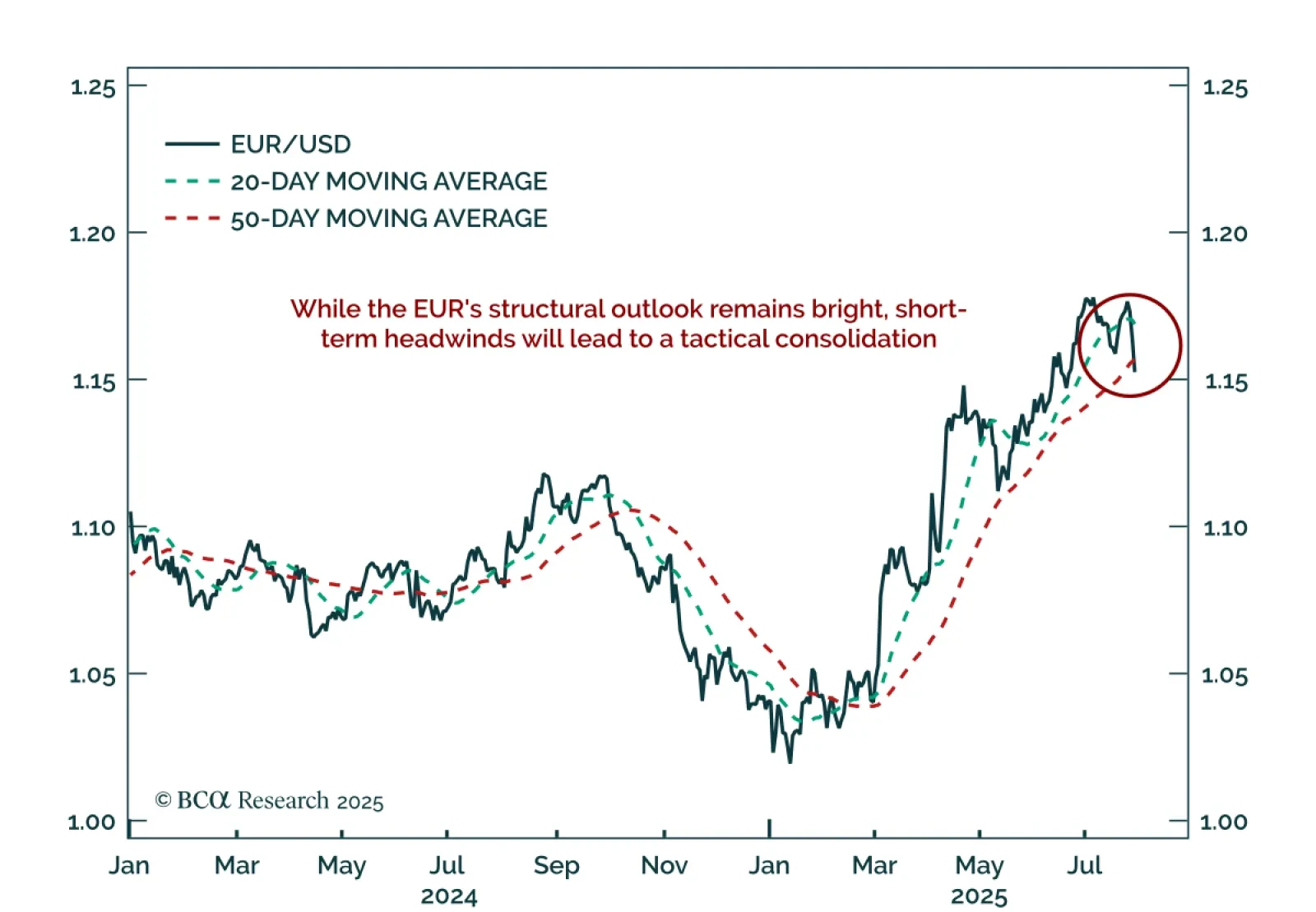

EUR/USD has broken below key support, and near-term risks justify a tactical bearish stance while longer-term investors should buy dips. The pair fell through its 50-day moving average, which, along with the 20-day, had provided…

We will only move to a fully defensive stance if the “whites of the recession’s eyes” appear. So far, they have not. We will be increasingly looking to our MacroQuant model for guidance on when the next turning point in markets may…

