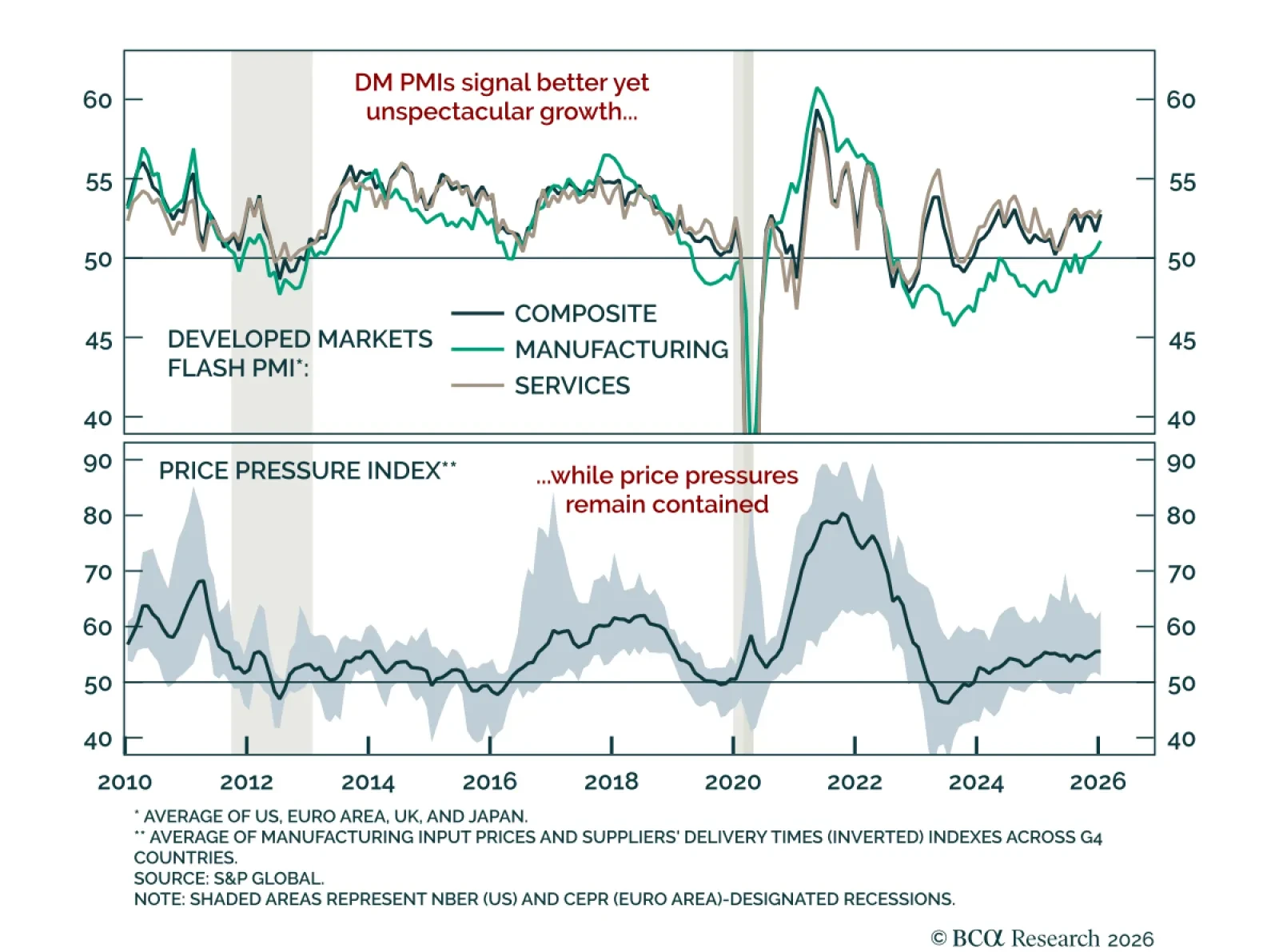

January flash PMIs point to better, though unspectacular, global growth momentum. Developed markets PMIs showed improvement in global growth momentum. PMIs have largely moved sideways through 2025, with manufacturing now recovering…

Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026…

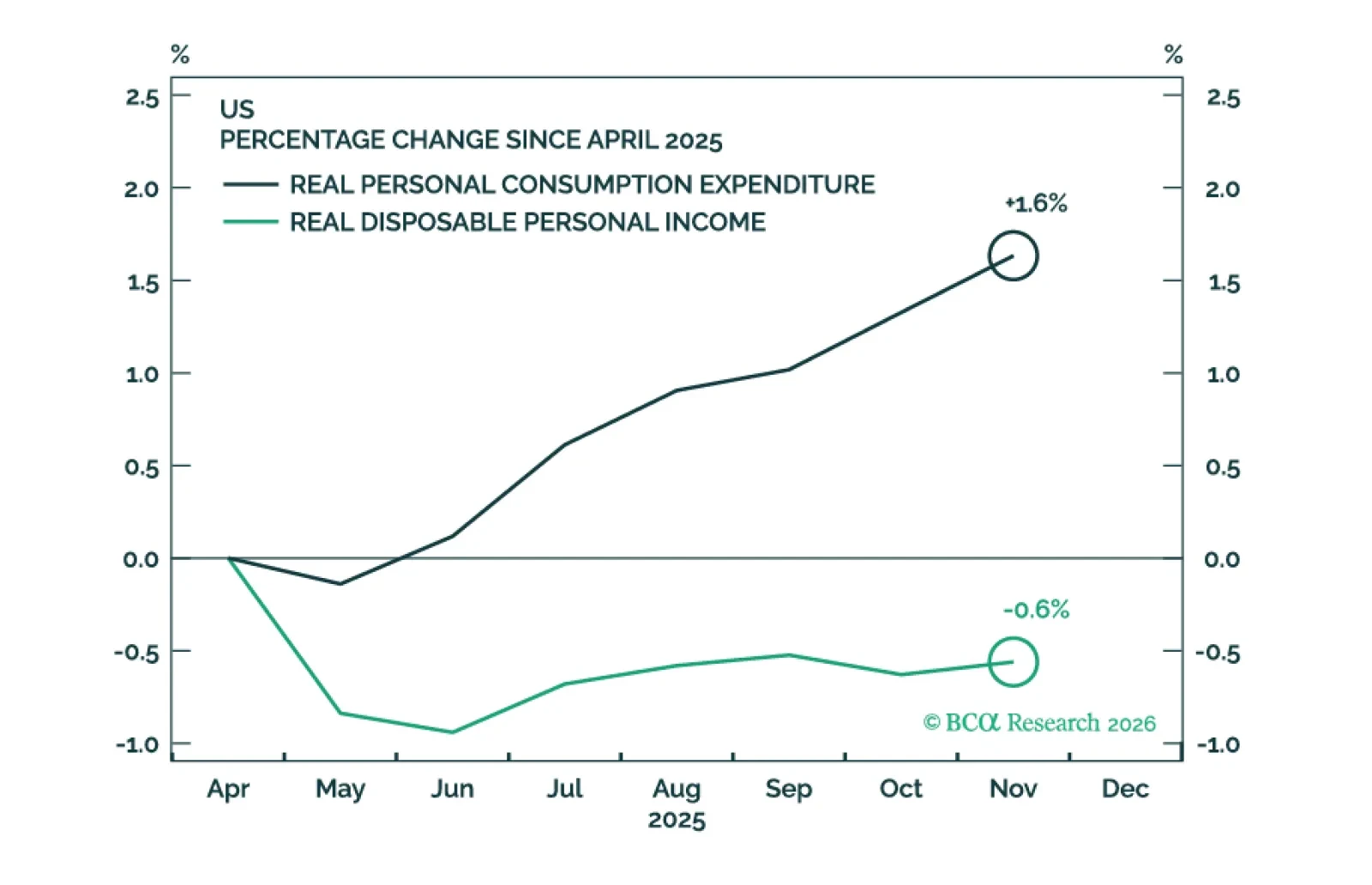

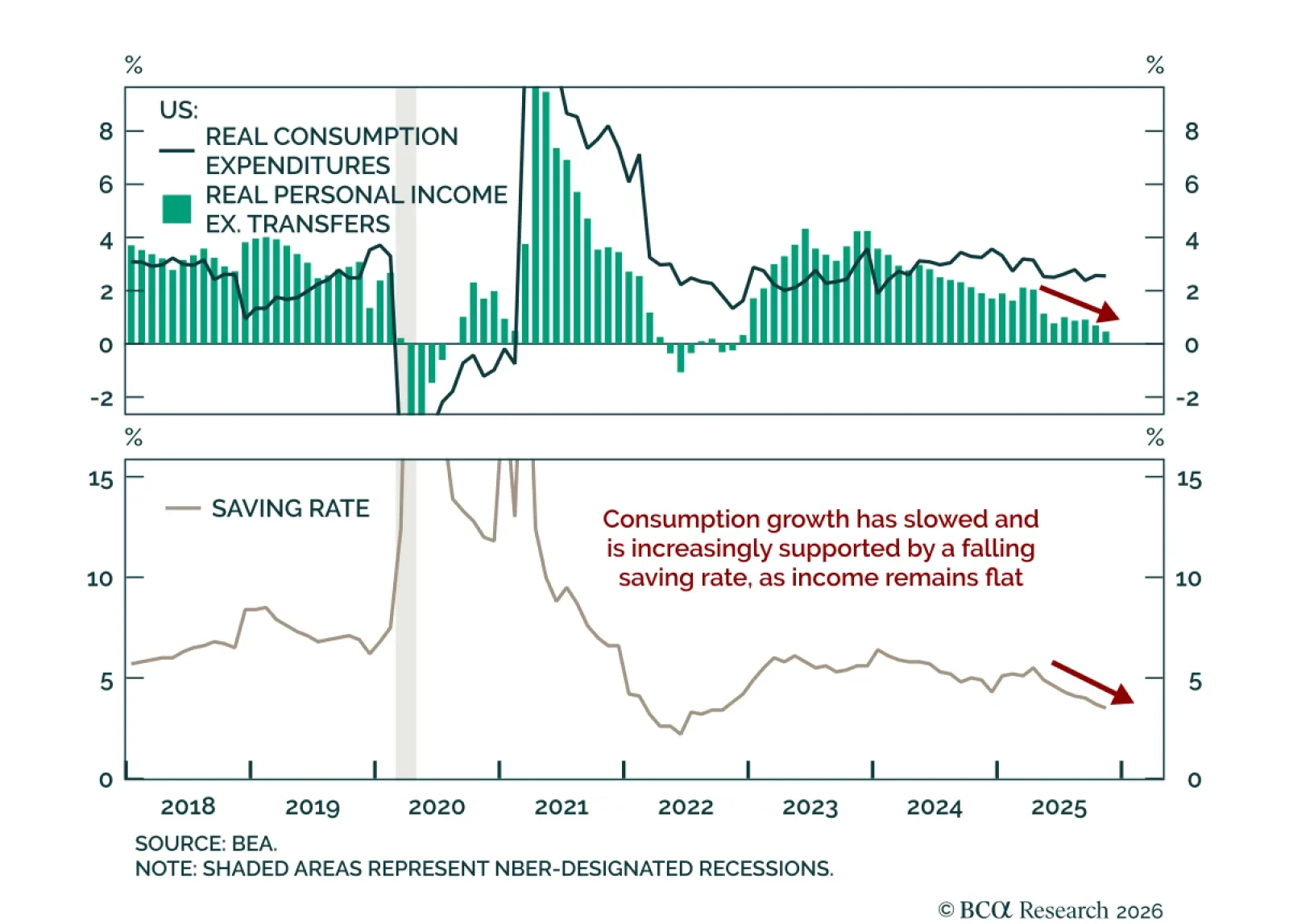

Maintain a modestly defensive stance as consumption fundamentals become increasingly fragile. US consumption in October and November was stronger than expected, but its support pillars have become more fragile. Real spending rose 0.3…

