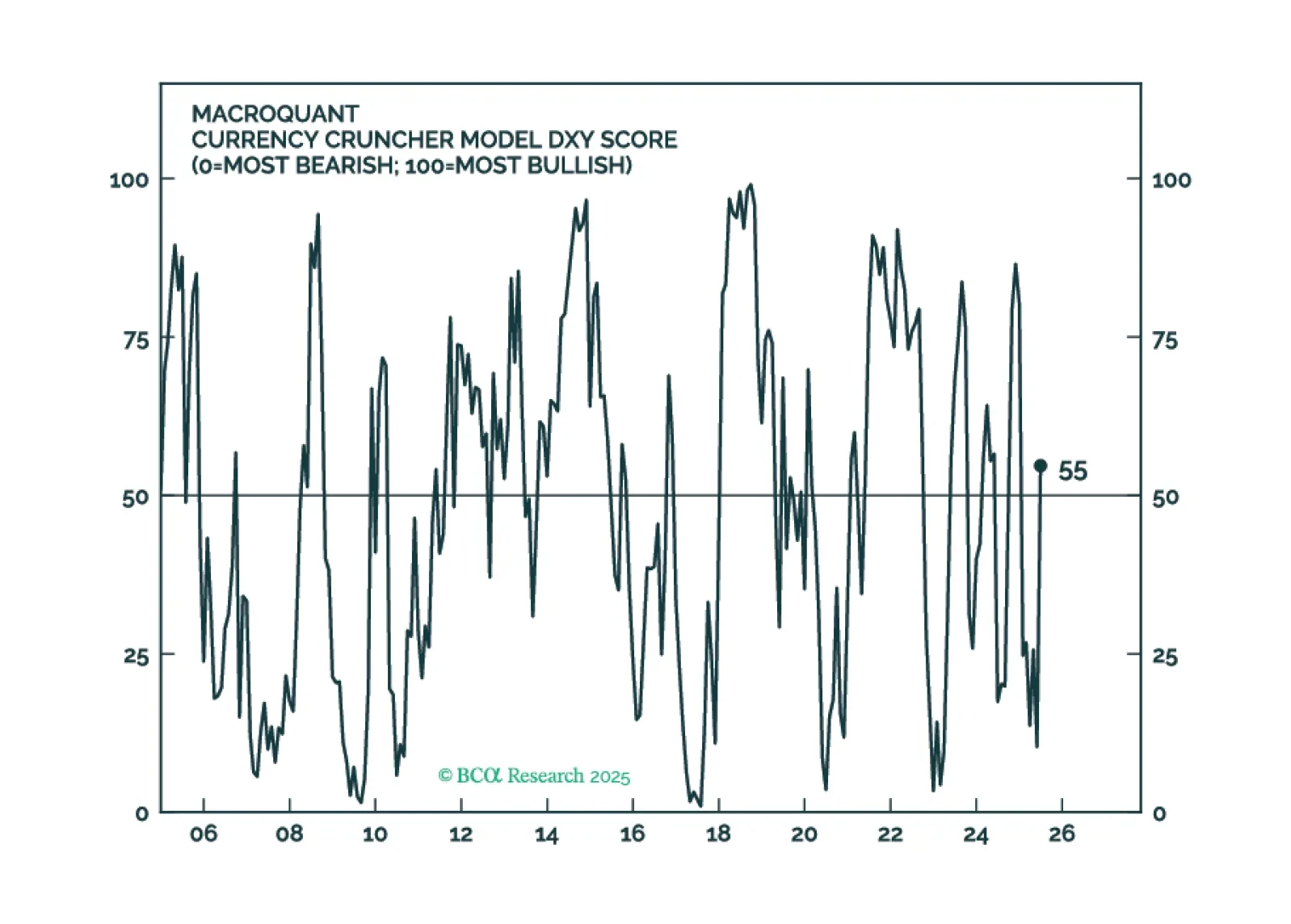

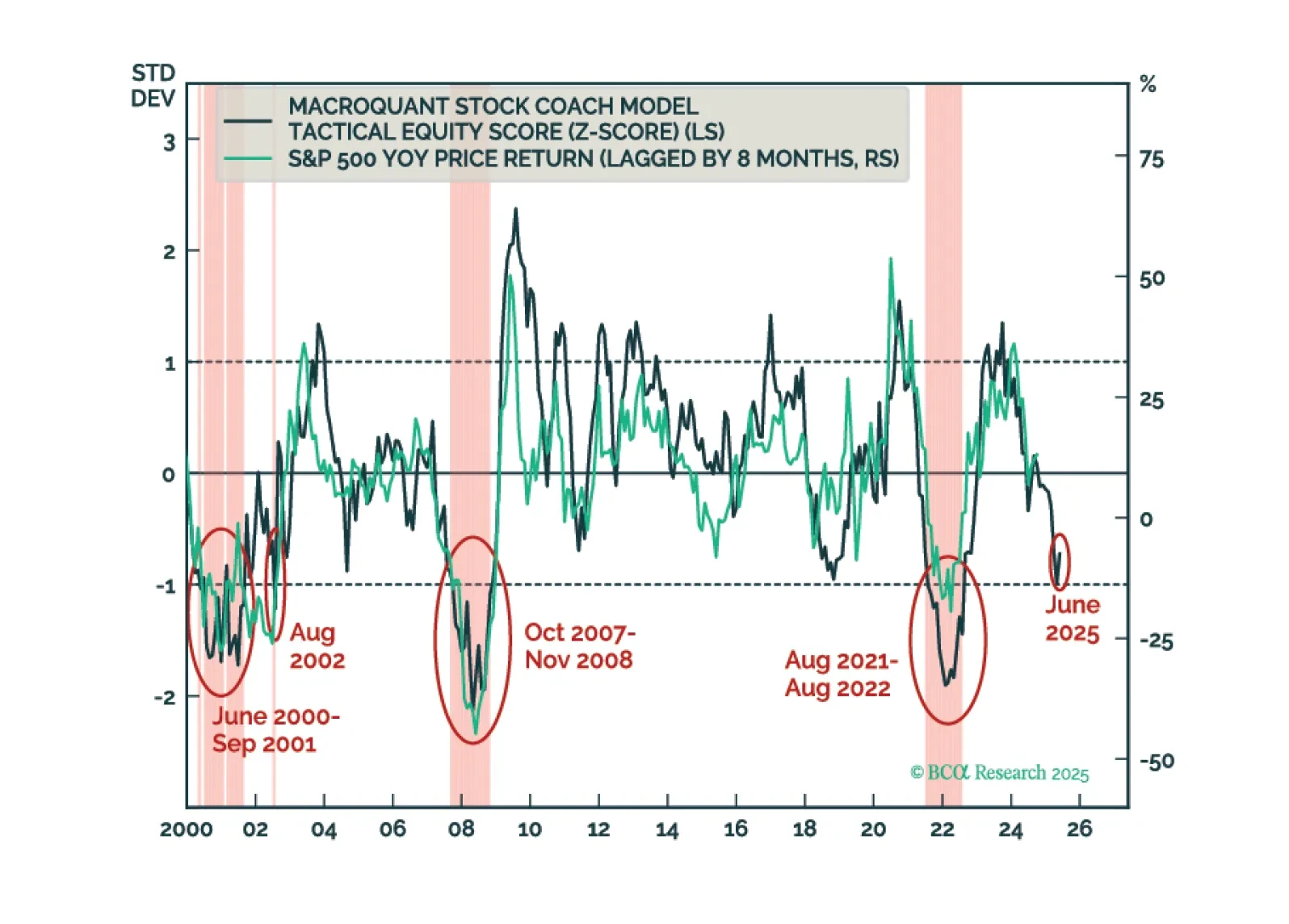

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.

