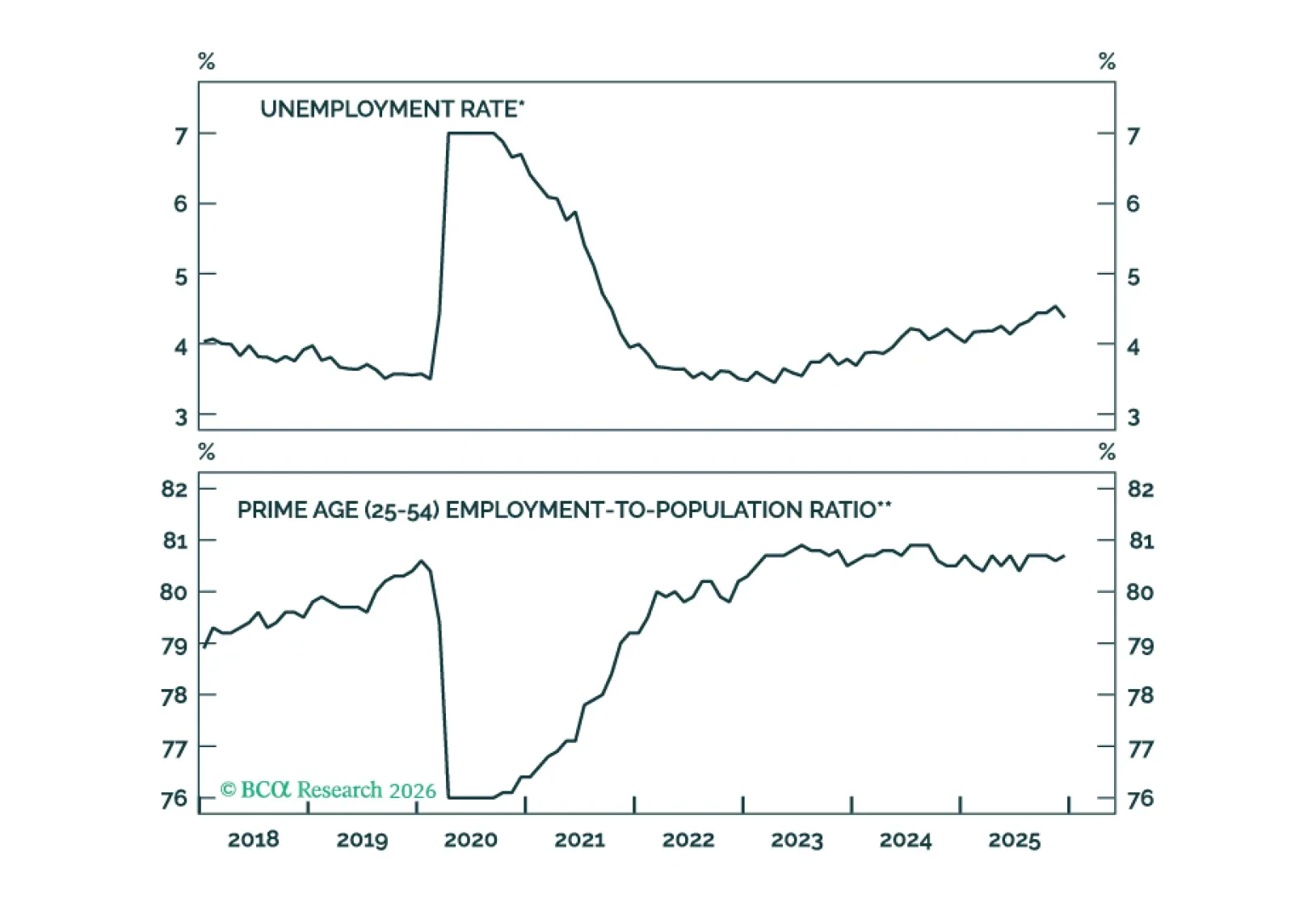

Measures of labor market utilization improved in December, ruling out a January cut and significantly reducing the odds of a March cut.

