Highlights As central banks continue to push on a string for 2 percent inflation, it will underpin the valuation of equities and other risk-assets. So long as the global 10-year bond yield remains well below 2.5 percent, equity market…

Highlights The breakout in financial asset prices stands at odds with a deteriorating profit outlook. This suggests a high probability of a coiled-spring reversal in one of the two variables as we enter the thin summer trading months.…

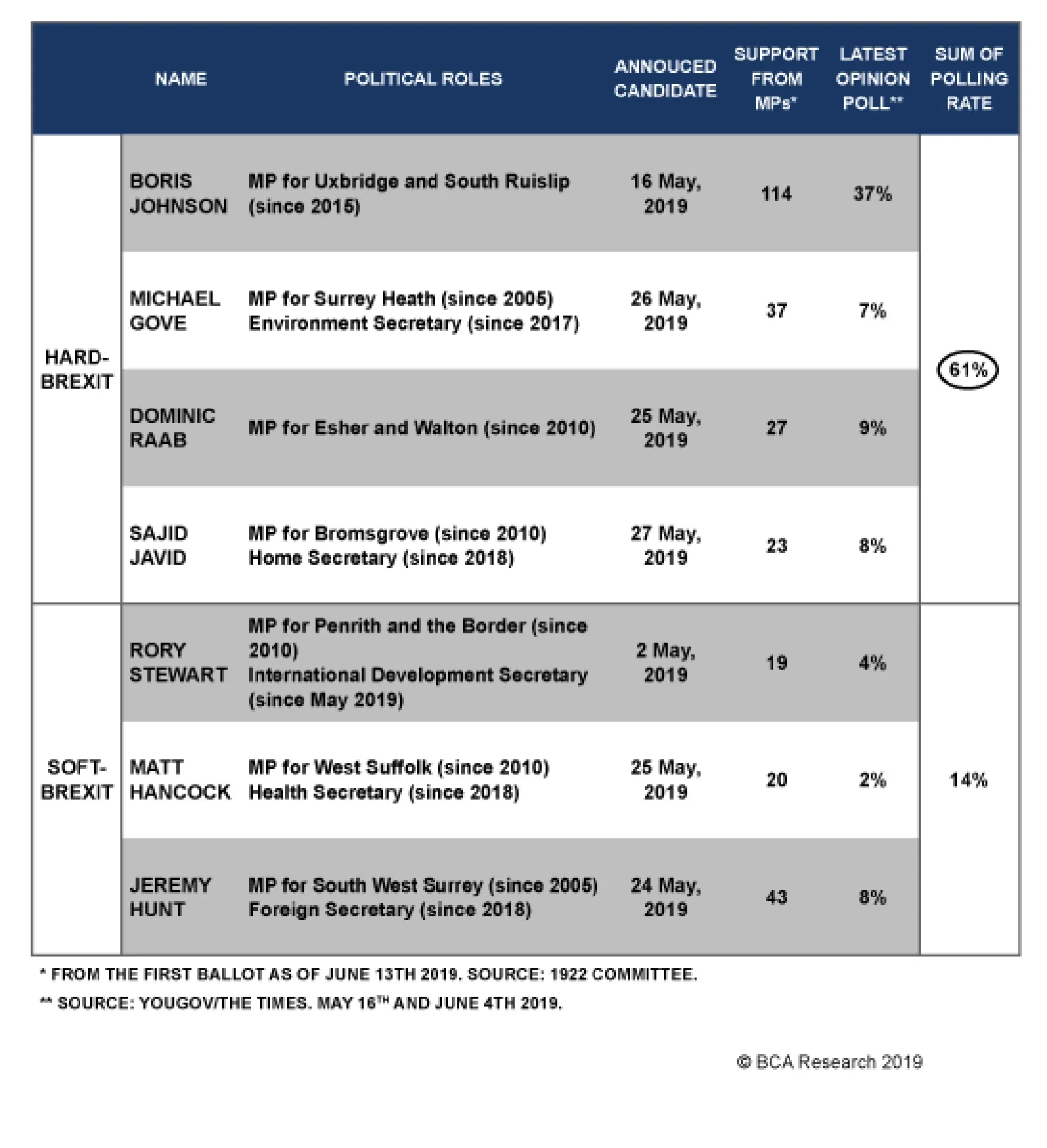

It is not yet a done deal, but the shift within the party in favor of accepting a “no deal” exit is clear. None of the remaining candidates is willing to forgo that option. The newest development advances us along…

