On Monday, Moody’s downgraded the credit ratings of 10 small to mid-sized US banks and placed some of the biggest US banks on downgrade watch. The latter include Bank of New York Mellon, US Bancorp, State Street, and Truist…

Although the RMB has cheapened, macro conditions are not yet favorable for the Chinese currency. We expect the RMB to decline by at least another 5% in the next six months. A weak currency and subdued economic growth lead us to…

The S&P 500 rally broadened in July, lifting this year’s laggards. Surging long yields are altering the macroeconomic backdrop, as the market absorbs that monetary policy will stay restrictive for a long time. Yet, a move down in…

Investors remain cautious about the US economy and still have significant cash that needs to be put to work which could extend the rally further. Earnings rebound later in the year will be supported by rising sales growth and surging…

We see challenges ahead for Global Buyout across geographies as valuations need further resetting. While we are concerned with capital controls and flight risk in Asia-Pacific Venture Capital, the upside potential from AI may be…

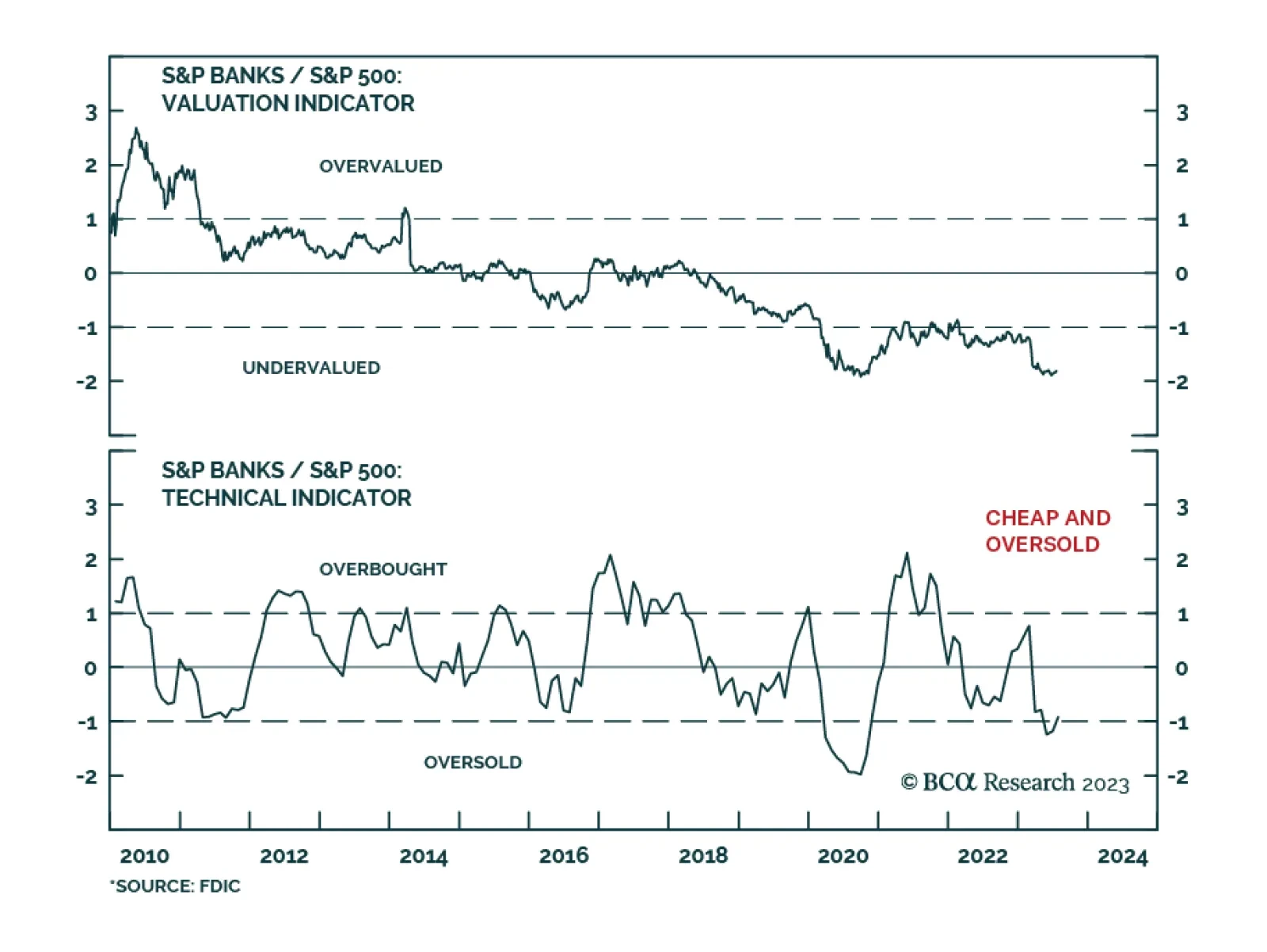

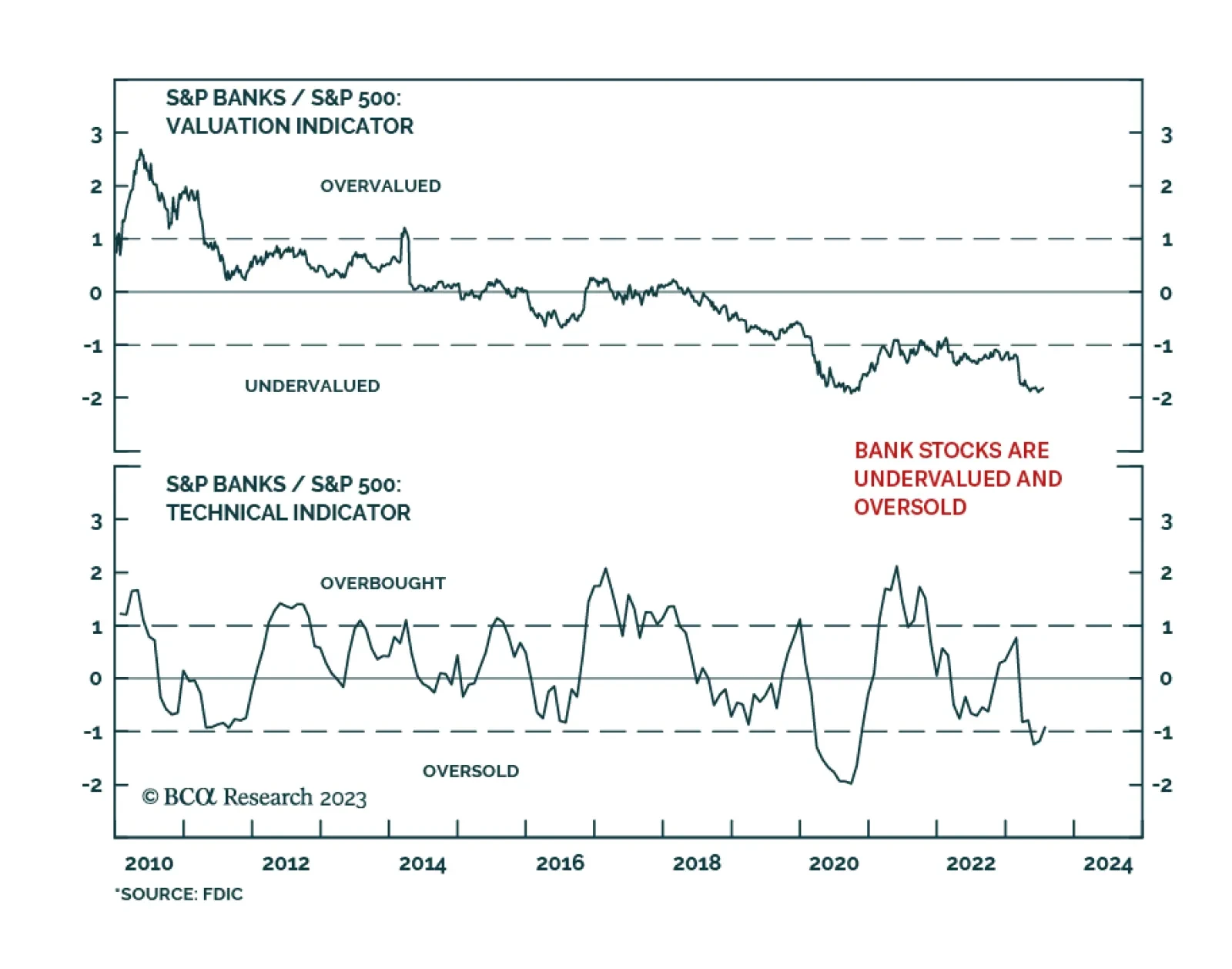

BCA Research’s US Equity Strategy service recommends investors move to overweight banks over a tactical horizon. Q2 earnings results, while cheered by investors, were quite a mixed bag. And most of the bank challenges…

