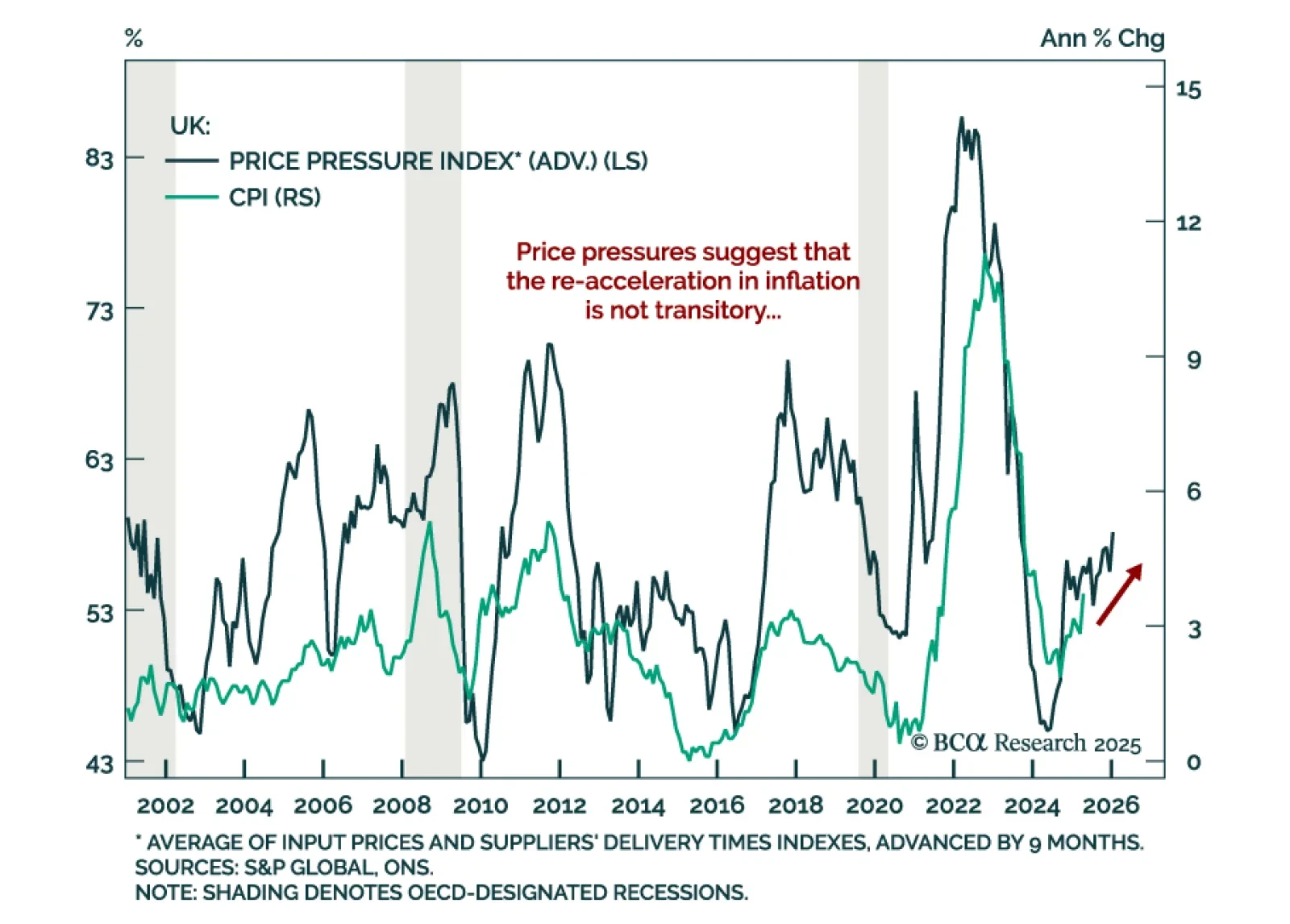

UK inflation surprised to the upside in April. Headline inflation rose to a 15-month high of 3.5%, from 2.6% the month before. Core inflation also surprised above estimates, printing 3.8% vs. 3.4% in March. Services inflation climbed…

