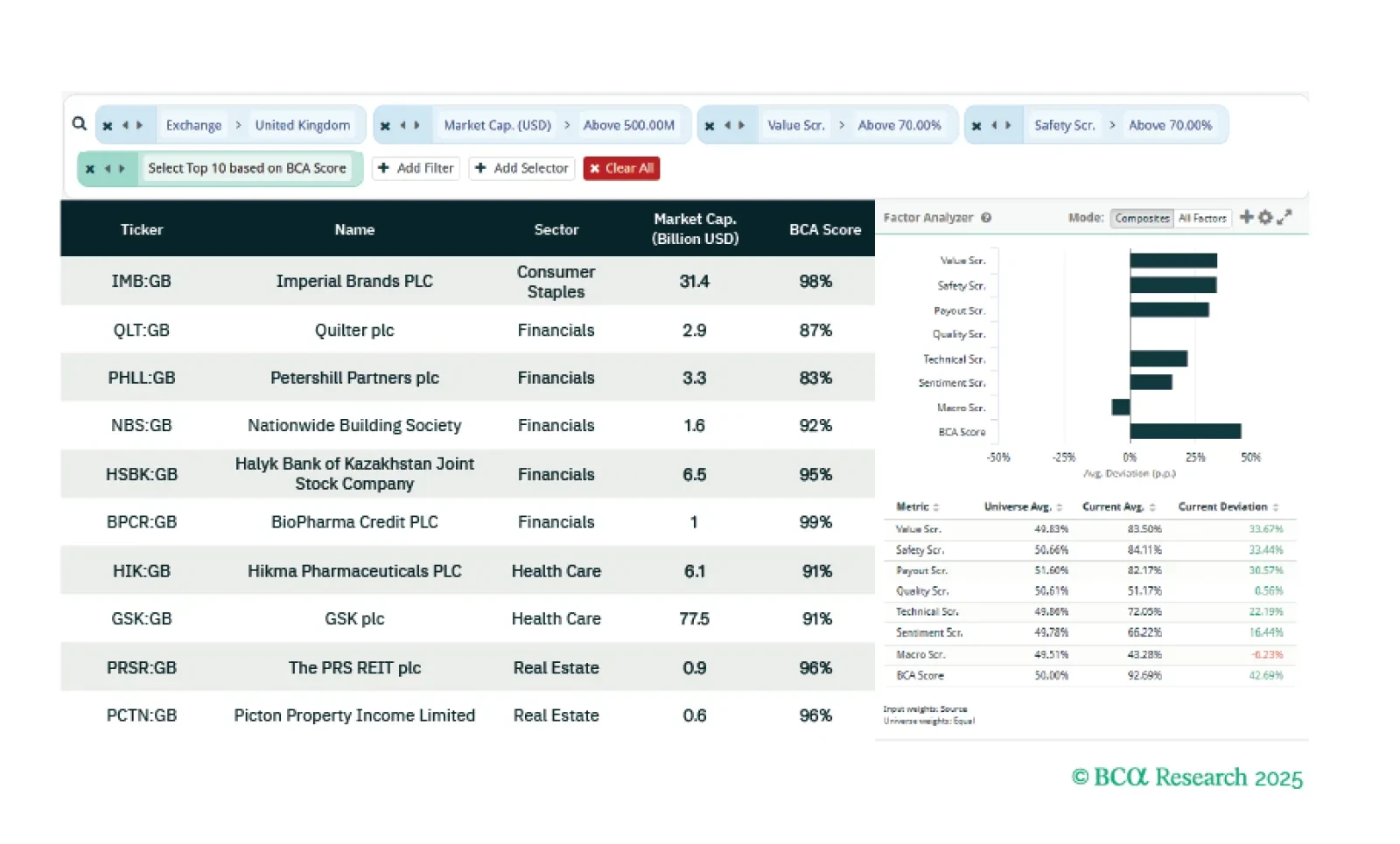

This week our three screeners explore: UK stocks that are cheap and offer a geopolitical hedge; French stocks that are sensitive to China; and US Value and dividend paying stocks.

