US Labor Market

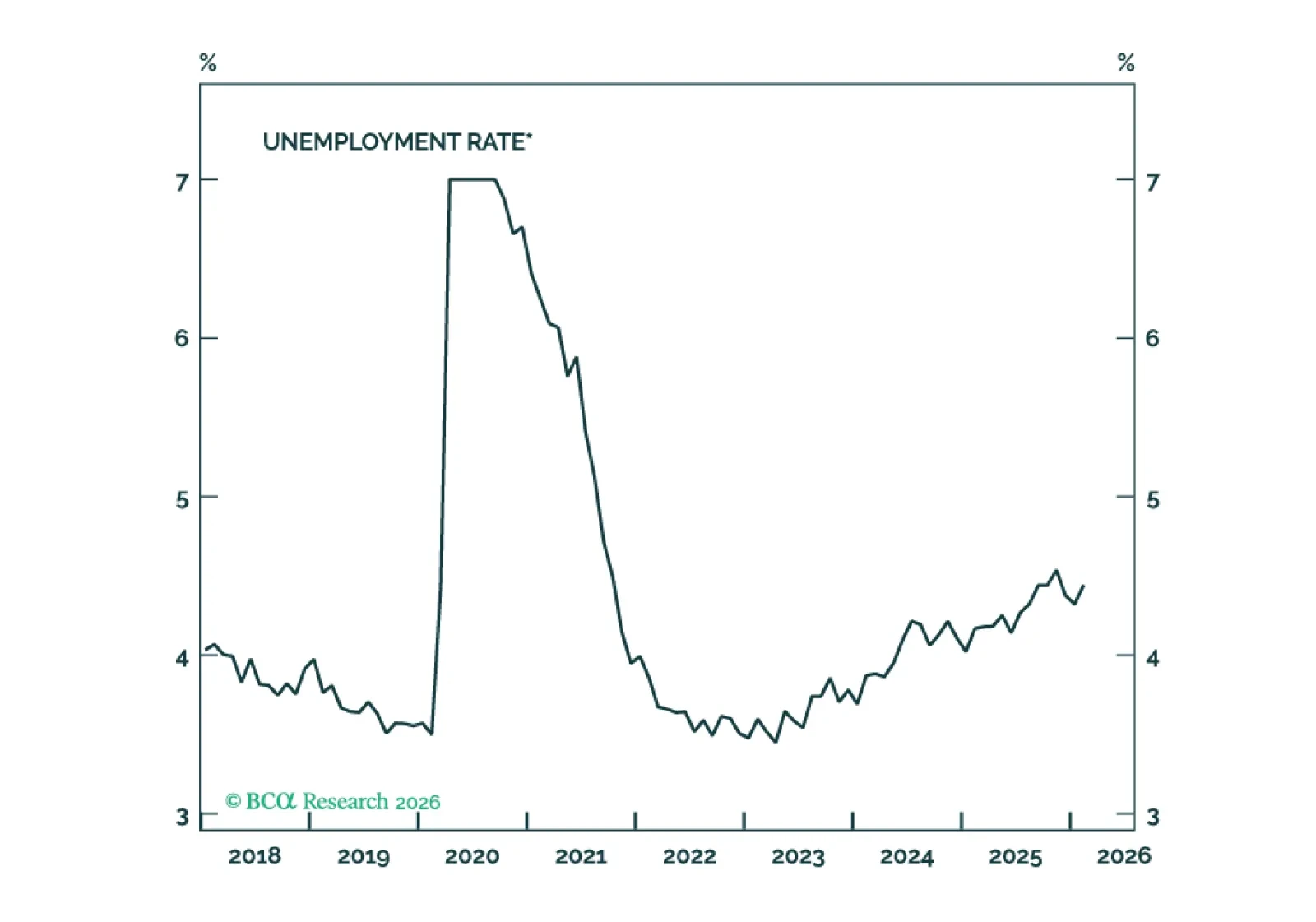

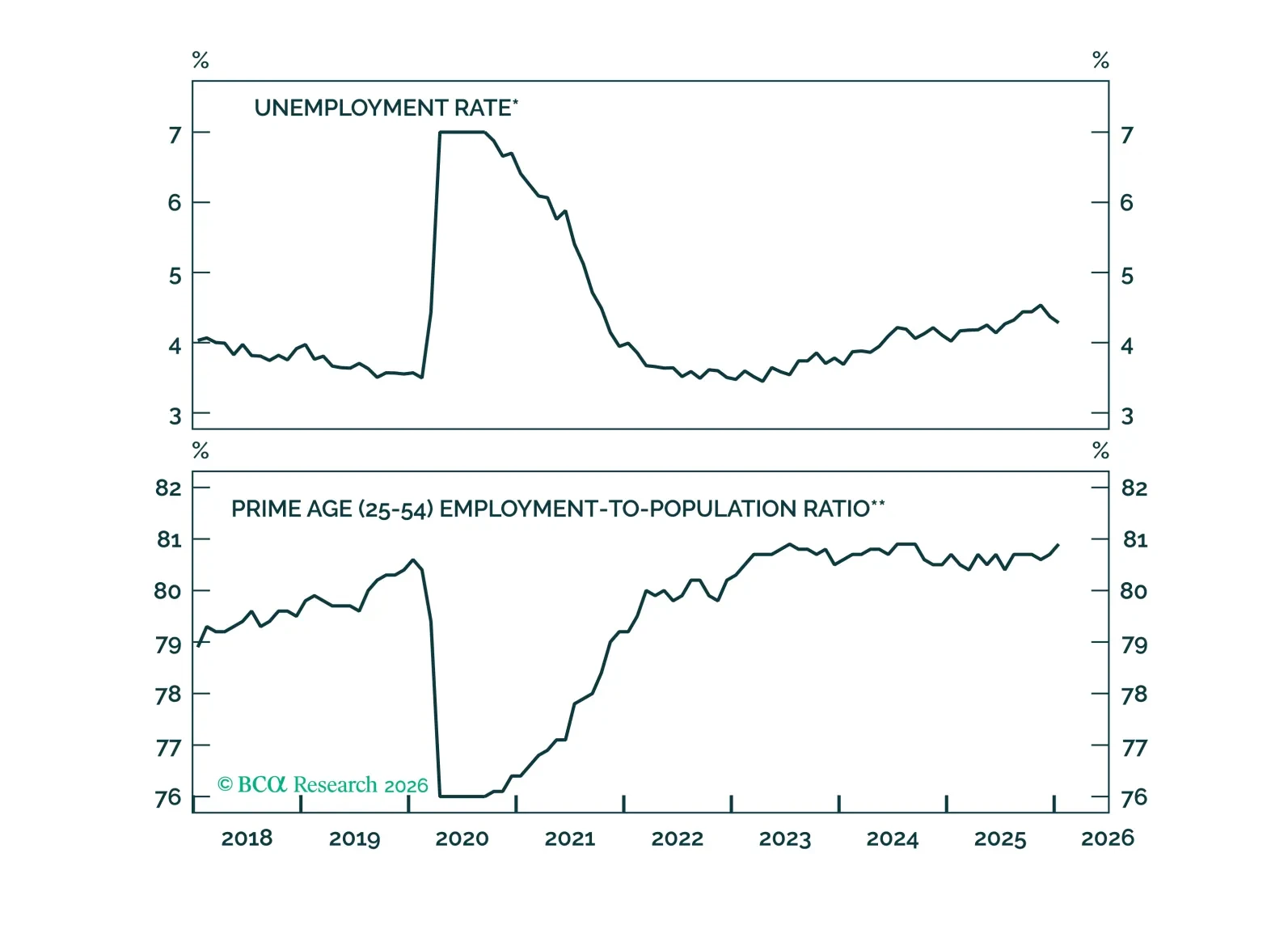

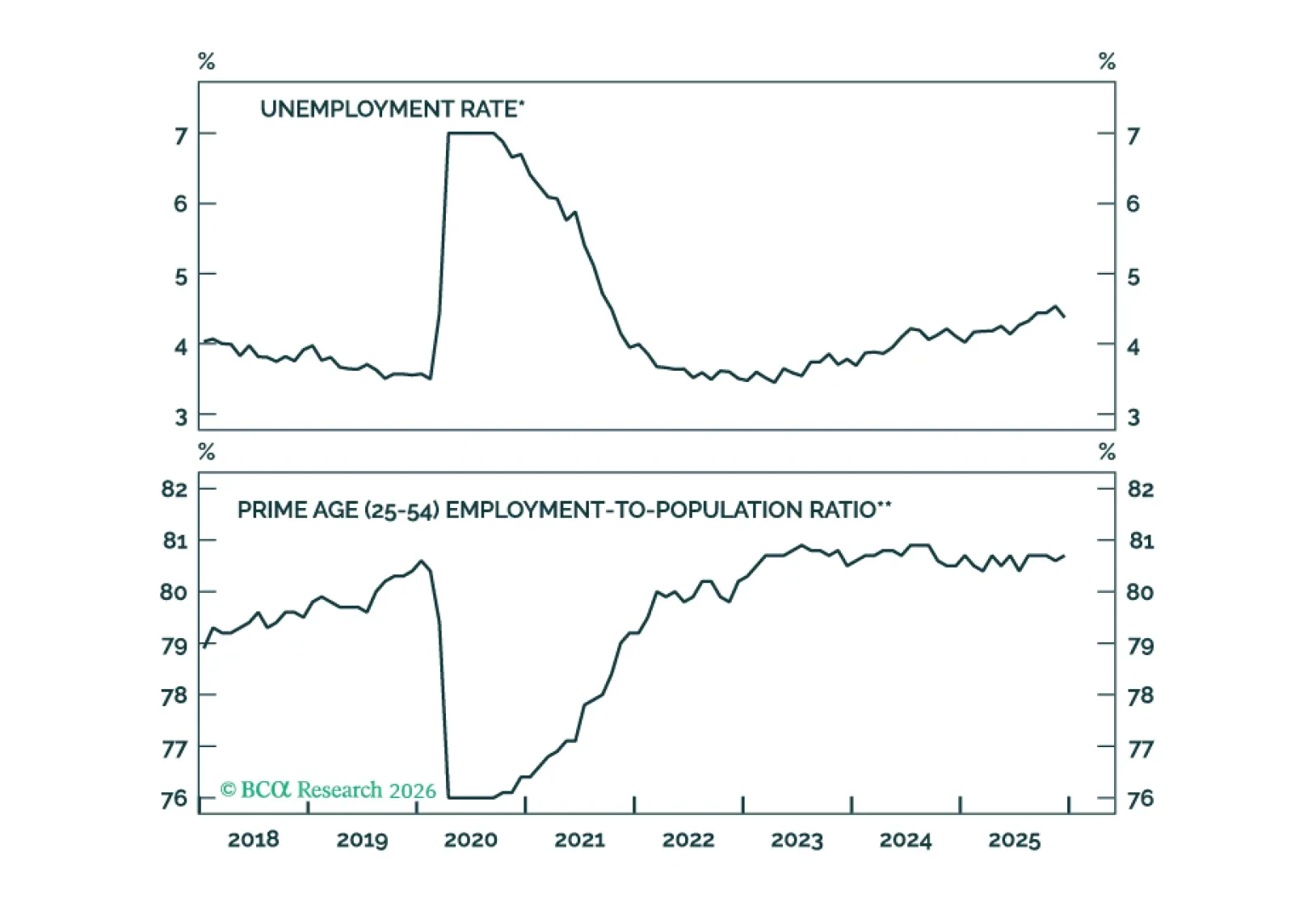

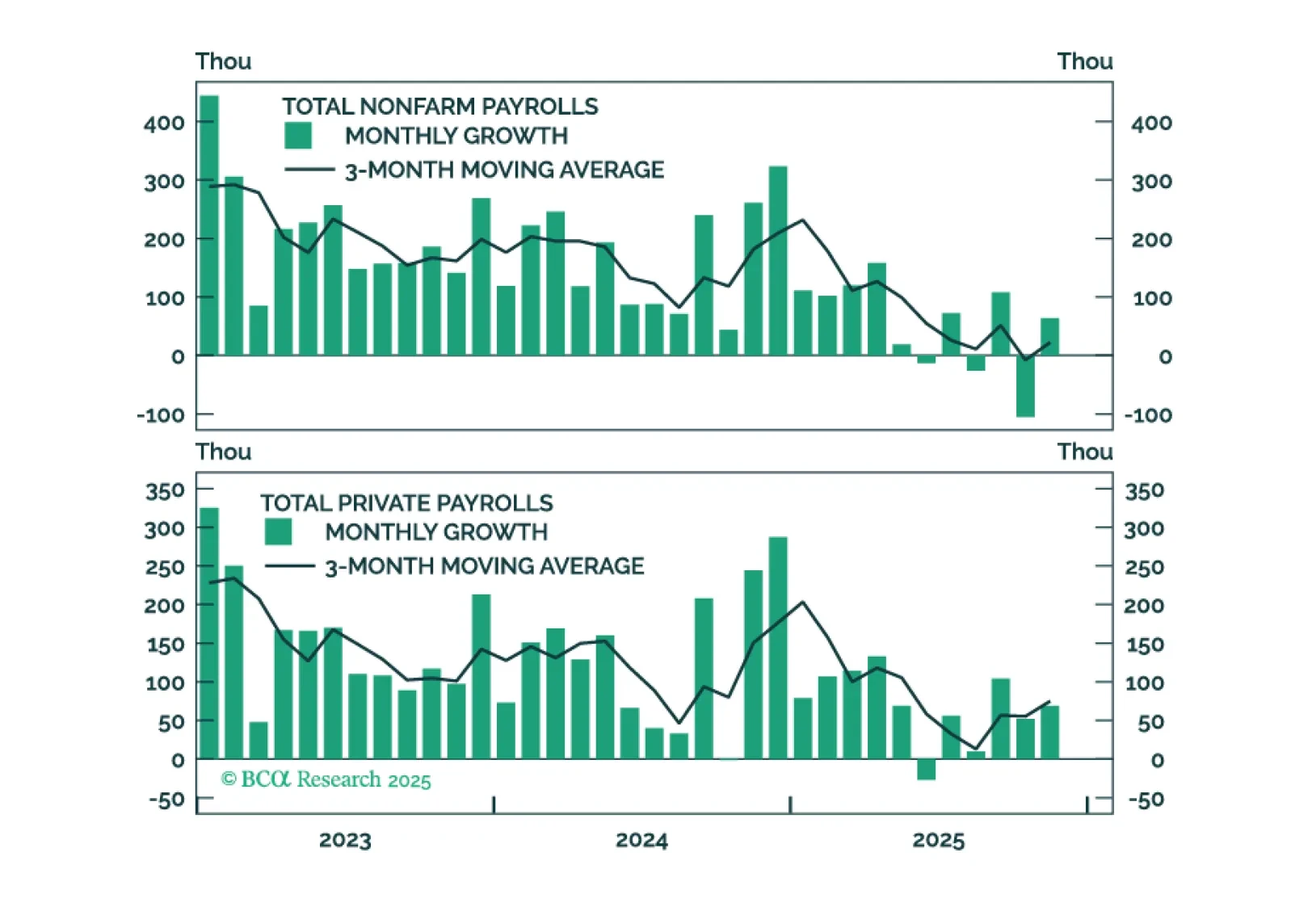

Looking through month-to-month volatility, job growth’s underlying trend is stable and consistent with a flat-to-slightly higher unemployment rate.

In Section I, Doug recommends cutting US equity exposure in favor of Europe as reduced recession odds make it unlikely that the US will draw safe-haven capital flows. In Section II, Jesse ranks middle economic powers across hard and soft power dimensions and recommends investing in their defense and industrial sectors.

In Section II, Jesse ranks middle economic powers across hard and soft power dimensions and recommends investing in their defense and industrial sectors.

