The US removal of Venezuela's Maduro does not presage an invasion of Greenland. But it does justify a lingering risk of conflict with Iran.

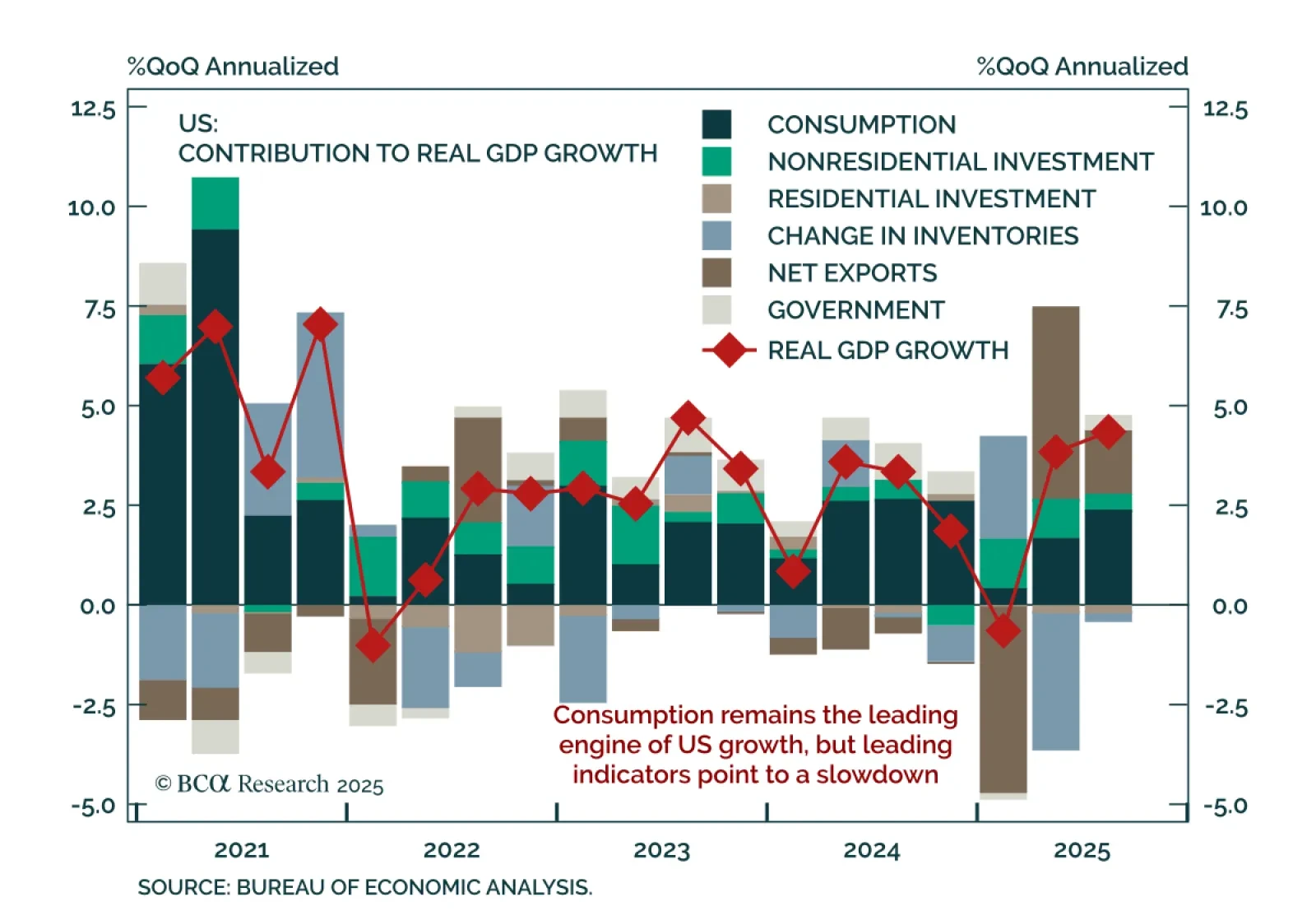

Remain neutral on equities; strong Q3 growth hinged on consumer resilience that leading indicators suggest will fade. US Q3 GDP beat estimates, accelerating to a 4.3% annualized pace from 3.8% in Q2, the fastest in two years.…