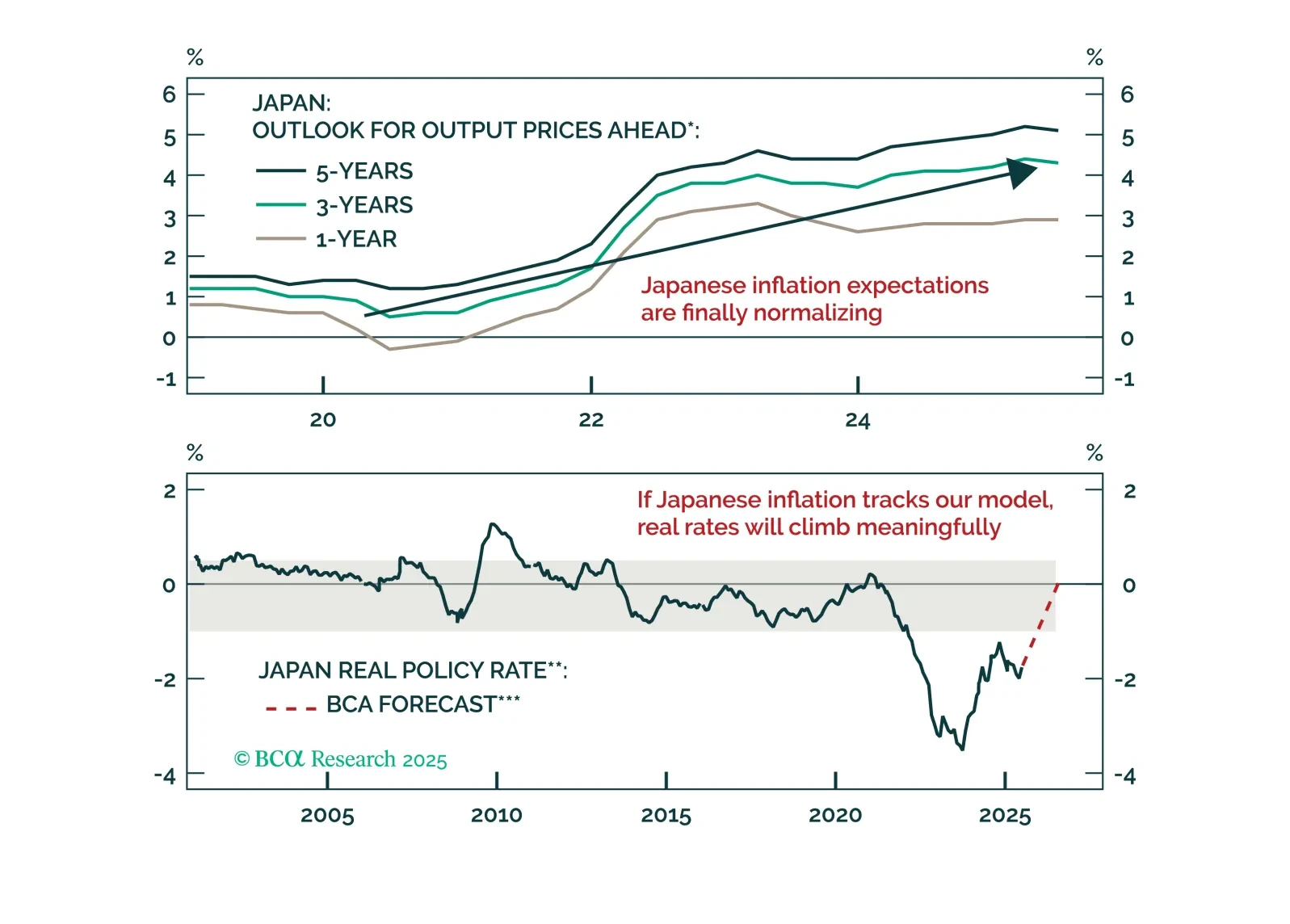

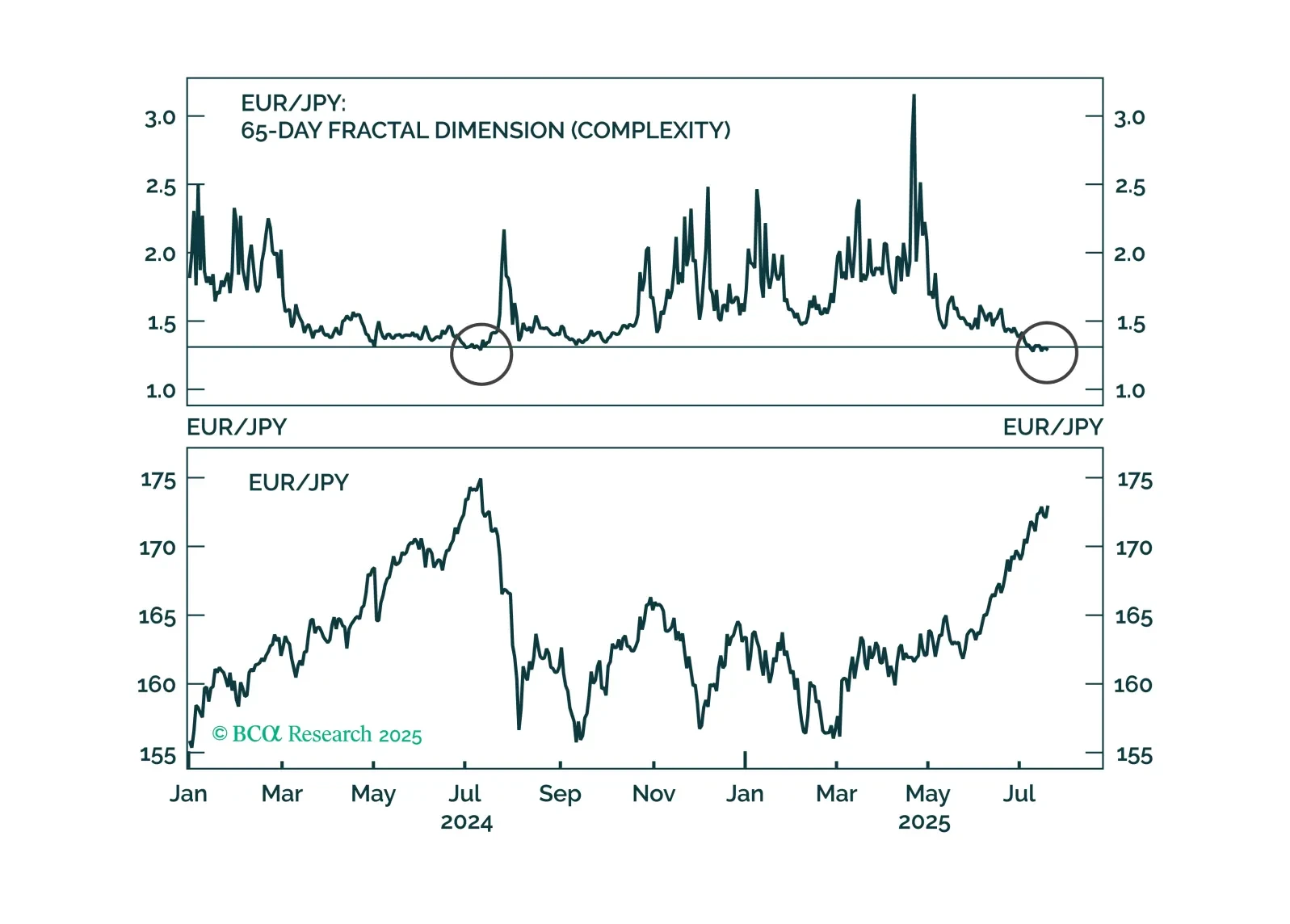

The yen’s discount, surplus, and rising real rates line up for a multi-quarter surge. Find out why EUR/JPY is the first short and when USD/JPY follows.