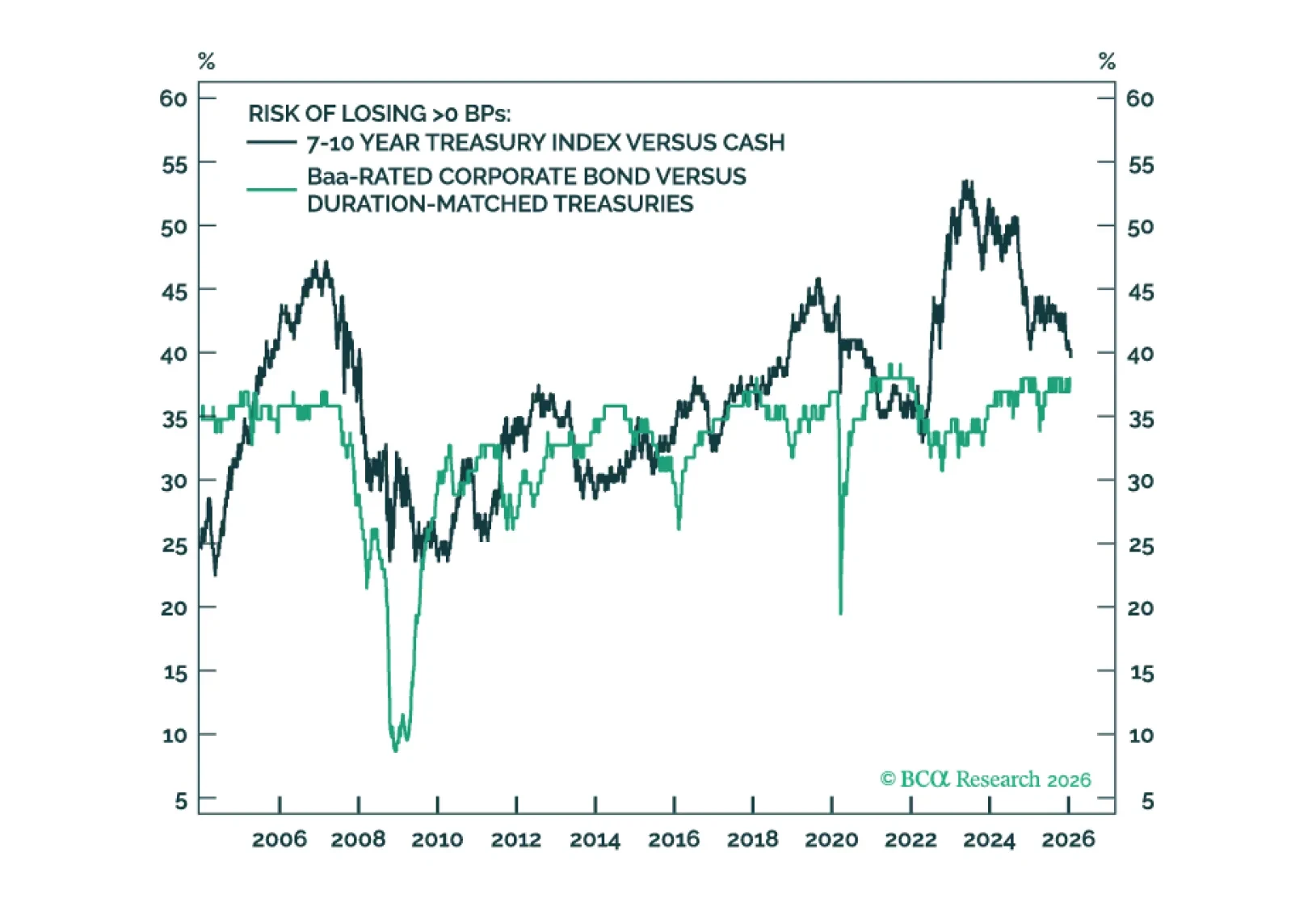

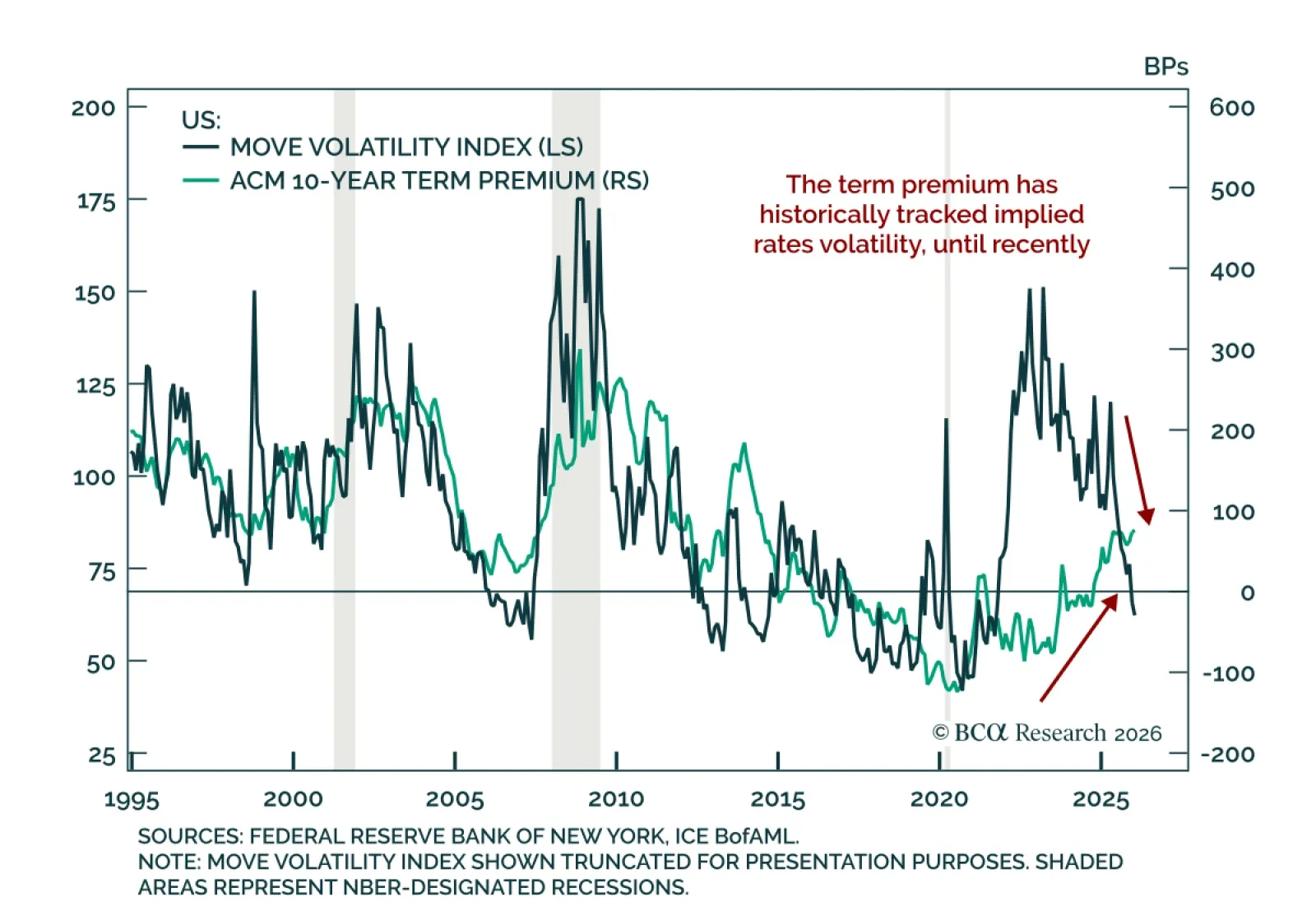

Our US Bond strategists expect long duration positions to outperform long credit risk in 2026. The Treasury term premium remains high despite declining rates volatility and tight credit spreads. The divergence between the term…

The 10-year Treasury term premium is now competitive with Baa- and Ba-rated credit spreads. Even without term premium compression, duration carry trades could outperform credit carry trades in a low rate vol environment.

