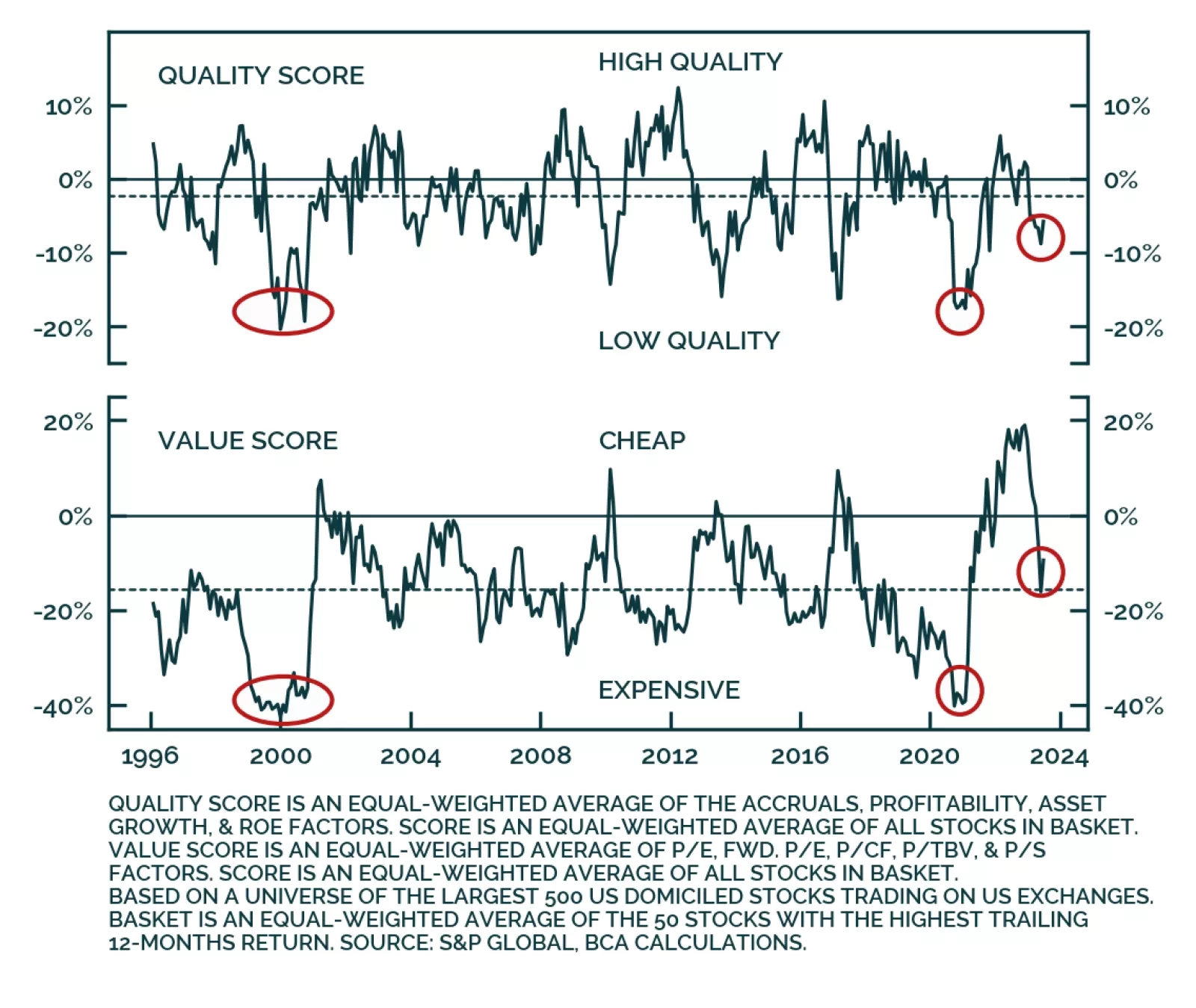

This chart breaks down the factor exposure of the top performers in the US large cap space relative to the largest 500 stocks in the US to see how the current market leaders compare to history relative to their peers. The values…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

