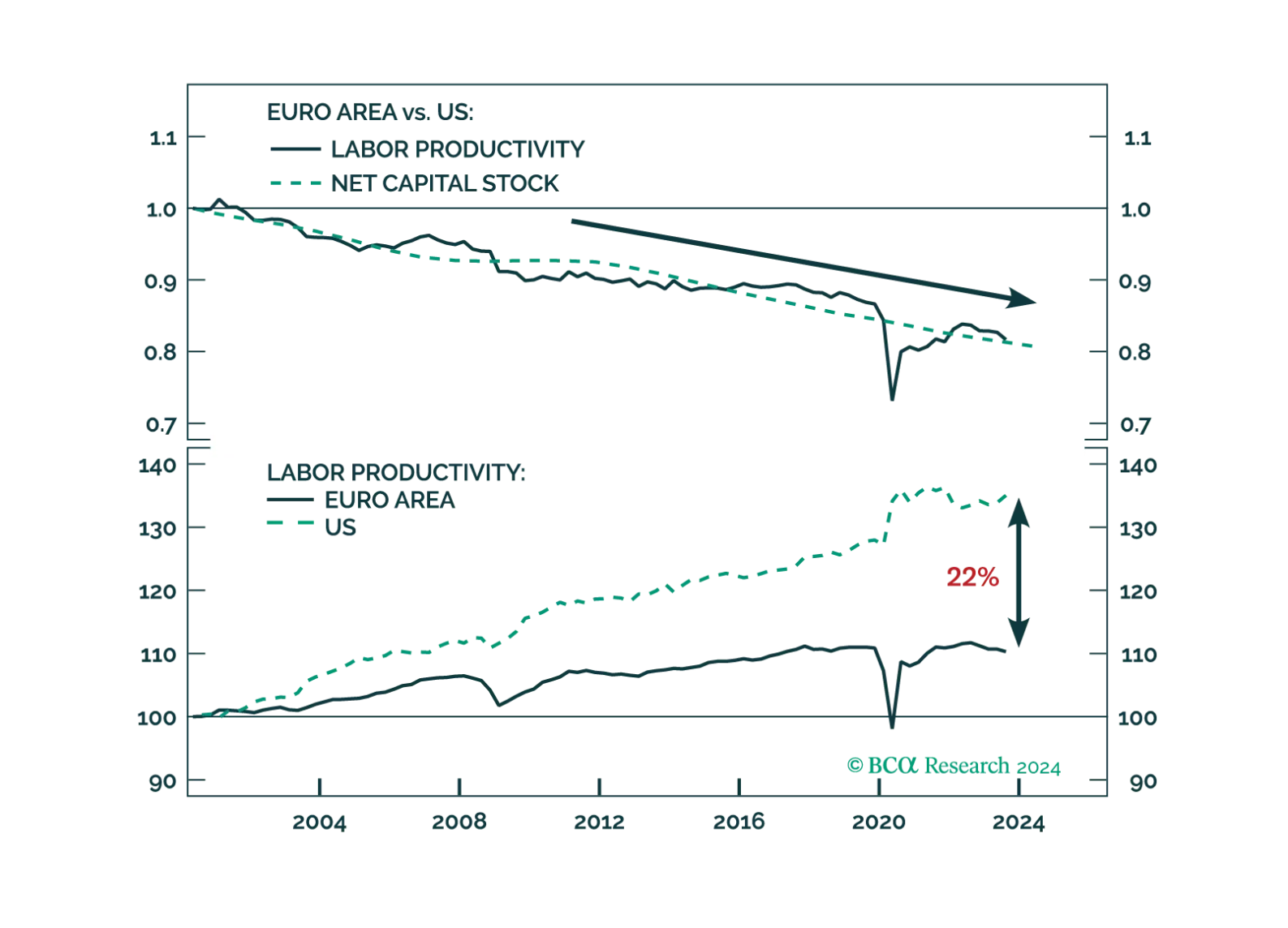

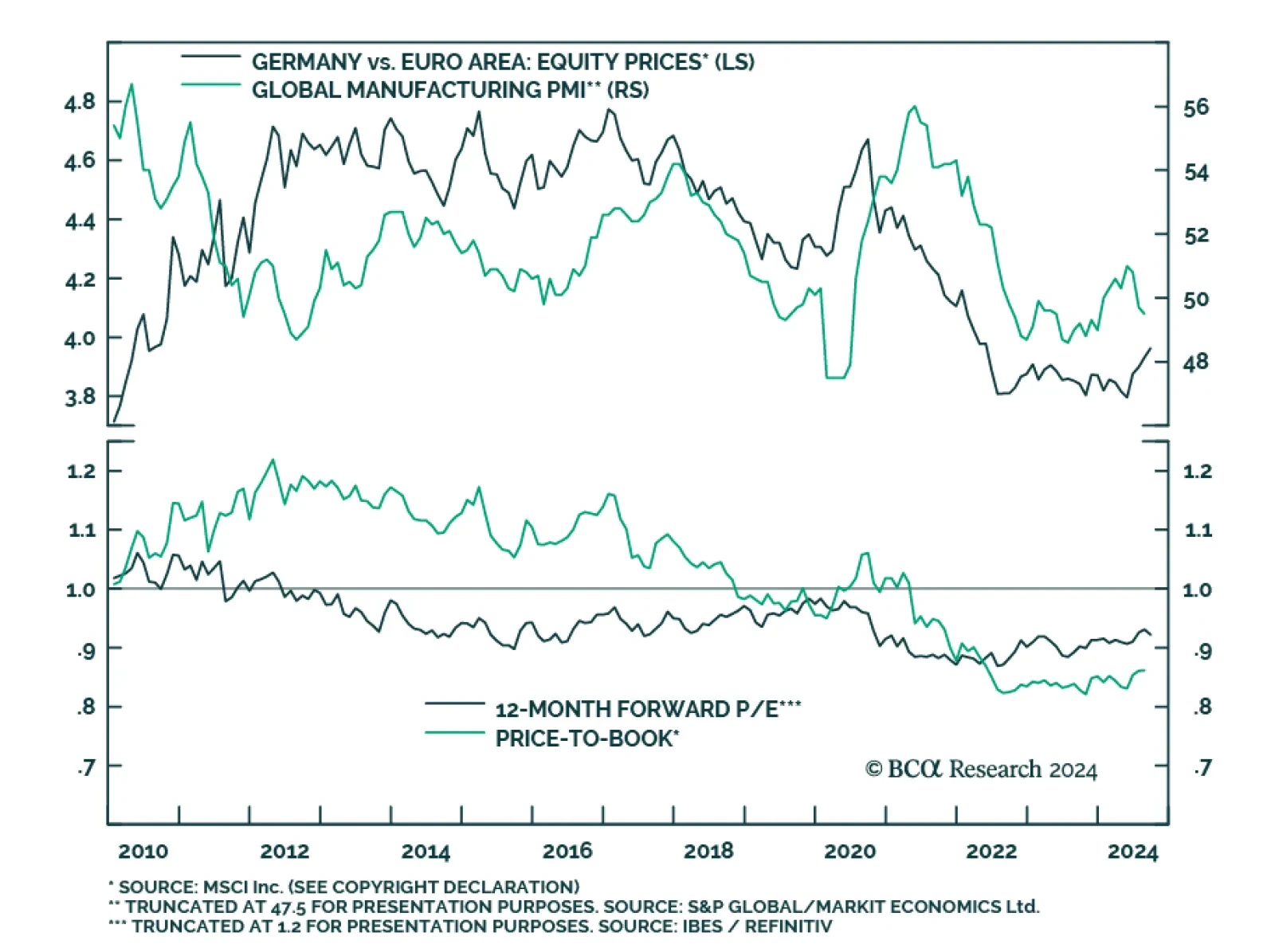

German equities have outperformed their Euro Area peers on a year-to-date basis, with the gap widening since May. The MSCI Germany Index returned nearly 4.5 percentage points more than the MSCI Eurozone index over the latter…

The Draghi report highlights sensible reforms that would address many of Europe’s productivity shortcomings. Whether European capitals heed Mario Draghi’s advices remains to be seen.

