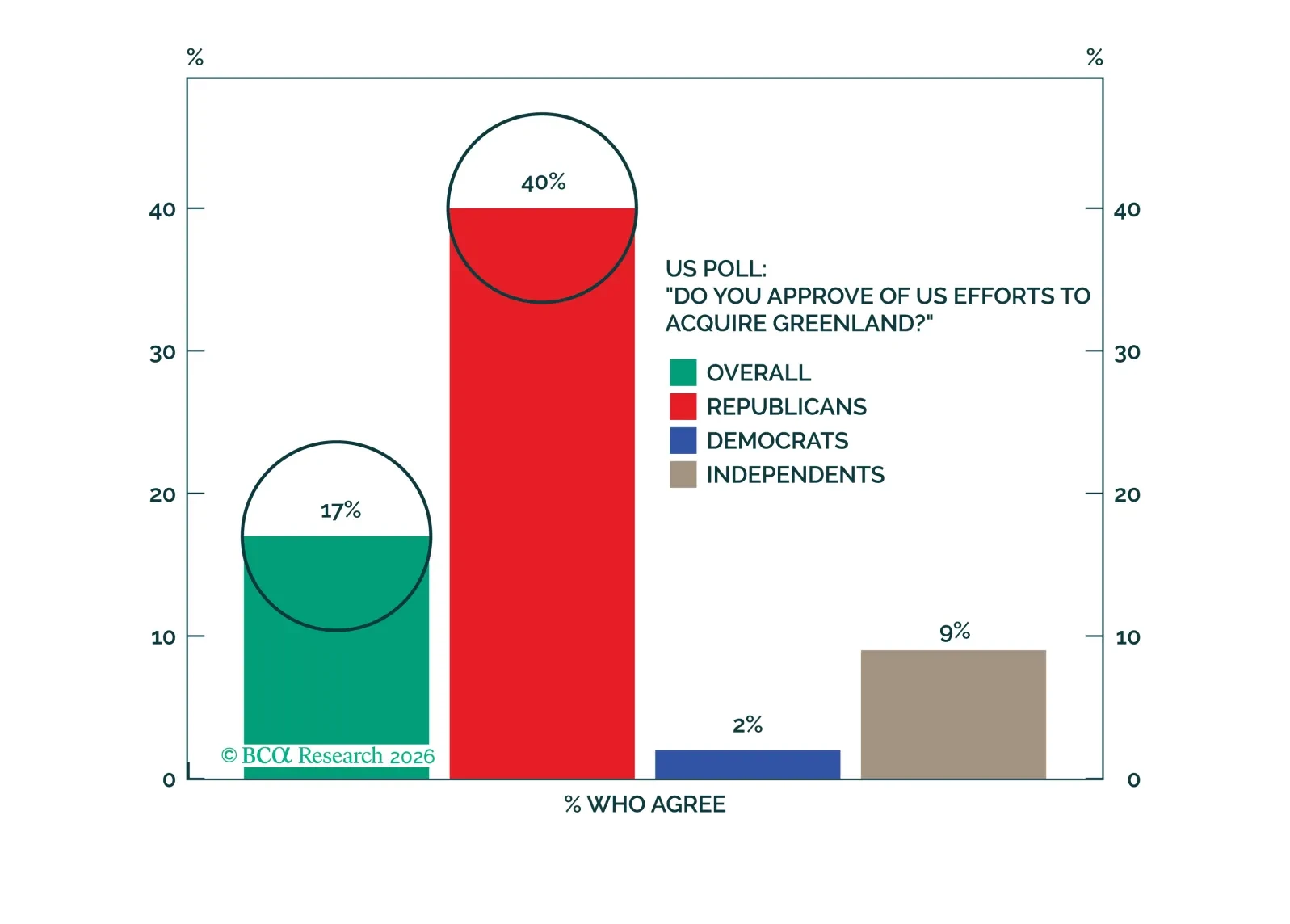

Investors should bet against the US seizing Greenland by force and collapsing NATO. But stay tactically defensive anyway.

