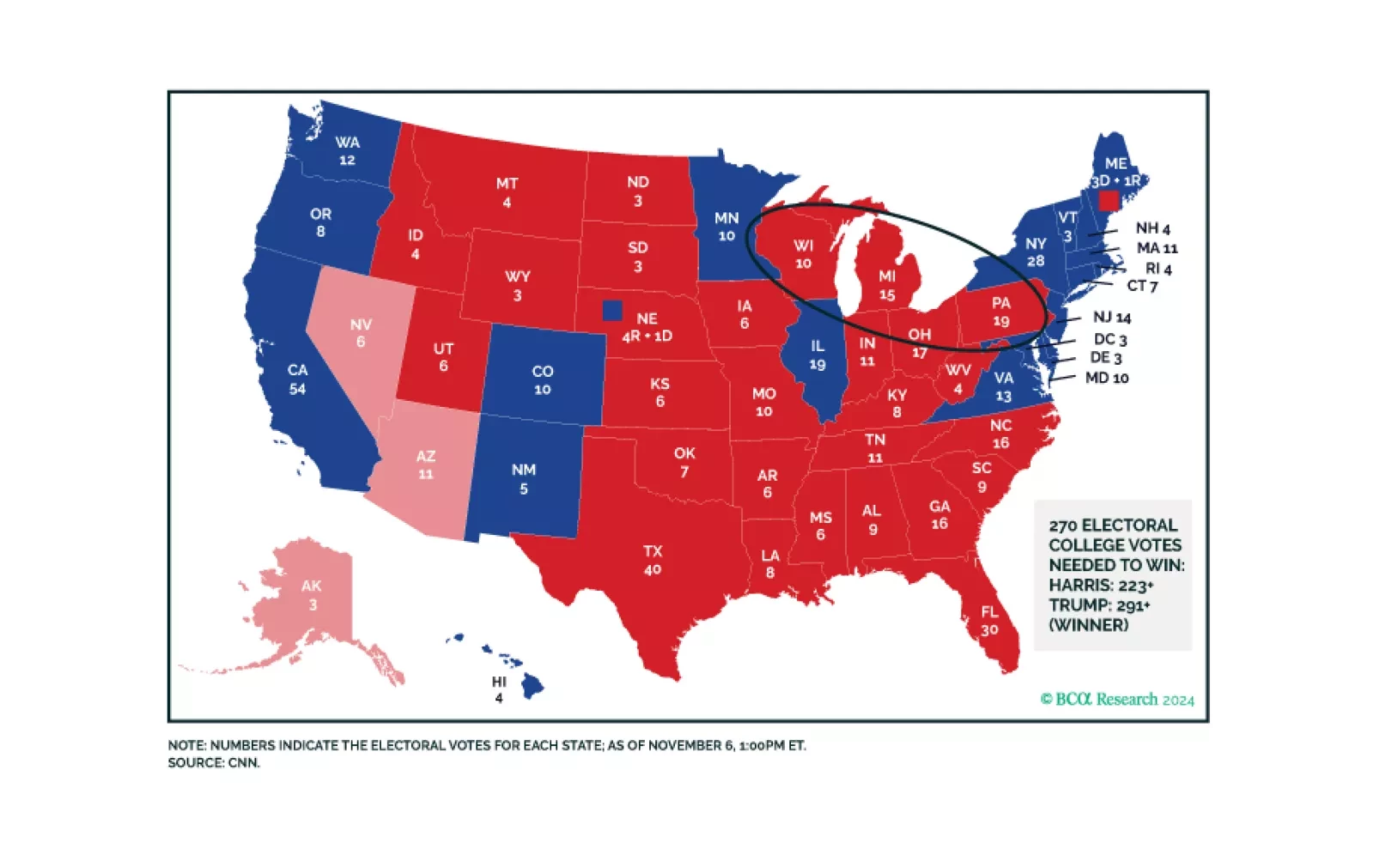

Our US Political strategists assessed the magnitude of the Republican sweep and discuss the path ahead as they take control of Washington. The GOP sweep was a resounding victory as they also clinched the popular vote. The…

