Highlights Driven by its fear that deflation is a more intractable danger than inflation, the Federal Reserve has enshrined its pause for the remainder of 2019 in order to lift inflation expectations. Since the U.S. business cycle…

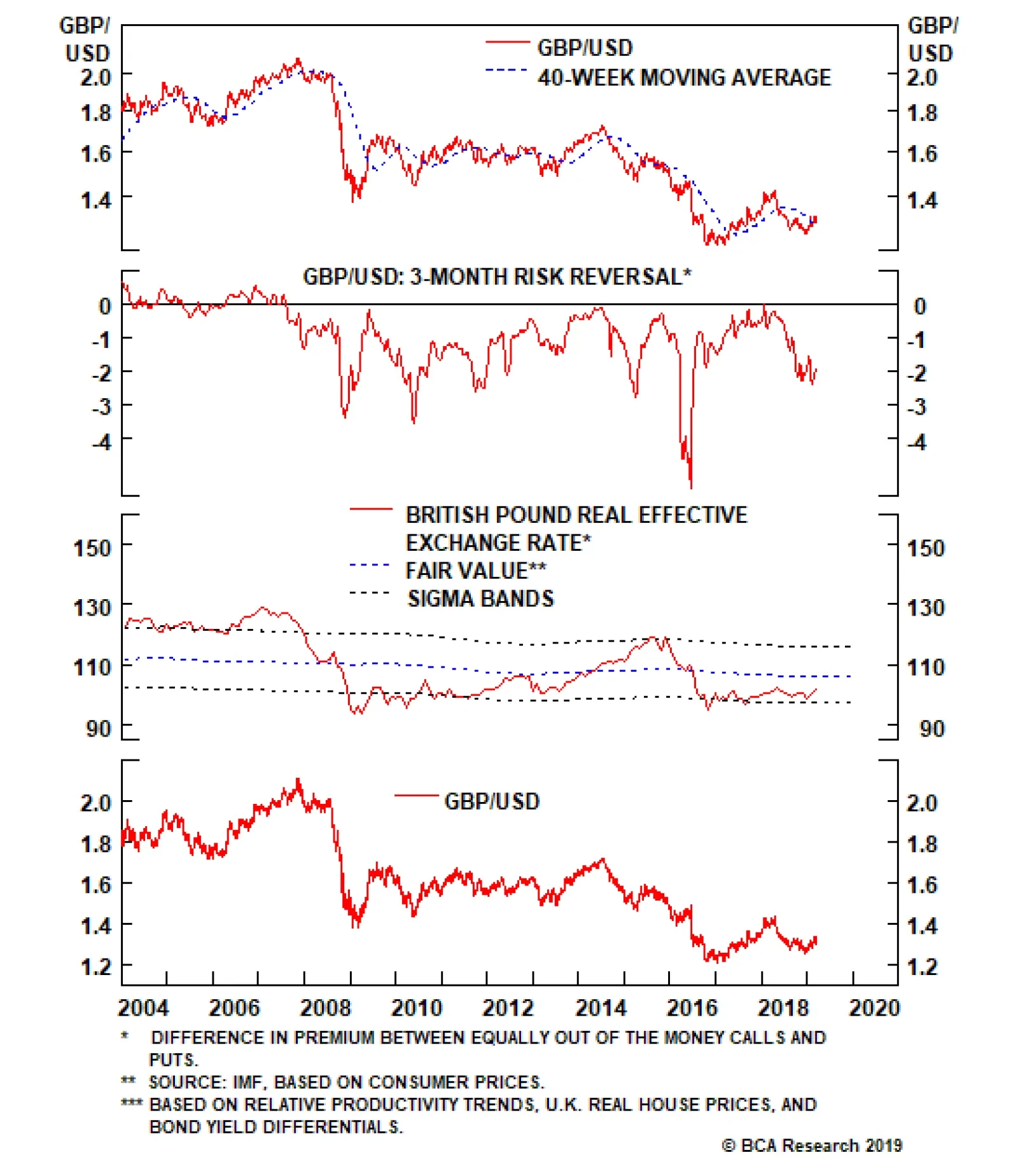

After all of the chaos from last week’s U.K. parliamentary sessions, an extension will likely be granted untill the May 23-26 European Union elections. For long-term sterling investors, what is clear is that developments…