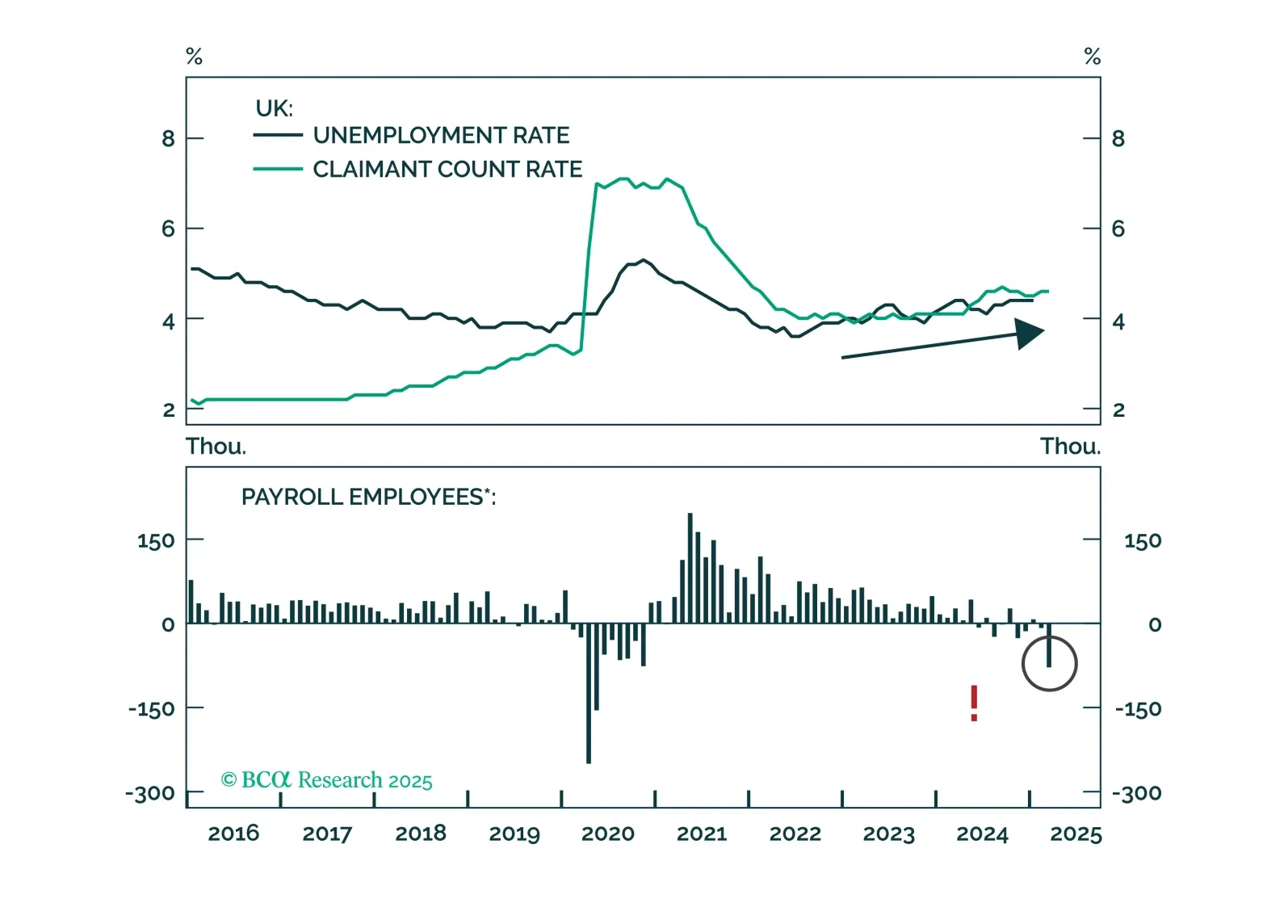

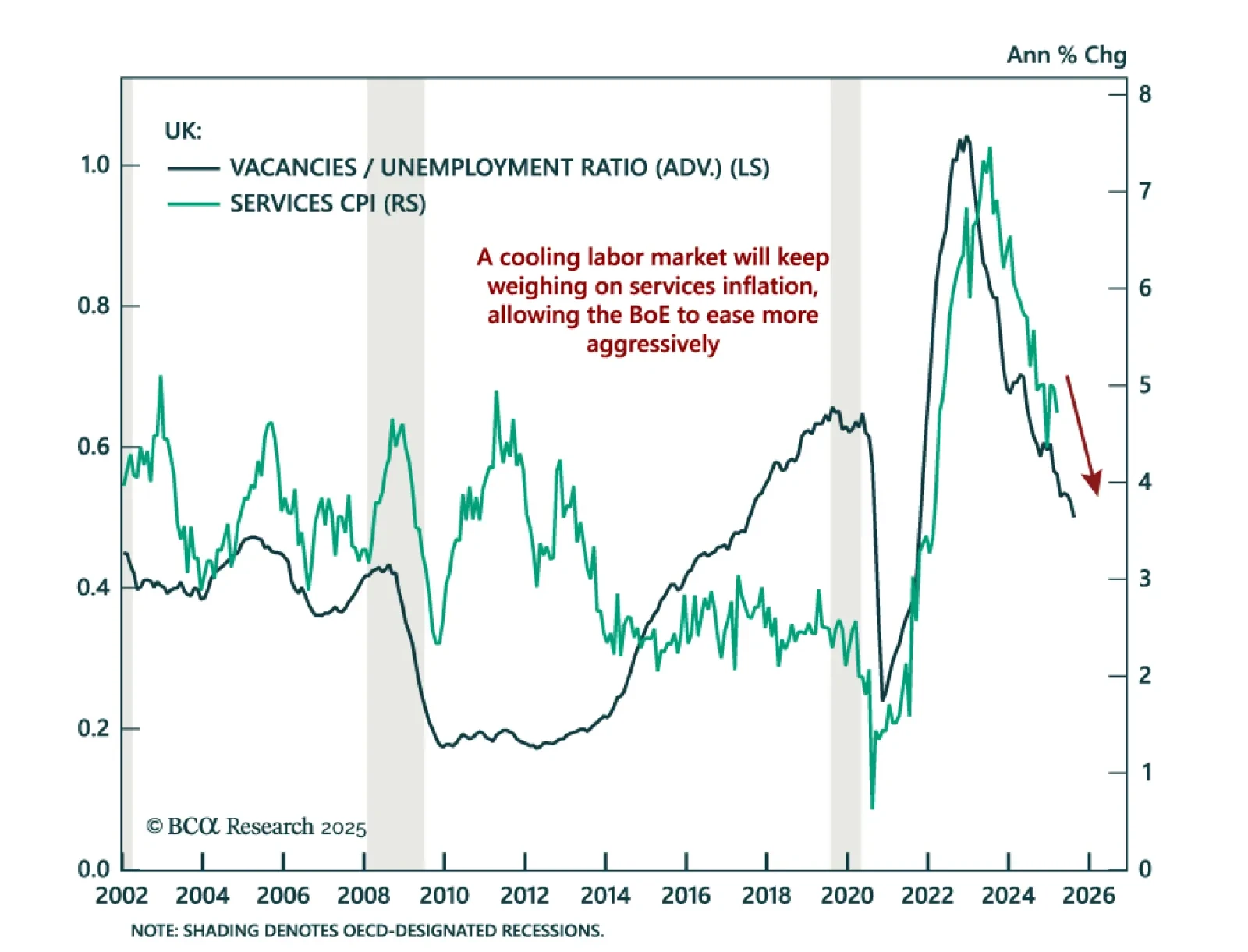

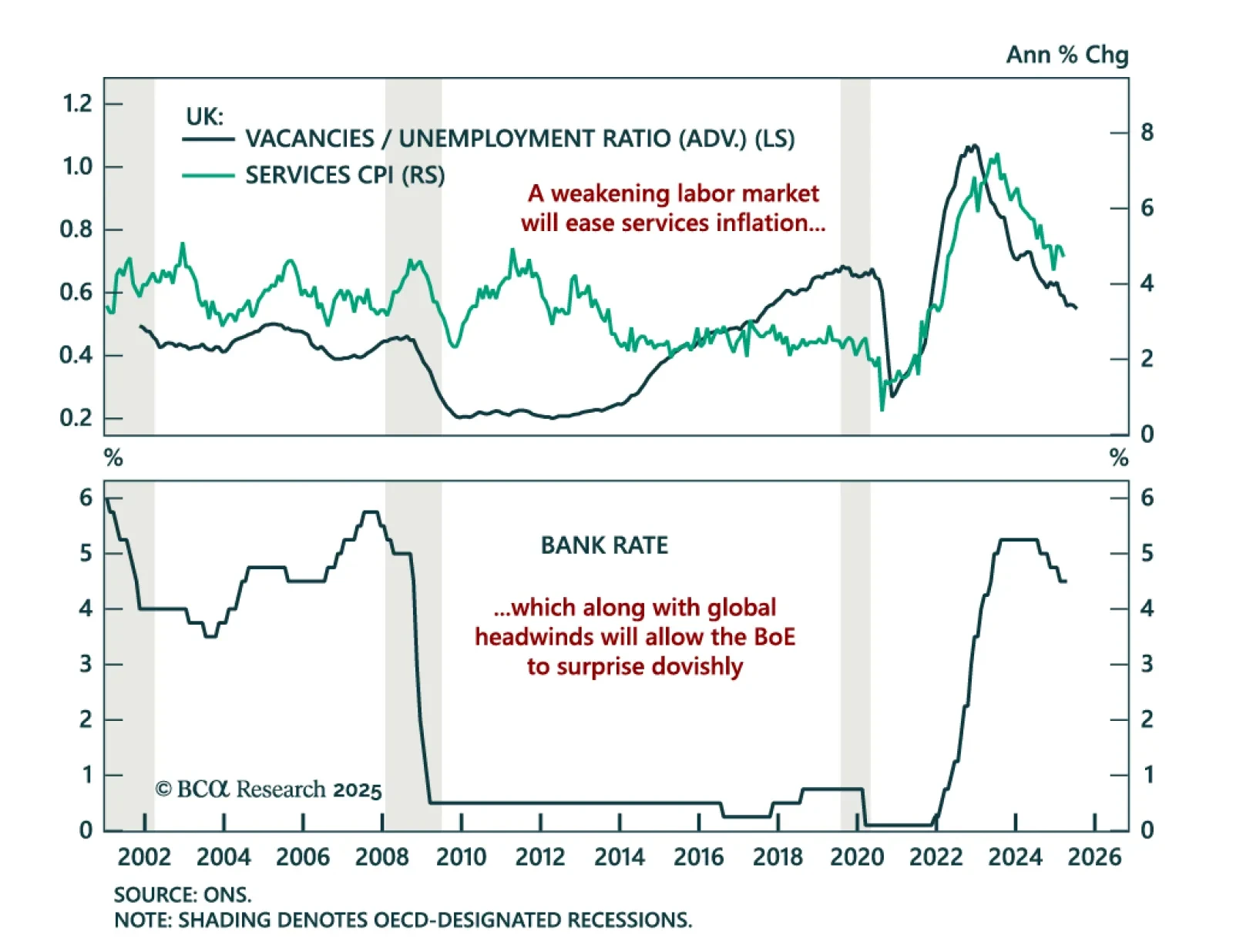

