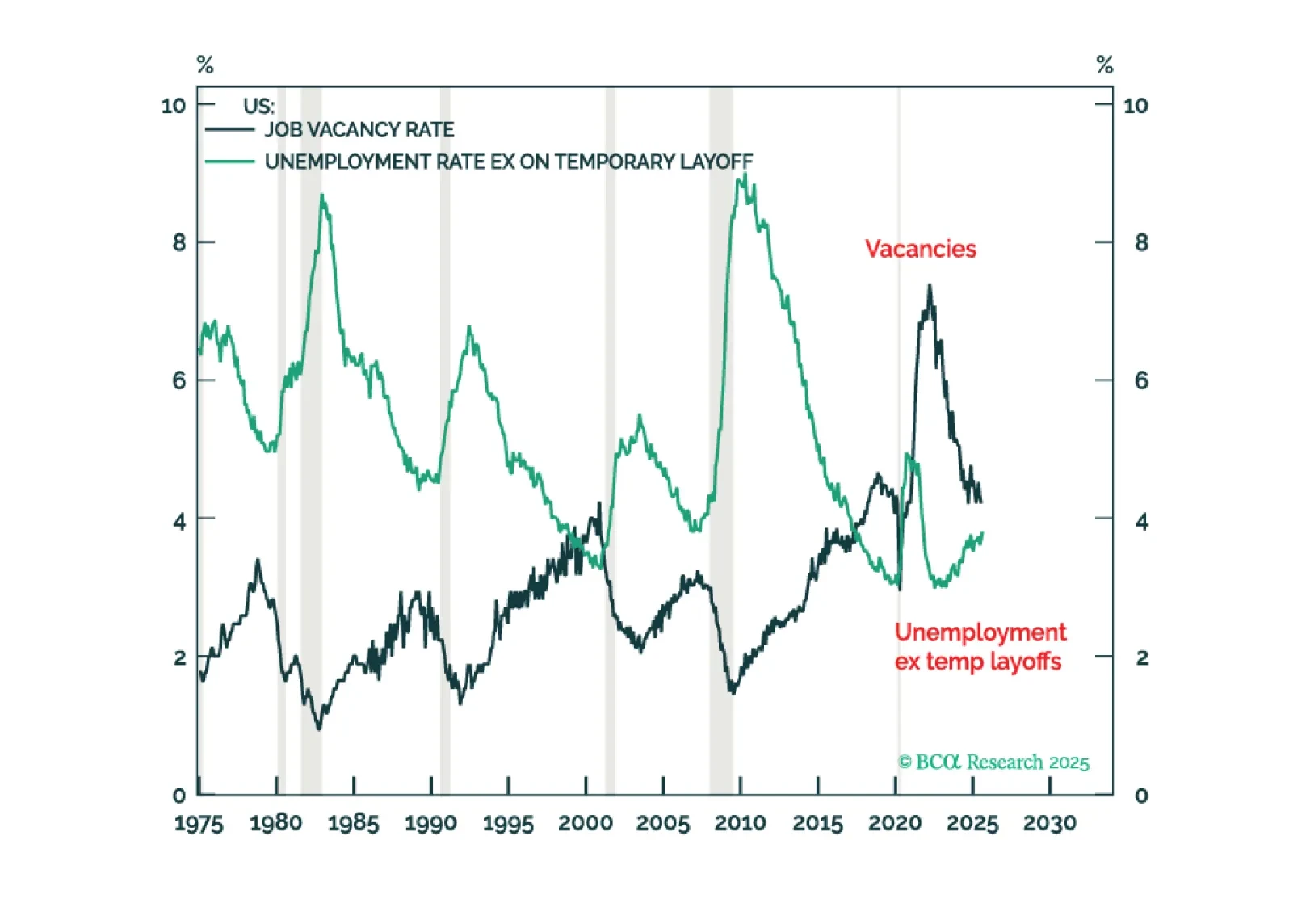

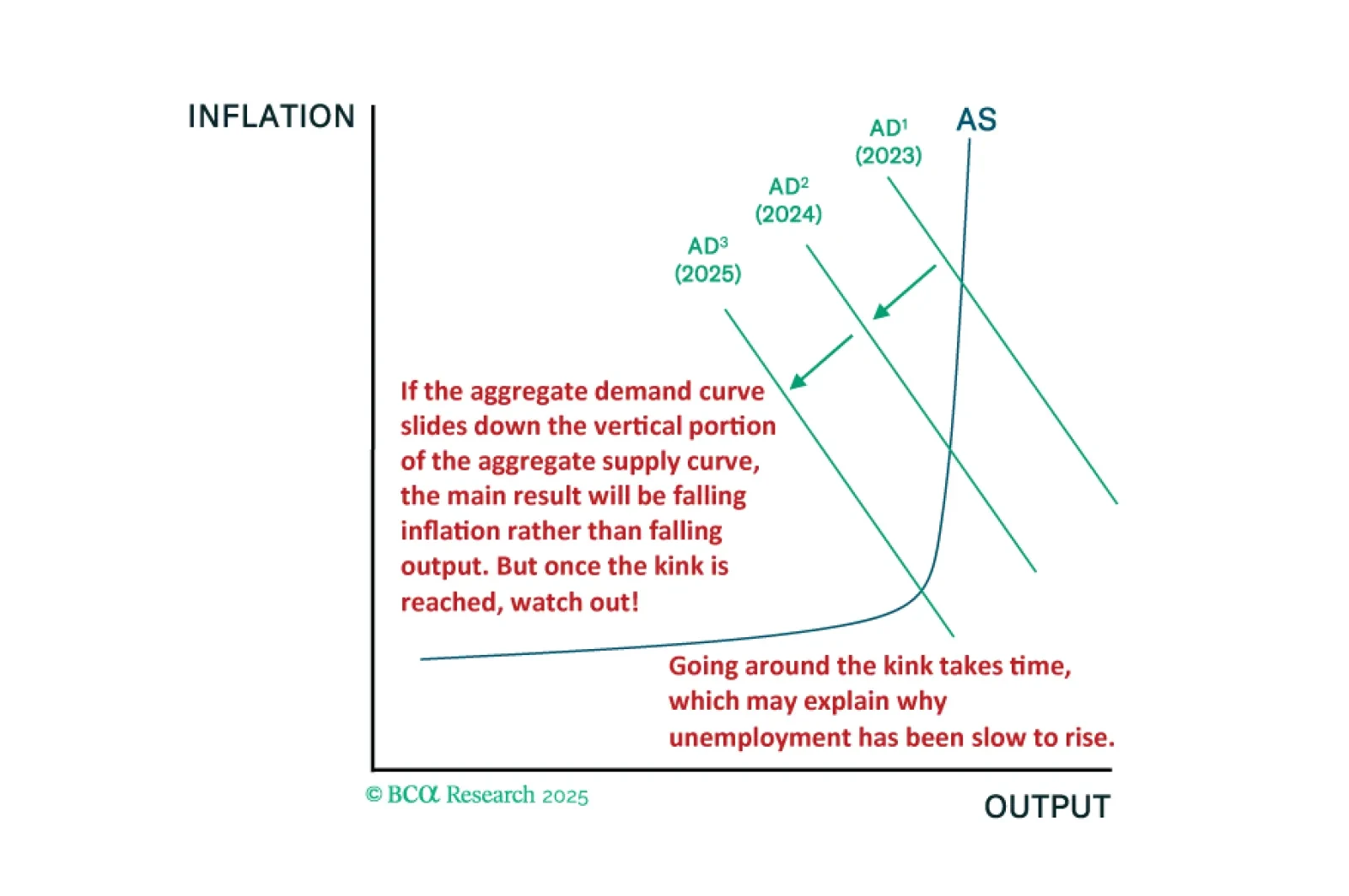

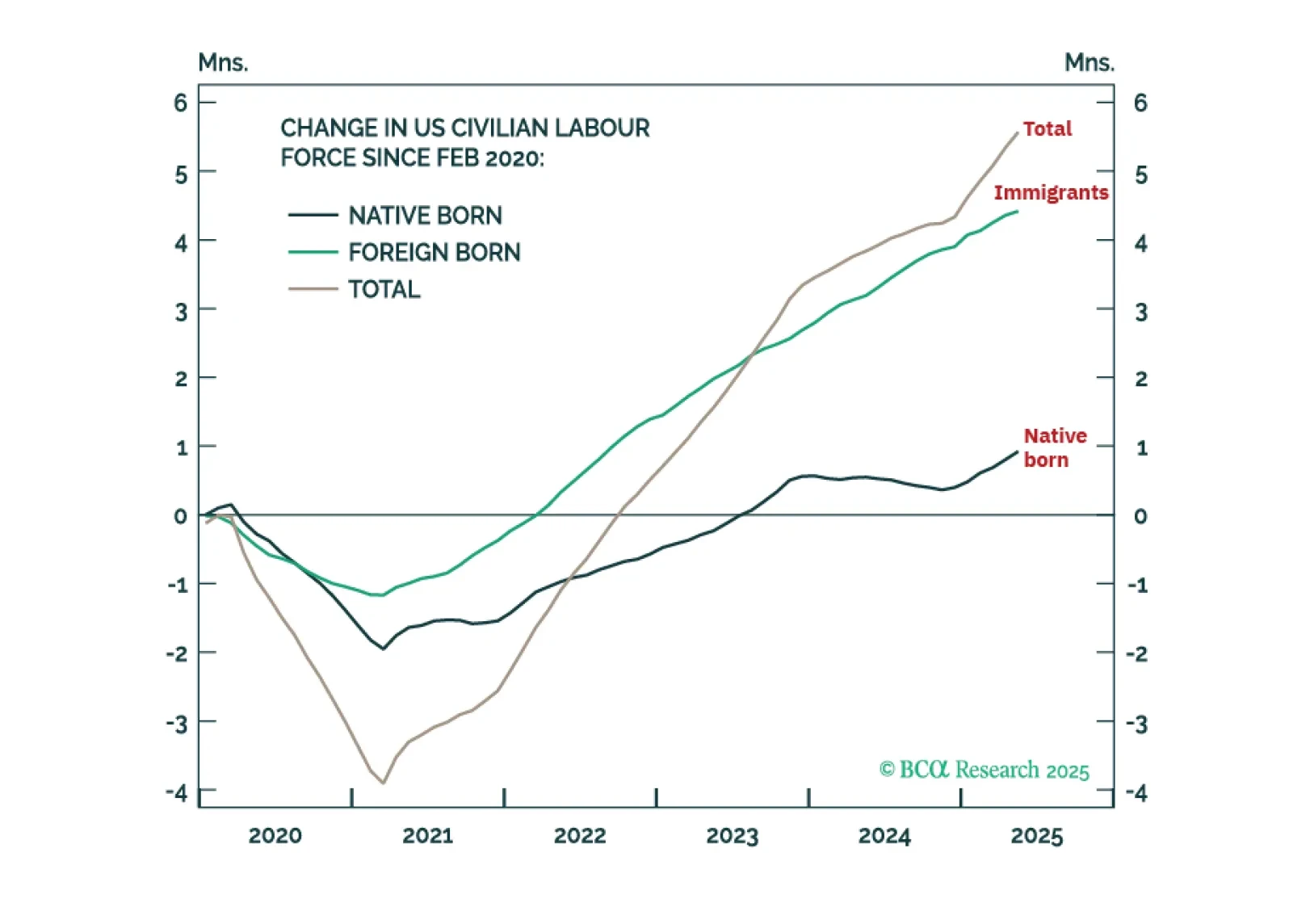

For the next few months at least, inflation risk trumps recession risk for both US markets and world markets. This because, correctly gauged, the US jobs market is still supply-constrained with ‘jobs looking for a worker’ exceeding ‘…

Although our recession conviction has risen, we conclude our strategy review by closing our equity underweight and our fixed income and cash overweights. AI momentum is too strong to have anything more than modest exposure to an…