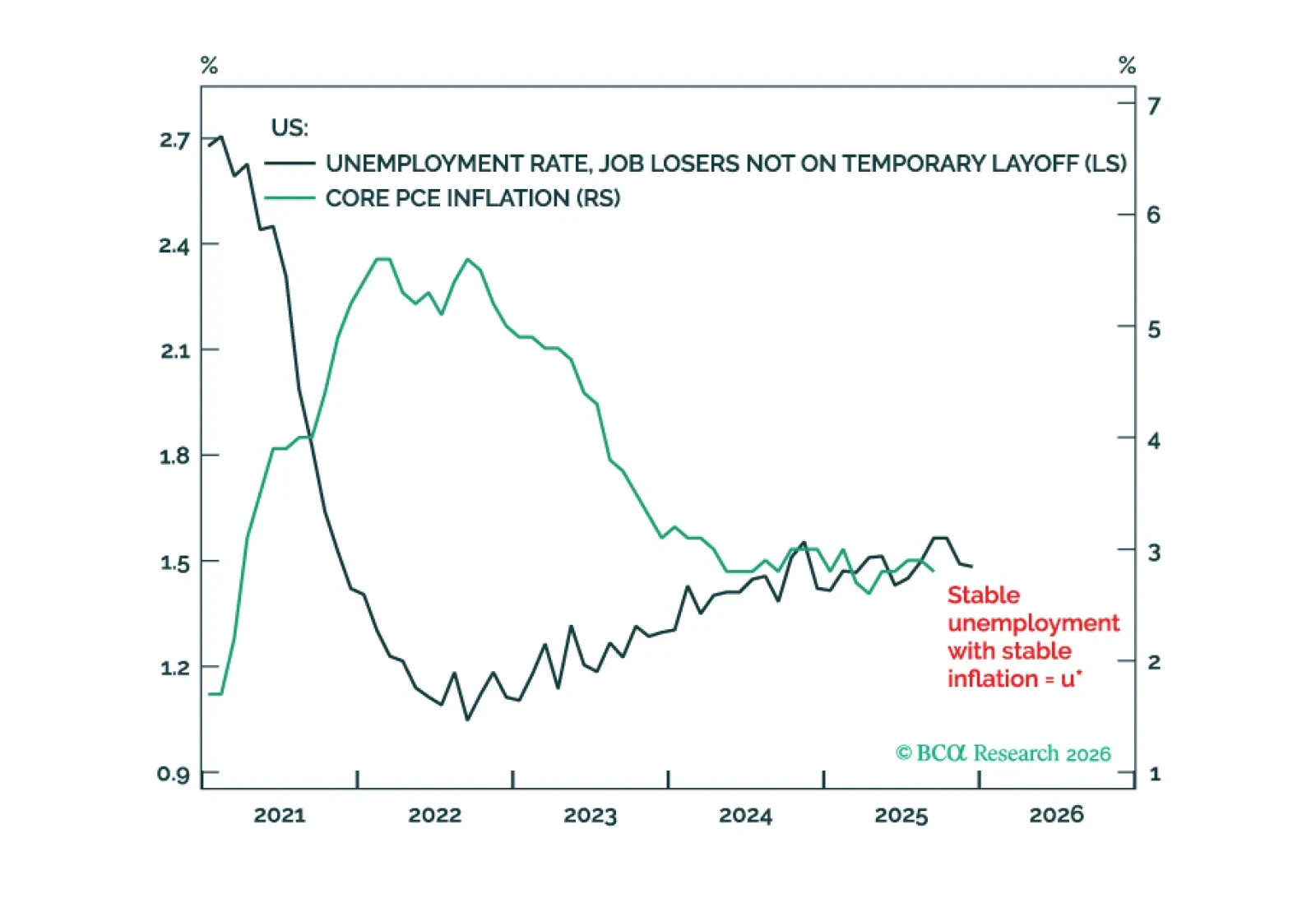

The labor market tightened in January, significantly lowering the odds of a H1 2026 rate cut. Rate cuts driven by lower inflation are still likely in H2 2026.

