Our US Investment strategists recommend maintaining benchmark equity exposure, despite weakening job gains, as the AI narrative may still drive a late-cycle melt-up. While recession risks are building, they argue against…

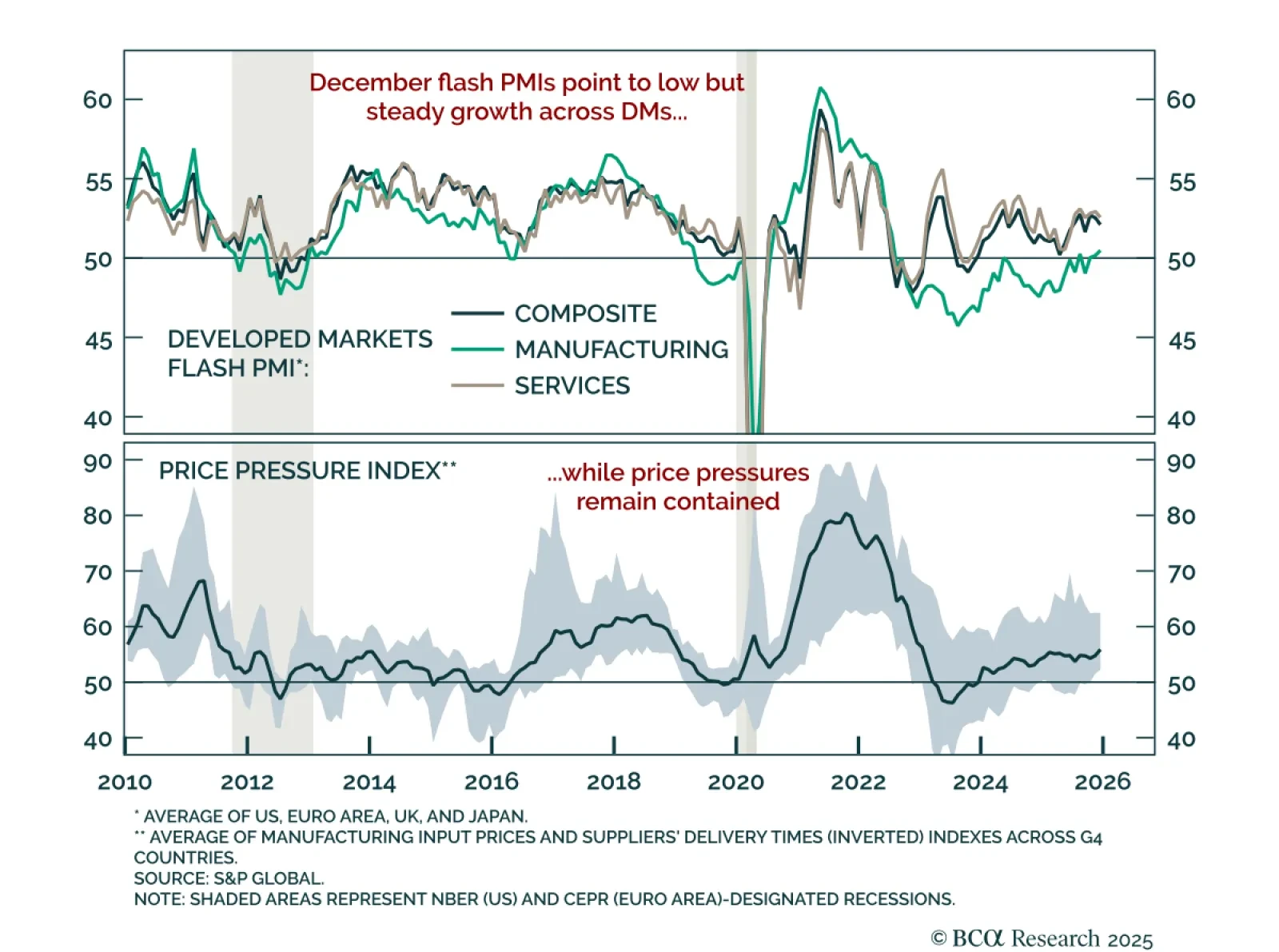

Maintain an underweight in industrial commodities as flash PMIs confirm weak global growth momentum. December flash PMIs for developed markets pointed to subdued activity. The US composite slowed to 53 from 54.2, a six-month low,…

