In the absence of official government data, investors are turning to alternative sources to gauge the direction of the US economy. Our analysis of this data suggests that the economy has continued to expand at a moderate pace over…

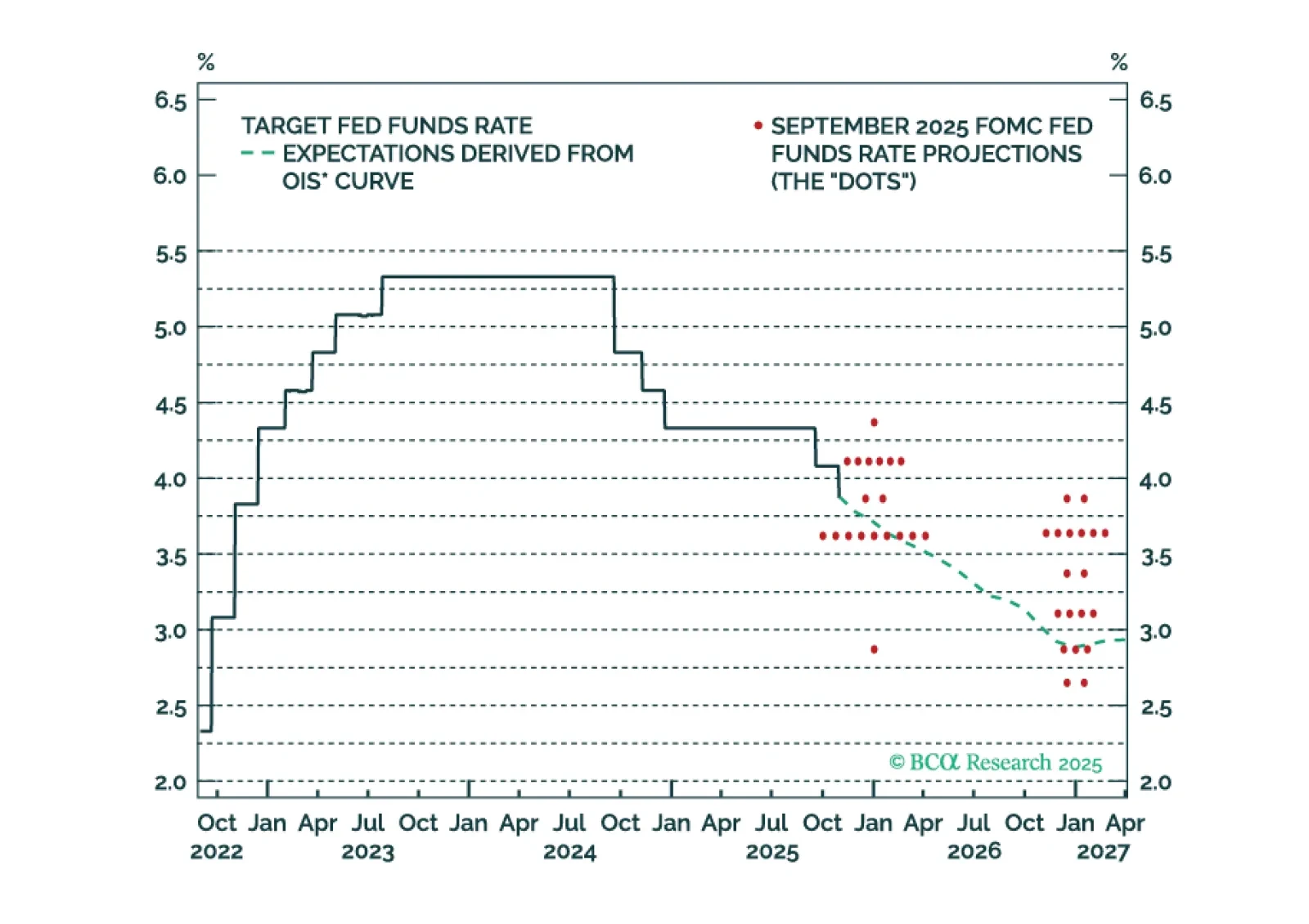

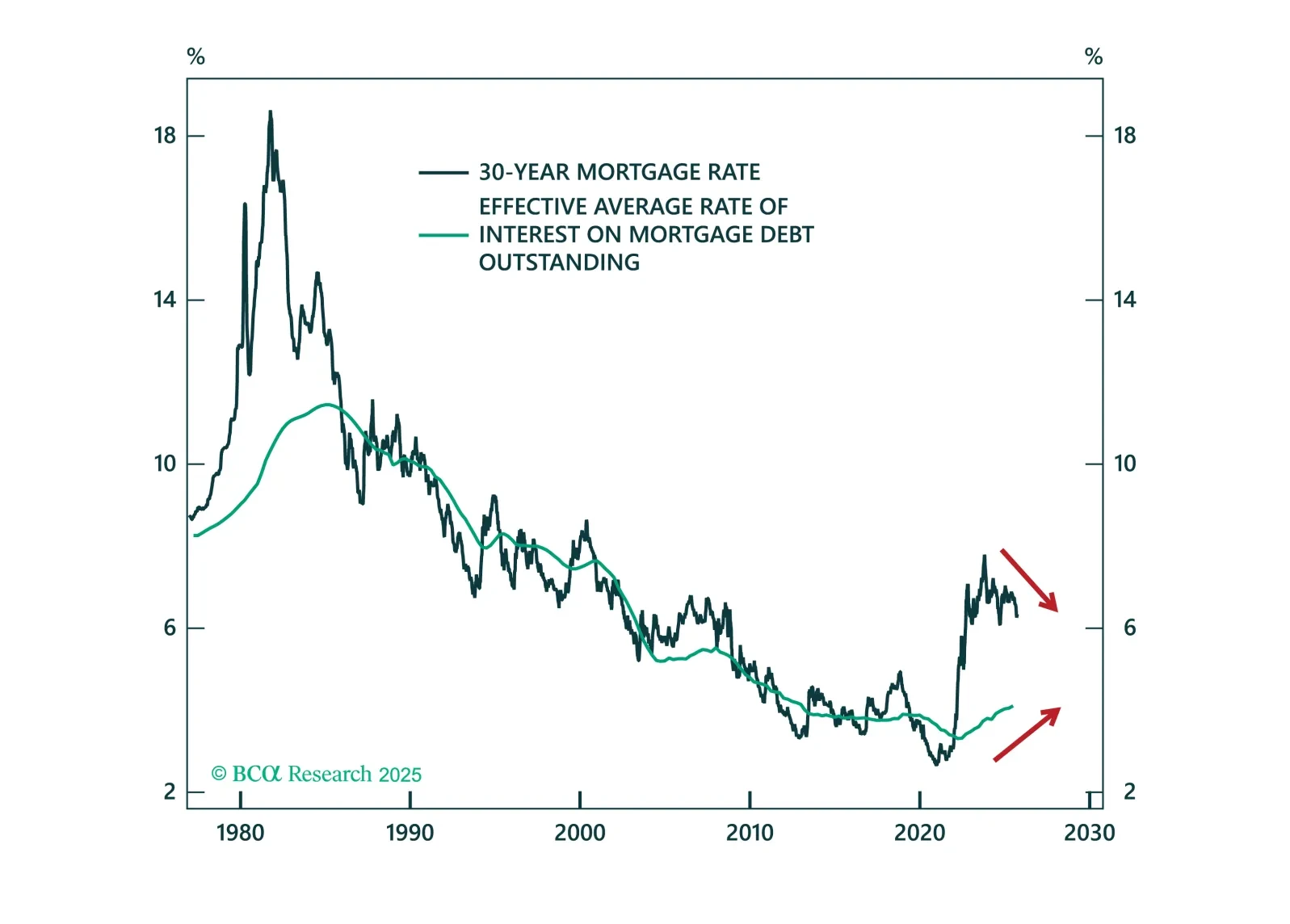

The Fed cut rates today, but a follow-up rate cut in December is uncertain. It will depend, in large part, on who wins a debate about the neutral rate of interest.

