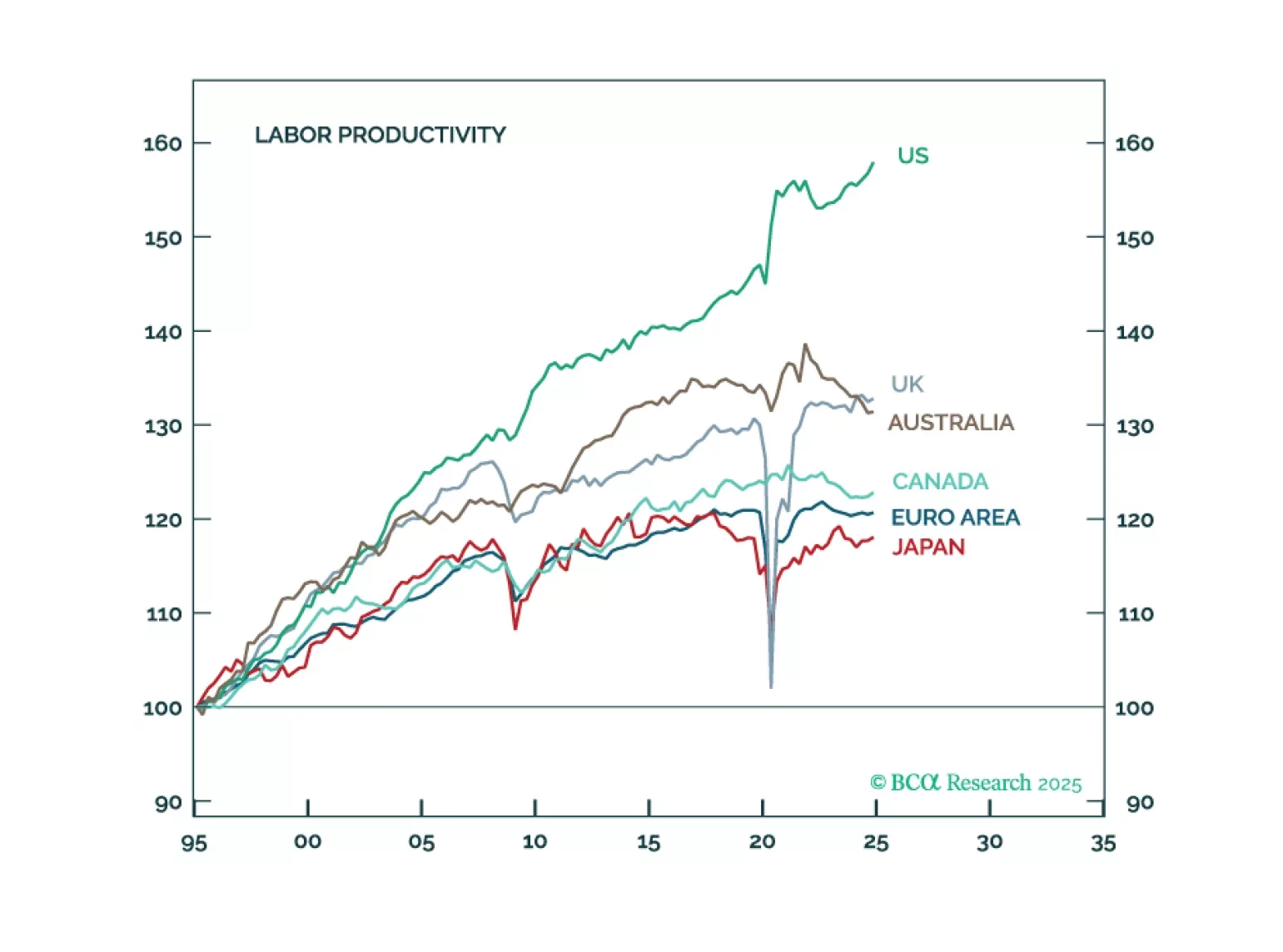

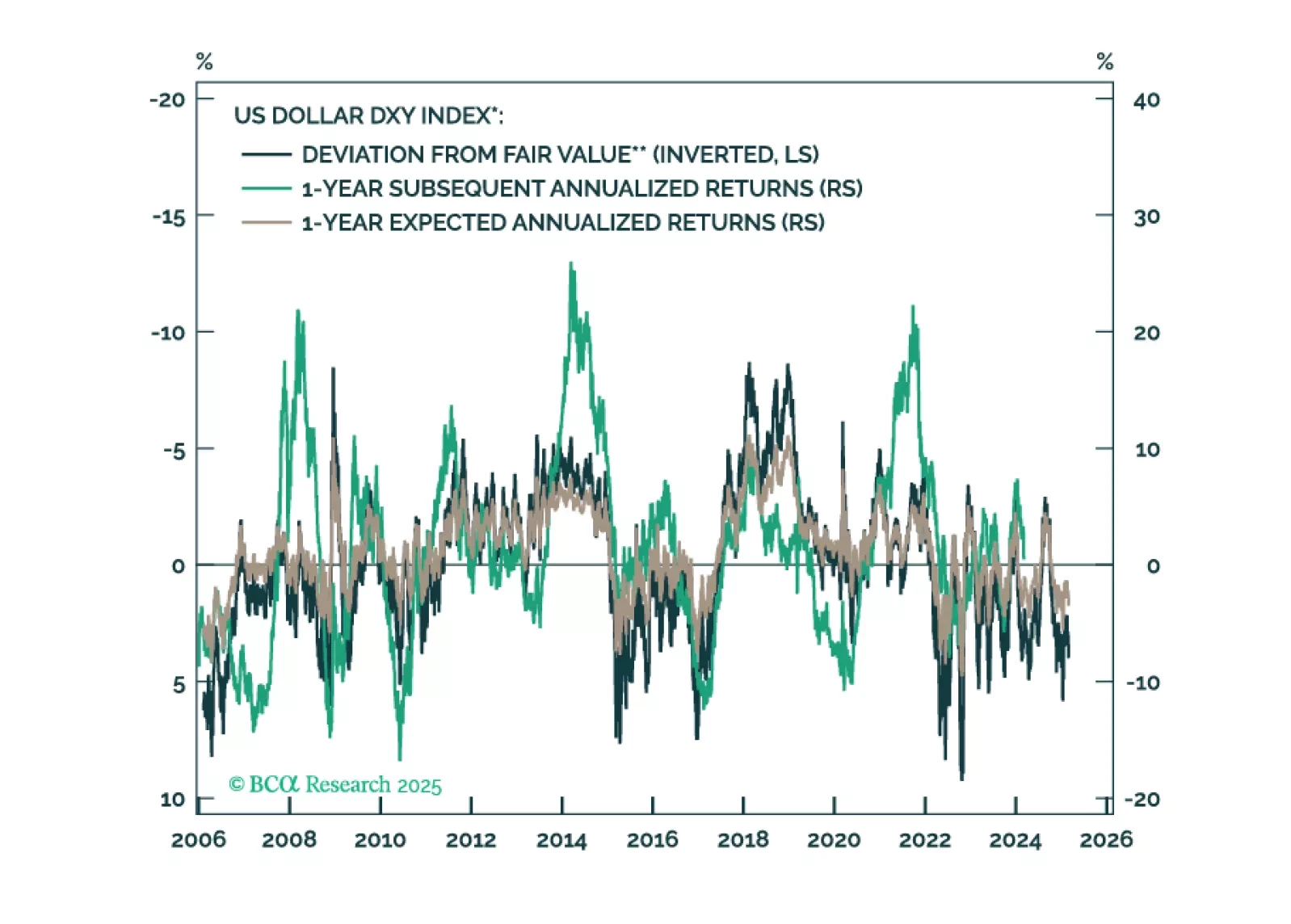

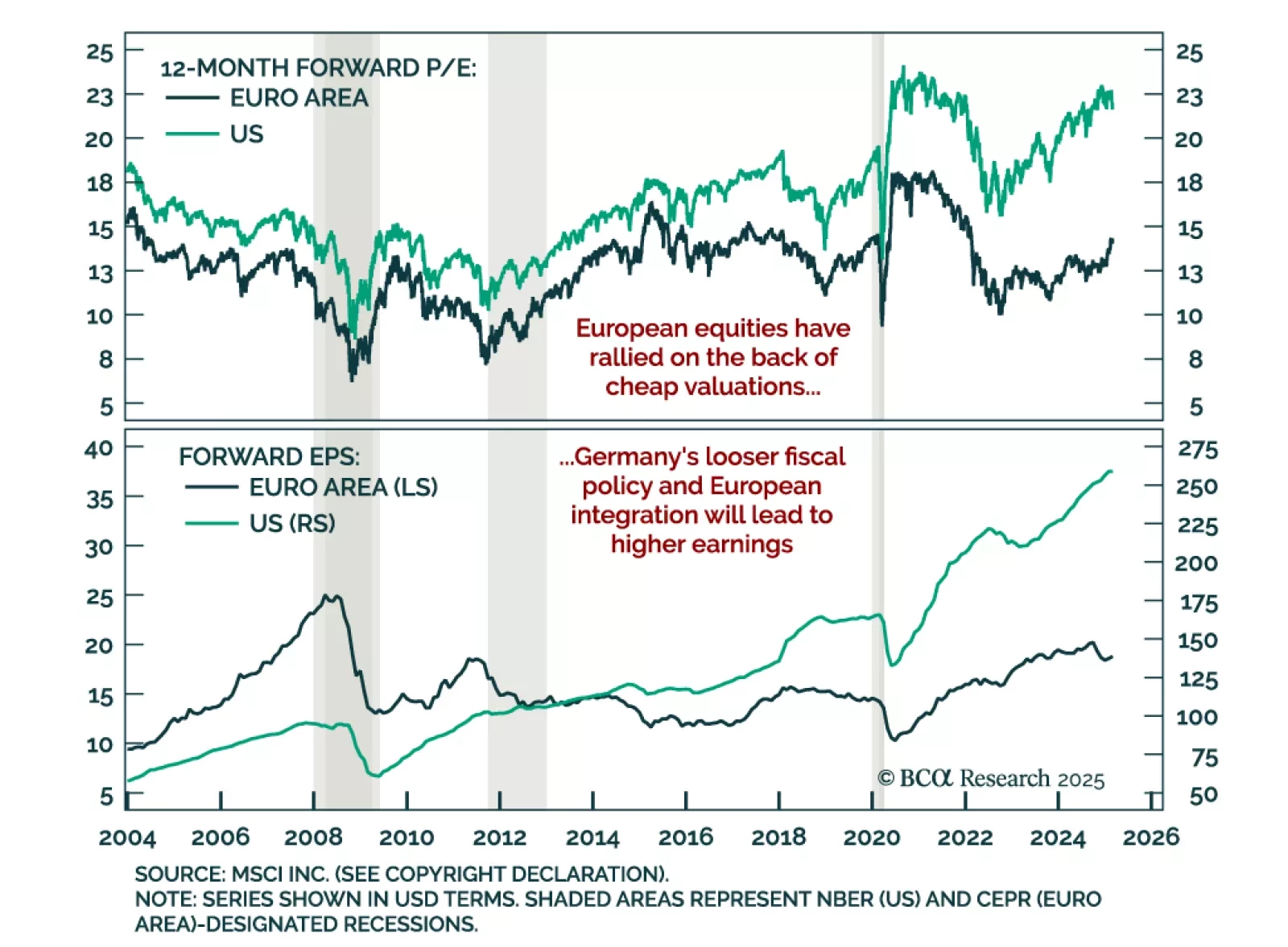

Although the sell-off in