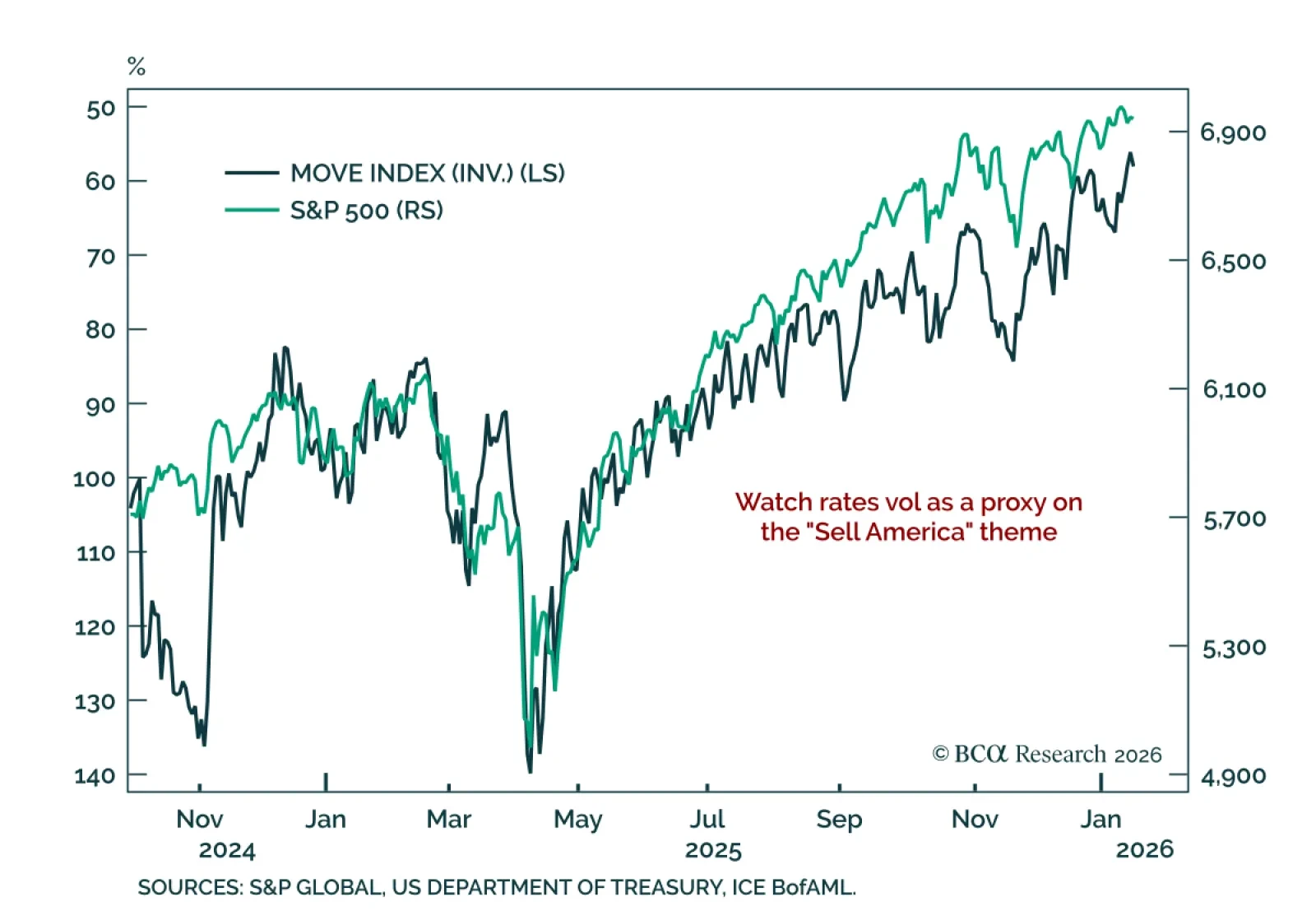

Do not add tactical risk yet, and monitor rates volatility for a potential re-entry point. A key factor supporting the S&P 500 beyond the AI narrative in 2025 has been declining rates volatility. Despite occasional wobbles, the…