Highlights Every diversified currency portfolio should hold the yen as insurance against rising market volatility. However, for tactical investors, the latest dovish shift by global central banks almost guarantees the Bank of Japan…

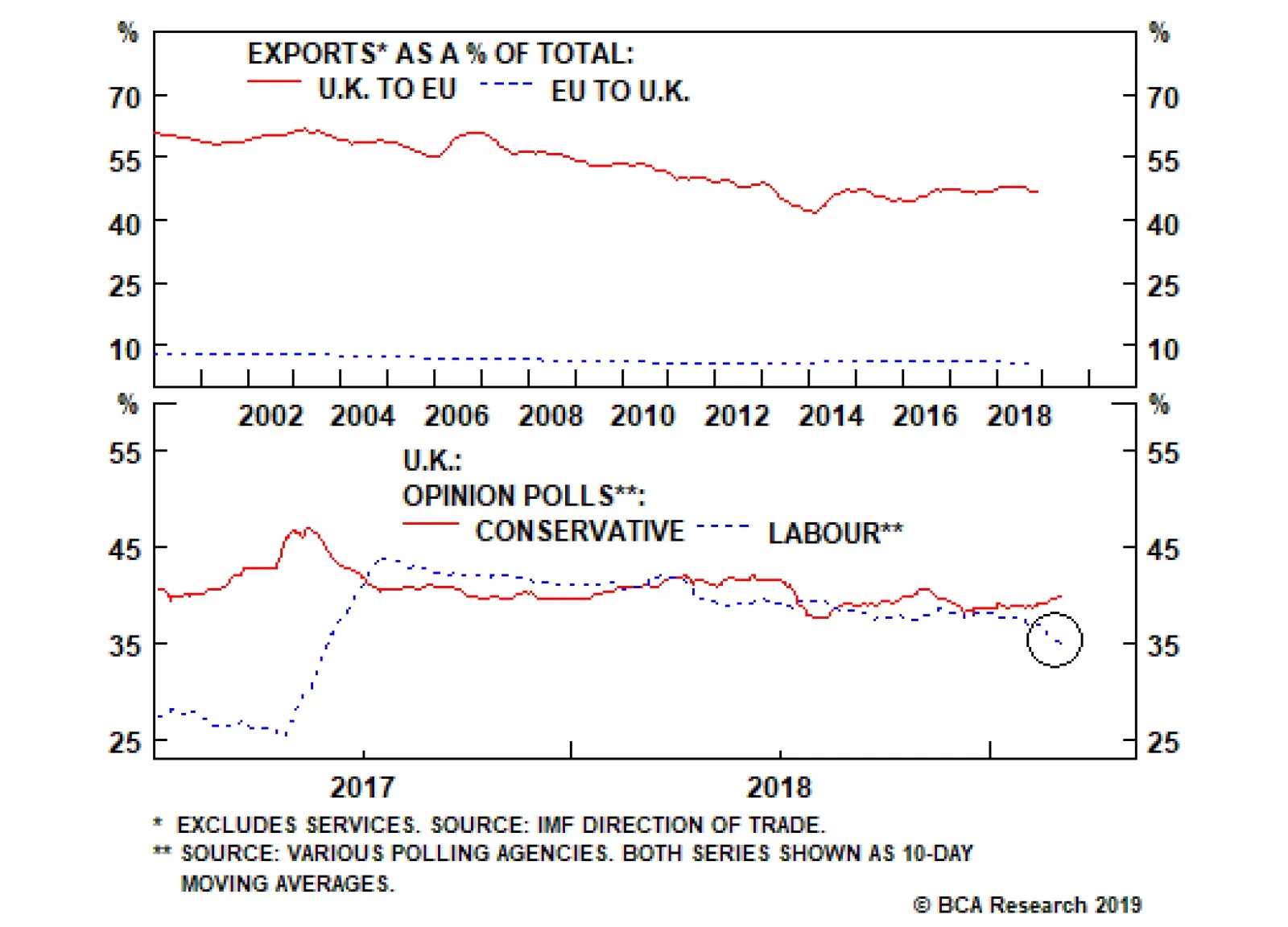

From the moment almost three years ago that the U.K. voted to leave the EU, it was clear that a rational and measured Brexit would require the U.K. to remain in a customs union with the EU. Rational and measured because a…