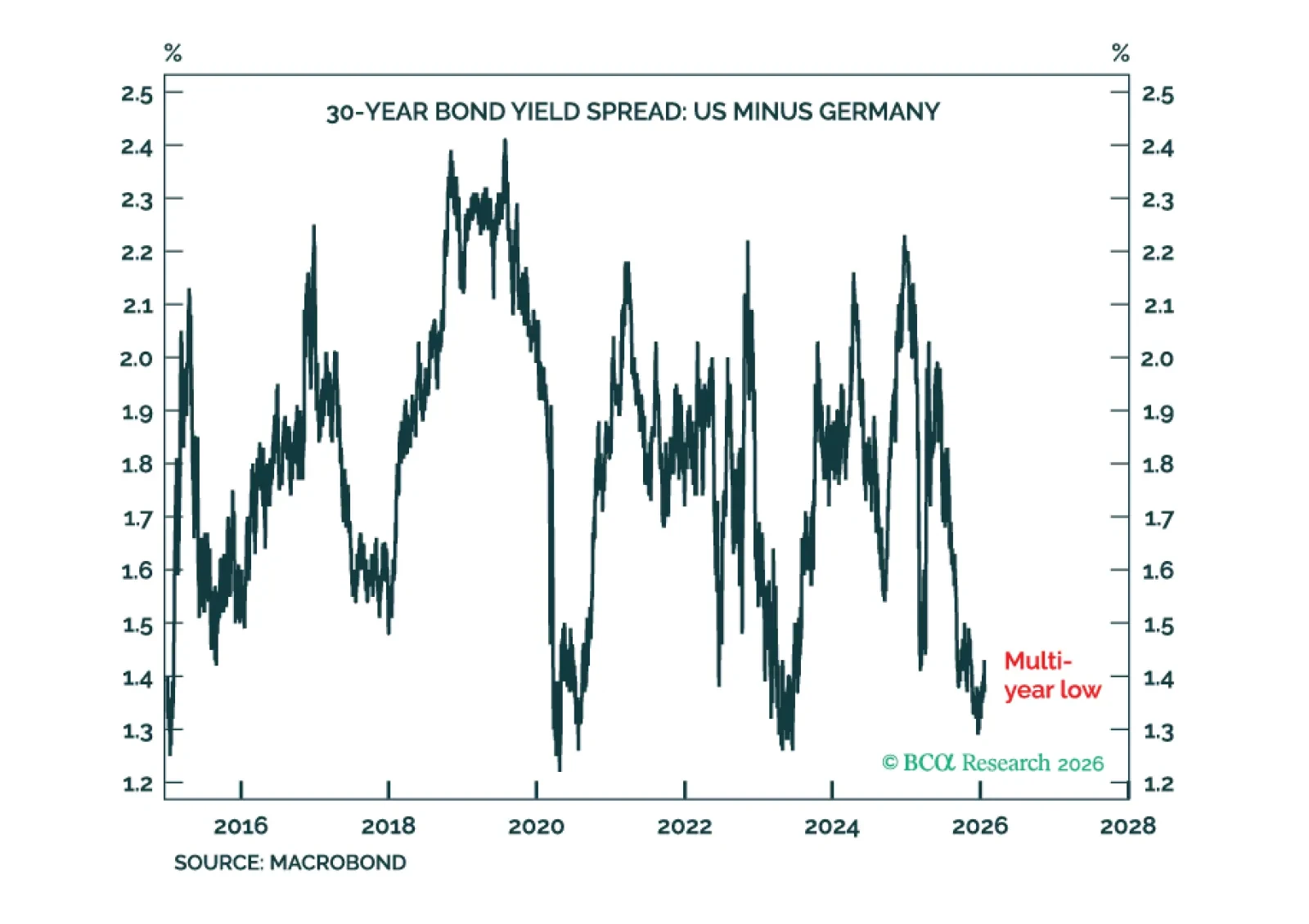

US Treasury yields require a higher premium for both geopolitical risk and inflation risk, but higher bond yields are not necessarily bad for stocks.