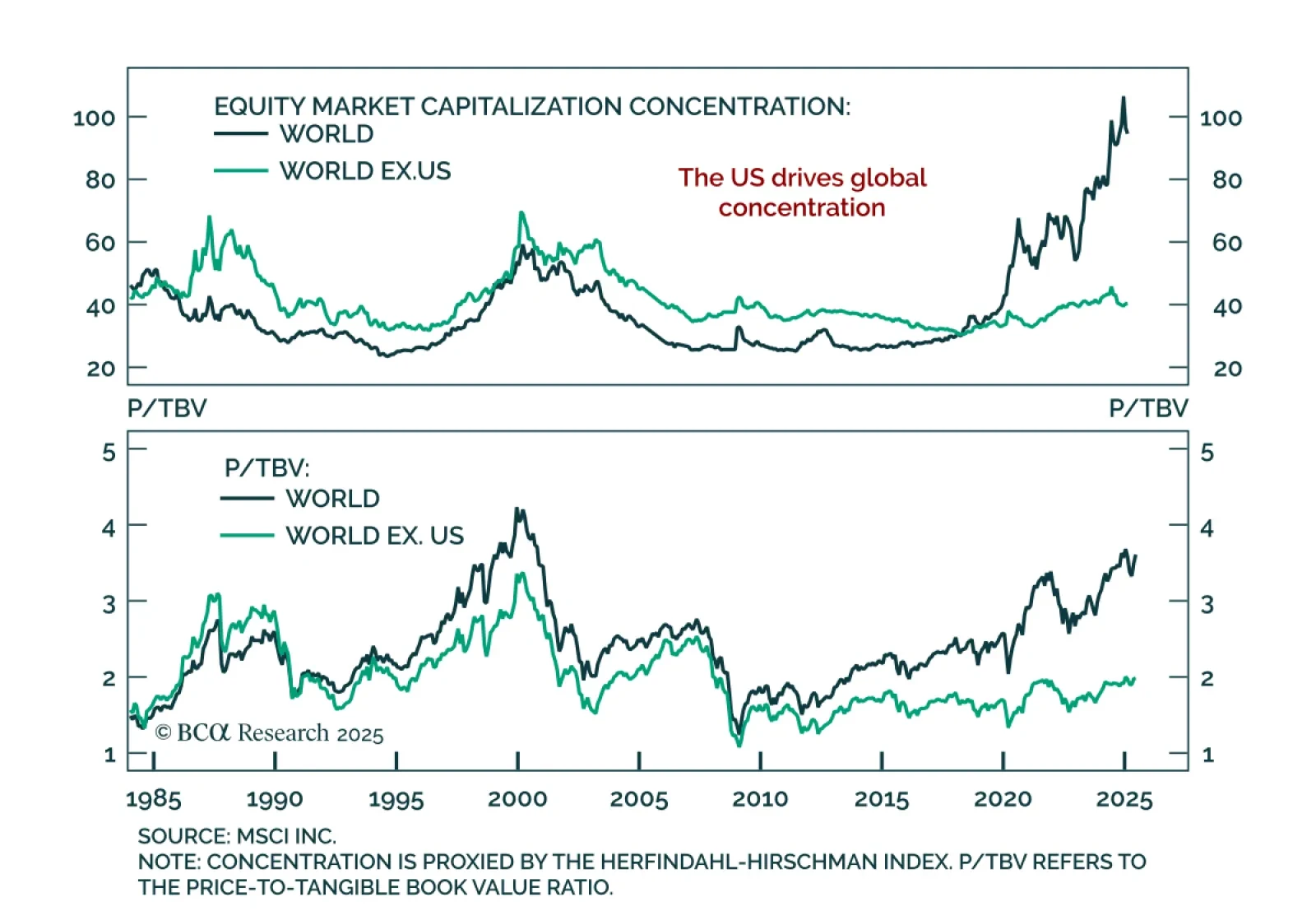

Our Global Asset Allocation strategists argue that equity market concentration is not a meaningful risk factor and does not help forecast returns. Cross-sectional concentration reflects index size, with smaller indices typically…

EUR/JPY has reached stretched levels, prompting new short trade recommendations across BCA Strategies. The calls are underpinned by compelling valuation, macro, and technical signals.