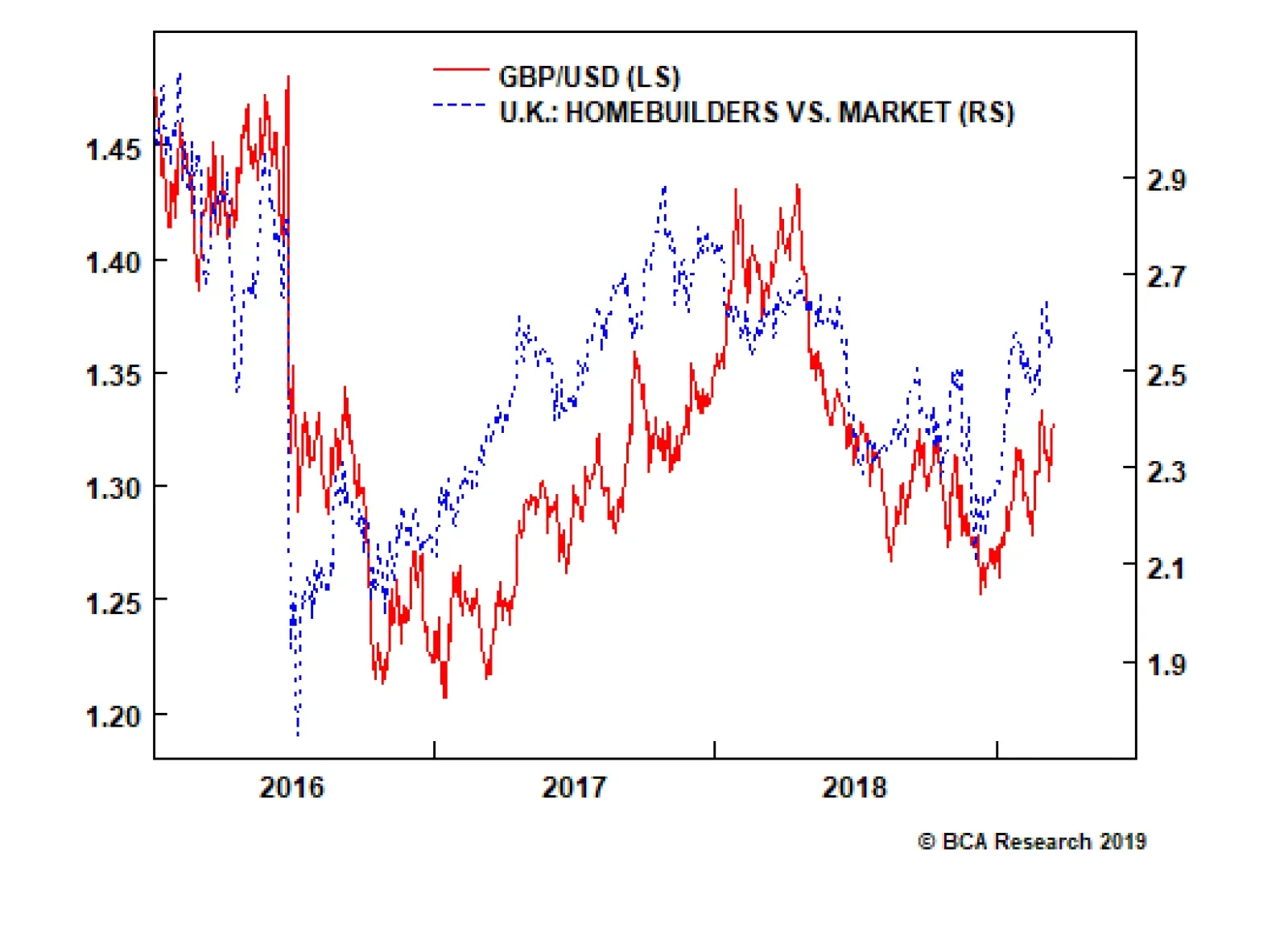

Highlights Await the U.K. parliament to coalesce a majority on a on a credible strategy for Brexit that is also acceptable to the EU27. At that point, buy the pound, the FTSE250, and U.K. homebuilder shares. An eerie calm has…