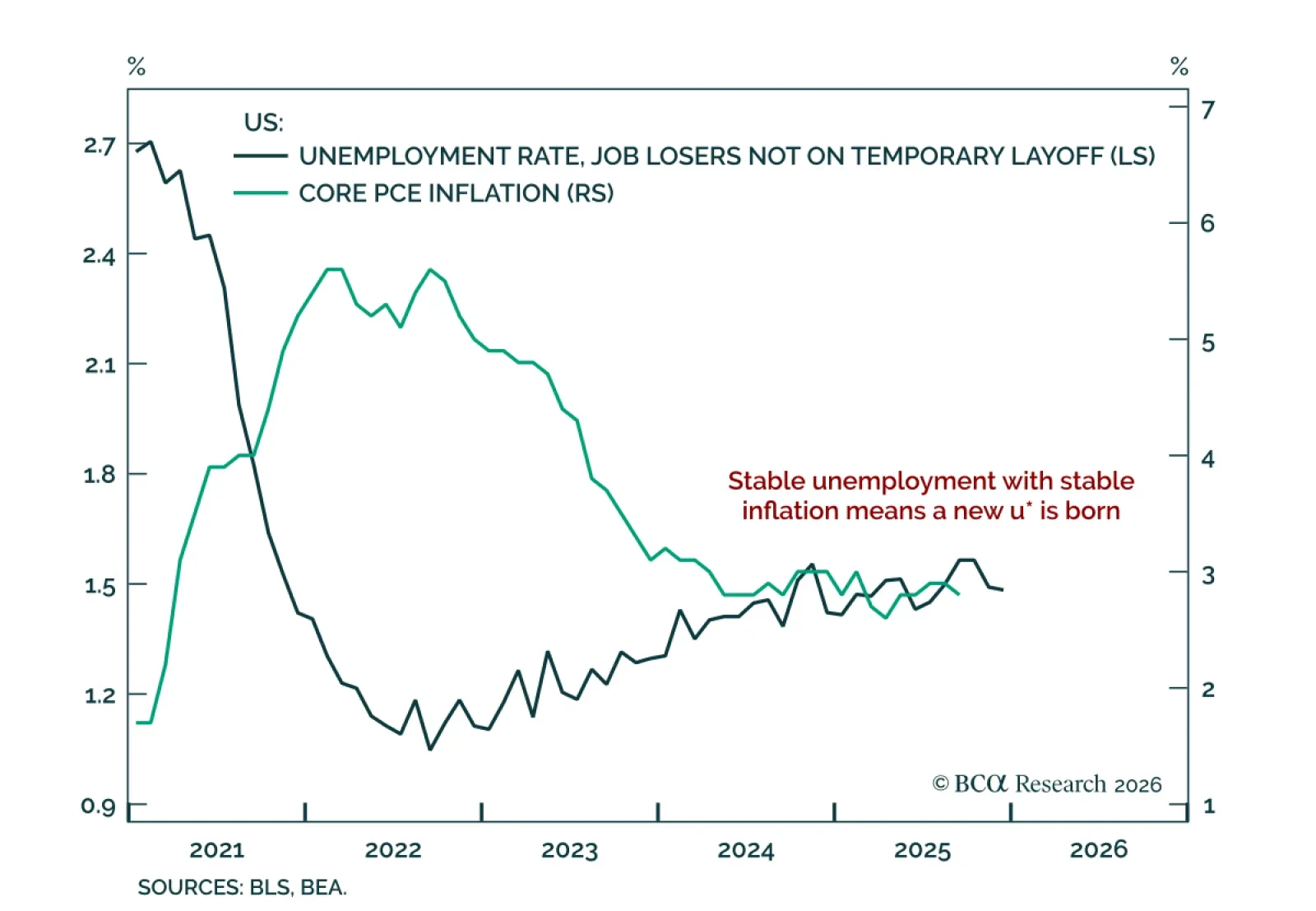

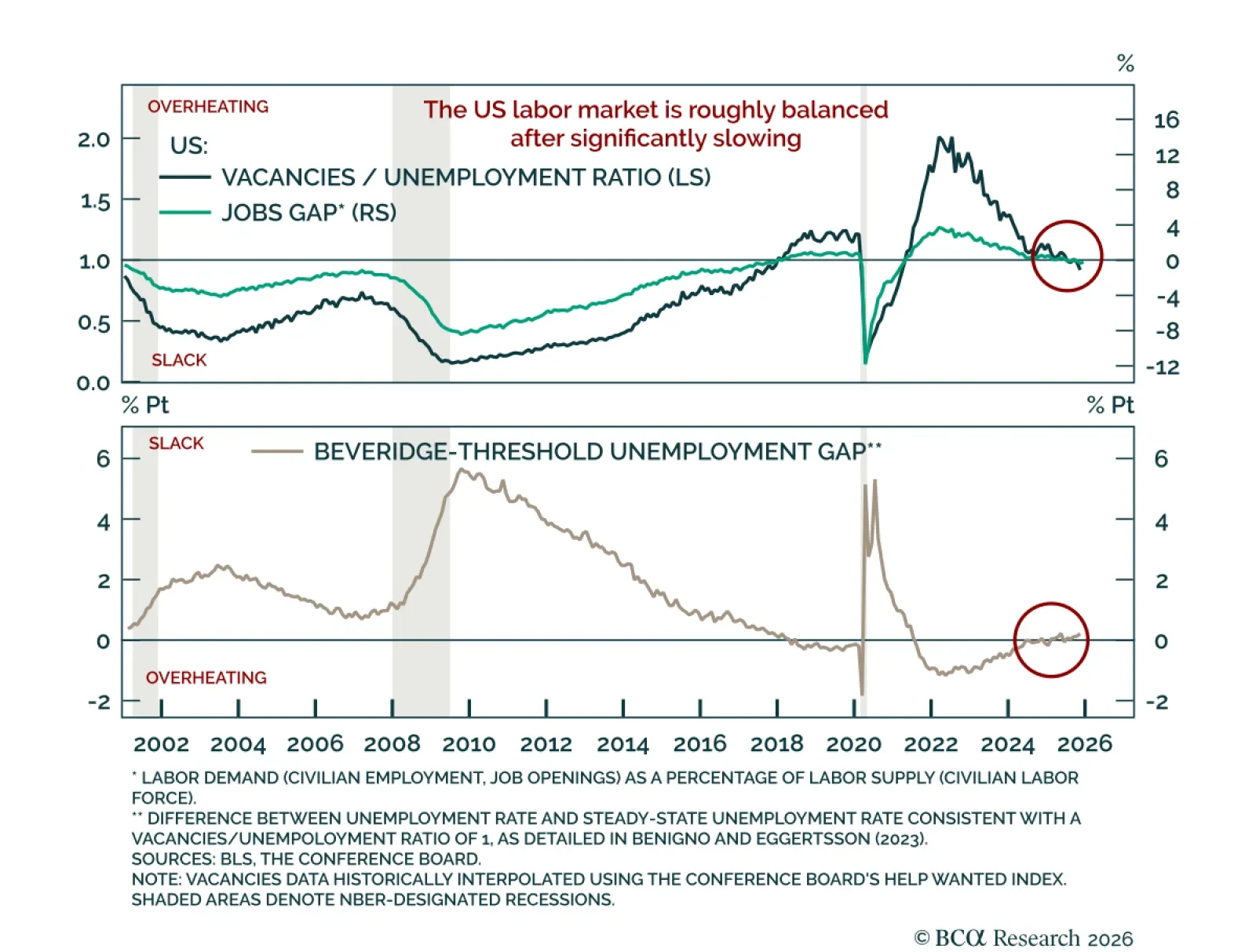

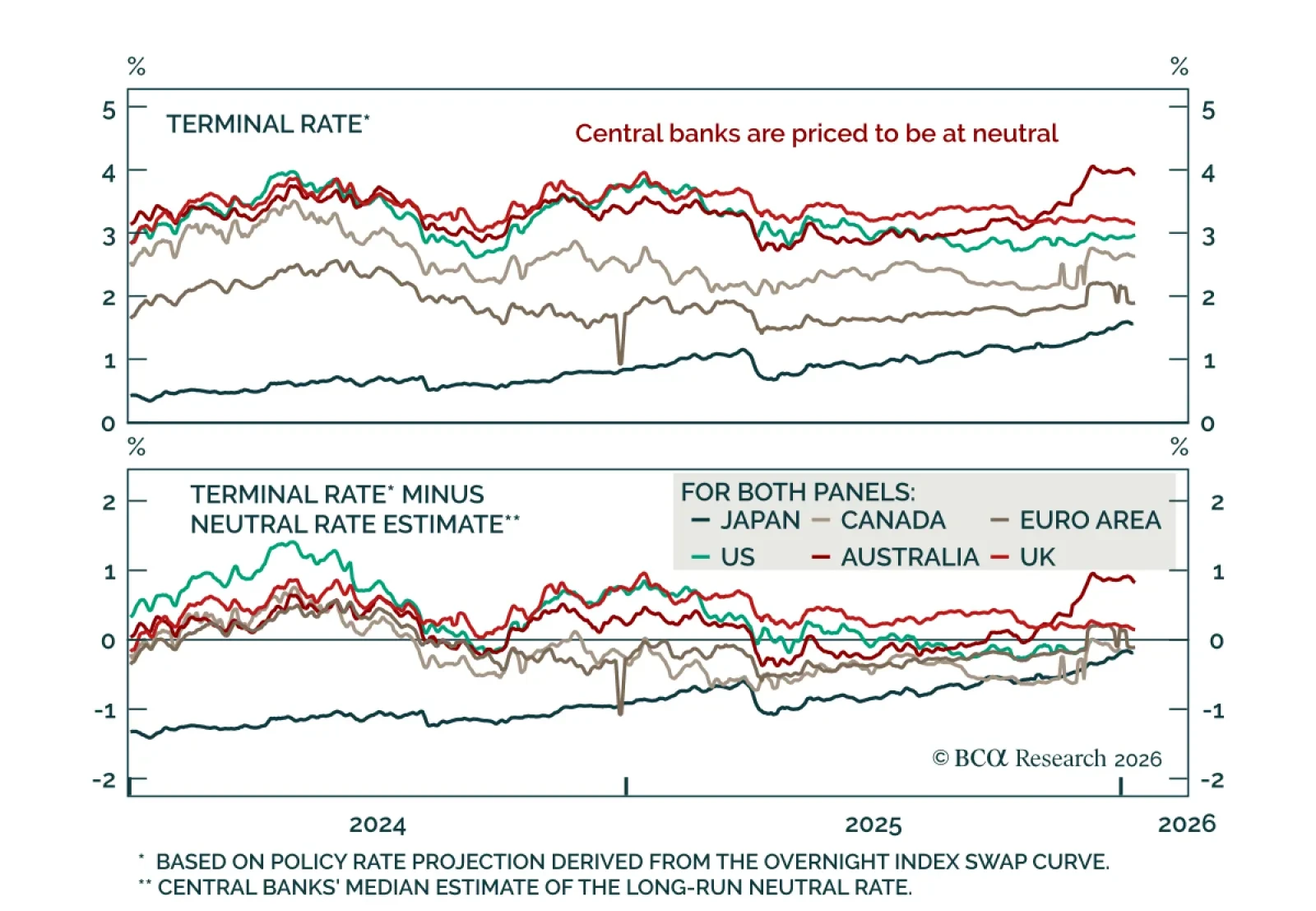

Our Counterpoint Strategists remain underweight duration, underweight US Treasuries versus other DM bonds, and underweight the dollar, as they see Fed cuts risk reigniting inflation. With both the unemployment rate and interest rate…