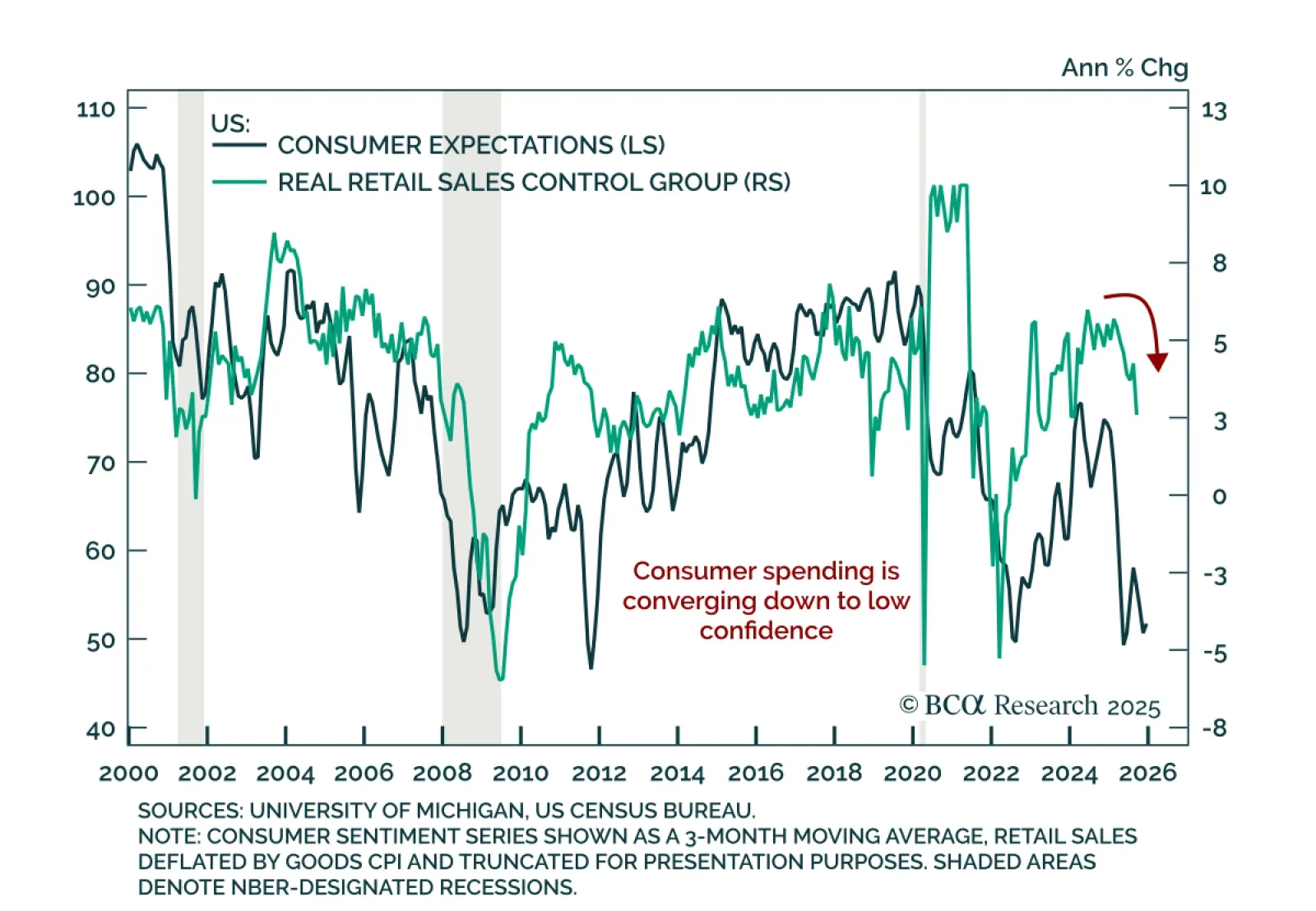

Maintain a modestly defensive allocation as retail sales show slowing consumption despite firmer underlying details. October US retail sales presented a mixed picture, with a second consecutive soft headline reading. Headline sales…

Our Geopolitical strategists expect geopolitical risk to move sideways in 2026, as the US seeks a ceasefire with Russia and a tariff truce with China ahead of midterm elections likely to result in gridlock. The Trump administration’s…

