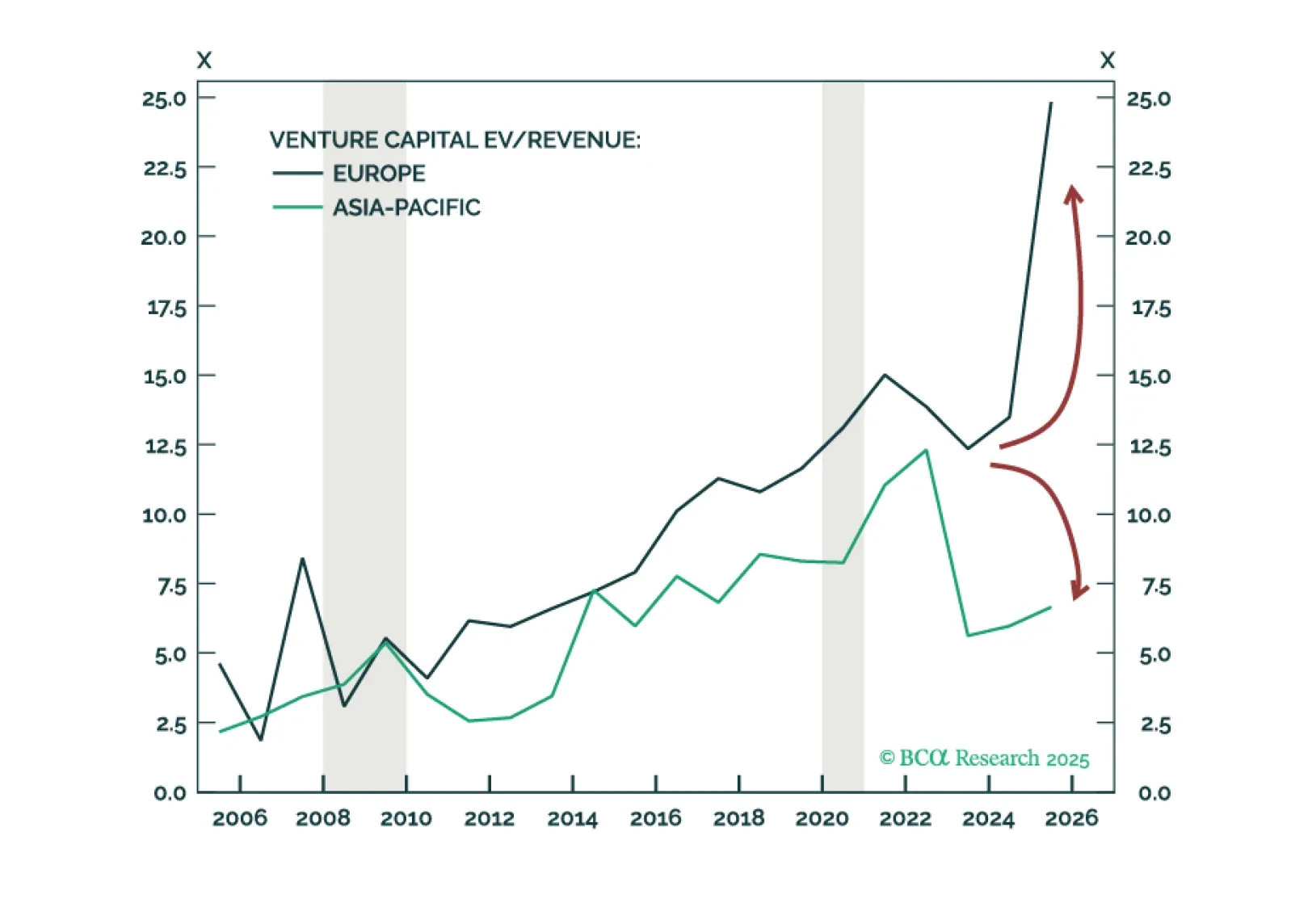

European euphoria is overdone. The most exceptional asset class in Europe is Infrastructure, but granular opportunities span other asset classes by sector and country. Venture Capital is a North America and Asia-Pacific play. We…