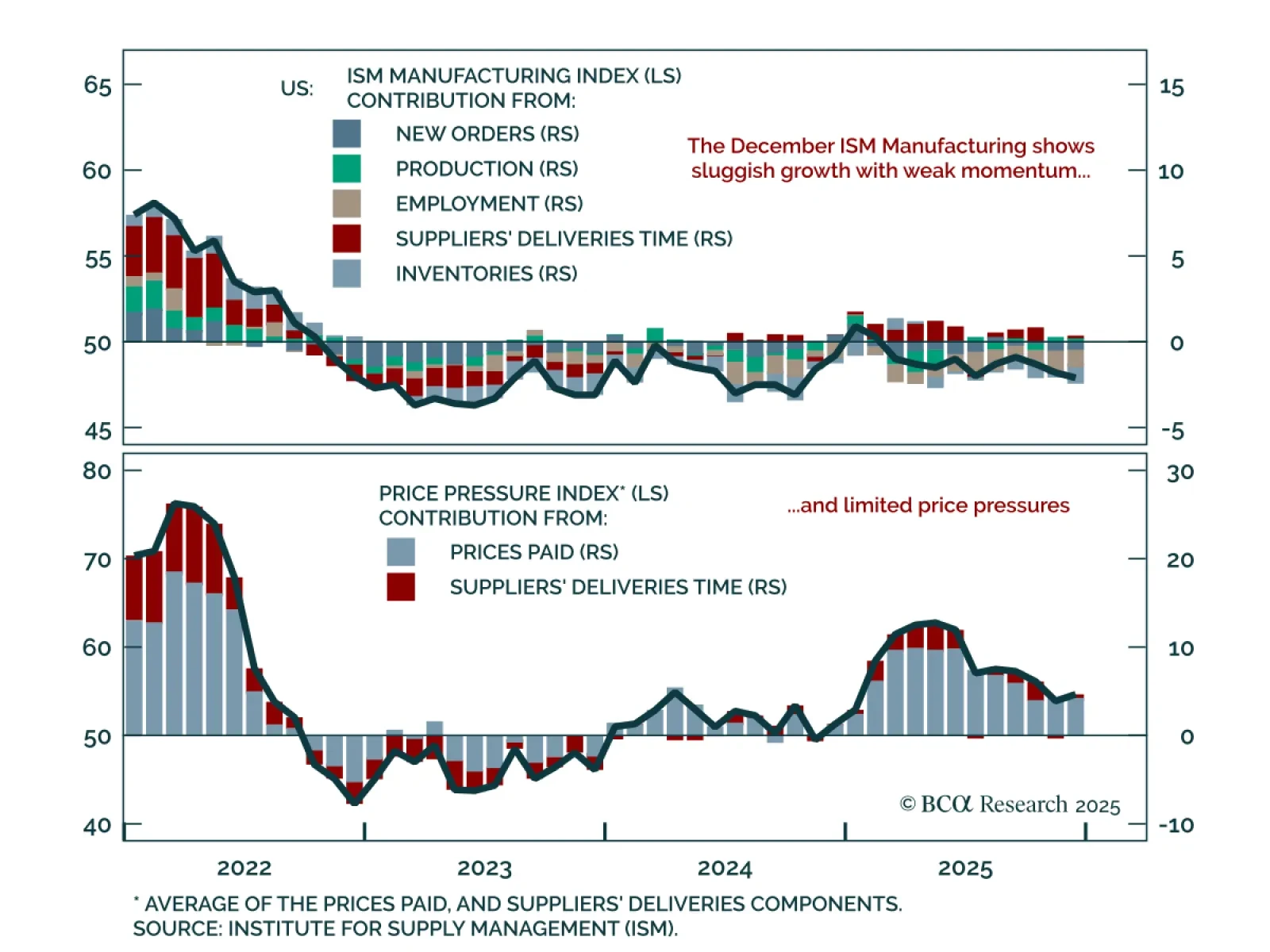

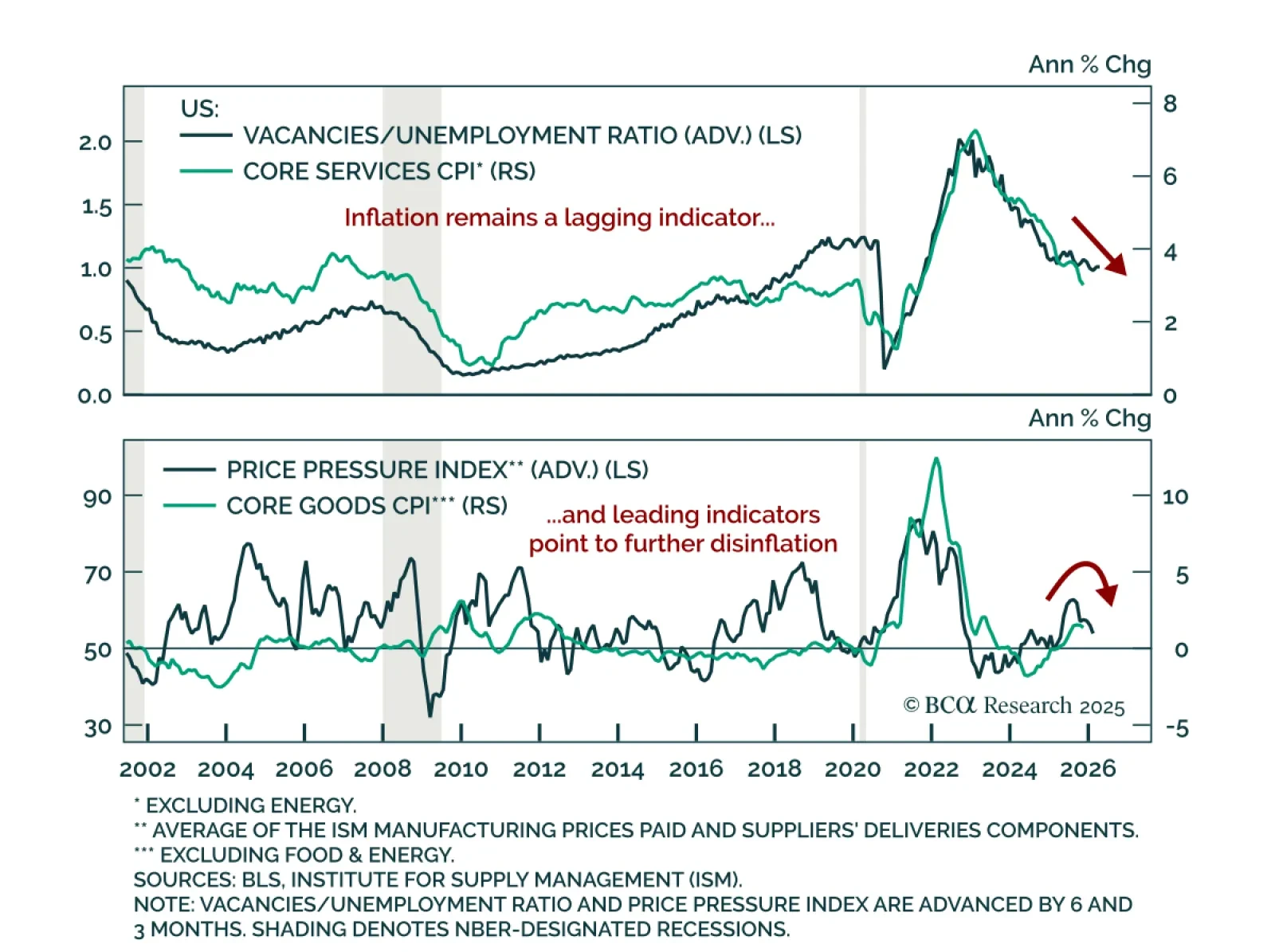

Stay overweight duration and favor curve steepeners as sluggish growth will allow the Fed to cut more than priced. The December ISM Manufacturing index missed estimates, falling to 47.9 from 48.2 and marking a tenth consecutive month…

