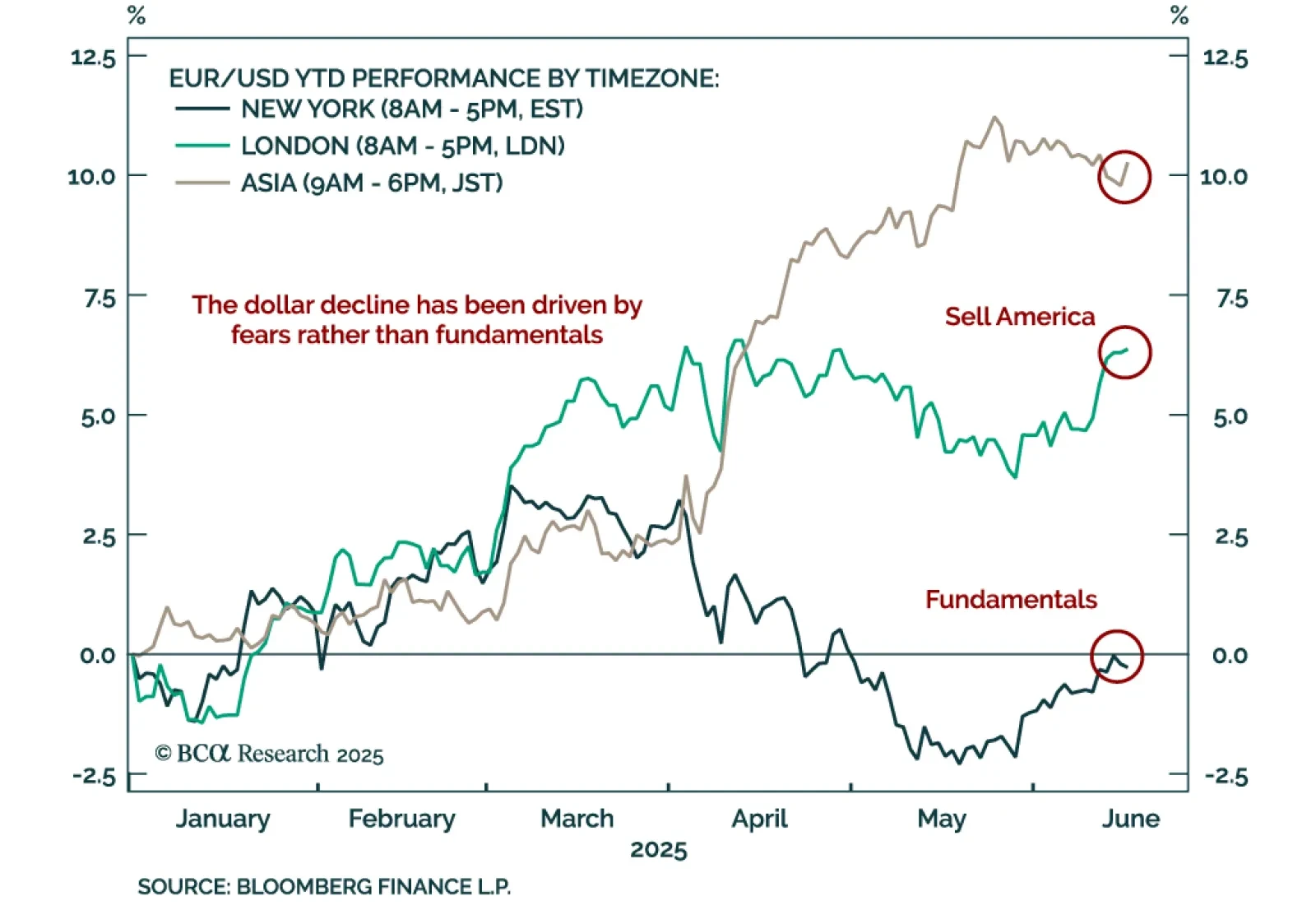

Foreign investors are selling US assets. Our Chart Of The Week comes from Juan Correa, Chief Global Asset Allocation Strategist. Splitting cumulative year-to-date EUR/USD returns by trading session reveals a clear