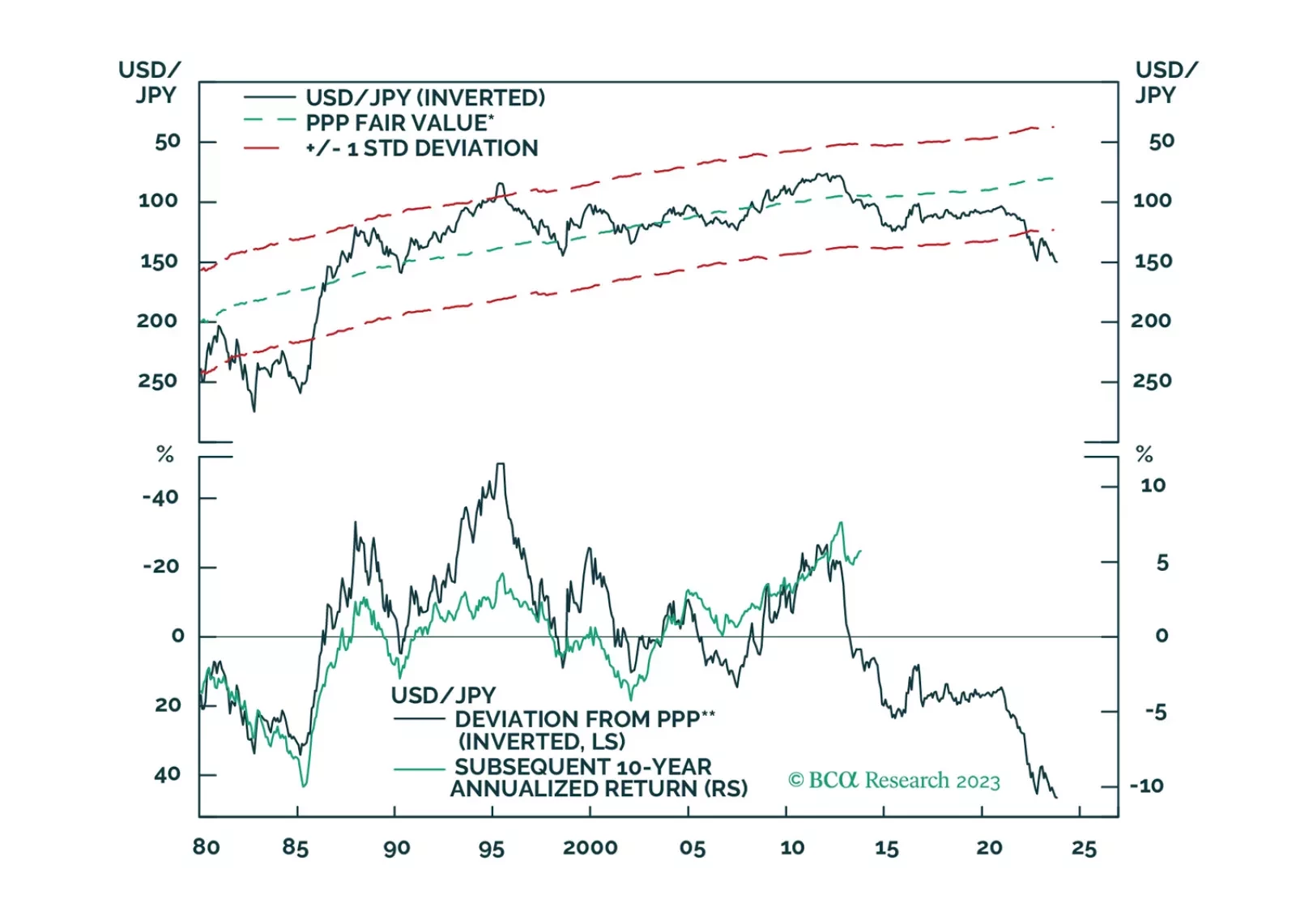

There is a high probability that the global economy will tip into recession in the second half of 2024. A long yen position is an excellent hedge against that risk.