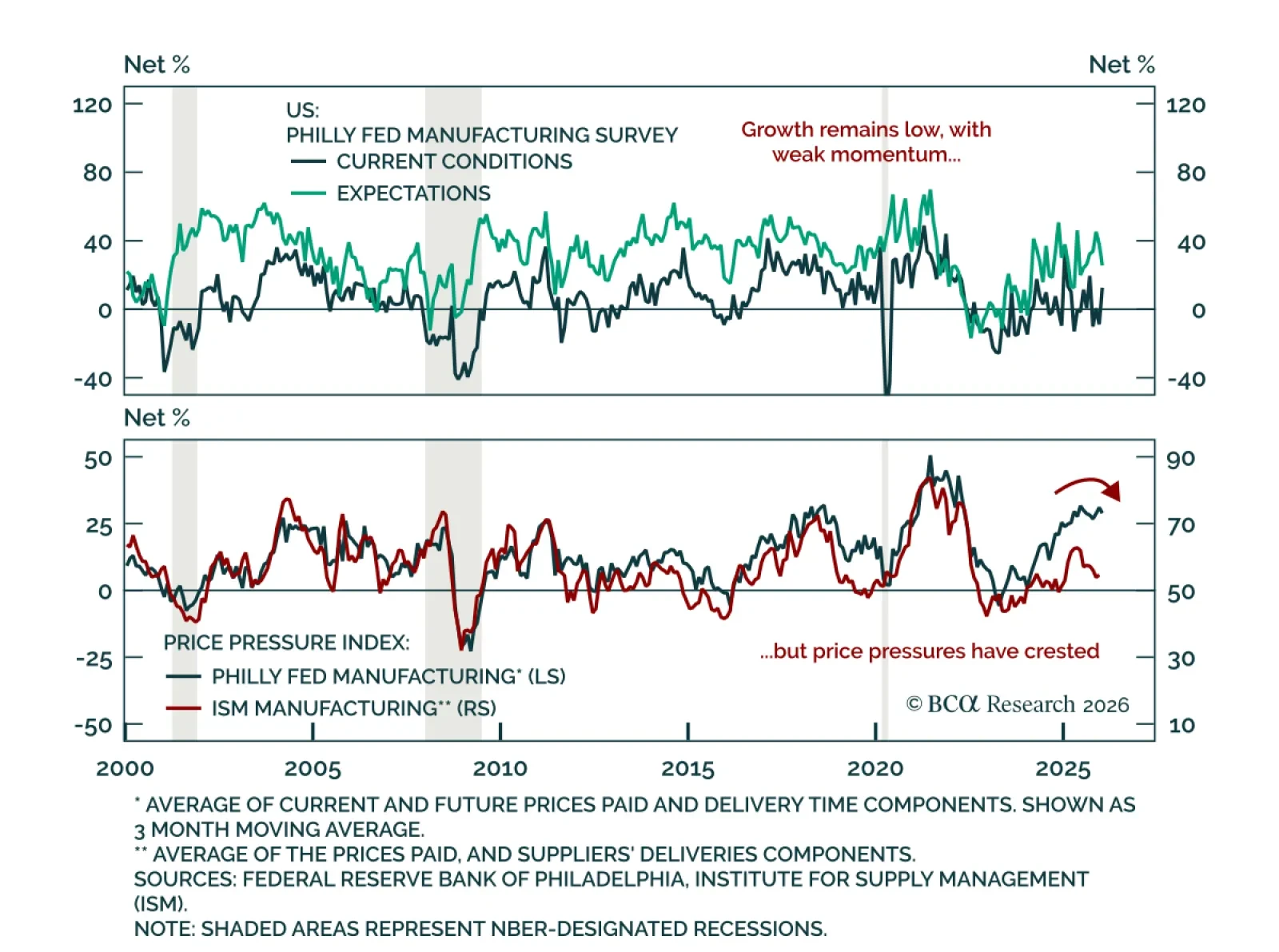

Maintain a modestly defensive allocation as manufacturing surveys signal resilience without momentum. The January Philly Fed and Empire Manufacturing surveys both beat estimates, rebounding to 12.6 from -10.2 and to 7.7 from -3.9,…