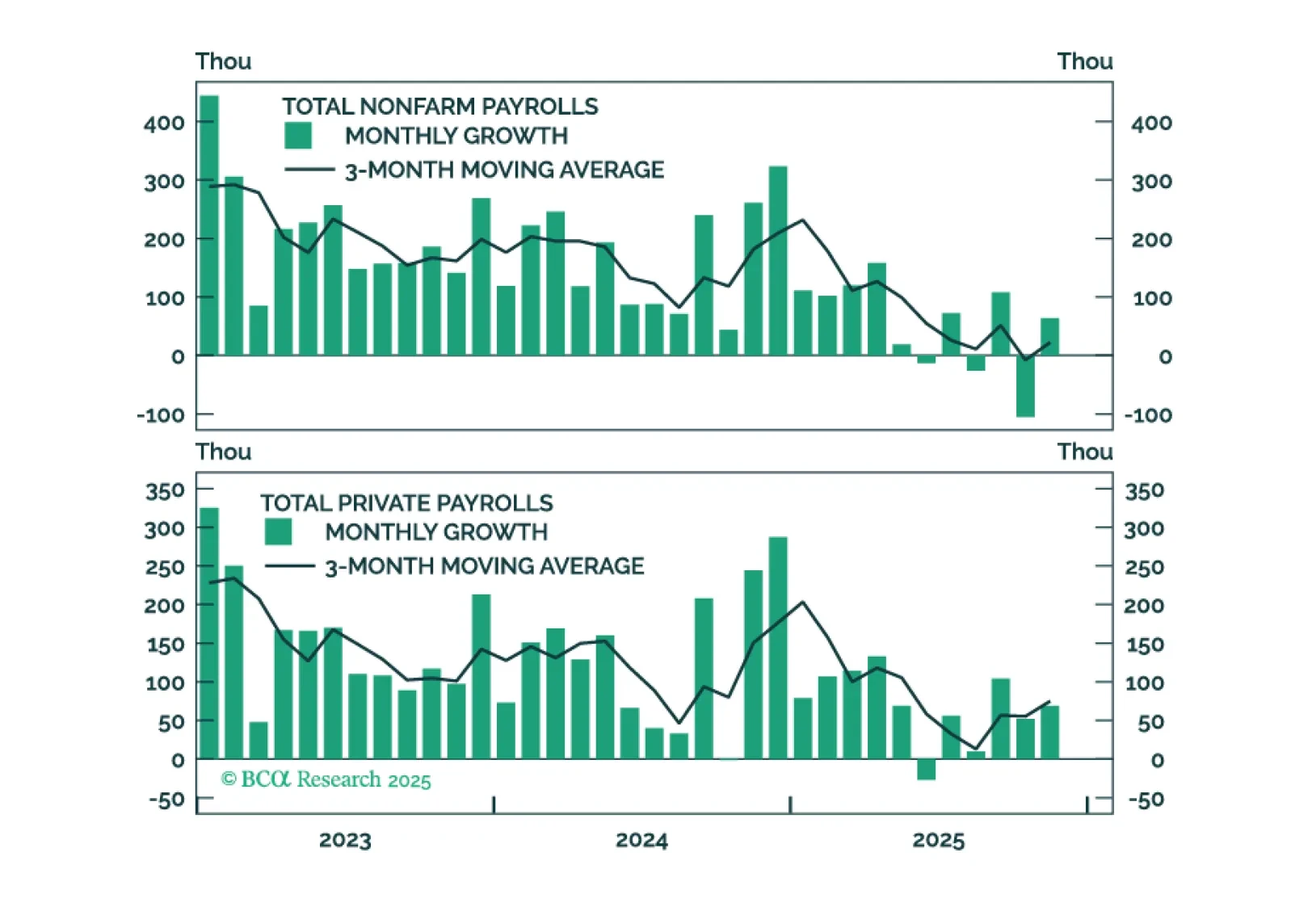

Employment Data Point To Dovish Policy Surprises In 2026

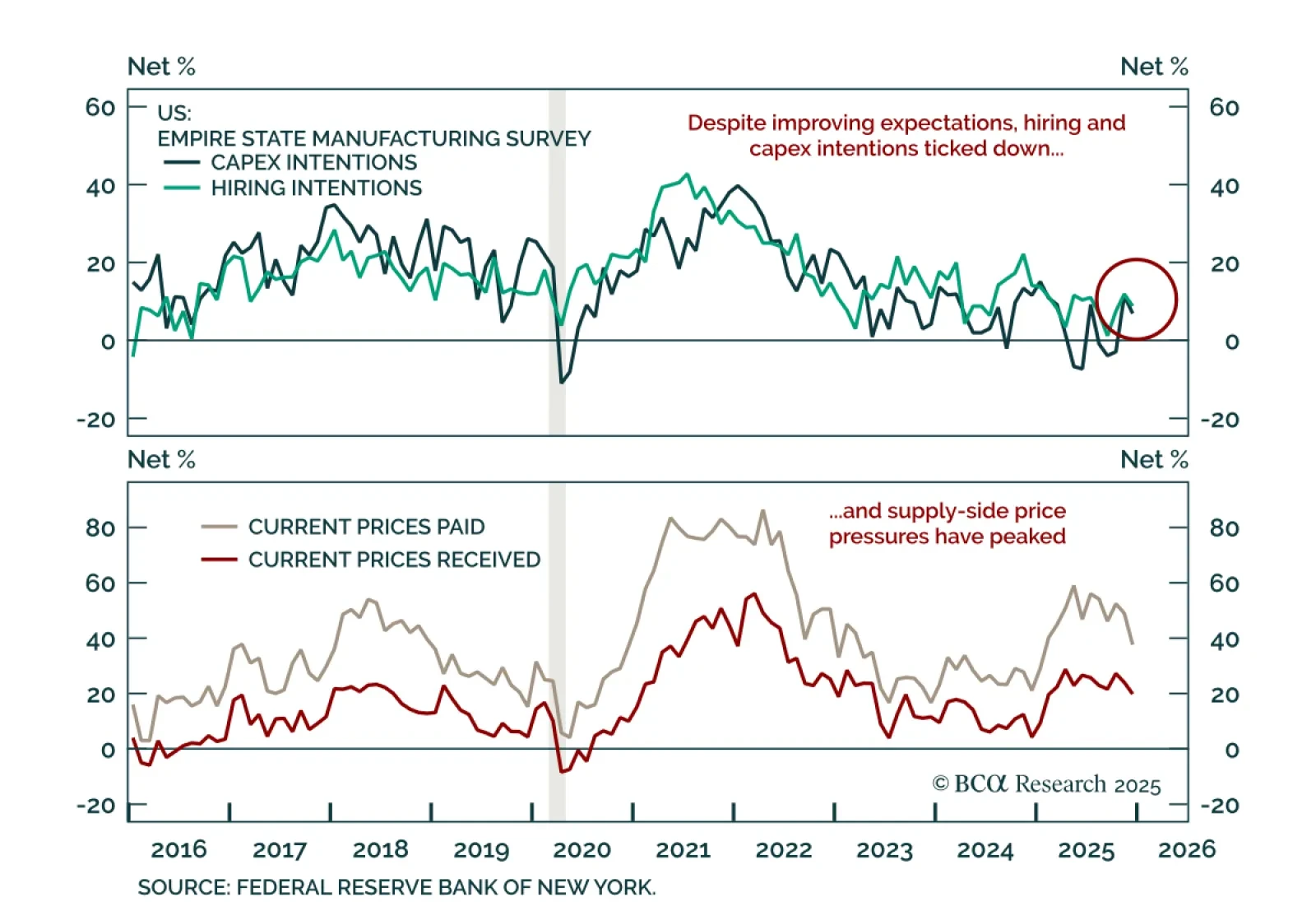

Maintain a modestly defensive stance as the Empire survey reinforces a picture of slow and fragile growth. The December Empire Manufacturing survey missed estimates, falling to -3.9 from 18.7 and implying a slight decline in activity…