The recent bear-steepening of the US Treasury curve has been driven by the combination of stronger-than-expected economic growth and stable Fed rate expectations. Historically, such periods do not last very long, and we see the…

The market has been held hostage by surging rates. Zombie companies are “alive” and are multiplying – they are highly sensitive to surging borrowing costs. Underweight Utilities to reduce portfolio duration. Maintain neutral…

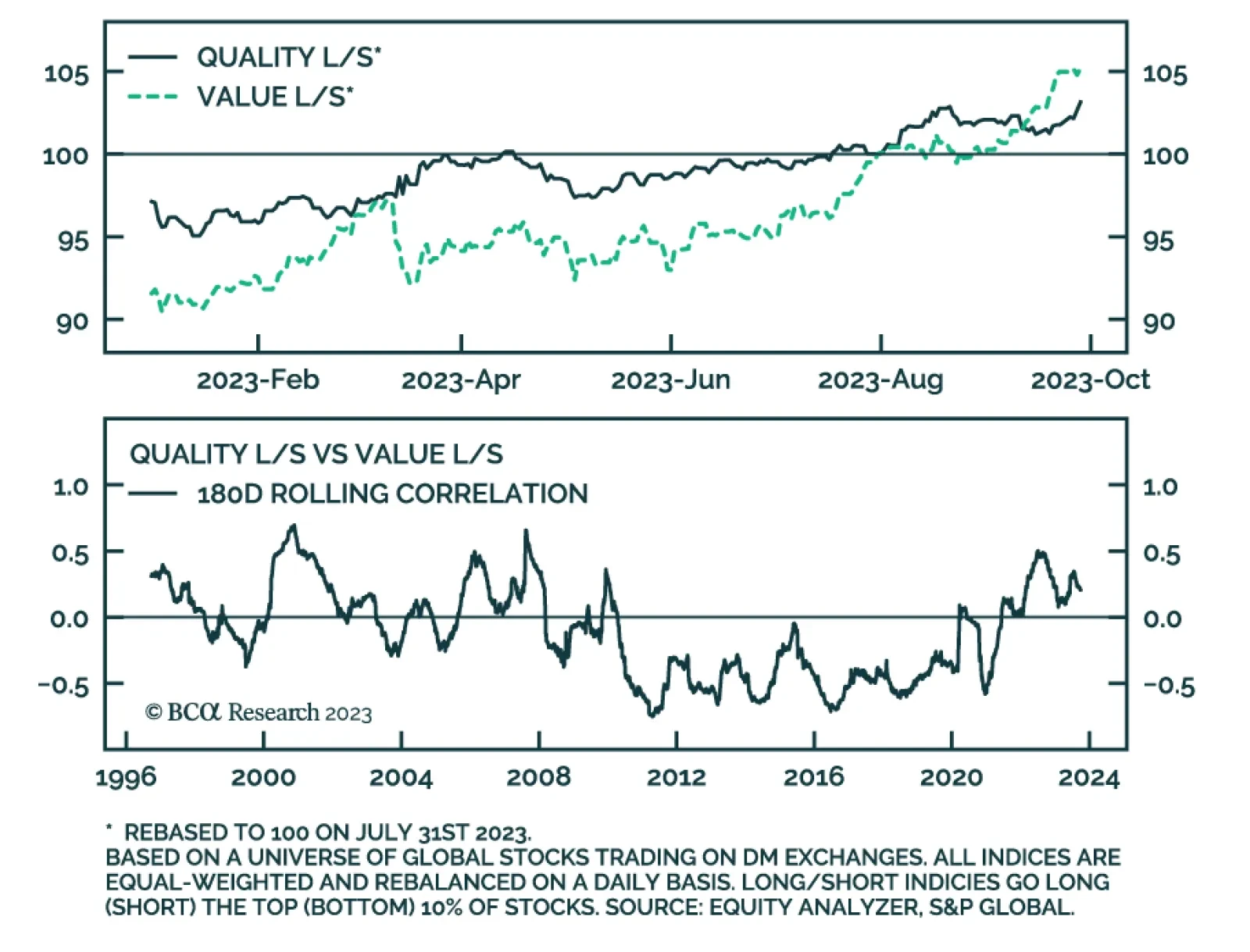

Our Equity Analyzer service is a stock selection platform powered by the BCA Score, a 30-factor stock ranking system. The model tends to benefit from periods of uncertainty due to its high-quality and low volatility tilt. The…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