the US dollar and relative outperformance of non-US stocks will pause over the coming months as a global recession begins, the fading of US exceptionalism will still cause the dollar to weaken and US stocks…

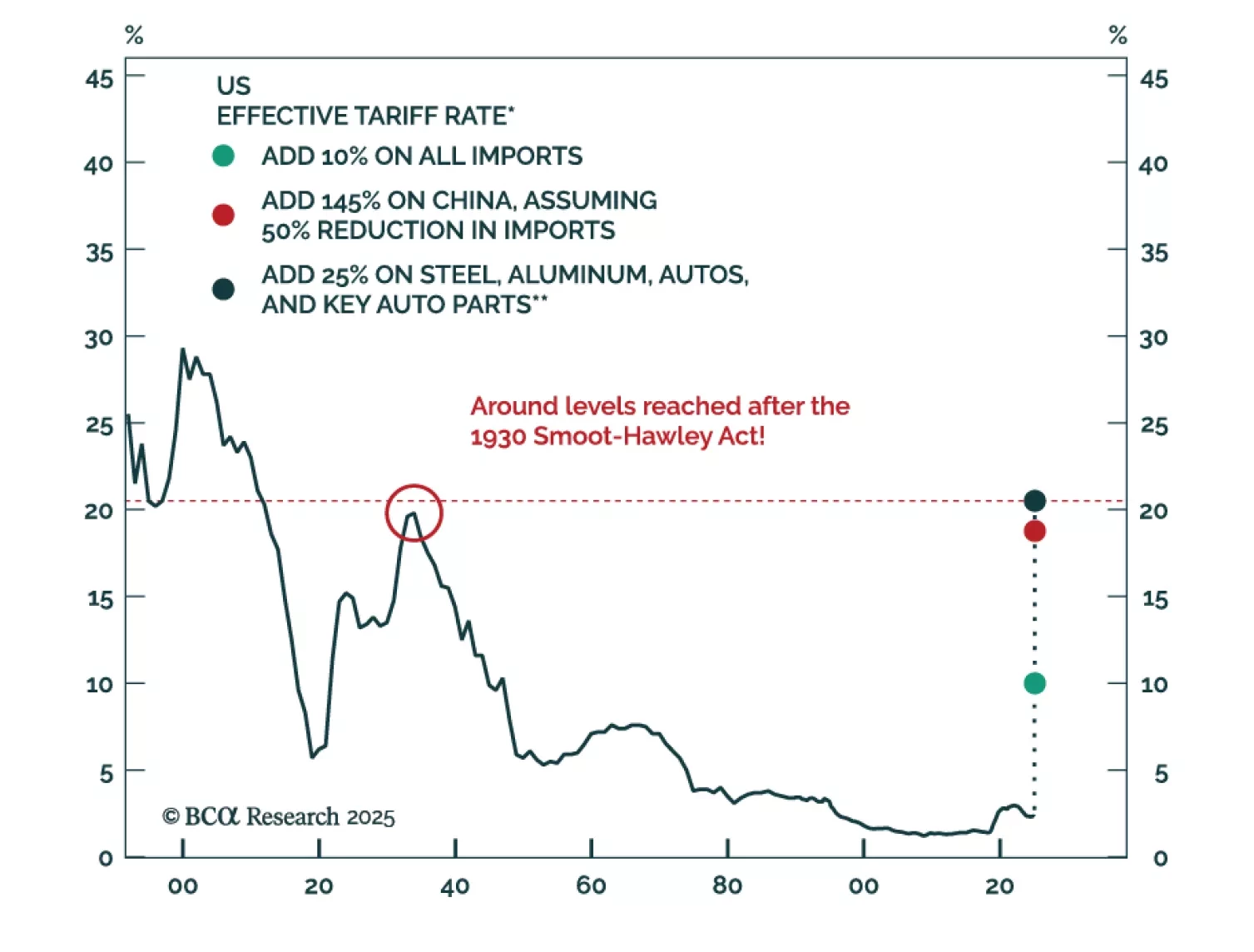

Barring a dramatic further de-escalation of the trade war, the US and much of the rest of the world will enter a recession over the next few months. Investors should remain defensively positioned for now.