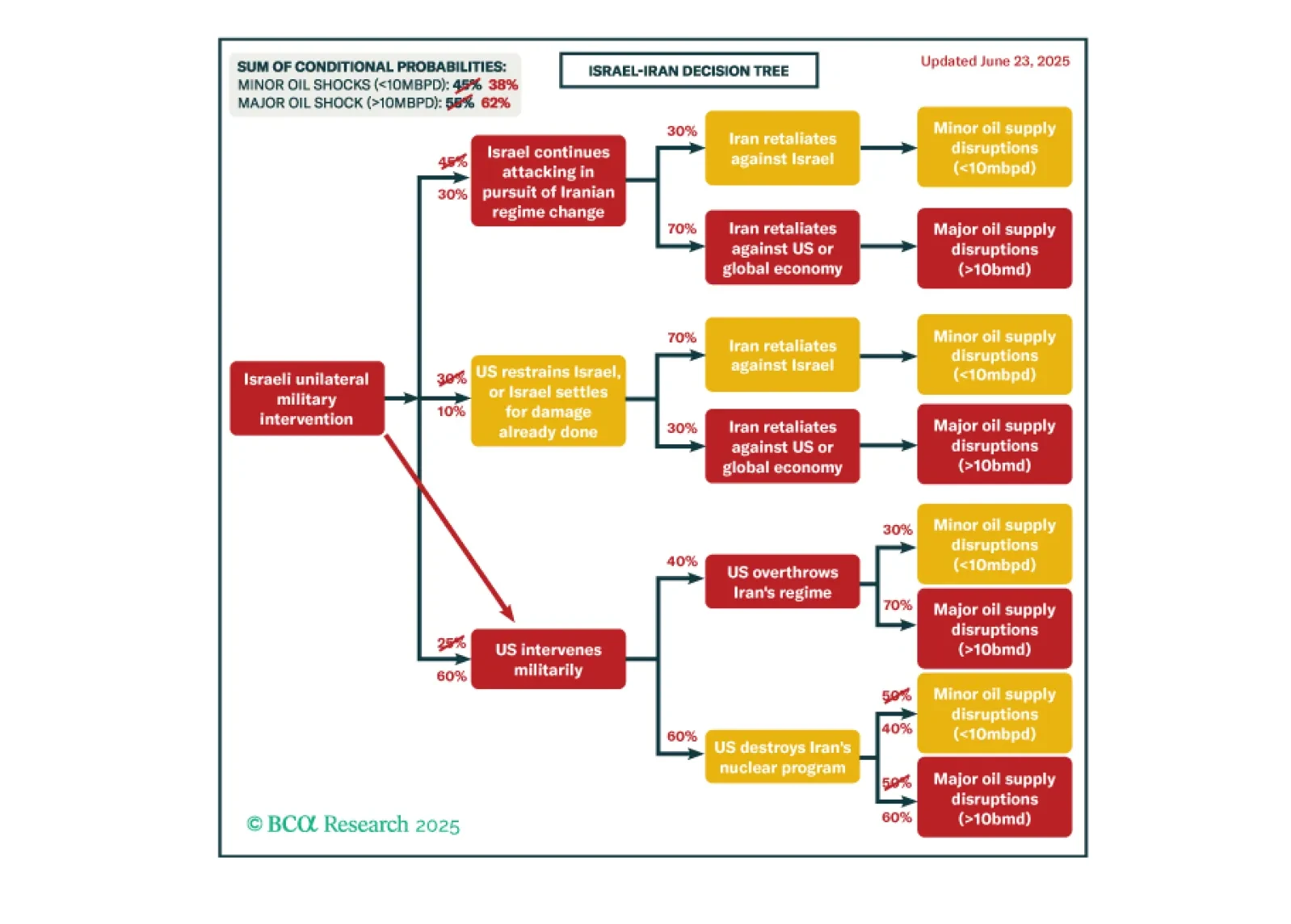

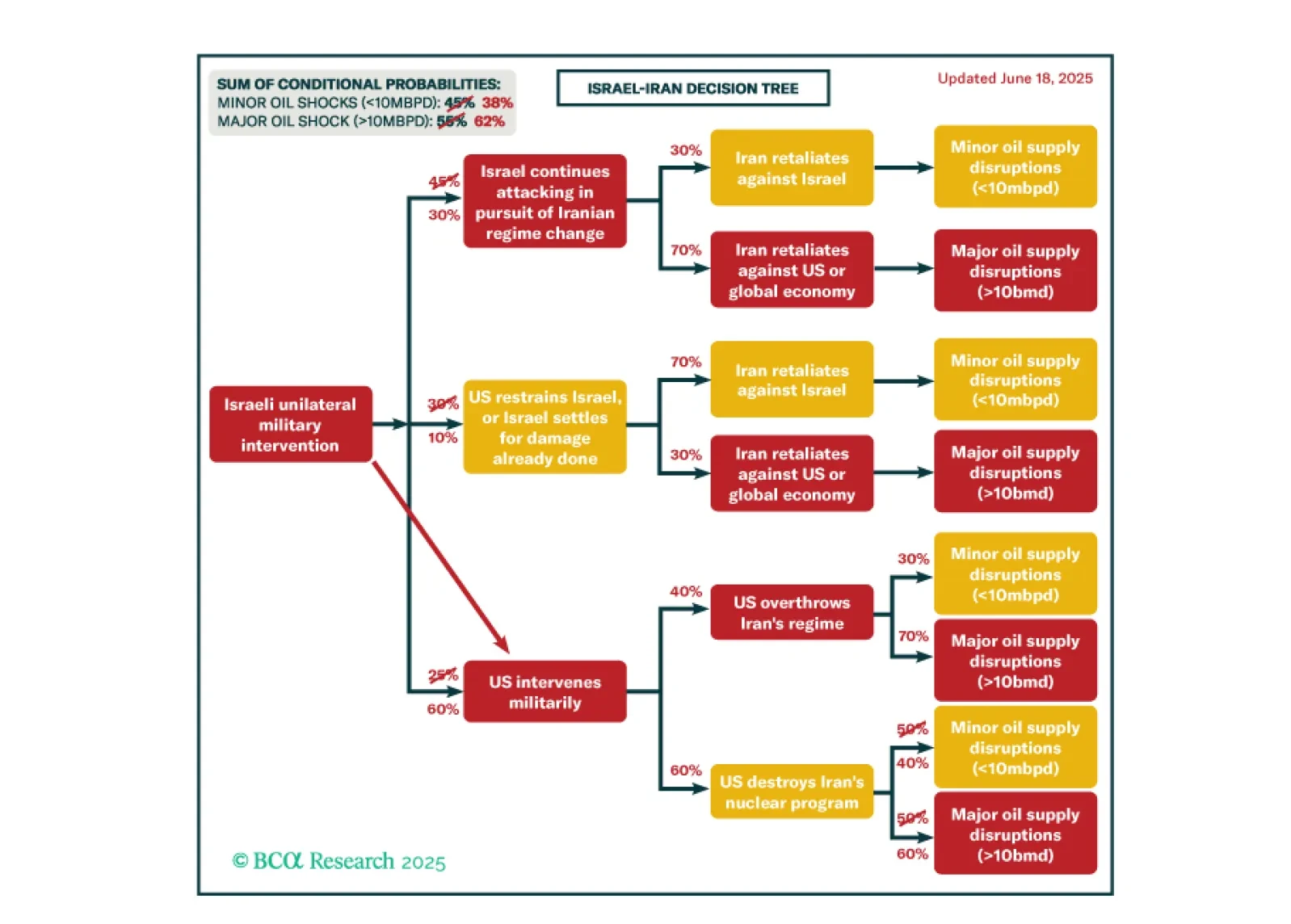

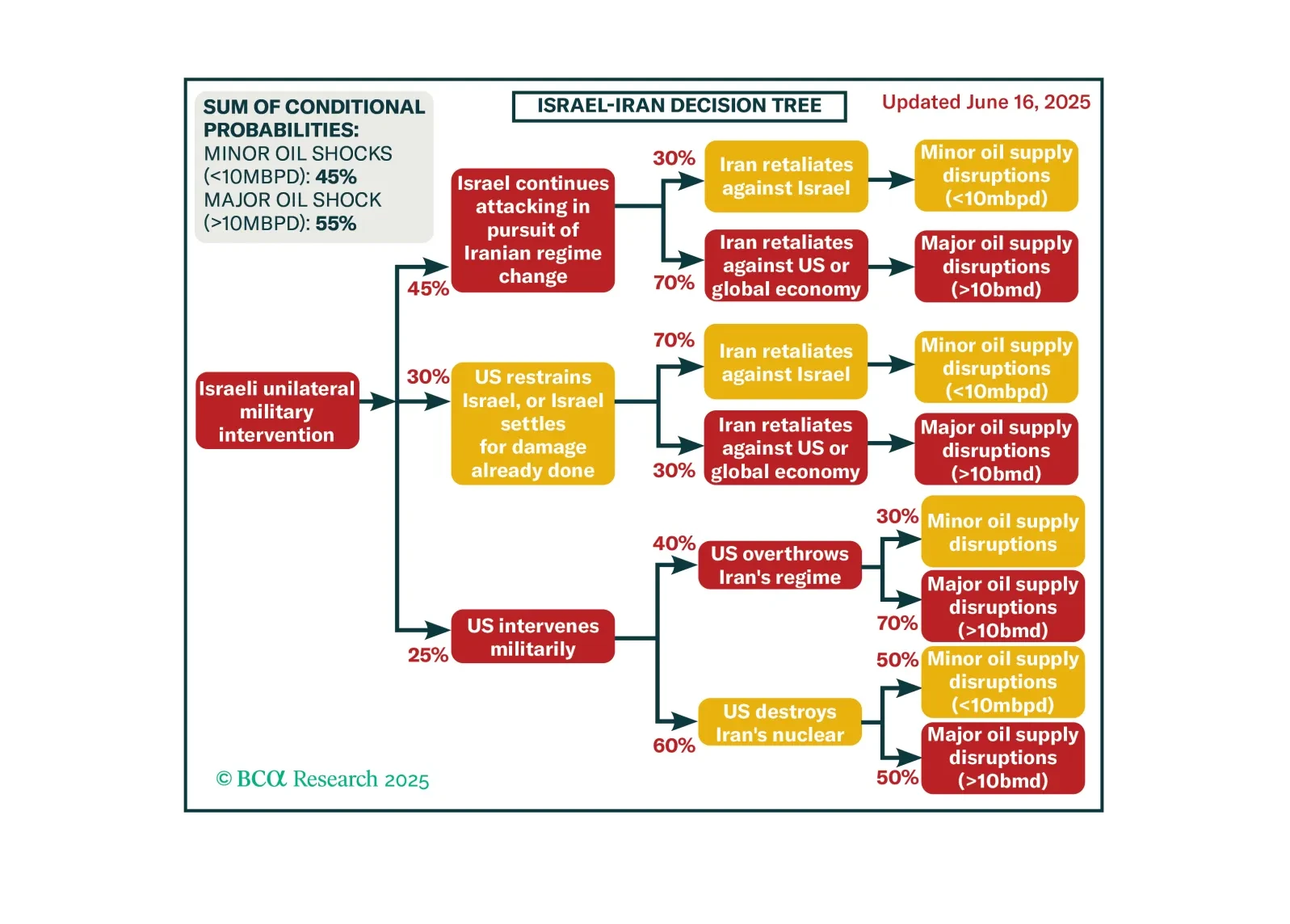

It is not yet clear that the Iran war is deescalating, despite the best efforts of global financial markets to dismiss its significance. True, Iran’s missile attacks on US military bases in Qatar and Iraq appear ineffectual as we go to…

Even if Iran tries to revive talks, the US has an irresistible opportunity to dismantle its nuclear program. Tactically, investors should favor Treasuries over the S&P, defensive sectors over cyclicals, energy stocks over…

Israel’s attacks on Iran will continue until Iran is forced to strike regional oil supply to get the US to restrain Israel. That may not work. Investors should prepare for a broader economic impact of the conflict.