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

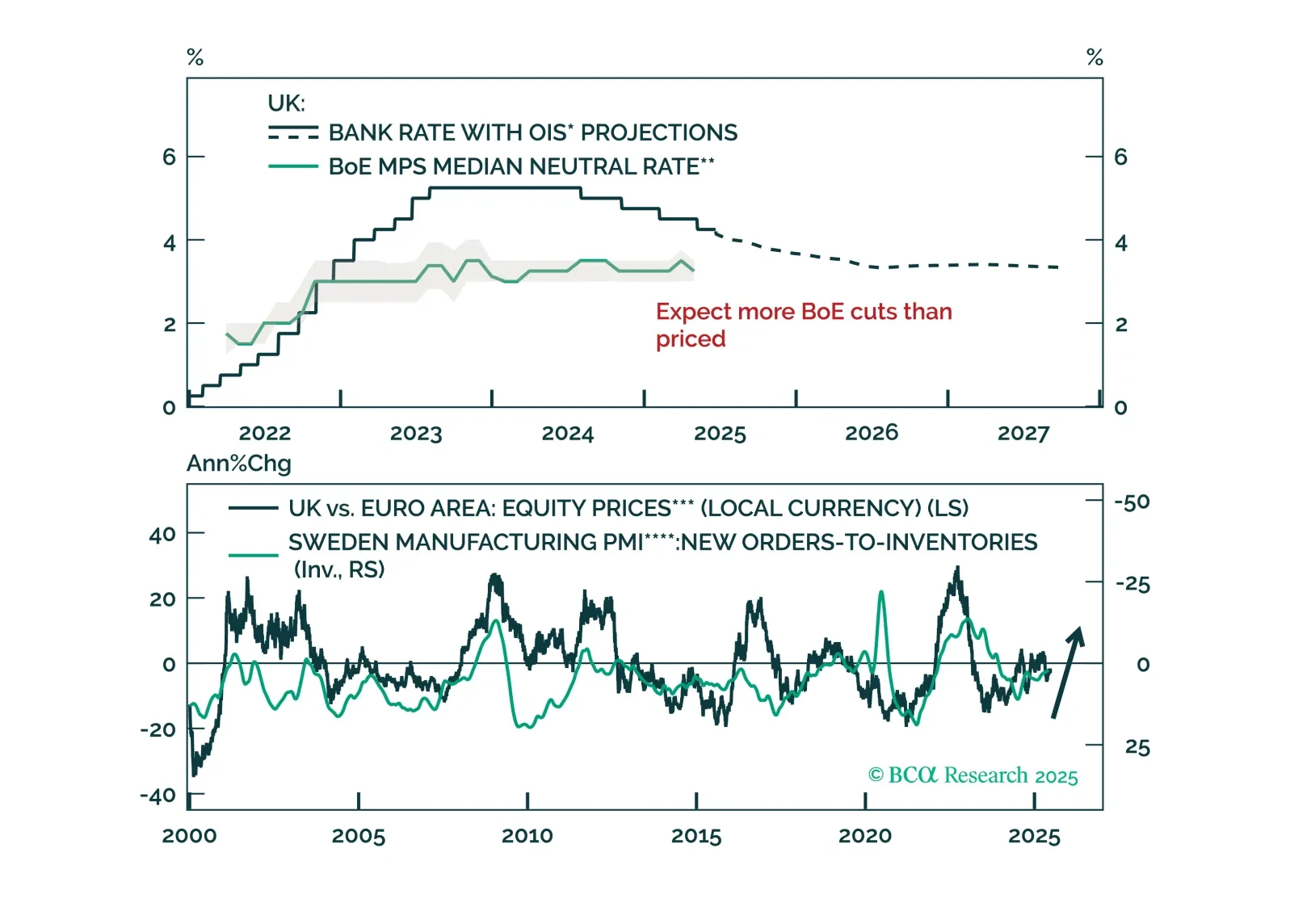

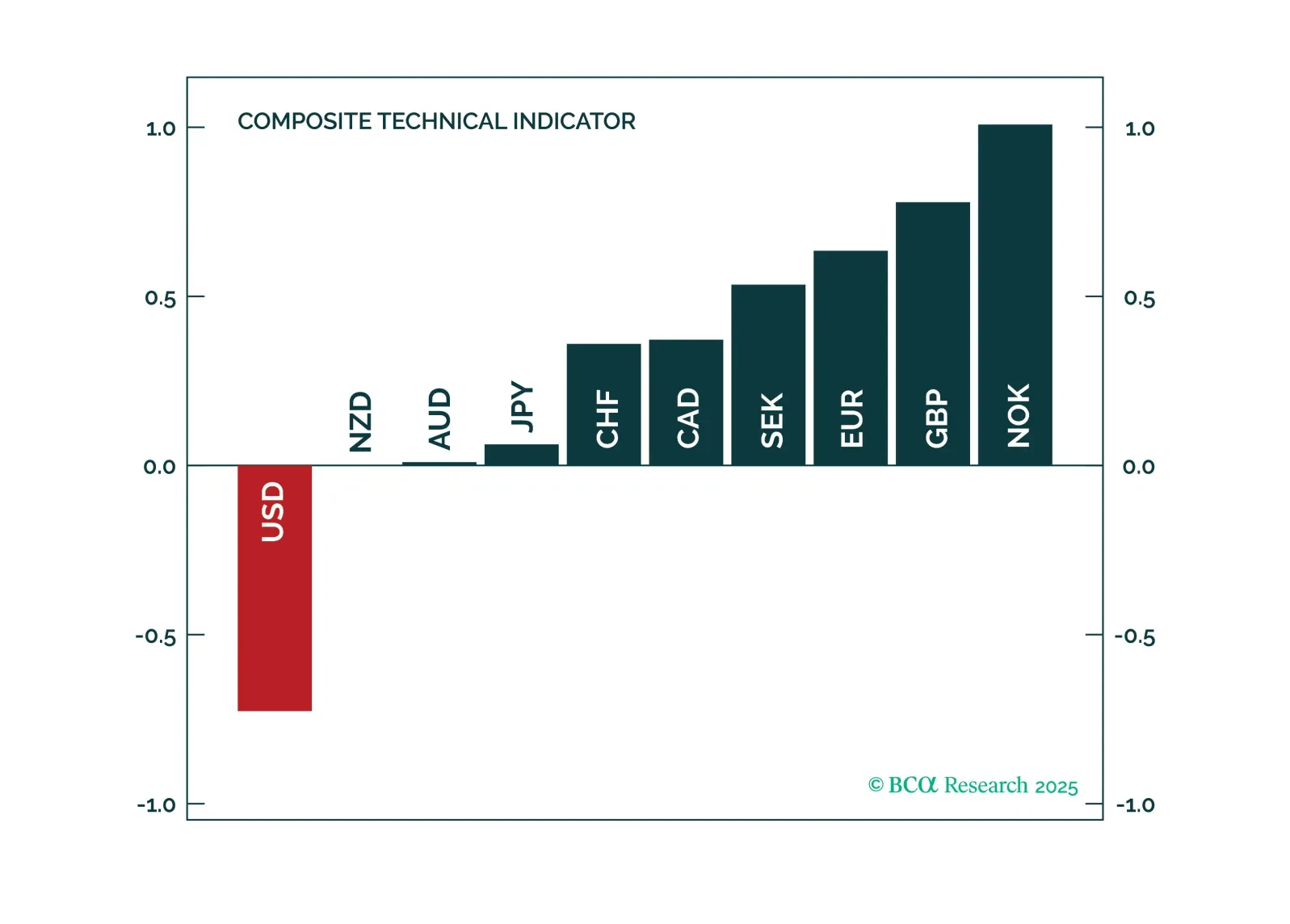

