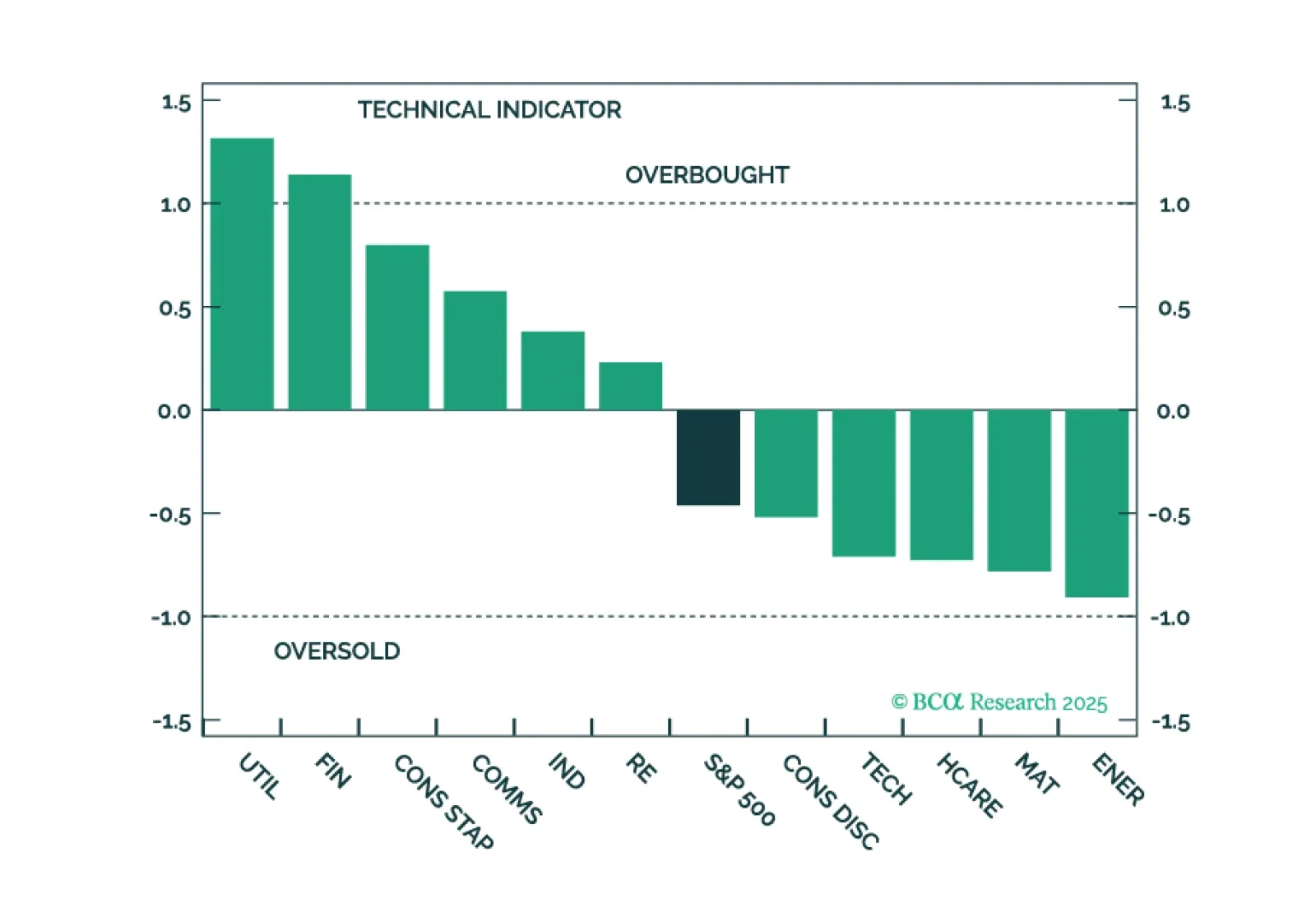

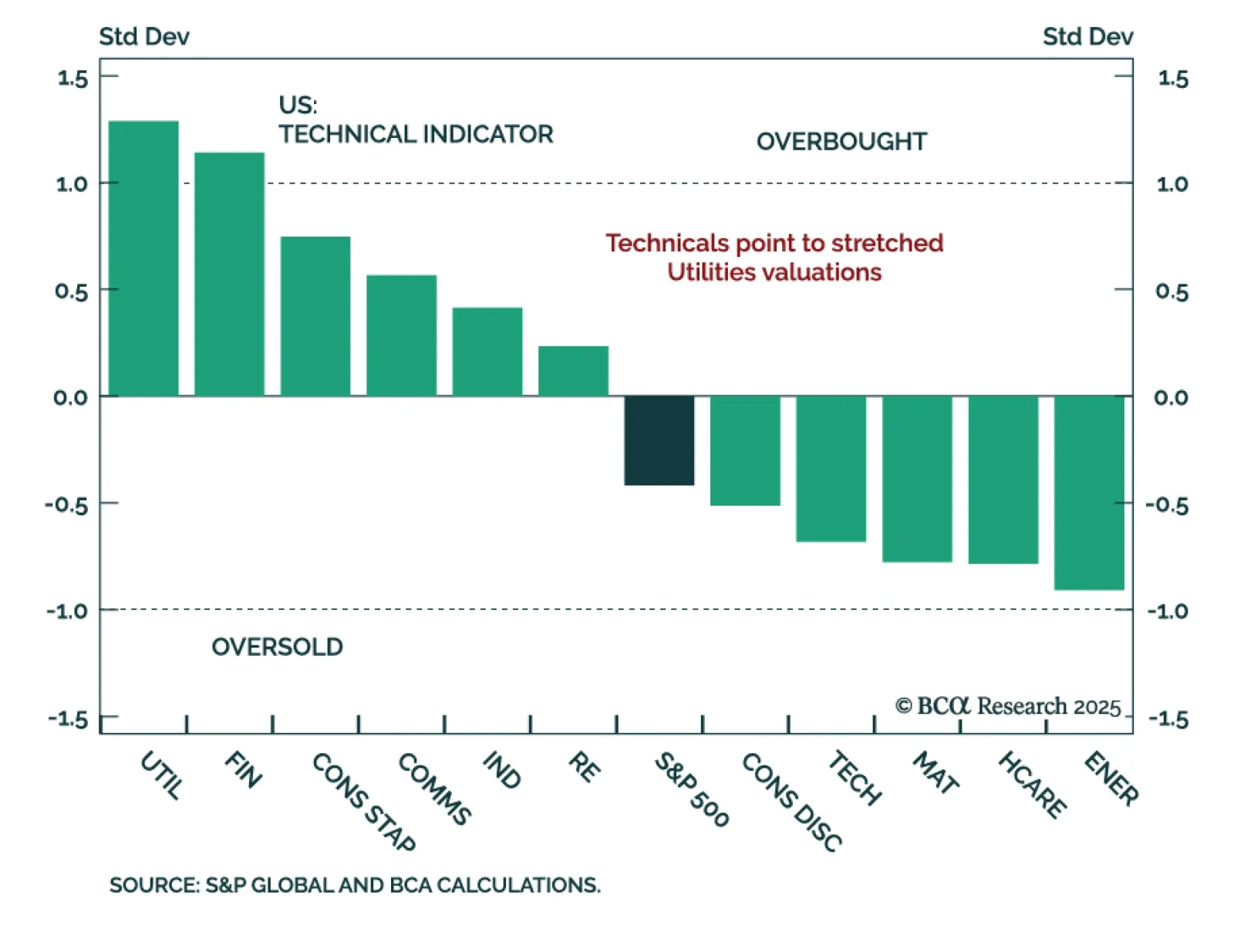

Our US Equity strategists are closing their tactical overweight in Utilities, as the trade is now crowded and priced for perfection. While the long-term outlook remains attractive, near-term upside is limited given elevated…

Utilities remain a long-term structural investment theme thanks to the tailwinds from GenAI, EV, and onshoring. However, there is little upside left over the tactical investment horizon as all the positives are priced in. We…