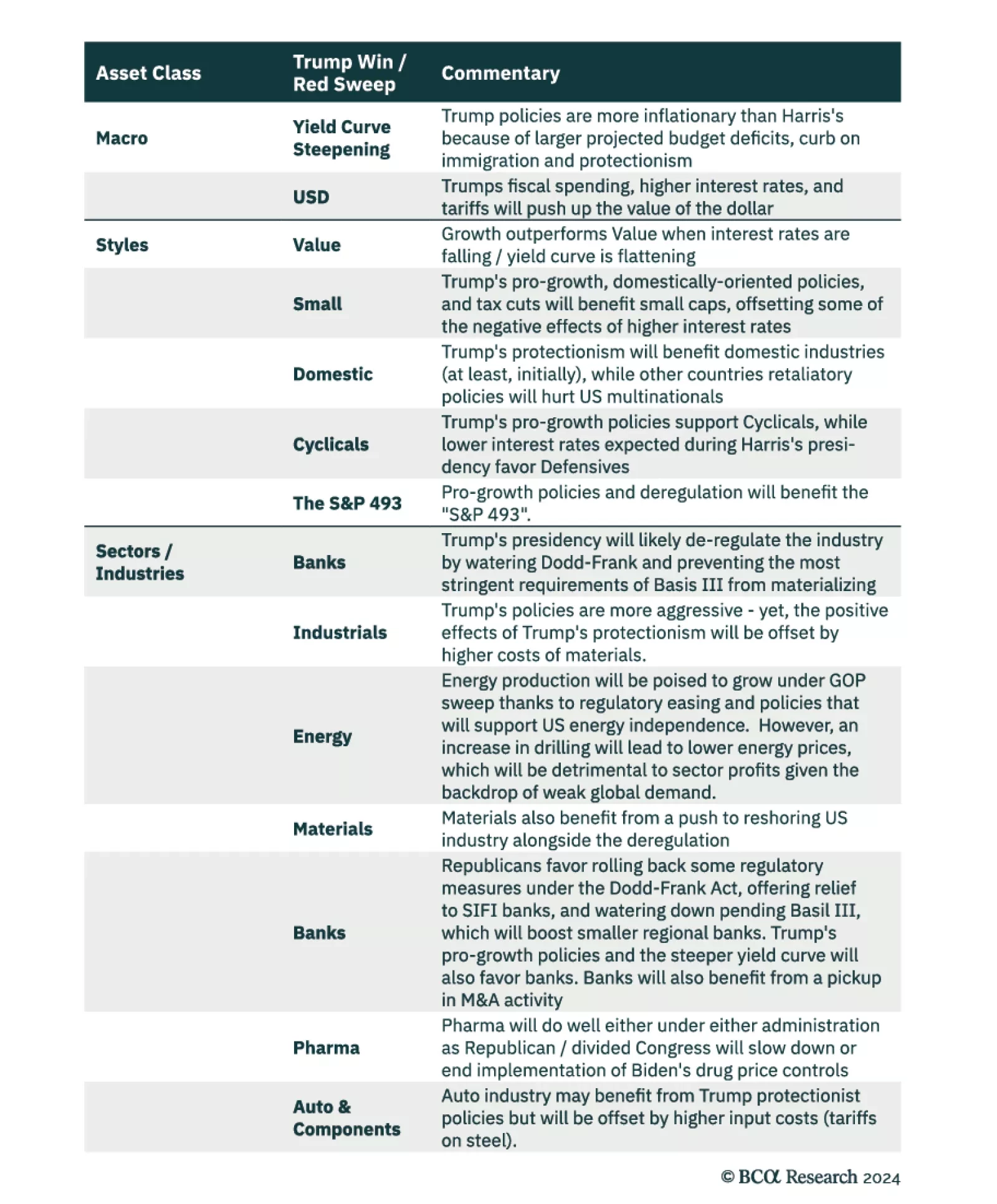

Our US Equity strategists prepared a Post-Election US Equity Cheat Sheet. Here are highlights of their recommended positioning for a US equity portfolio in a Red Sweep scenario. Protectionism and pro-growth domestic policies will…