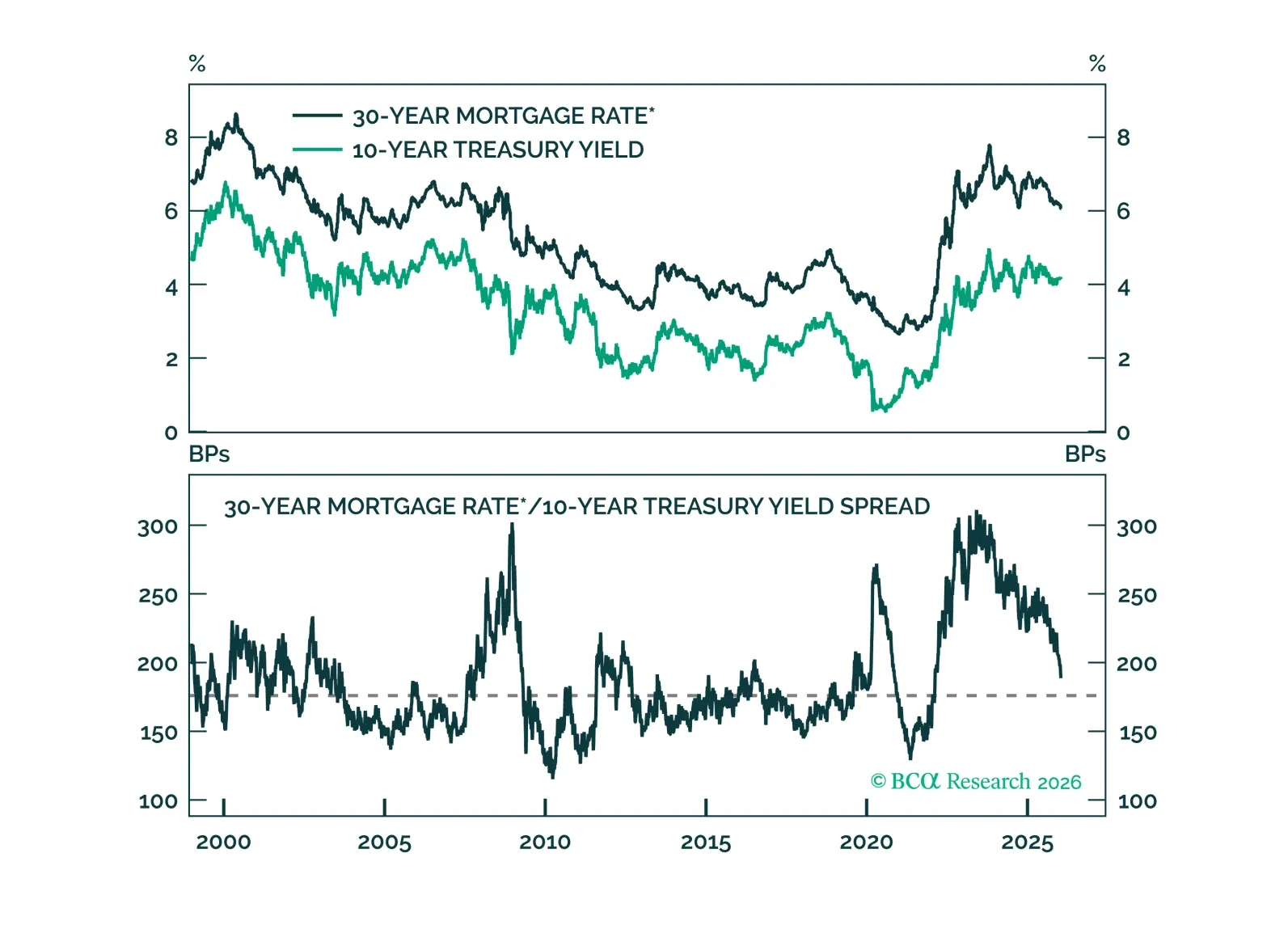

Mortgage spread tightening has run its course. Any further drop in mortgage rates will necessitate lower Treasury yields.