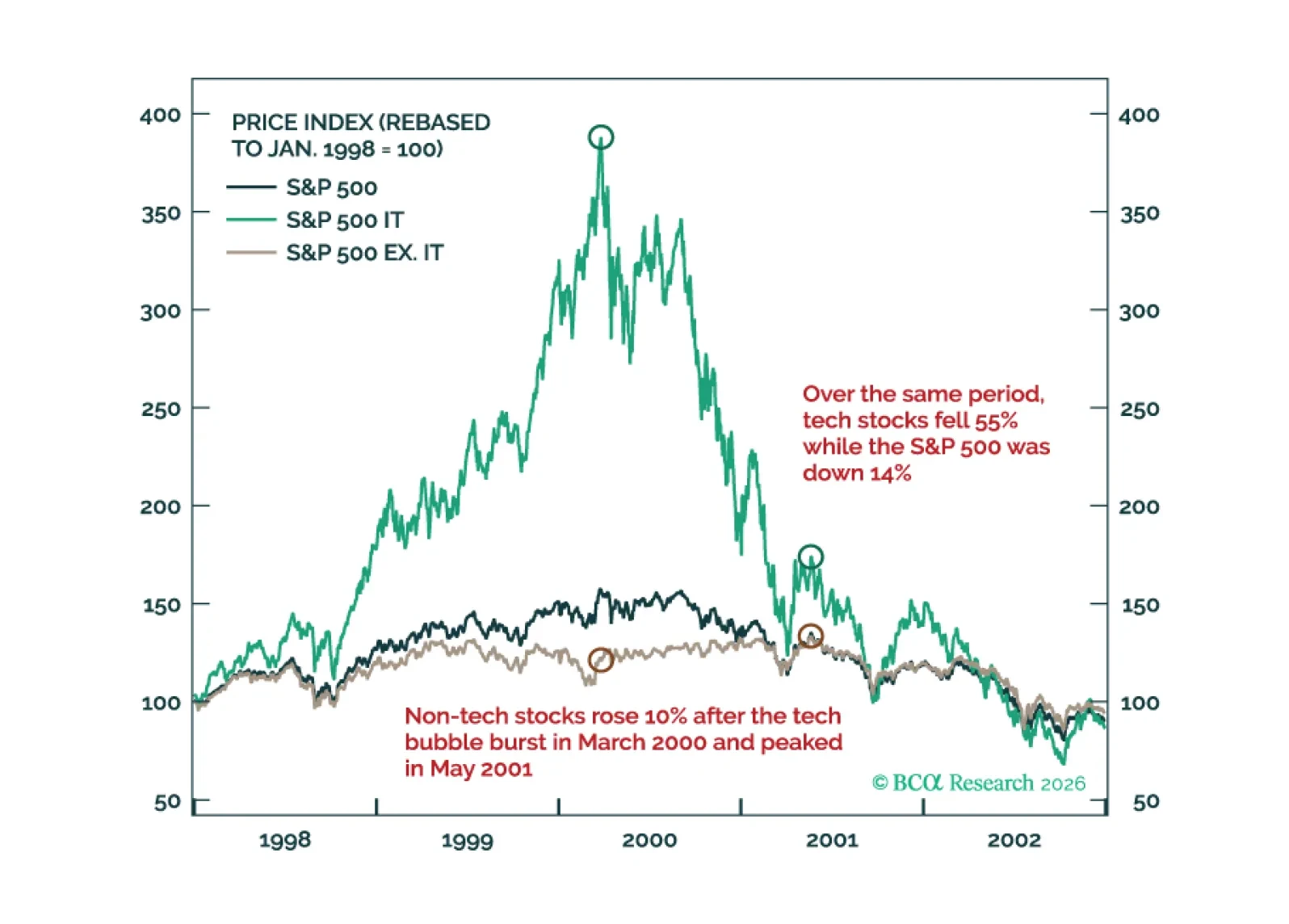

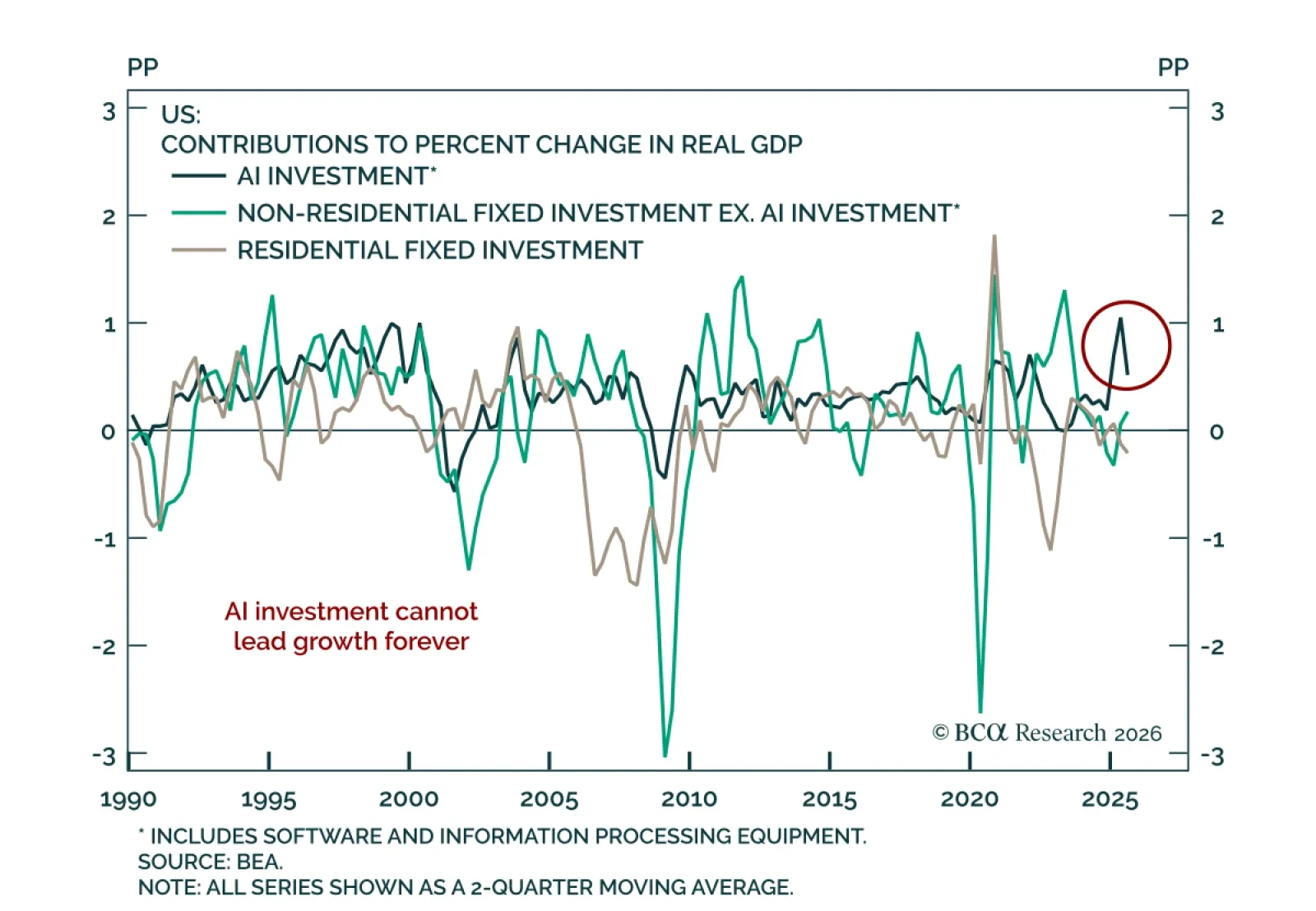

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

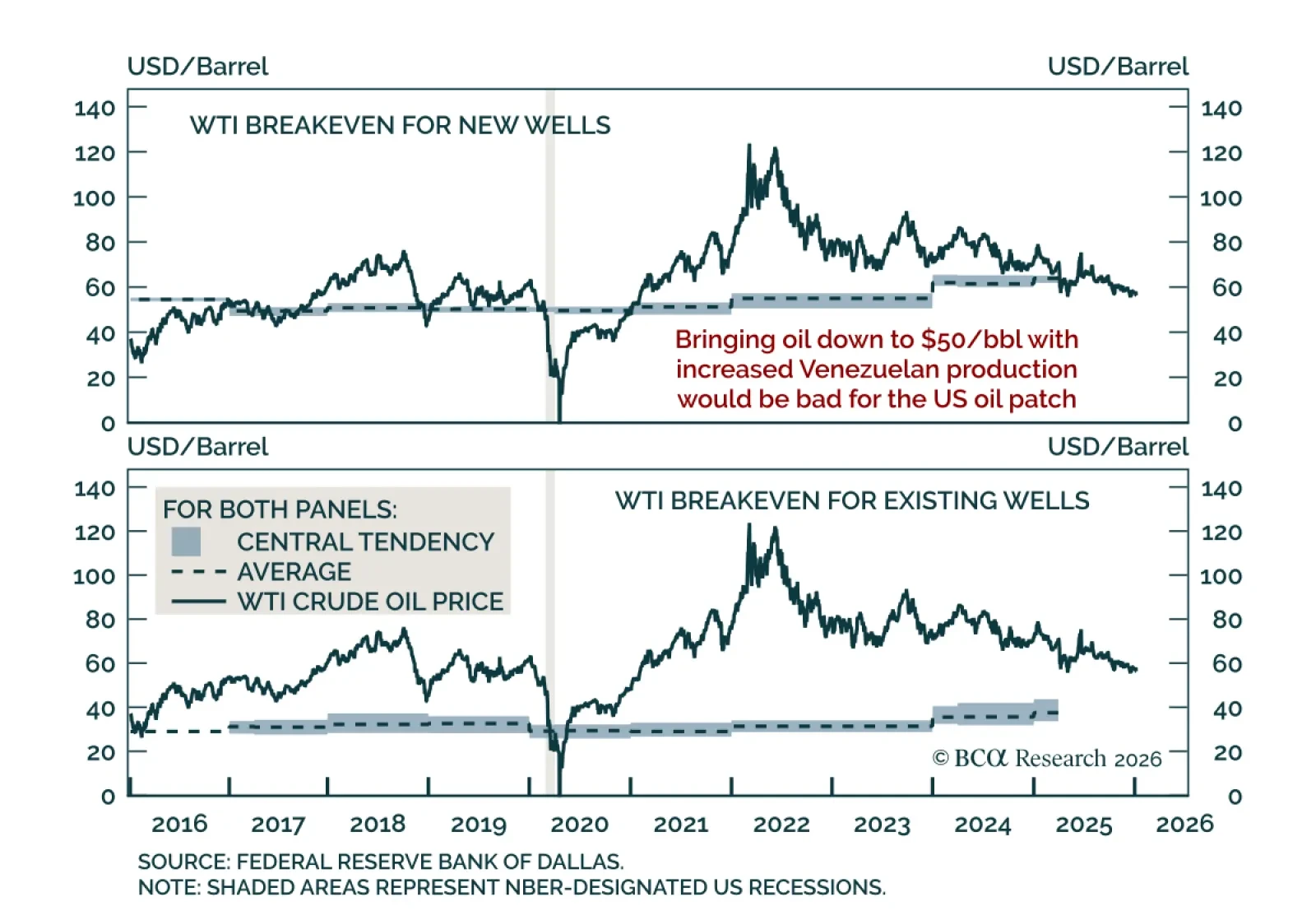

Expect oil to keep trending lower on macro fundamentals, not on increased Venezuelan production. In the aftermath of US intervention in Venezuela and at the start of a midterm year, President Trump said he wants oil prices down to $…

Our Portfolio Allocation Summary for January 2026.