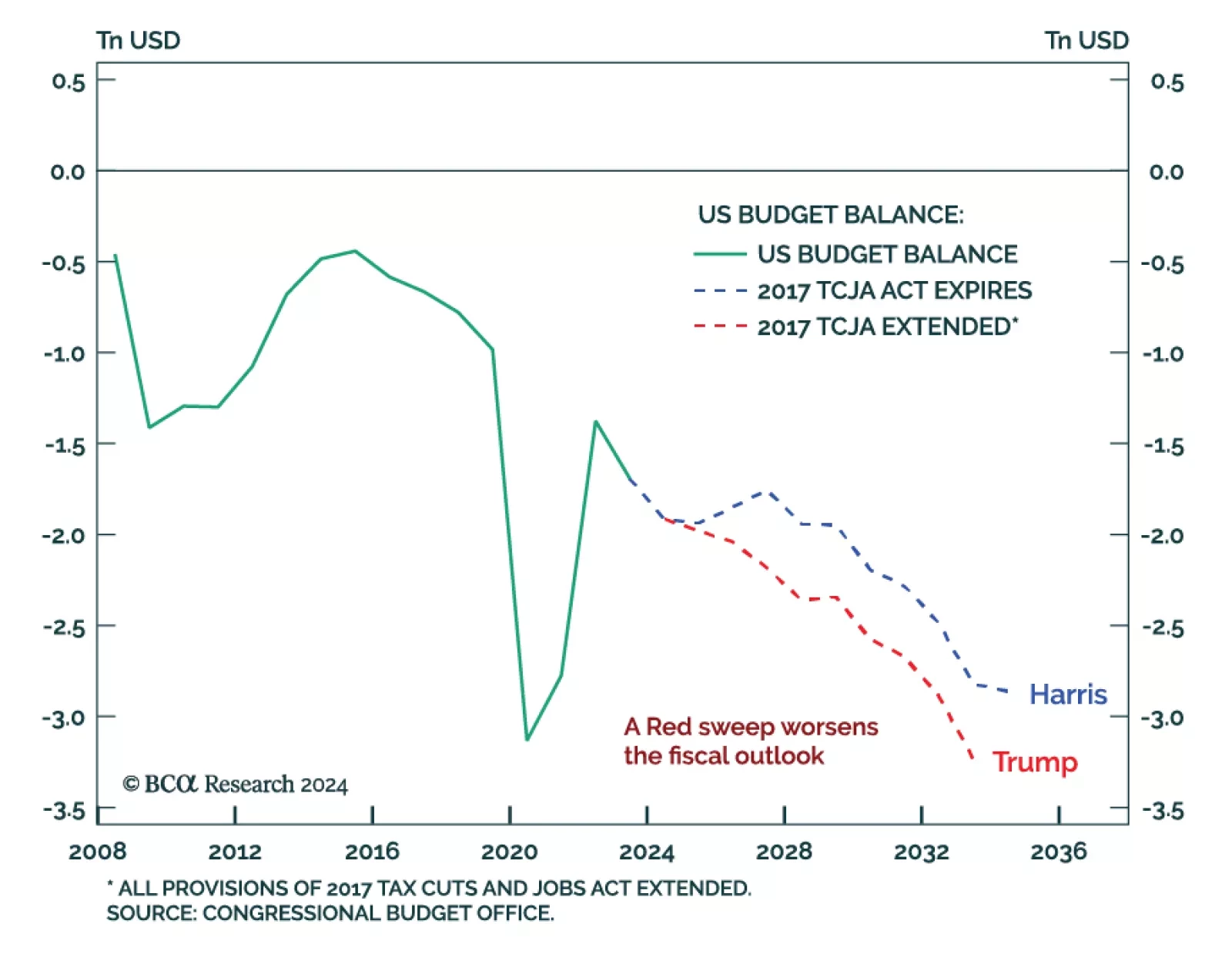

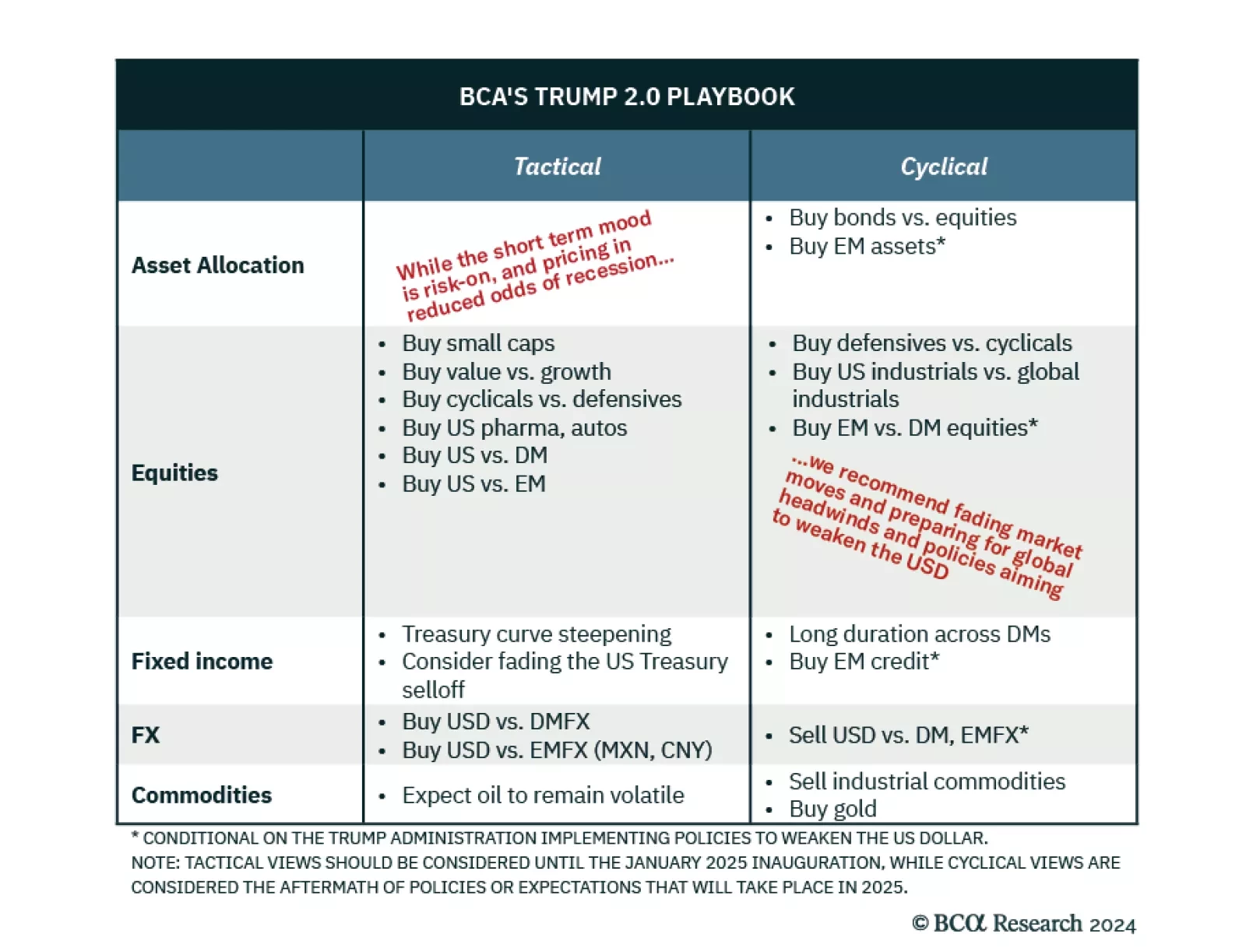

Although foreseen by our US & Geopolitical strategists, a “Red Sweep” now makes the macro environment more volatile. After convening for our BCA Live & Unfiltered meeting, we offer three main takeaways.…