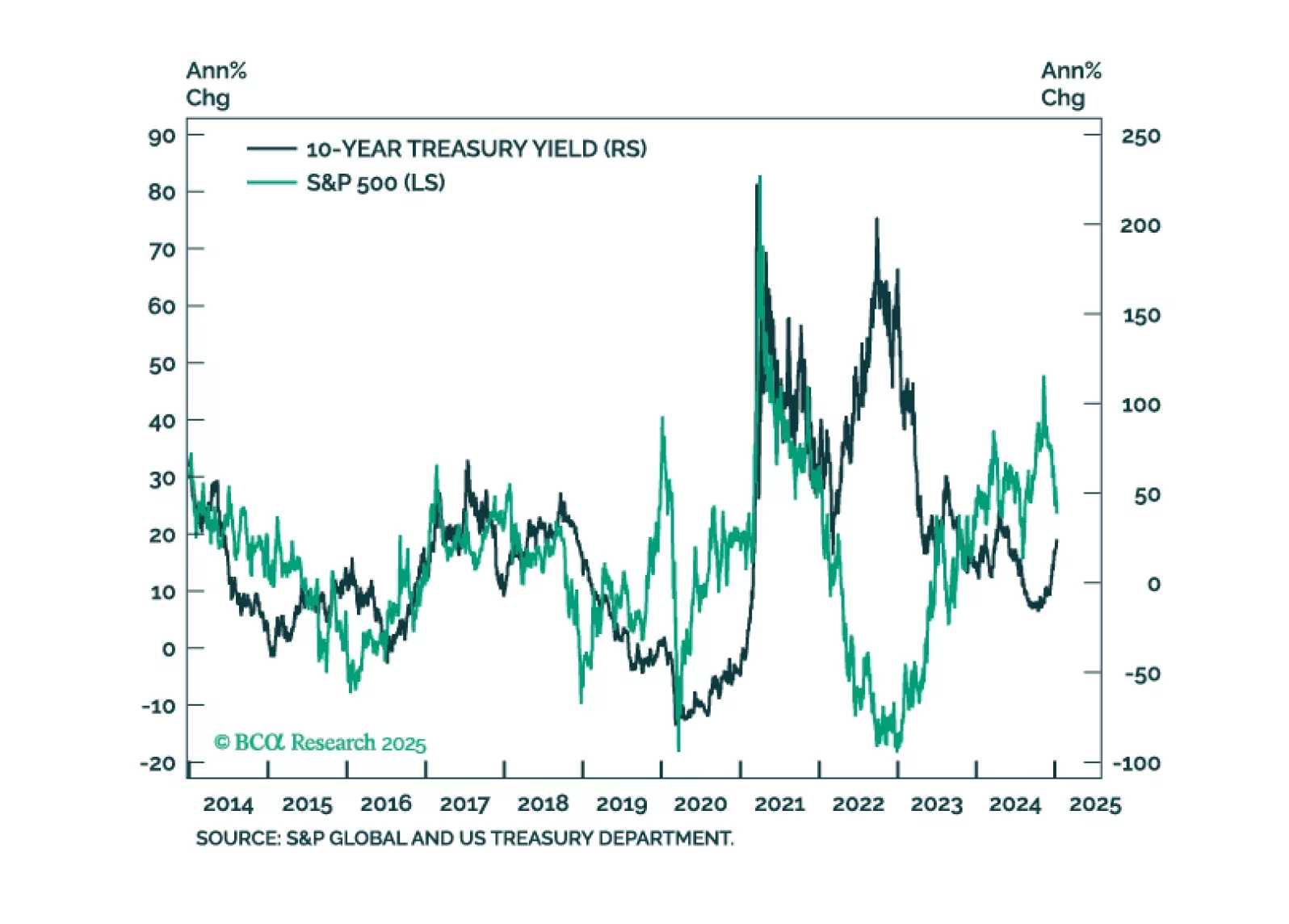

In this first presentation of 2025, we start with an overview of the 2025 outlook webcast polls, and a brief post-mortem of the 2024 market performance. Then, we shift gears and examine what is behind the recent surge in bond yields…