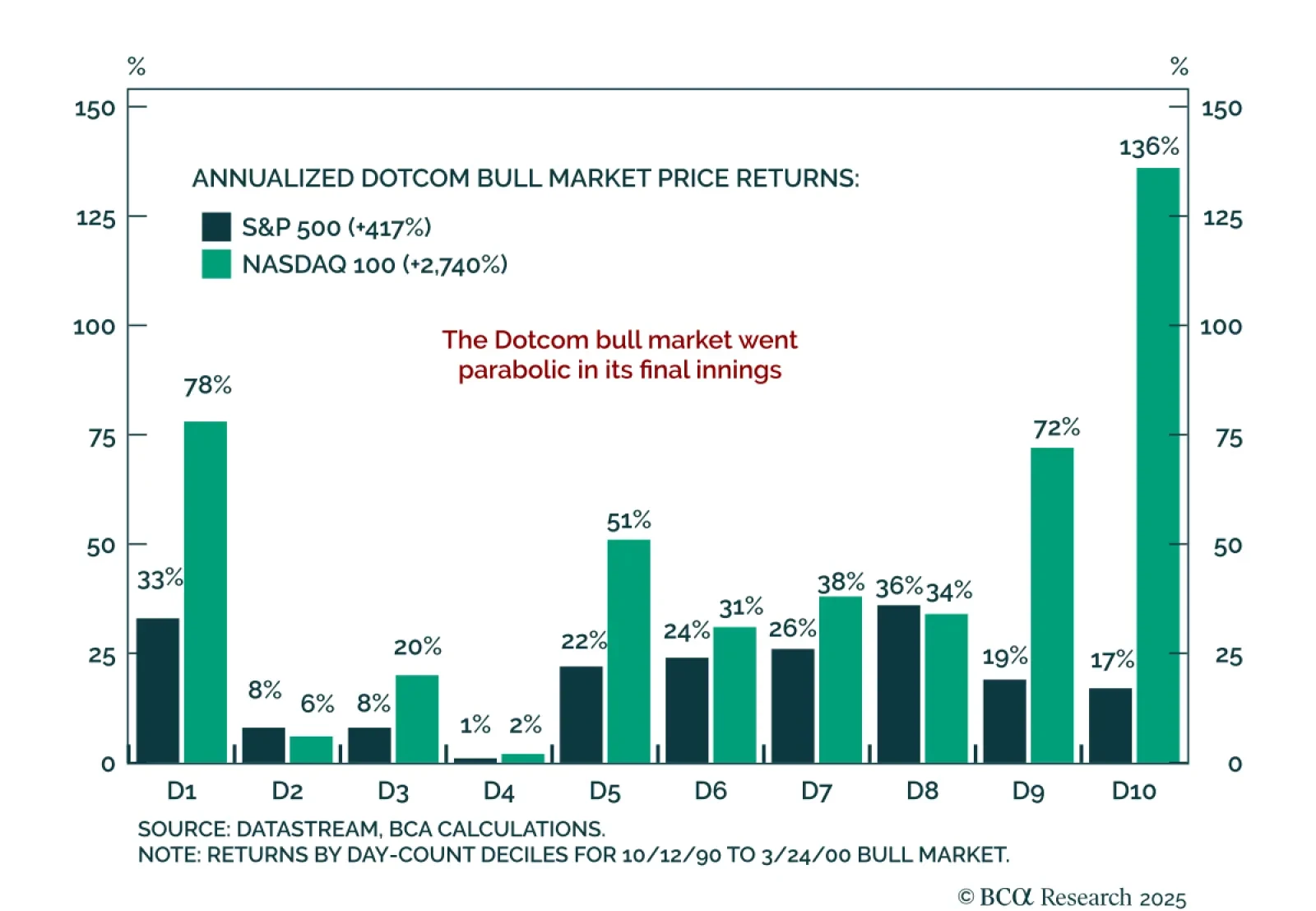

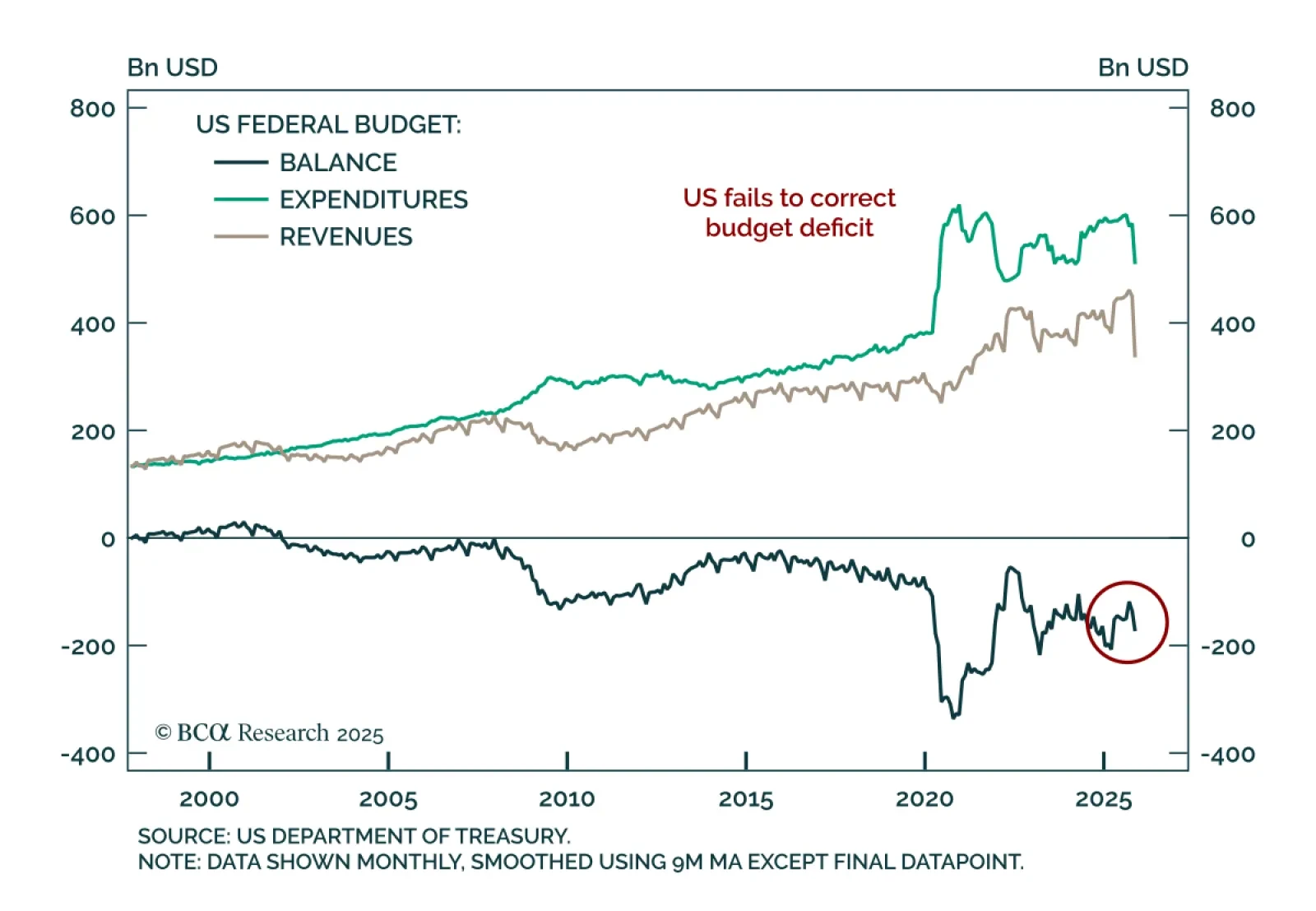

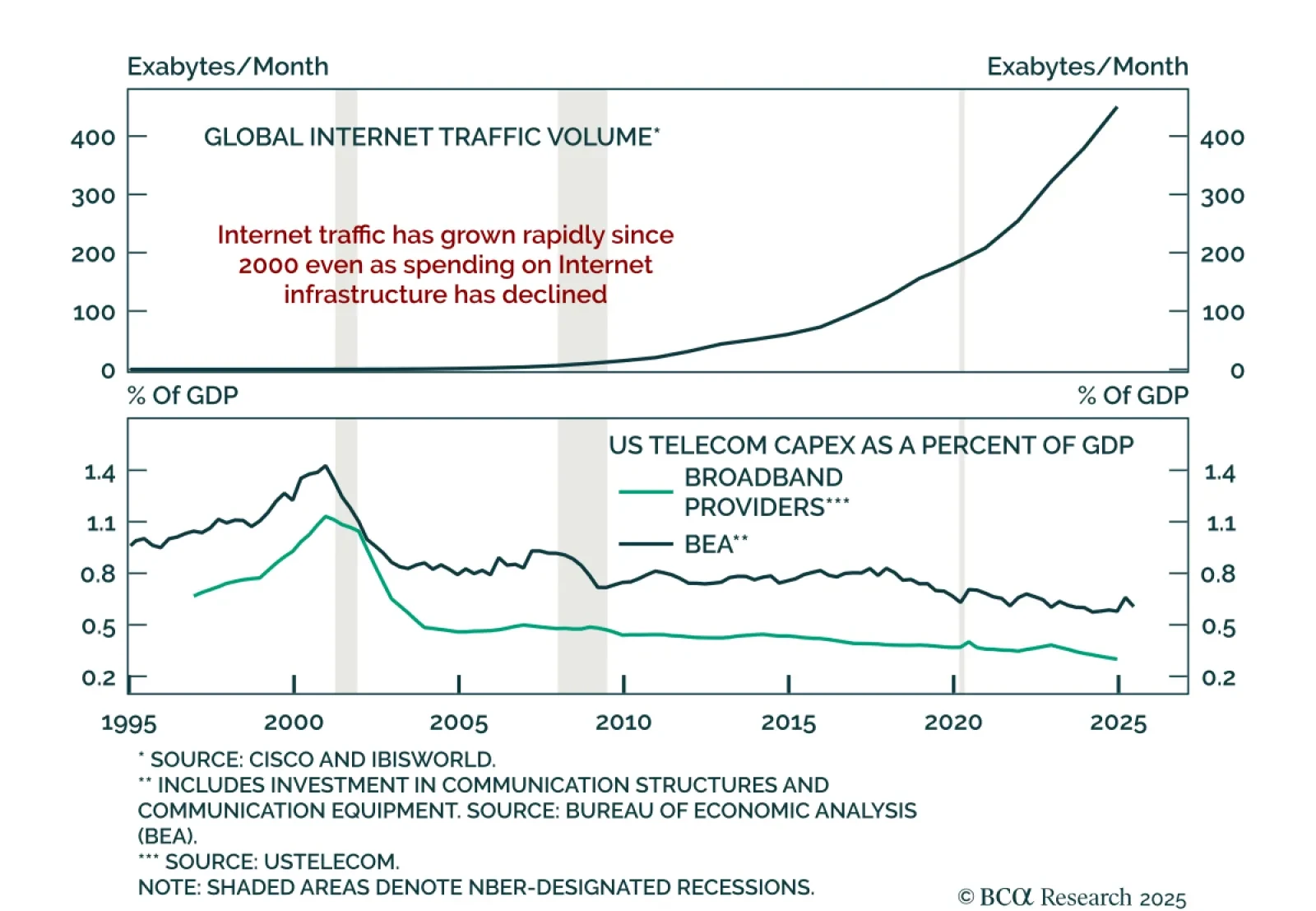

Our Global Investment strategists expect 2026 to mark the turning point from AI boom