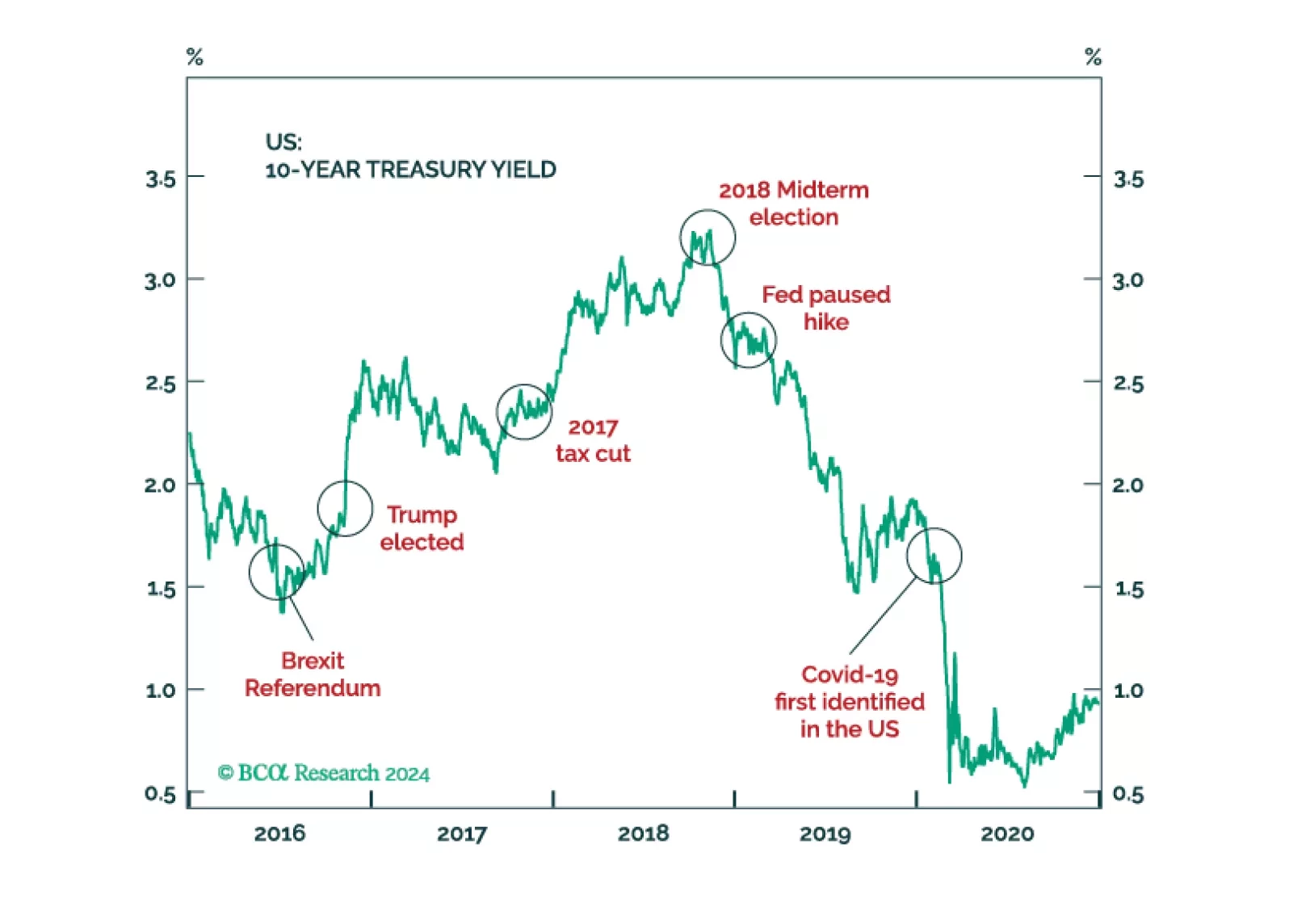

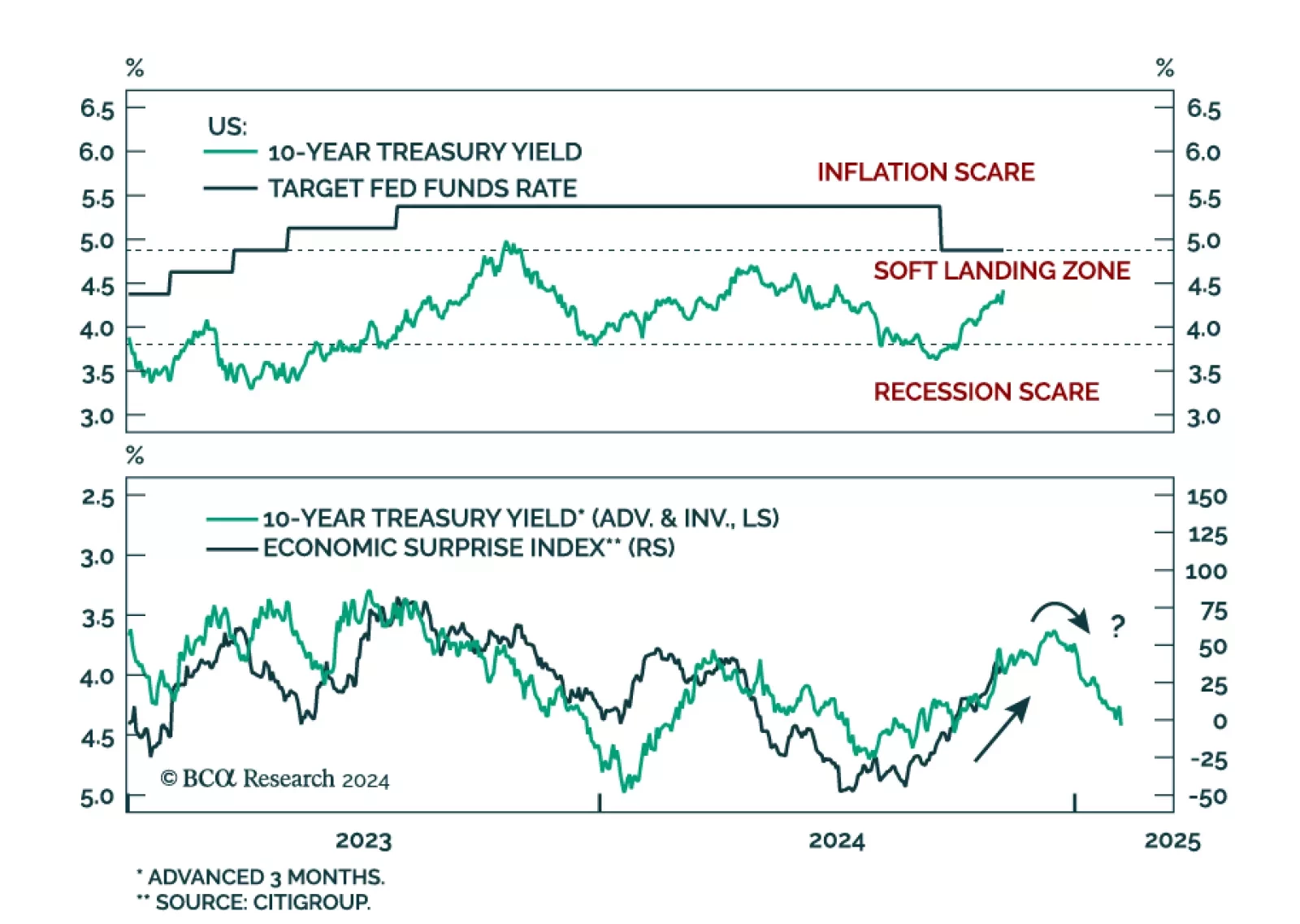

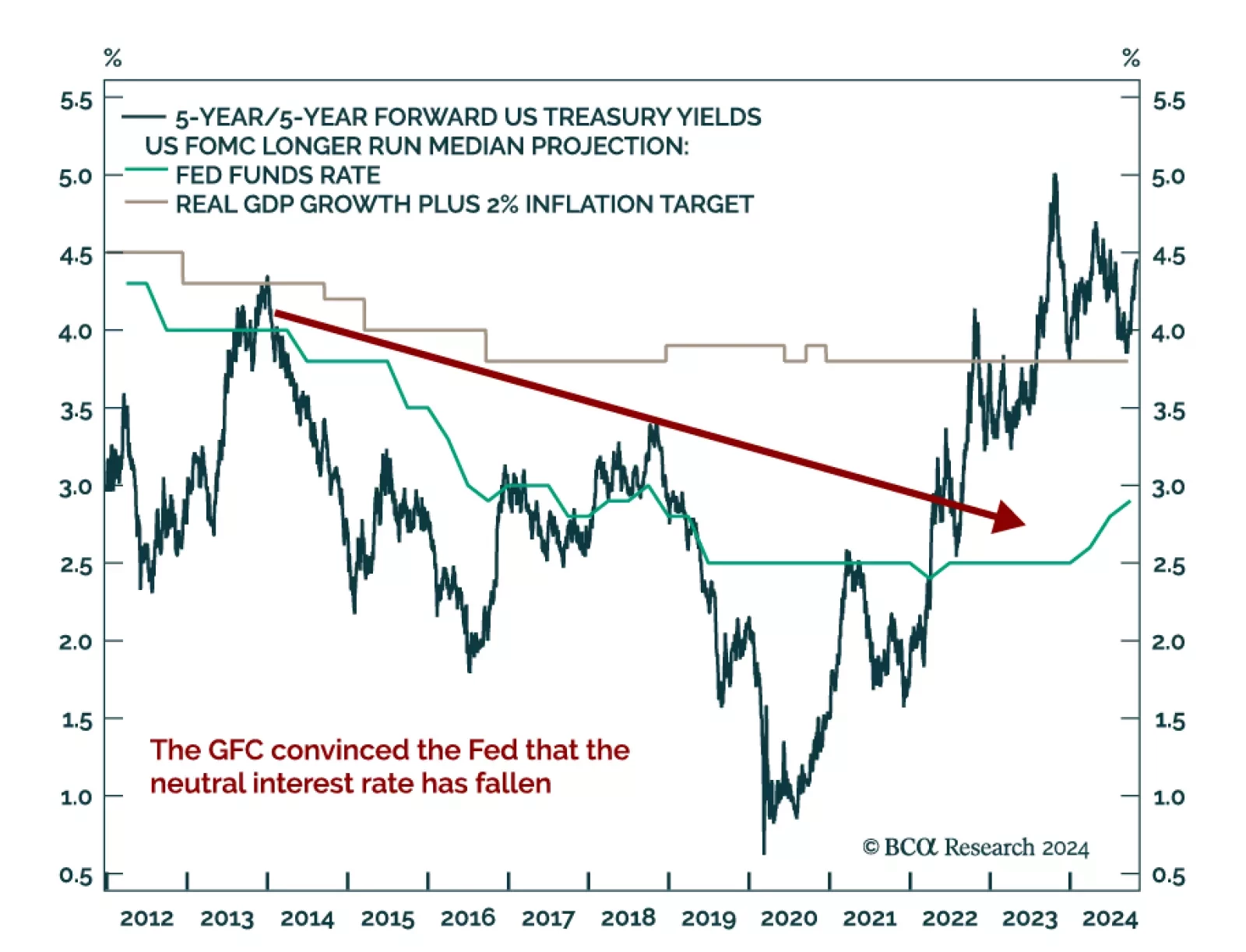

The bond market had long anticipated a Trump 2.0 administration, but bond yields still spiked as a Trump victory materialized. What’s the path ahead for US rates? Our US bond strategists believe 10-year yields can go up…