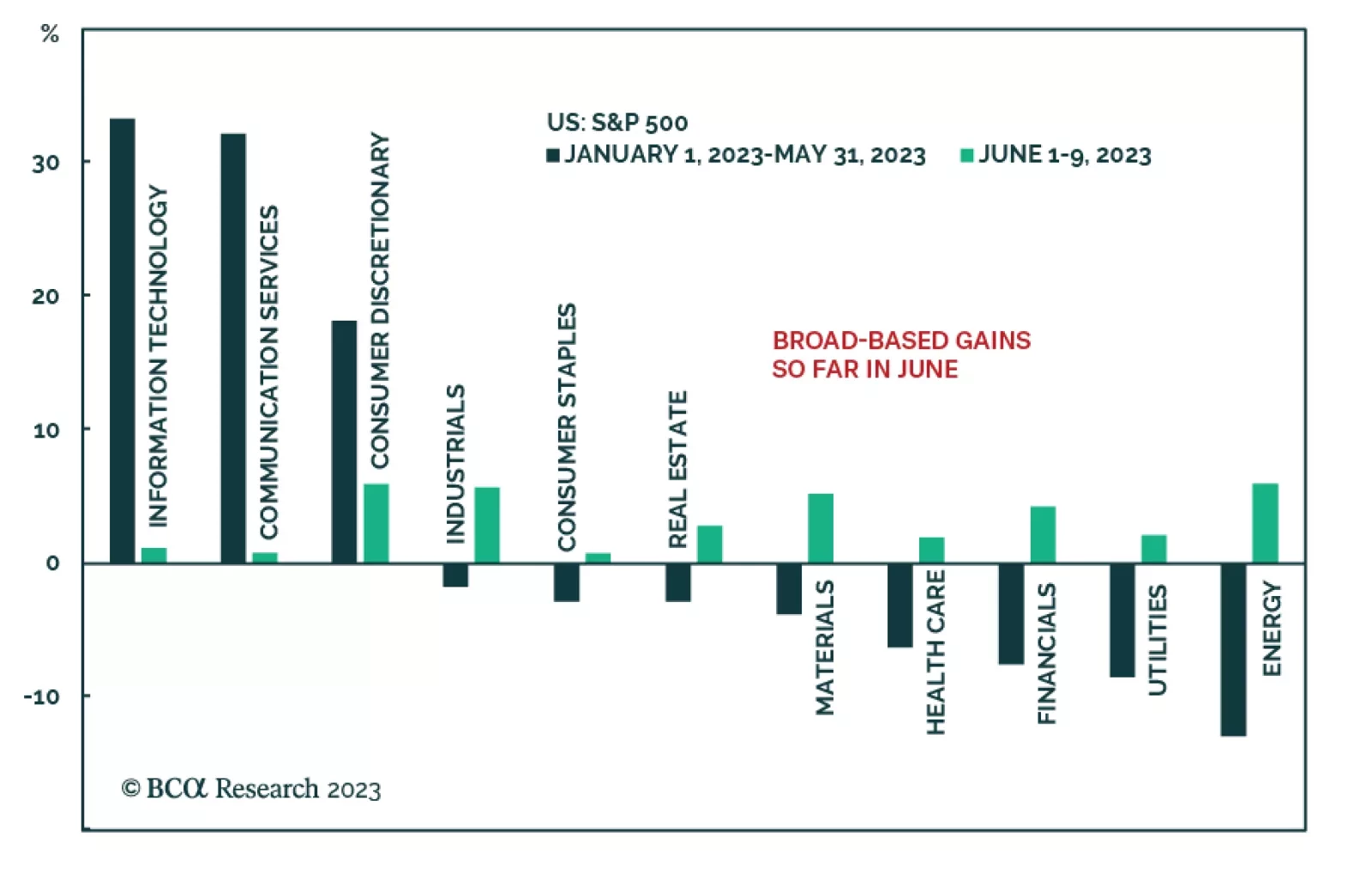

As we’ve highlighted in recent Insights, the S&P 500’s year-to-date rally has been concentrated among a few mega cap stocks. In particular, companies that benefit from the AI craze have driven the gains. This…