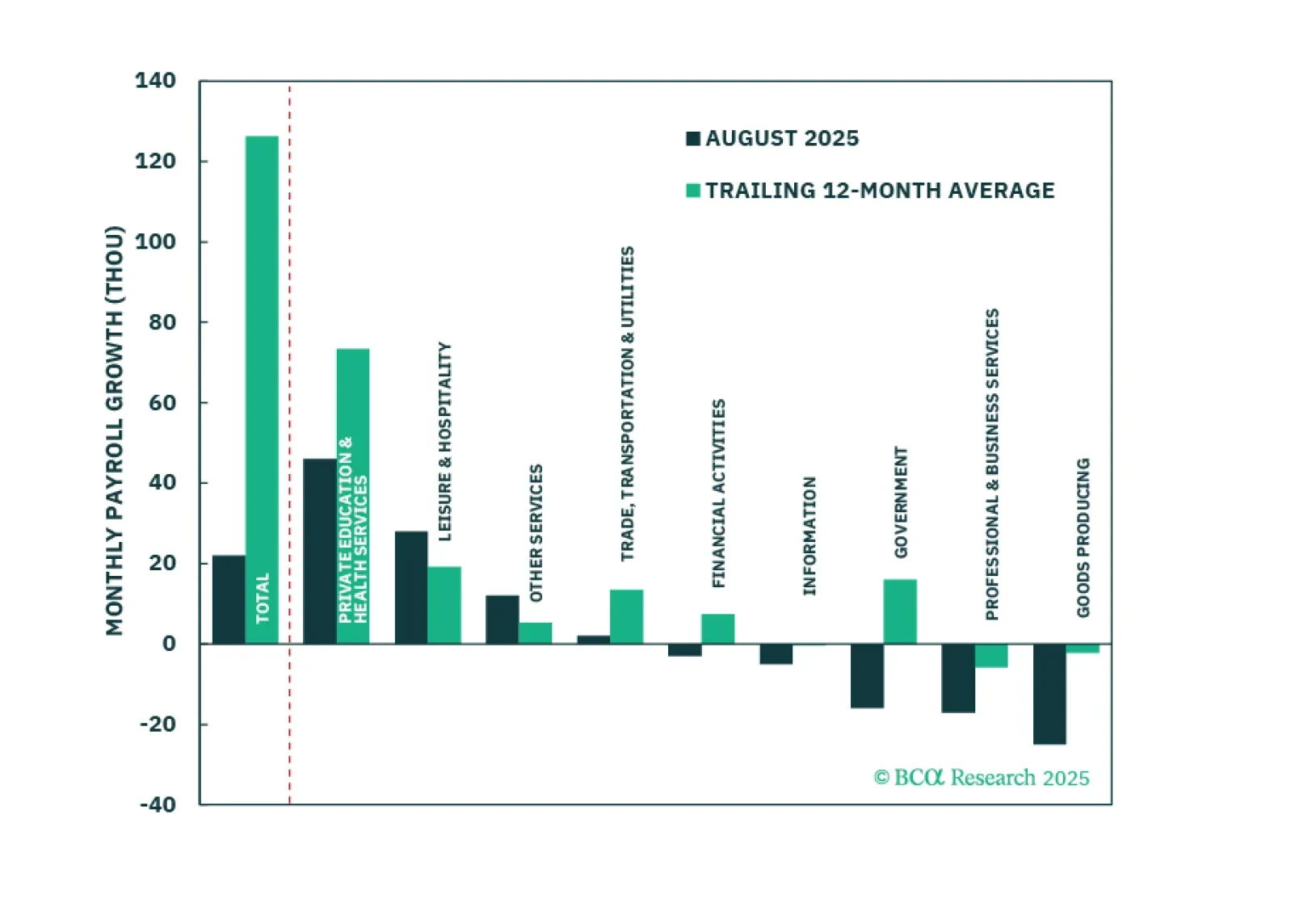

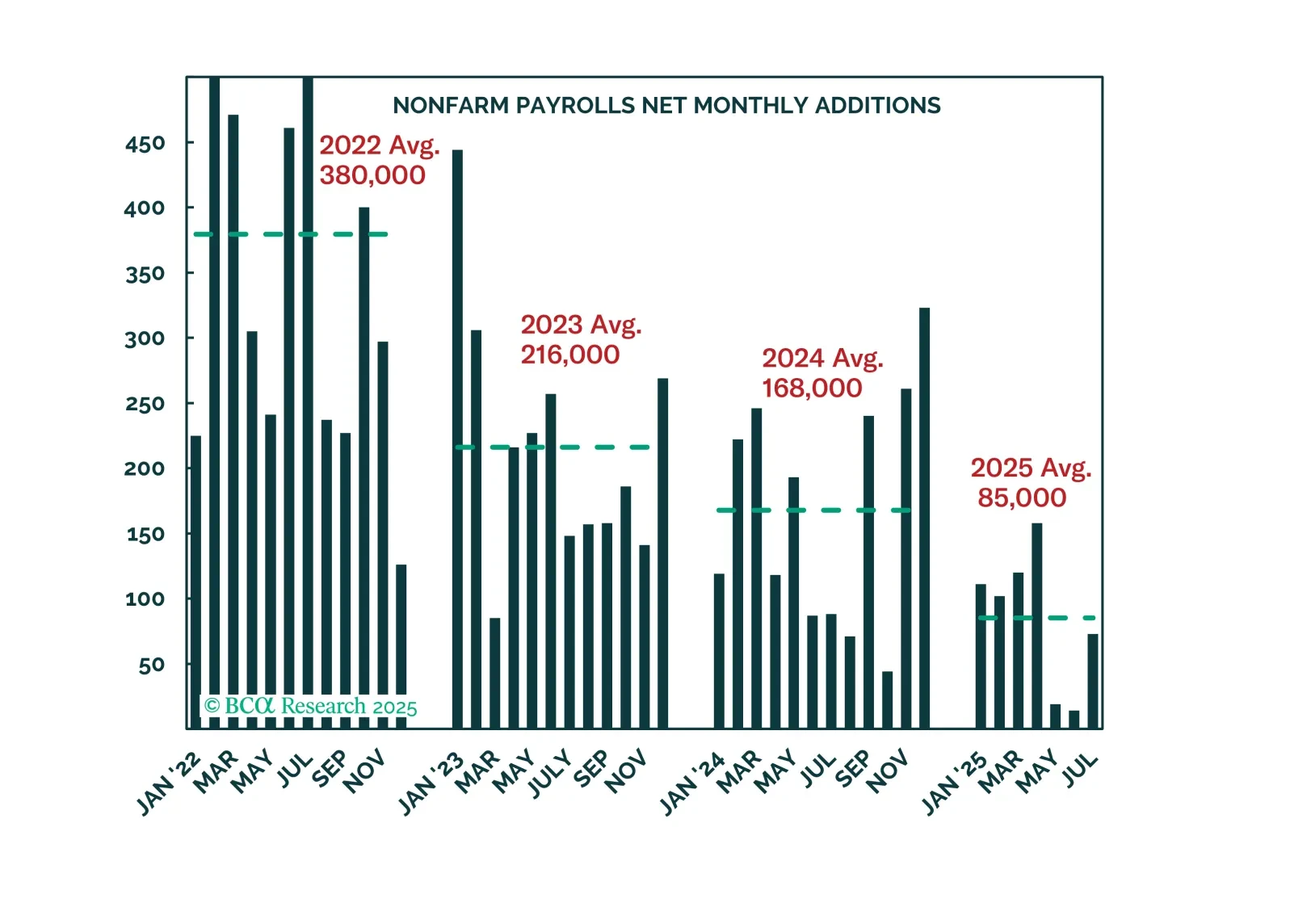