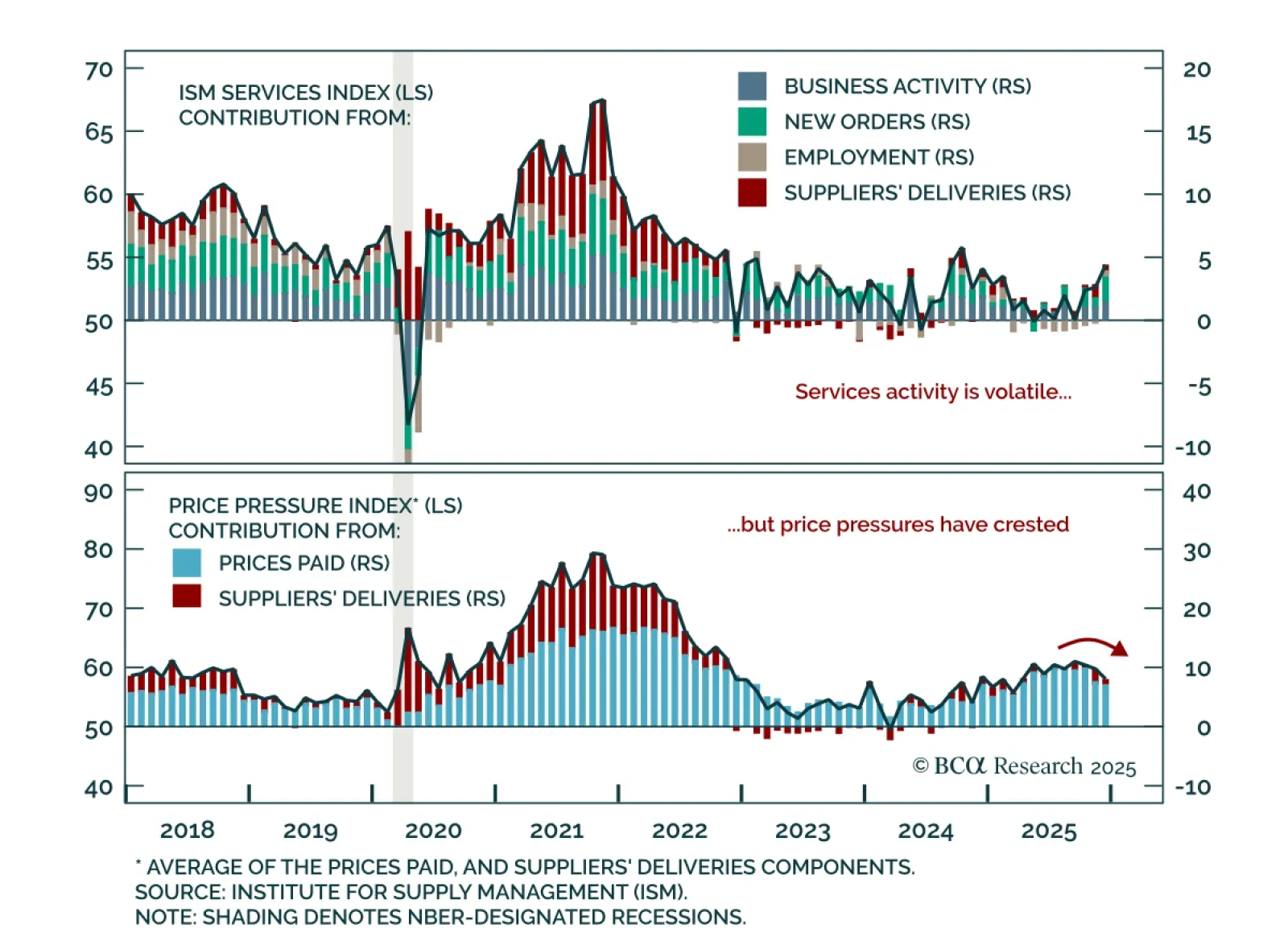

Maintain a neutral stance on equities as the ISM Services beat does not alter the broader risk backdrop. The December ISM Services PMI beat estimates, rising to 54.4 from 52.6 when a decline had been expected. New orders and…