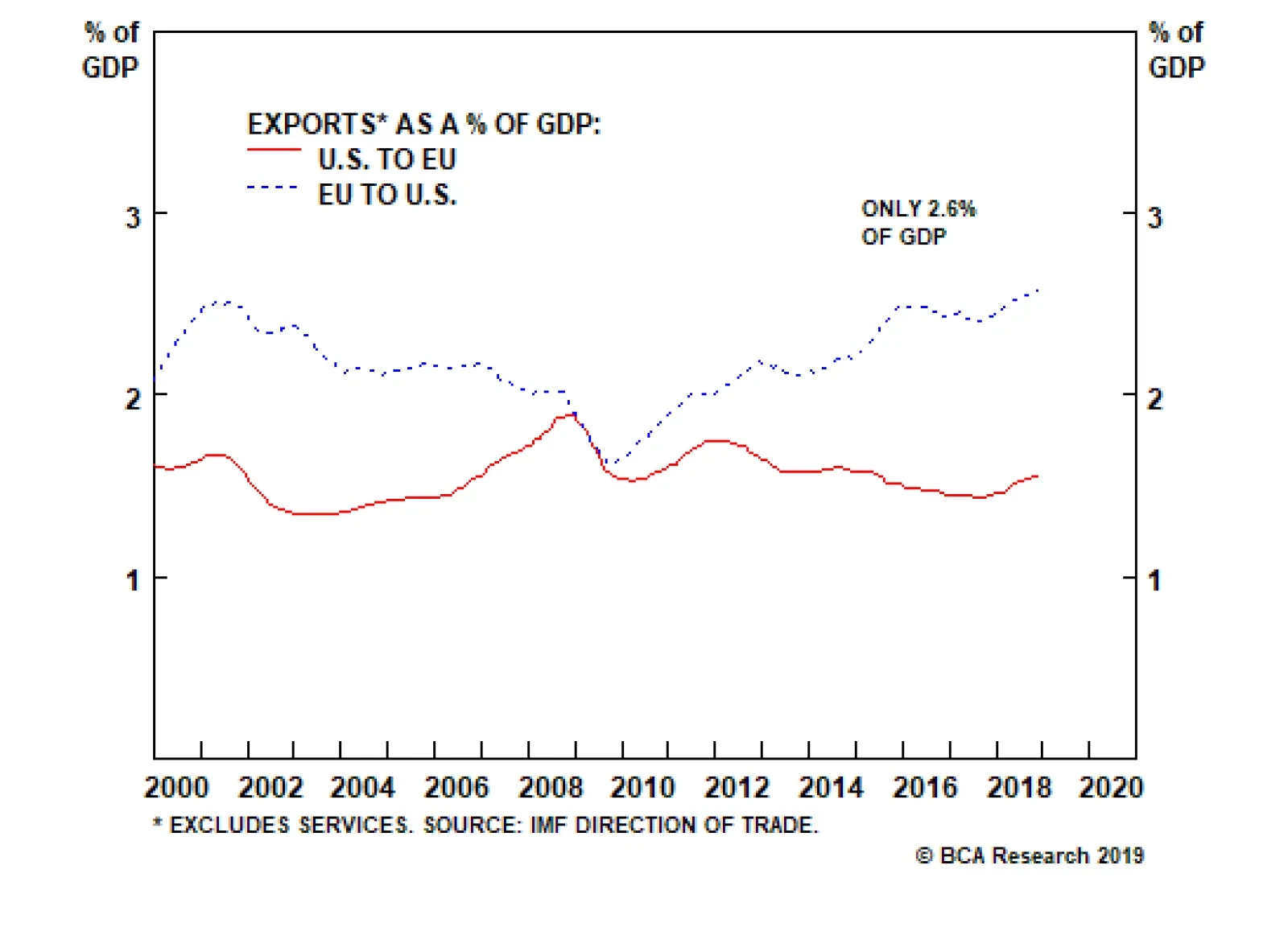

Highlights So What? The late-cycle rally still faces non-trivial political hurdles. Why? U.S.-China trade talks, the U.S. threat of tariffs on auto imports, and Brexit continue to pose risks. A shocking revelation from the…

The first vote, as we go to press on Tuesday, has resulted in a rejection of Prime Minister Theresa May’s exit plan by 149 votes – the second rejection after her colossal defeat in January by 230 votes. However,…

If Trump concludes a deal with China, the next question for investors is whether he will impose Section 232 tariffs on auto and auto imports on the EU and other partners. A rotation of Trump trade policy to focus on Europe is…