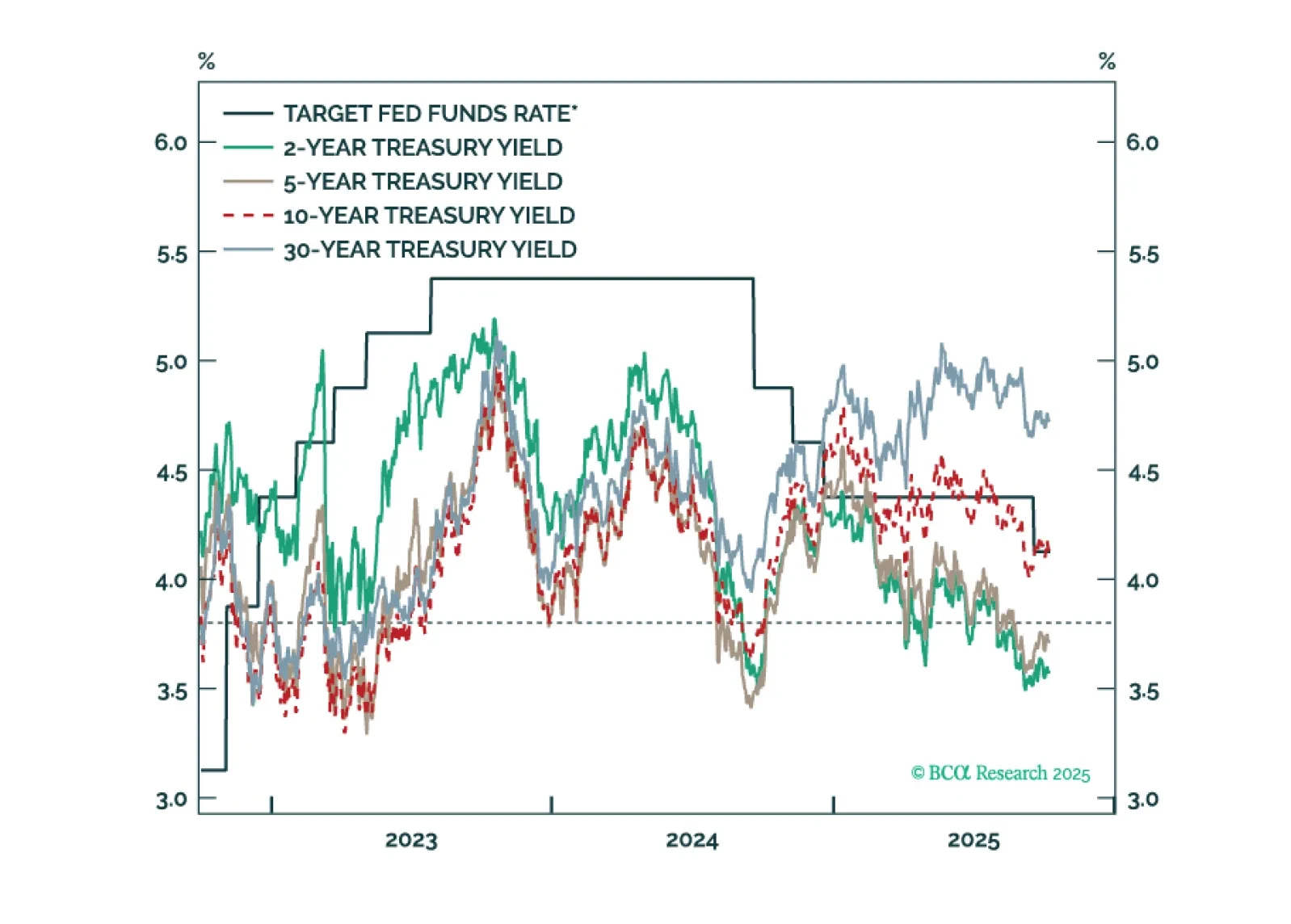

Treasury yields are generally following the pattern of past interest rate cycles, but with a larger term premium keeping the curve steeper than usual.

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

The K-shaped economy aptly describes the bifurcation between low- and high-end households but it’s not something investors should celebrate if they want the expansion to continue.