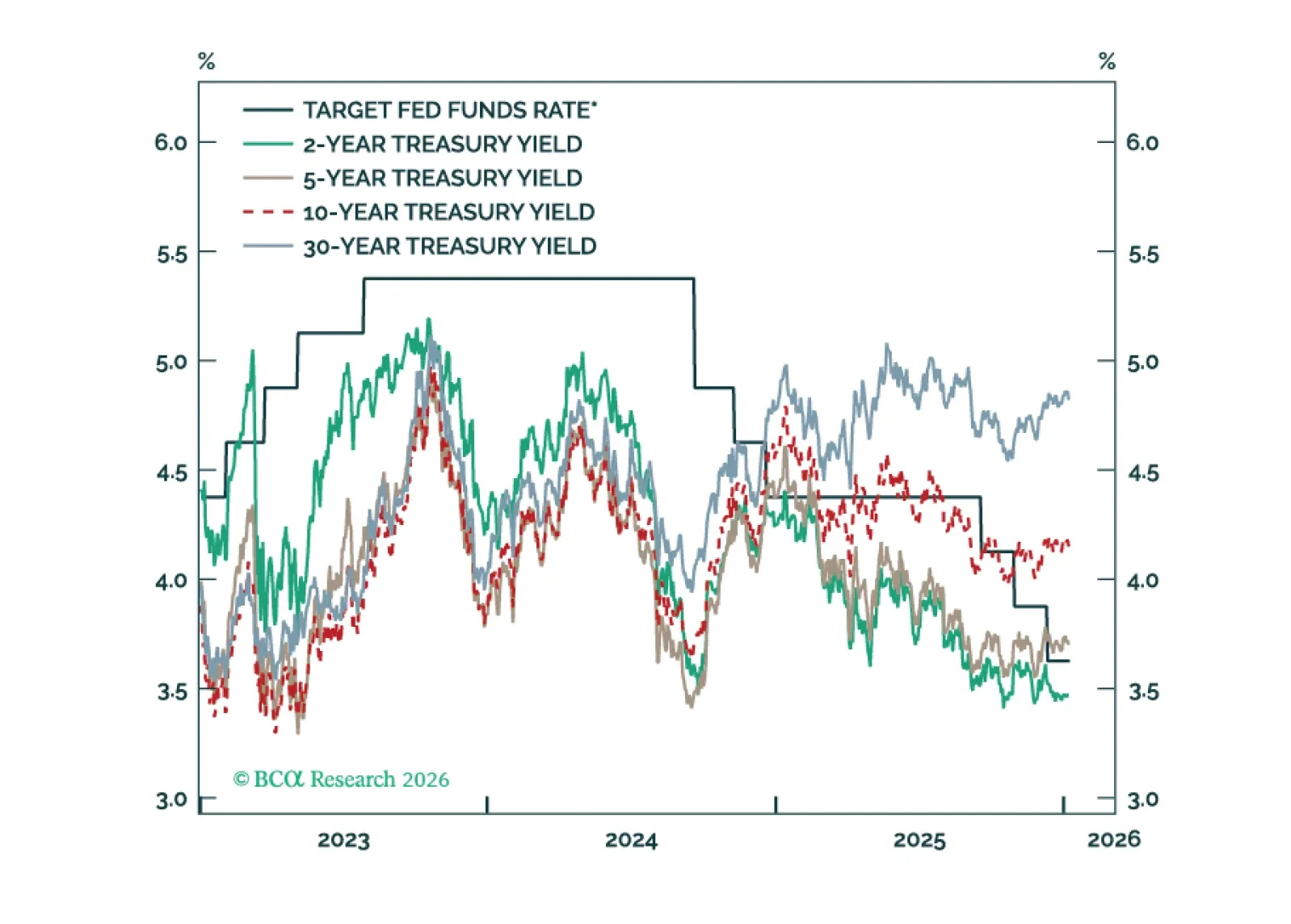

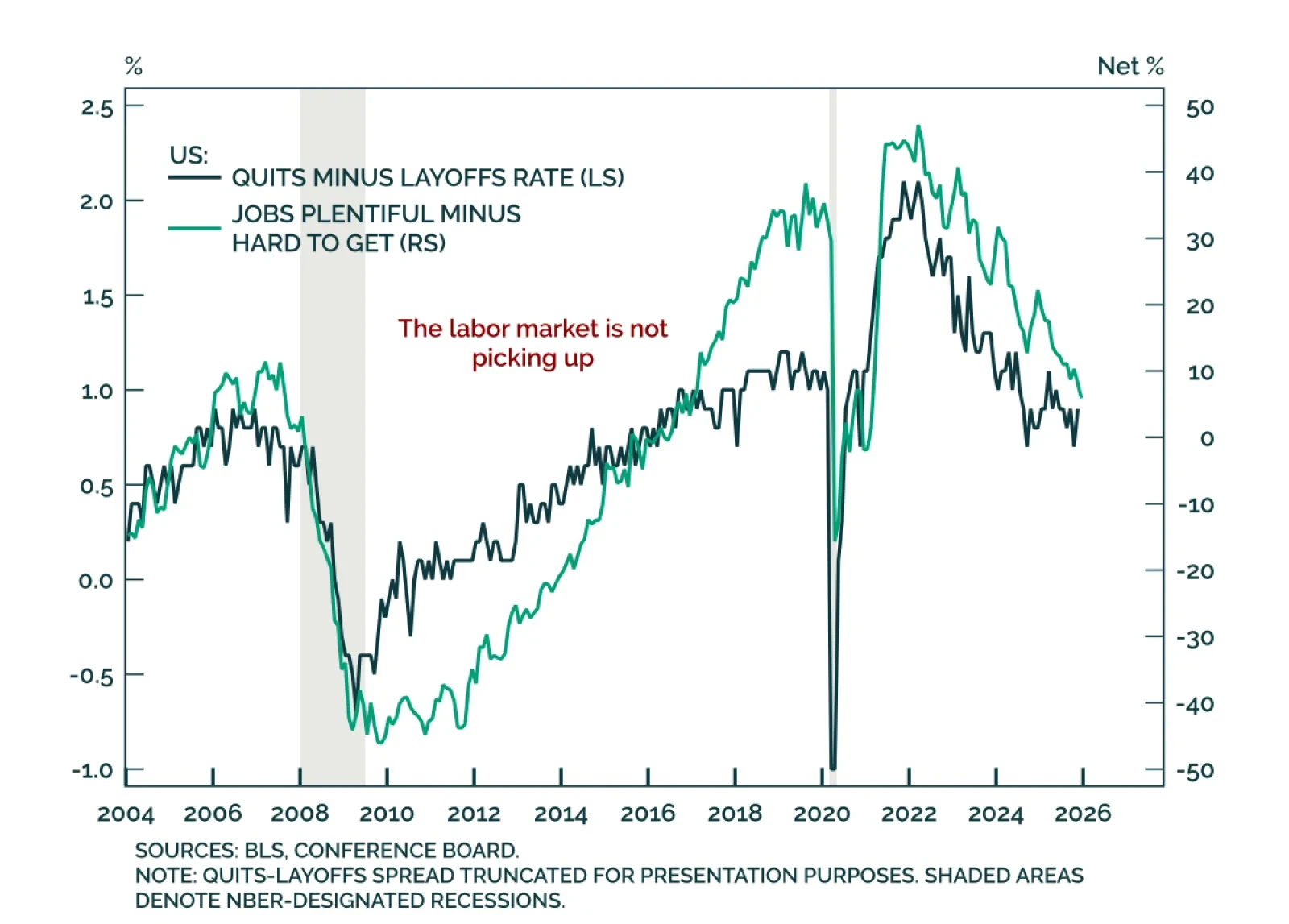

Maintain long duration and favor tactical curve steepeners as the JOLTS data show no evidence of a labor-market re-acceleration. The November US JOLTS report sent mixed signals. Job openings fell more than expected to 7.15 m from 7.…