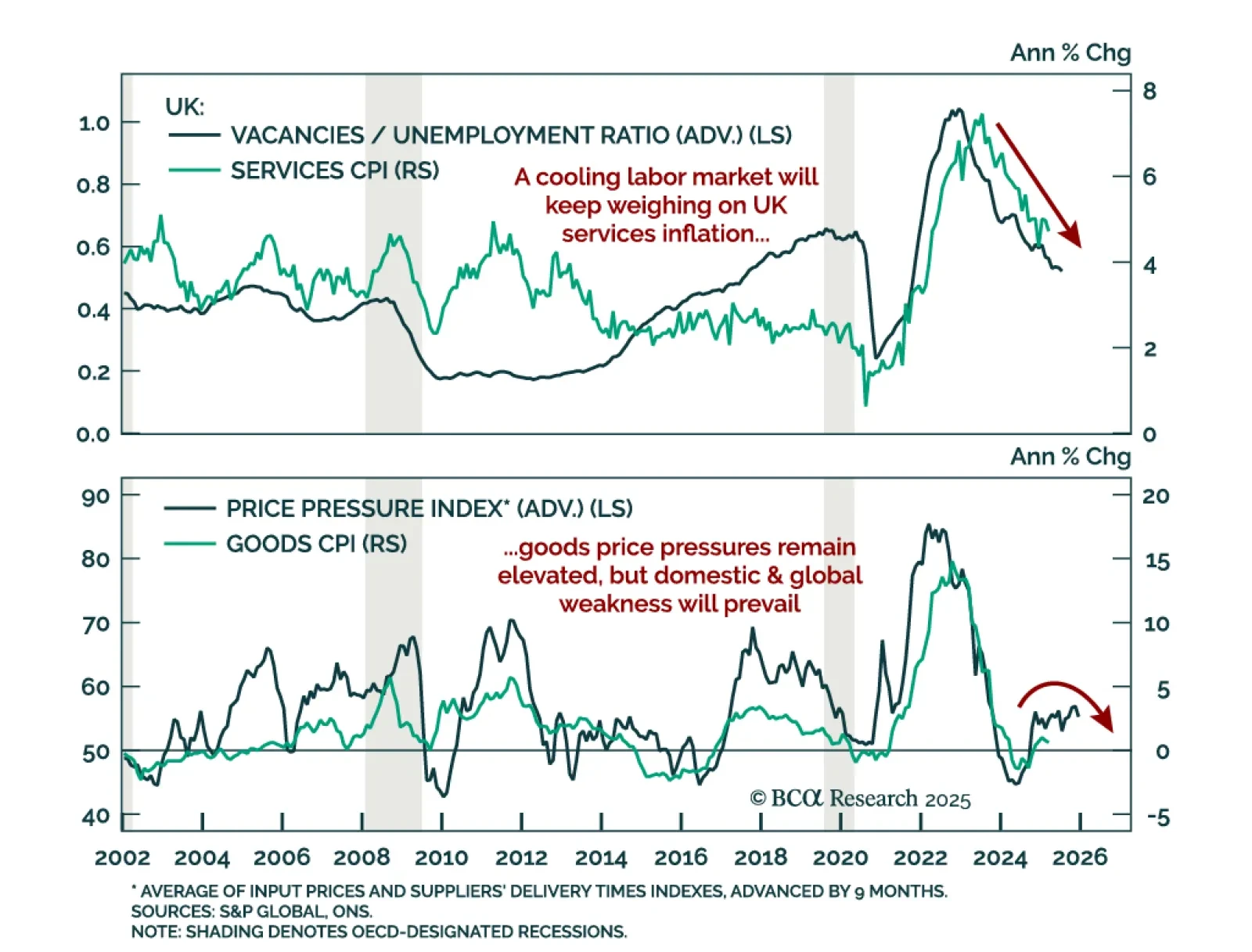

UK labor market weakness is reinforcing the case for BoE cuts and supporting our overweight in UK Gilts. April payrolls fell by 33k, marking a third consecutive monthly decline, while job vacancies remain below pre-COVID levels for…