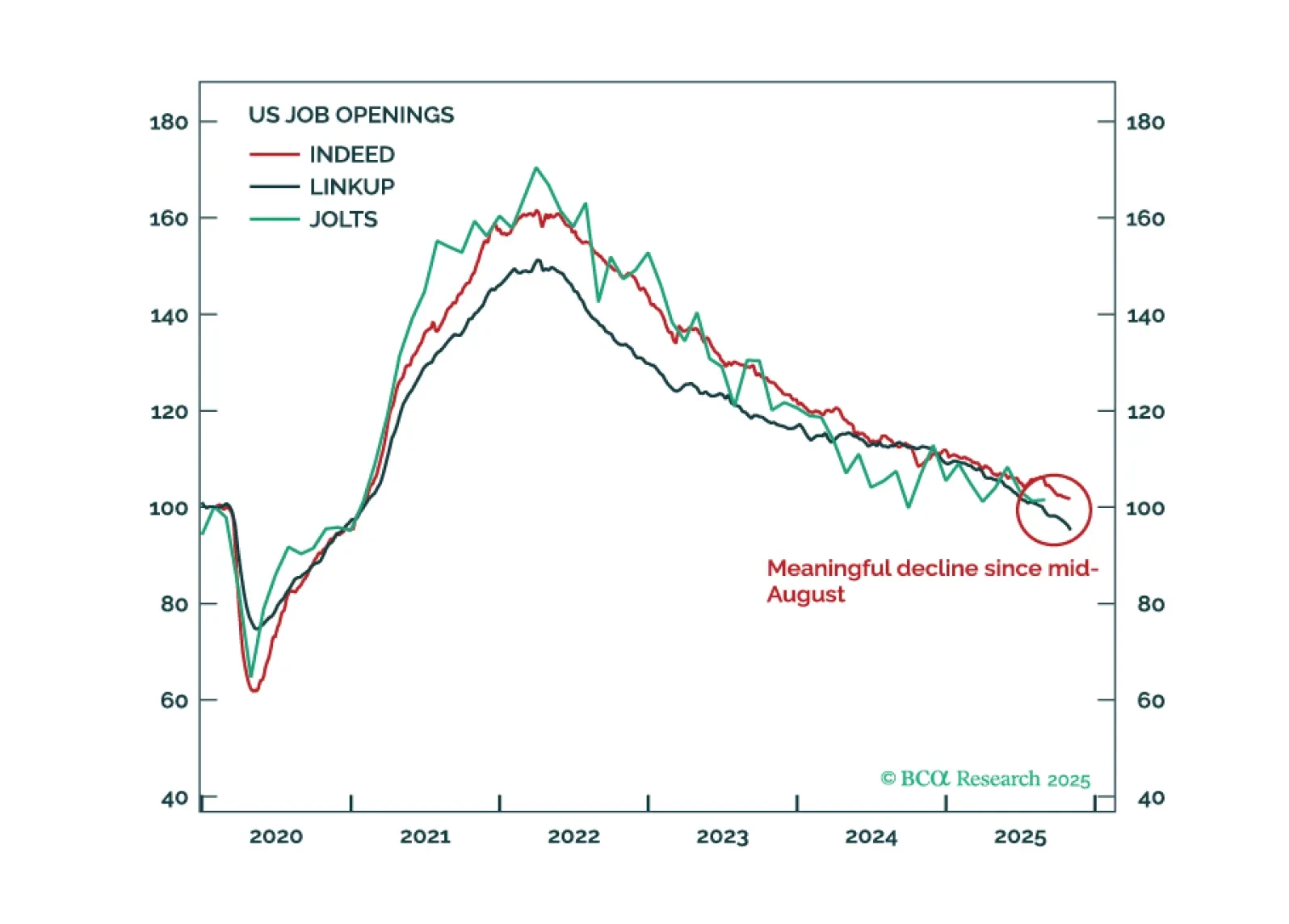

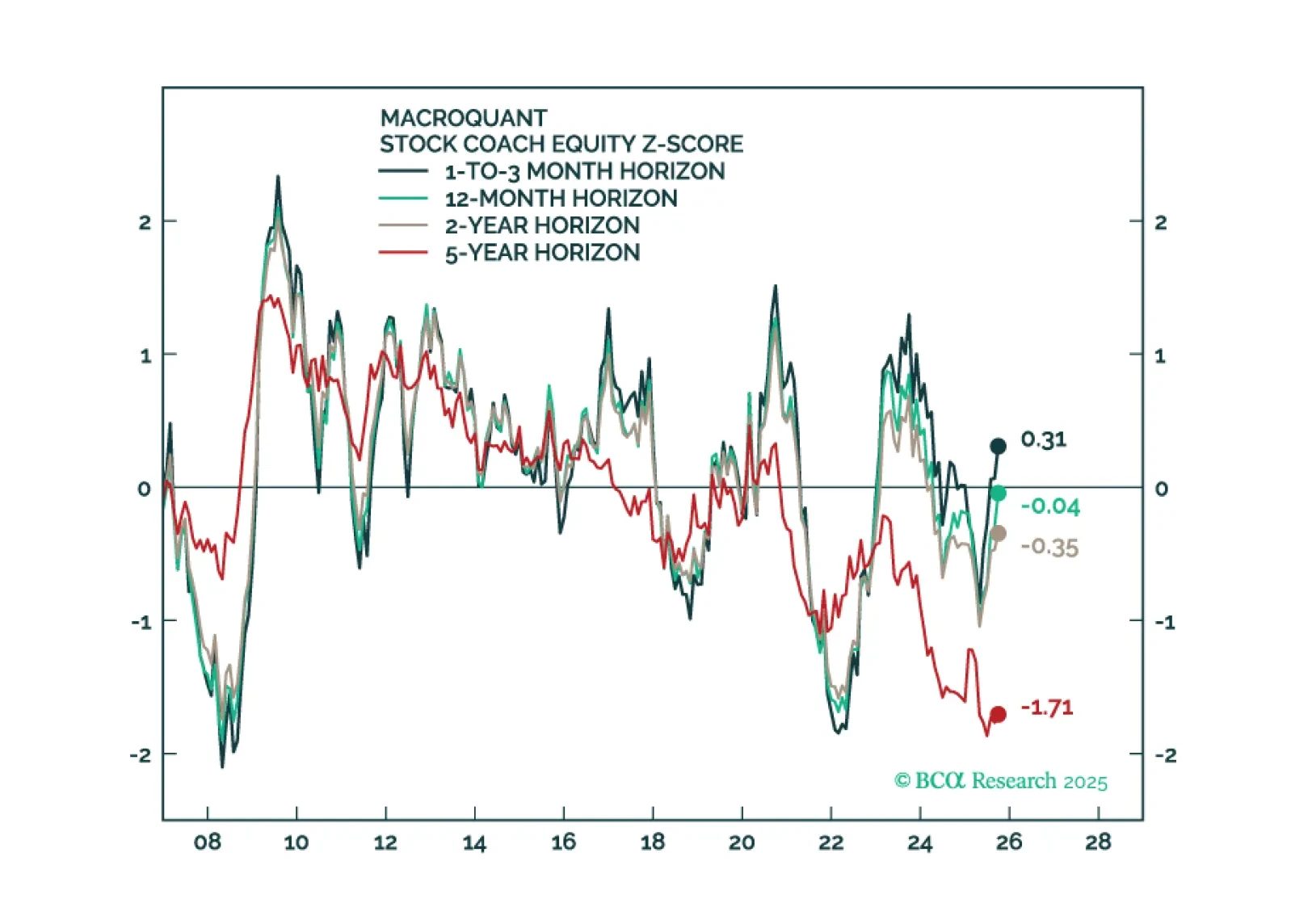

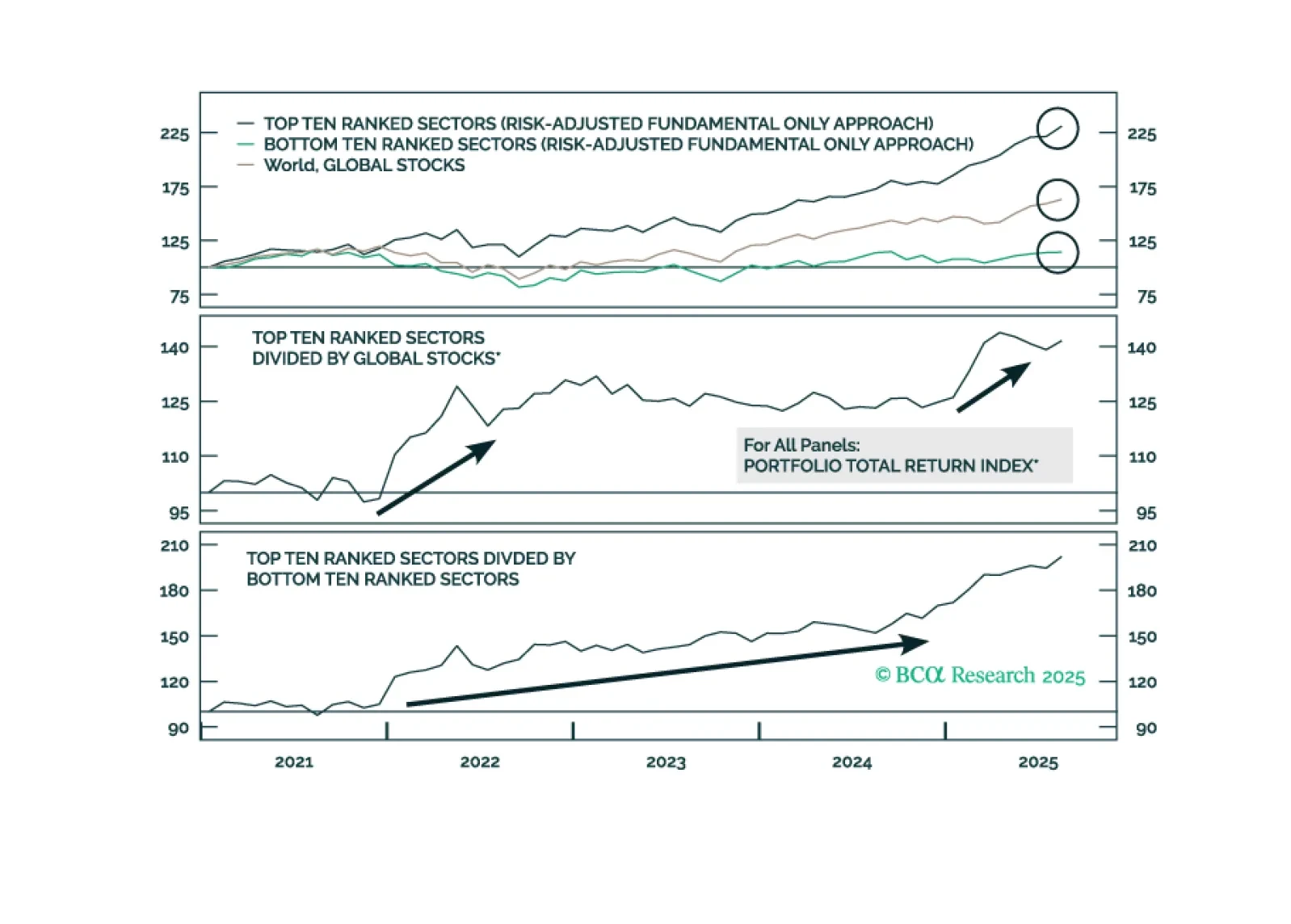

