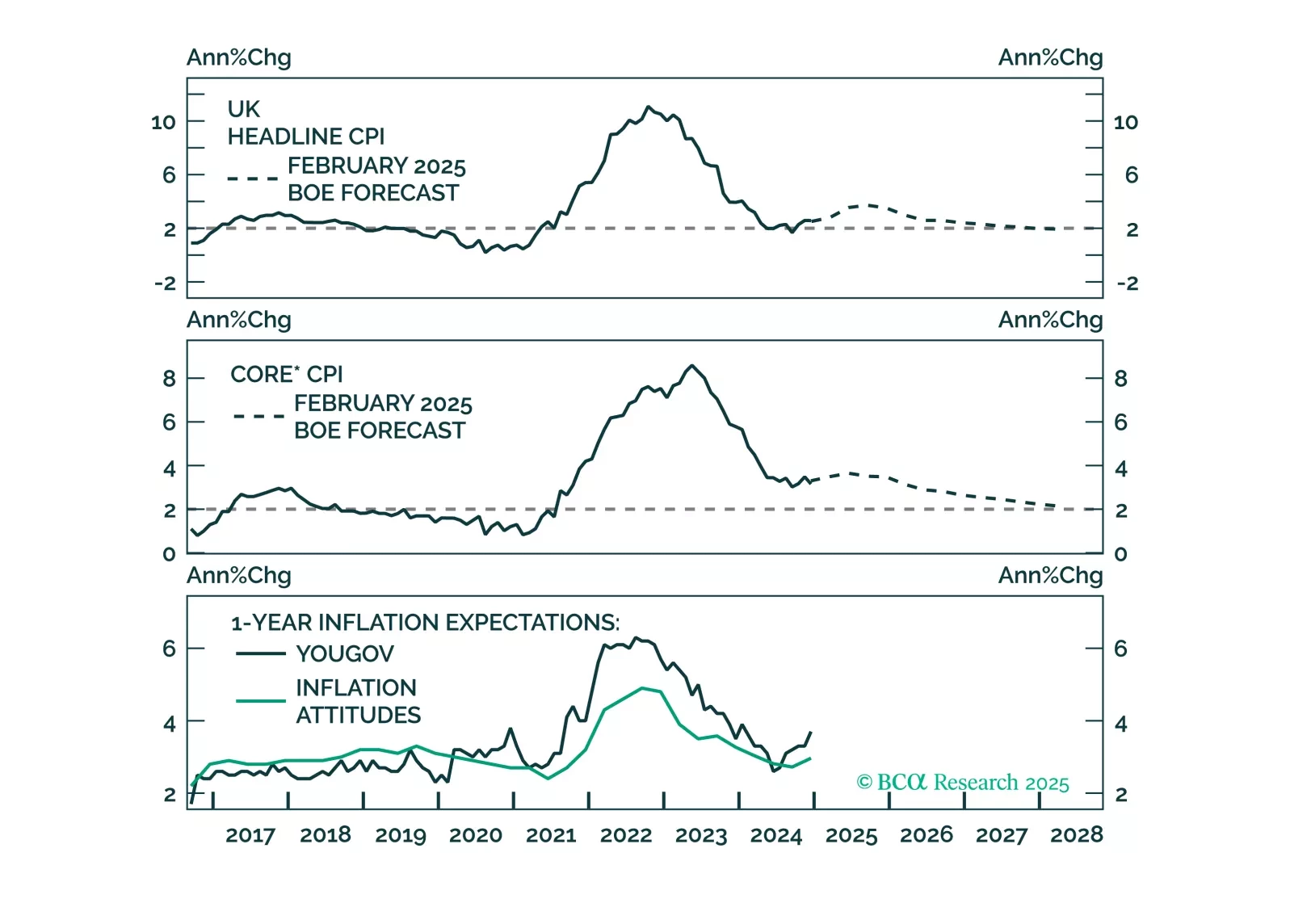

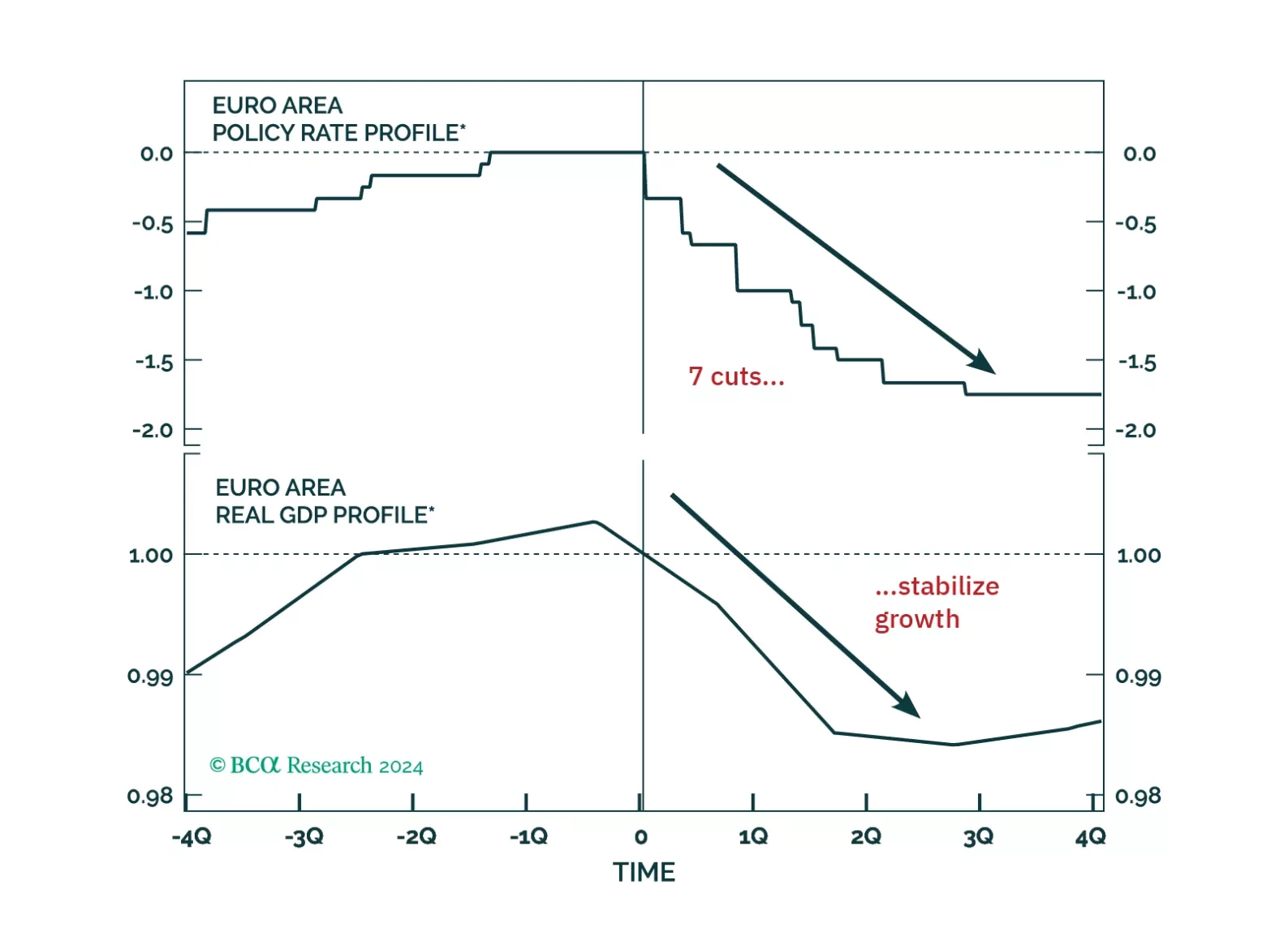

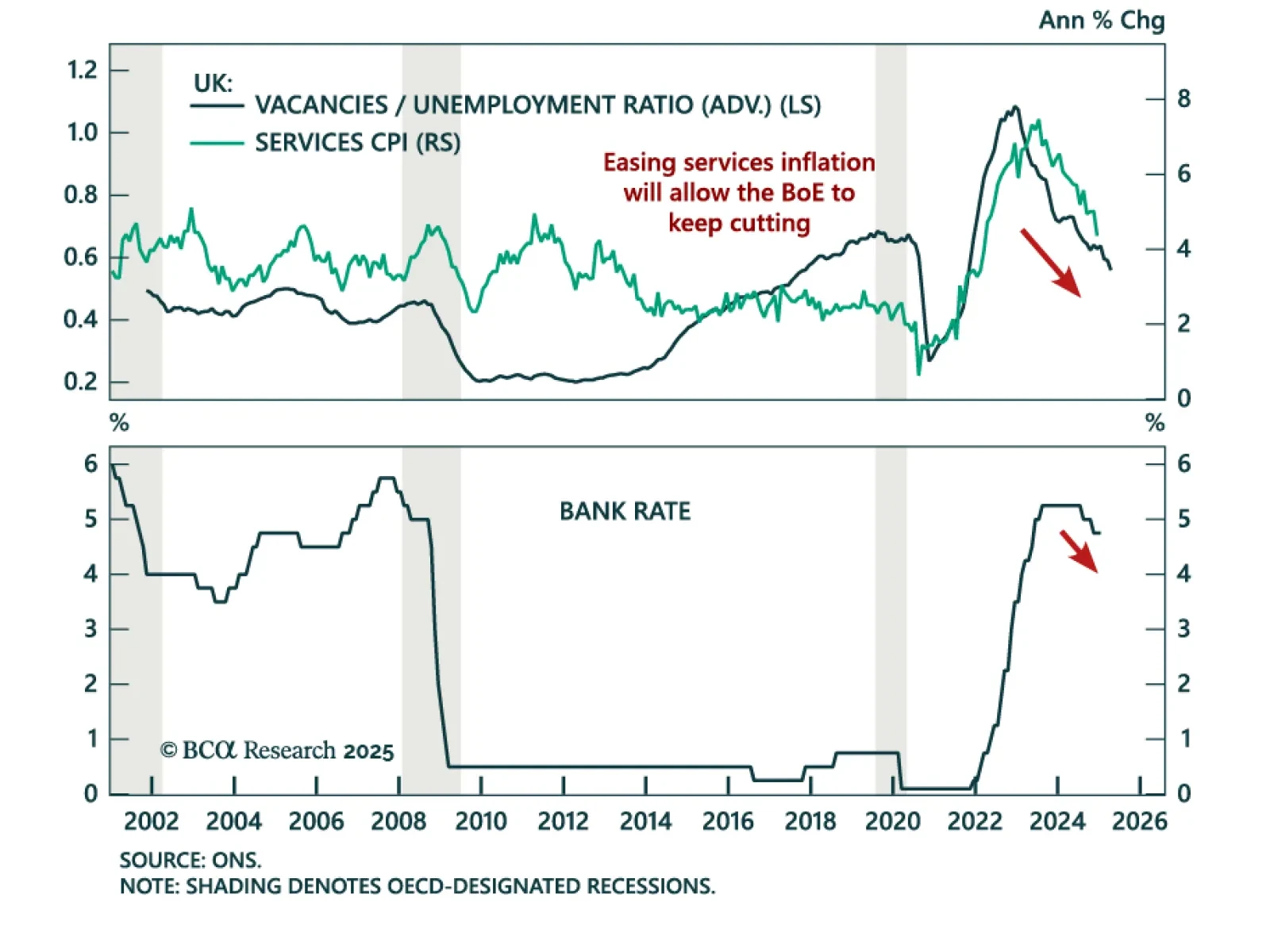

The Bank of England cut its policy rate by 25 bps to 4.5%, with two members of the MPC voting to cut 50 bps instead. The BoE acknowledged “substantial progress on disinflation”, driven by a tight policy stance and stabilized…