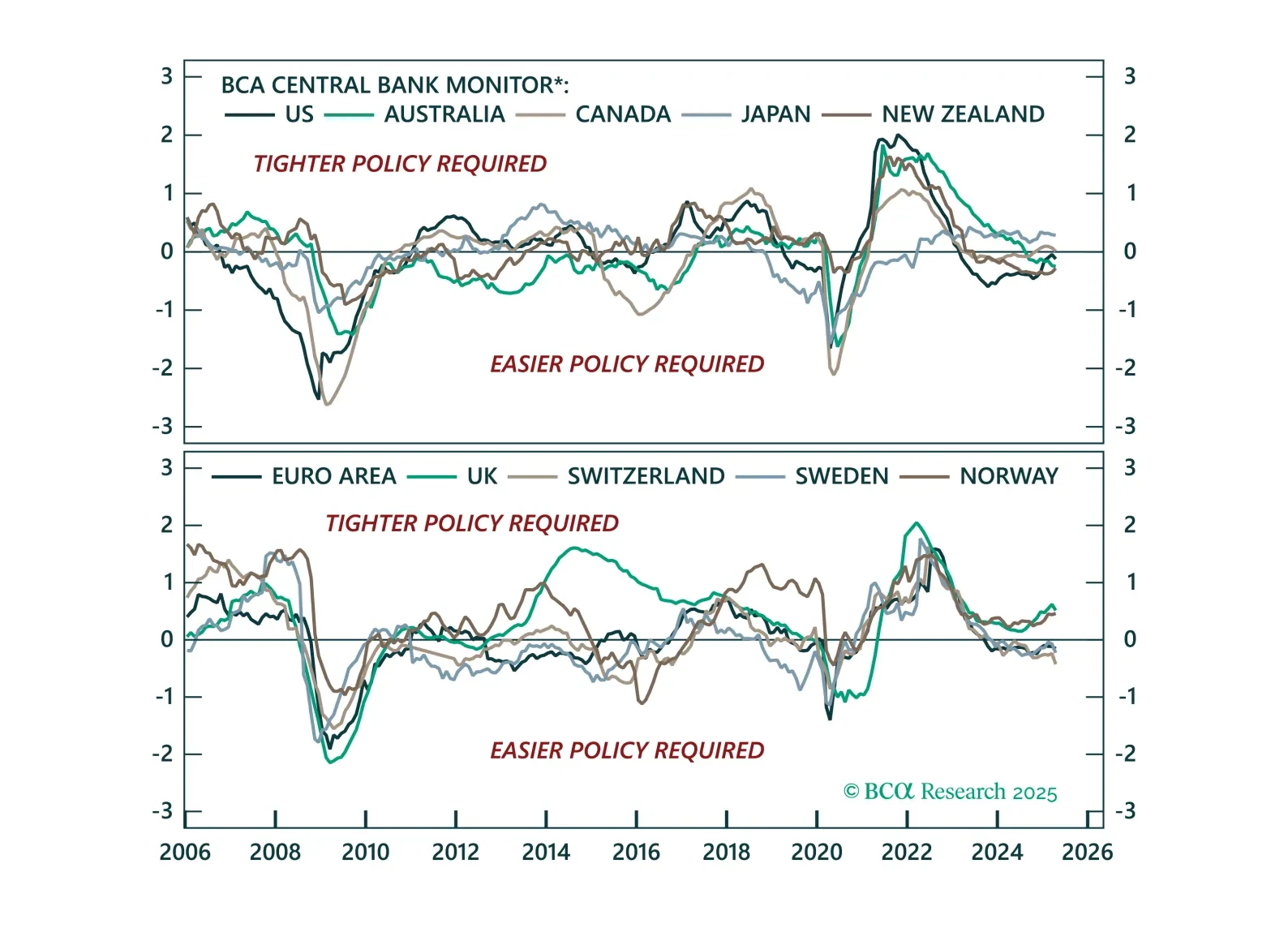

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

Rate cuts, recession risks, and relative value. This report unpacks how the BoE, Riksbank, and Norges Bank are reacting to global trade turmoil and where the opportunities lie.

The Bank of England’s hawkish cut reinforces our Gilts overweight and tactical short GBP view as global headwinds persist. The BoE lowered rates by 25 bps to 4.25% as expected, but the MPC vote was more split than expected. Five…

