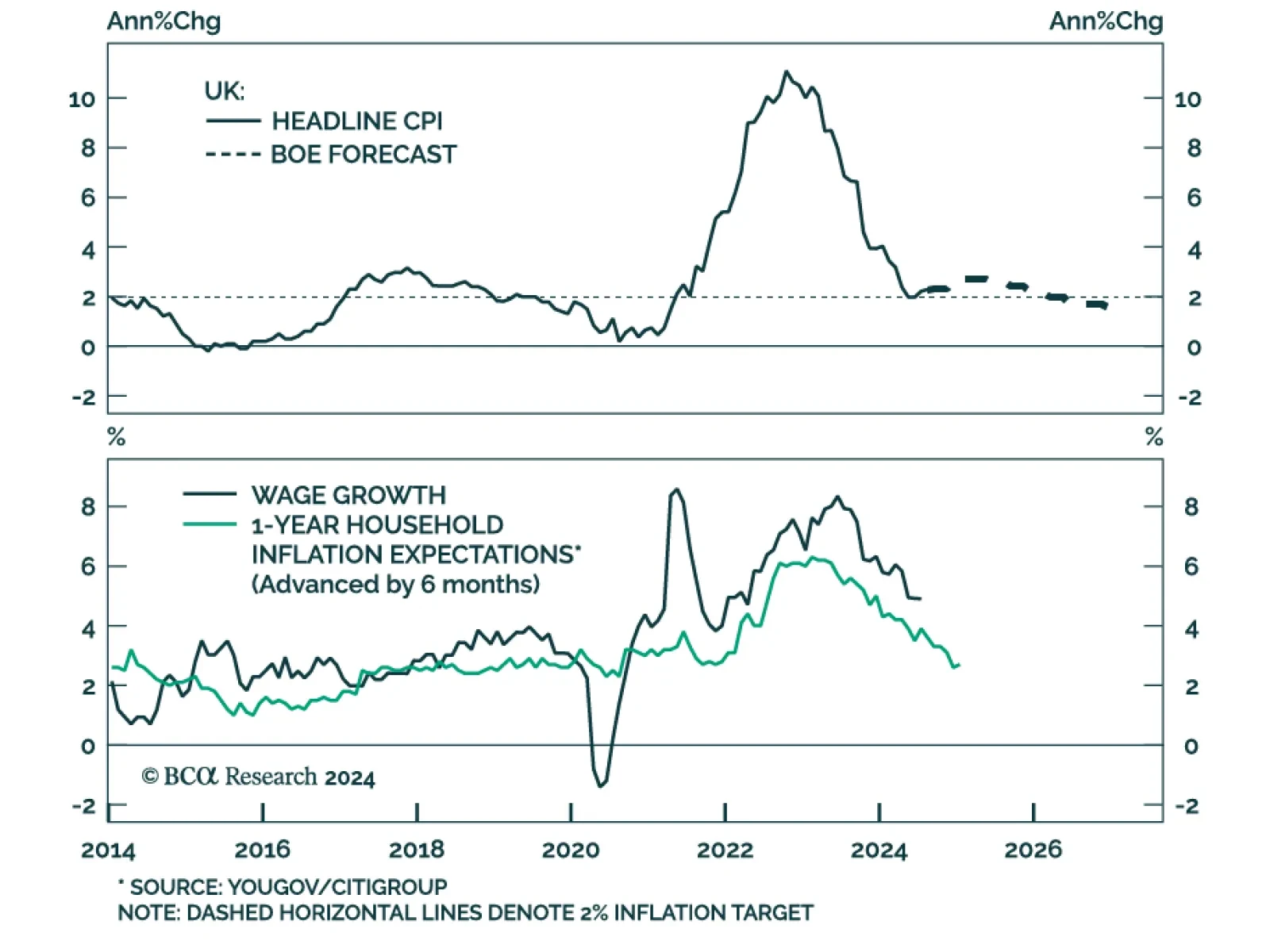

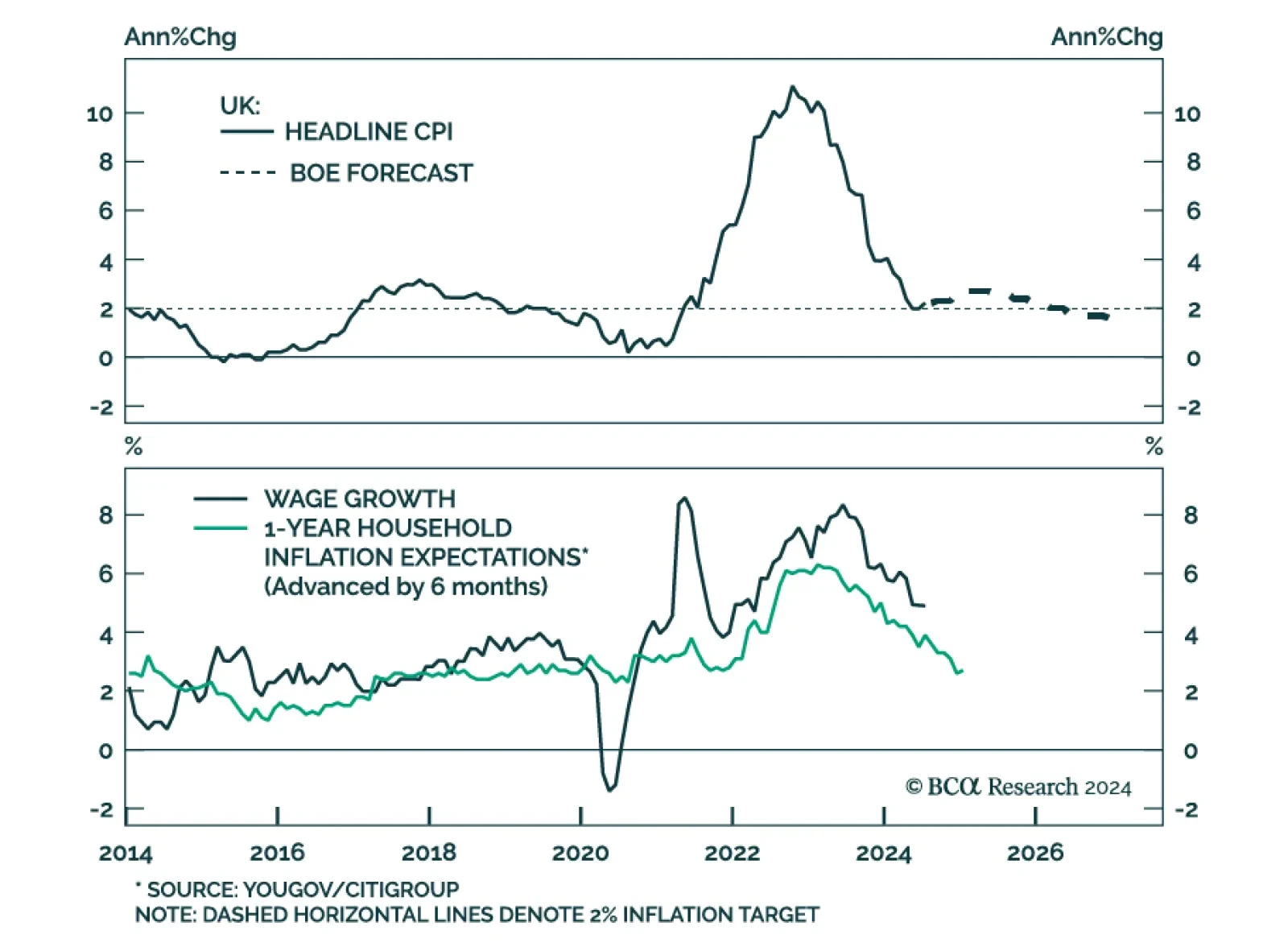

Comments from Bank of England Governor Andrew Bailey on Thursday, hinting at “a more aggressive” pace of rate cuts, marked a shift in rhetoric from previous meetings which signaled a “gradual” pace. The…