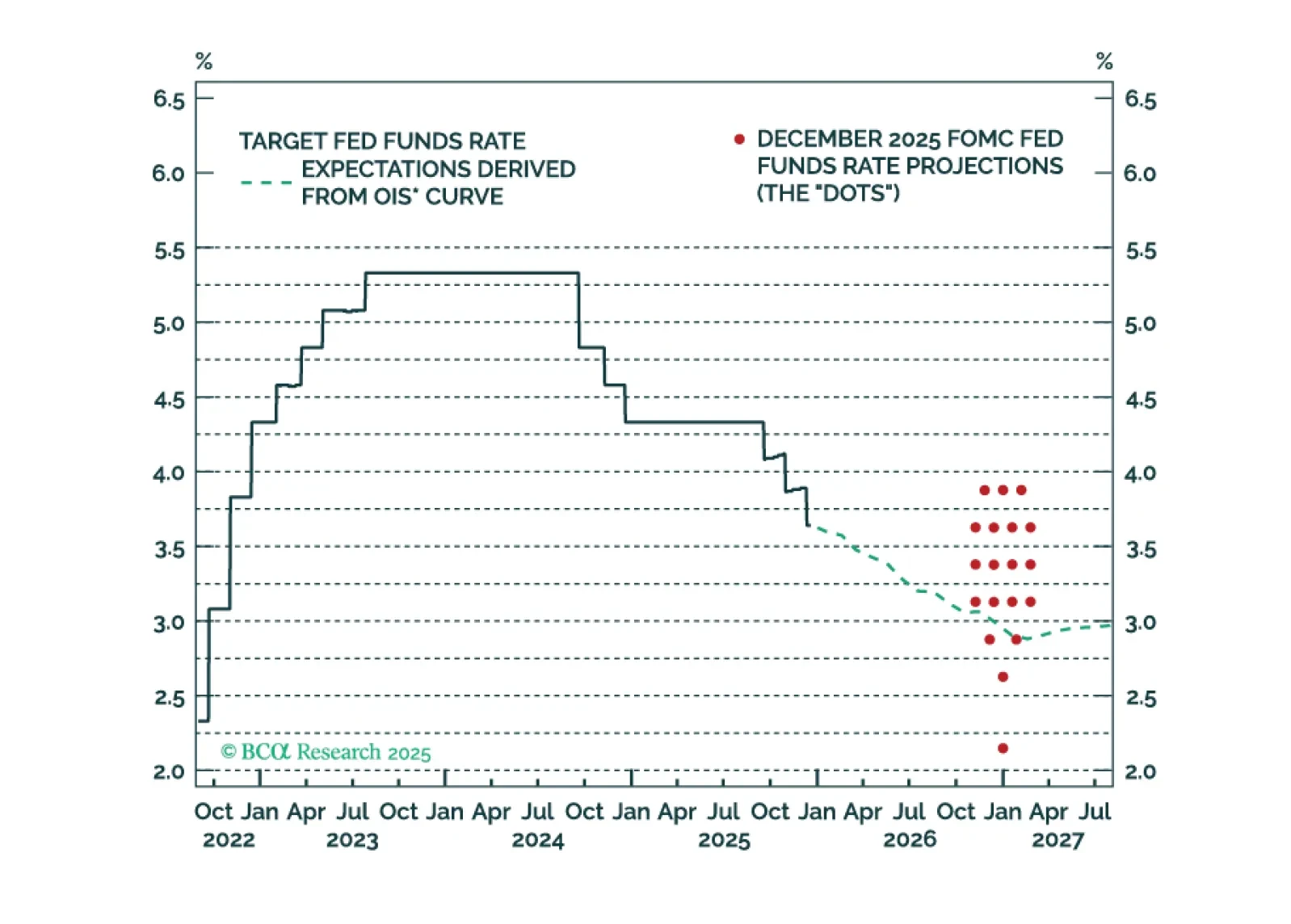

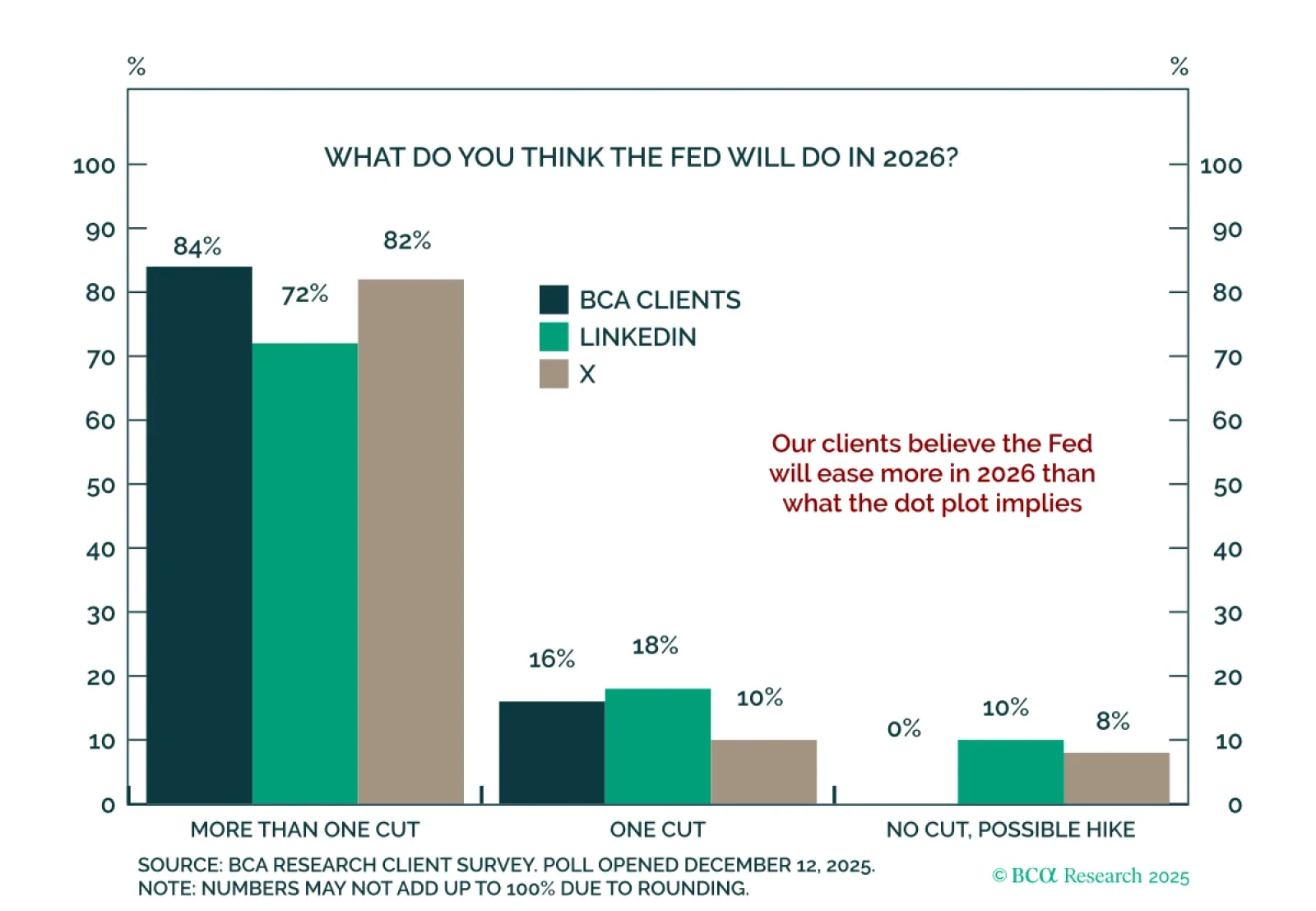

Investors expect more than one cut from the Fed in 2026. In this week’s poll, clients clearly answered that they expect the Fed to ease by more than the December dots suggest. Across the BCA website, LinkedIn and X, more than 70% of…

Markets rarely follow the playbook, and neither do the people best trained to handle chaos. Our Chart Of The Week comes from Juan Correa, Chief Global Asset Allocation Strategist. Each year, the GAA team curates a holiday…