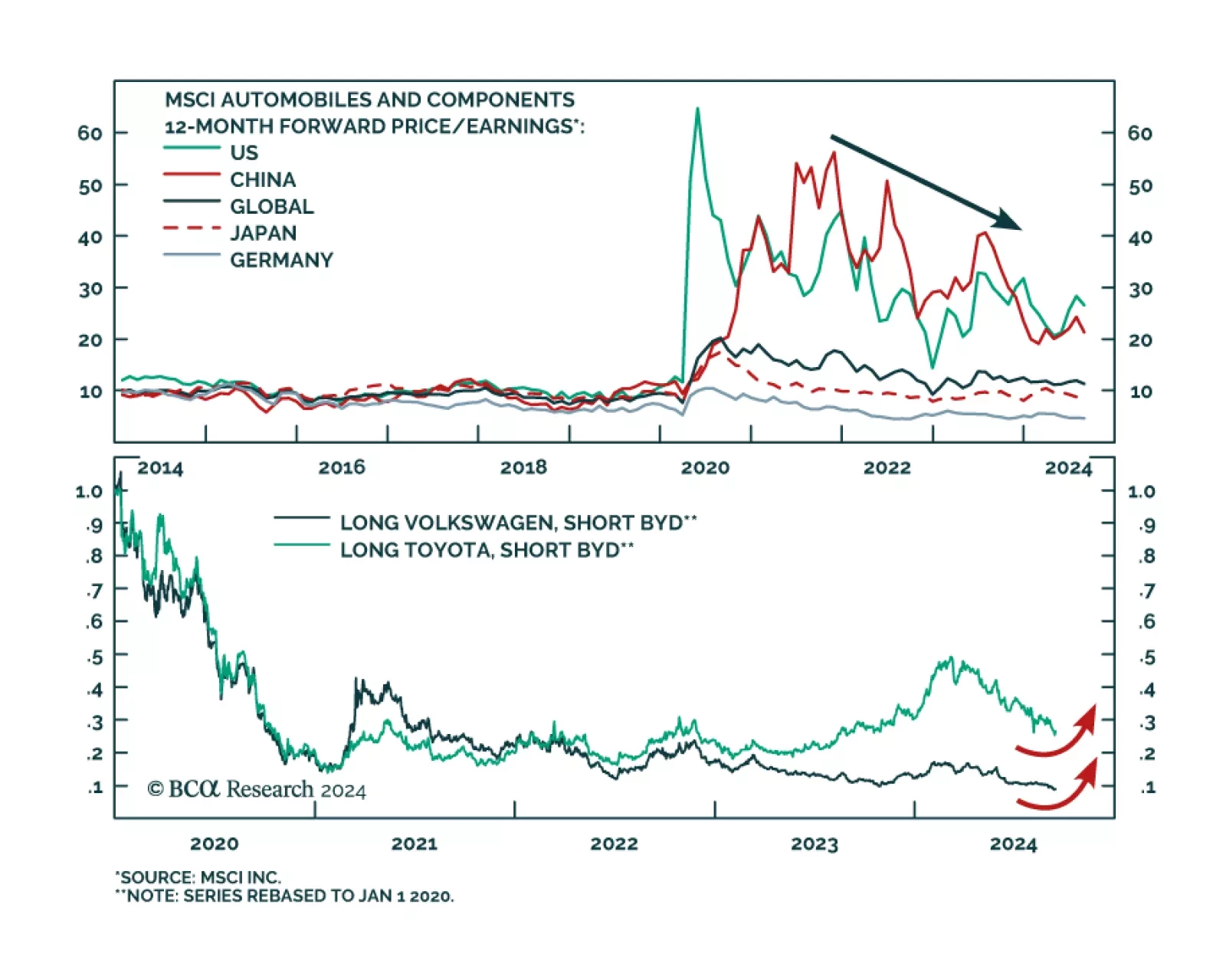

Volkswagen’s CEO has been making the point that the market for European carmakers has been deteriorating. Earlier last week, he went on to