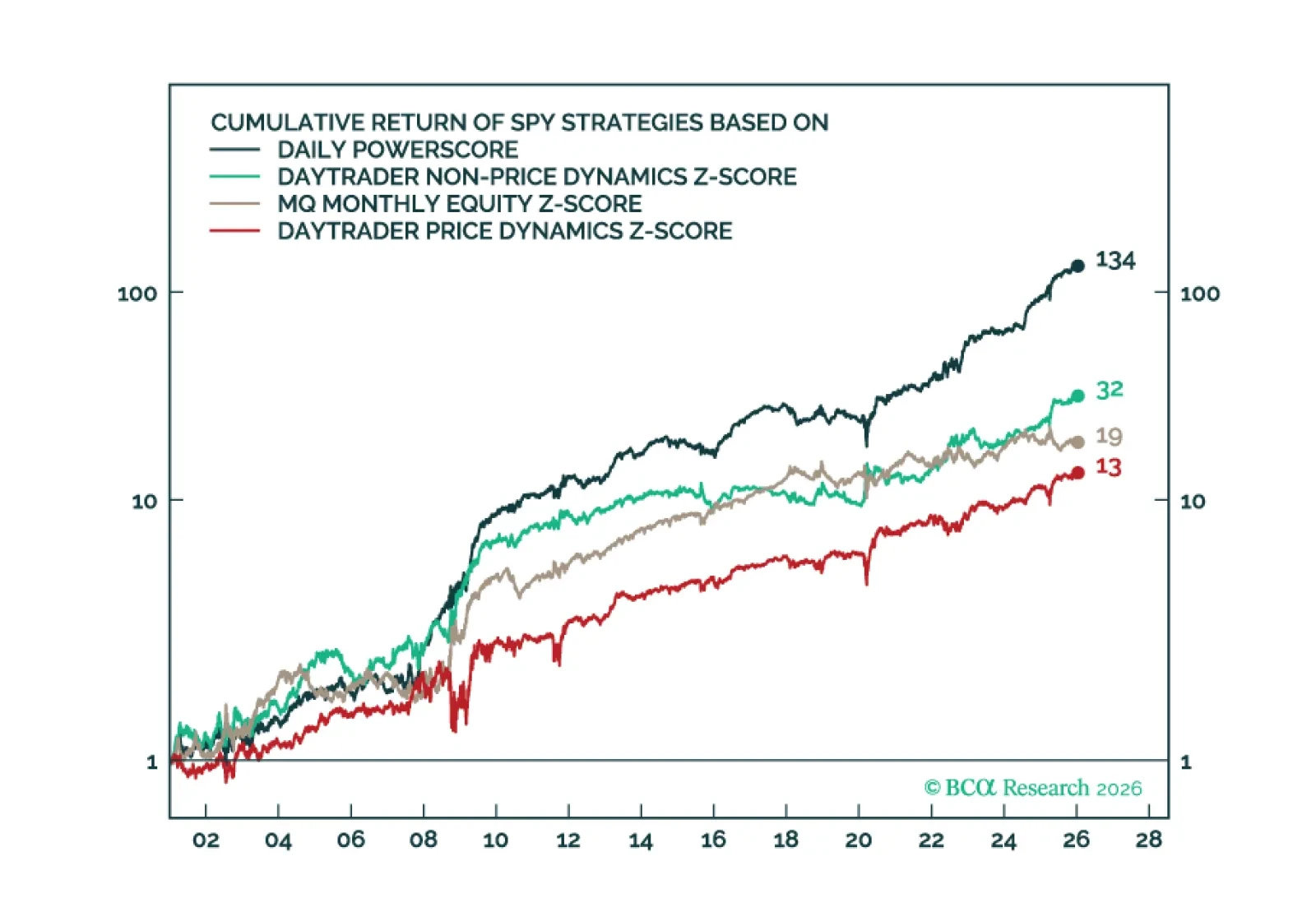

Over the past few months, we have been deploying new market-timing tools aimed at improving the accuracy of our calls. Today’s report highlights our ultra high-frequency Daily Oscillators, which provide daily signals on the near-term…