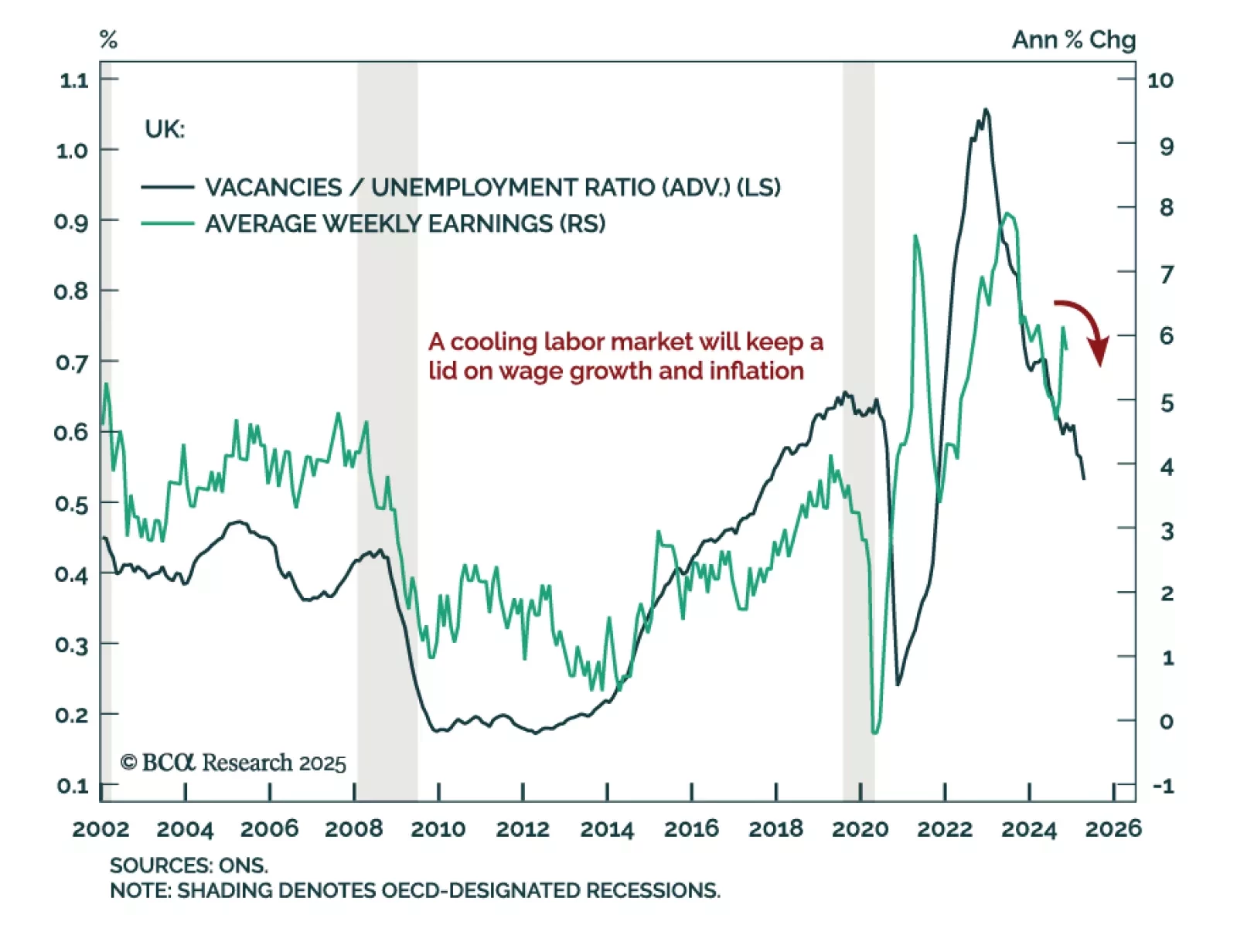

Following today’s Bank of England’s policy meeting, at which the policy rate was cut by 25 bps, we discuss our outlook for monetary policy in the UK. We expect the gradual easing to continue and discuss the investment implications…