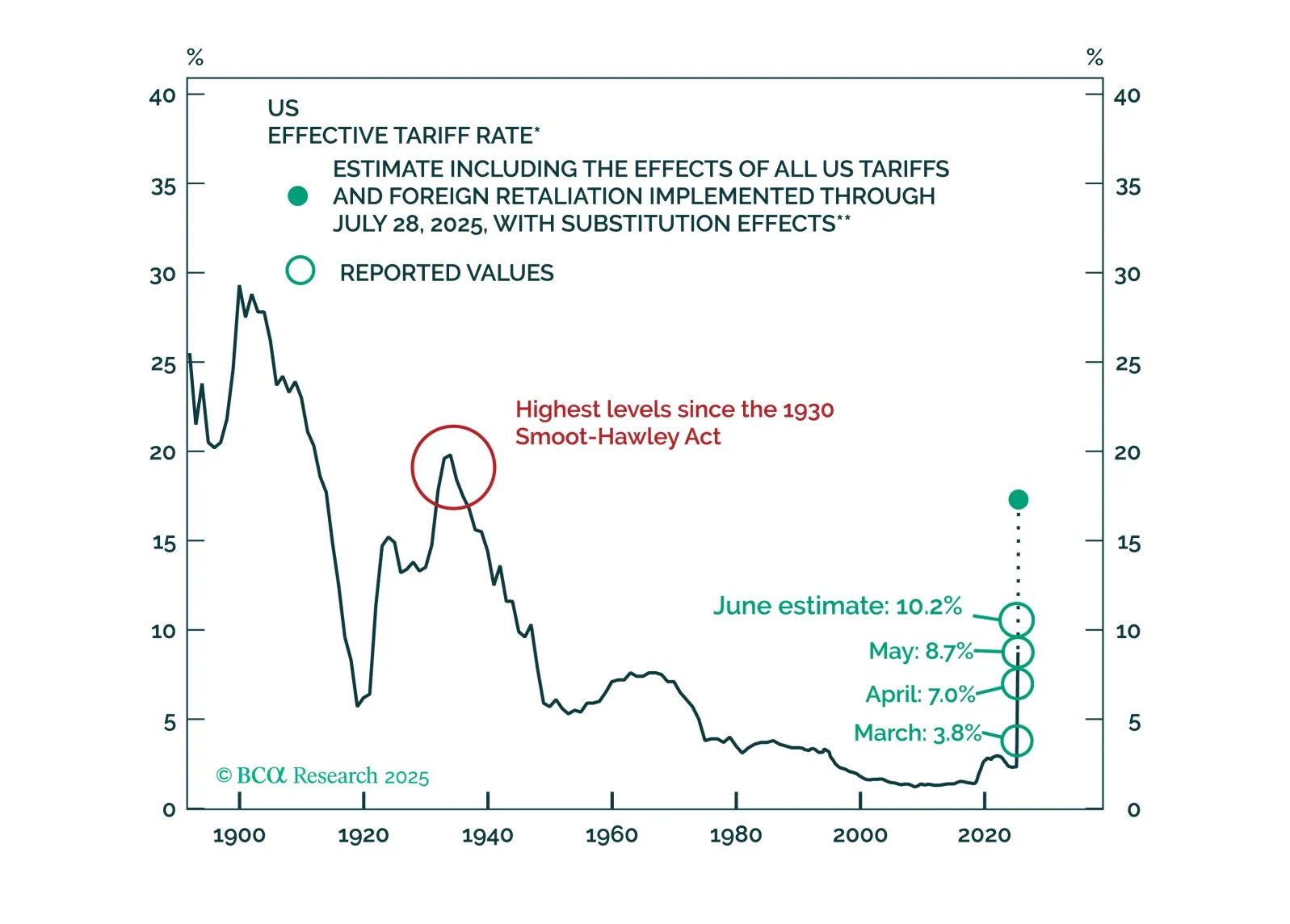

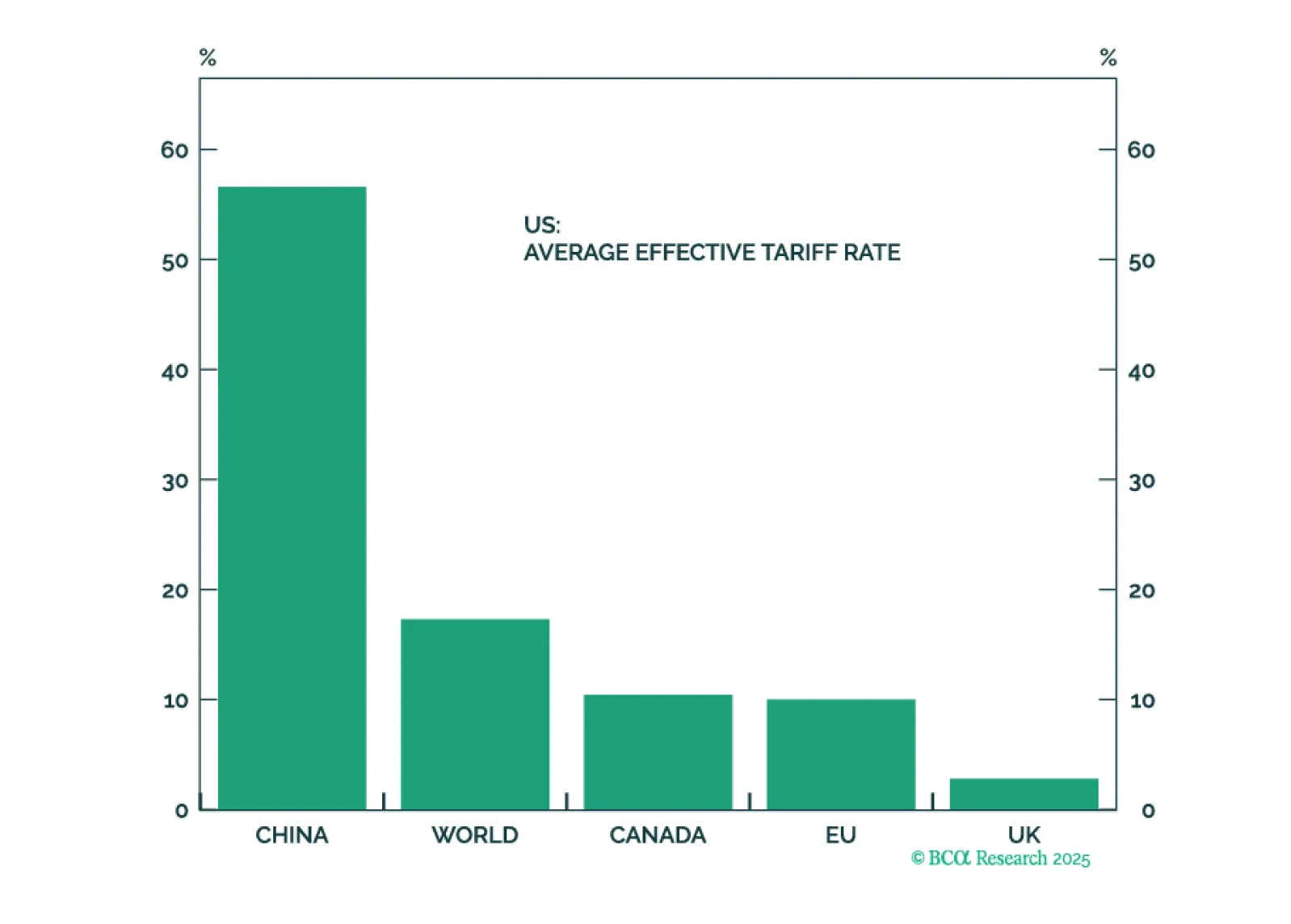

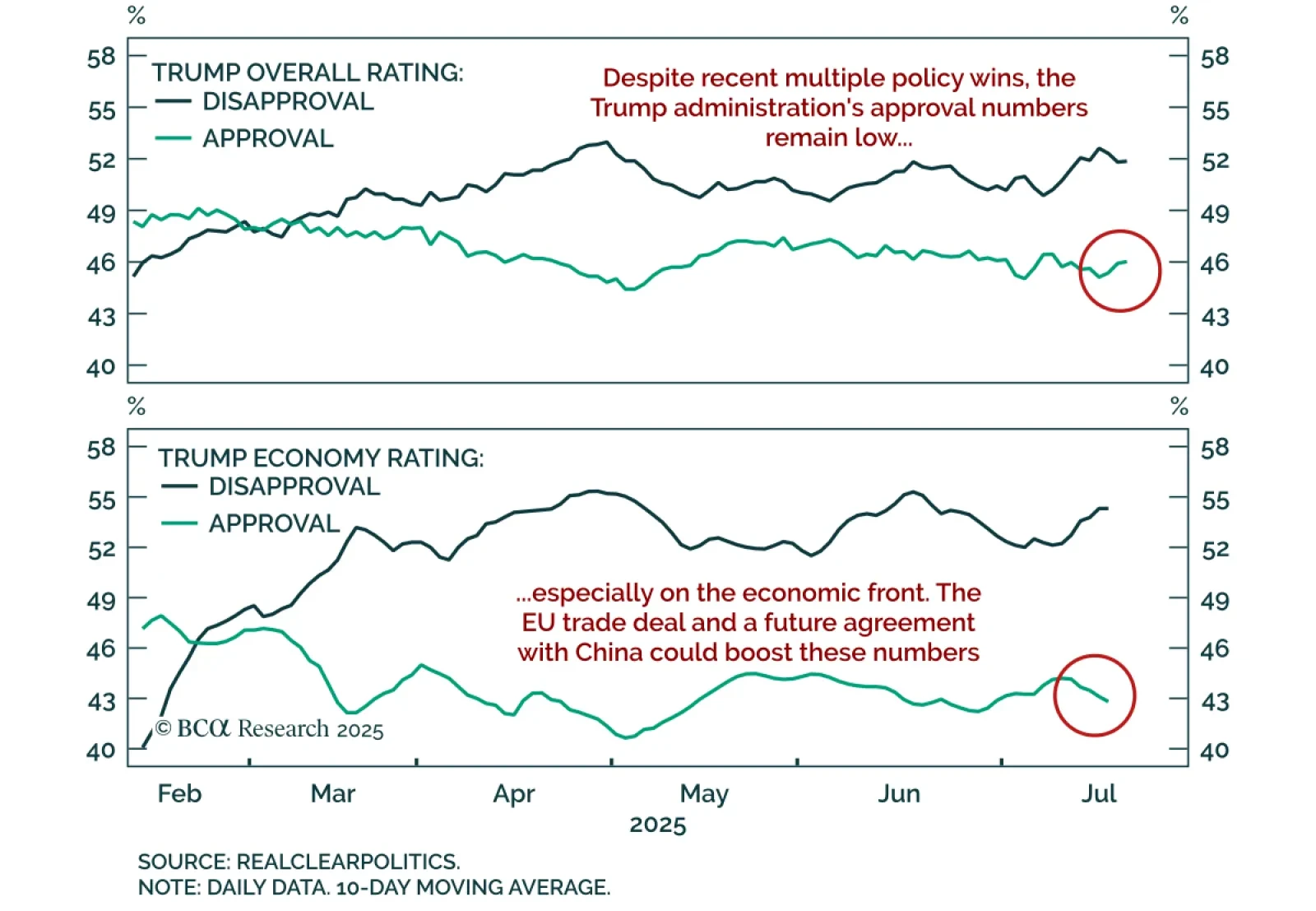

The US-EU trade deal lifts uncertainty but imposes high tariffs, weighing on the EUR and supporting our long USD positioning. The agreement includes a 15% tariff on all EU exports to the US, including cars and potentially,…