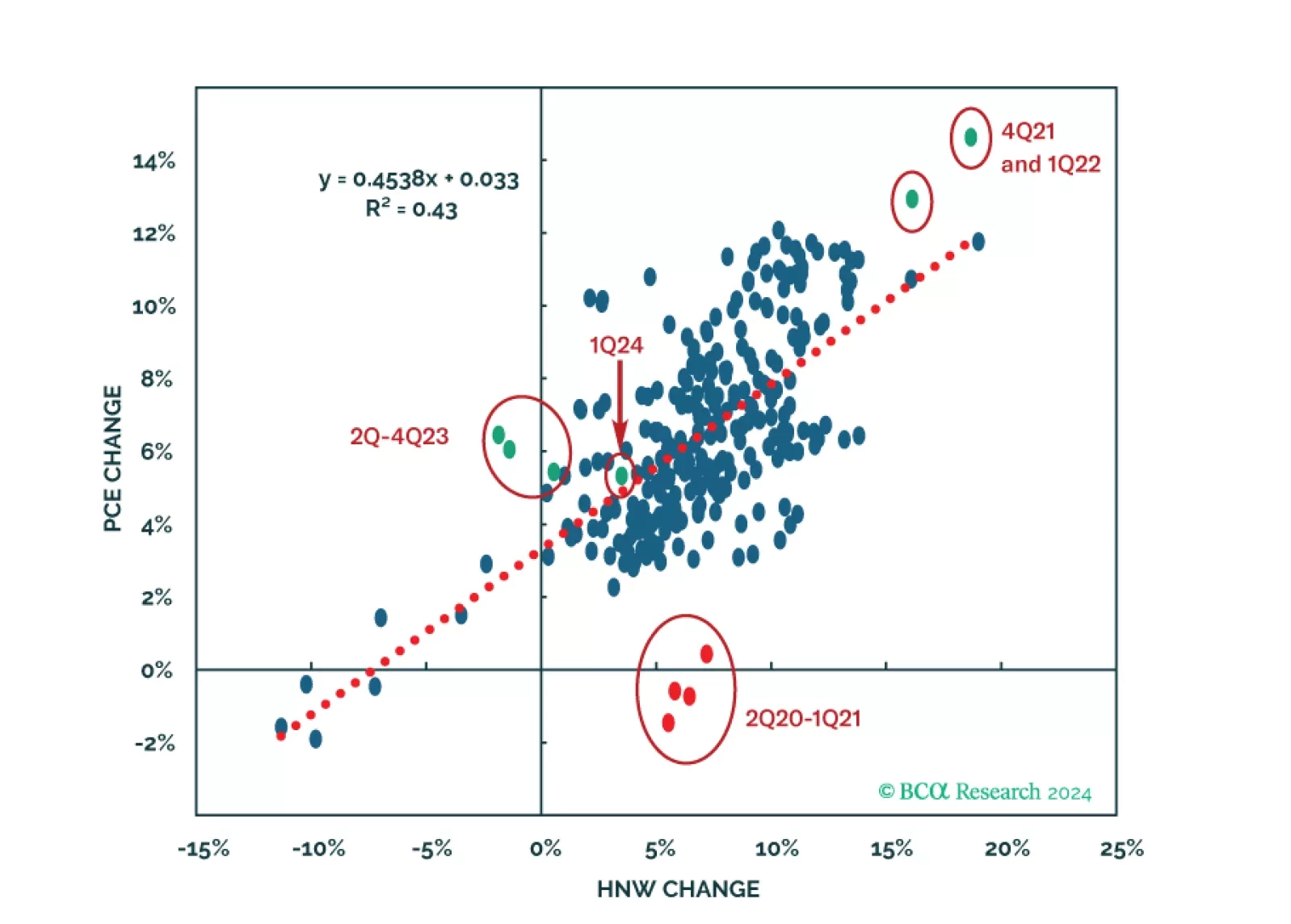

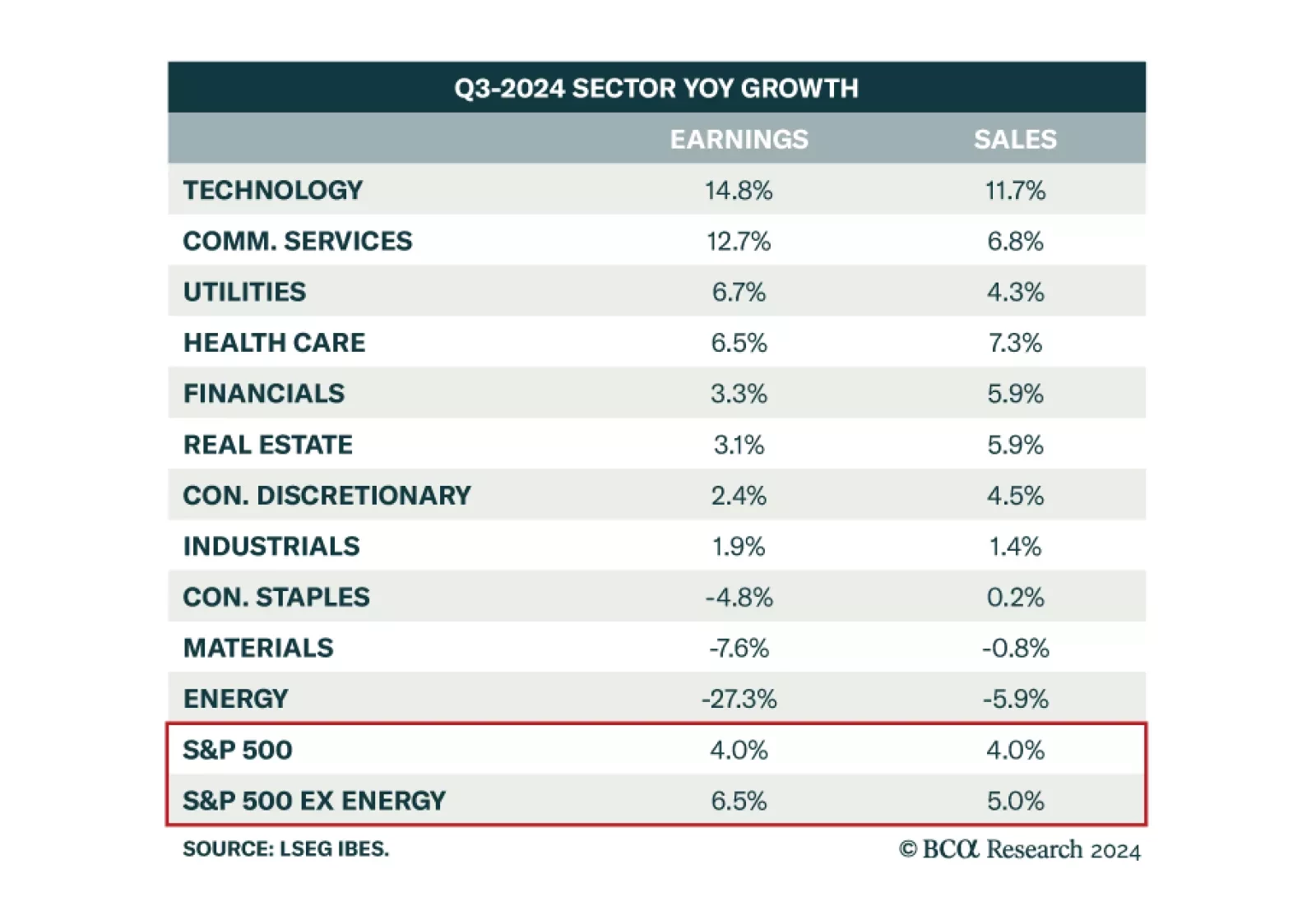

Our US Equity Strategy colleagues expect Q3 earnings to be strong enough to fuel the soft-landing narrative. Analysts expect S&P 500 earnings growth to be 4.0% year-over-year, with sales growth of 4.0% too. Yet, with…