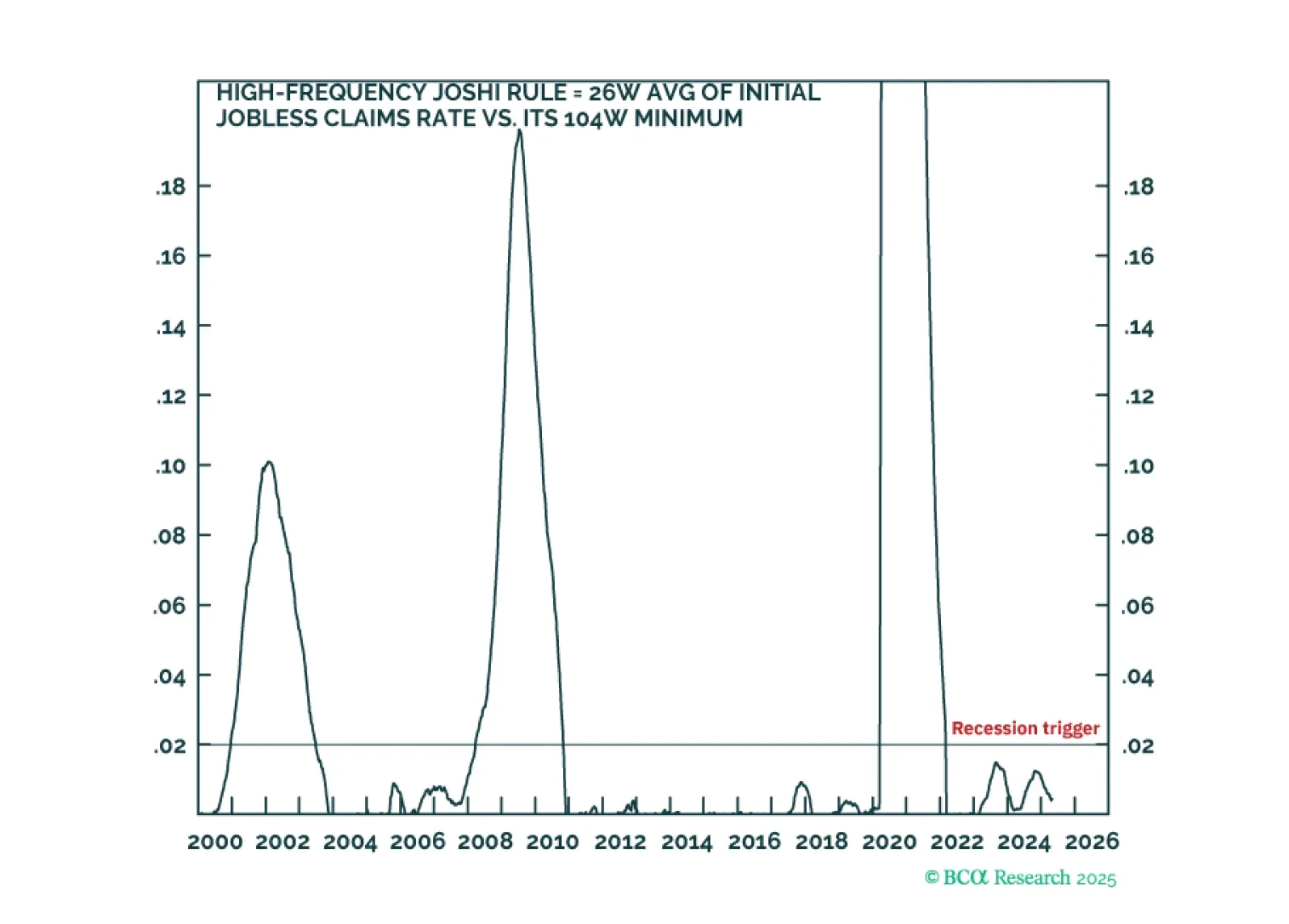

Today, we are introducing an additional ‘high-frequency Joshi rule’ which is updated weekly. The Joshi rules tell us that a US recession is not imminent. Until the Joshi rules are triggered, overweight non-US government bonds, and…

The latest UK data supports a May BoE cut, reinforcing our overweight in Gilts as growth headwinds build and inflation cools. Employment declined by 78k in March, accelerating from February’s downwardly revised 8k drop, while…