pattern:…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

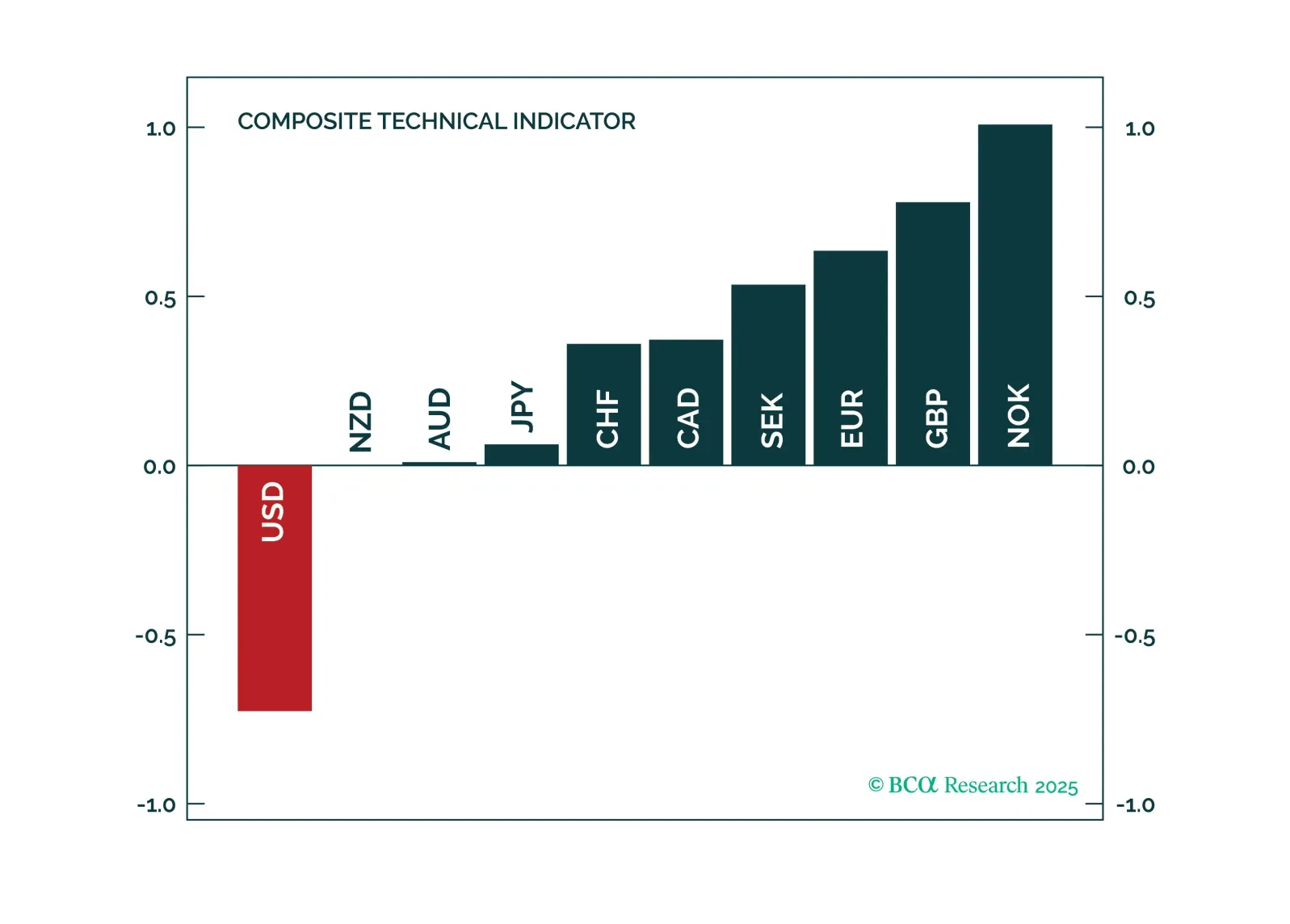

In this Insight, we highlight our strong conviction trades based on the central bank meetings held by the Bank of England, the Norges Bank, the Swiss National Bank and the Riksbank.

