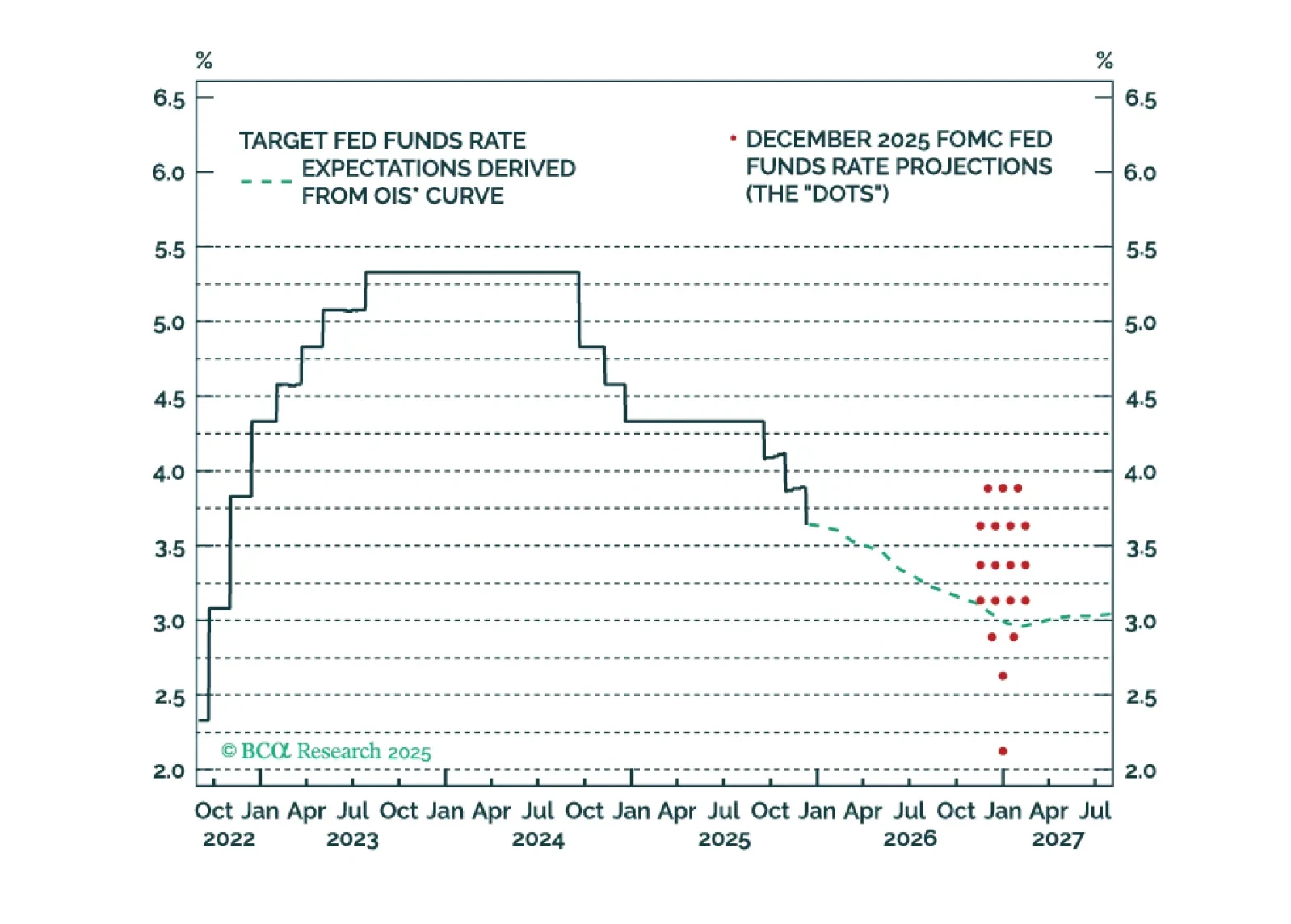

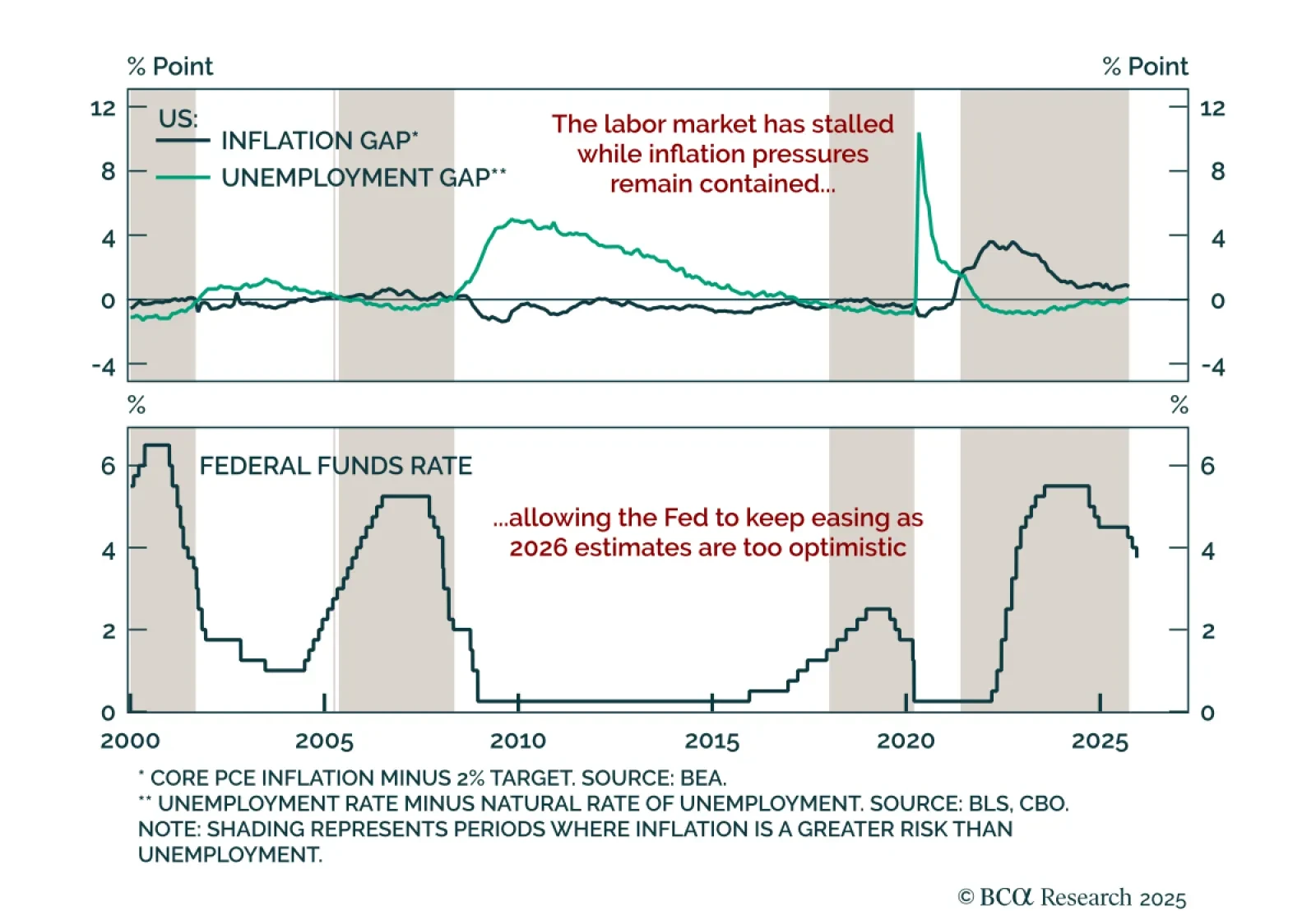

The Fed is on hold for now, but its 2026 economic projections are far too optimistic. The Fed will ease more next year than it currently anticipates.