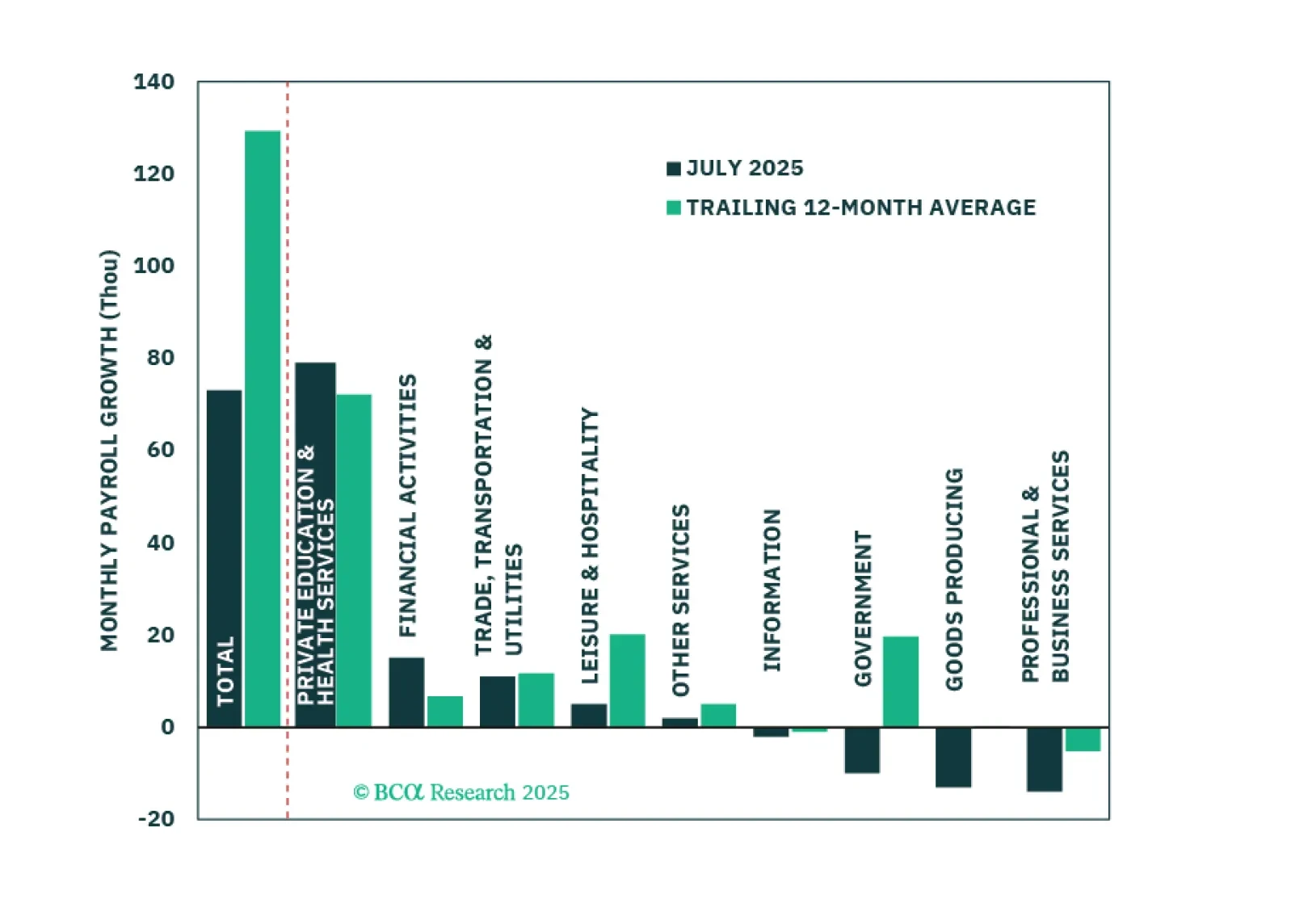

The August employment report showed a modest increase in labor market slack, enough to cement a 25-basis-point rate cut this month.