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

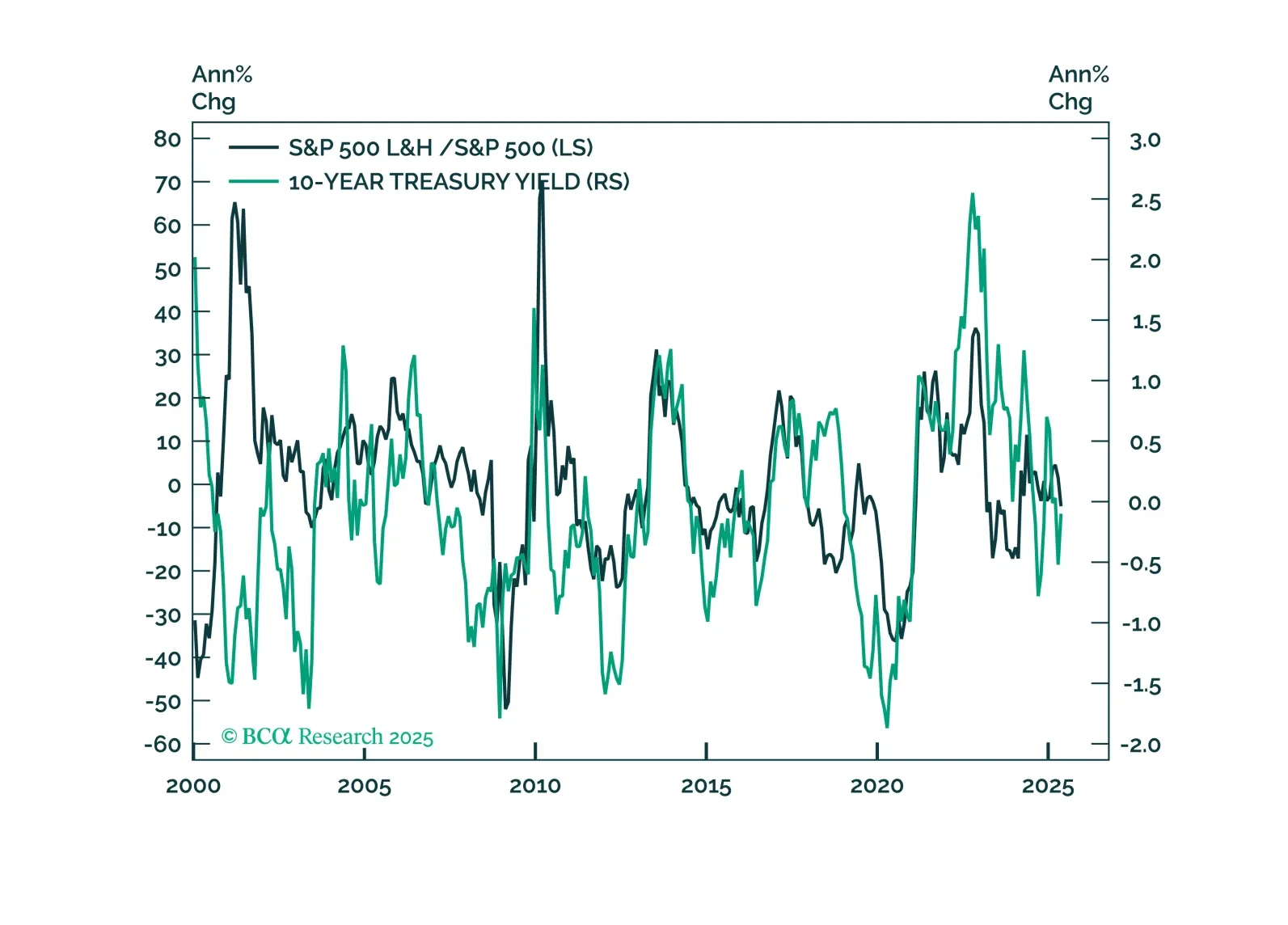

The Life and Health Insurance industry offers downside protection and portfolio diversification in the event of a market correction, surging inflation, or stubbornly high interest rates.