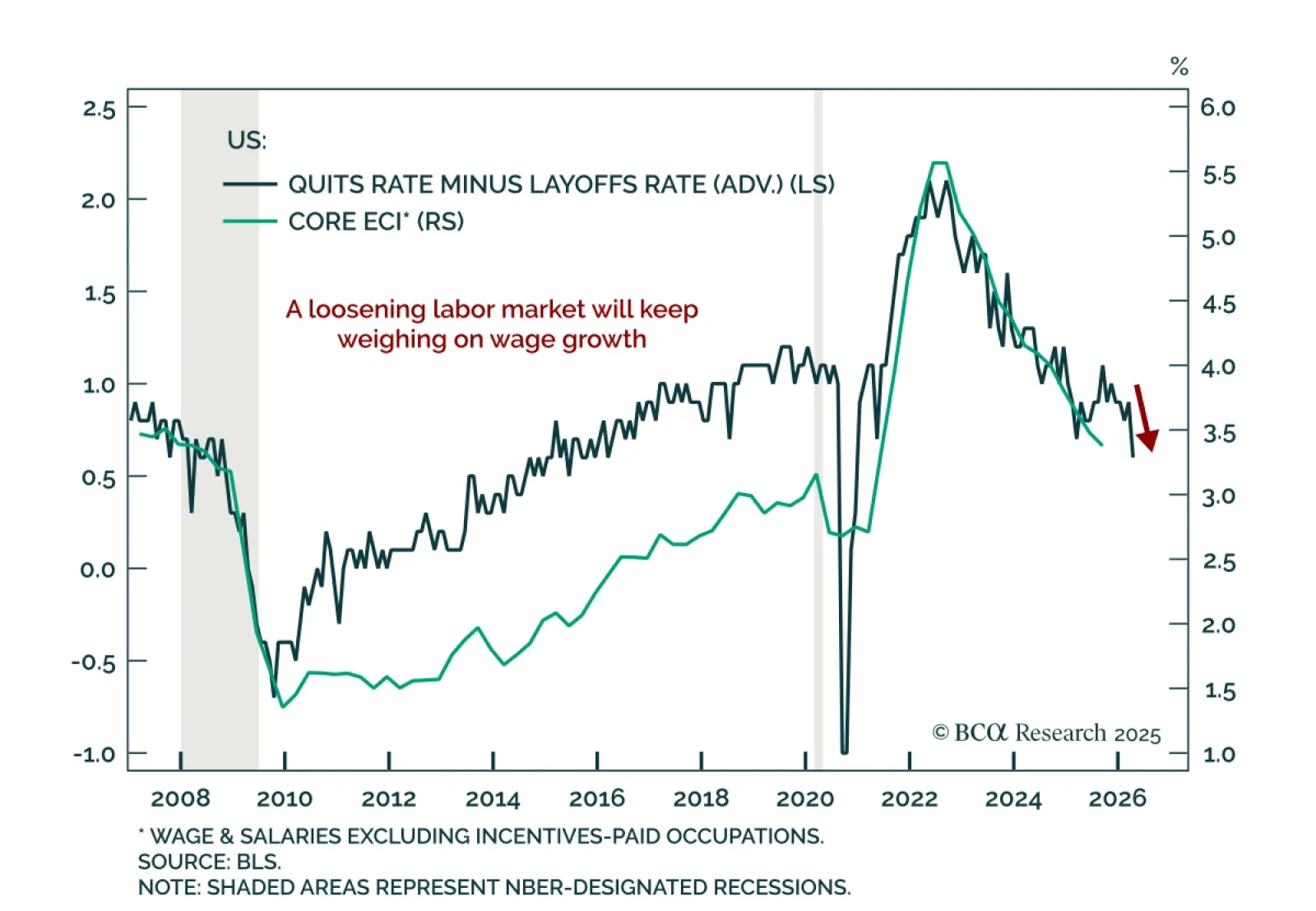

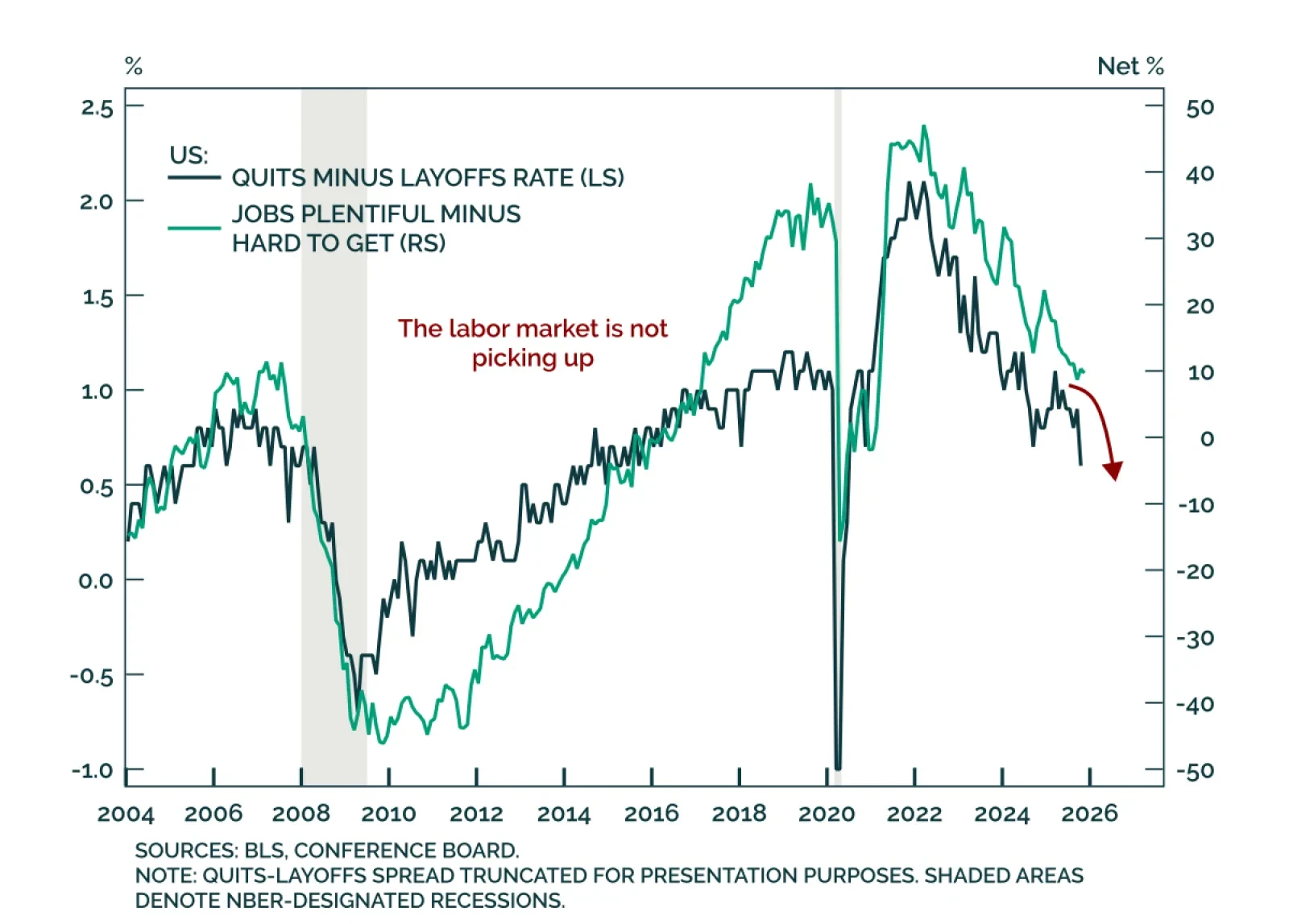

Maintain a modestly defensive stance as cooling wage growth reinforces labor-market weakness. The delayed Q3 Employment Cost Index missed estimates, slowing to 0.8% q/q. The “core” ECI measure, which excludes incentives-paid…

Maintain a long duration stance and favor curve steepeners as the Fed’s outlook remains too optimistic relative to ongoing labor and growth deterioration. The Fed cut rates by 25 bps to 3.5%–3.75%. The decision again drew two-sided…