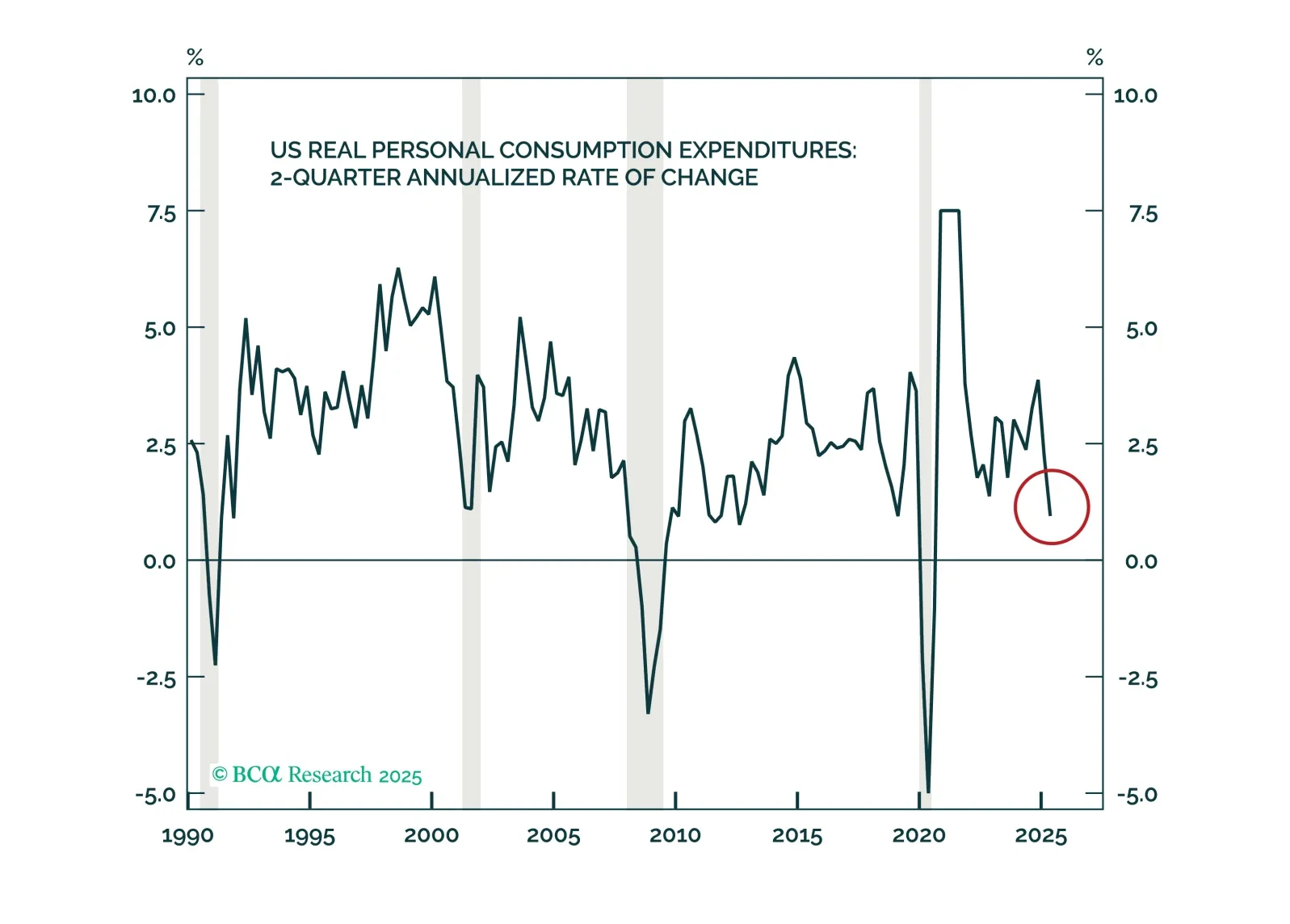

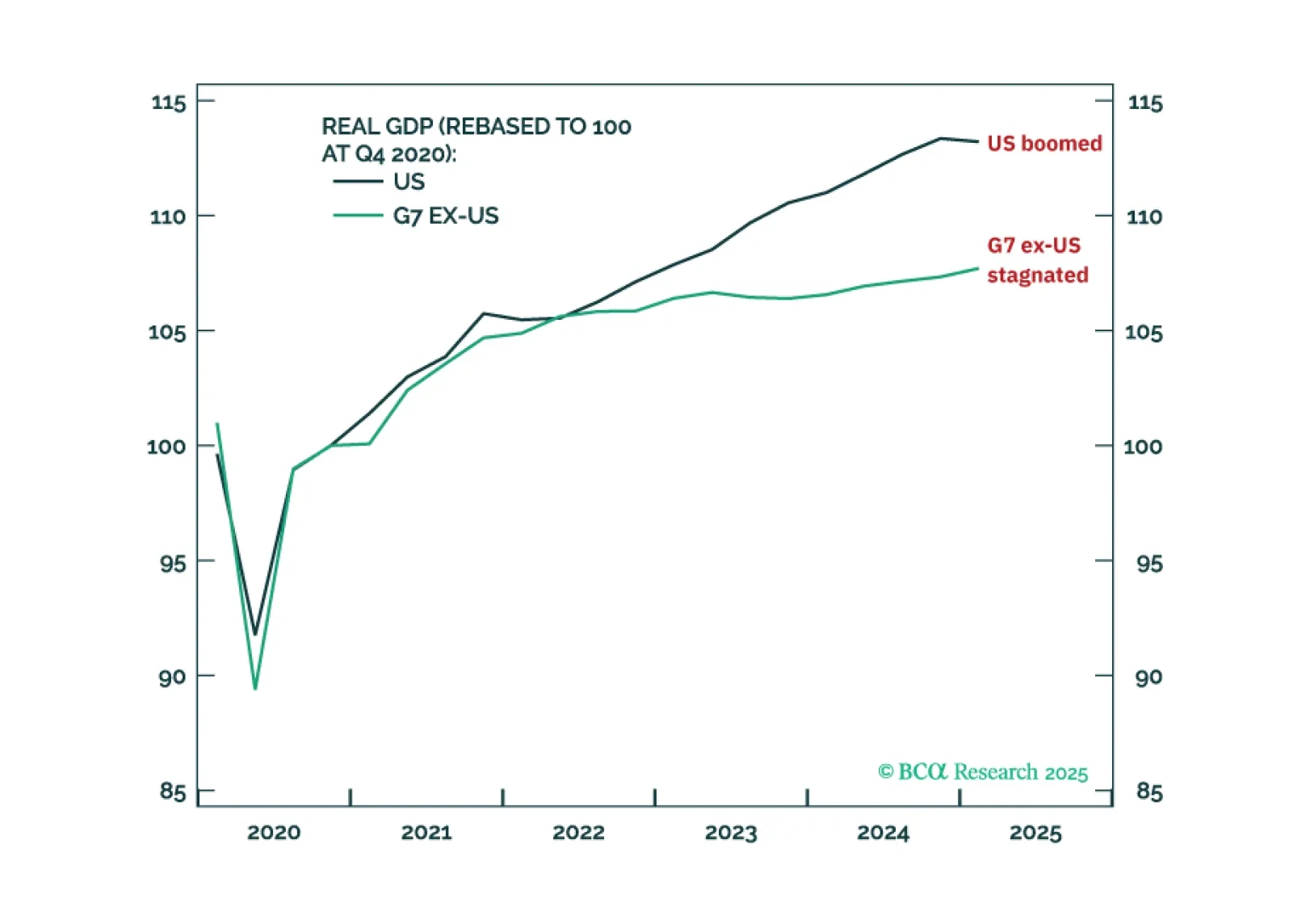

Economic activity plainly slowed in the first half, led by decelerating consumption and payrolls growth, but financial markets didn’t care. If the next two weeks of data don’t indicate that the May-June slowdown stretched into July…

Data received since we began reassessing our bearish stance supported our notion that the economy is not as strong as the investor consensus perceives. But the softness will likely have to intensify in July and August to preserve our…

Economic activity and hiring cooled significantly in the first half of the year. The most important question for investors is whether this signals an imminent increase in labor market slack.

The fact that the US economy has been slower to deteriorate than in past cycles is entirely consistent with our kinked Phillips curve framework. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

Euro area and Chinese interest rates must fall much further to prevent monetary policy from becoming ultra-restrictive. But Trump’s attempts to force unwarranted rate cuts from the Fed risks a vicious backlash from the bond…

Trump’s immigration policies are protecting the US economy from a sharp rise in unemployment but steering it into a ‘mini stagflation’. Plus: a new tactical trade is to underweight global technology (IXN).