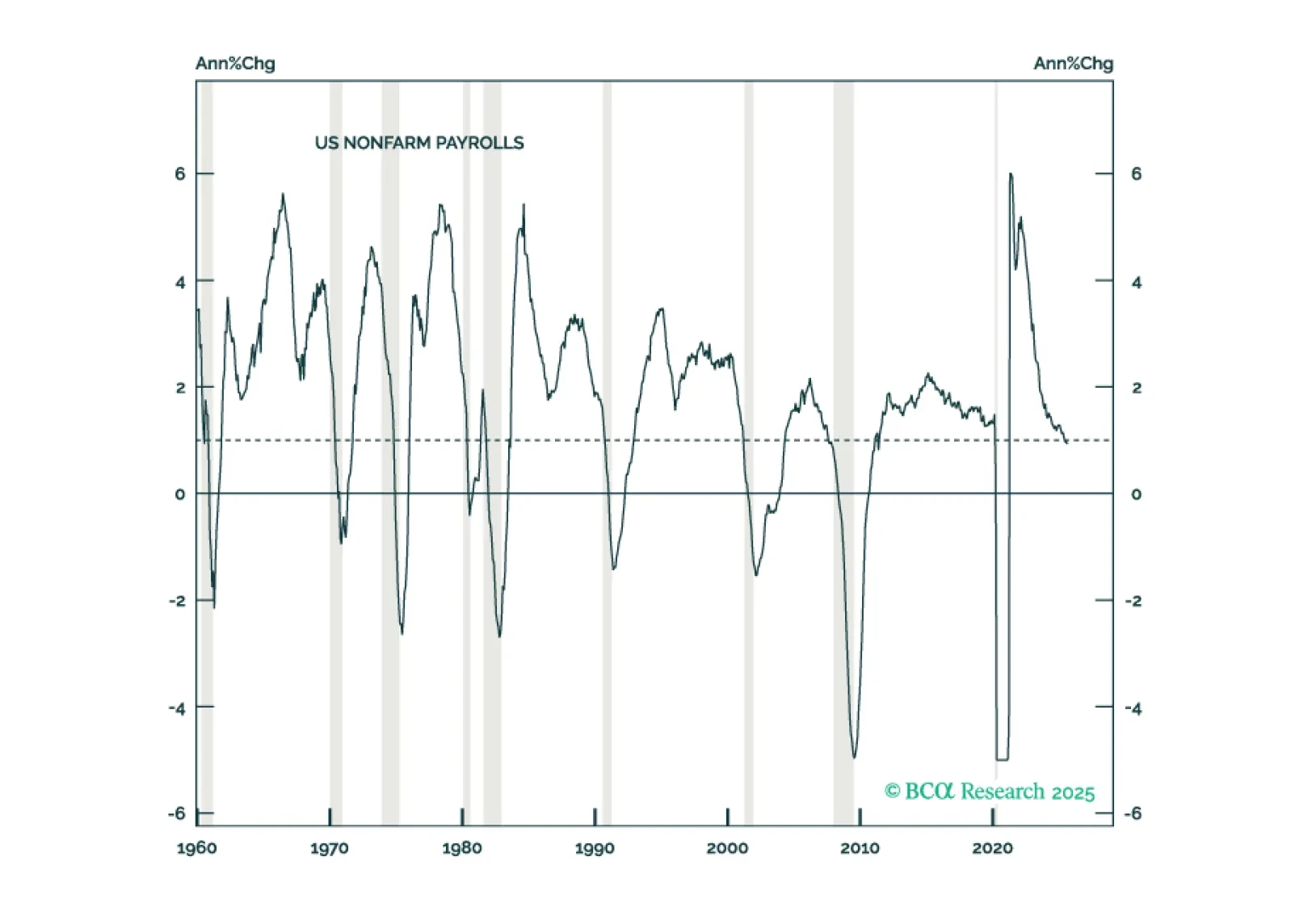

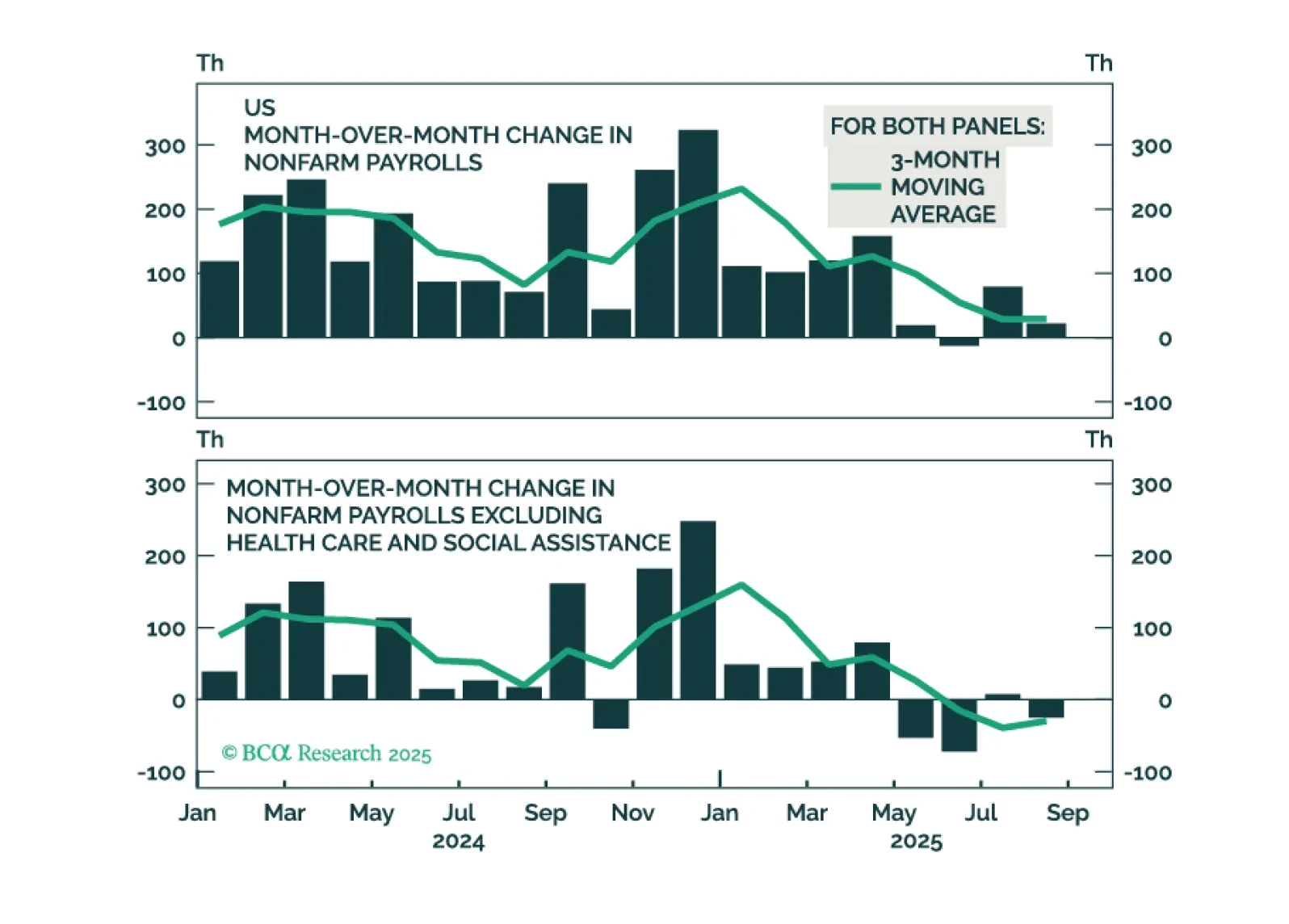

In Section I, Doug highlights that benchmark positioning in equities, fixed income and cash is now recommended. Still, the US macro situation warrants continual monitoring, given weakening labor market momentum. In Section II,…