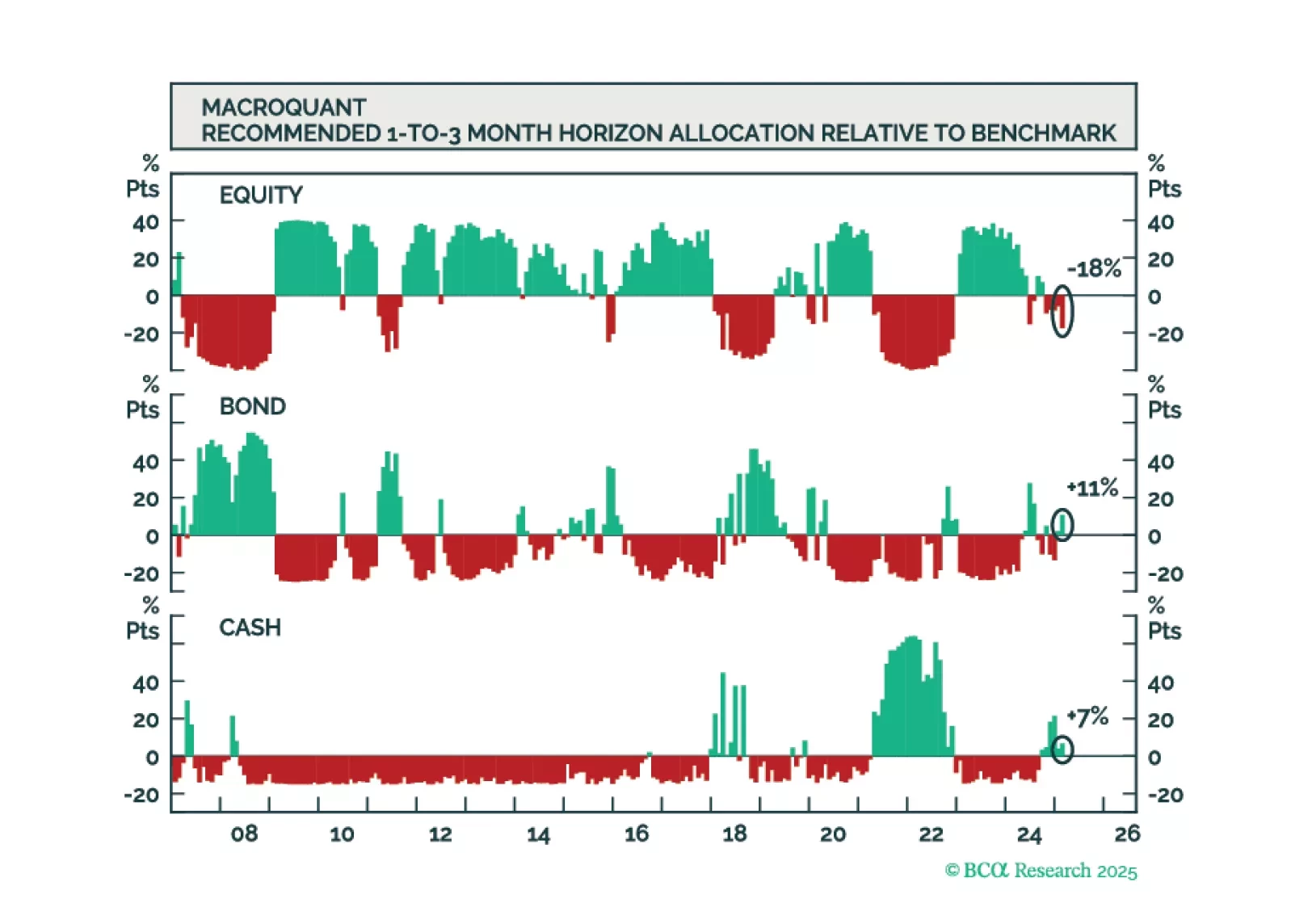

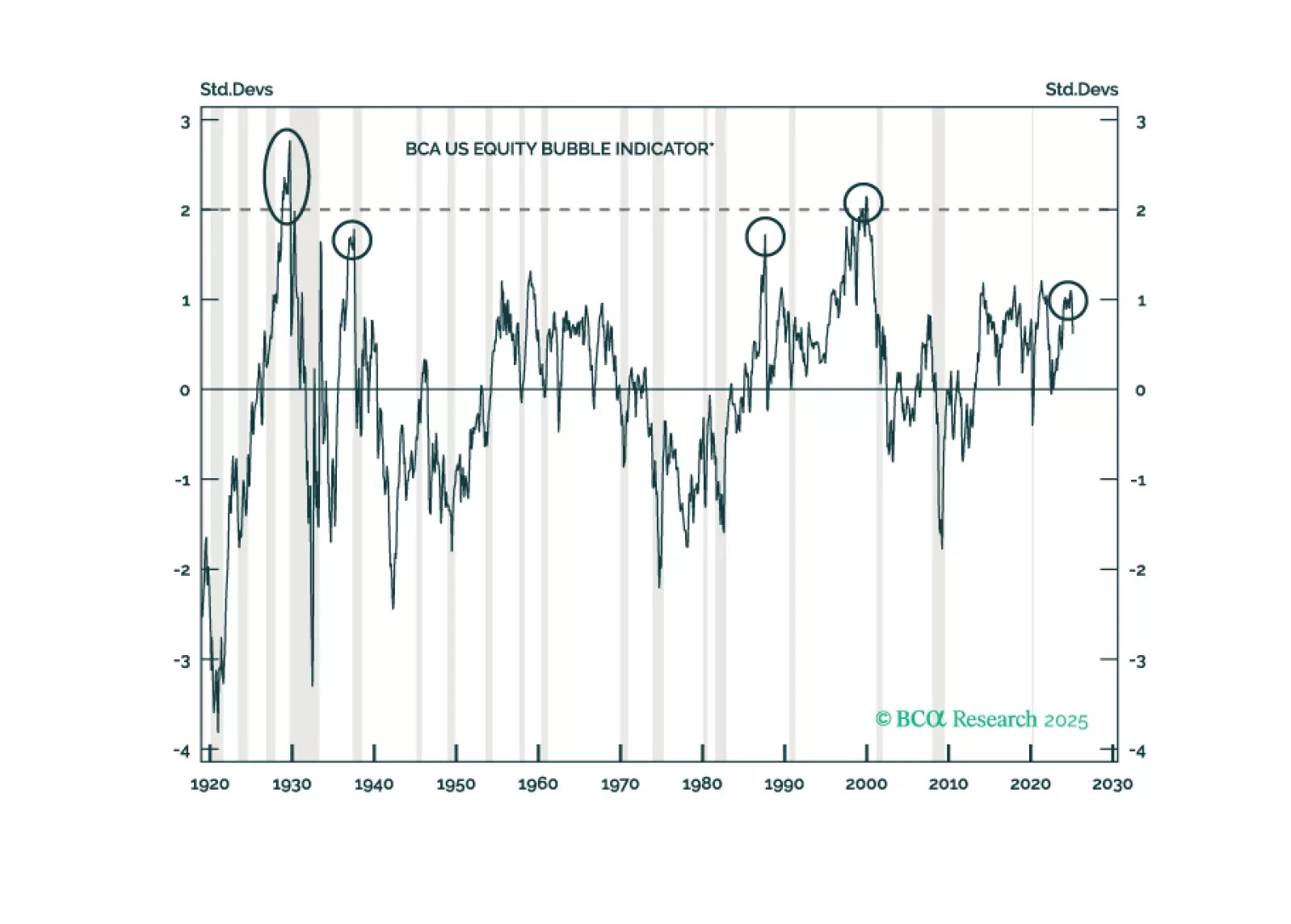

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

Despite our bearish predisposition towards stocks, we are open-minded to anything that could challenge our thesis. As such, in this report, we review five upside scenarios for equities.