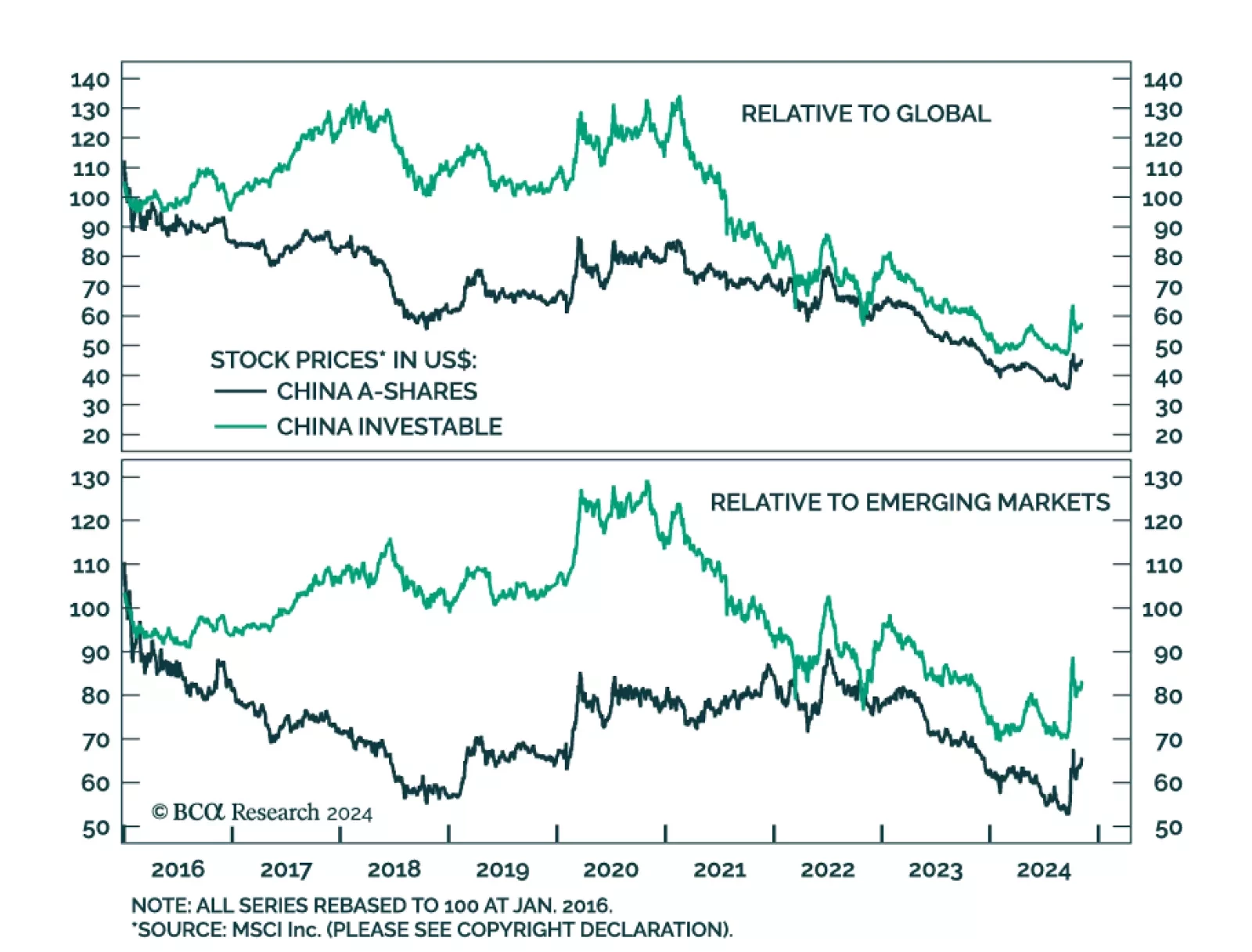

Will the prospect of expanding trade tensions lead to more Chinese stimulus, and create an opportunity for Chinese equities? Not necessarily, as the election results were already factored in our EM and China strategists’…

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…

Given the charged atmosphere surrounding the US election, our Bank Credit Analyst colleagues investigate whether the Fed’s dovish pivot last December was politically motivated. The Fed’s actions appear overly…