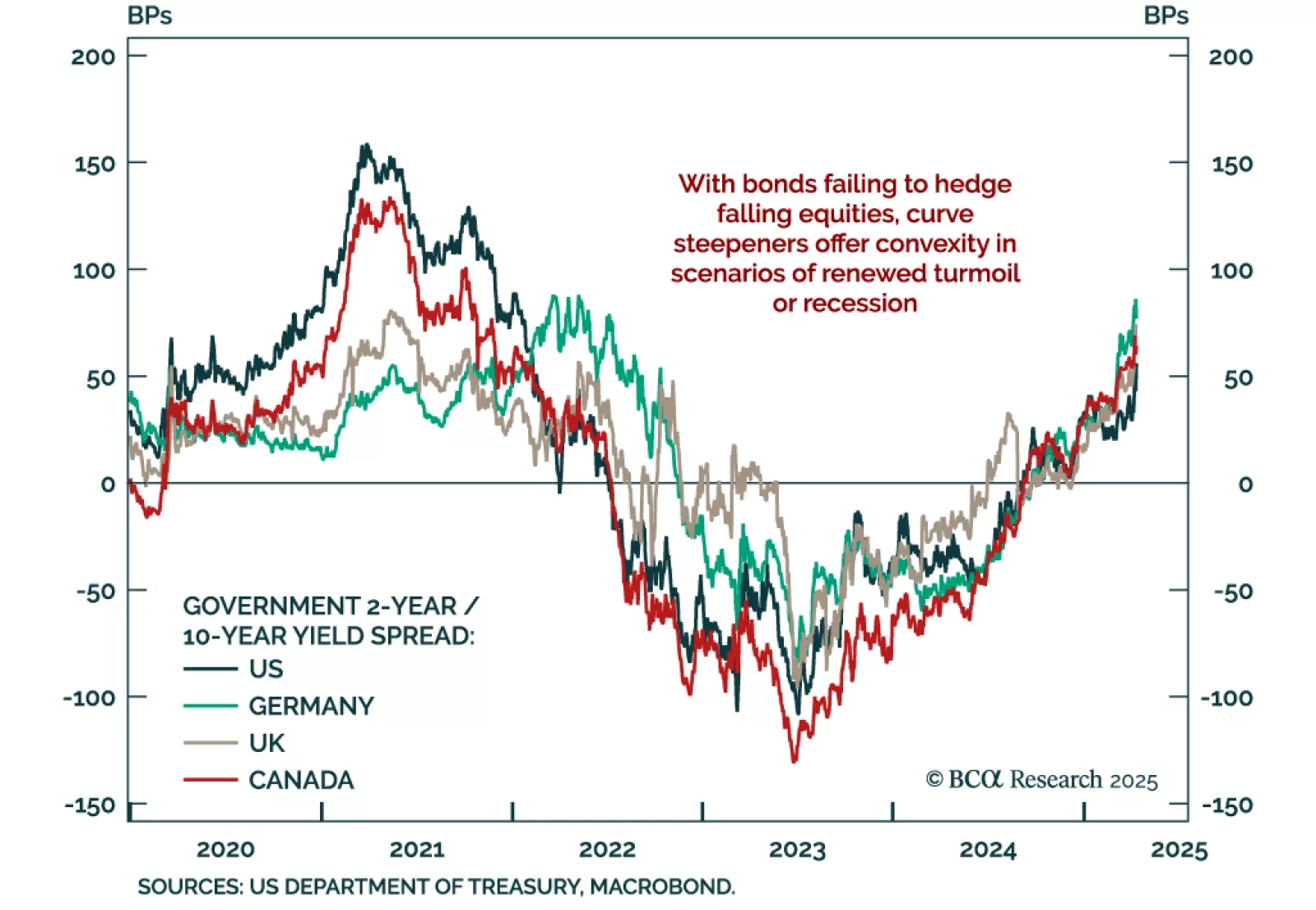

Bonds are failing to deliver defensive convexity; asset allocators should look to tactical curve steepeners for protection. Despite rising growth fears, Treasury yields have risen sharply at the long end. This is a clear break from…