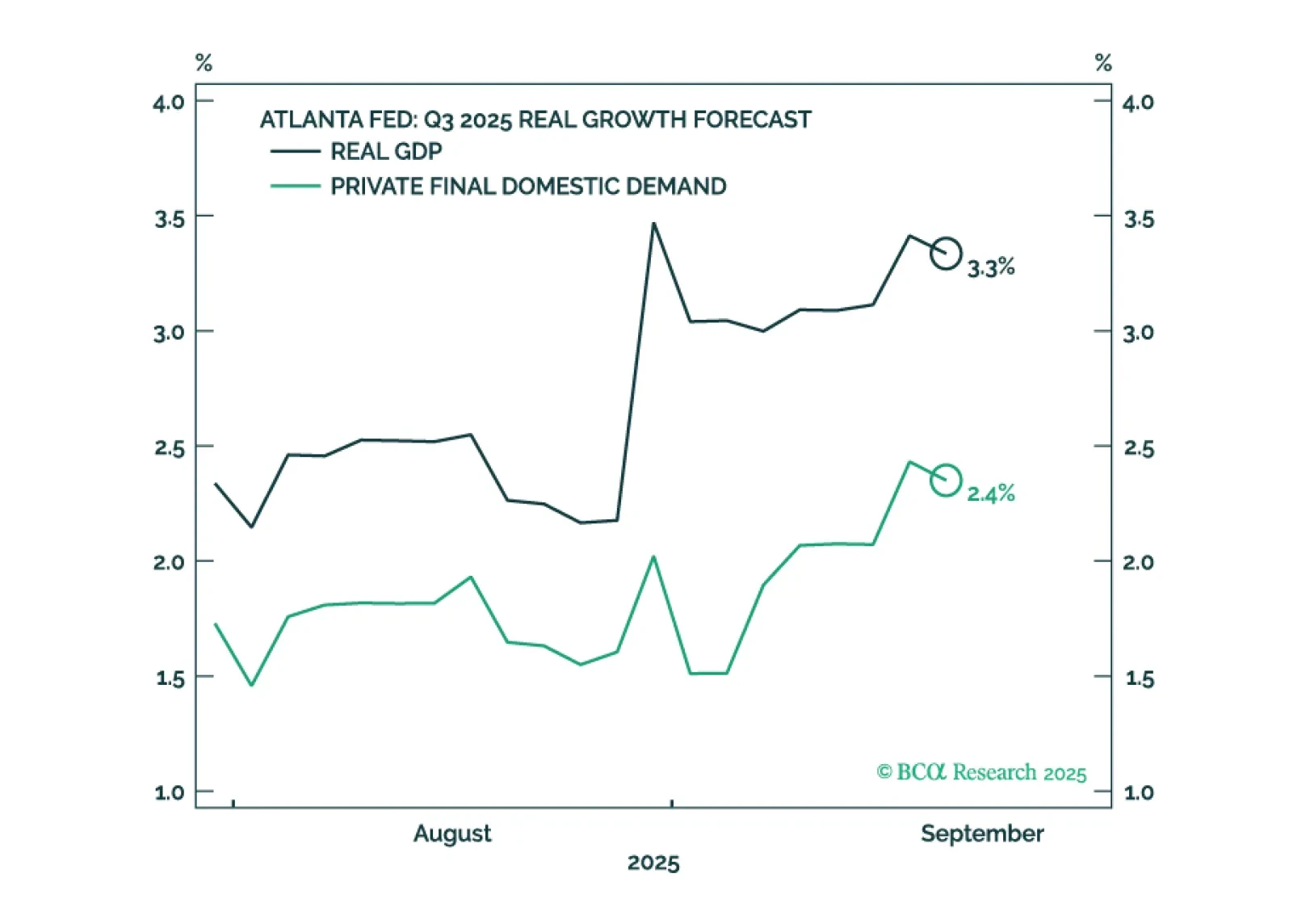

US GDP growth appears to have accelerated even as employment growth has faltered. We will make a final decision in early October when we publish our next Strategy Outlook, but most likely, we will cut our 12-month US recession…