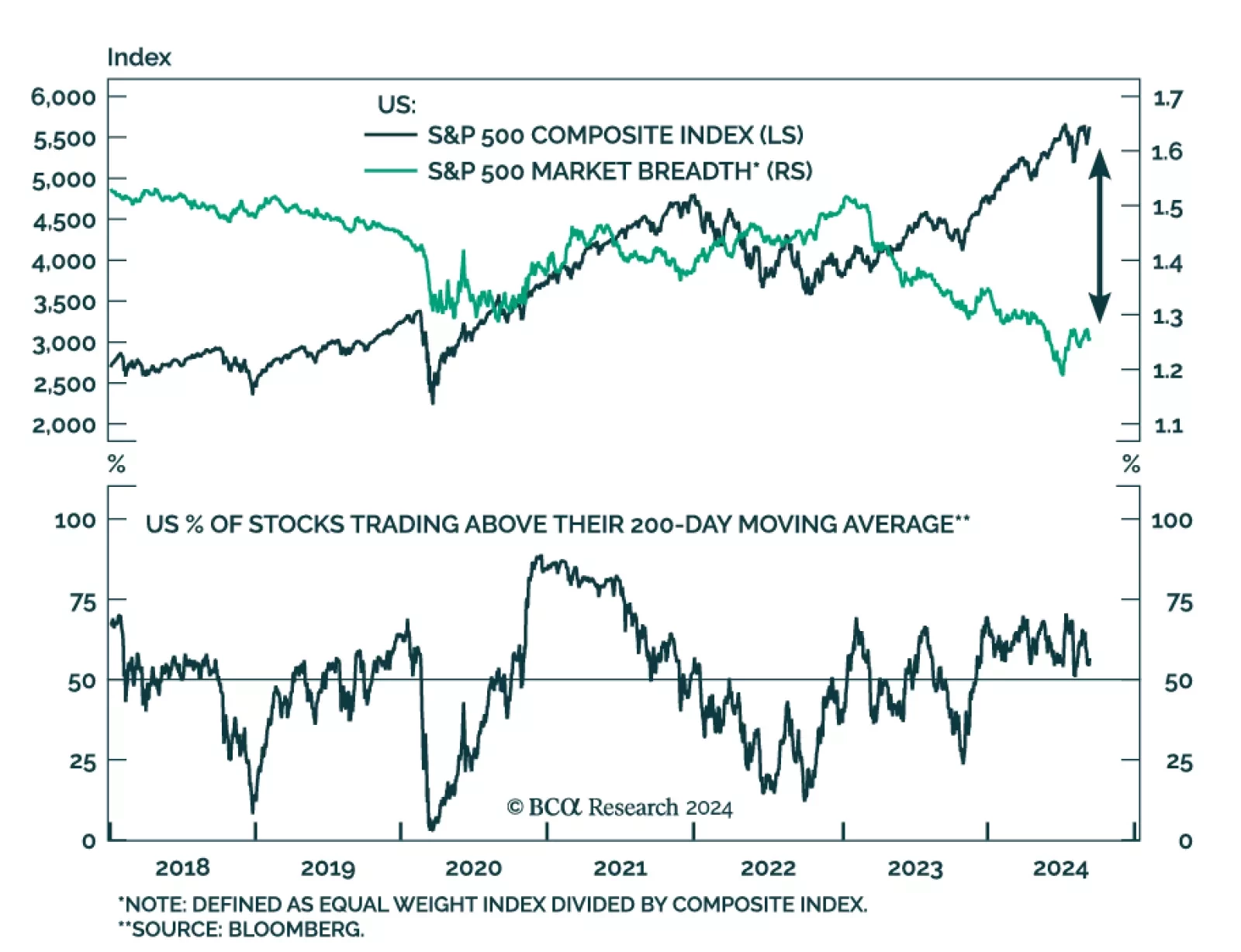

Investors are pricing in a soft landing in the US. Notably, we noted that pro-cyclical assets topped the performance ranking in August. At the same time, the S&P 500 is currently trading only 1% below its all-time highs.…