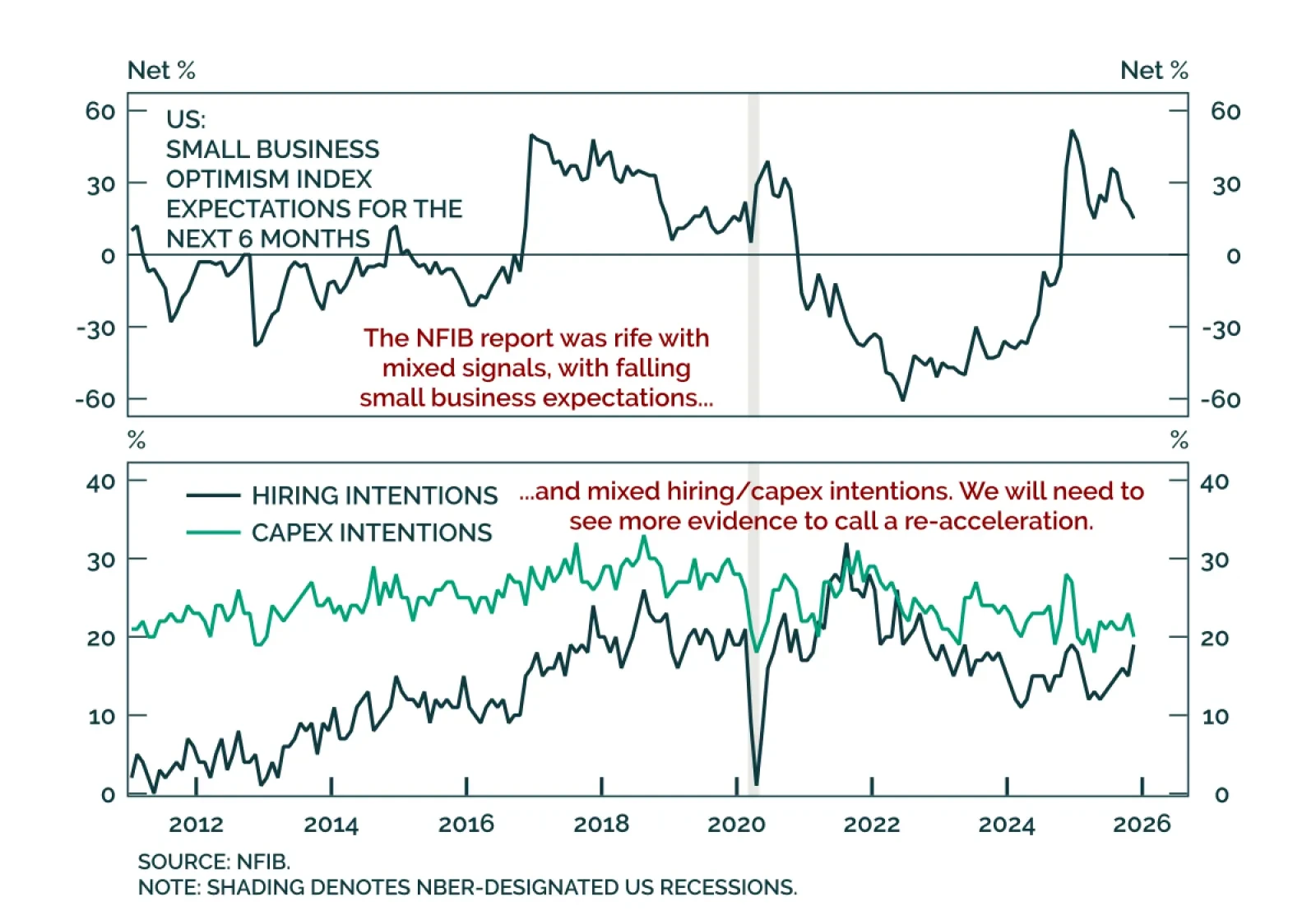

Maintain a modestly defensive stance as the NFIB shows no signs of a growth or labor-market re-acceleration. The November NFIB Small Business Optimism Index beat estimates, rising to 99.0 from 98.2 and slightly above its long-term…

Maintain long duration and favor tactical steepeners as the JOLTS data show no evidence of a labor-market re-acceleration. The delayed October JOLTS report showed job openings rising slightly to 7.67m from 7.66m, but underlying…

