Executive Summary The US inflation surprise increases the odds of both congressional gridlock and recession, which increases uncertainty over US leadership past 2024 and reduces the US’s ability to lower tensions with China and…

Executive Summary China: GeoRisk Indicator A new equilibrium between NATO, which now includes Sweden and Finland, and Russia needs to be reestablished before geopolitical risks in Europe subside. Russia aims to inflict a…

Executive Summary Russia Squeezes EU Natural Gas Major geopolitical shocks tend to coincide with bear markets, so the market is getting closer to pricing this year’s bad news. But investors are not out of the woods…

Executive Summary Natural Gas Markets Eerily Quiet An eerie calm in European natural gas markets belies the state of war in Ukraine that already is producing a cutoff of Russian natgas supplies in retaliation for the EU…

Executive Summary EU Embargoes Russian Oil The EU imposed an embargo on 90% of Russian oil imports, which will provoke retaliation. Russia will squeeze Europe’s economy ahead of critical negotiations over the coming 6-…

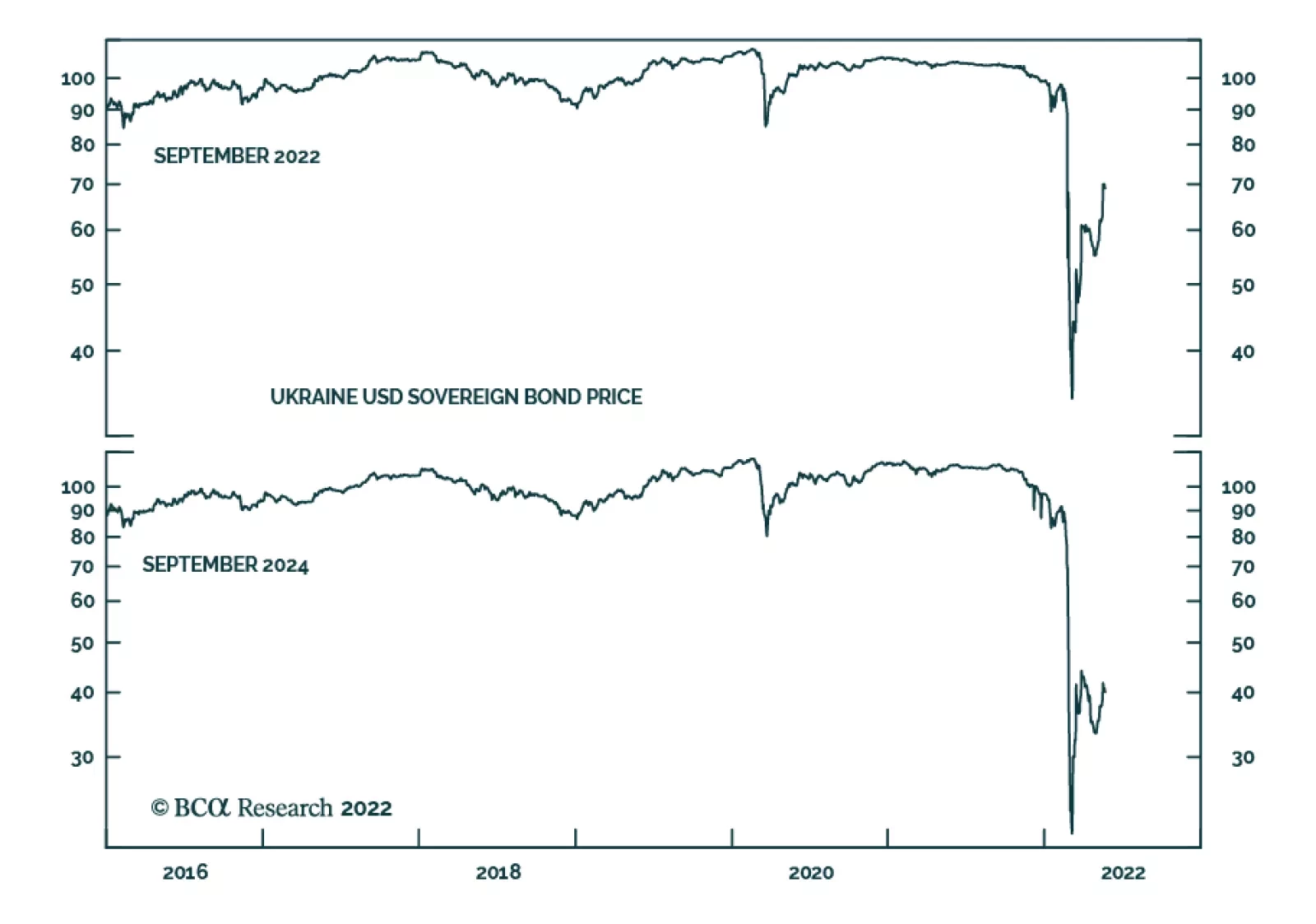

Although Ukranian US dollar sovereign bonds have rebounded since the beginning of the war, their risk-reward tradeoff is not yet attractive. First, the war is likely to be prolonged. US and NATO military and economic…

Listen to a short summary of this report. Executive Summary The US Inflation Surprise Index Has Rolled Over Global equities are nearing a bottom and will rally over the coming months as…

Executive Summary The surge in food prices following Russia's invasion of Ukraine will drive EM headline inflation higher, given more of individuals' incomes in these economies are spent on food. Economies in the…