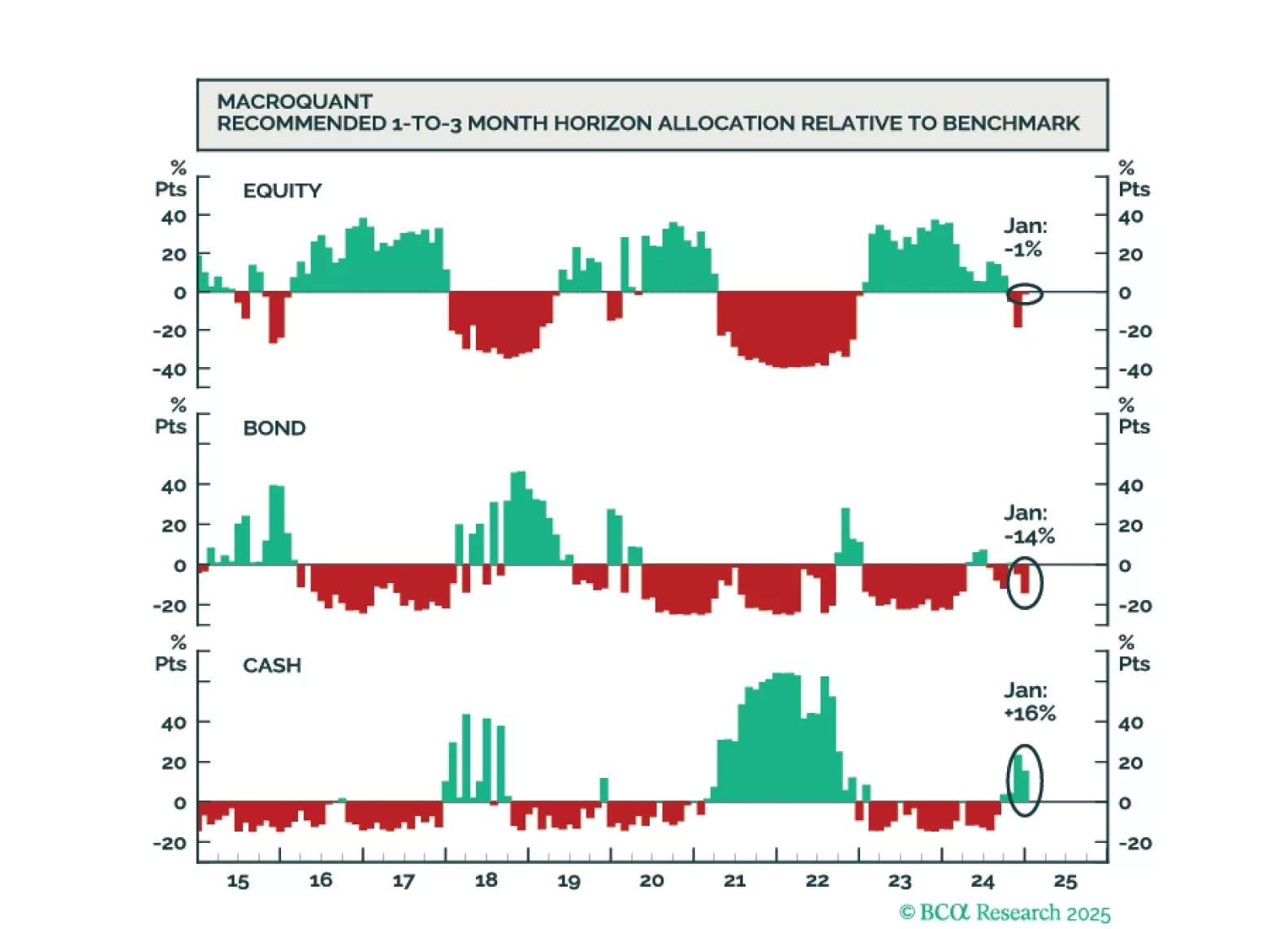

While the US economy could remain upright on the tightrope for a while longer, it will inevitably fall, leading to a major bear market in stocks. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