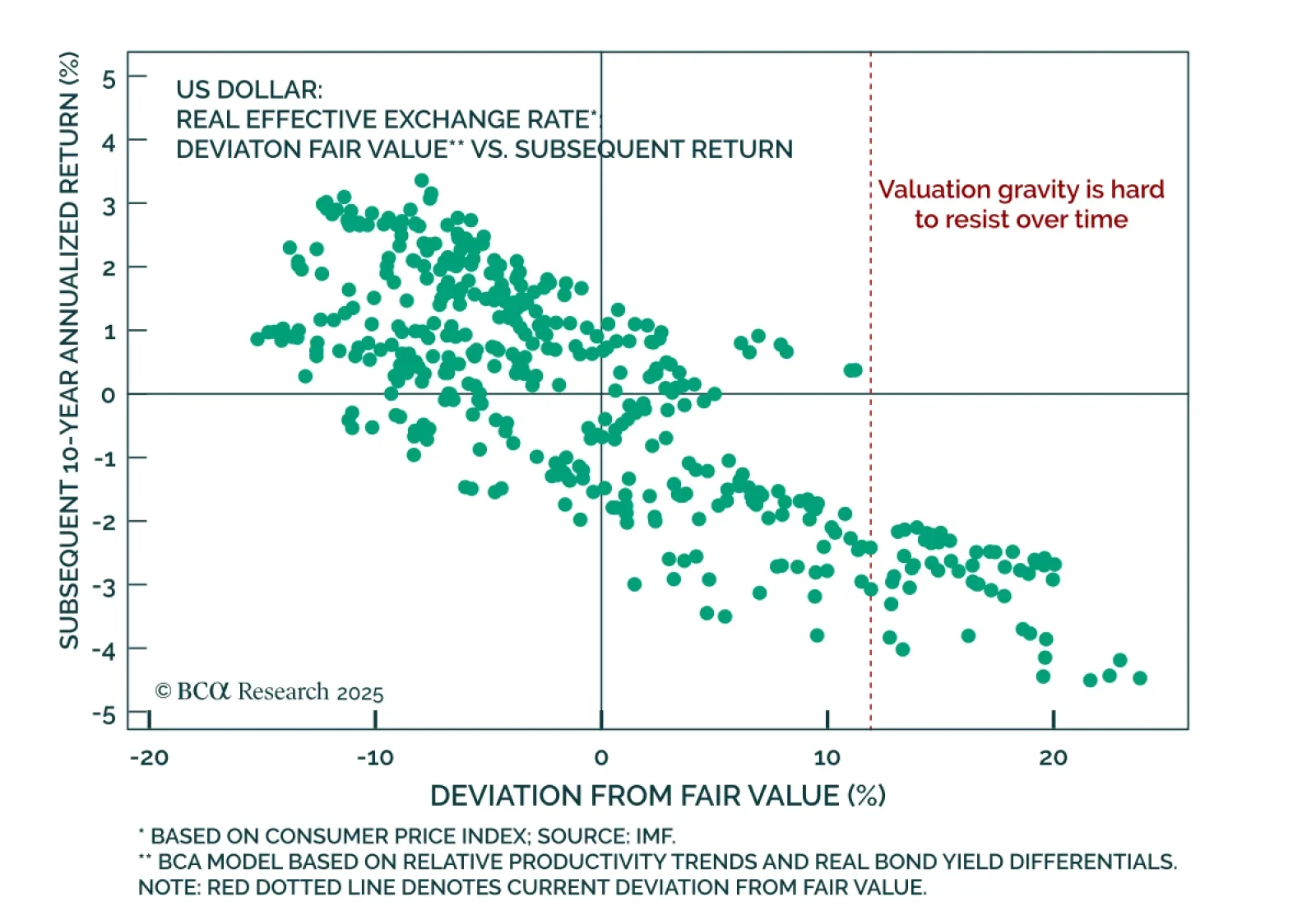

Our FX strategists view the dollar as increasingly vulnerable in 2026, with structural headwinds building and cyclical supports fading. A multi-year downtrend is becoming more likely unless the US can sustain economic and equity…

Maintain a long-duration stance and favor curve steepeners as disinflation remains well on track. US November CPI showed cooling inflation, but the report was heavily impacted by the government shutdown, with October data…