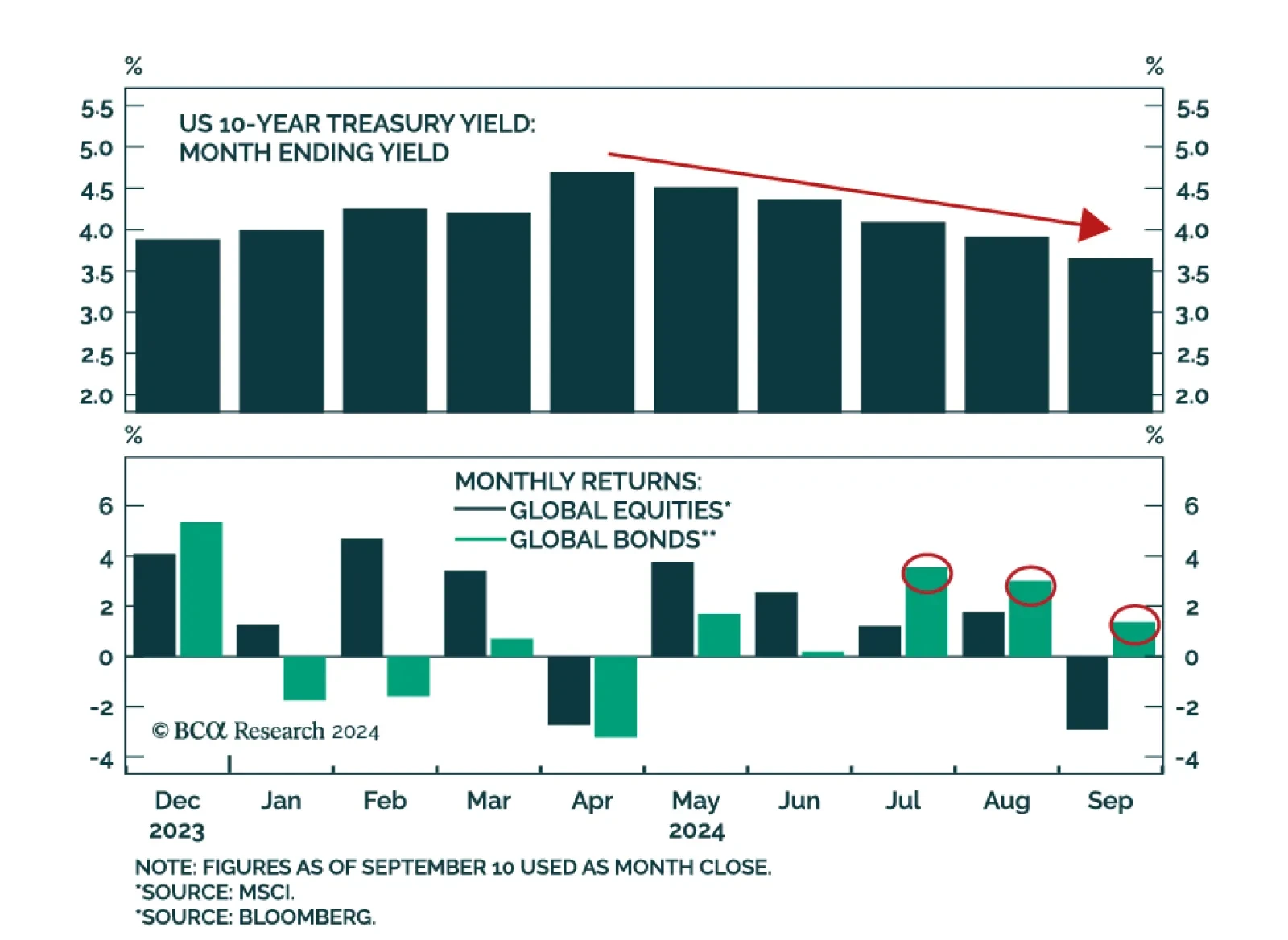

Despite global bond yields having trended lower since April, bonds have only started outperforming equities since July in US dollar terms. We expect this outperformance to persist going forward. Sentiment has largely driven…

