Highlights Four ghosts of 2016 are knocking at the door: Brexit, Trump, Brazil, Italy. President Trump and U.S. trade policy are keeping uncertainty high. Upgrade the odds of a no-deal Brexit to about 33%. Expect limited stimulus…

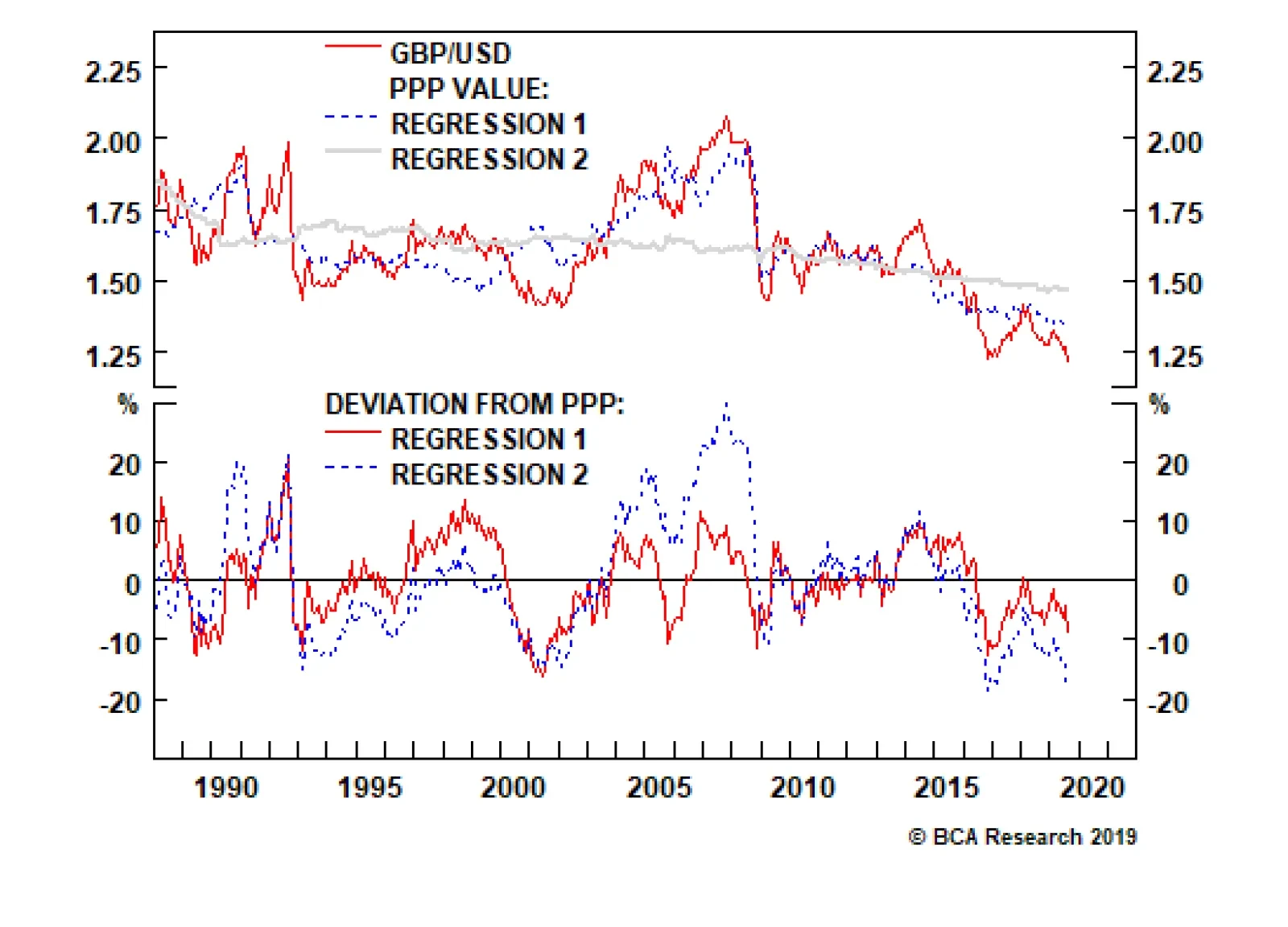

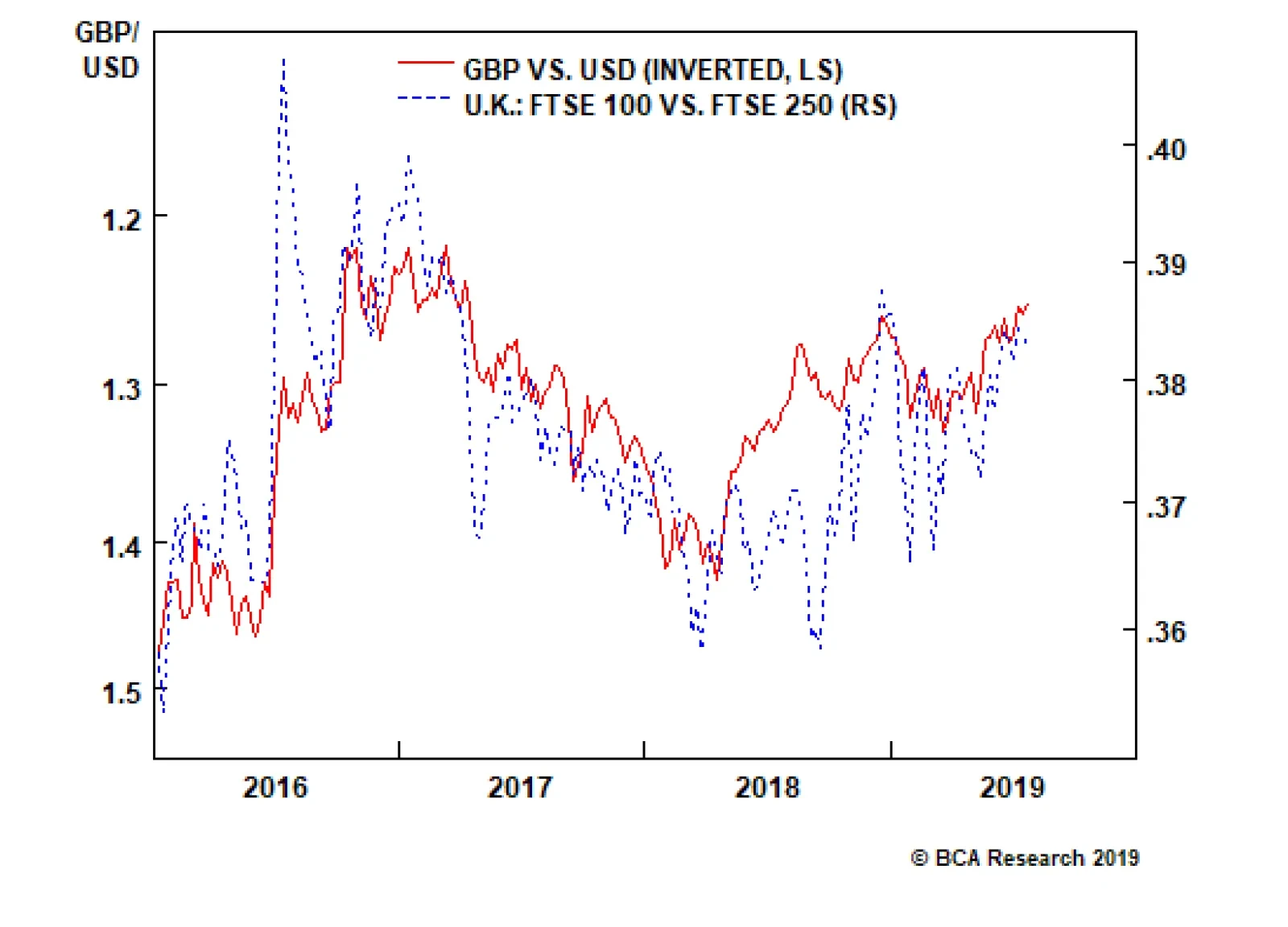

Both our regression models show the pound as undervalued. This supports our view that over the long term, the pound is attractive. The consumption baskets in both the U.K. and the U.S. are roughly similar, which means traditional…

Highlights Duration: Global manufacturing growth will rebound near the end of this year. Much like in 2016, this will result in higher global bond yields on a 12-month horizon. Investors should keep portfolio duration close to…