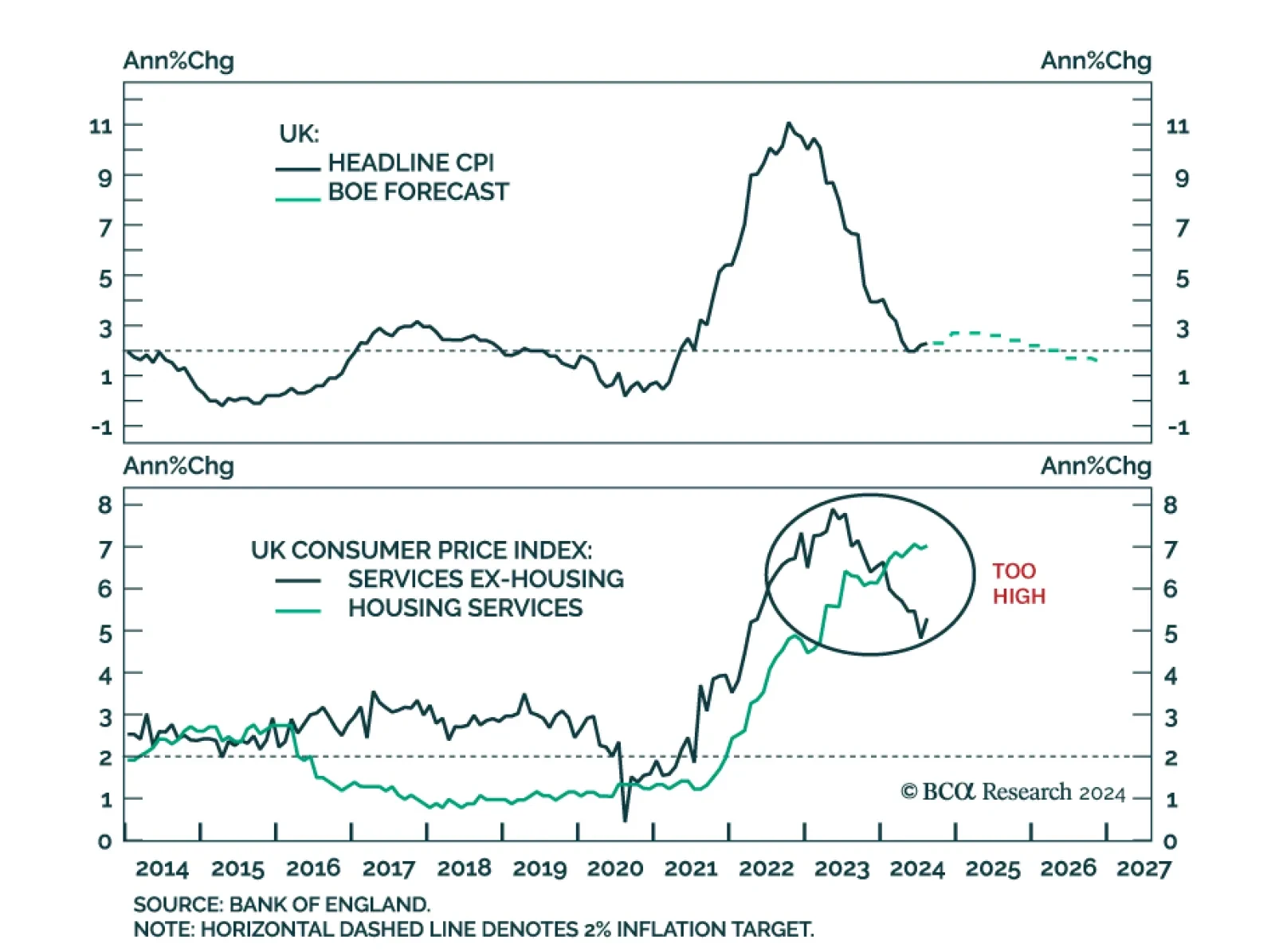

UK headline CPI grew at a stable 2.2% y/y in August, though the core measure accelerated from 3.3% to 3.6%, in line with expectations. An 11.6% annual increase in airfare largely drove core CPI higher, while offsetting…