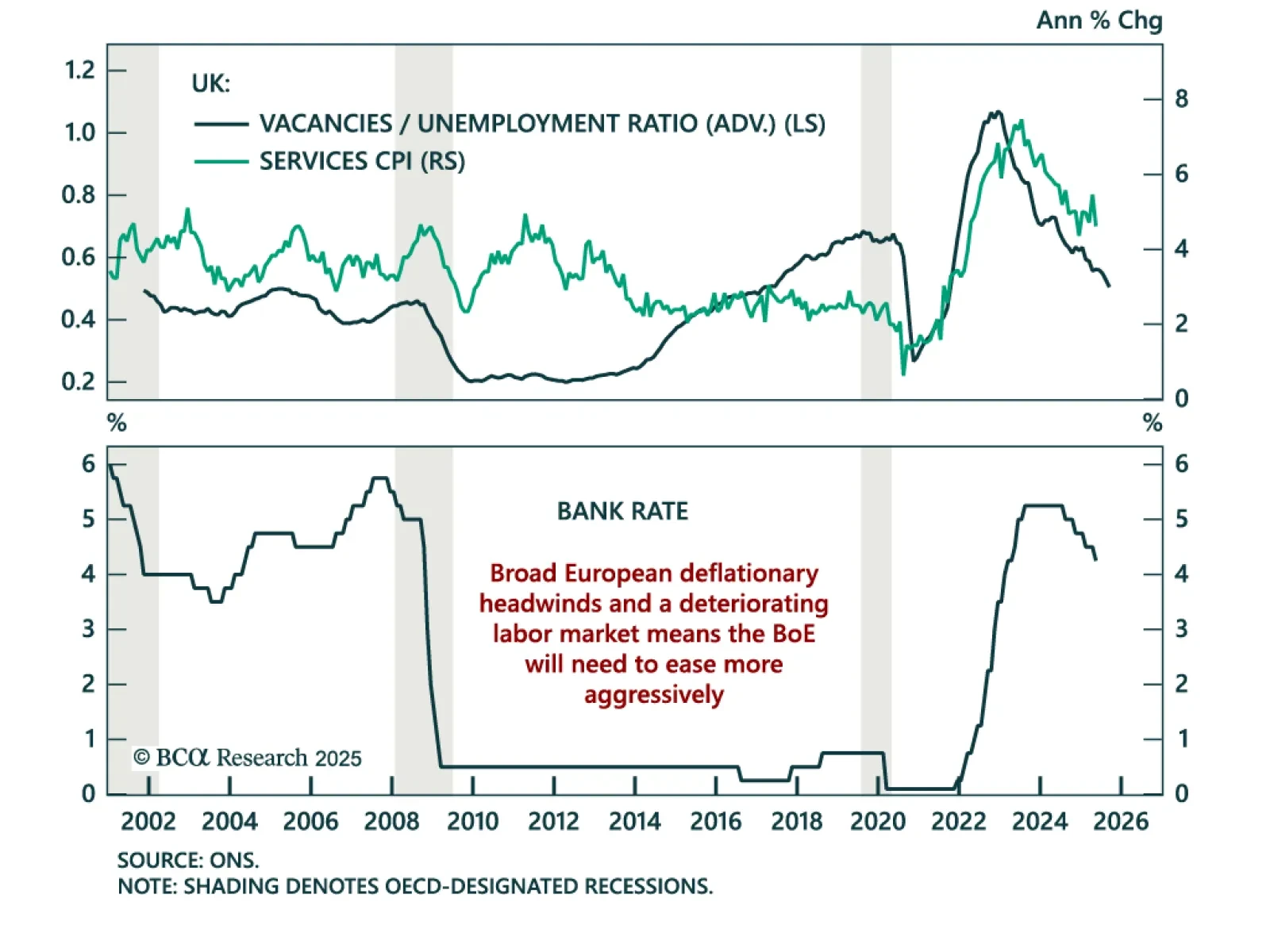

In this Insight, we highlight our strong conviction trades based on the central bank meetings held by the Bank of England, the Norges Bank, the Swiss National Bank and the Riksbank.

