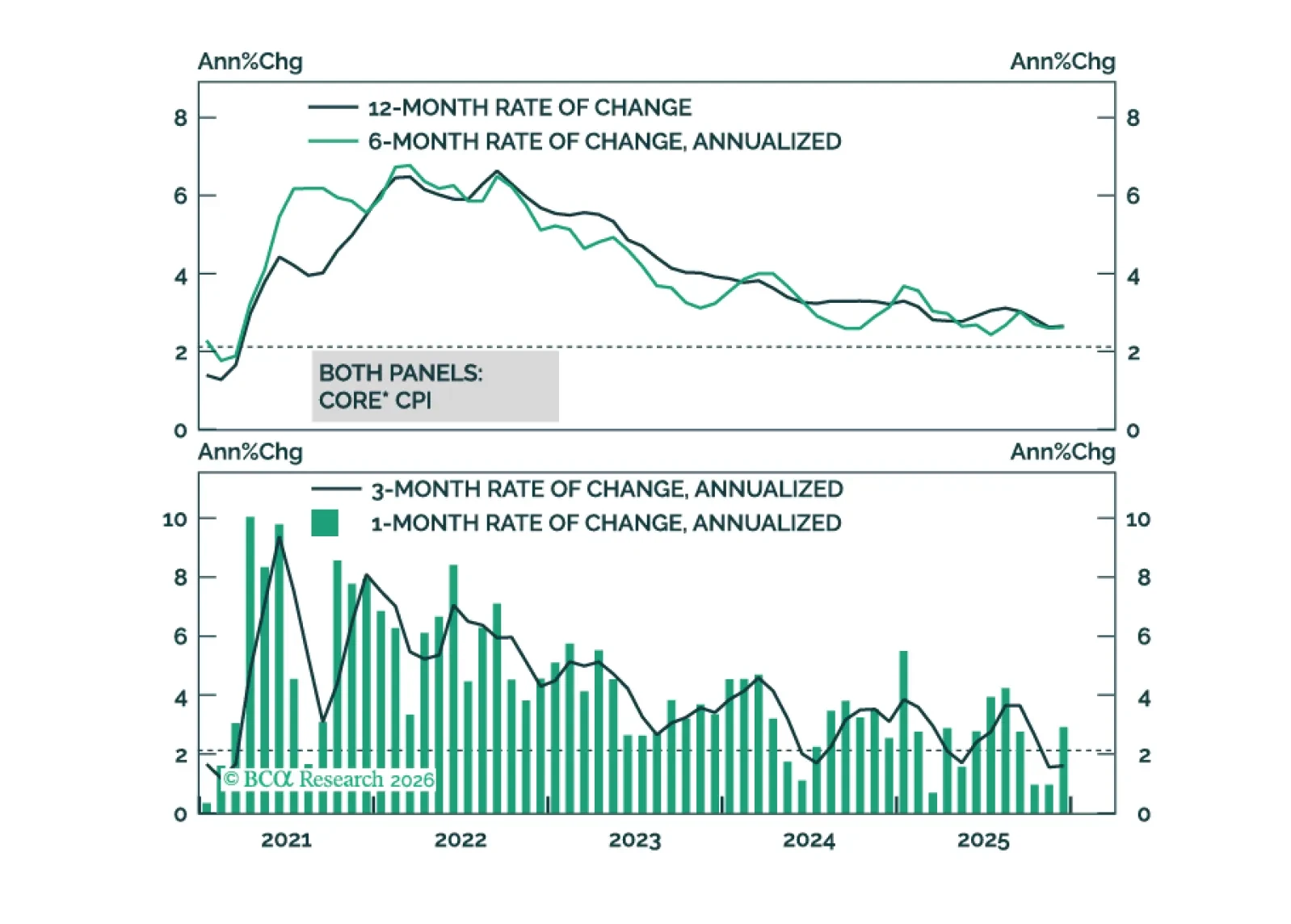

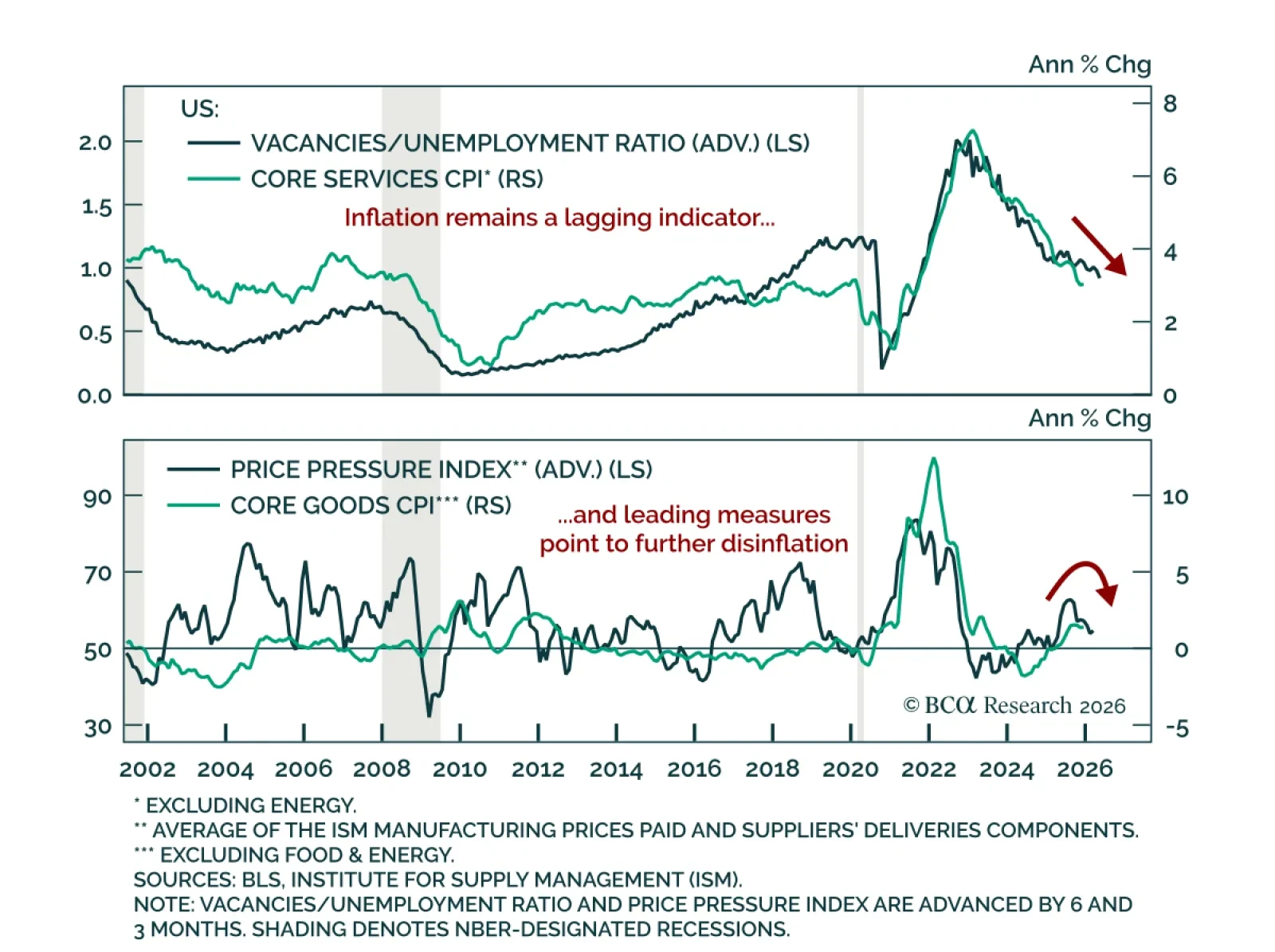

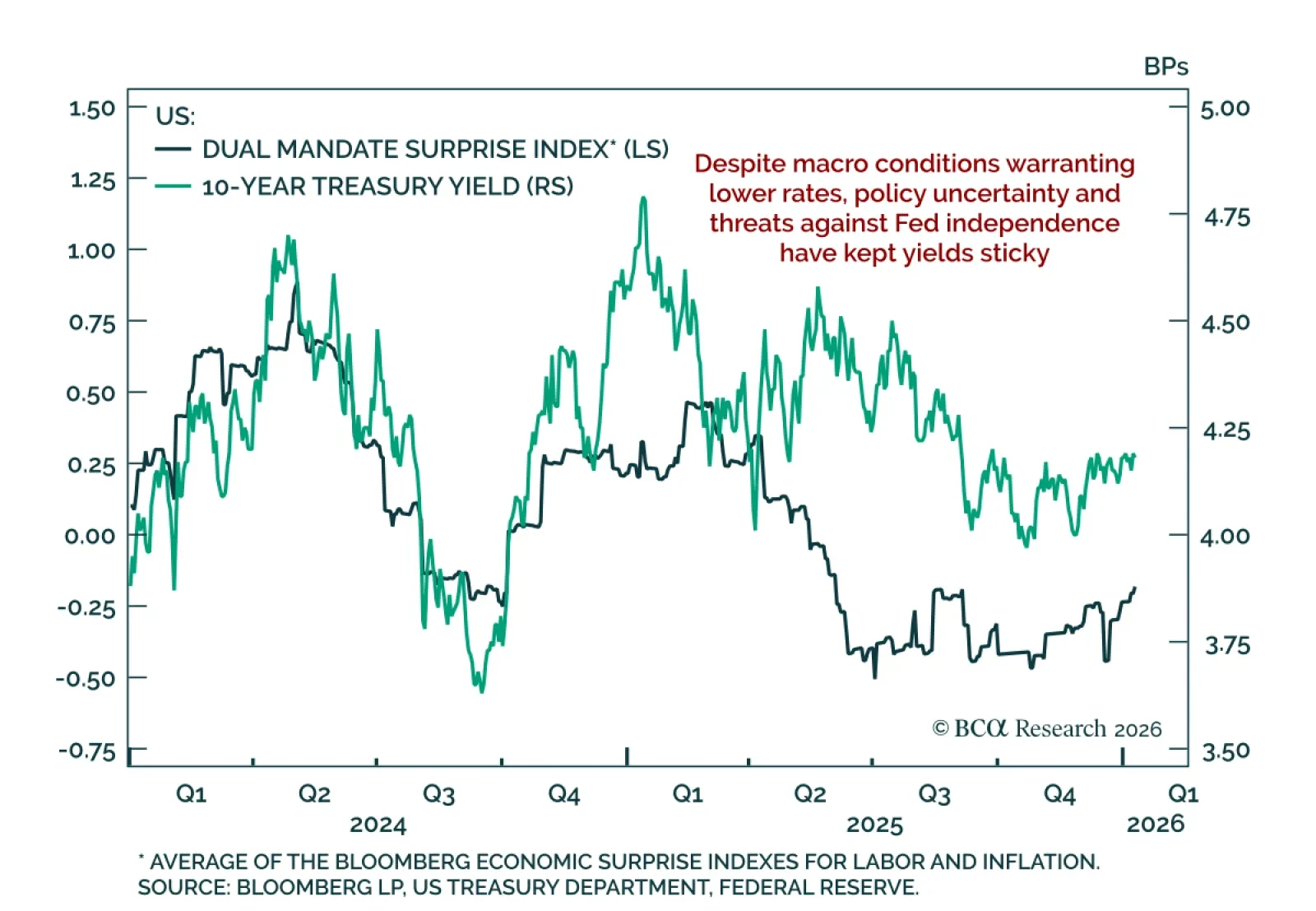

Maintain above-benchmark duration and 2-year/5-year Treasury steepeners as disinflation continues to support Fed cuts. US December CPI came in slightly cooler than expected, with headline inflation rising 0.3% m/m (2.7% y/y) and core…

This morning’s CPI report signals that the worst of the tariff impact on inflation may already be in the rearview mirror.

