With economic headwinds building and fiscal dynamics shifting, bond markets are at a turning point. Our latest note outlines why German bund yields are set to decline and why UK gilts are poised to outperform — and how to position…

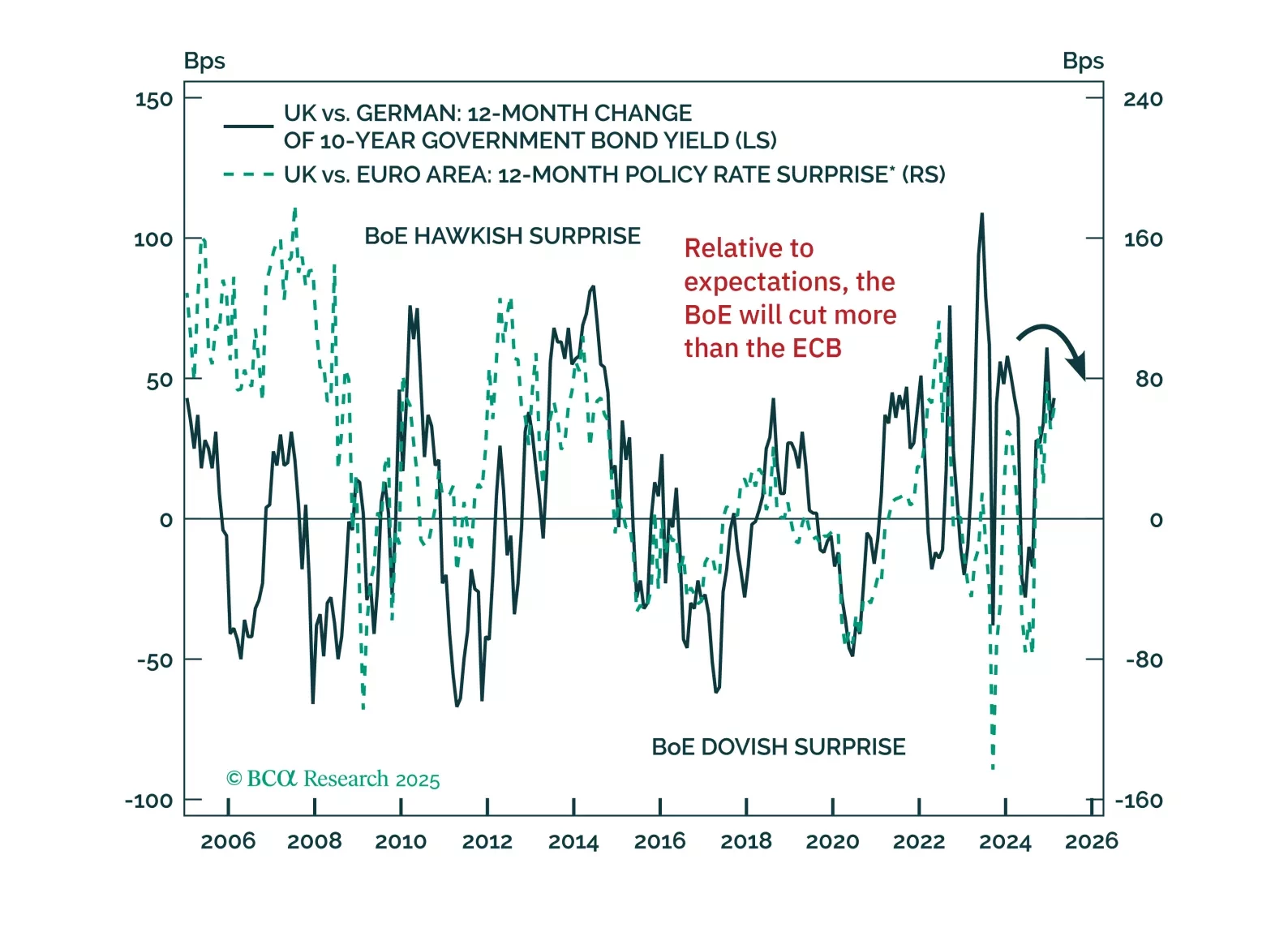

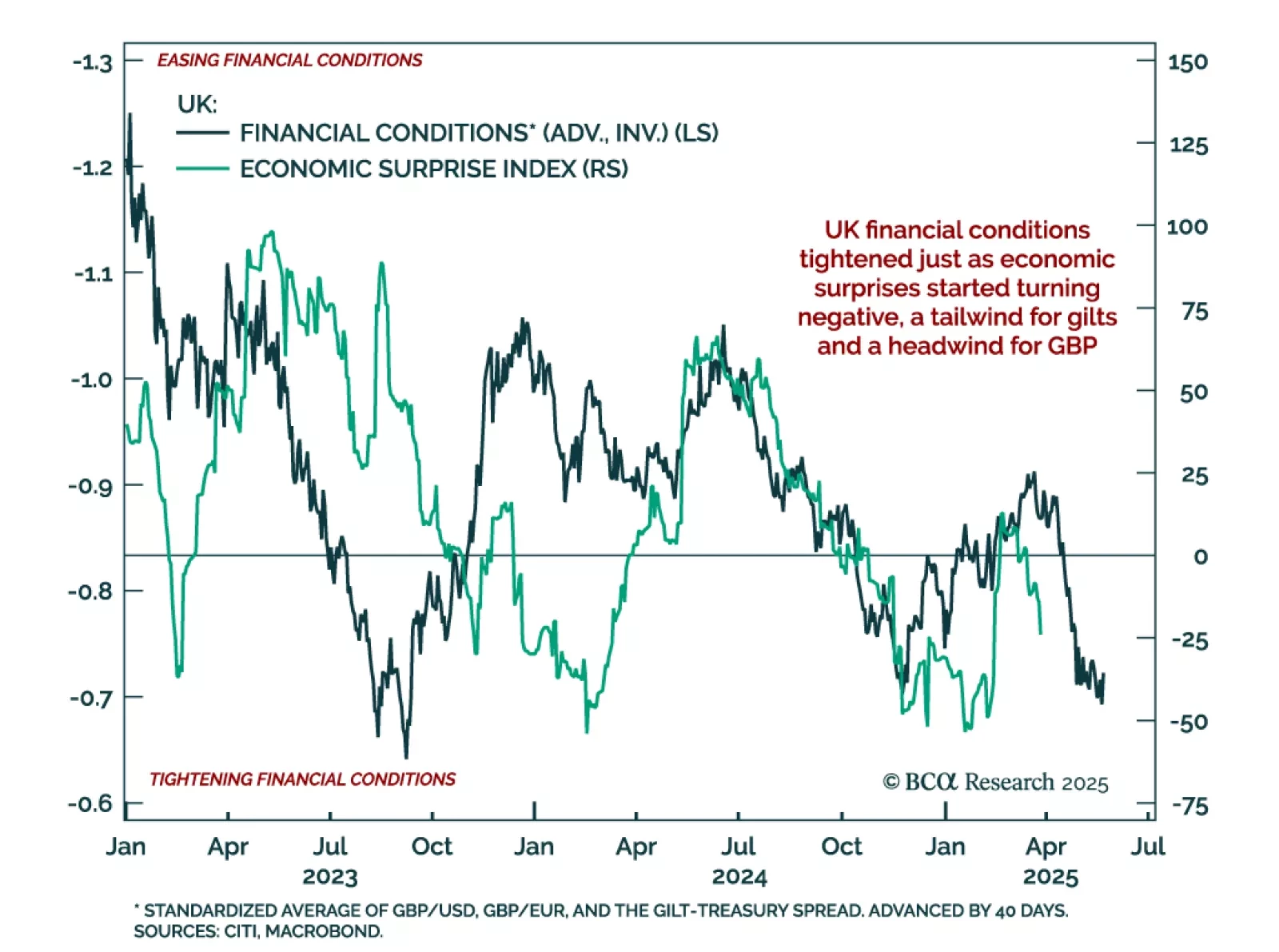

UK financial conditions have tightened just as economic surprises have turned negative, an uncomfortable combination that reinforces our tactical positioning. We remain overweight UK gilts within a global bond portfolio and are…

This report is a quick take on our views on UK bonds and FX, given the recent budget.