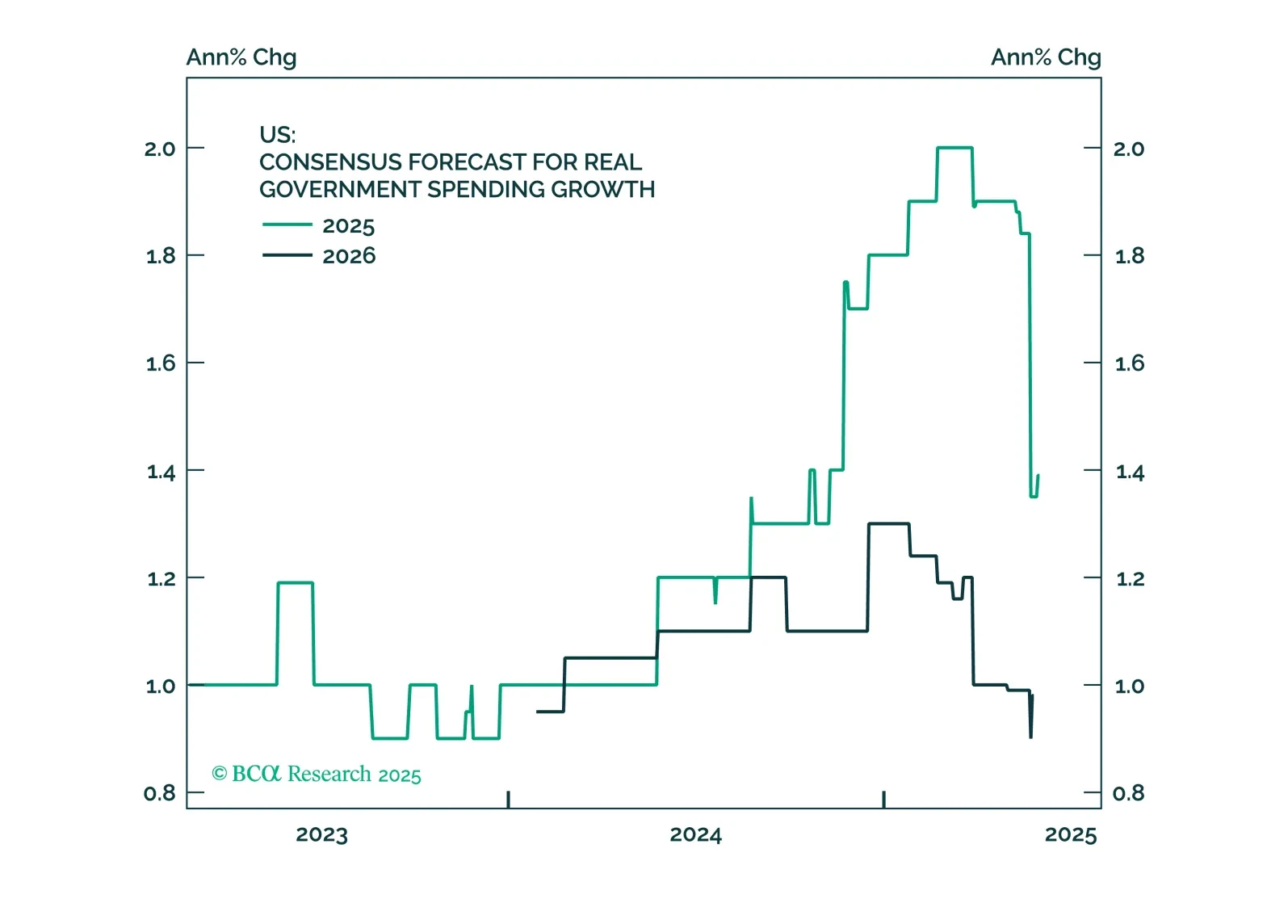

This month, we focus on the One Big Beautiful Bill Act (OBBBA). Our assessment in the Alpha report is that there won’t be any remaining alpha to harvest by shorting duration. The team that coined the “Human Steepener” moniker for…