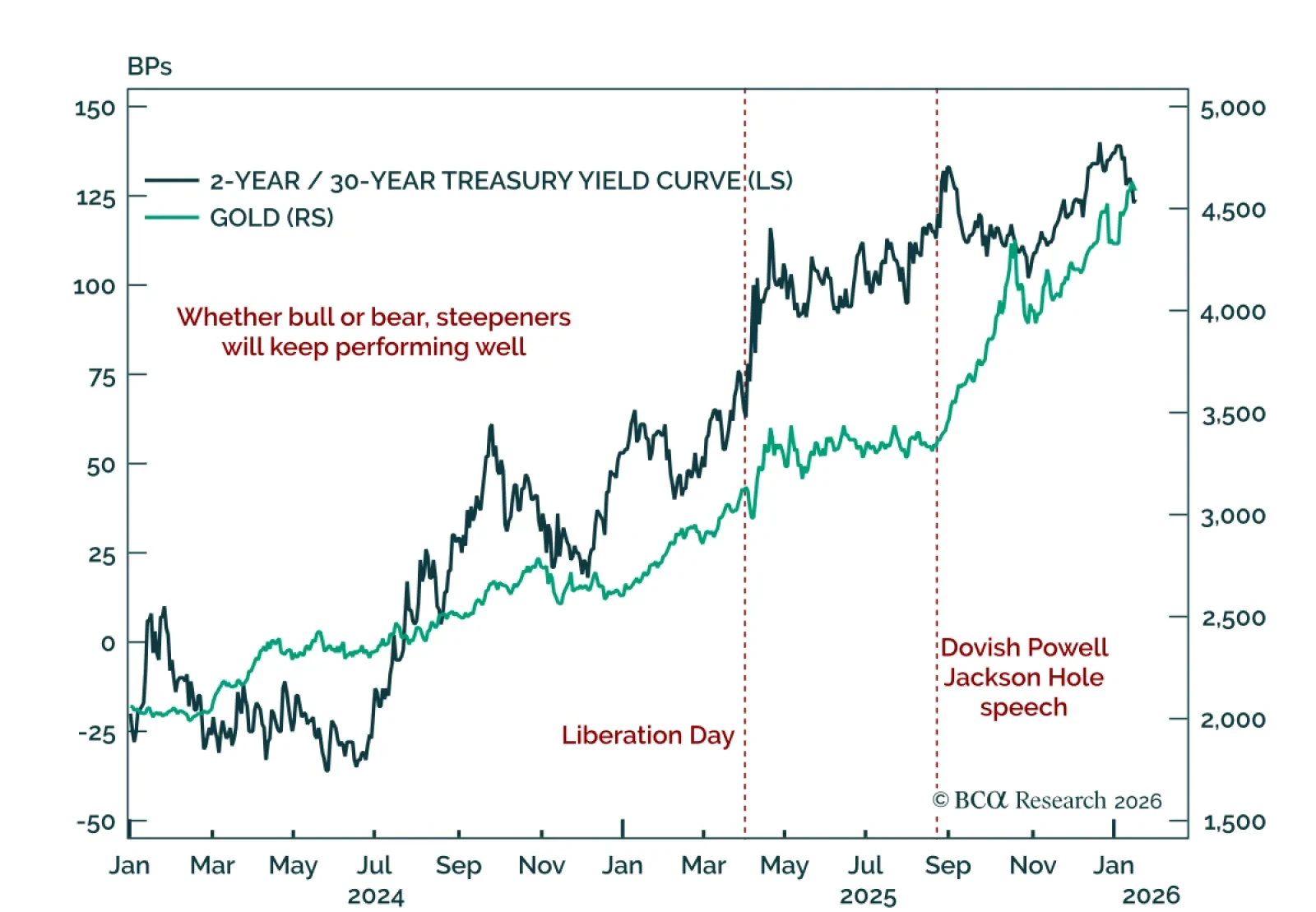

Favor curve steepeners and gold as recent price action highlights rising term premia and diversification away from US assets. With markets closed on Monday for the MLK holiday, Tuesday’s session saw price action reminiscent of last…