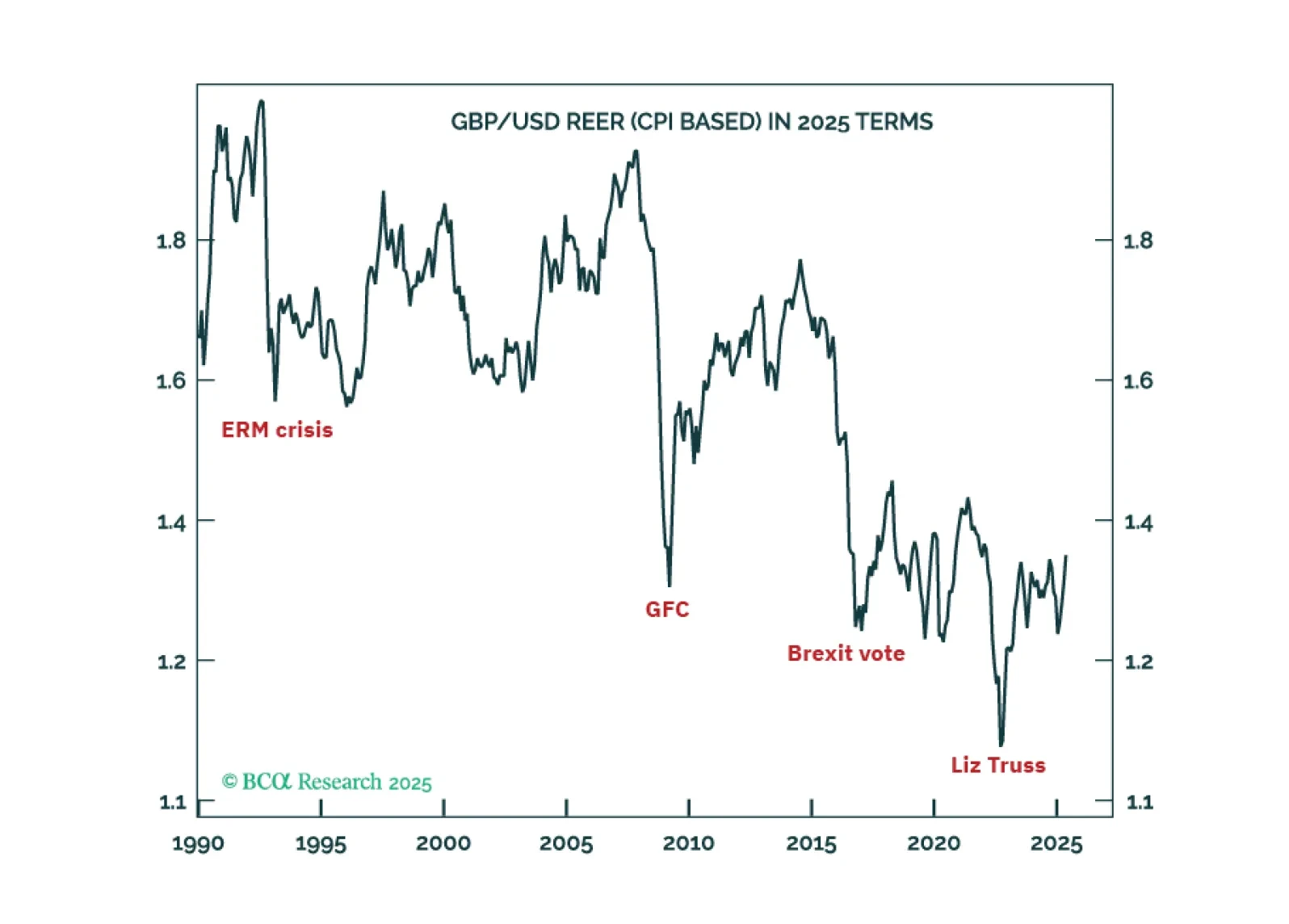

The pound will reach $1.60 if ‘America’s Brexit’ cancels out ‘Britain’s Brexit’. Meanwhile, the flight from the fiat dollar to non-fiat bitcoin will enable the preeminent cryptocurrency to reach $200,000+.