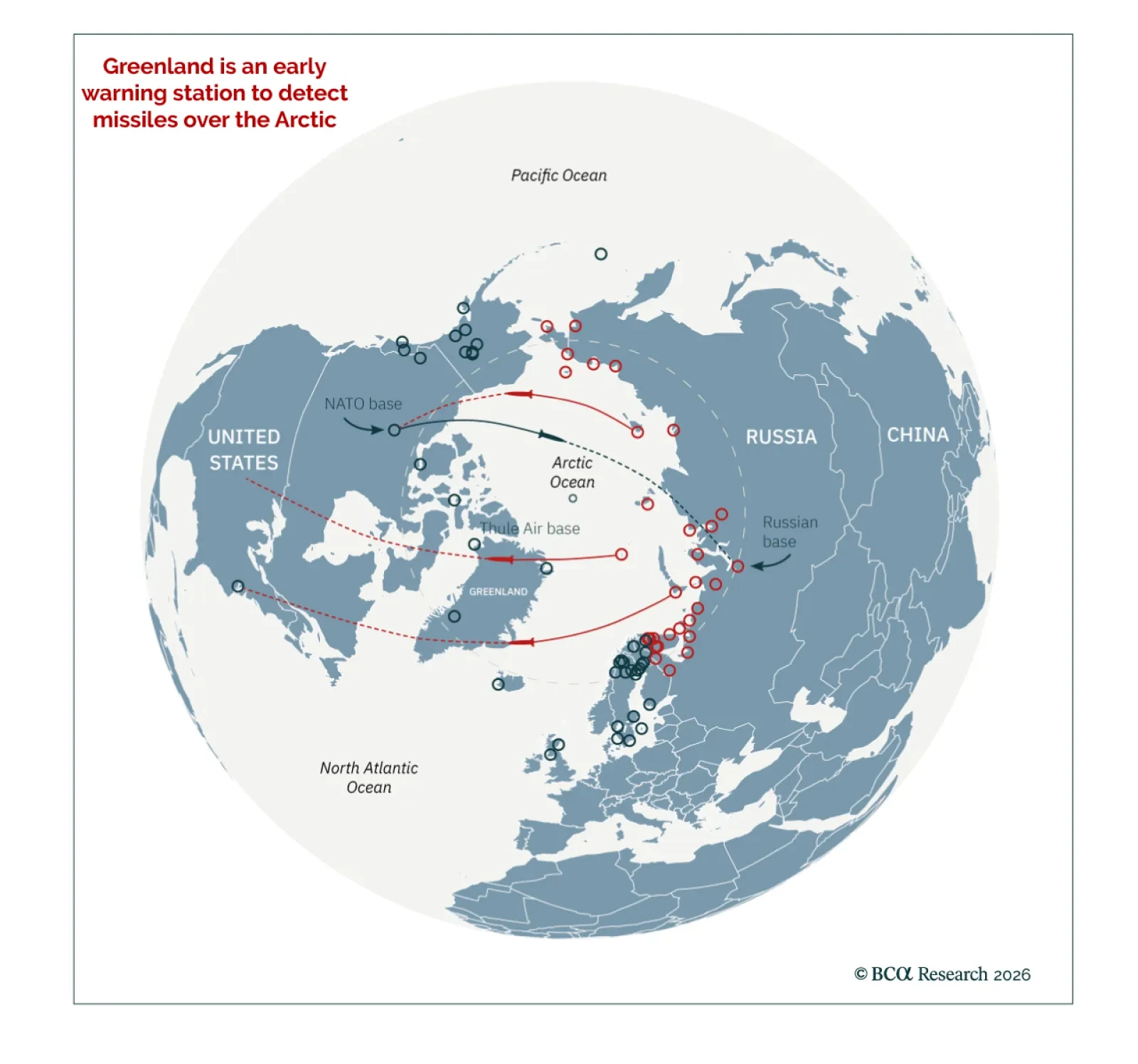

Stay constructive on European defense stocks and increase strategic exposure to industrial metals as geopolitical priorities reassert themselves. Following the capture of Venezuelan President Maduro, top US officials seem to confirm…