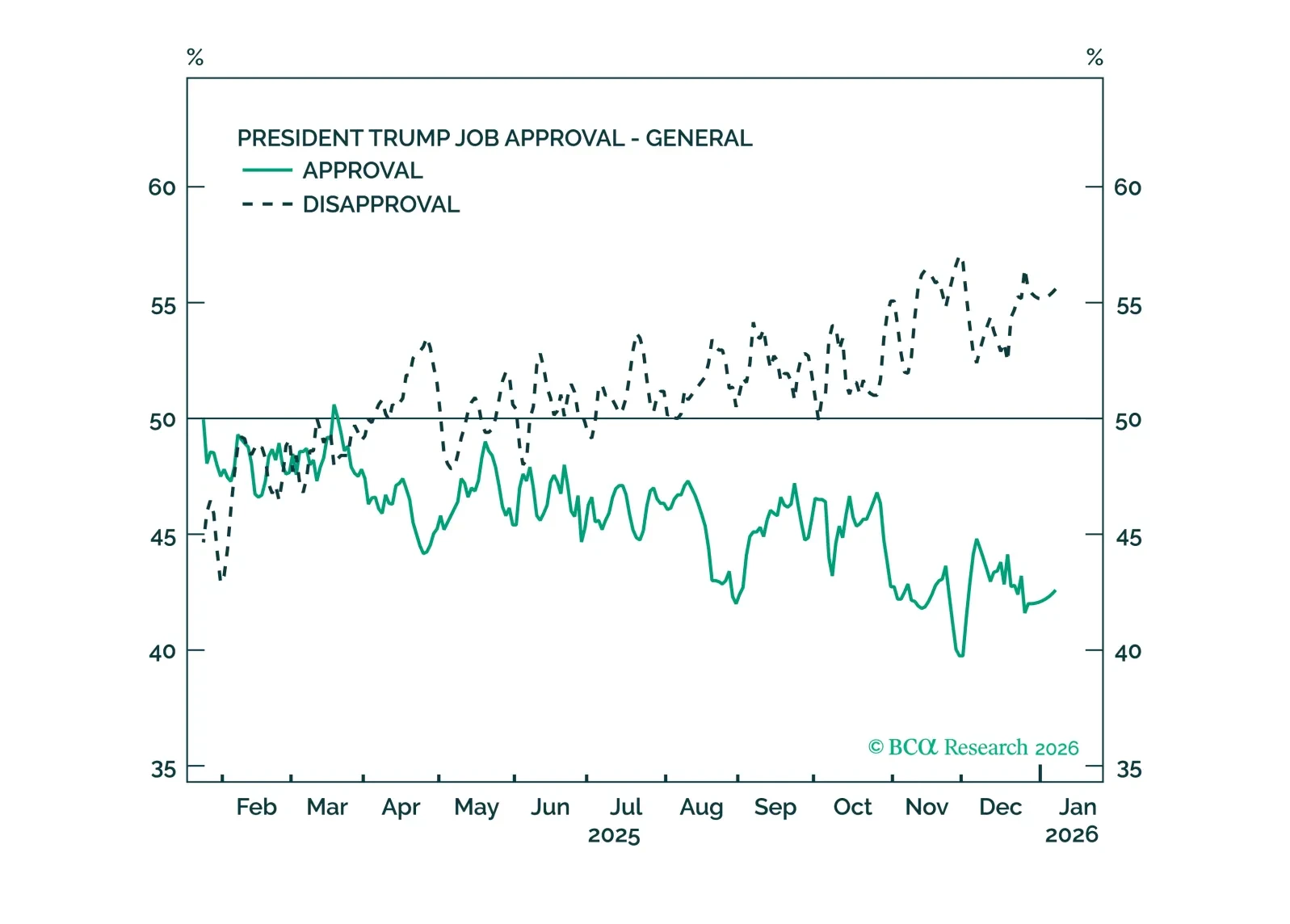

Congress will ultimately limit Trump from acting on his worst impulses, but his efforts to bypass those limits will cause market volatility.

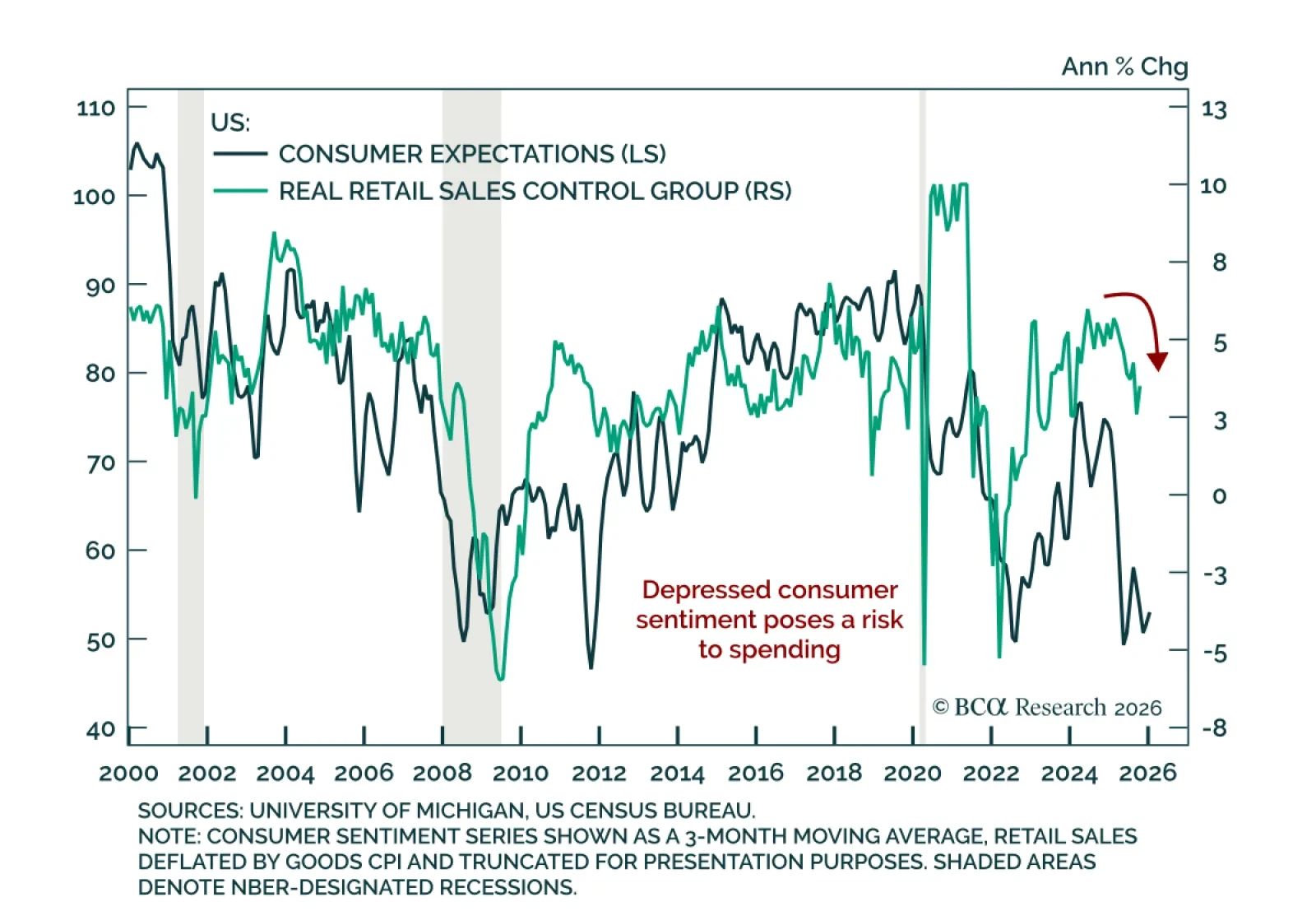

Maintain a conservative tactical stance as subdued sentiment and slowing labor dynamics pose risks to consumption. The preliminary January University of Michigan Consumer Sentiment Index slightly beat expectations, rising to 54.0…

Expect limited near-term market impact but longer-run USD headwinds as challenges to Fed independence play out. The Federal Reserve was served grand jury subpoenas by the Department of Justice threatening a criminal indictment. Fed…