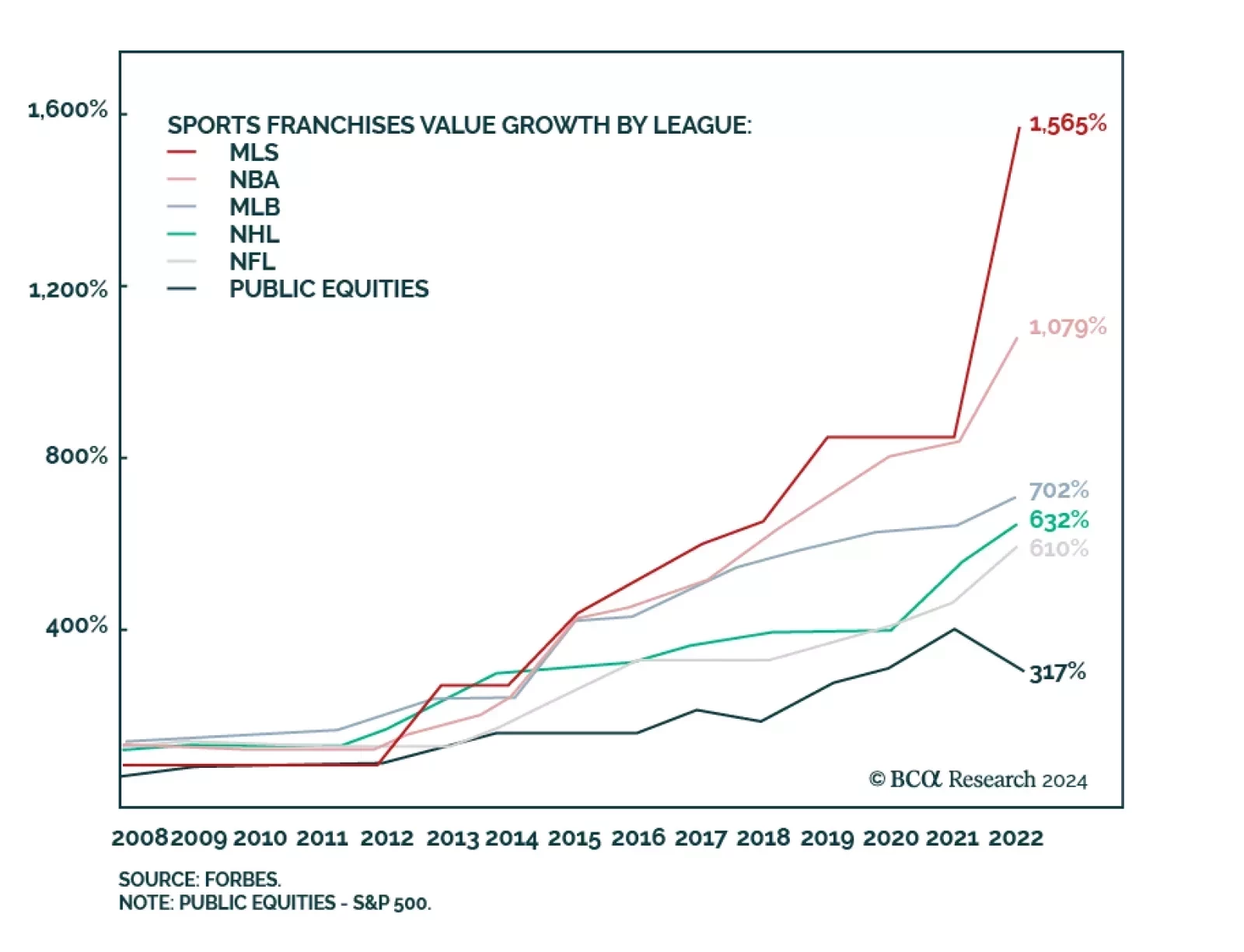

According to BCA Research’s Private Markets & Alternatives service, the Sports Franchise market presents a compelling opportunity for Private Equity due to its strong growth potential, evolving business models, and…