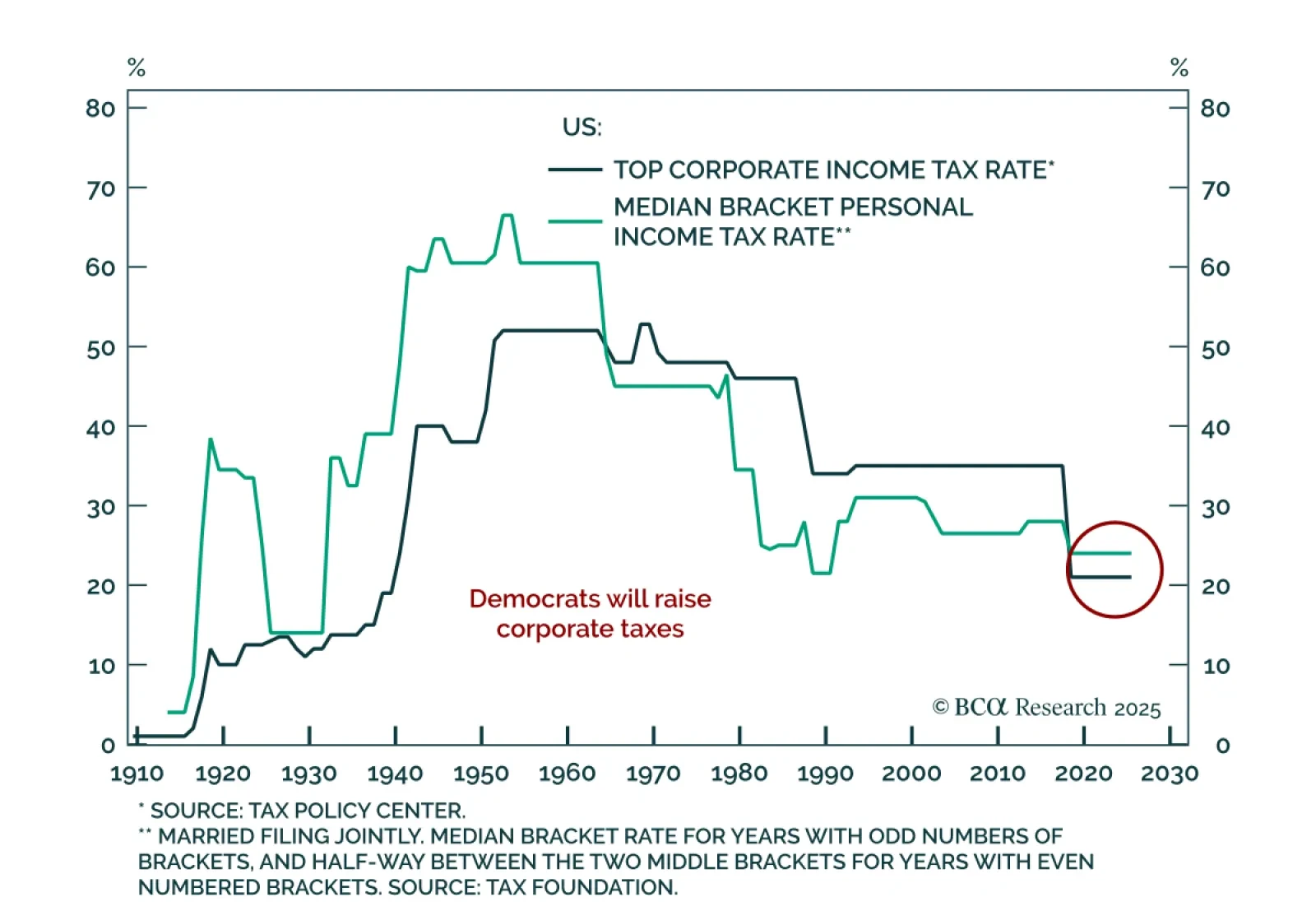

Our US and Geopolitical strategists see rising demand for a third party in the US, but expect the two-party system to hold through the 2028 election. The macro backdrop will shape whether a left-wing populist emerges as the…