While it is impossible to know exactly when global equities will peak, there are now enough vulnerabilities to justify keeping one’s finger near the eject button.

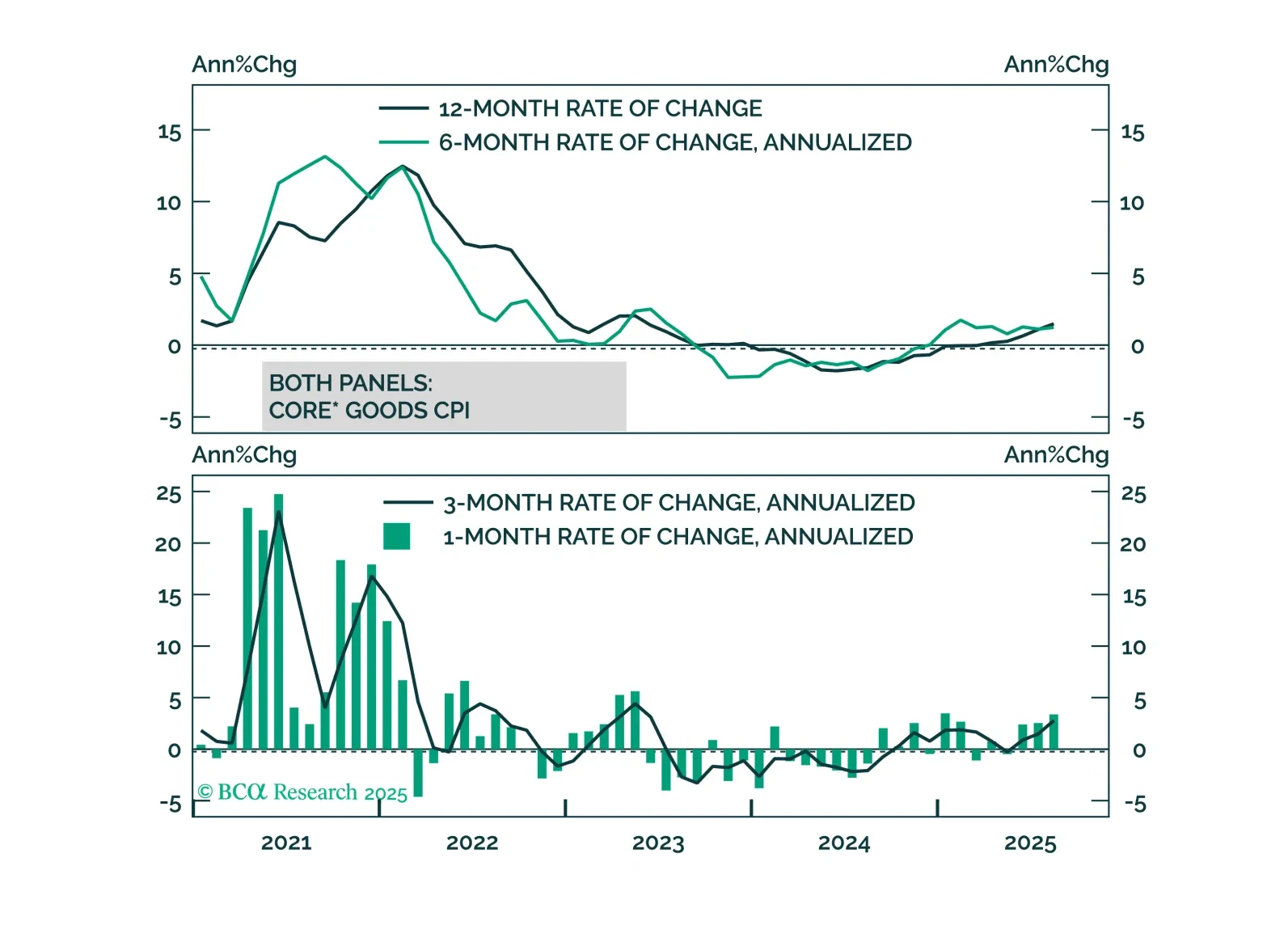

High US inflation is being driven by tariffs, not domestic inflationary pressure. This argues for Fed easing and a bull-steepening of the Treasury curve.