to bust, with their highest conviction trade (short QQQ / long TLT) positioned to capitalize. Internet infrastructure data offers a warning: Traffic…

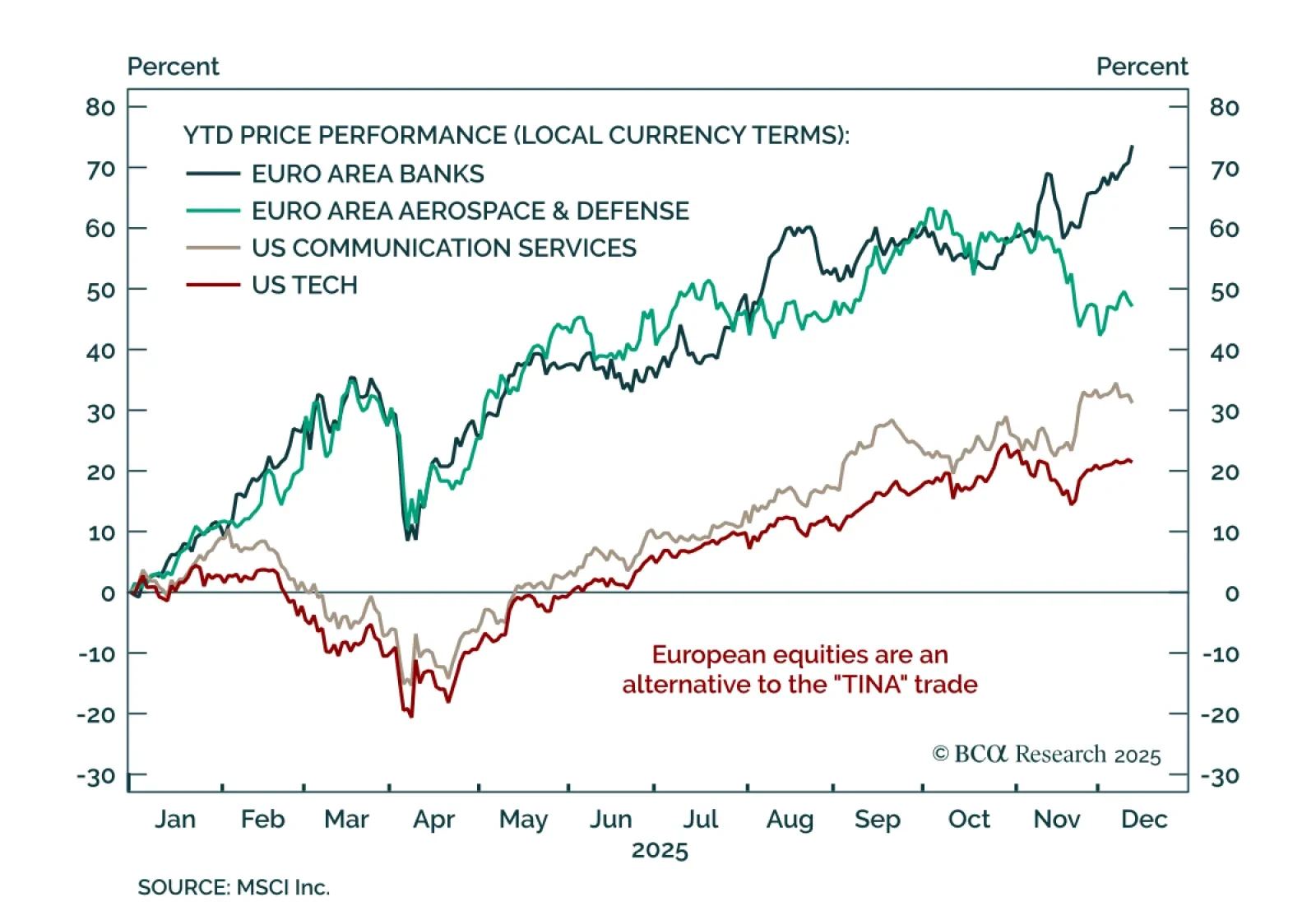

Europe’s equity outperformance is real, and even stronger once adjusted for FX. Our Chart Of The Week comes from Jeremie Peloso, Chief European Investment Strategist. Banks and defense stocks (not tech and communication services…