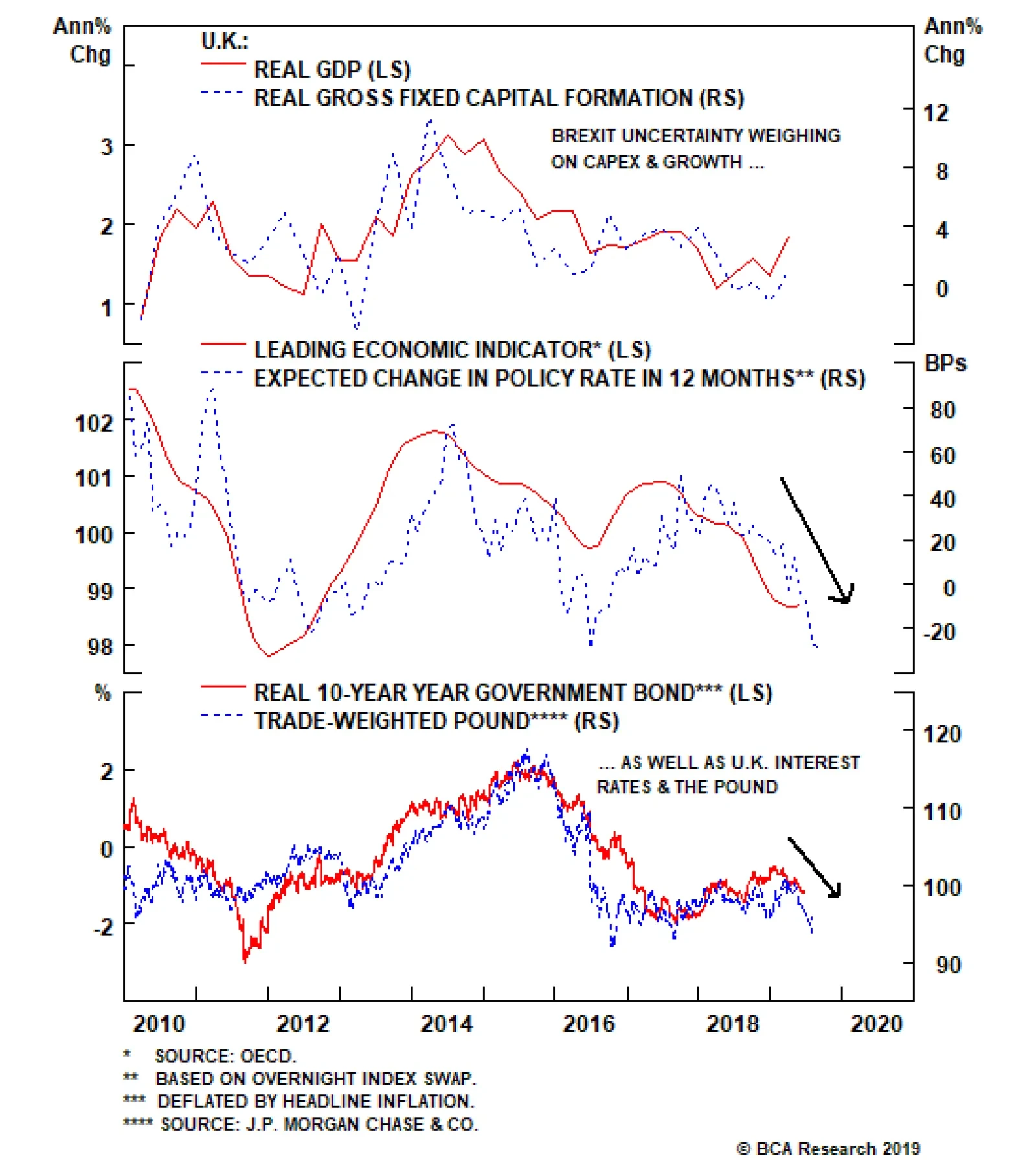

The Bank of England (BoE) held rates steady at last week’s Monetary Policy Committee (MPC) meeting, keeping the Bank Rate at 0.75%. The MPC modestly lowered its growth forecasts for 2019 and 2020 due to the dual…