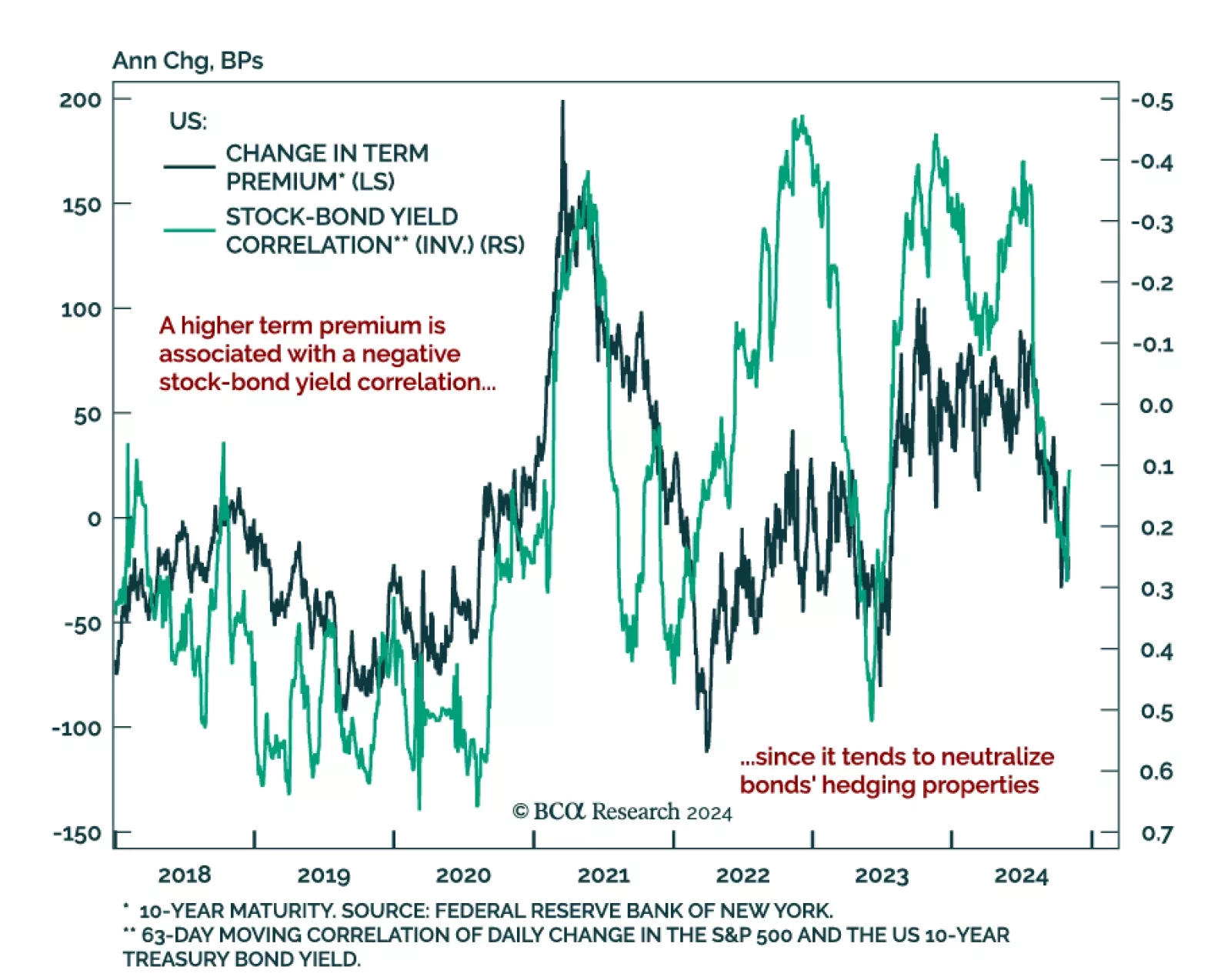

The post-COVID inflation pushed bond yields higher, turning the stock-bond yield correlation negative and taking away bonds’ hedging properties. The relationship normalized this summer as economic data surprised negatively…

The Election Day is finally upon us. No, there is no final “silver bullet” forecast contained in