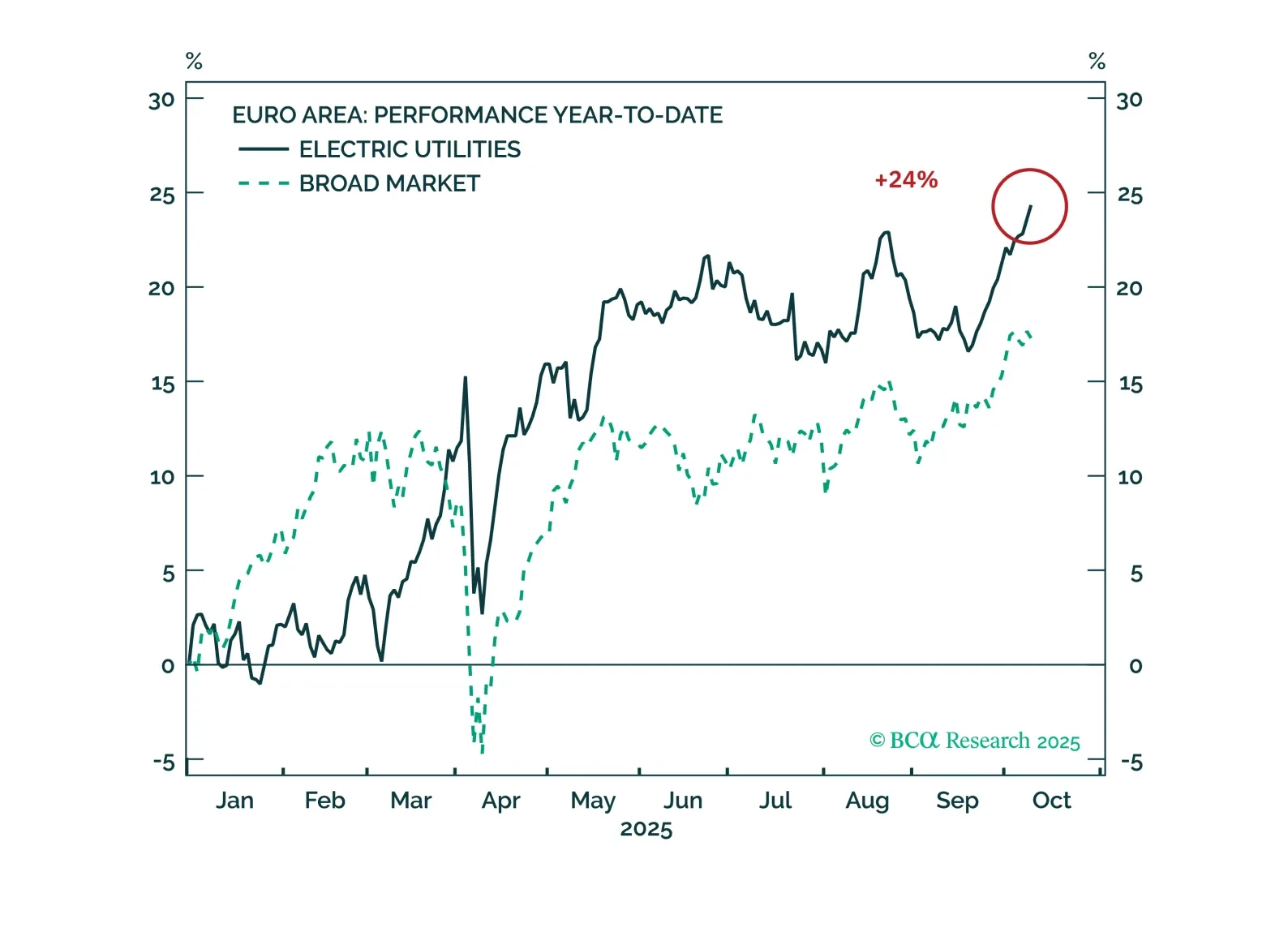

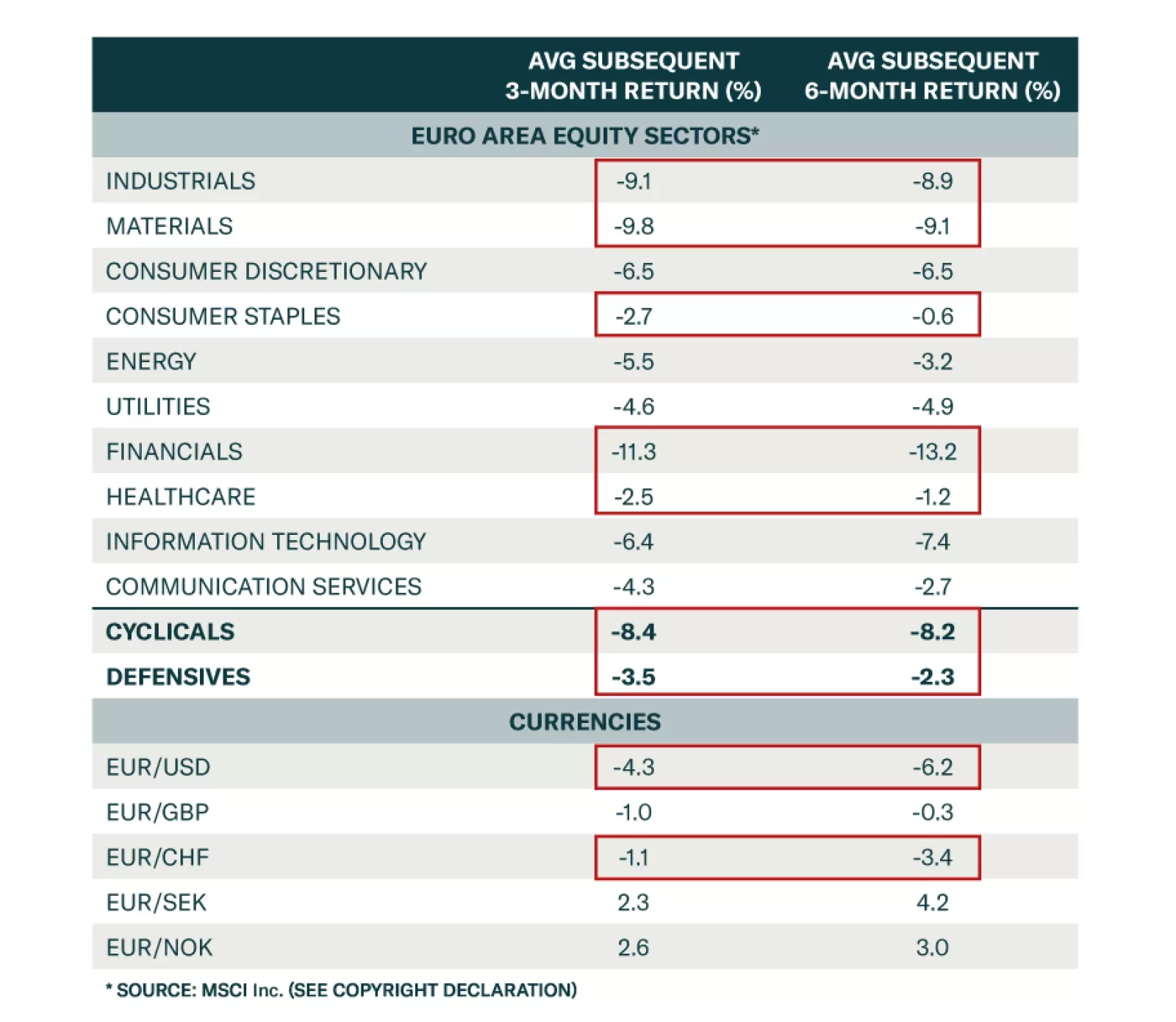

BCA Research’s European Investment strategists looked at previous episodes of carry-trade blowups and assessed the performance of the Eurozone’s key sectors, national markets, and currencies three and six months…