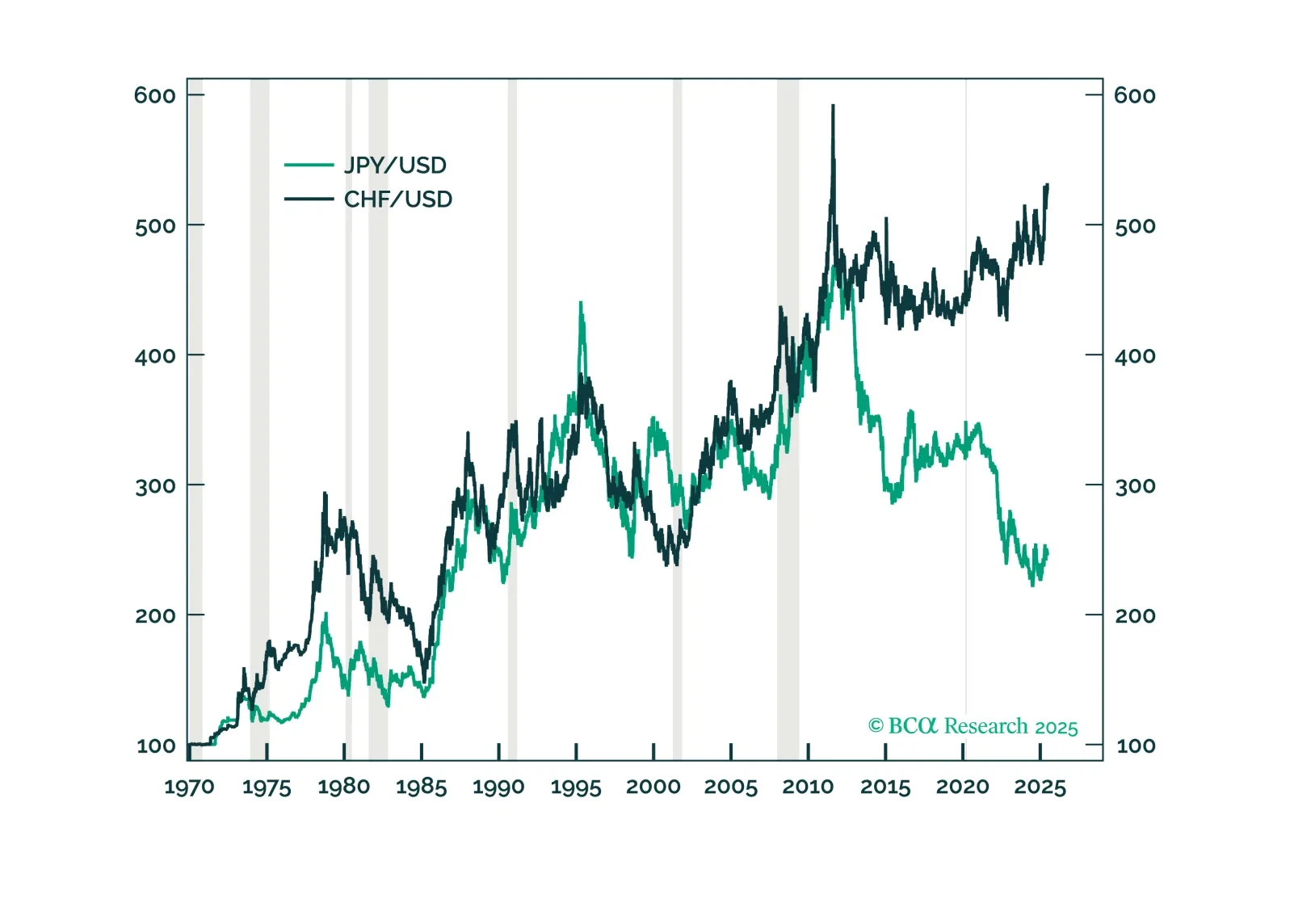

In this FX note, we provide a rationale for why it is important to pay attention to technical indicators, while still keeping your eyeball on the structural factors that drive