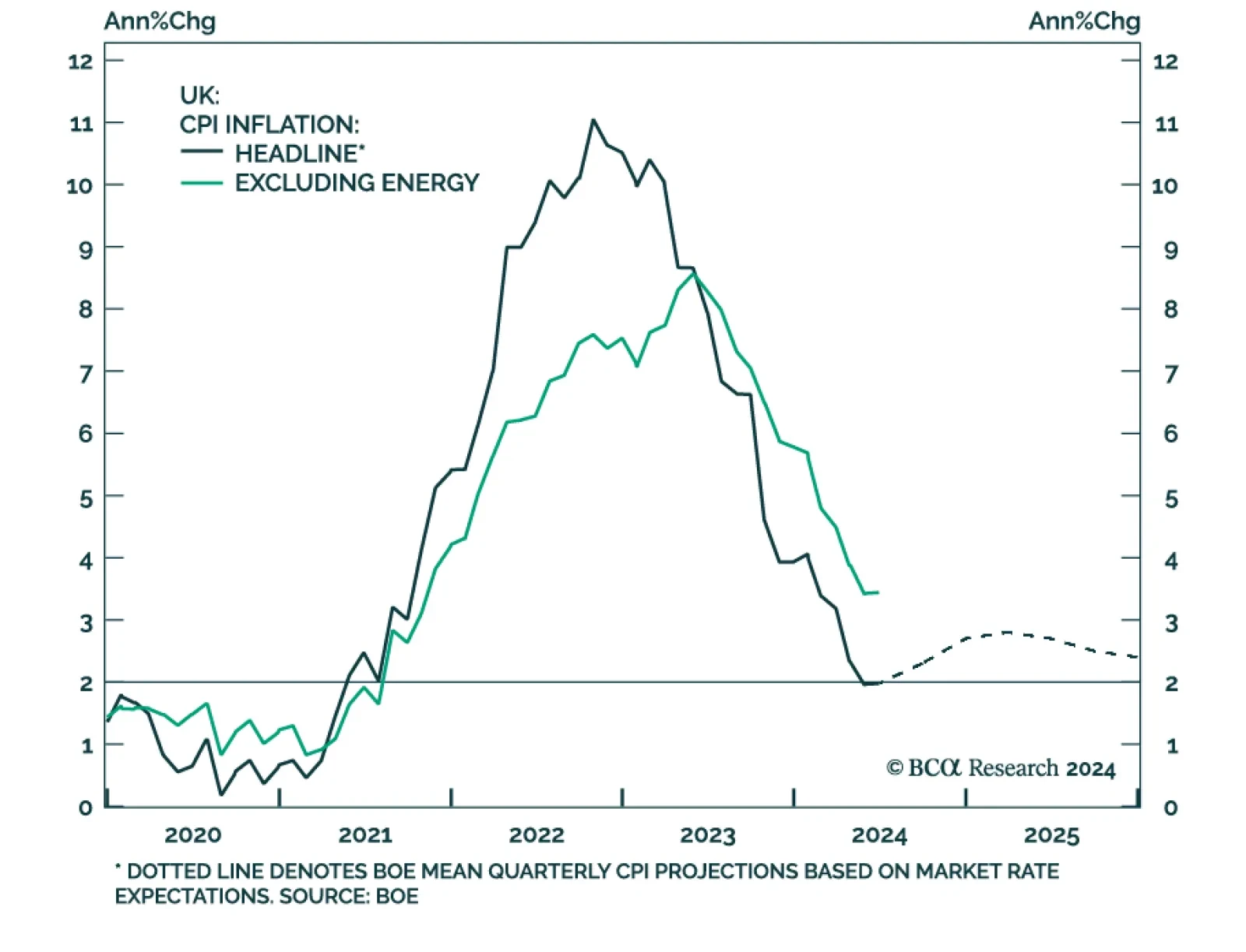

The BoE embarked on its easing cycle in August, delivering its first 25 bps rate cut. The decision was nowhere near unanimous, with 5 MPCs out of 9 voting in favor of lowering policy rates. Indeed, while headline inflation is…