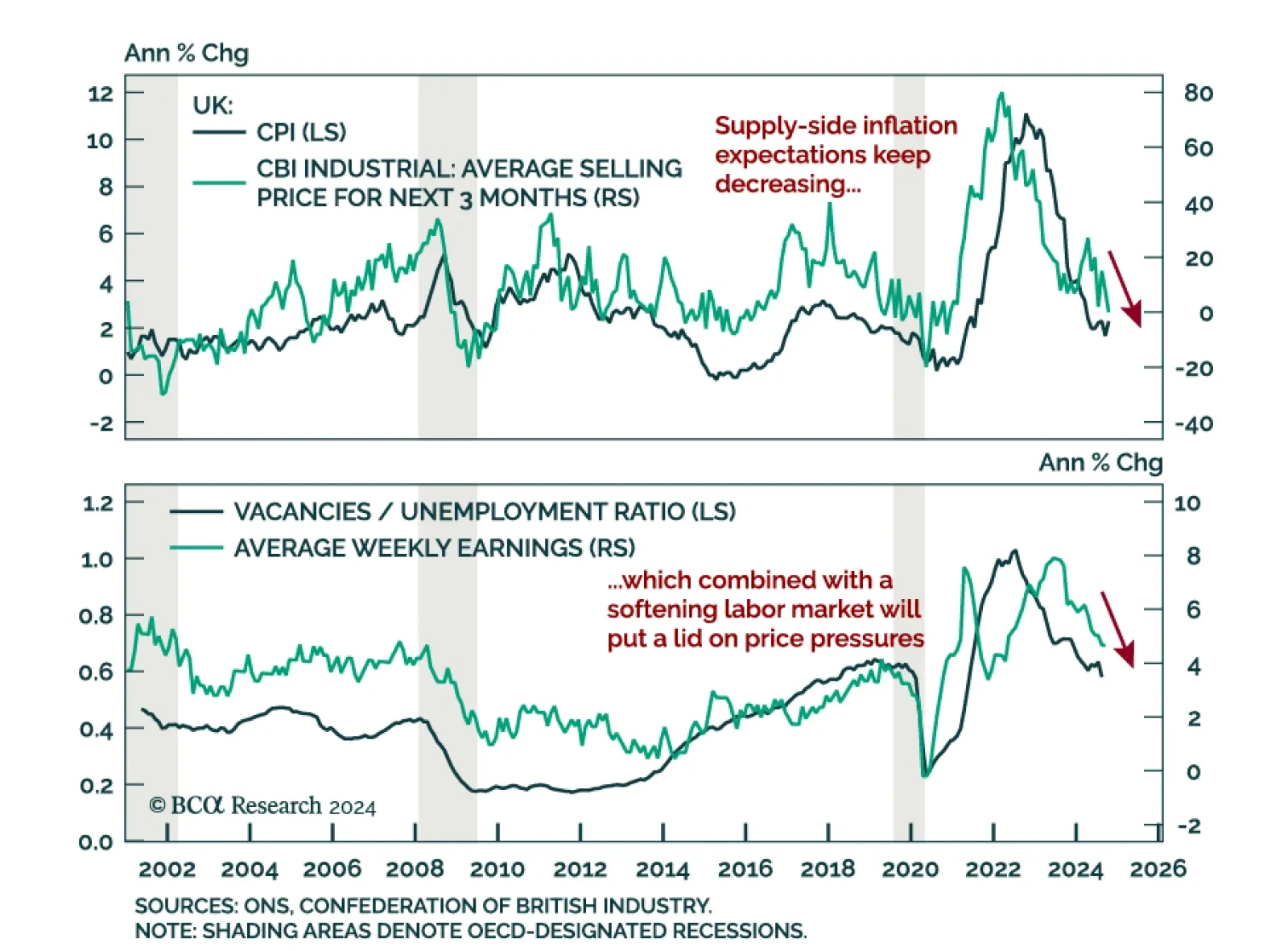

November/December UK employment data was mixed. The November unemployment rate rose 0.1% to 4.4%, in line with expectations. Payrolled employees decreased faster than expected at a 47k pace in December, surpassing the 35k contraction…

UK inflation surprised to the downside in December. Headline inflation retreated below estimates to 2.5% y/y from an eight-month high of 2.6% in November. Core inflation also decreased below estimates, printing 3.2% vs. 3.5% in…

