Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook. This report is an edited transcript of our recent conversation. Mr. X: I have…

Highlights The relative performance of developed market (DM) versus emerging market (EM) equities just corresponds to the relative performance of healthcare versus financials. On a six month horizon, DM will underperform EM. Within…

Highlights Global growth has not yet bottomed, this will provide additional support for the dollar. EUR/USD will be a buy once it dips below 1.1, as slowing global growth means that European activity will continue to lag behind the U.…

Highlights Duration Strategy: The recent market turmoil was a long overdue risk asset correction that does not change any fundamental underpinnings for rising global bond yields. Stay below-benchmark on overall global duration exposure…

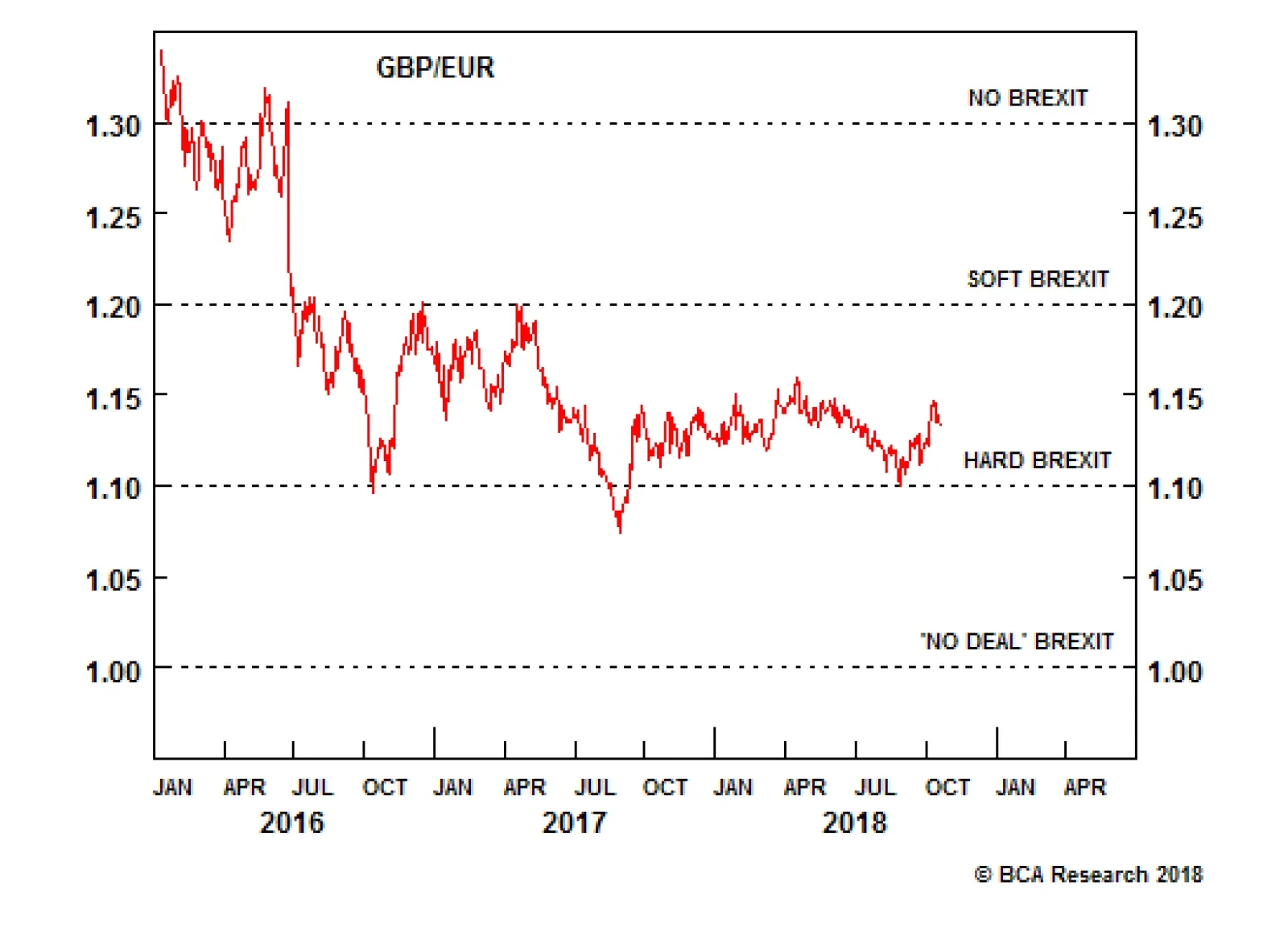

The first option, to stay in the EU, is politically impossible unless a new referendum in the U.K. overturns the original referendum's vote to leave. The second option, to join the European Economic Area, the European Free…

Highlights The long term direction for the pound is higher... ...but as the EU withdrawal bill passes through the U.K. parliament, expect a very hairy ride. The stock markets in Norway, Sweden and Denmark are driven by energy,…

Highlights The U.S. midterm elections are far less investment-relevant than consensus holds; Trump will increase the pressure on China and Iran regardless of the likely negative election results for the GOP; The Iranian sanctions,…