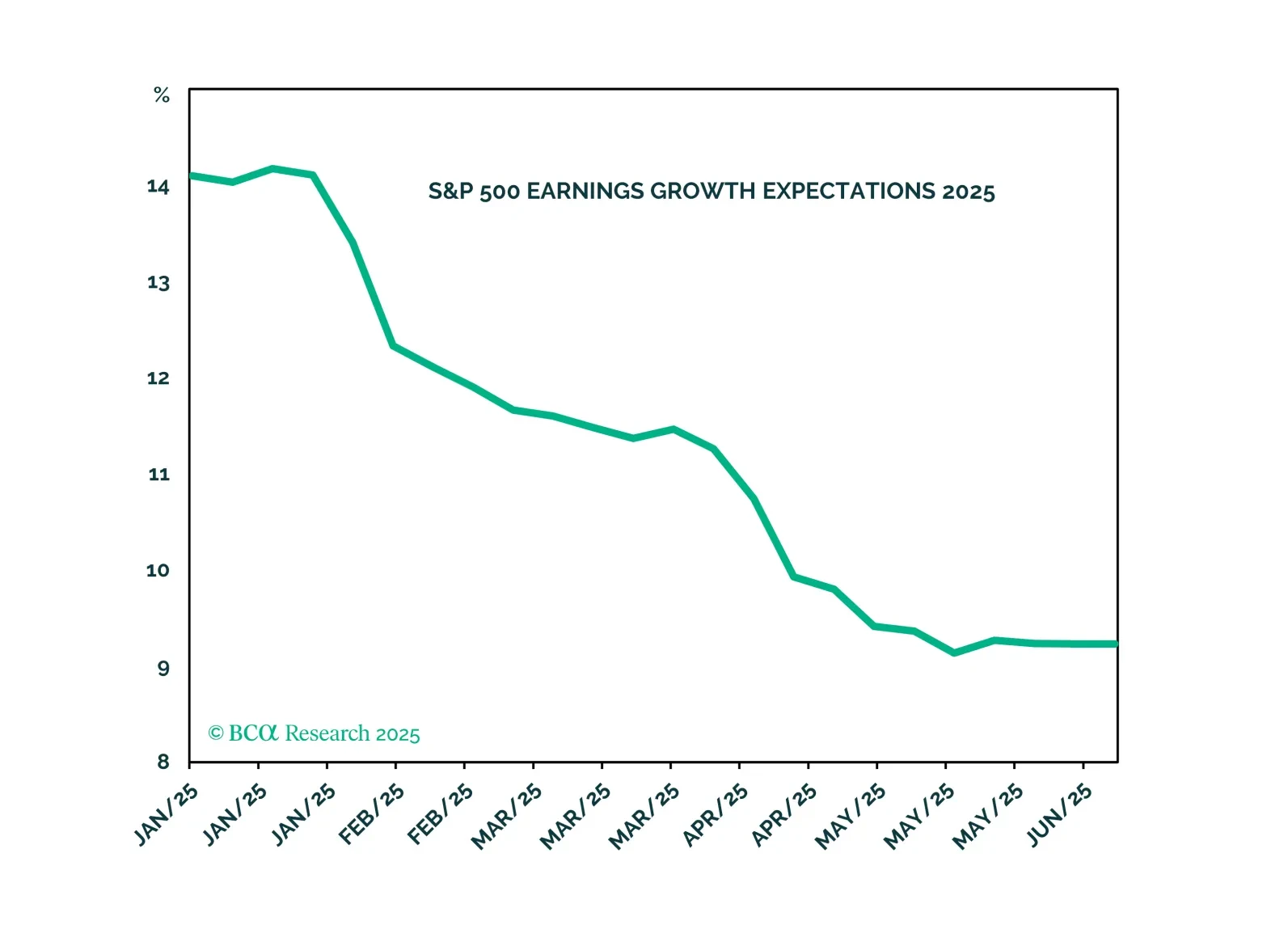

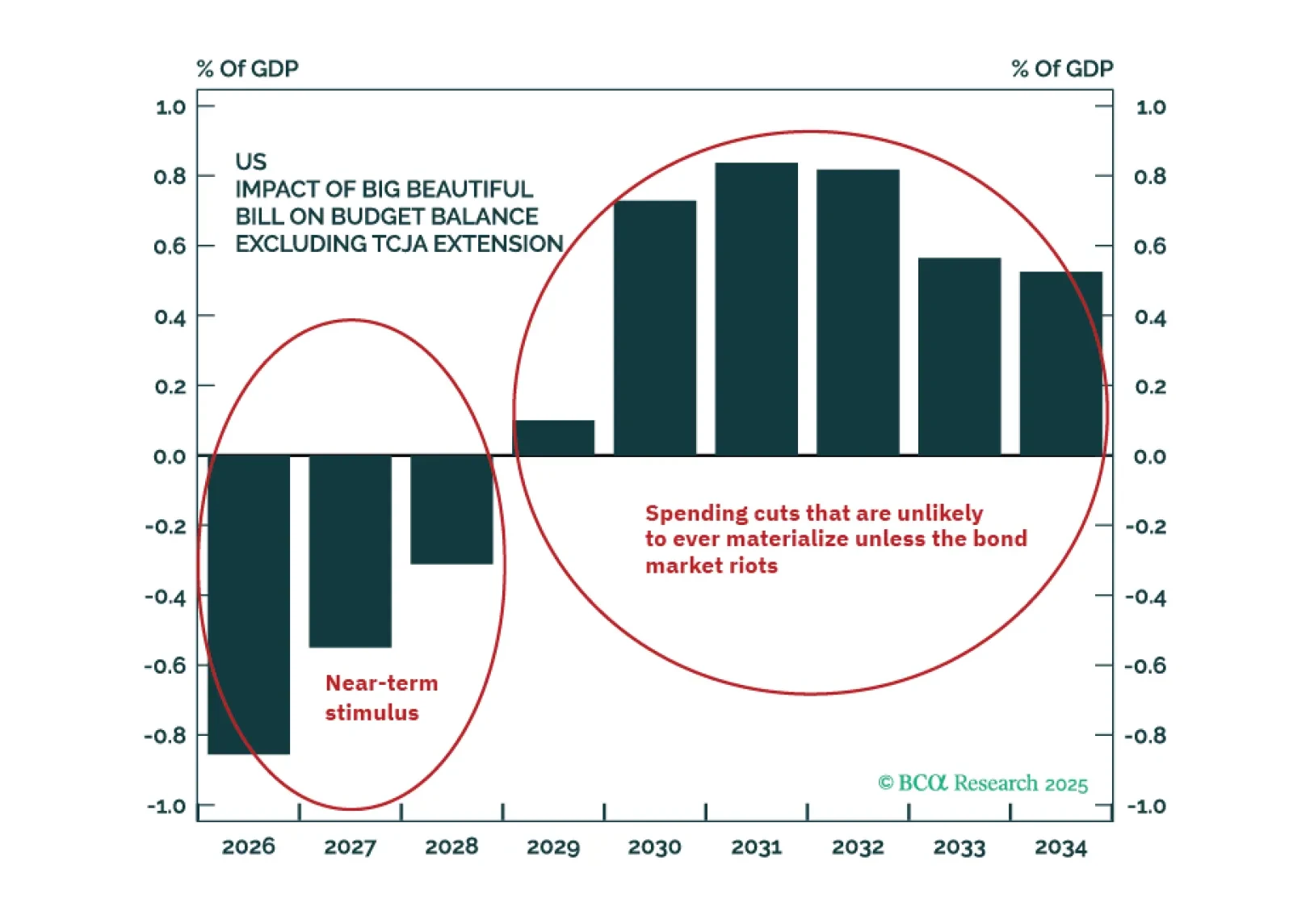

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

Imminent monetary and fiscal easing, along with resilient earnings growth, support a constructive outlook for equities. However, in the near term, significant tail risks persist. We recommend strengthening downside protection by…

The US economy has held up better so far this year than we had expected. For the time being, investors should remain modestly underweight equities. A more aggressive underweight would be justified only once the “whites of the…