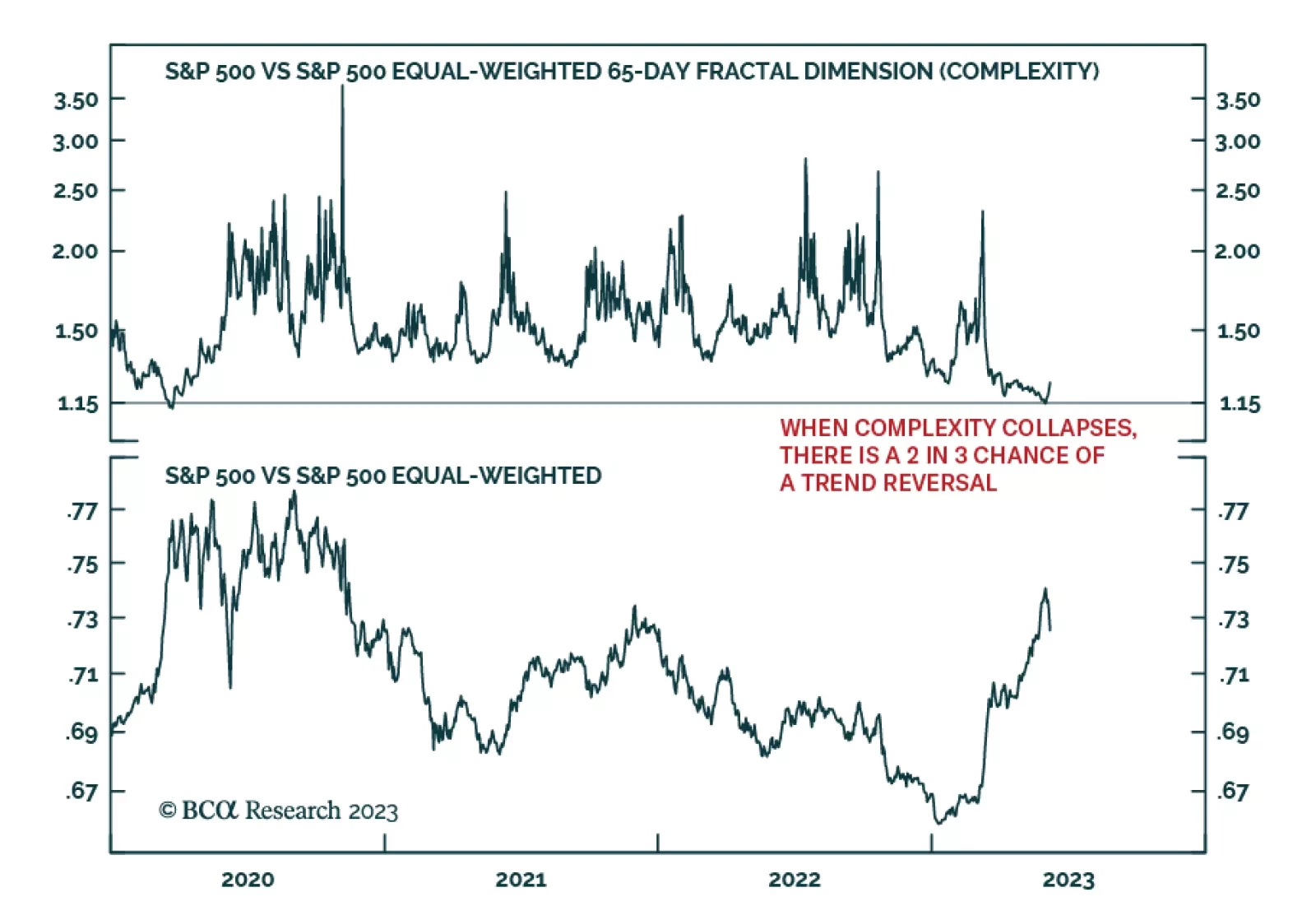

According to BCA Research’s Counterpoint service, an analysis of the AI rally’s complexity suggests that the rally is nearing a potential reversal point. Can the AI euphoria continue to drive the S&P 500 higher…

This week we present our Portfolio Allocation Summary for June 2023.

The AI craze could further lift stock prices, boost capex, and delay the onset of the next recession. Looking further out, reaping the profit windfall from AI may take longer than many investors expect.

In this Month-In-Review report, we go over the latest G10 data releases and rank currencies’ fundamental standing based on our updated macroeconomic model.

US bond investors should increase portfolio duration from “at benchmark” to “above benchmark” on a cyclical (6-12 month) investment horizon. We also recommend exiting Treasury curve flatteners and closing short positions in the…

Once the debt ceiling soap opera ends, investors will likely turn their attention to some of the tailwinds supporting stocks. These include stronger earnings growth, diminished bank stresses, better housing data, early signs of an…

In this US Bond Strategy Insight we discuss the outlook for bank bonds.