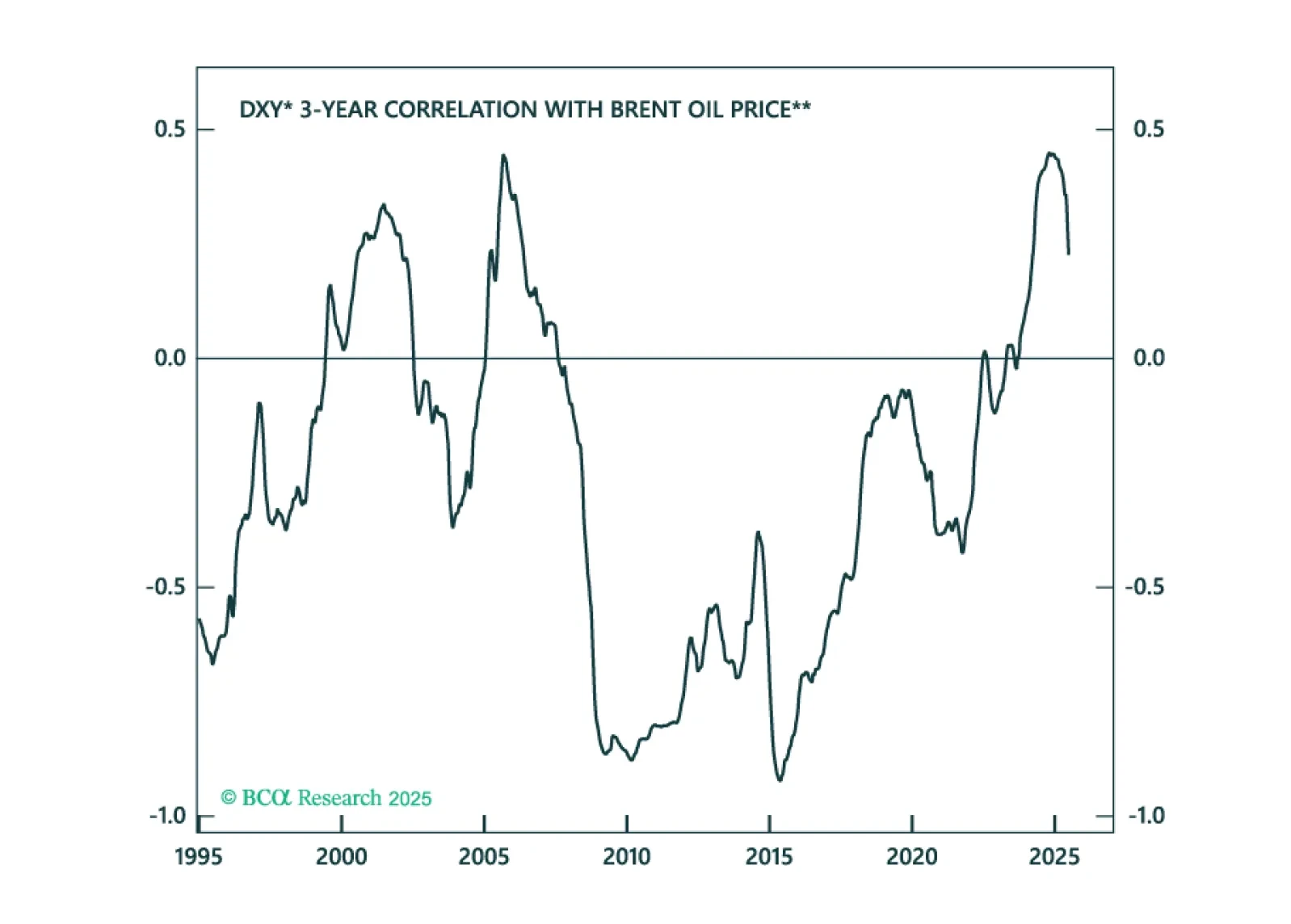

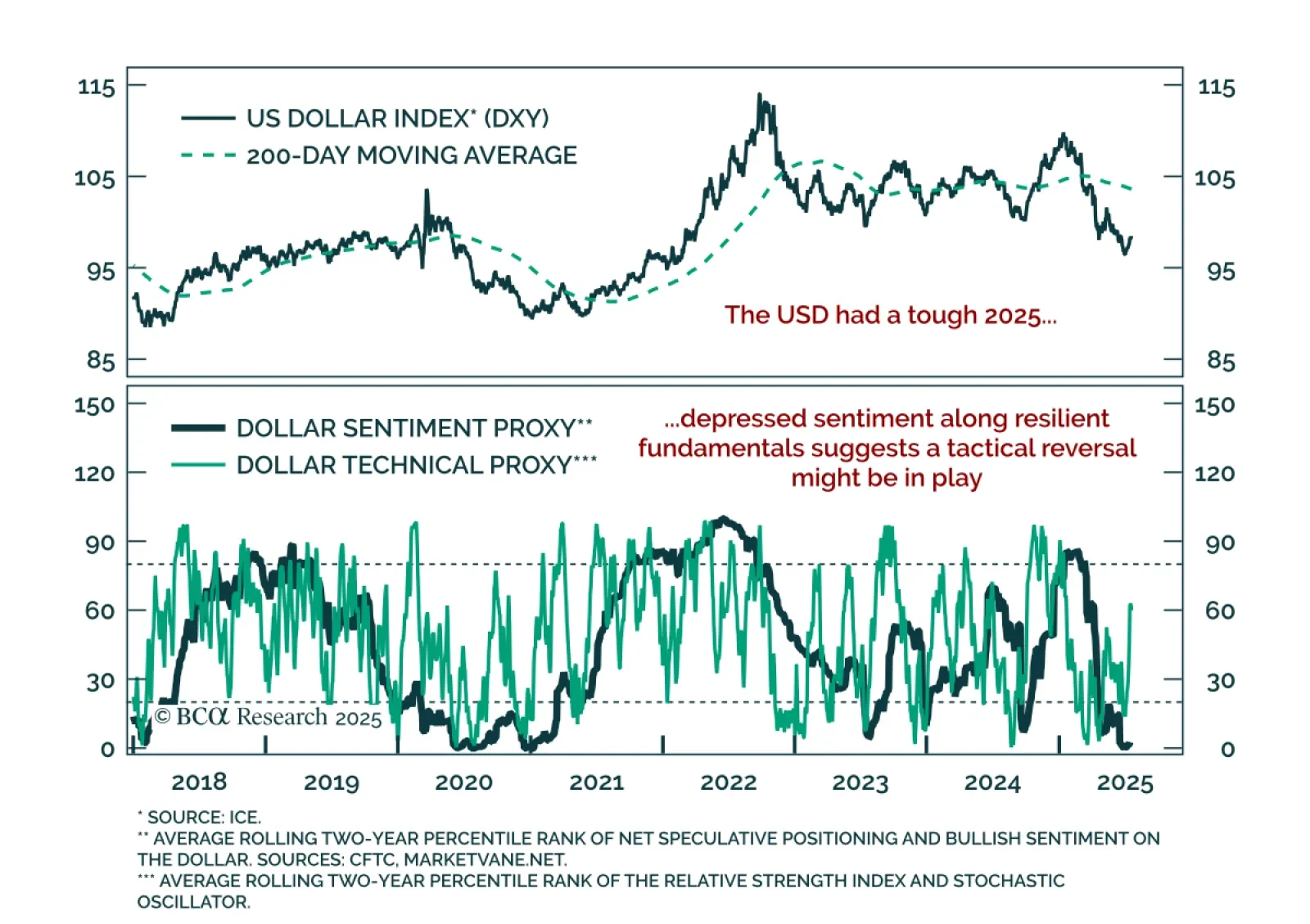

The USD remains structurally challenged, but near-term tactical conditions suggest a temporary bottom is in place. After a sustained selloff and rising concerns around its reserve status, the dollar has decoupled from rate…