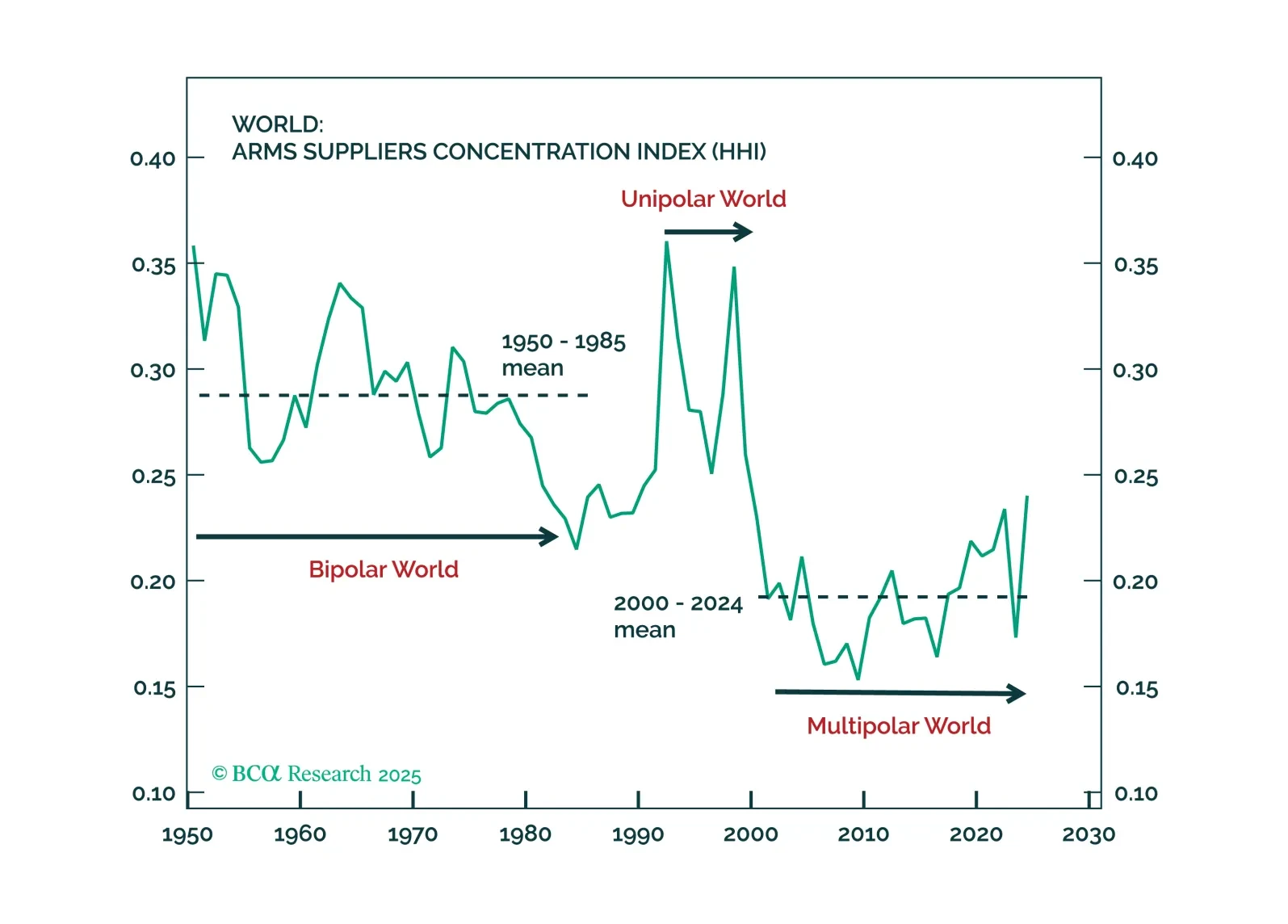

In our Beta report, we focus on our decade view. Many of our global allocator clients are scrambling to incorporate geopolitics into their strategic asset allocation. For most, this means thinking about war… or about future end-…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