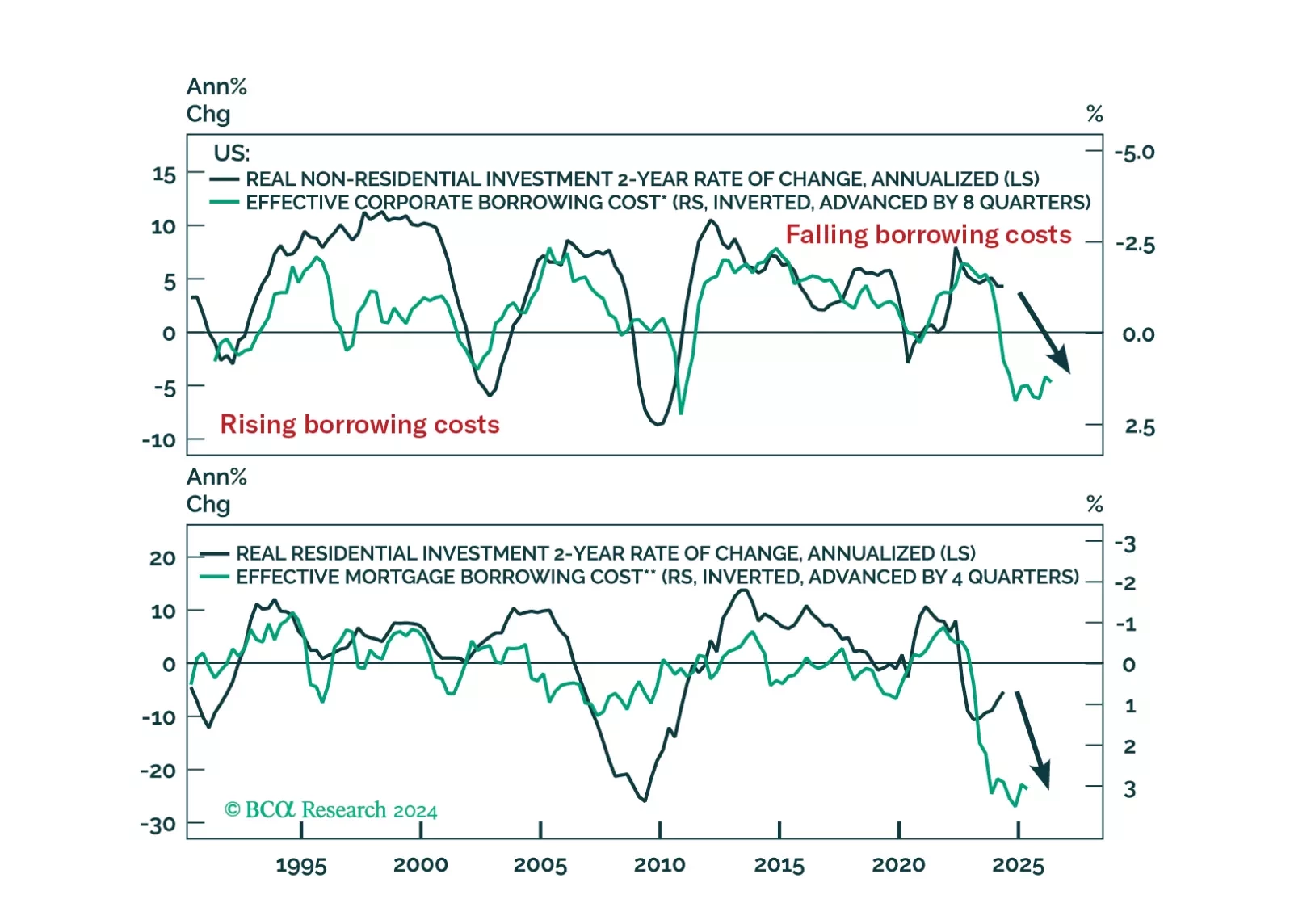

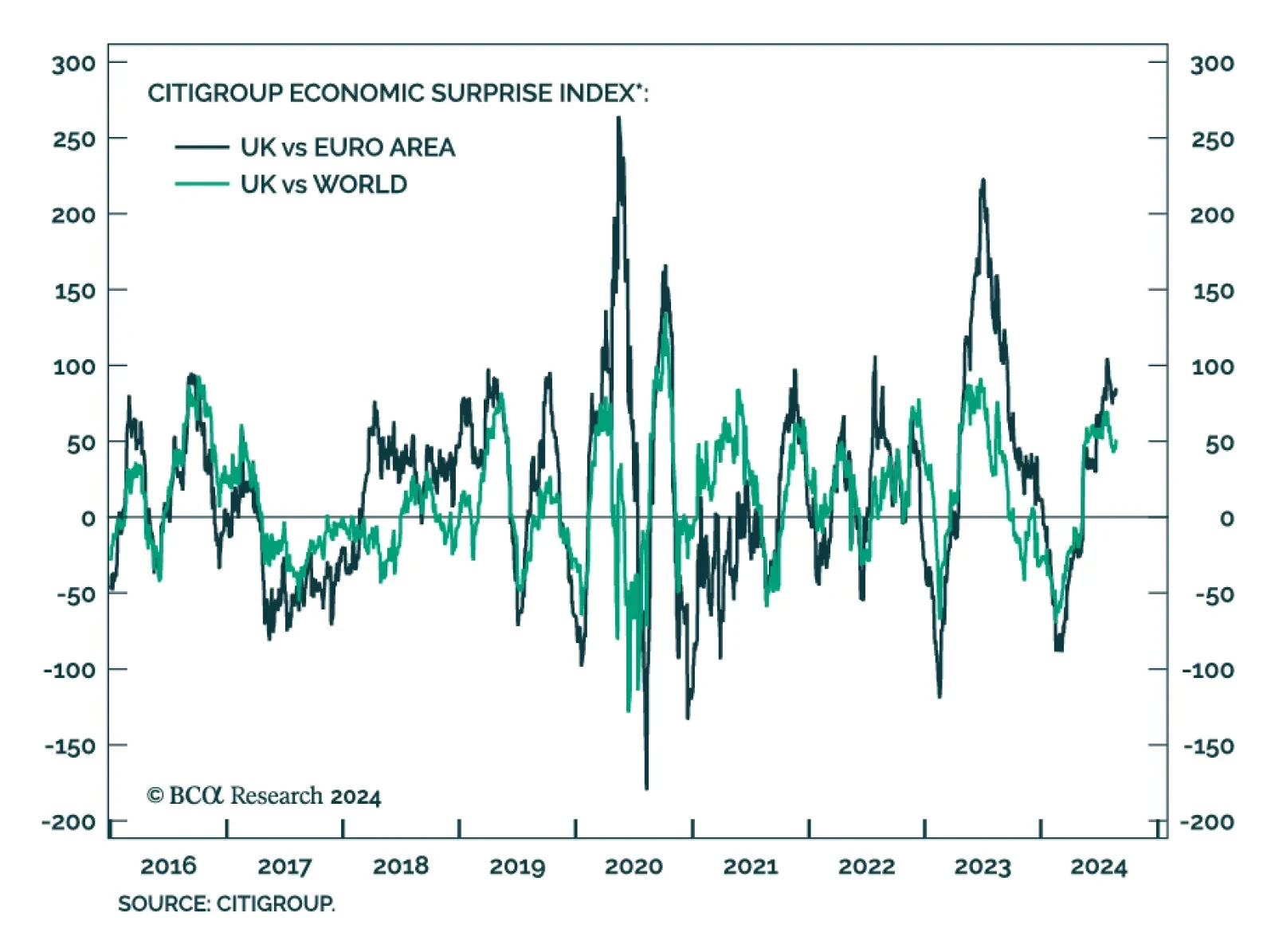

UK GDP growth accelerated to 0.6% in the second quarter, and the latest PMI data underscores contrasts with its DM counterparts (see The Numbers). Several tailwinds are supporting the UK economy. Two-year Gilt yields have…

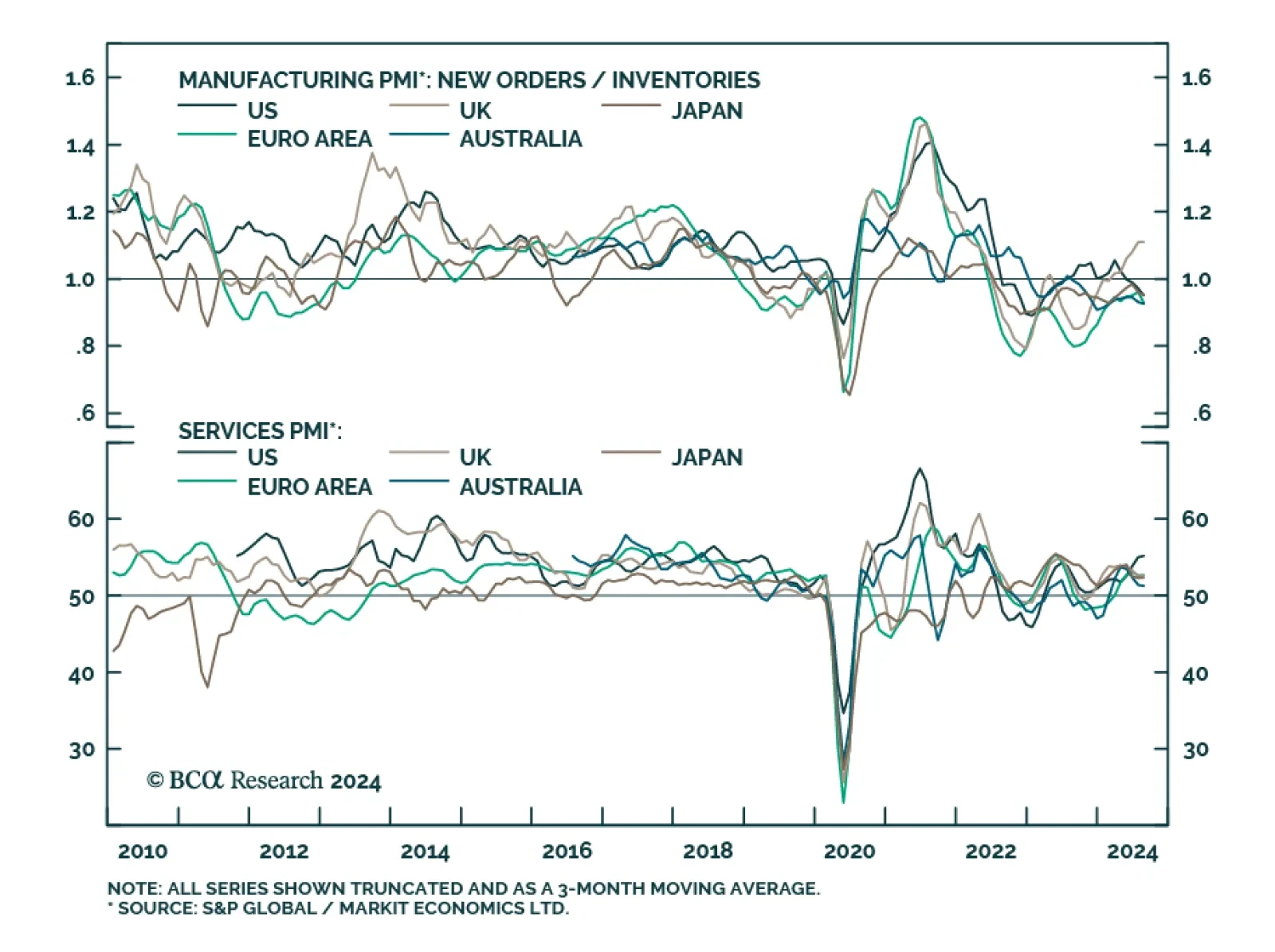

Preliminary estimates suggest that with the exception of the UK (see Country Focus), manufacturing activity remains lackluster in DM economies. Manufacturing declined at a slower pace in Japan and Australia but the contractions…

What do the mixed signals sent by the UK economy mean for the Bank of England, and what are the implications for Gilts and the British pound?