make a rather pointed reference at Chinese EV manufacturers. He was quoted…

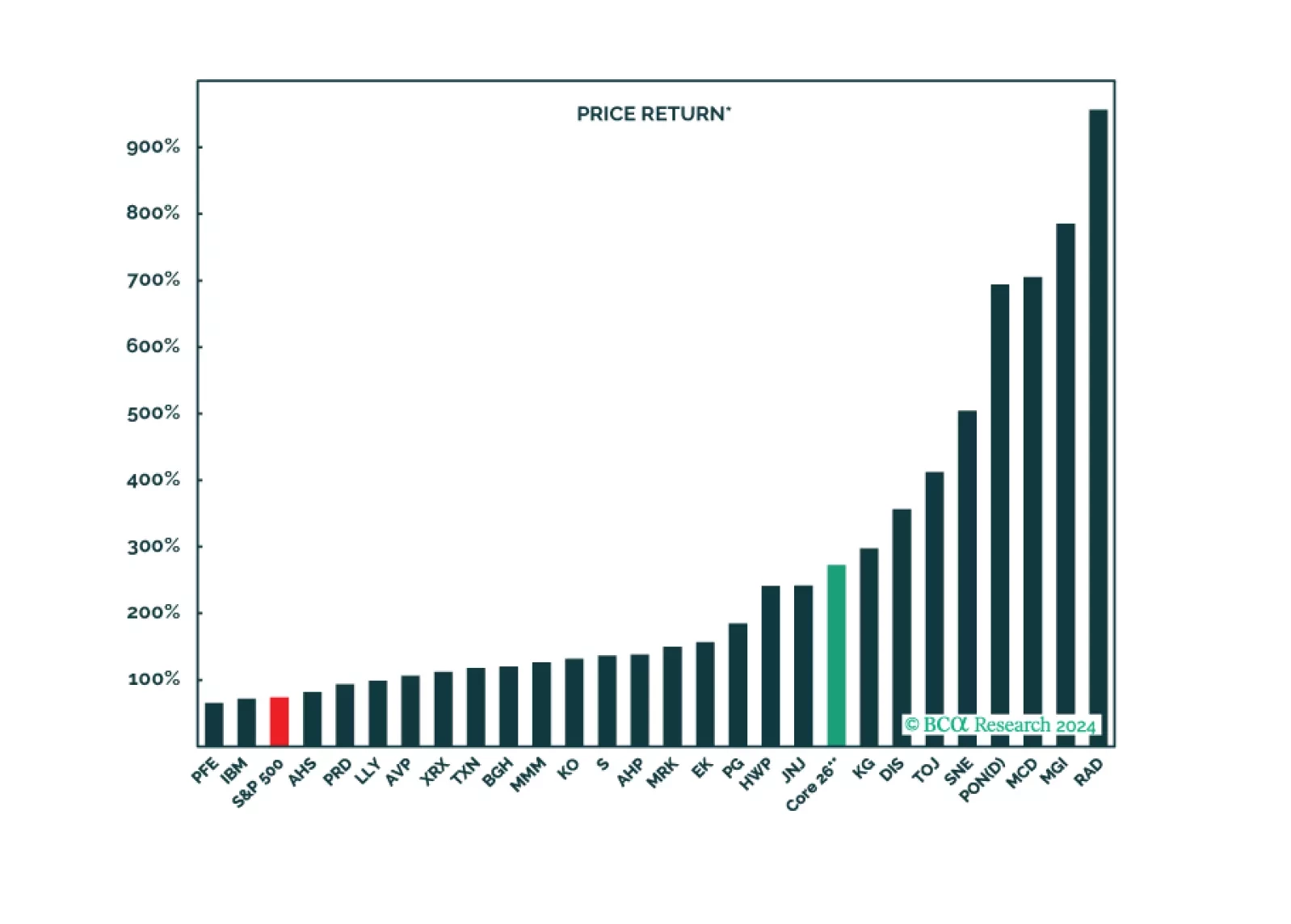

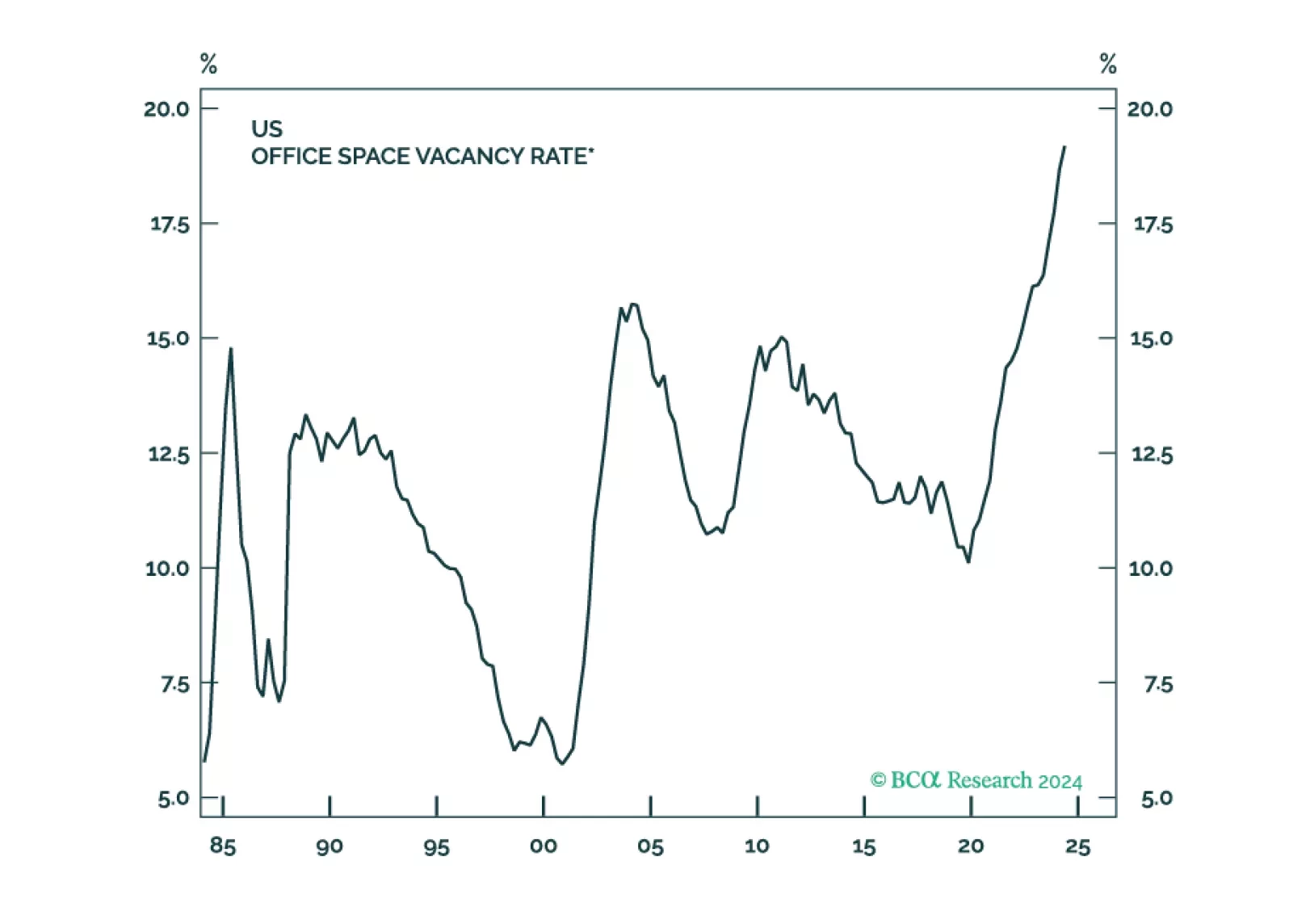

The US suffers from enough imbalances to produce a mild recession. Unfortunately, such a recession could lead to a significant bear market in stocks, just as it did during the very mild 2001 recession.