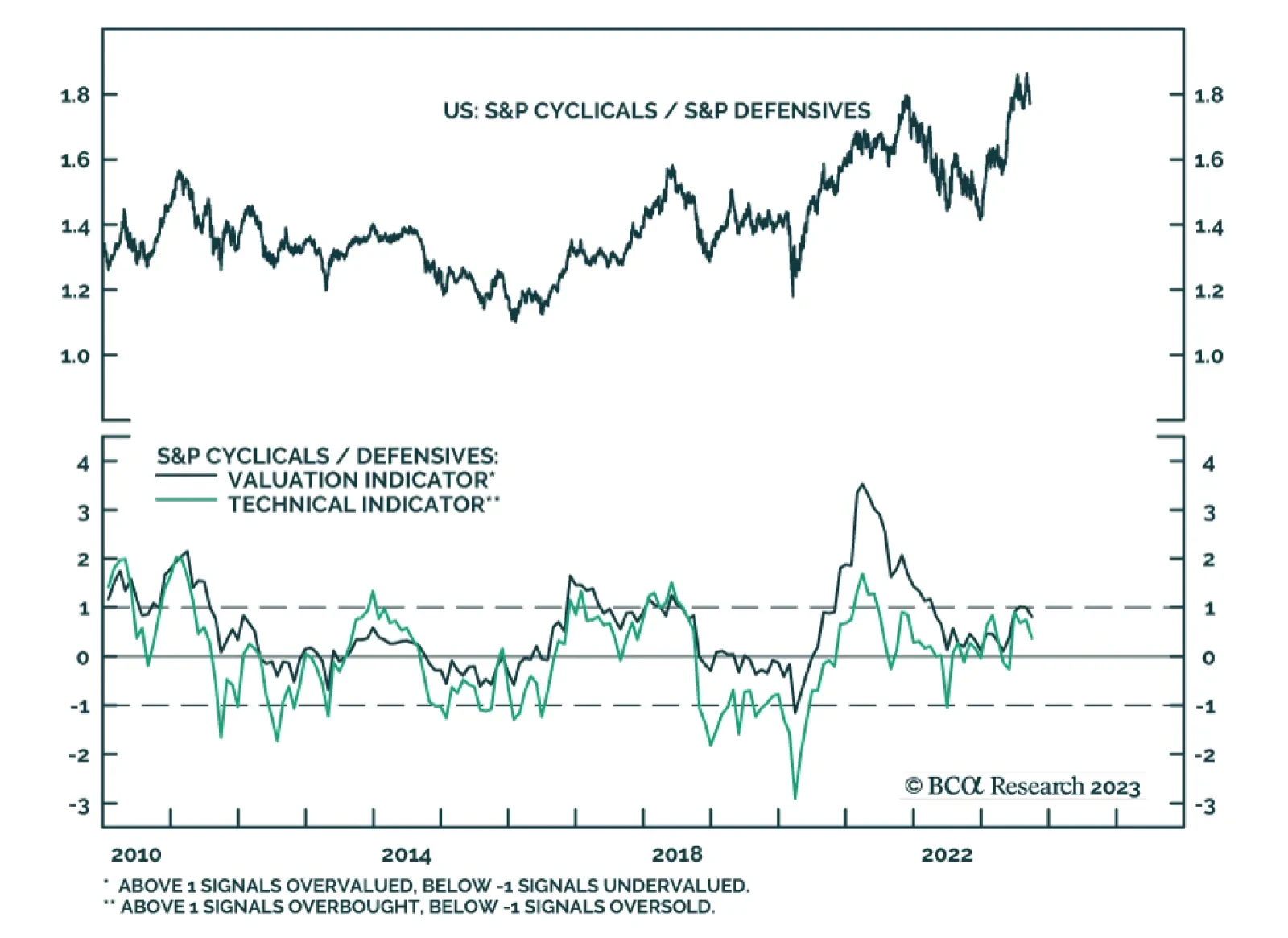

The year-to-date rally in US cyclical stocks has fizzled. After climbing 29% in the first seven months of the year, cyclical equities are down 6.0% since the beginning of August. This drop is happening in the context of a general…