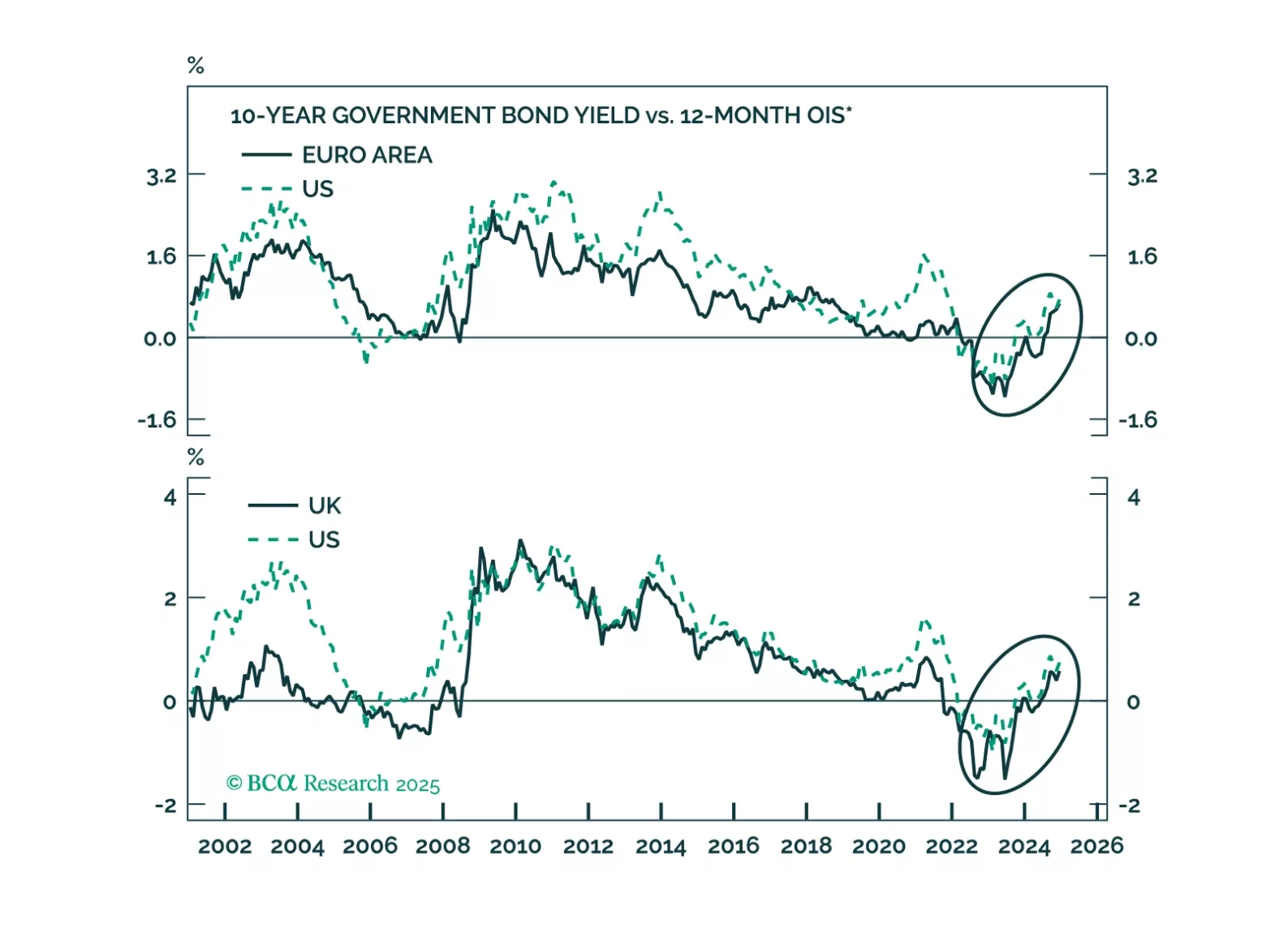

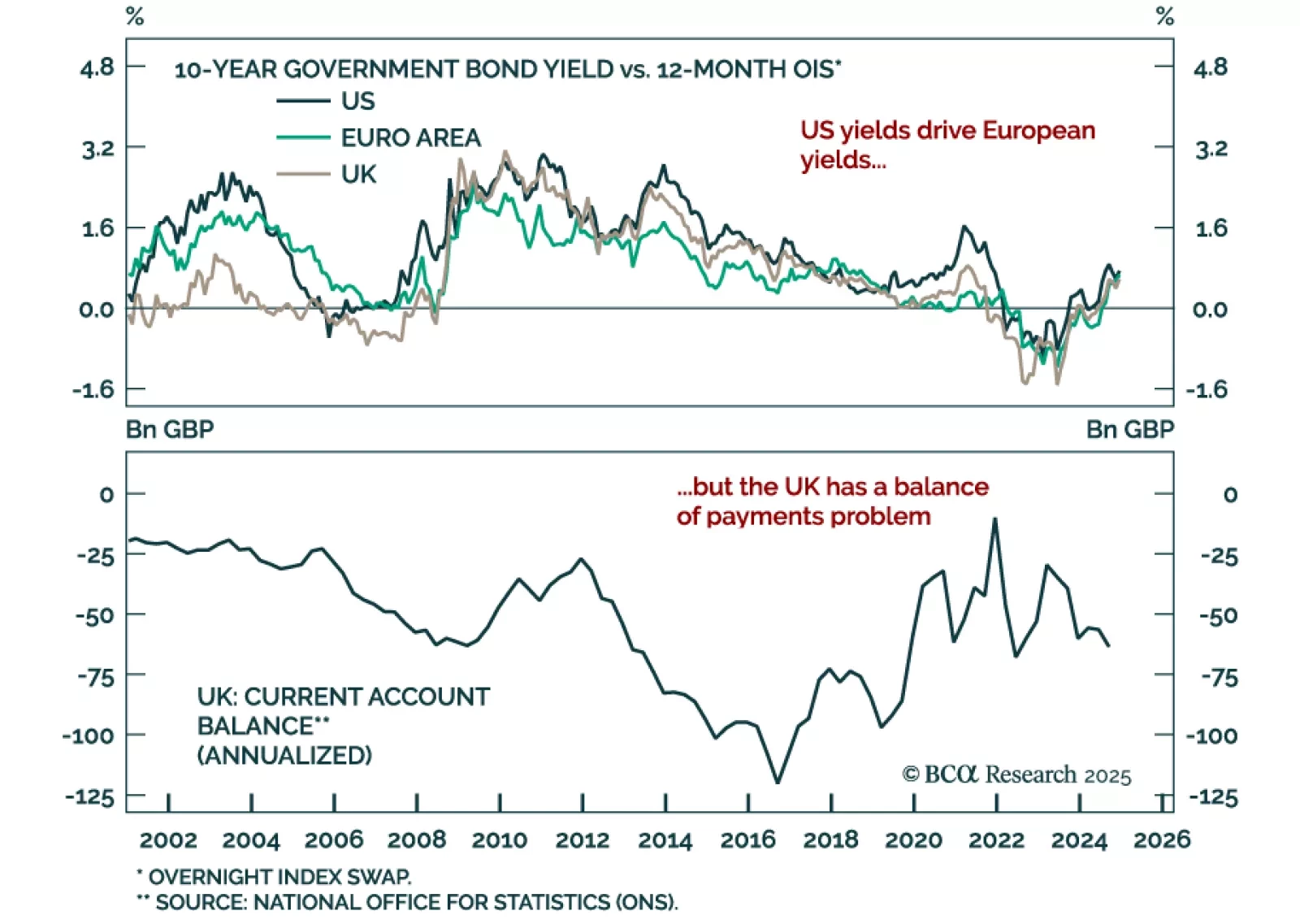

Our European Investment strategists looked at the developed markets bond selloff from a European perspective, focusing on Euro area and UK government bonds and currencies. The recent selloff in European bonds is driven primarily…