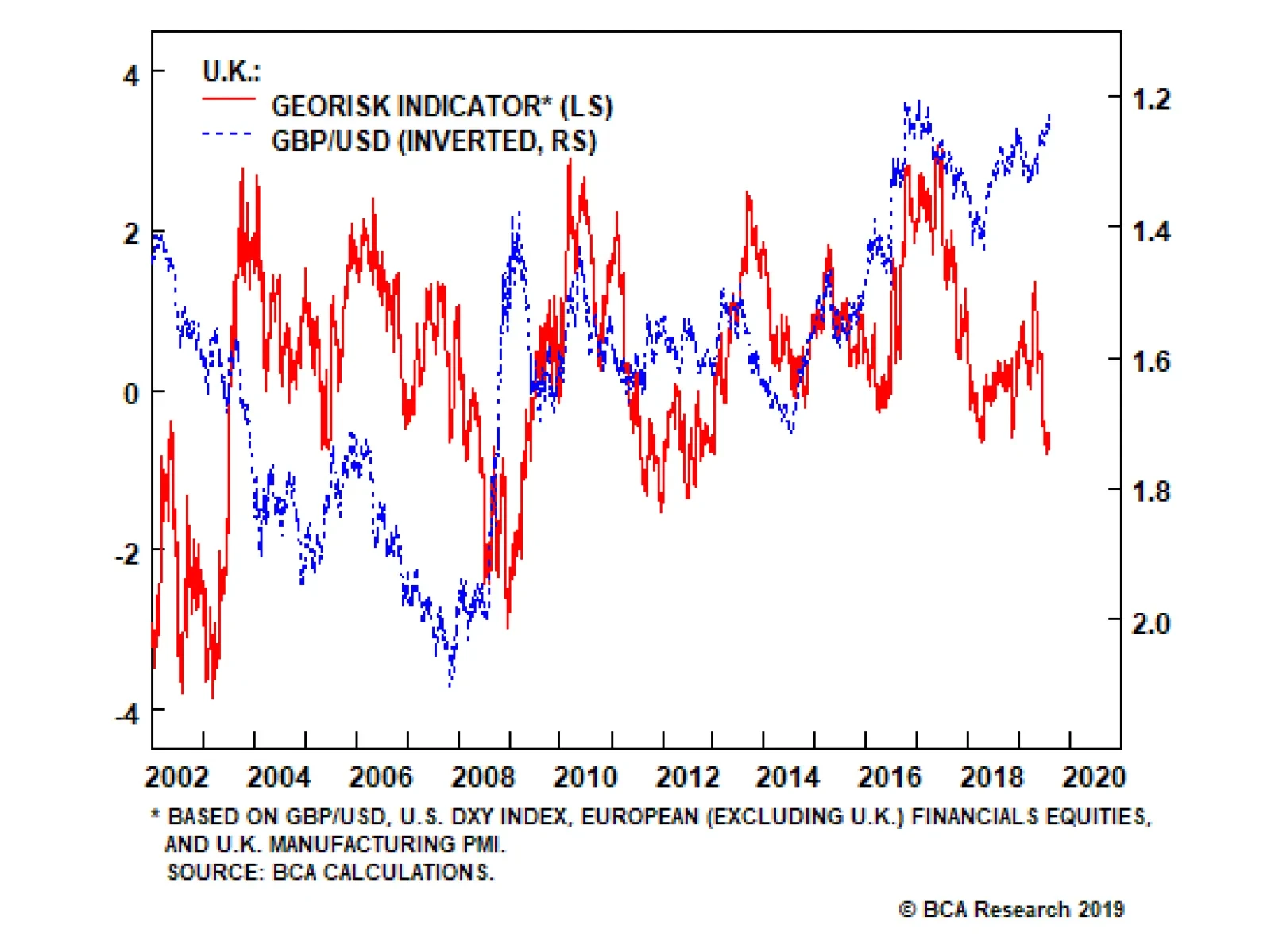

All of Boris Johnson's moves, since he took over, were anticipated – hence the decline in our Geopolitical Strategy Service's GeoRisk indicator – but the pound sterling is falling now that the confrontation is…