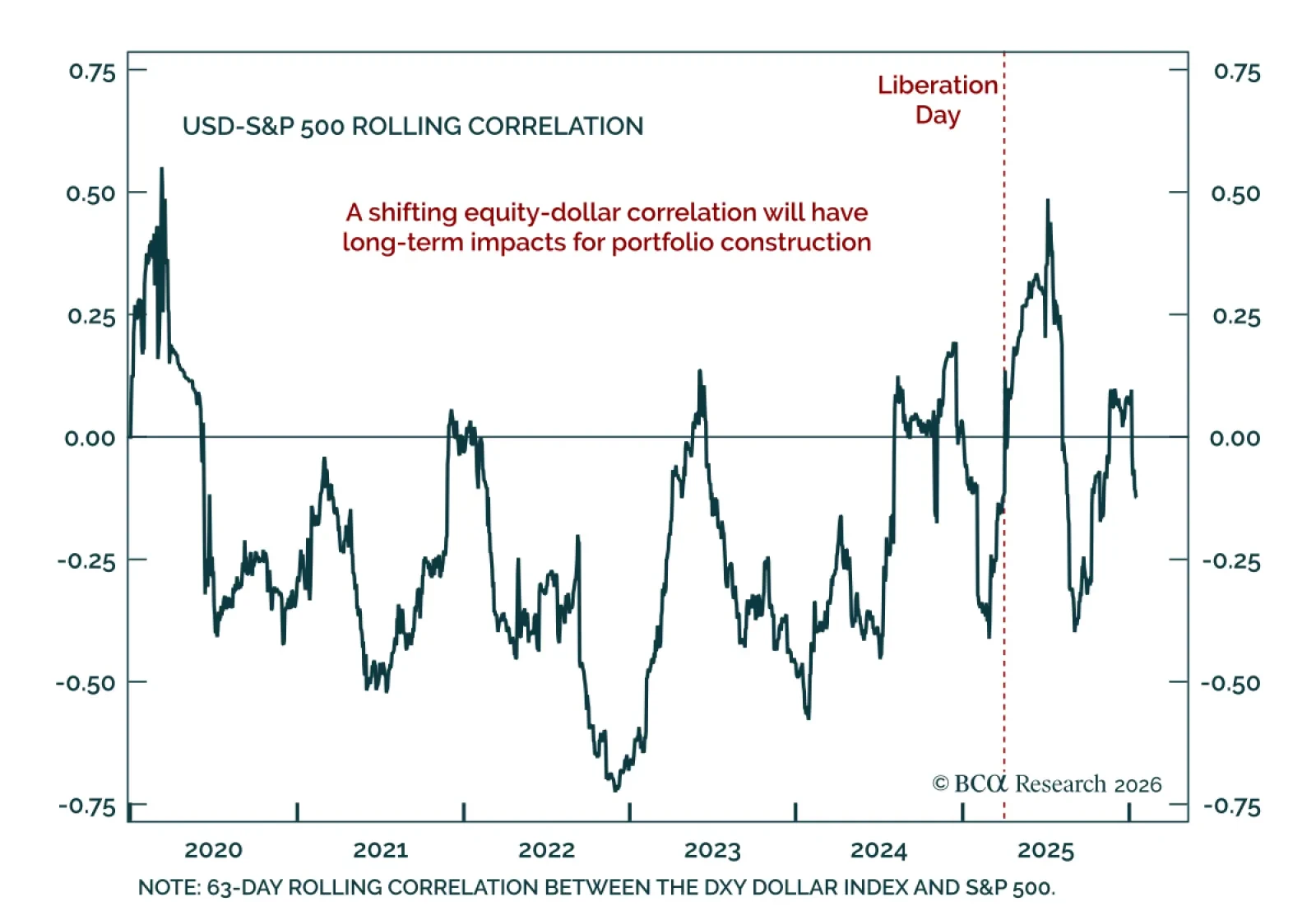

Remain cautious on US equities and the dollar. Our monthly BCA Views meeting concluded that the outlook has become slightly more constructive. Recession risk over the next 6-12 months remains elevated but has diminished as growth and…