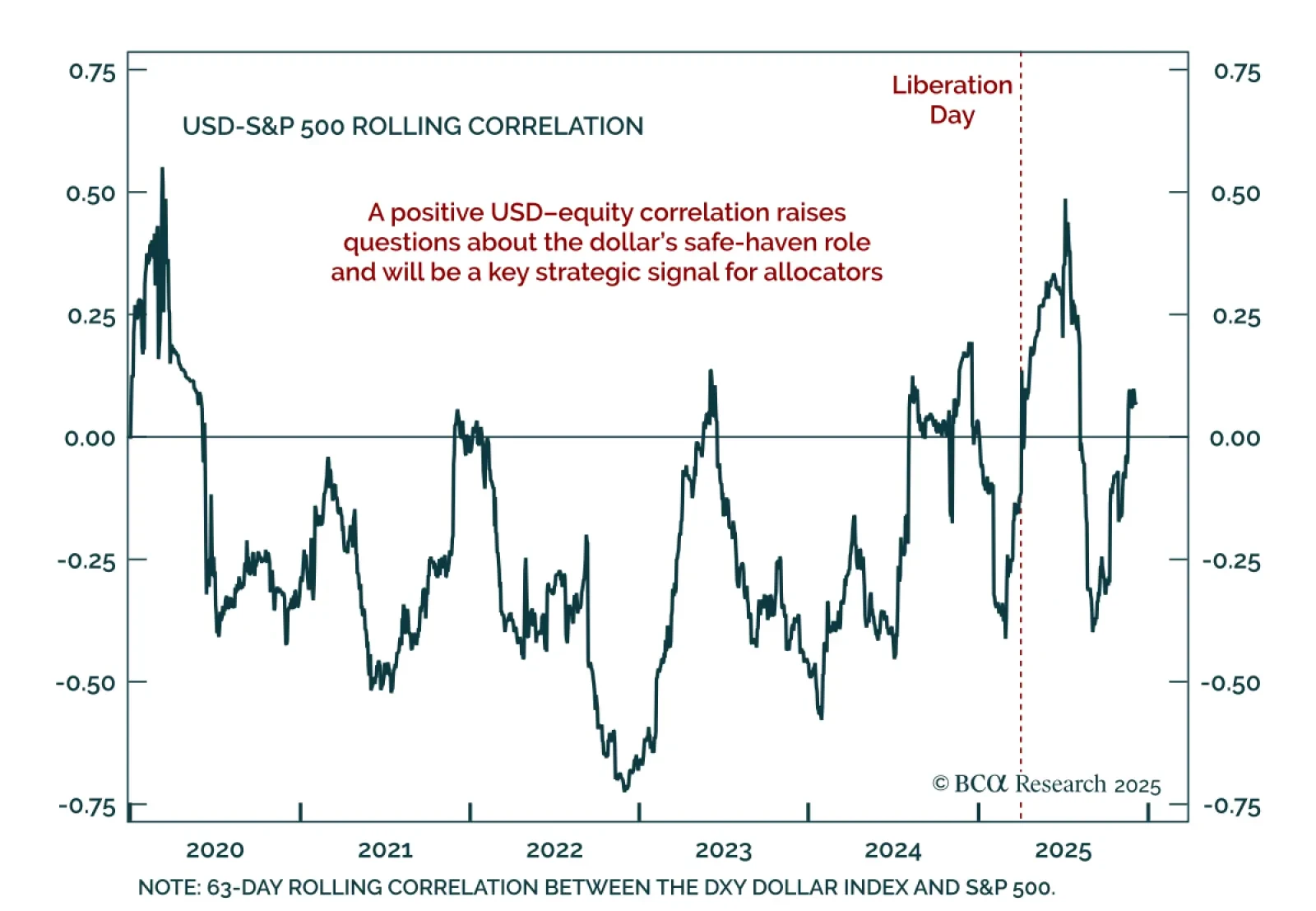

Watch the shift in correlation between equities and the USD; a positive co-movement will carry major implications for asset allocation and hedging. Shifting correlations have been a defining theme of the year. They often signal…