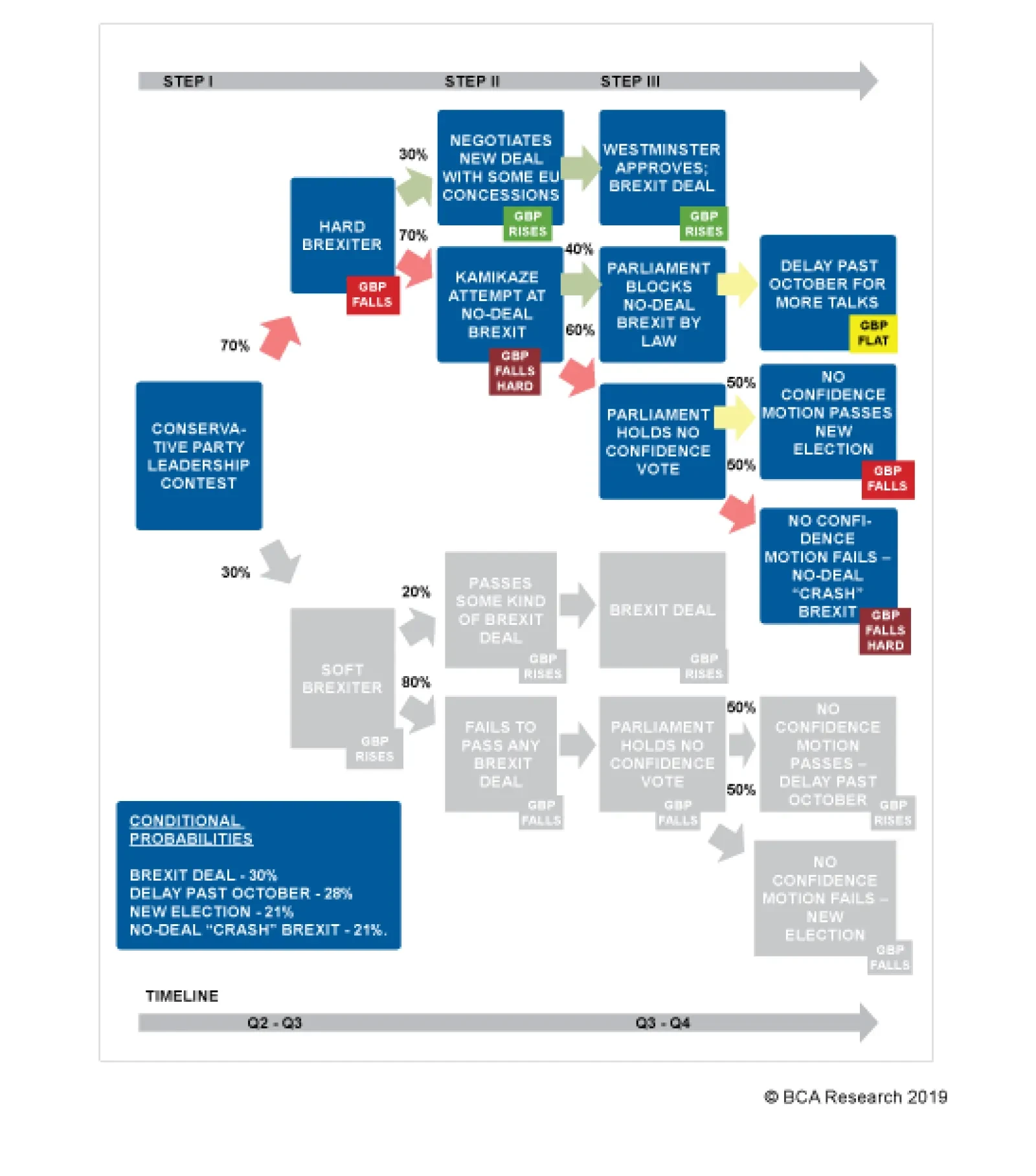

Politicians have to pay attention to the opinion polls as well as the referendum result, since opinion polls impact the next election. These show a plurality in favor of remaining in the EU and a strong trend against Brexit since…

Highlights So What? Prime Minister Boris Johnson’s threat to take the U.K. out of the EU without a withdrawal deal in place is a substantial 21% risk. Why? The odds of a no-deal exit could range from today’s 21% to around…

While the Conservatives and the U.K. have a new leader, as far as Brexit is concerned, plus ça change plus c’est la même chose. A new leader does not change the tight parliamentary arithmetic in which the…

Highlights So What? Key geopolitical risks remain unresolved and most of the improvements are transitory. Maintain a cautious tactical stance toward risk assets. Why? U.S.-China relations remain the preeminent geopolitical risk to…