currencies. This report answers the following questions:…

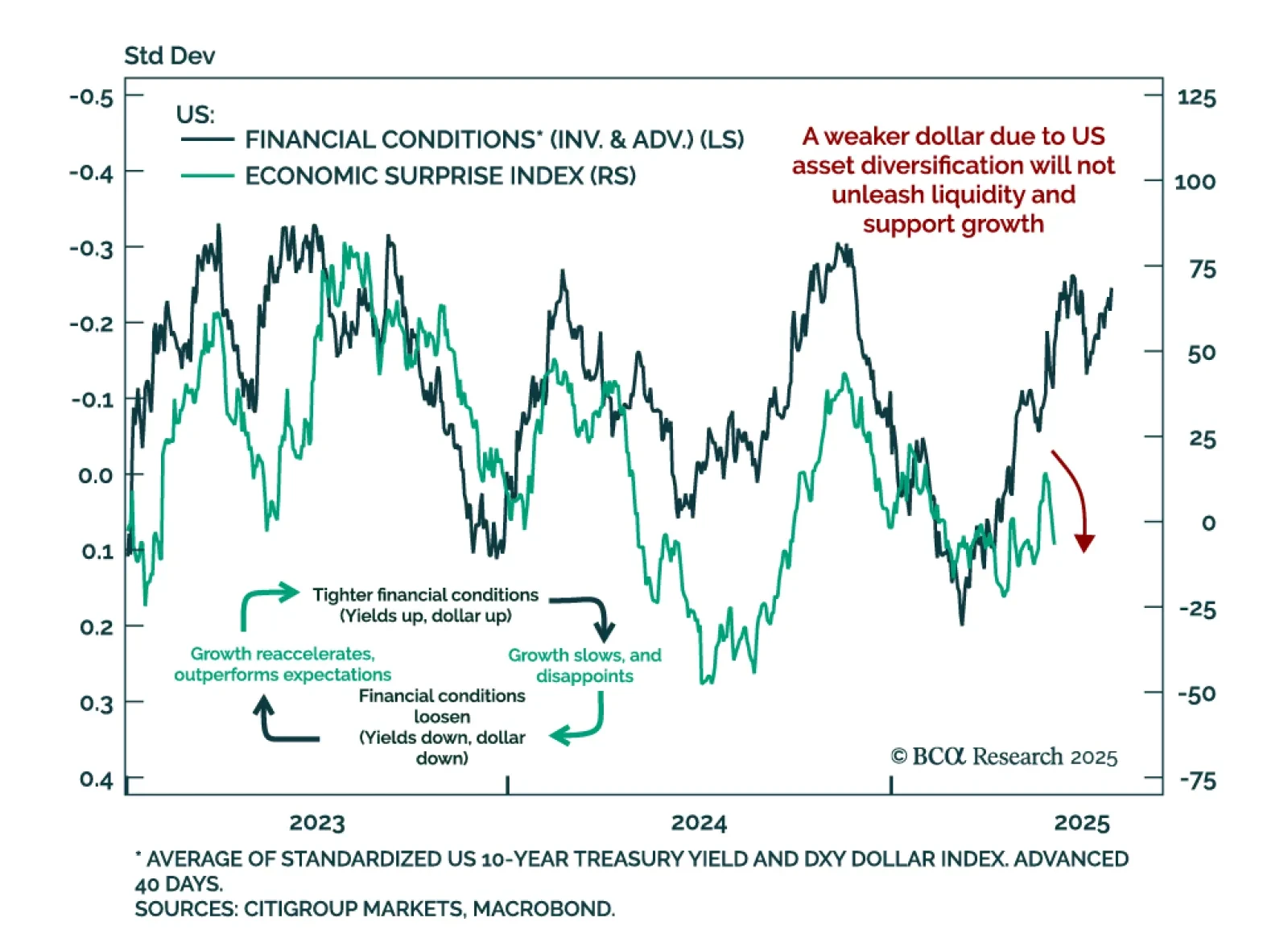

A falling dollar usually eases financial conditions, but recent dollar weakness is unlikely to reverse negative growth surprises, reinforcing