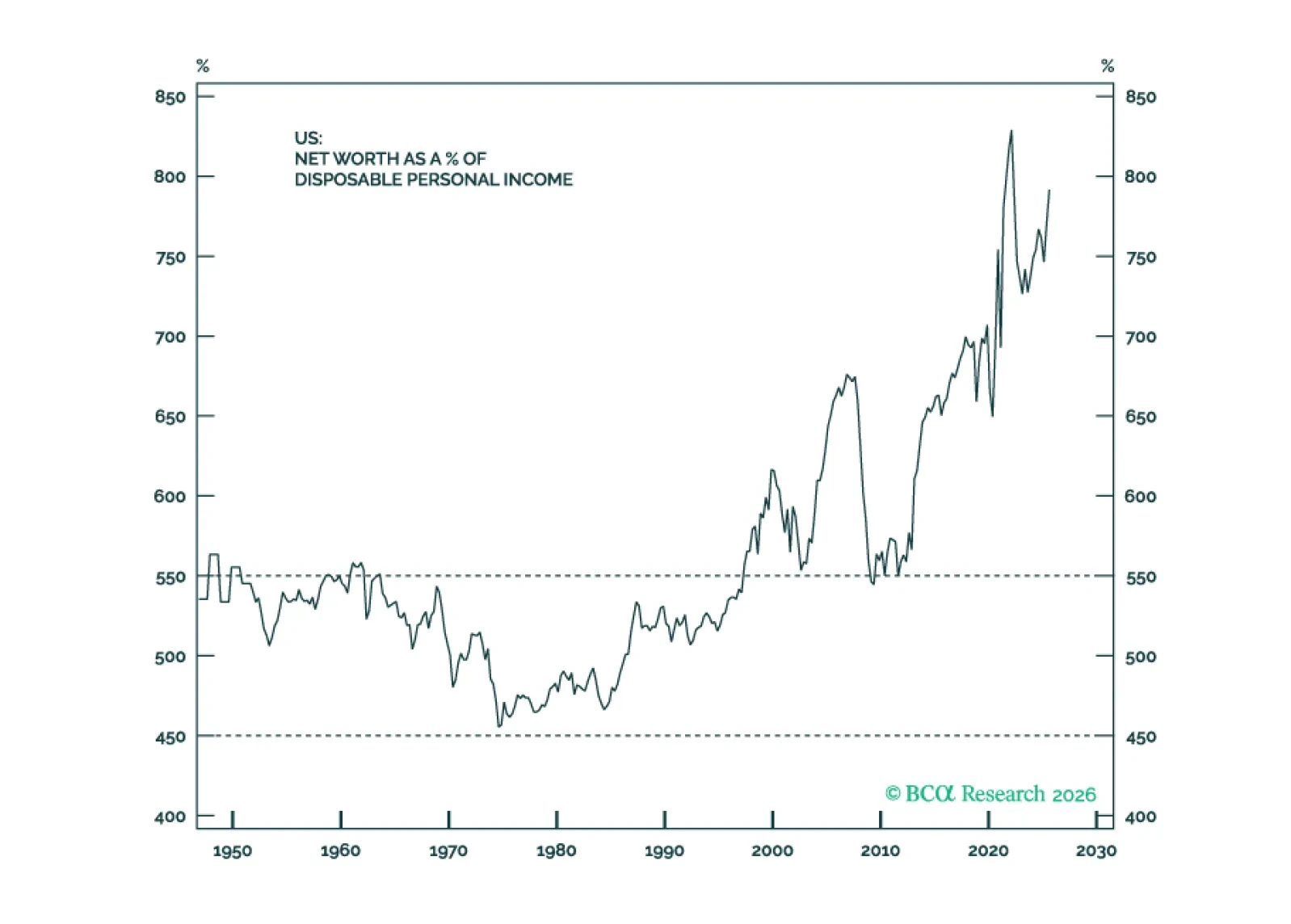

With the US unemployment rate and interest rate close to the ‘neutral’ u-star and r-star respectively, further Fed rate cuts risk pushing up inflation and long-term inflation expectations. This is bad for bonds but good for stocks. Plus, two new trades are: short TOPIX versus DAX; and short CAT versus SPX.

Measures of labor market utilization improved in December, ruling out a January cut and significantly reducing the odds of a March cut.

Employment Data Point To Dovish Policy Surprises In 2026

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.

Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30 PM CET) to discuss the economy and financial markets. We will also host a Webcast for APAC on Tuesday, December 16 at 8:00 PM EST (9:00 AM HKT+1 day).