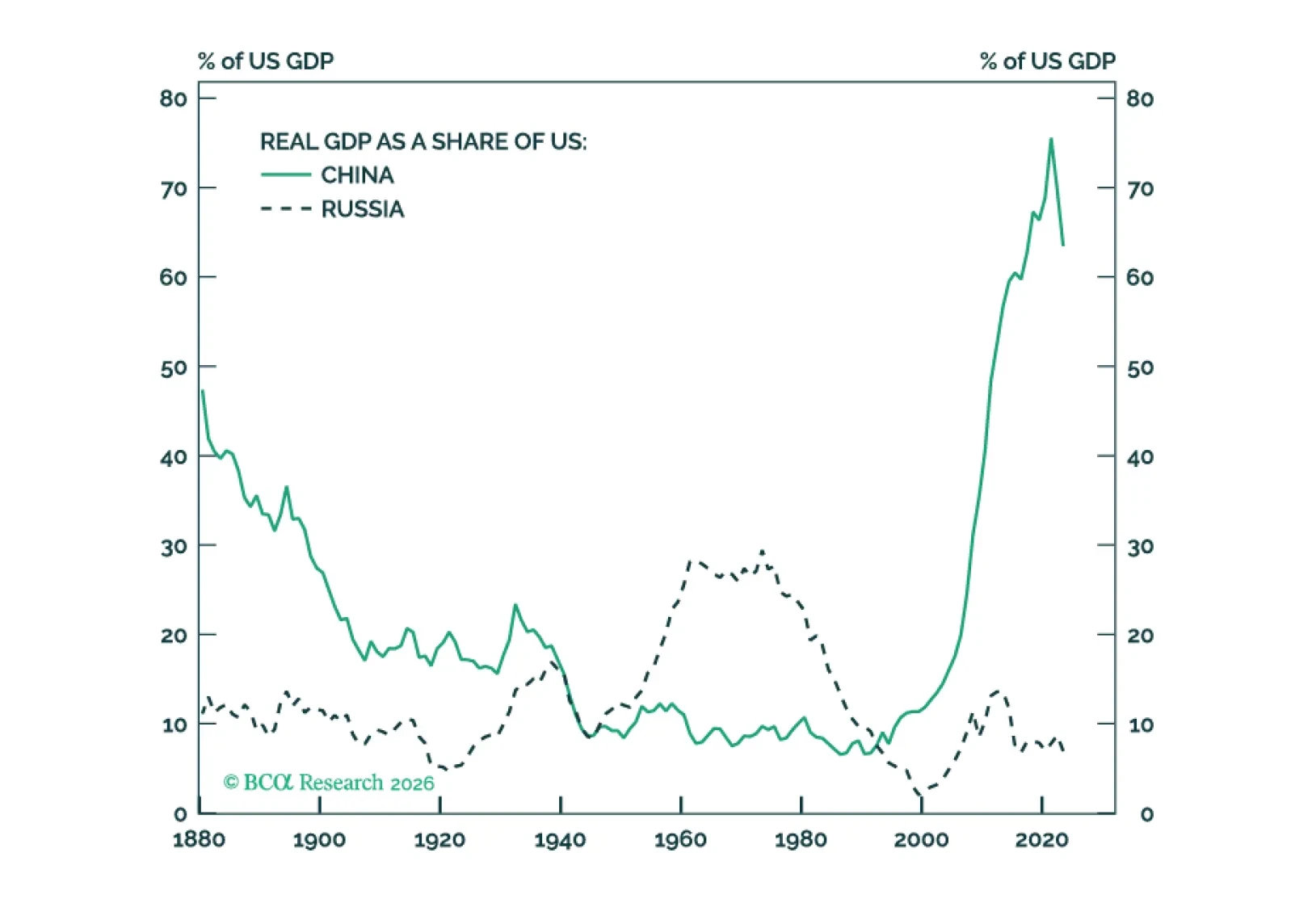

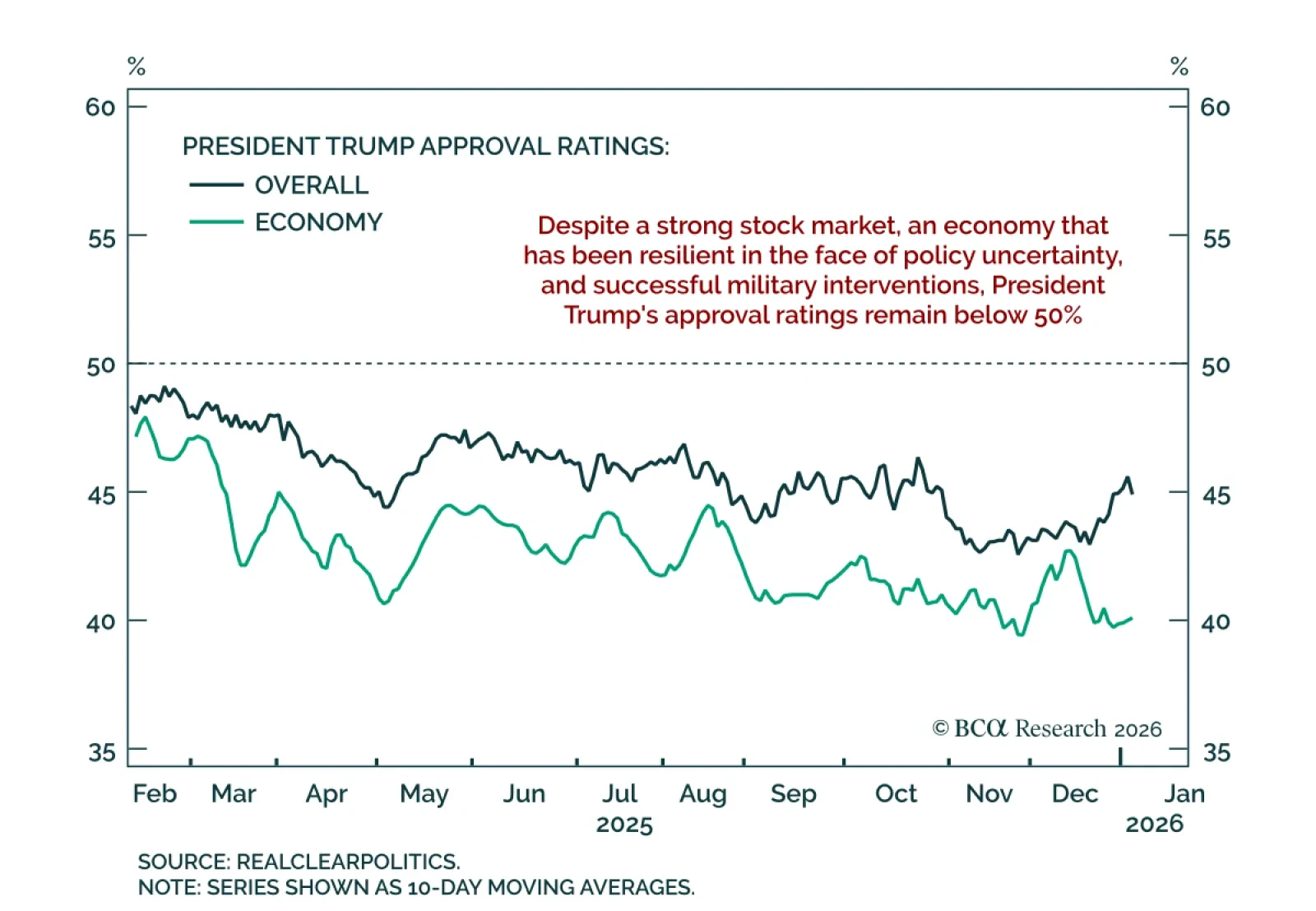

Maintain a moderately defensive stance as a bold but constrained Trump keeps policy risk elevated. President Trump’s second mandate has been quite different from his first. Trump remains a disruptive and unorthodox actor deliberately…