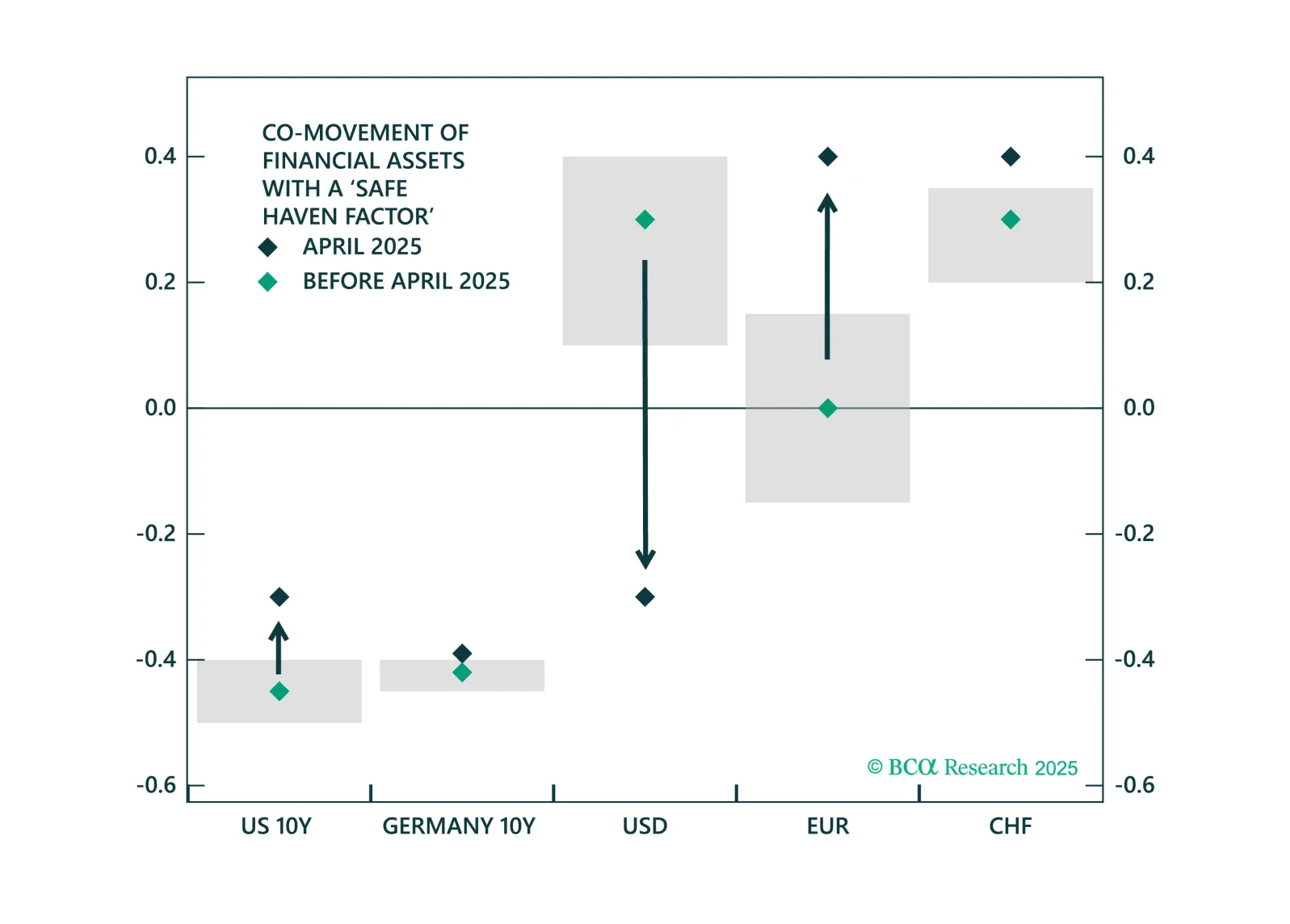

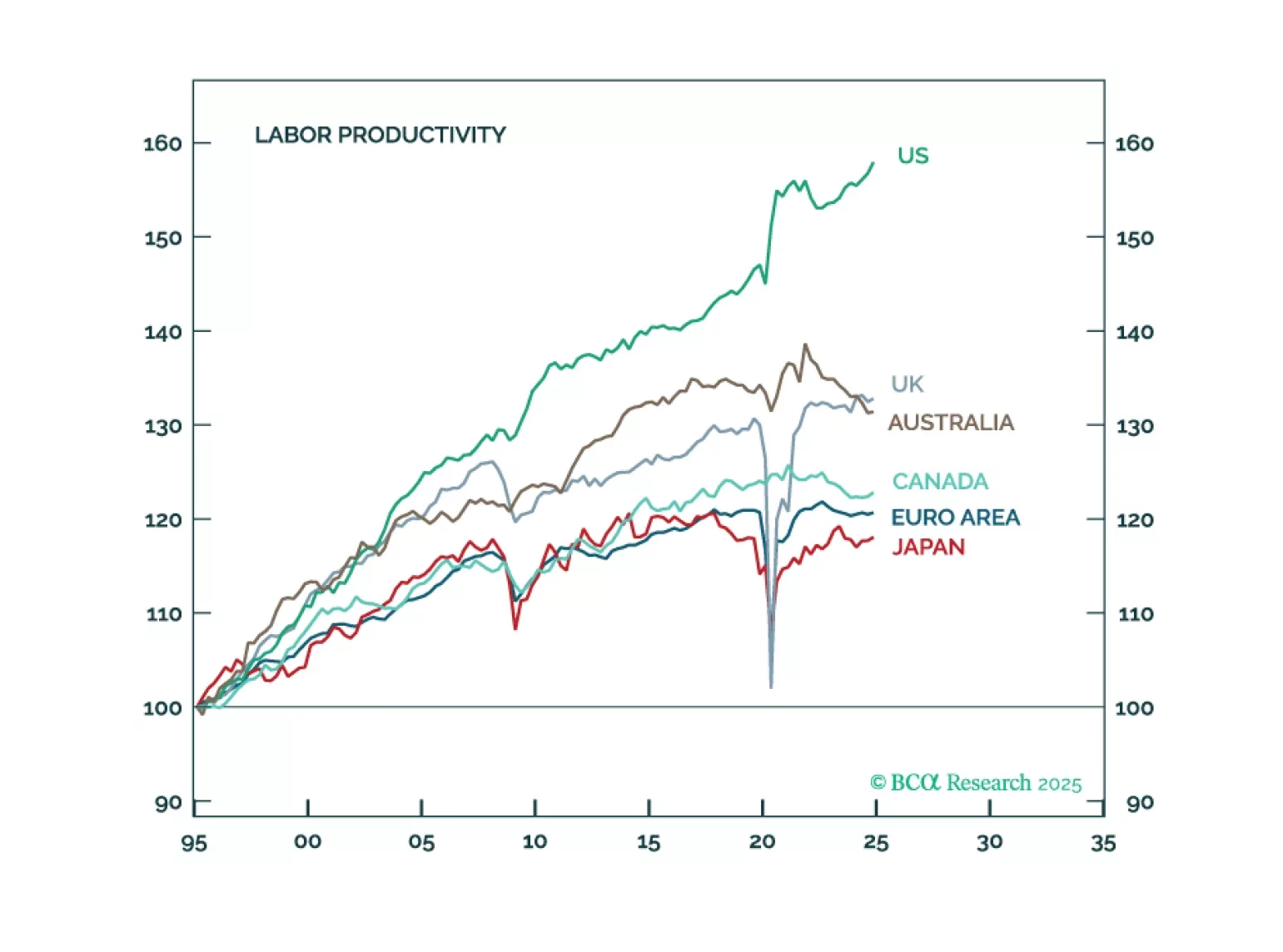

Although the sell-off in the US dollar and relative outperformance of non-US stocks will pause over the coming months as a global recession begins, the fading of US exceptionalism will still cause the dollar to weaken and US stocks…

I’d like to personally invite you to join me and my colleagues at BCA Research on Tuesday, April 15 (12 PM EDT/ 9 AM PST) for a webcast exclusive to long-term institutional investors.