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

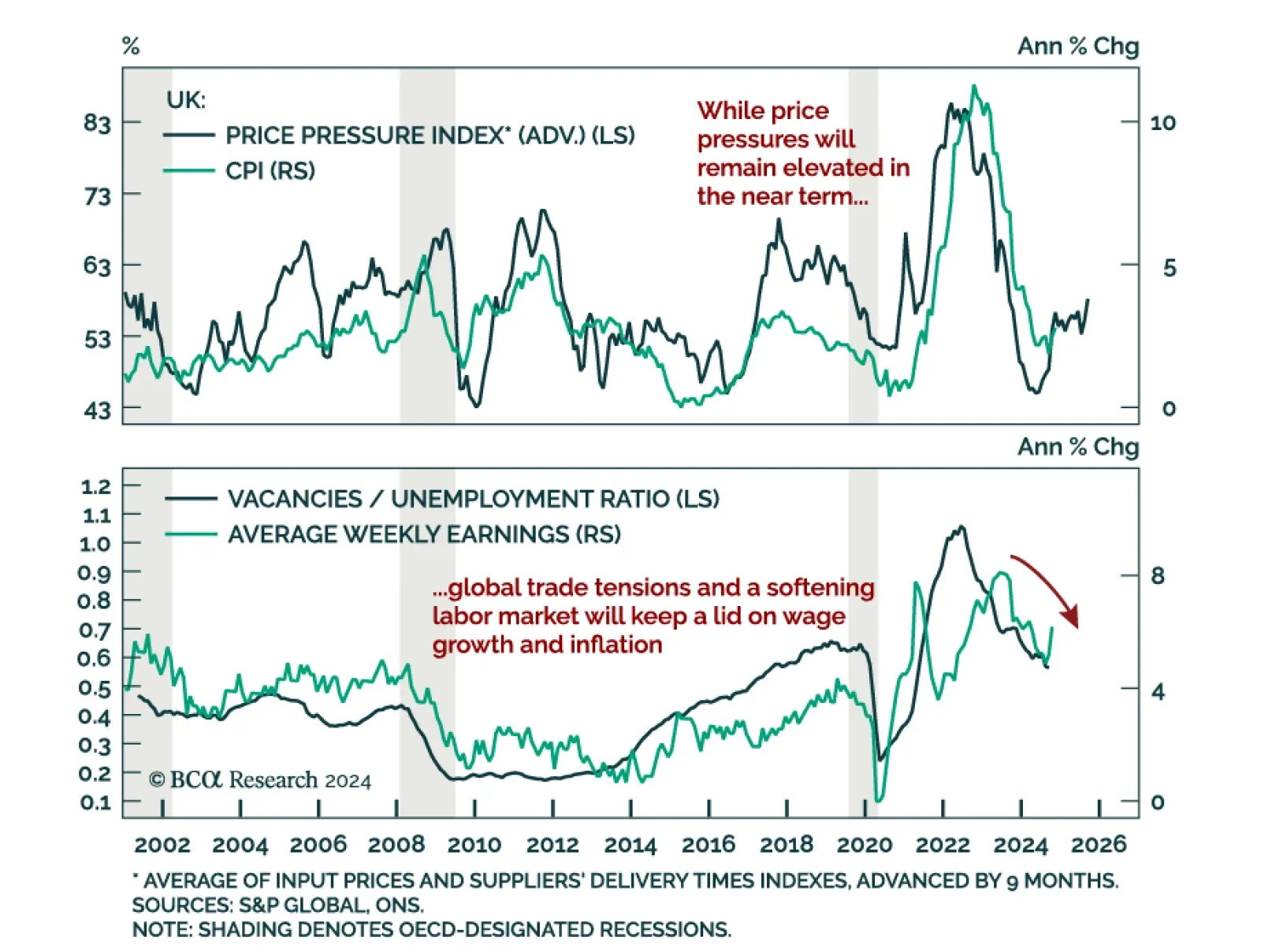

The November UK CPI, in line with estimates, hit an eight-month high, accelerating from 2.3% y/y to 2.6%. Core and services inflation were also strong at 3.5% (vs. 3.3% in October) and 5.0% (flat from October), respectively.…

UK inflation was hotter than expected in October, rising to 0.6% m/m from being flat in September. Core inflation also ticked up, printing at 3.3% y/y vs. 3.2% a month prior. Services inflation remains elevated at 5.0% y/y.…