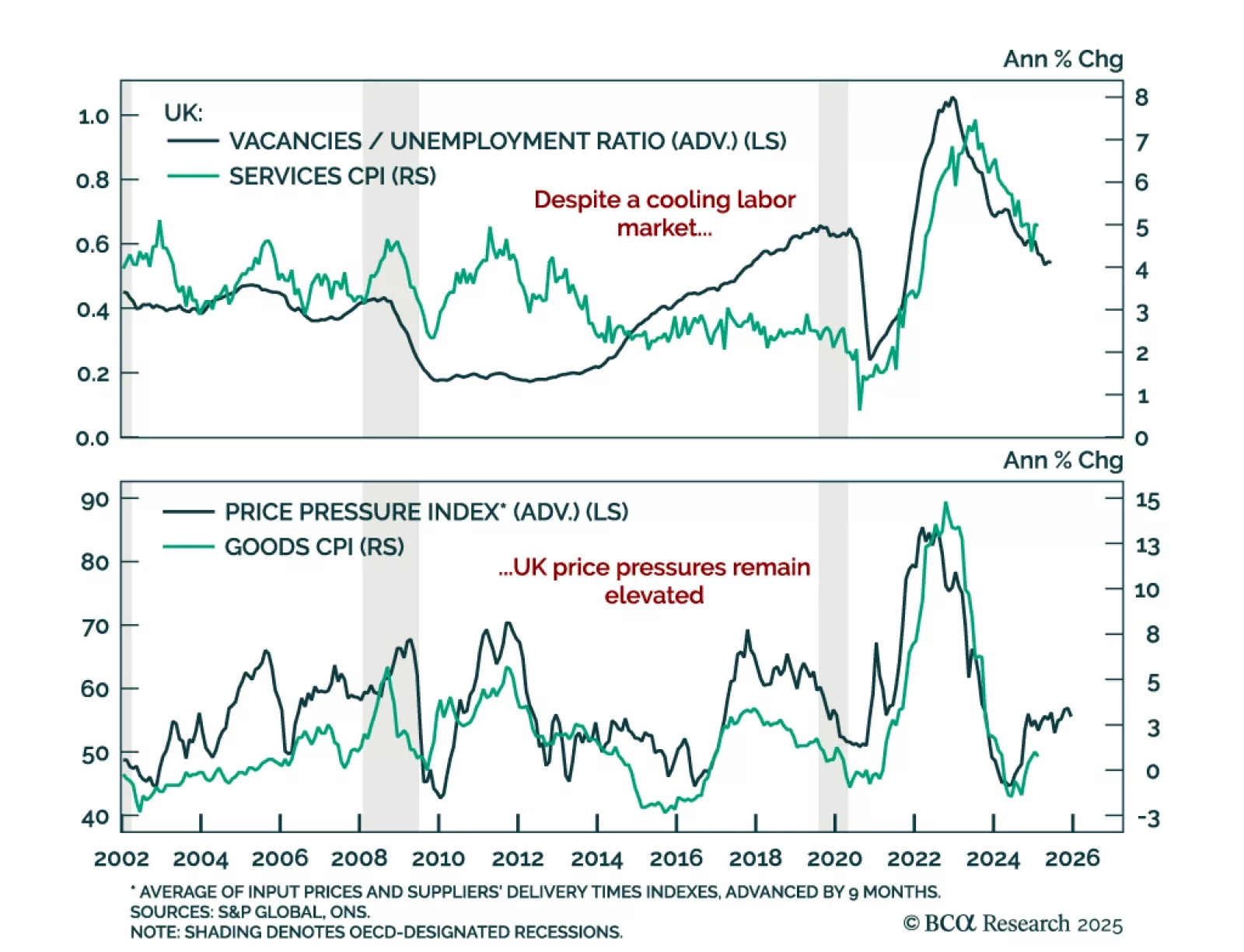

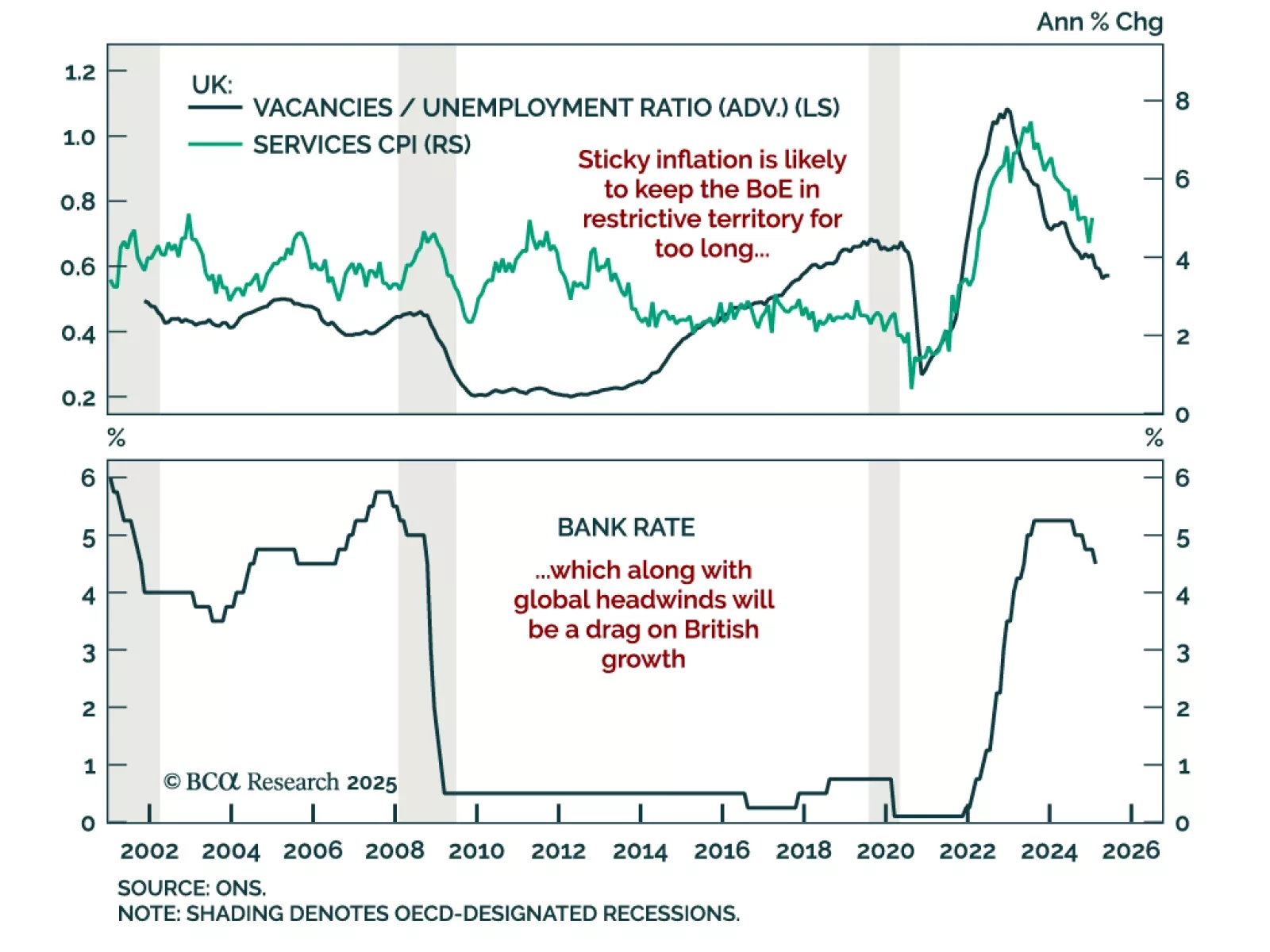

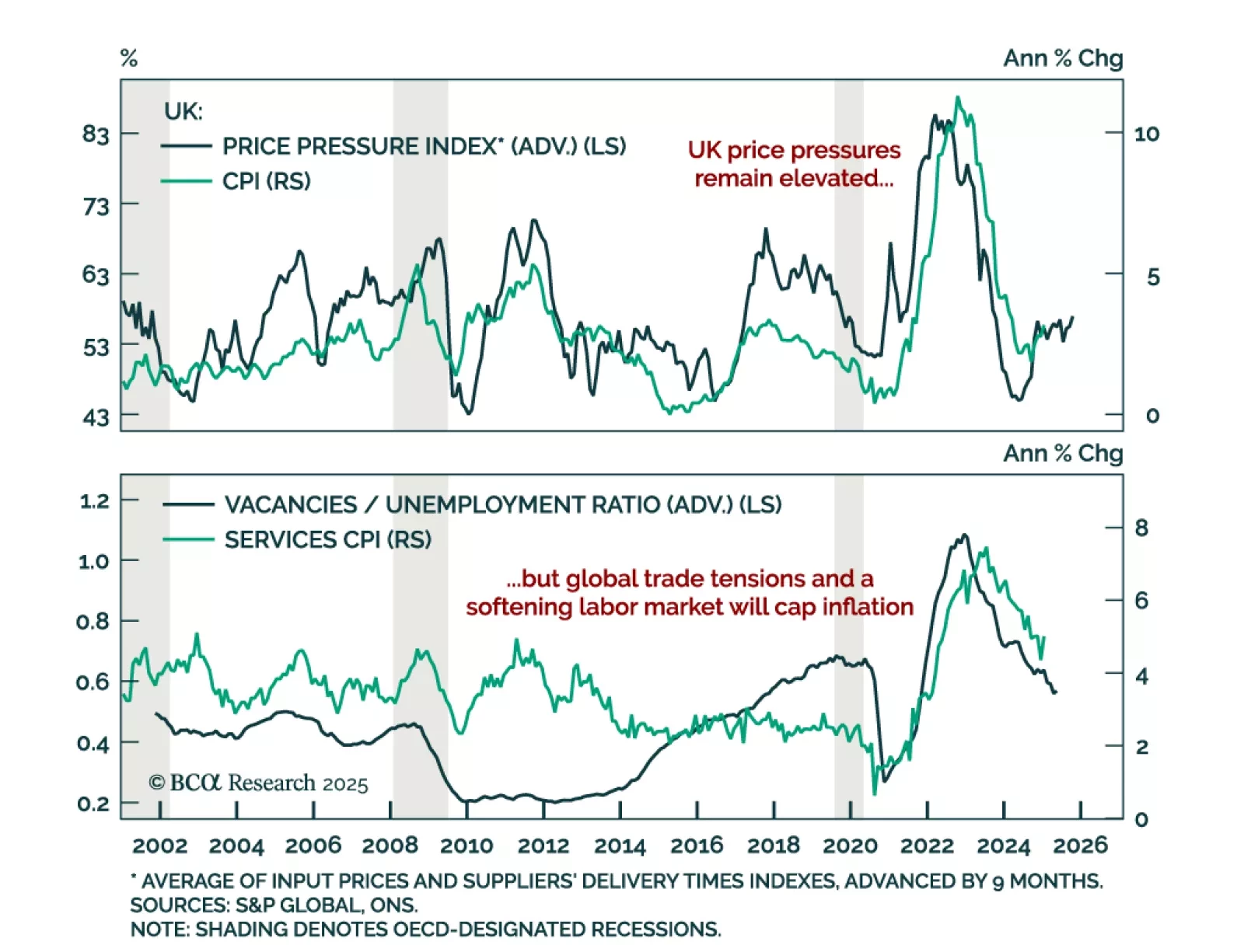

UK inflation came in cooler than expected in February, but lingering price pressures and a still-firm labor market keep the BoE sidelined, for now. Our Global Fixed-Income strategists view the BoE as the most likely DM central bank…

The Bank of England held its policy rate at 4.5%, with only one MPC member dissenting to cut 25 bps. The BoE signaled a slower pace of easing, as inflation remains elevated while global growth becomes increasingly uncertain. …

Given the meetings between the Bank of Japan, the Bank of England, and the Swiss National Bank, our highest convictions views are:Overweight UK Gilts. It is also time to sell sterling. We are short sterling, as of 1.30. …