our call to sell risk assets on strength. Our tactical framework tracks the reflexive…

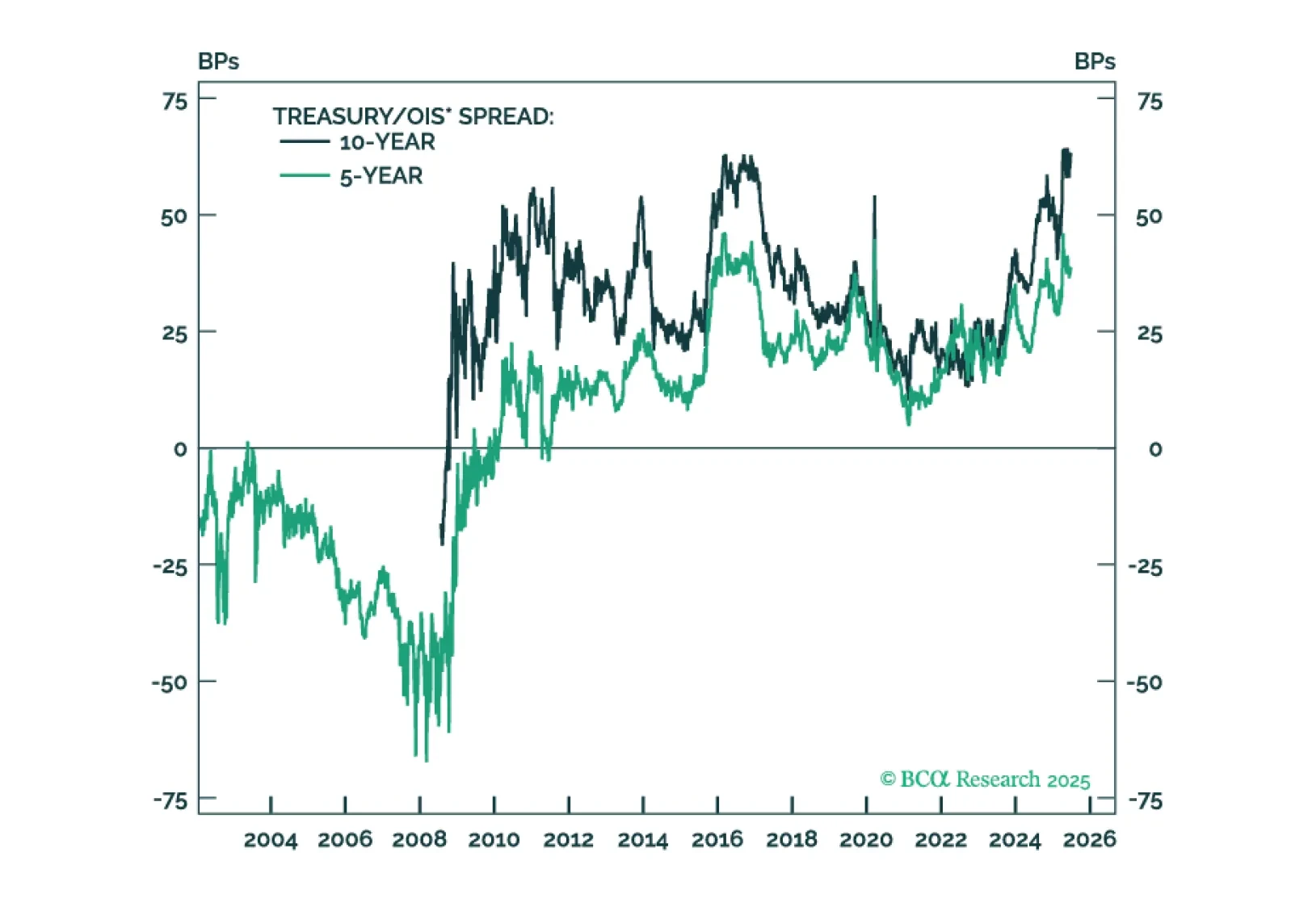

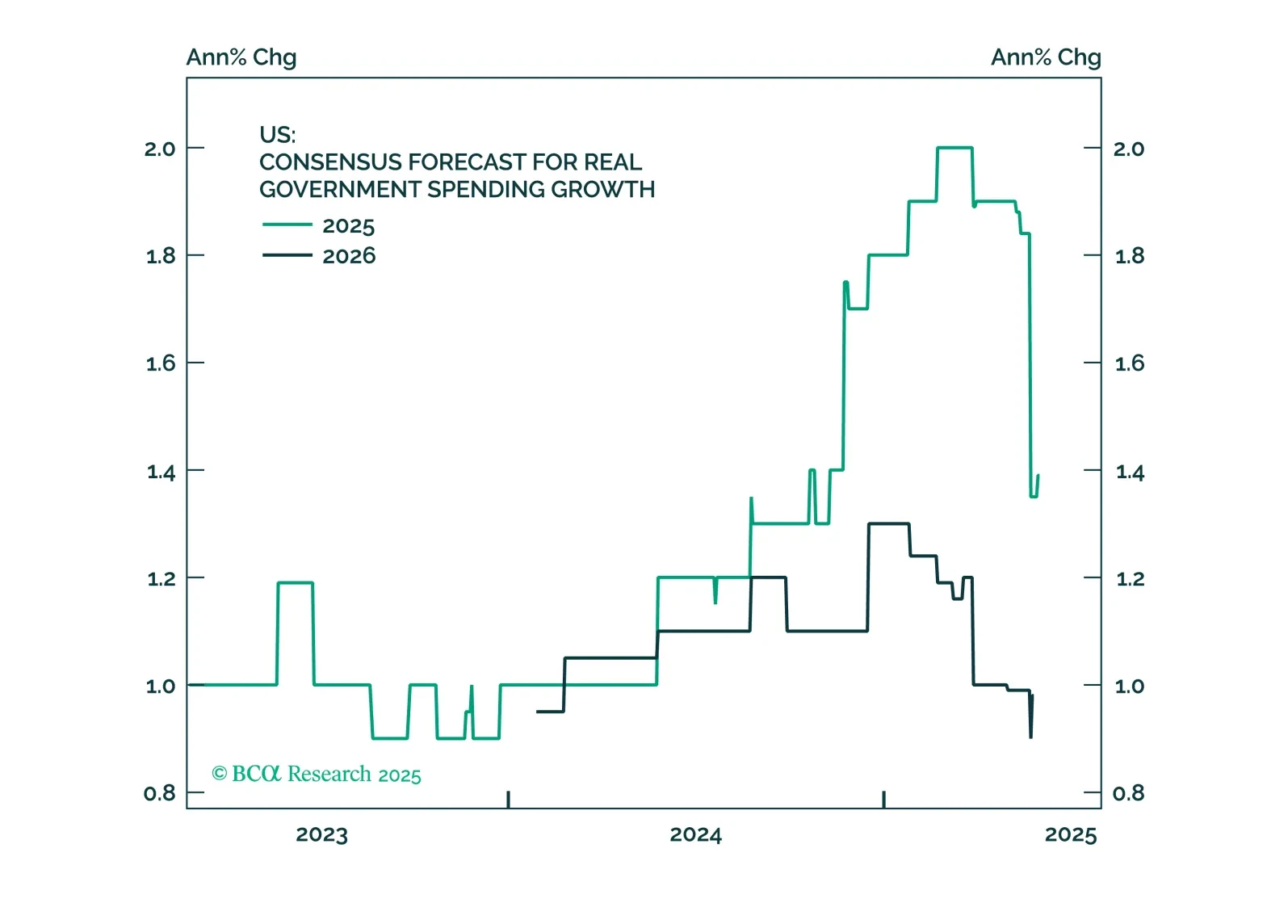

This month, we focus on the One Big Beautiful