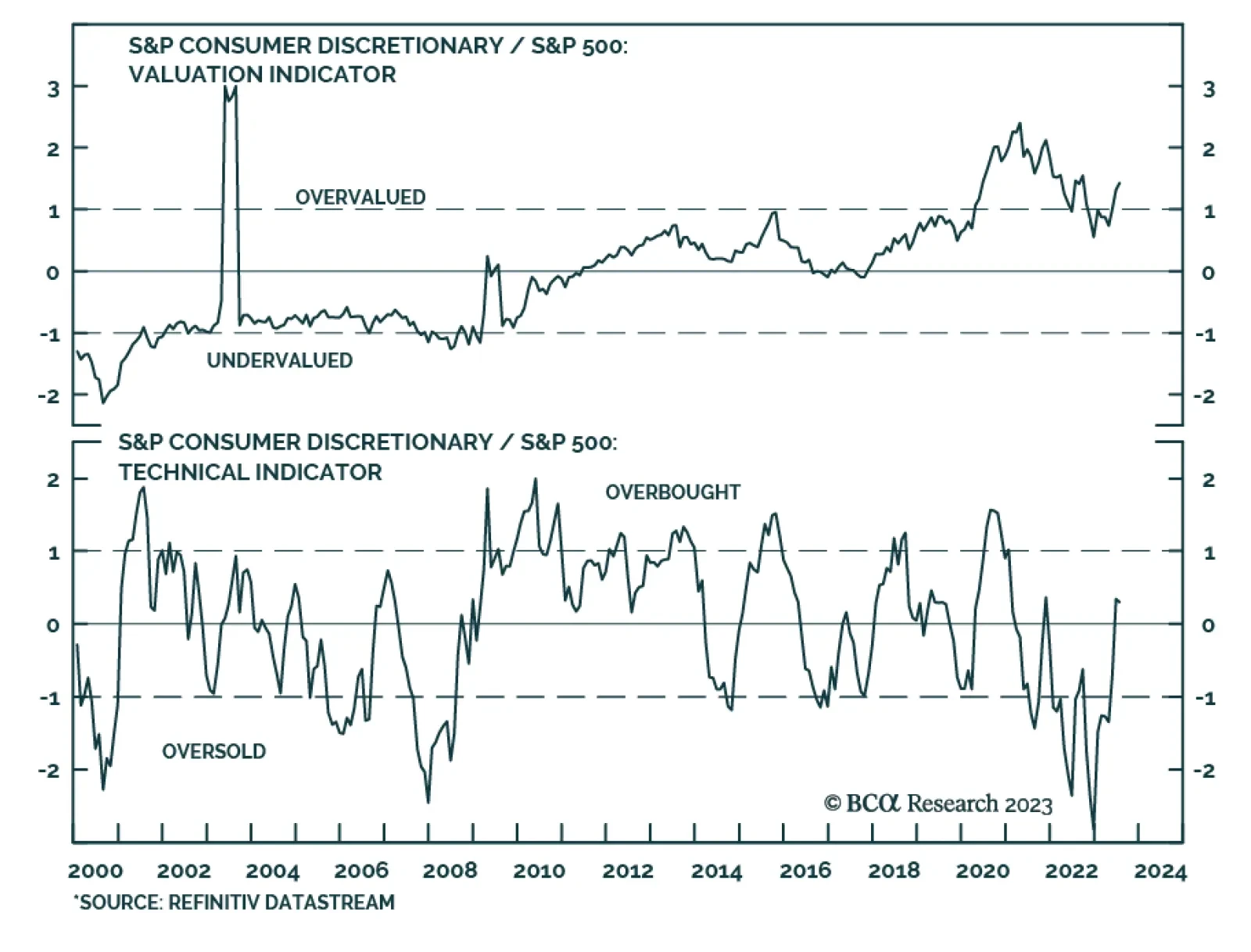

In the first five months of the year, optimism about GAI (generative AI) drove a narrow rally in US equities. The three sectors that contain companies that are most exposed to this dynamic were the only ones that experienced…