And with that, I will sign off for the year. I wish you and your loved ones a very happy and healthy 2026. We will be back on Friday, January 2 with our MacroQuant Model Update.

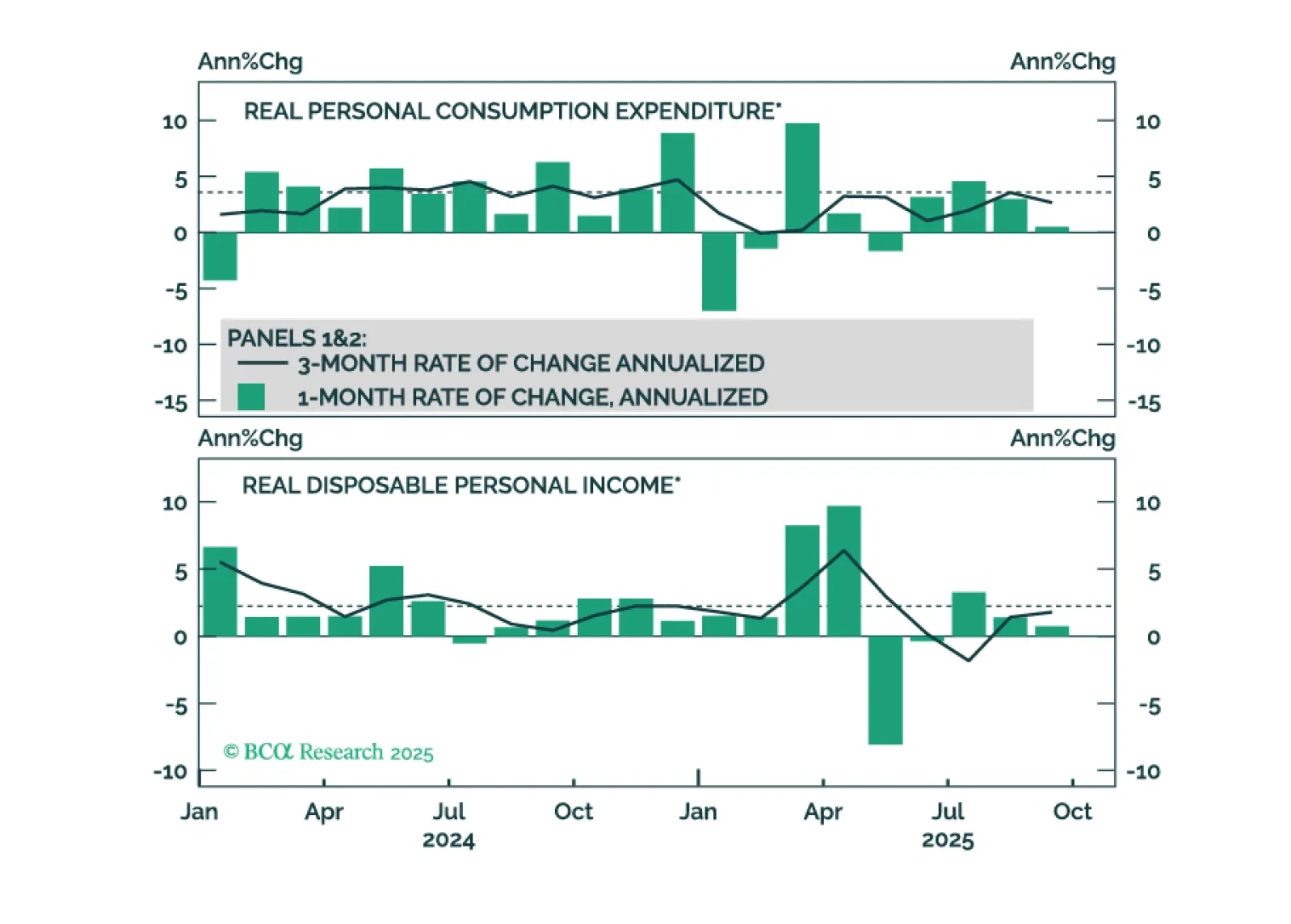

September’s weak consumer spending data challenge the K-shaped recovery narrative and suggest that spending will slow to match already-weak employment growth.