Highlights The unifying chorus among global central banks is currently for more monetary stimulus. In the race towards lower interest rates, the ultimate winners will be pro-cyclical currencies. Italian 10-year real government bond…

Highlights So What? Geopolitical risks are not about to ease. Why? Fiscal policy becomes less accommodative next year unless politicians act. Financial conditions give President Trump room to expand his tariff onslaught. Our…

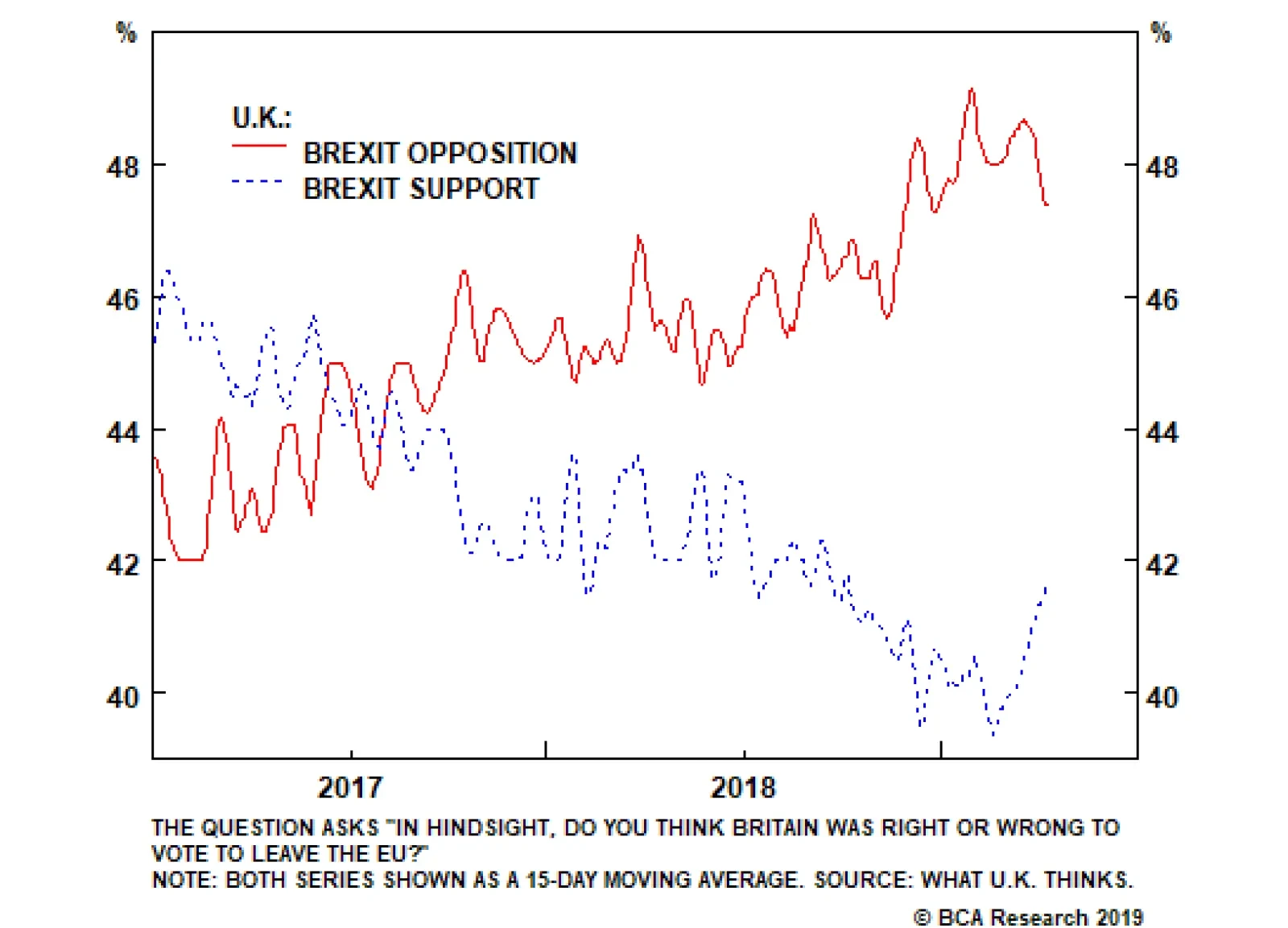

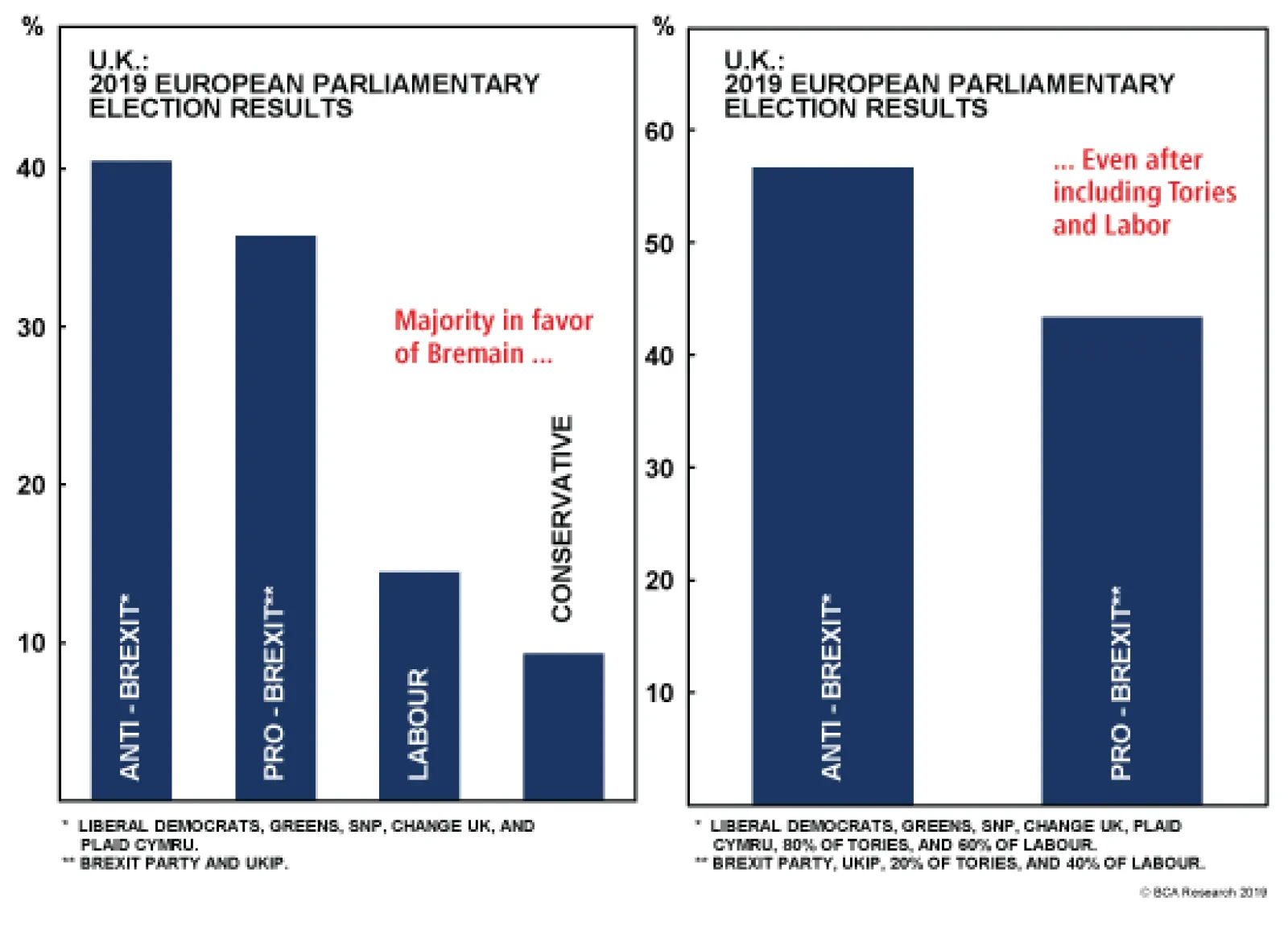

While the timeline for this process is straightforward, the impact on the Brexit process is not. The odds of a “no-deal Brexit” have increased but so has the prospect of parliament passing a soft Brexit prior to any…

The no-deal option is the default scenario if an agreement is not finalized by the Halloween deadline and no further extension is granted. However, Speaker of the House of Commons John Bercow recently stated that the prime…

Highlights So What? U.S.-China relations are still in free fall as we go to press. Why? The trade war will elicit Chinese stimulus but downside risks to markets are front-loaded. The oil risk premium will remain elevated as Iran…