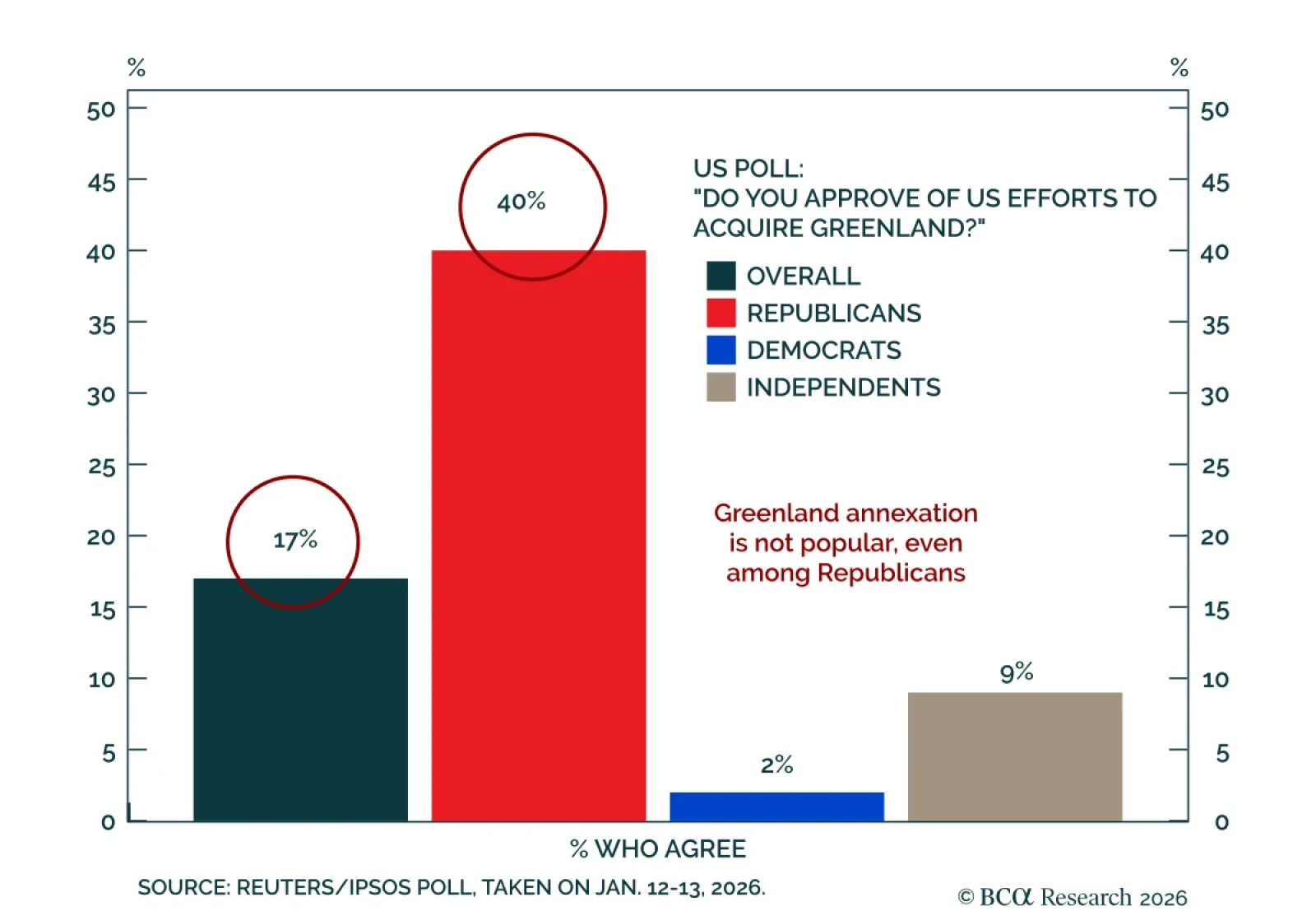

Greenland has moved to the forefront of geopolitics, but a non-military resolution remains the most likely outcome. Our Geopolitical strategists do not expect the US to seize Greenland by force or collapse NATO. Nonetheless, they…