this email. Just our long-term forecast of how the election will, no matter who wins, impact the markets.

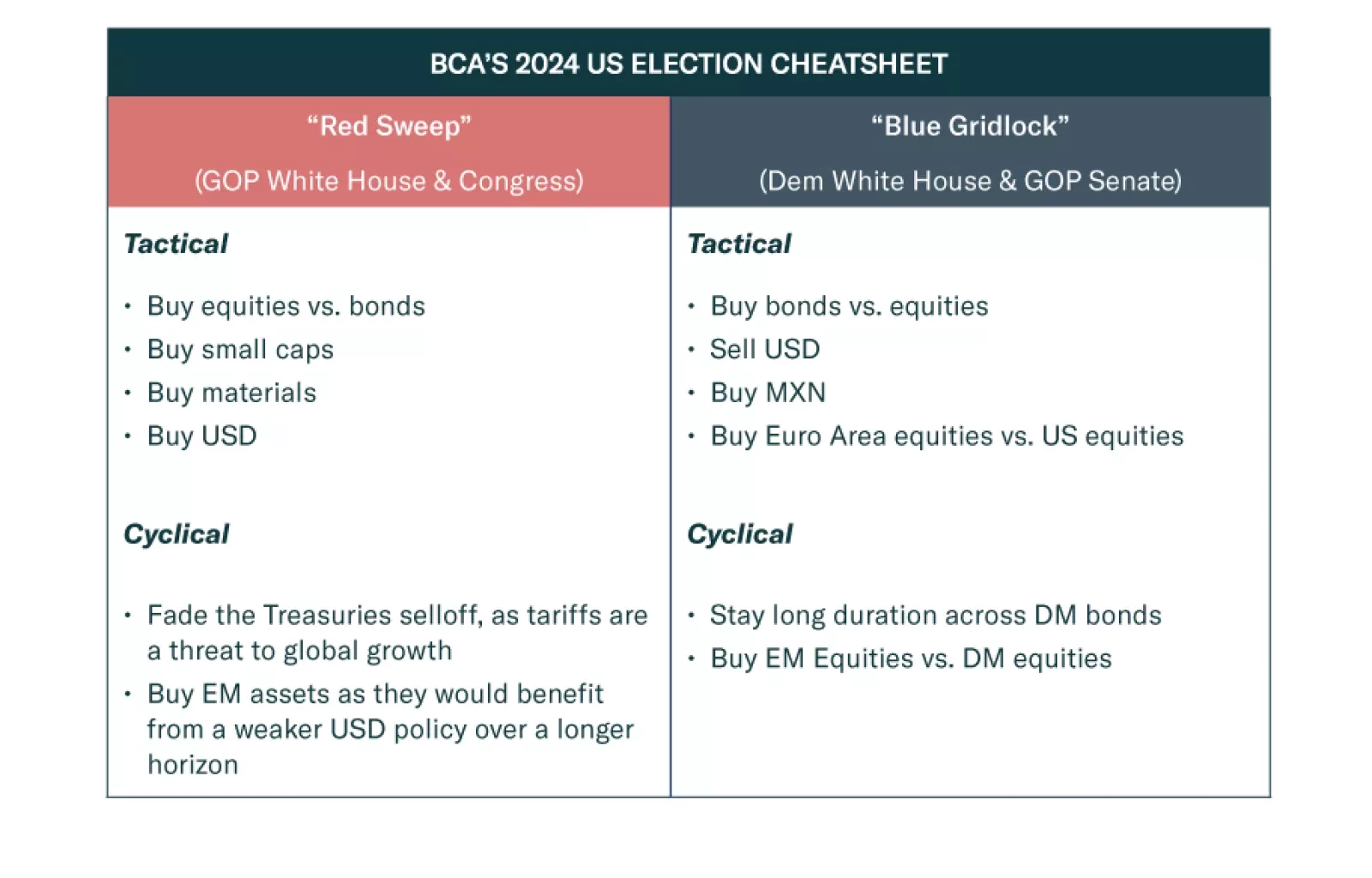

As markets settle into waiting mode for the US election, we provide a concise but not exhaustive cheatsheet for what to expect as the results come out. Our US & Geopolitical strategists’ two most likely outcomes are a…