Bill Act (OBBBA). Our assessment in the Alpha report is that there won’t be any remaining alpha to harvest by shorting duration. The team that coined the “Human Steepener” moniker for…

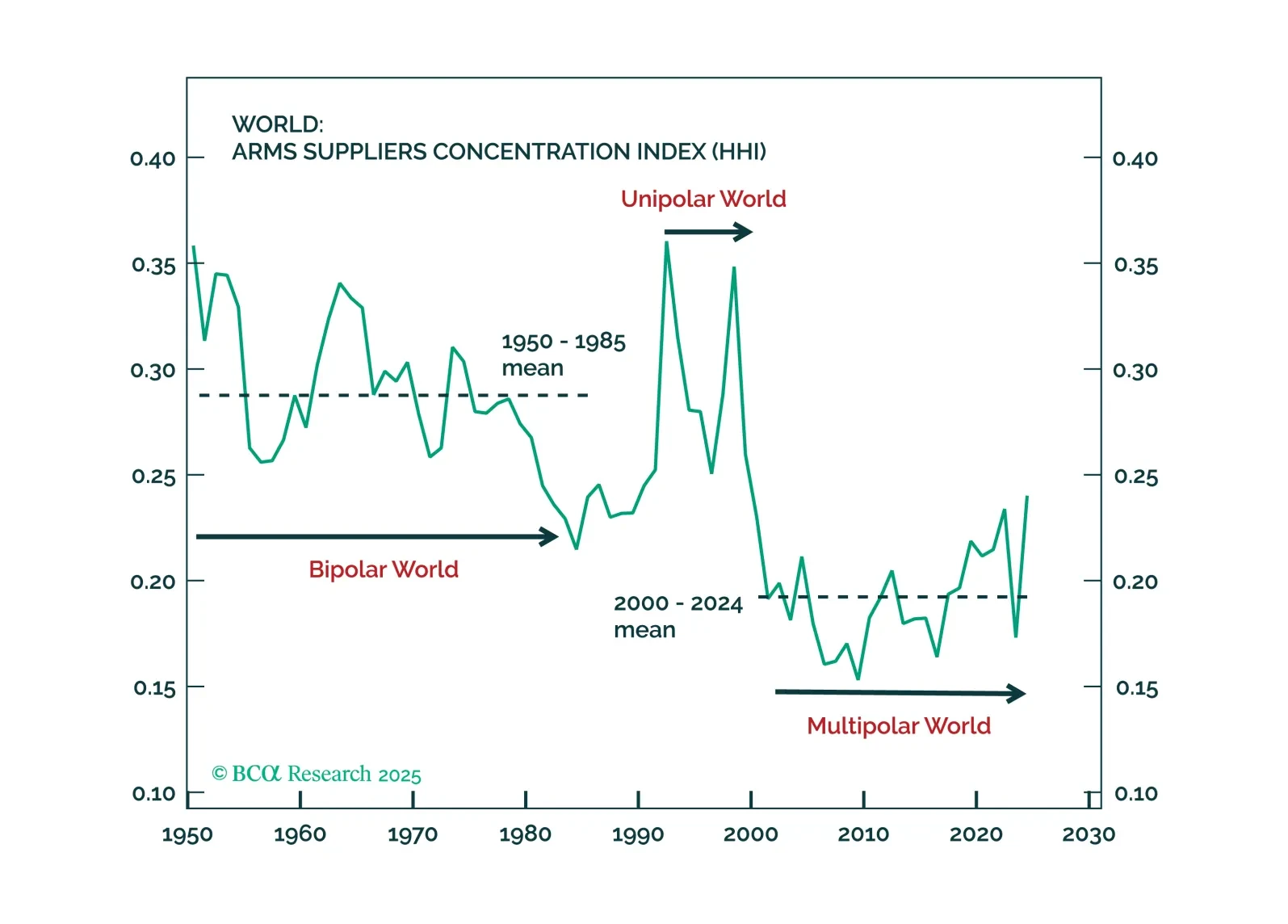

In our Beta report, we focus on our decade view. Many of our global allocator clients are scrambling to incorporate geopolitics into their strategic asset allocation. For most, this means thinking about war… or about future end-…