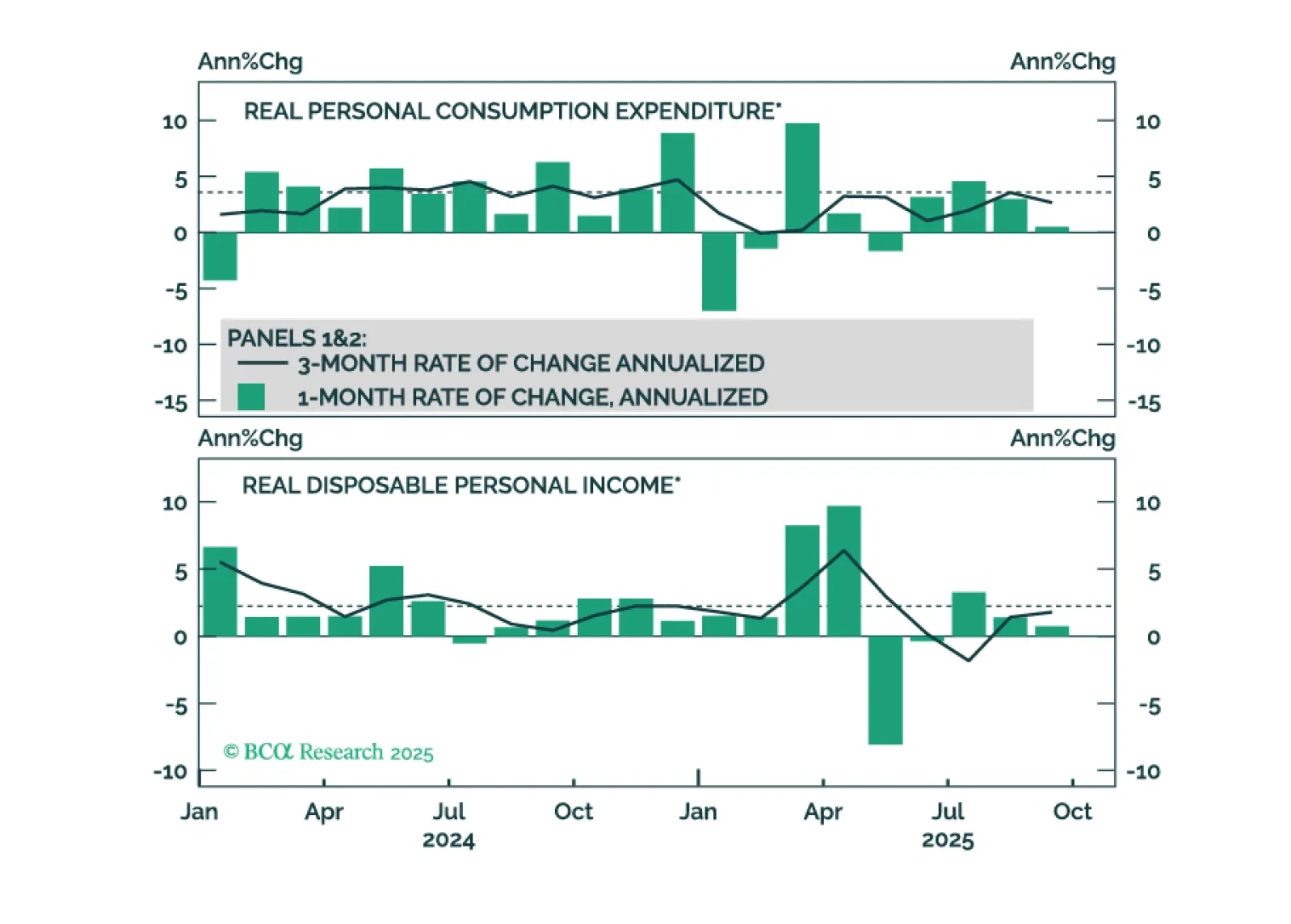

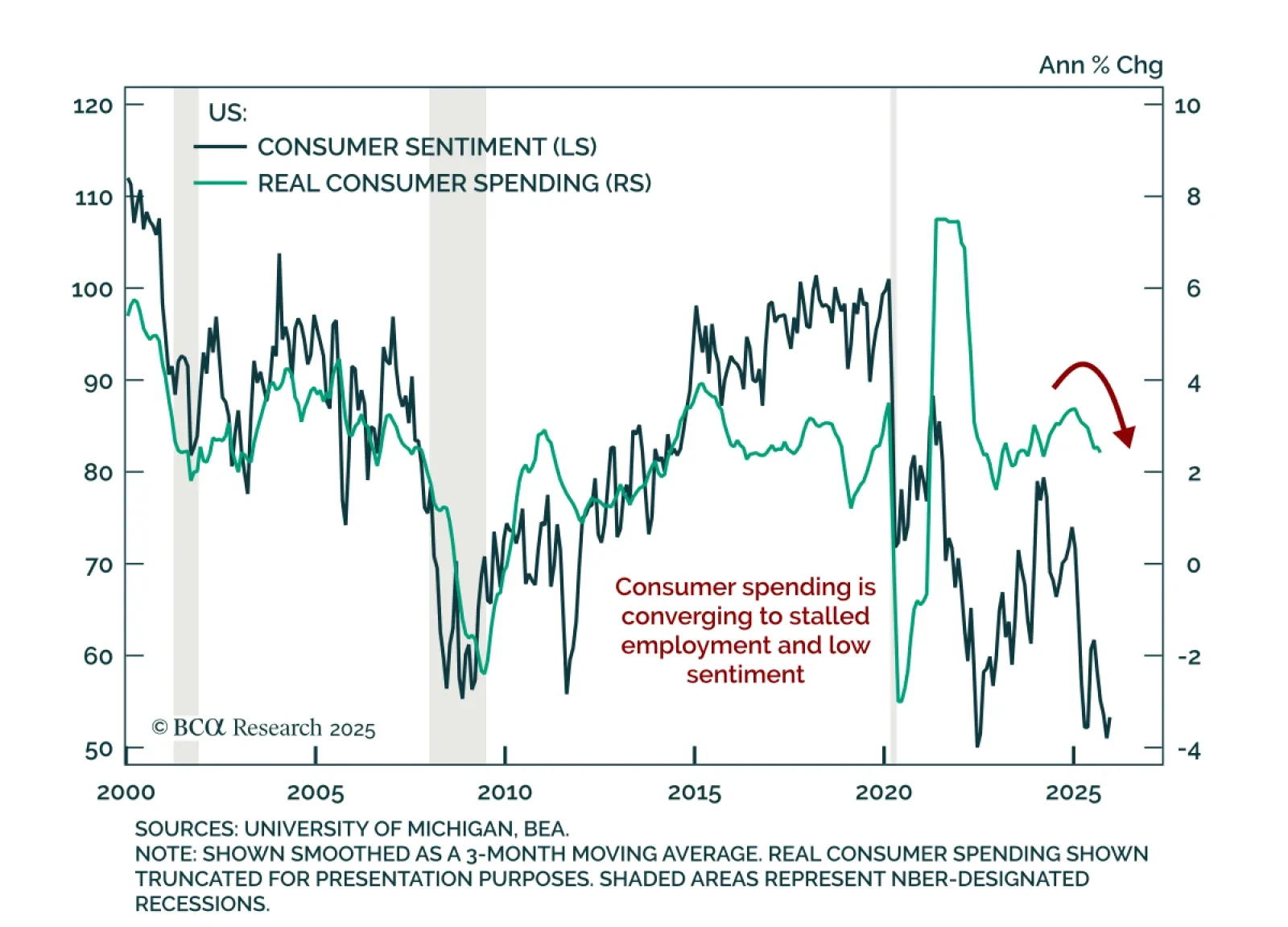

Expect more Fed easing than priced as stalled labor momentum and fragile consumption limit inflation pressure. The delayed September Personal Income & Outlays report showed a weaker picture than expected. Nominal income and…

Our US and Geopolitical strategists delivered accurate calls on Trump’s tariff shock and Israel’s strike on Iran in 2025 but missed the China equity rally and overestimated near-term prospects for a Ukraine ceasefire. Their 2025…

September’s weak consumer spending data challenge the K-shaped recovery narrative and suggest that spending will slow to match already-weak employment growth.