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

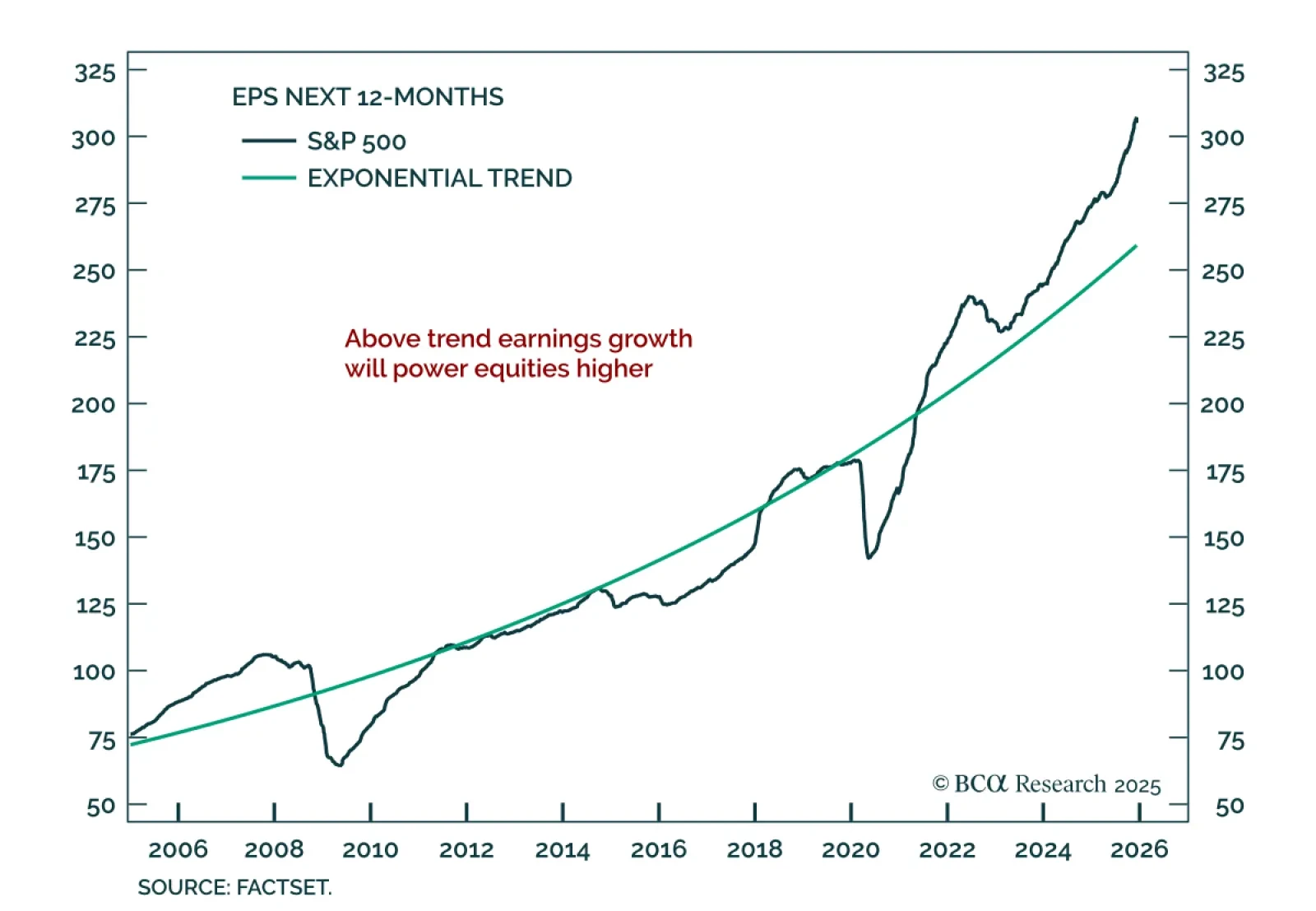

Our US Equity strategists remain constructive on equities in 2026, with monetary easing, fiscal support, GenAI capex, and strong earnings growth all favoring the asset class. While valuations are extended, they think bubble concerns…