The Bank of England (BoE) lowered its policy rate by 25 basis points to 5% at its meeting on Thursday. While the move was expected, the governing board was split, voting 5 – 4 in favor of reducing the key interest rate.…

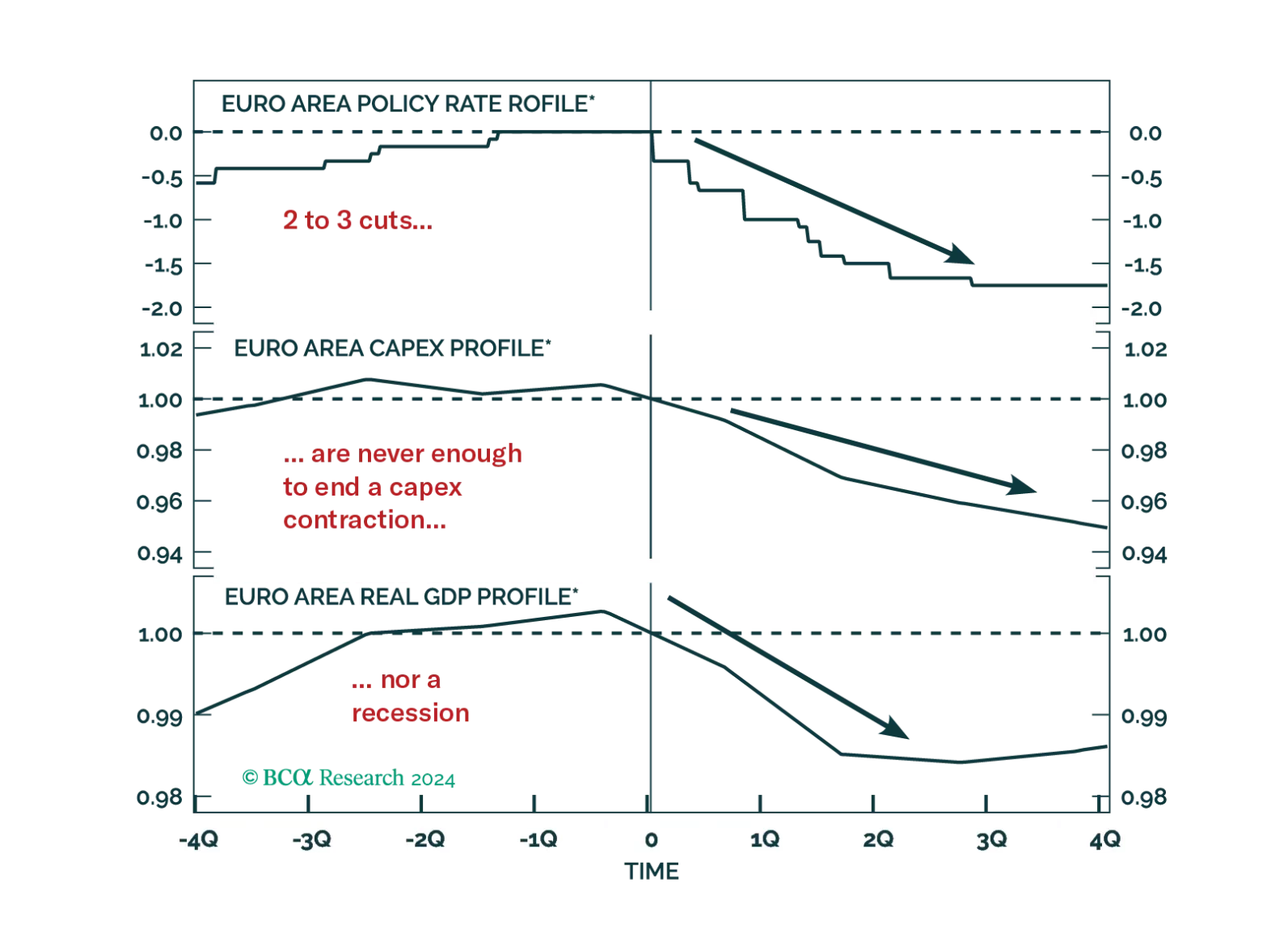

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?