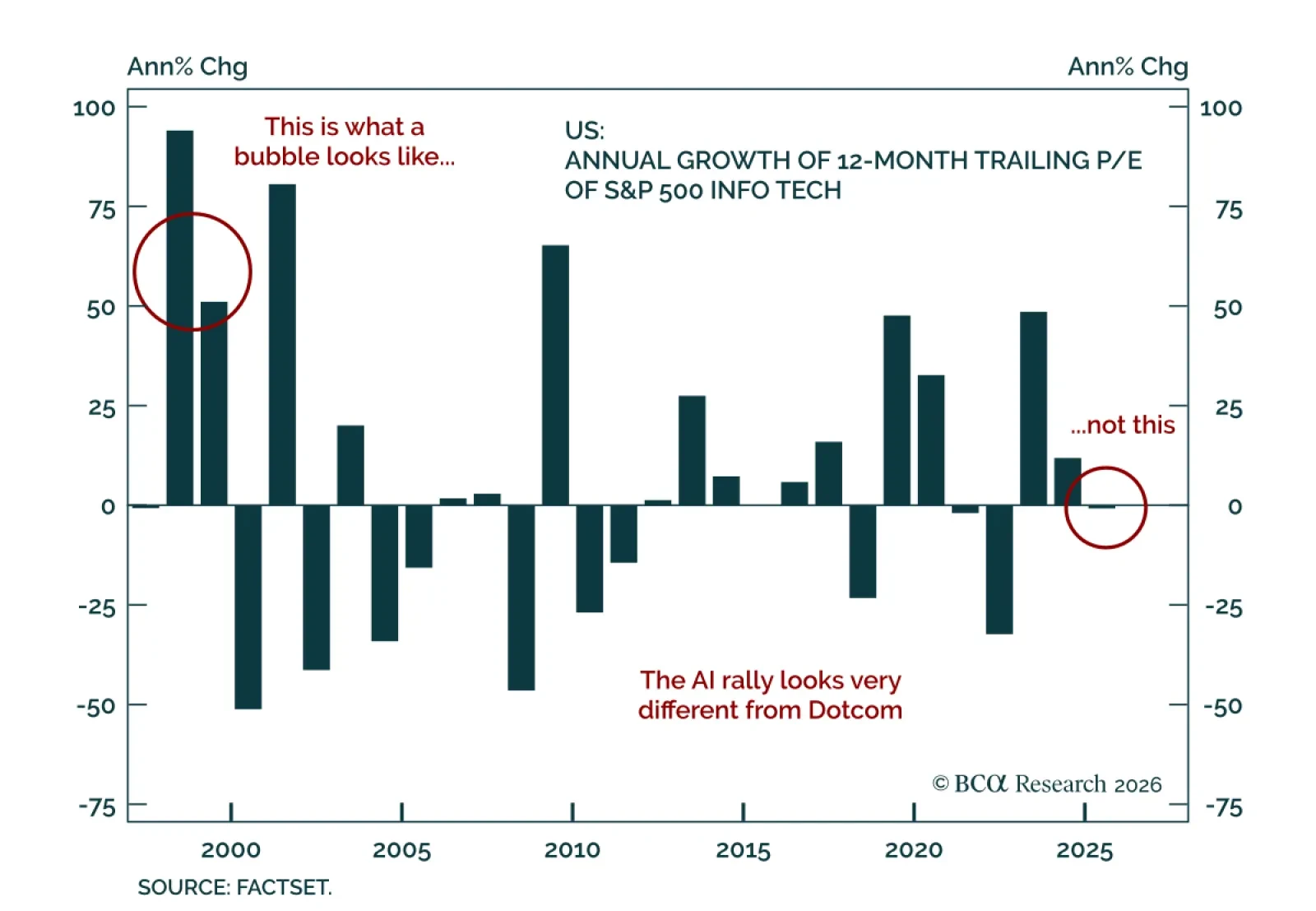

Our Global Asset Allocation strategists remain constructive on risk assets and continue to overweight cyclical sectors while recommending staying overweight tail risk protection as markets brace for tariff-related uncertainty. A…