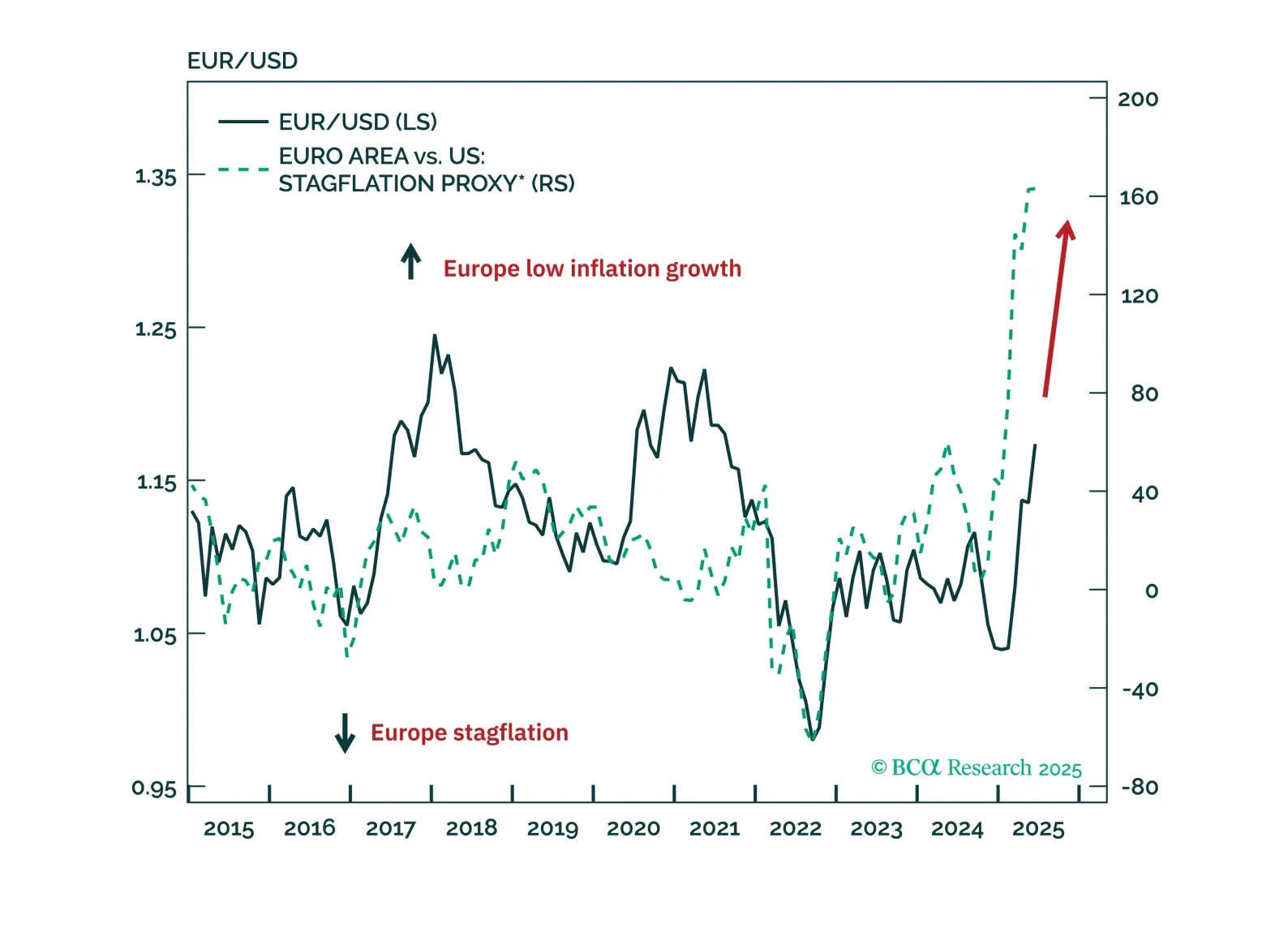

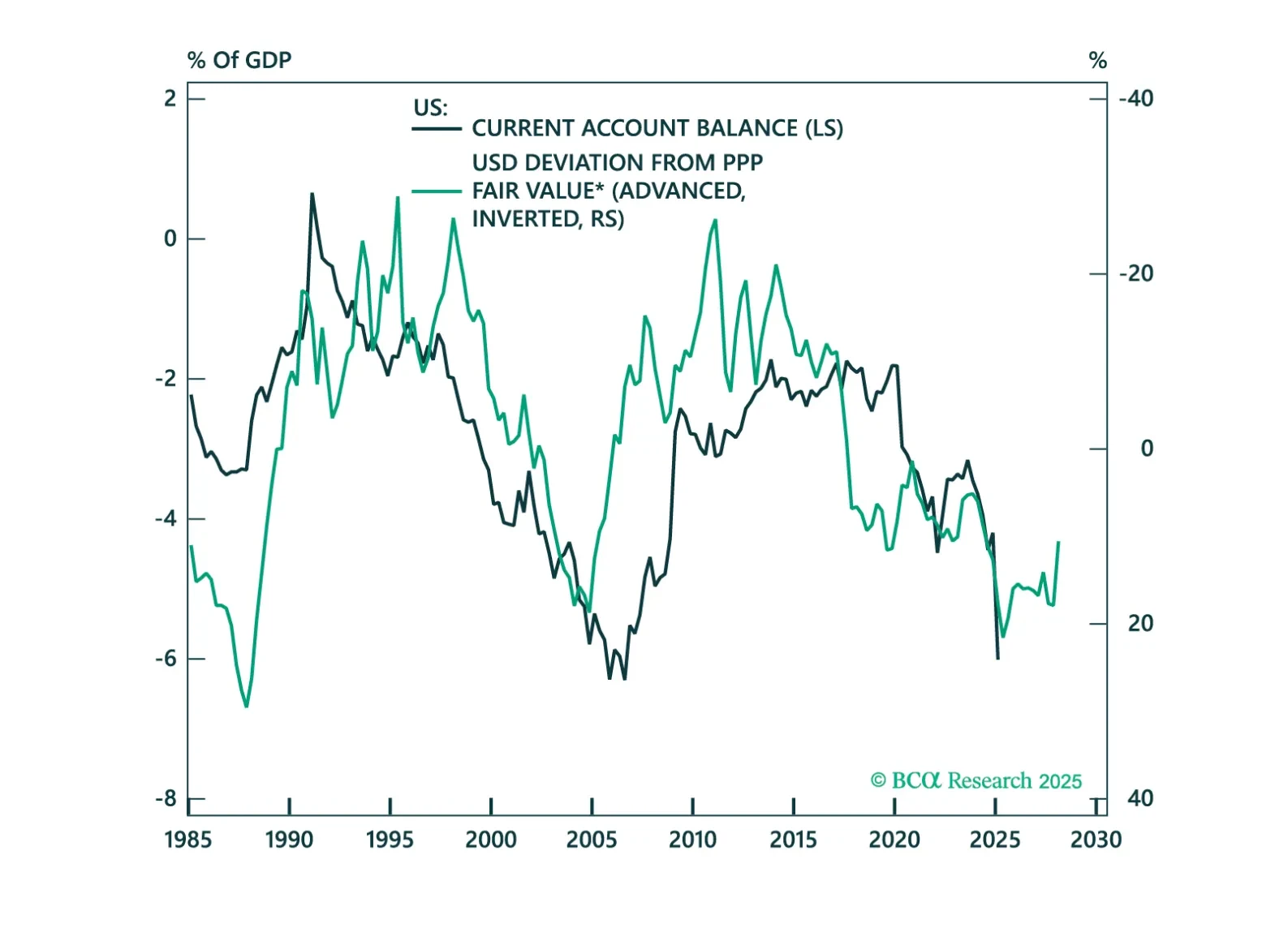

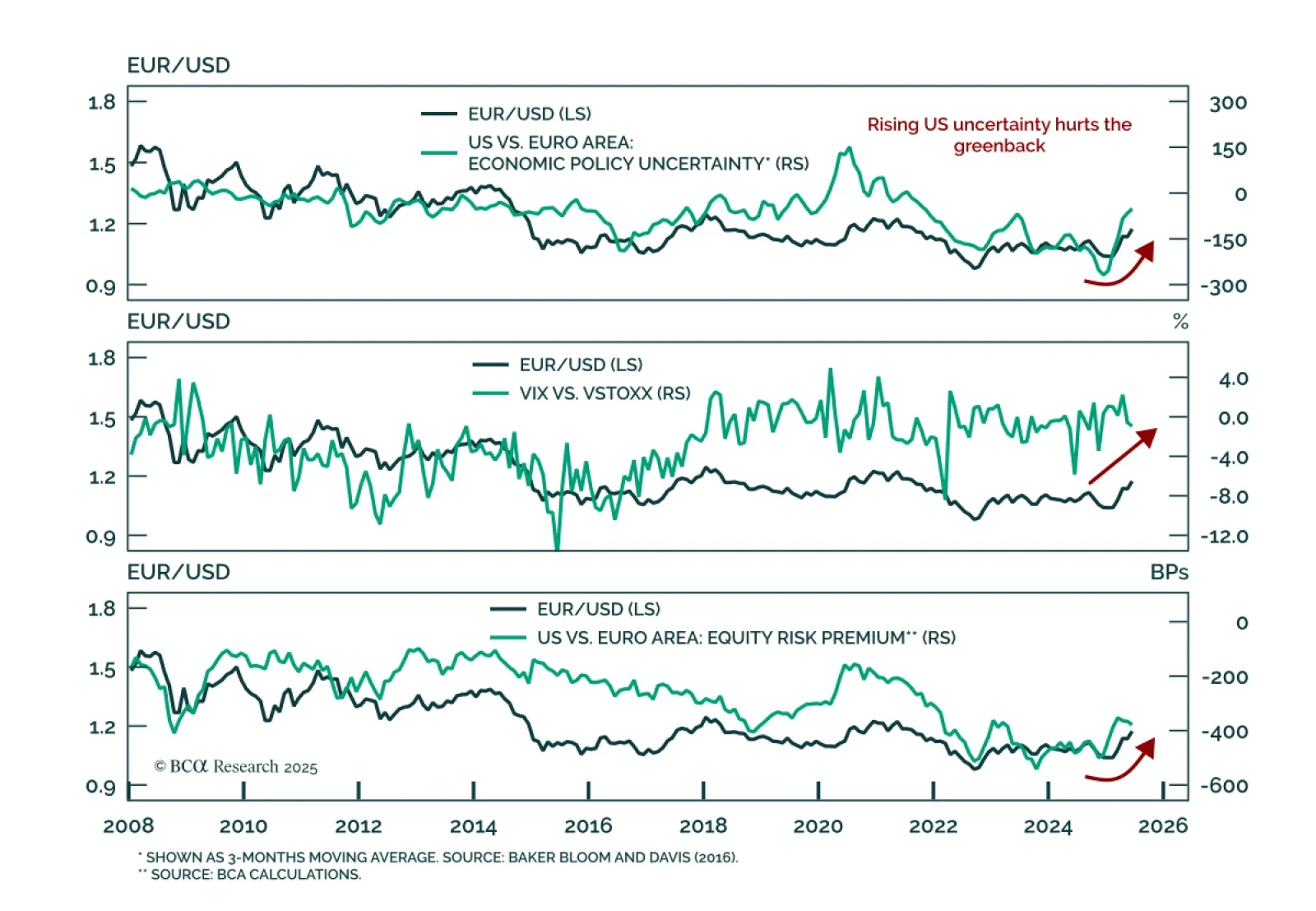

Rising US macro uncertainty and external imbalances are reinforcing euro strength and are supportive of a long-term bullish view on EUR/USD. Our Chart Of The Week comes from Mathieu Savary, Chief Strategist for Developed Markets ex…

Our DM ex-US strategists see EUR/USD in a multi-year bull market and recommend selling EUR/JPY at 172.5. The euro’s 2025 rally has been driven first by improving Eurozone growth expectations, then by mounting concerns over the US…

EUR/USD is in a multi-year bull market. A short-term pause is likely, but the longer-term trend remains higher toward 1.25, and eventually 1.40.

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

The dollar is breaking down, as capital leaves the US. The important question investors must answer is how much downside is left for the greenback, and whether depreciation will continue in a straight line over the coming months or pause (…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…