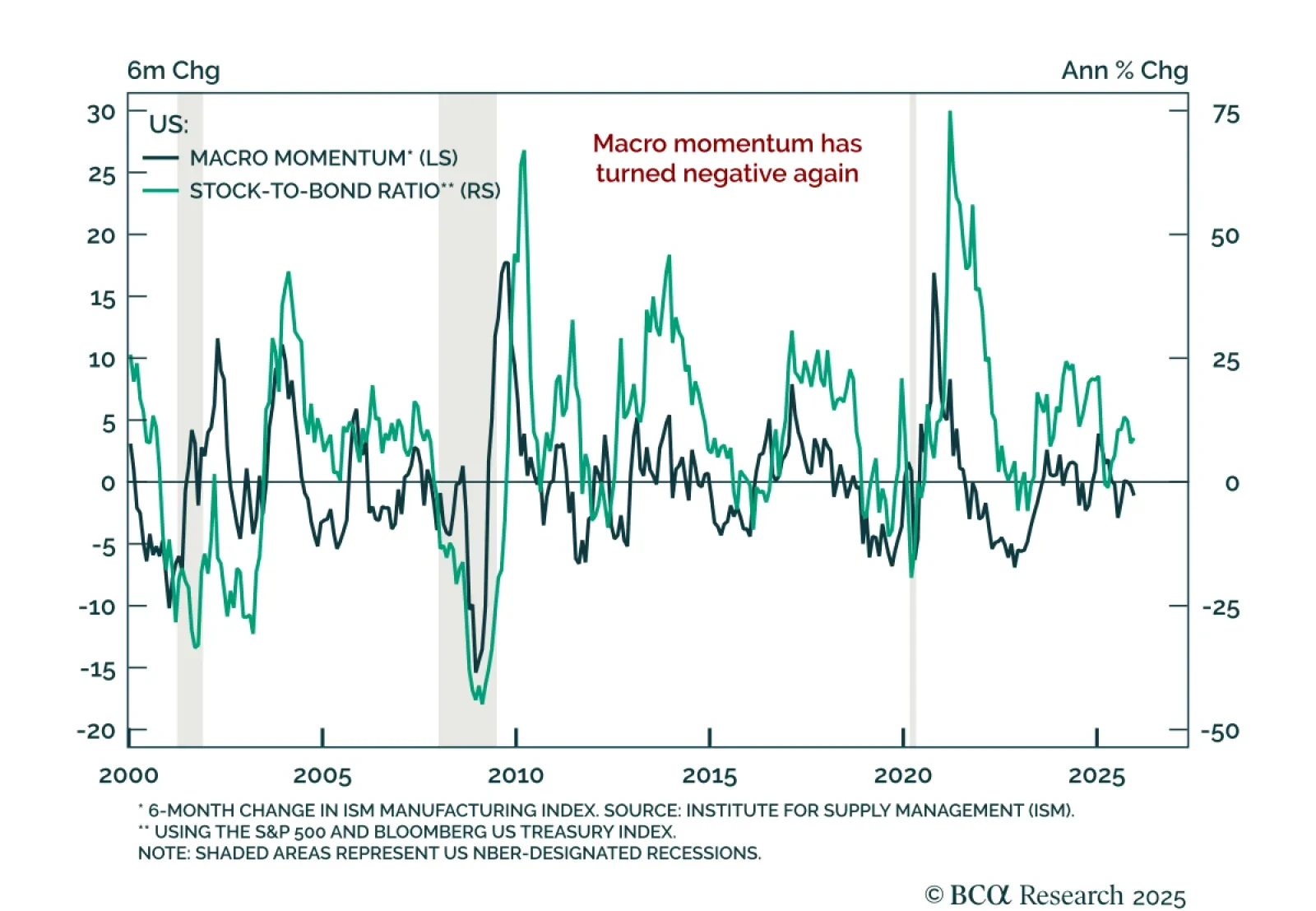

Remain tactically neutral on equities as deteriorating macro momentum does not justify taking additional risk. A key factor behind our tactical calls is macro momentum. Simply put, growth acceleration and deceleration (rather than…

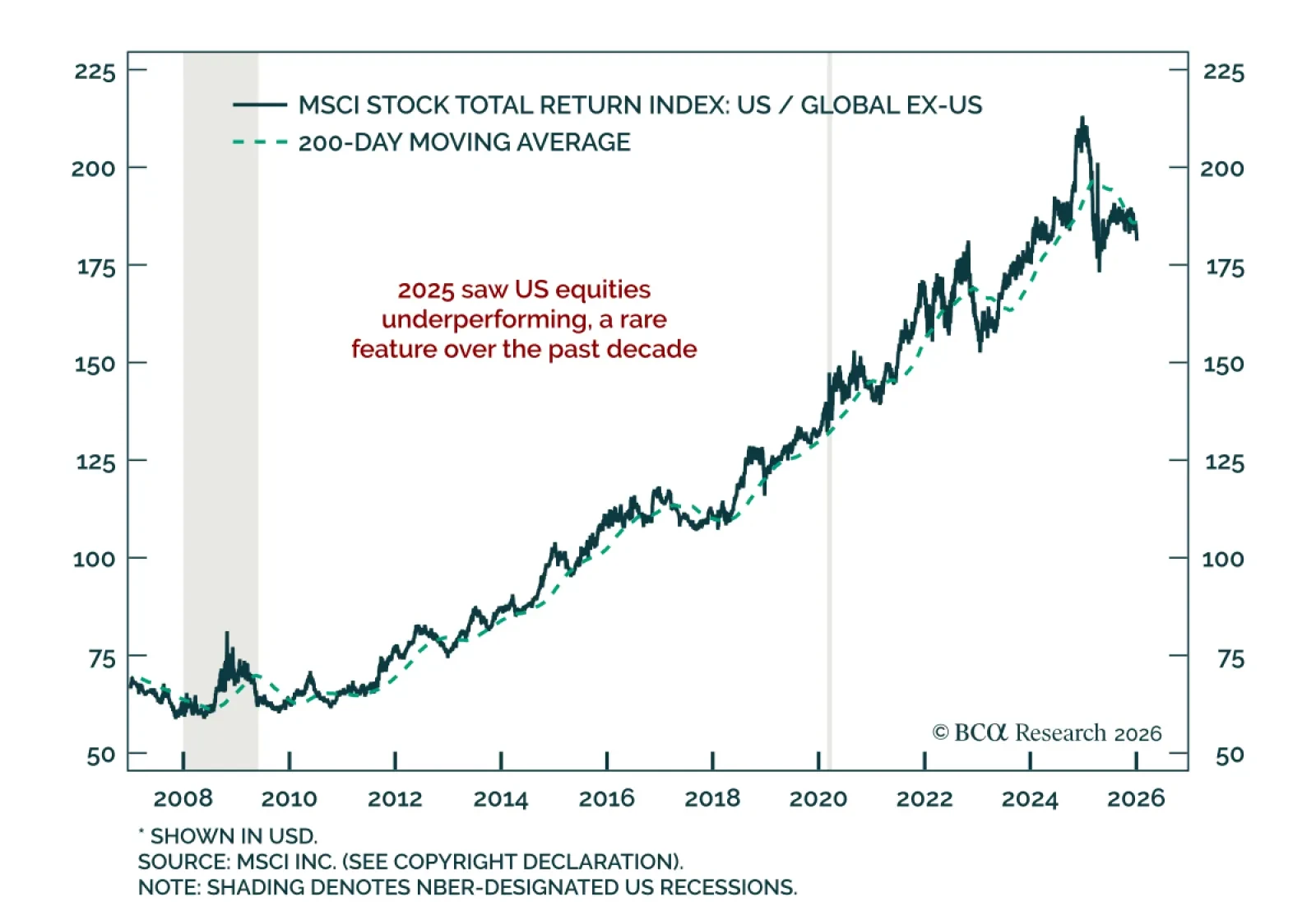

Favor Value over Quality and non-US equities as leadership broadens and late-cycle rotations gather pace. Global equities rose 21% in 2025, but leadership shifted meaningfully. The US finished in the bottom third of regional returns…

Our GeoMacro strategists turned tactically bearish on equities as the US 10-year Treasury yield remains stuck above 4%, reaffirming their mid-2025 view that elevated borrowing costs would pressure the economy. While they are open to…