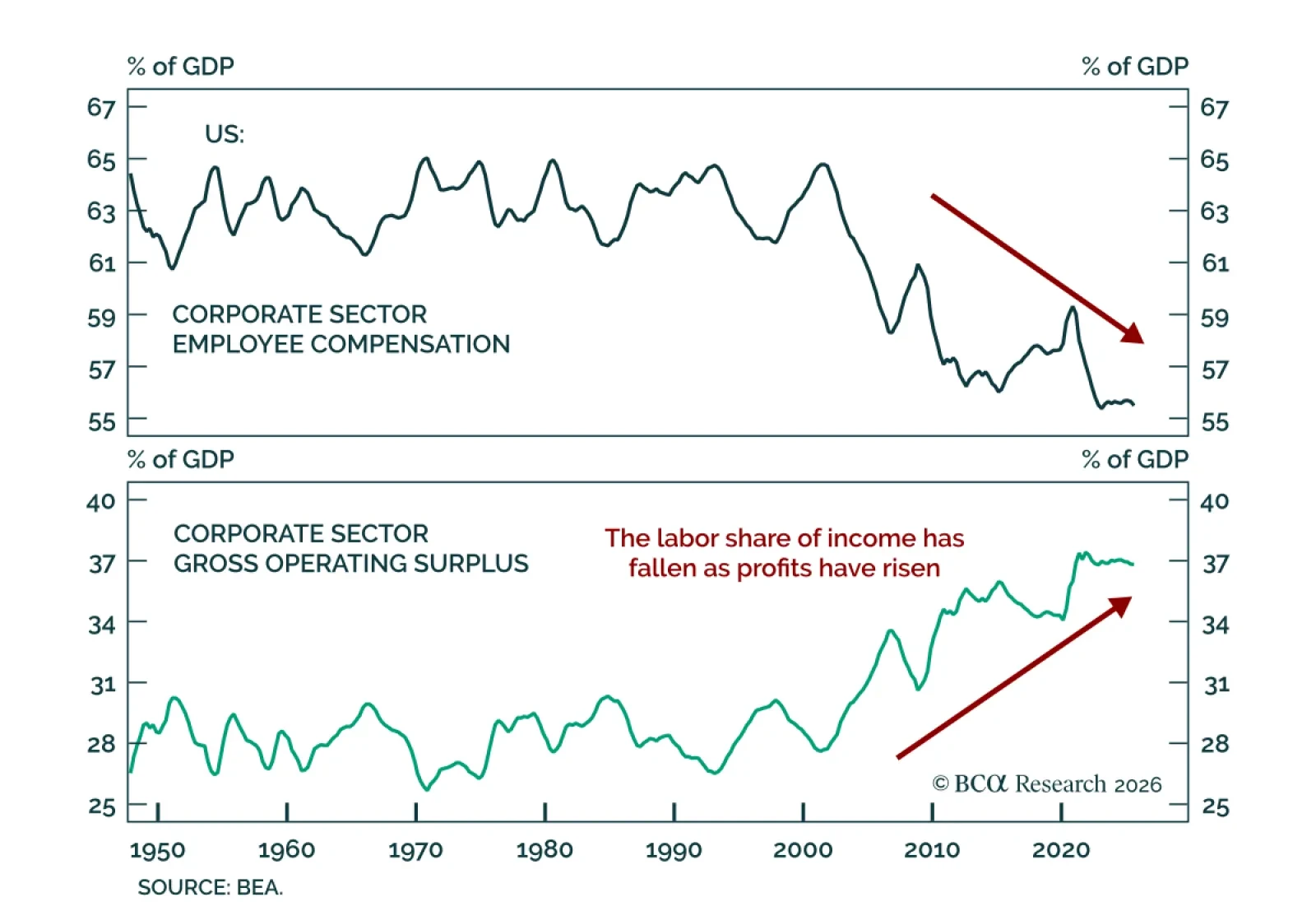

Political risk will increasingly weigh on US markets. Our Chart of the Week comes from Mathieu Savary, BCA’s Chief DM ex. US Strategist. Mathieu shows that US corporate-sector employee compensation has slipped to a post-war low as a…