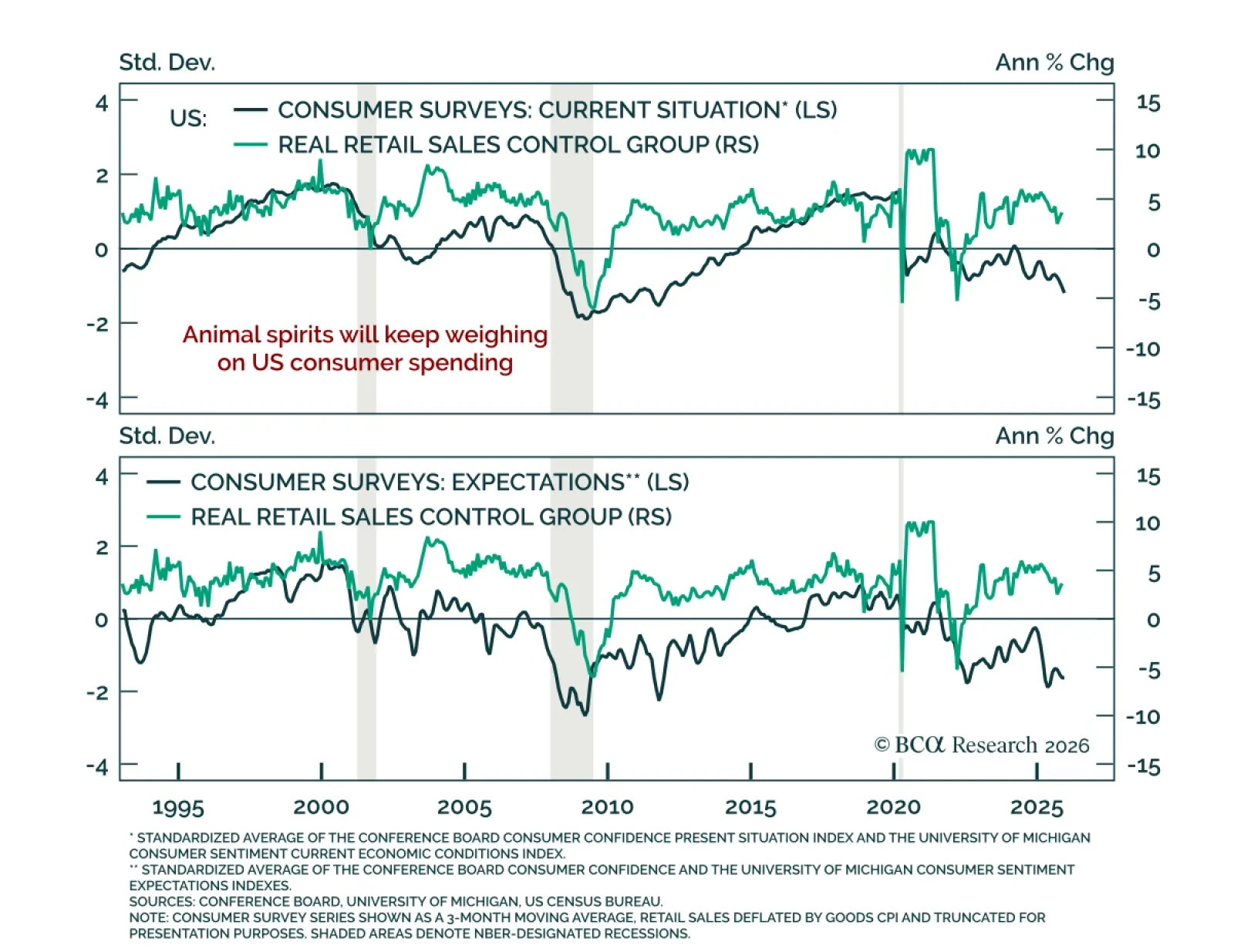

Maintain above-benchmark duration and 2-year/5-year Treasury steepeners as slowing labor income keeps downside risks for growth intact. November US retail sales beat estimates, with the headline rising 0.6% m/m after being flat in…

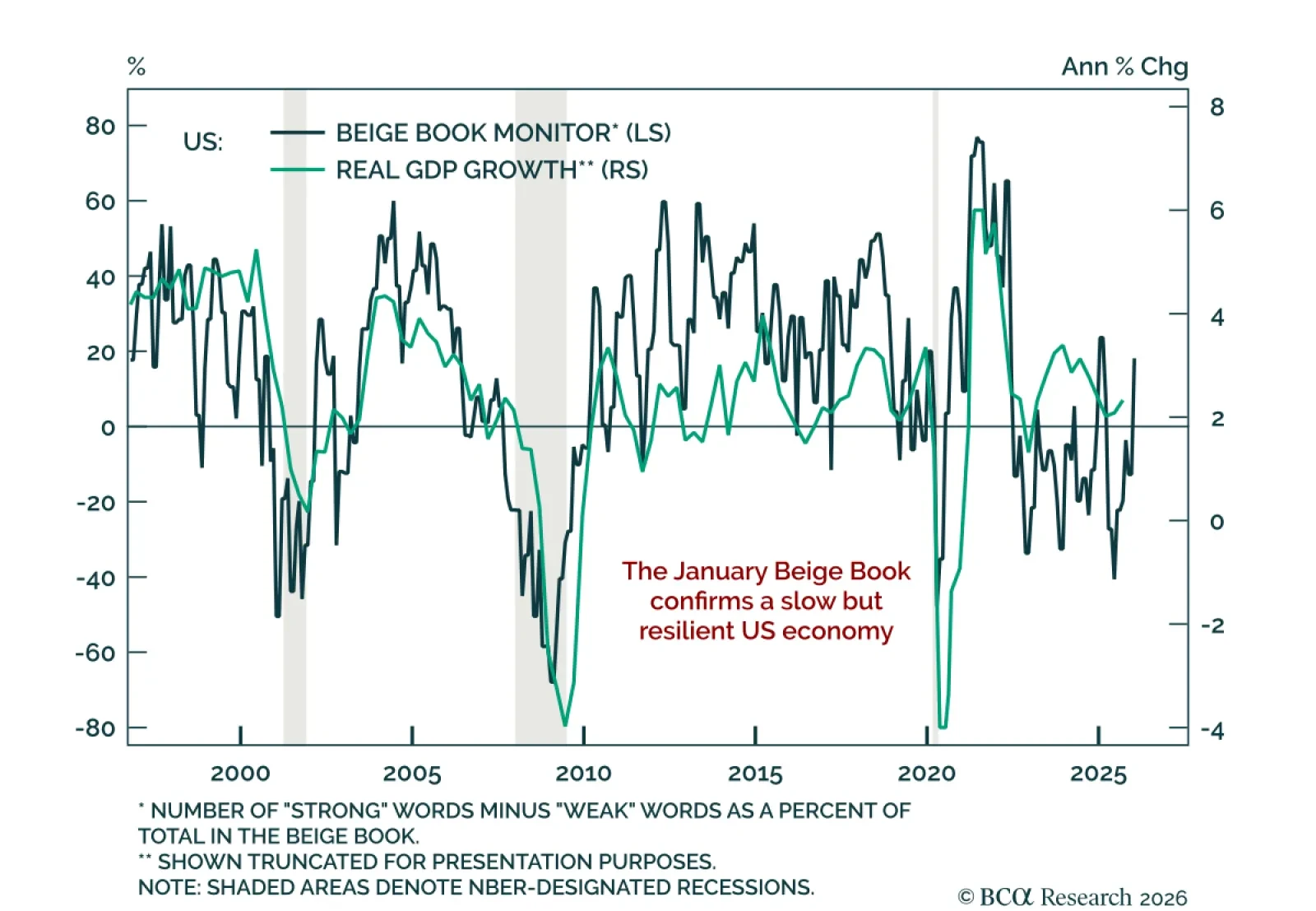

The Beige Book confirms a slow but resilient US economy. The January Beige Book points to activity increasing at a slight-to-modest pace in most Fed districts, a shift from earlier reports where most districts saw unchanged activity…