After entering 2025 with depressed growth expectations, measures of European sentiment have seemingly bottomed, and European assets rallied. However, given the changing geopolitical order and Europe’s forceful response thus far, are…

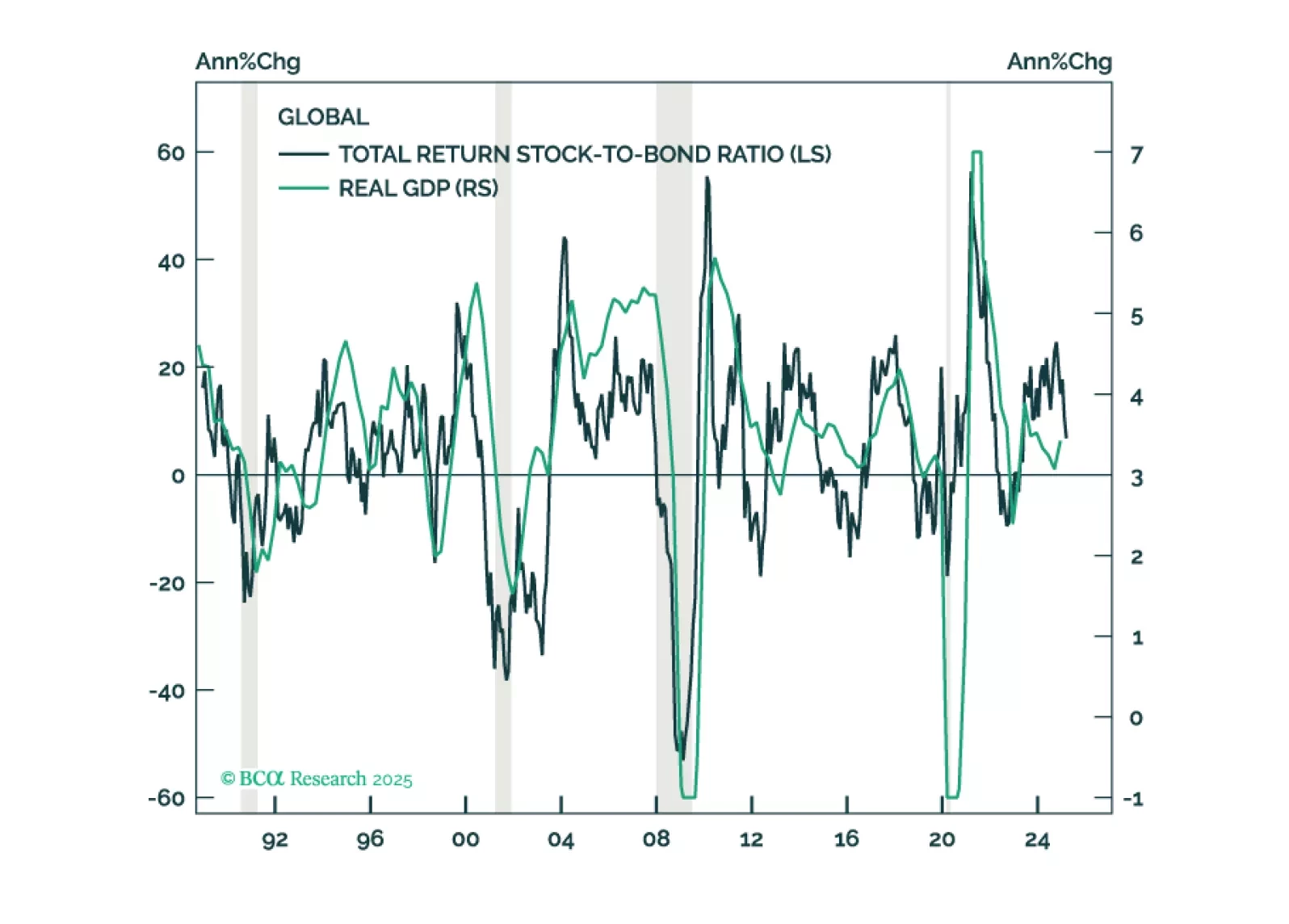

This report is our Part III series on valuation and subsequent returns, where we recalibrate our short-term models to emphasize signals over the next nine-to-twelve months. We will henceforth call these models STTM: Short Term Timing…