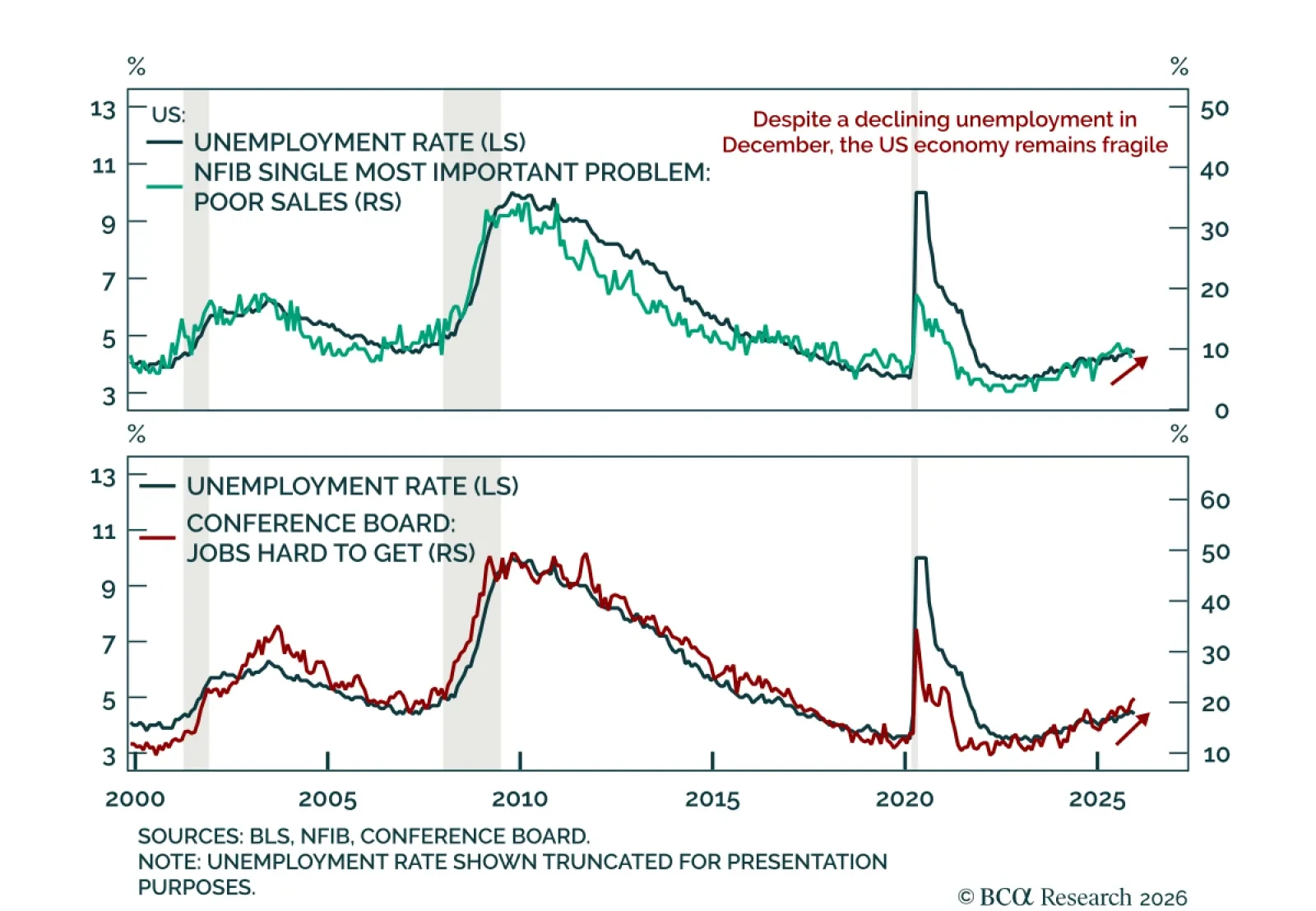

Maintain long duration and favor curve steepeners as a fragile labor backdrop keeps the door open to further Fed cuts. The December US employment report sent mixed signals. Nonfarm payrolls rose 50k, missing estimates and slowing…