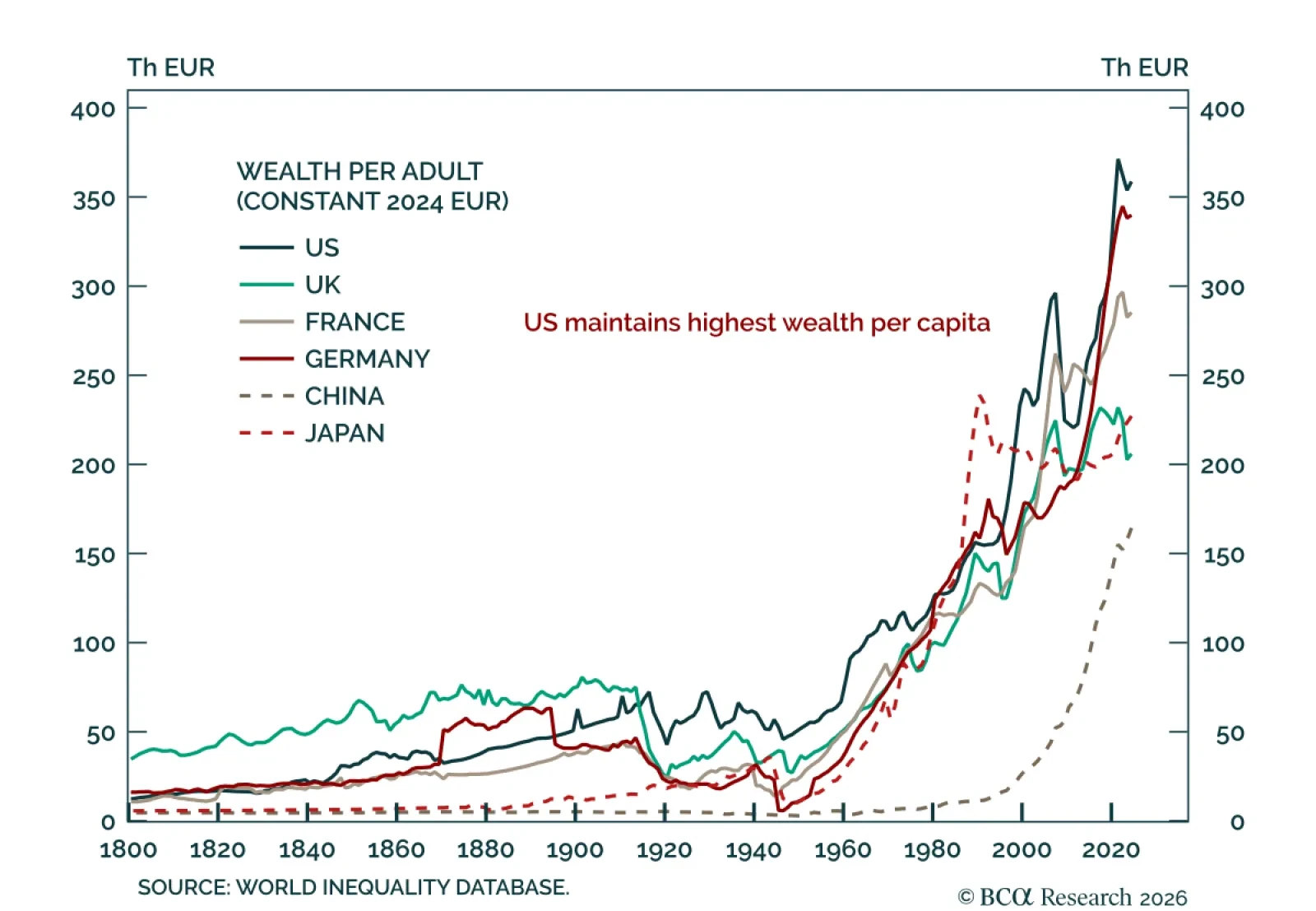

Our US and Geopolitical strategists argue that, despite intensifying socioeconomic and geopolitical challenges, the long-run case for US resilience remains intact. As the country marks its 250th year, the strategic rise of the US…

Remain neutral on equities and underweight credit as the US economy enters 2026 at a pivotal but fragile point. A new year does not reset the business cycle, yet the US economy is entering 2026 at an important juncture. Recession…

Our Global Fixed Income strategists maintain an above-benchmark duration stance as labor market risks continue to support downside yield potential, even as the global easing cycle winds down. With policy normalization largely…