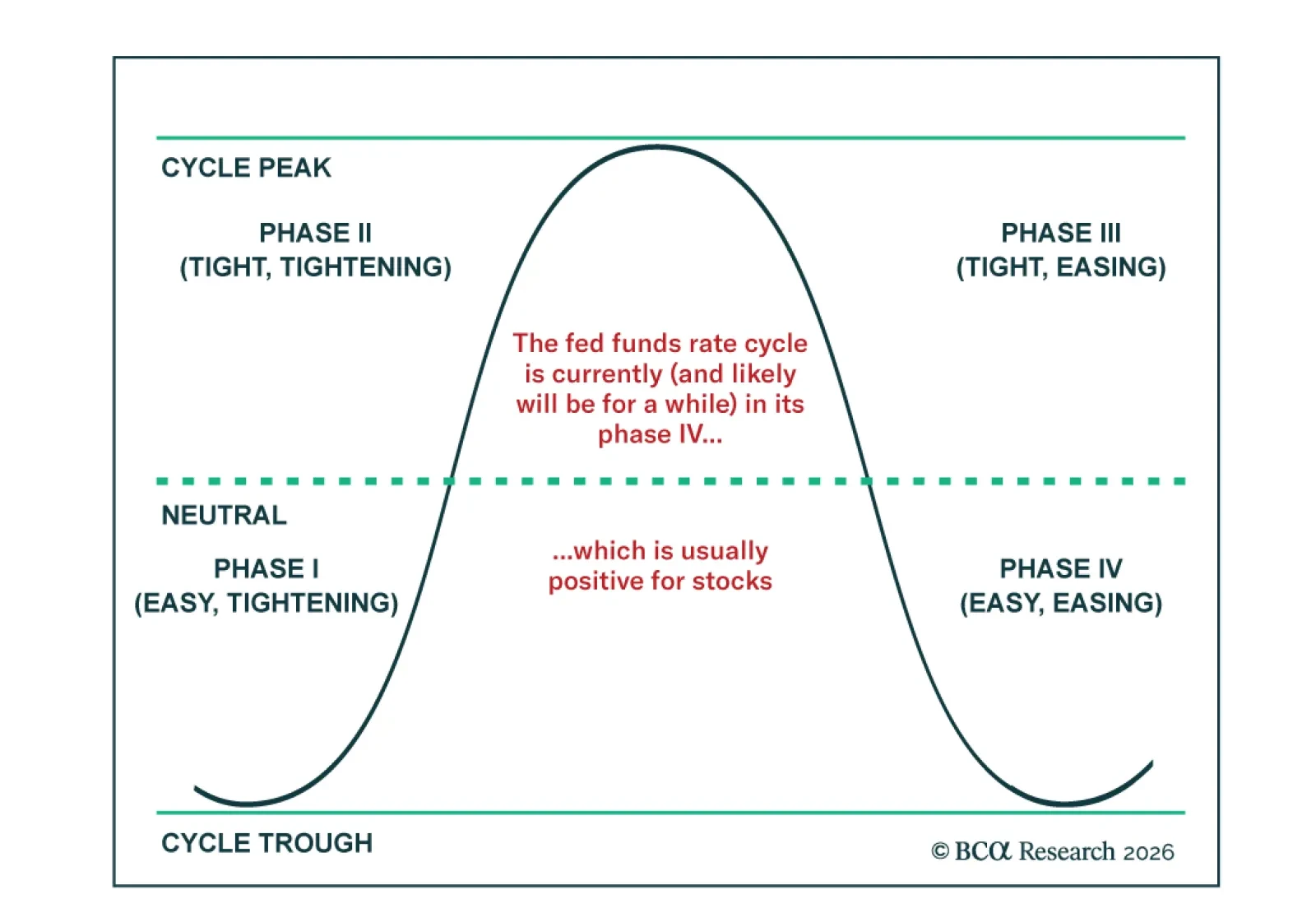

Our US Investment strategists expect accommodative monetary policy in 2026, but equities may be less responsive than in prior easing cycles. Historically, equity returns have been significantly stronger under easy policy, and further…