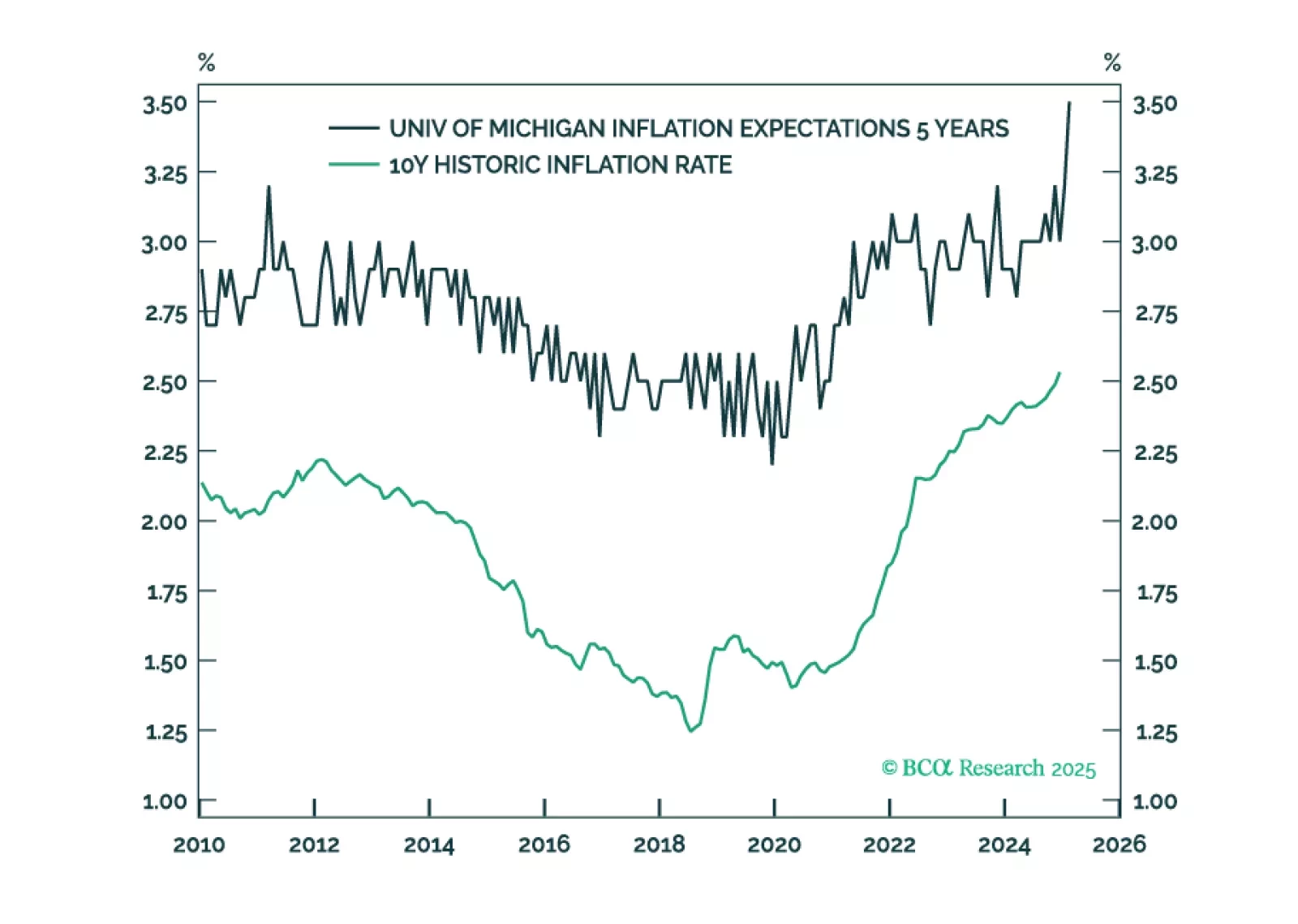

The US (and the UK) is staring down the barrel of a ‘mini-stagflation’ until a deflationary shock arrives to neutralise it. We describe a likely source for the deflationary shock and list three investment conclusions that are valid…

The January UK CPI was slightly hotter than expected. Headline inflation beat estimates, rising to 3.0% y/y from 2.5% in December. Core inflation also jumped but was in line with expectations at 3.7%. Services were strong, albeit…