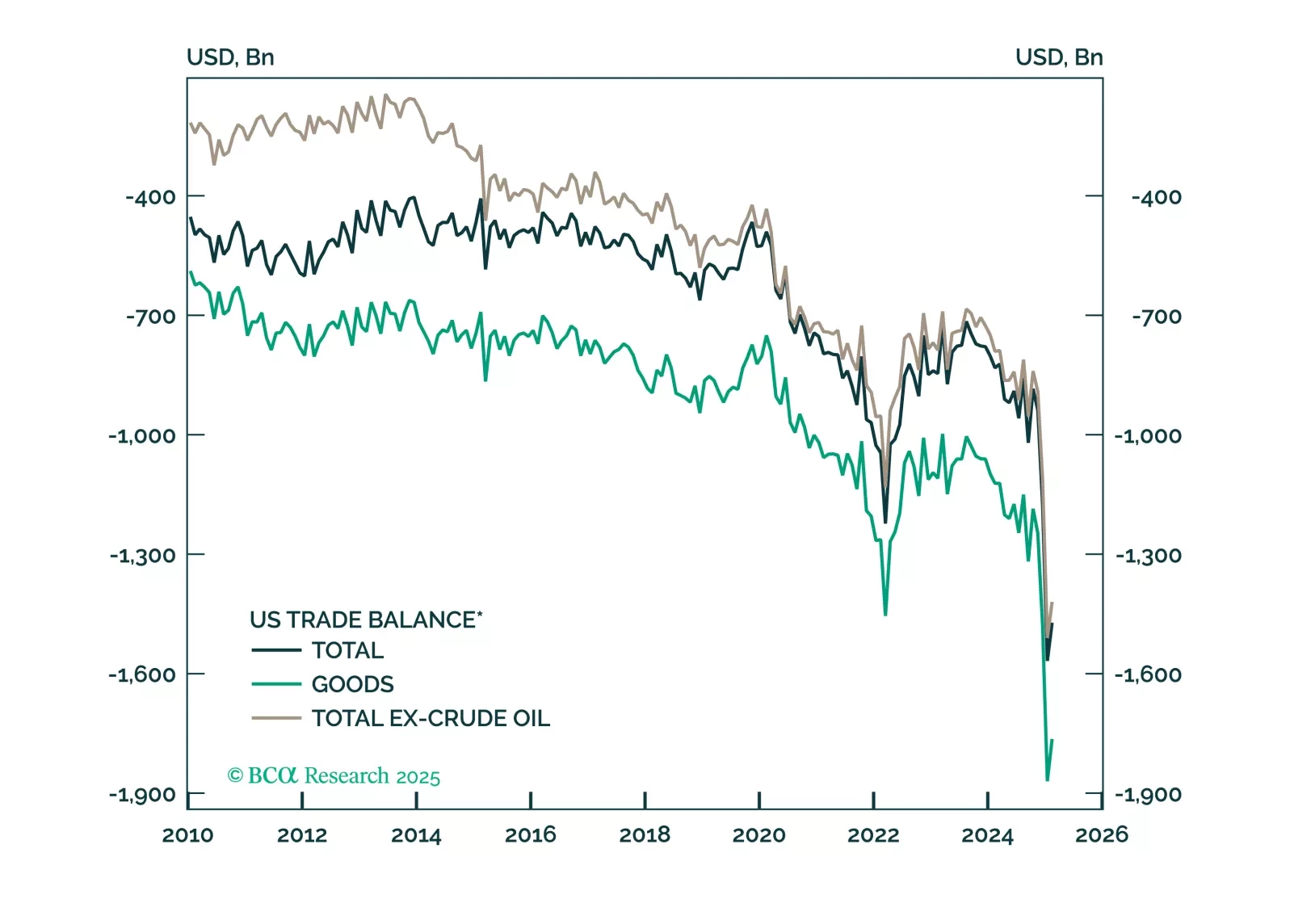

This report looks at the FX implications of the Trump tariffs, and the review of our Q1 trades.

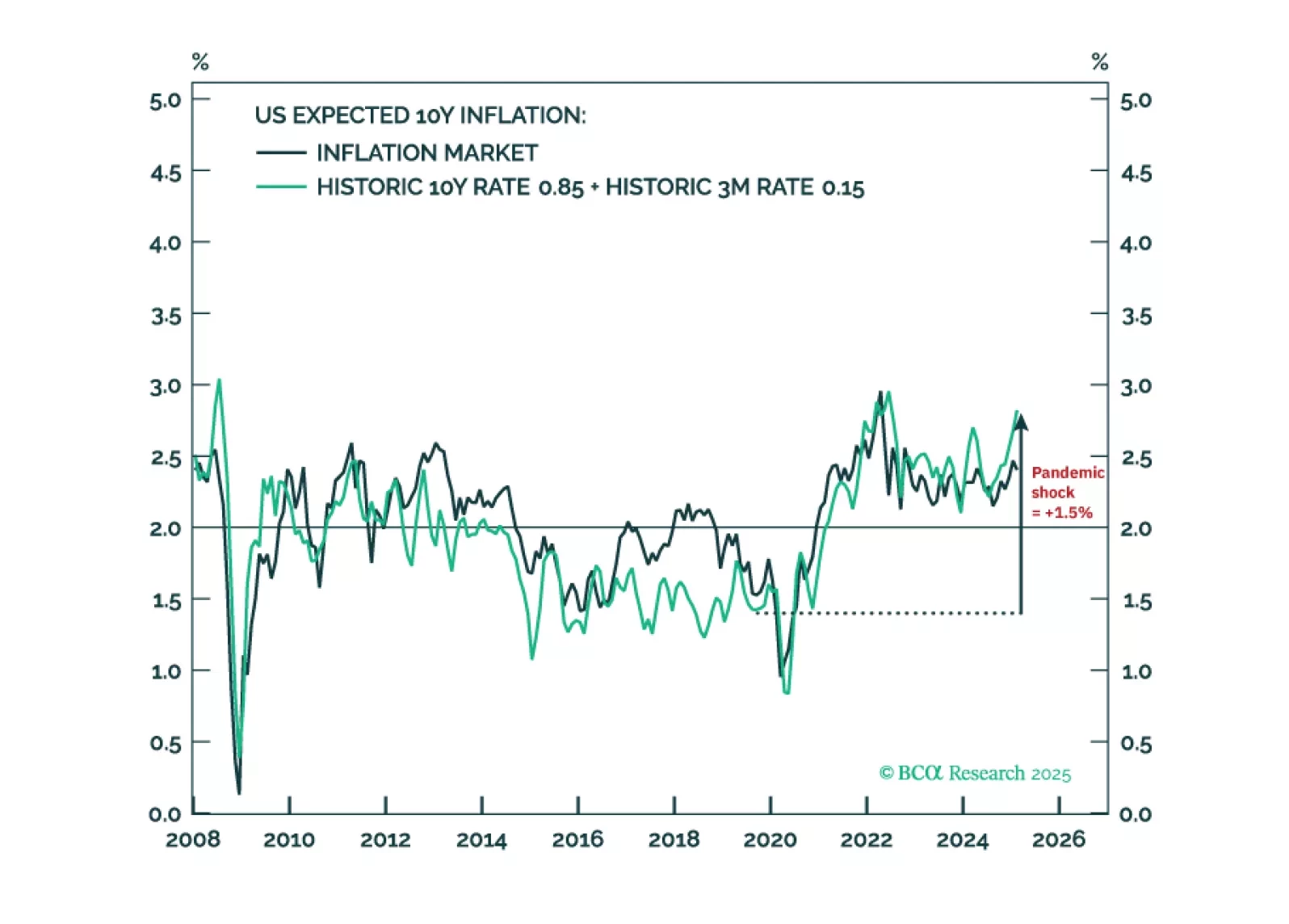

Tariffs will make a difficult job almost impossible. Hitting and sustaining a precise 2 percent inflation target is more about luck than judgement. It requires both the starting point for inflation expectations and any inflation/…