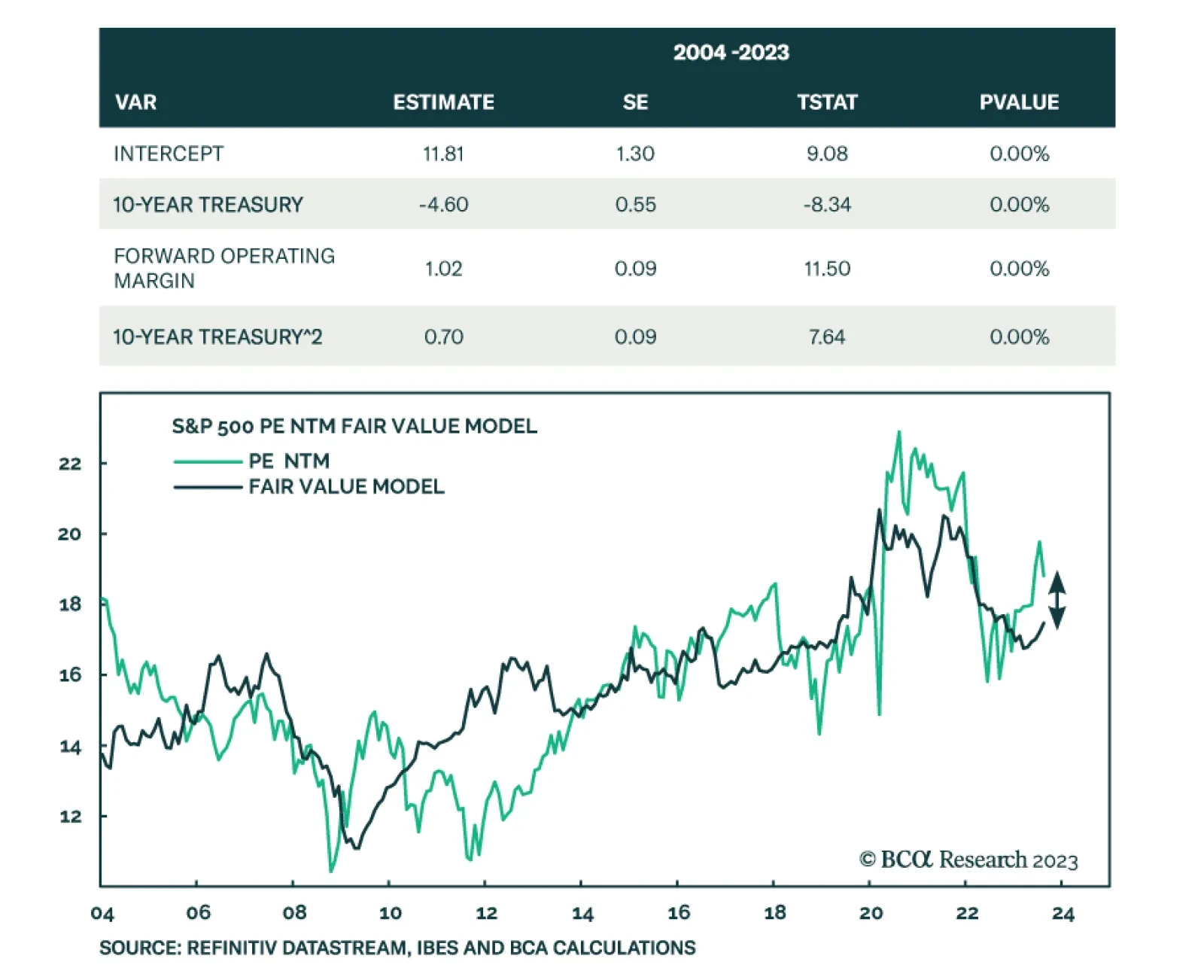

One of the few things US equity investors agree upon these days is that the S&P 500 is expensive whether it is relative to history, other asset classes, or the level of interest rates. But how overvalued is the market? To…

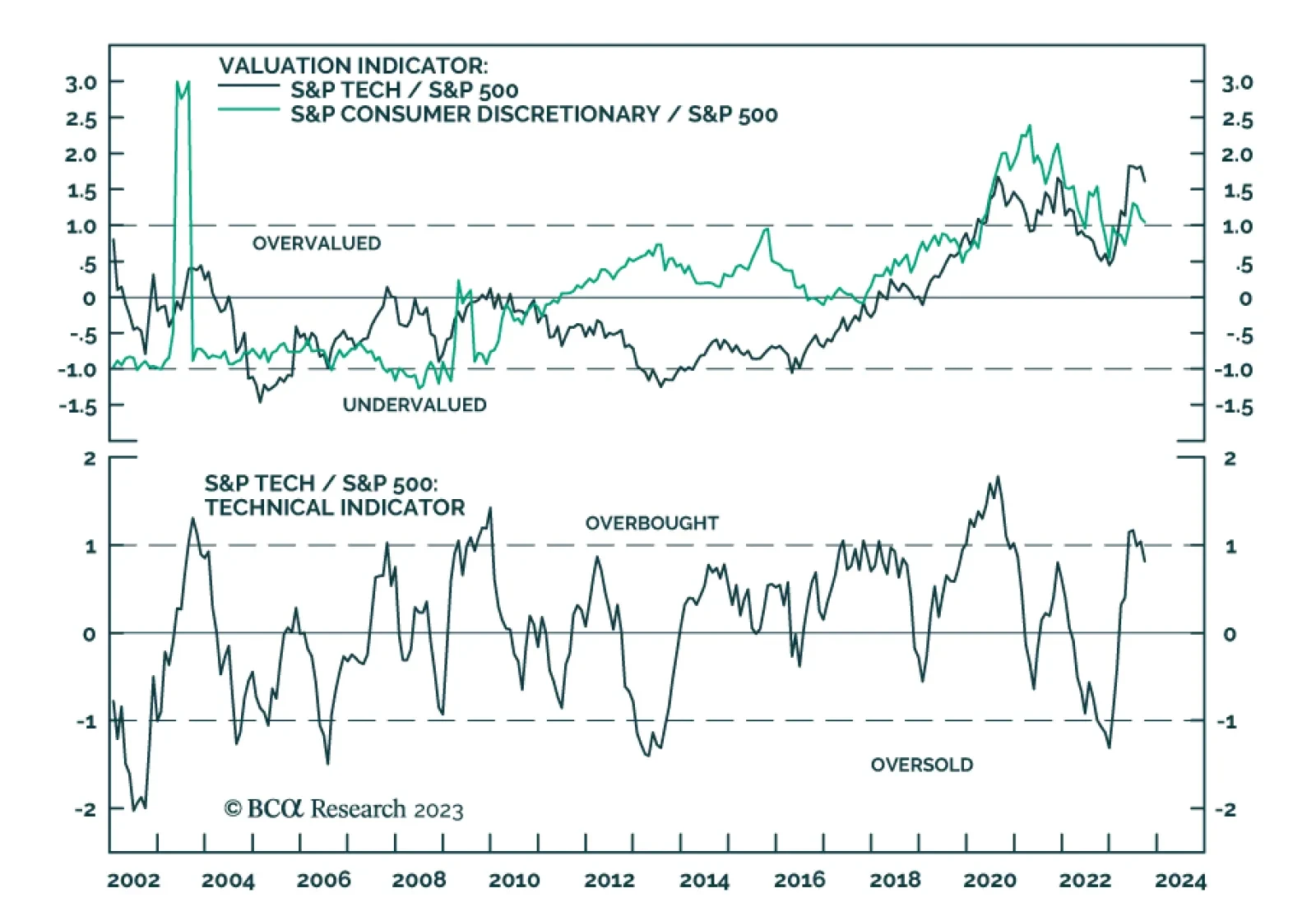

Tech stocks have recently been bearing the brunt of the US equity selloff. The Information Technology and Consumer Discretionary sectors – home to major H1 outperformers including Nvidia, Microsoft, Apple, Amazon, and Tesla…

Top-down measures of nonfinancial corporate sector balance sheet health have been flattered in recent quarters by inaccurate data on interest expense. After correcting for the inaccurate data, we see that our best measures of…

The implications of this morning’s CPI report for Fed policy, Treasuries and TIPS.