European central banks are pivoting quickly amid deflationary pressure, reinforcing our long UK Gilts and short GBP trades. The Norges Bank surprised with a 25 bps cut to 4.25%, abandoning its hawkish stance. The Swiss National Bank…

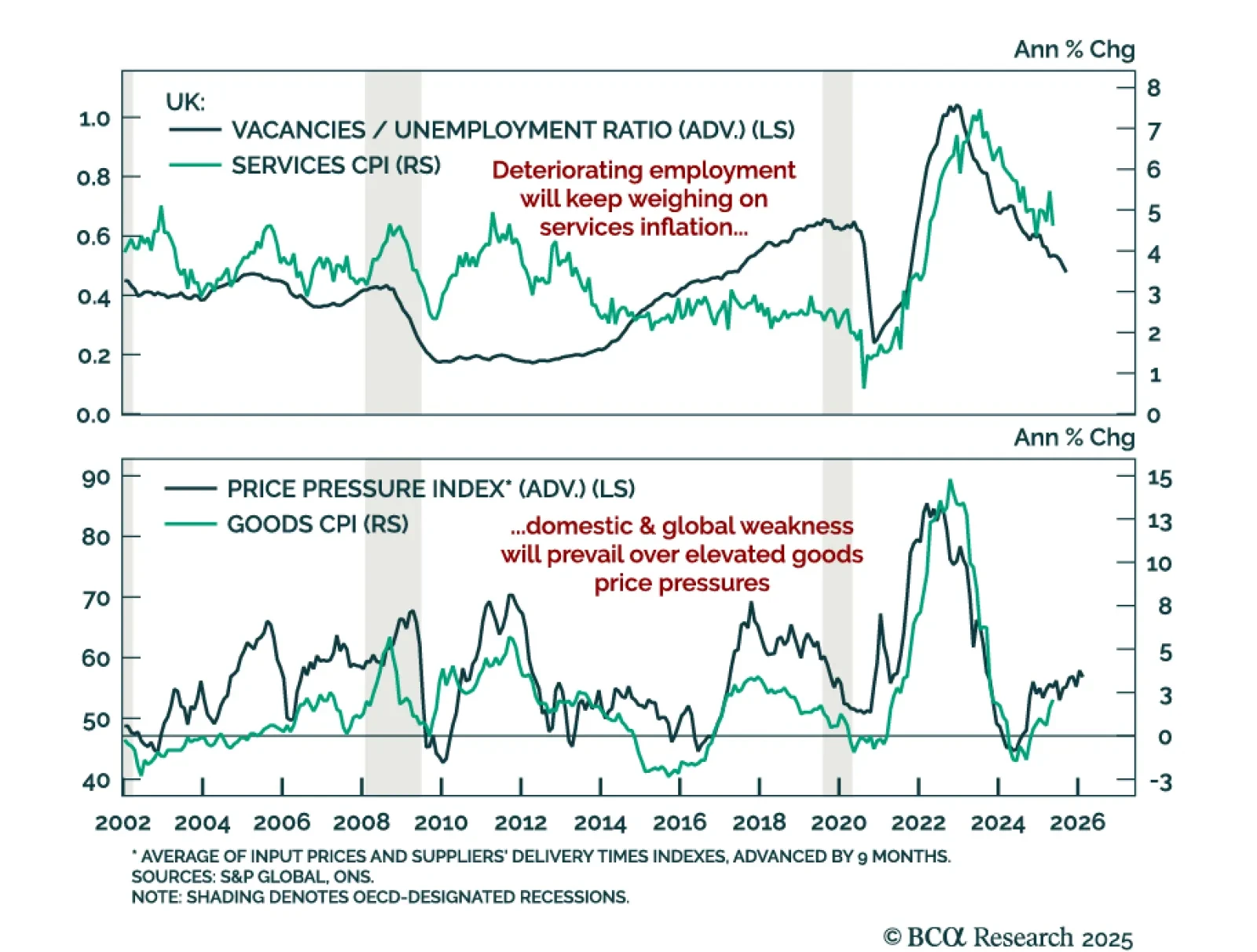

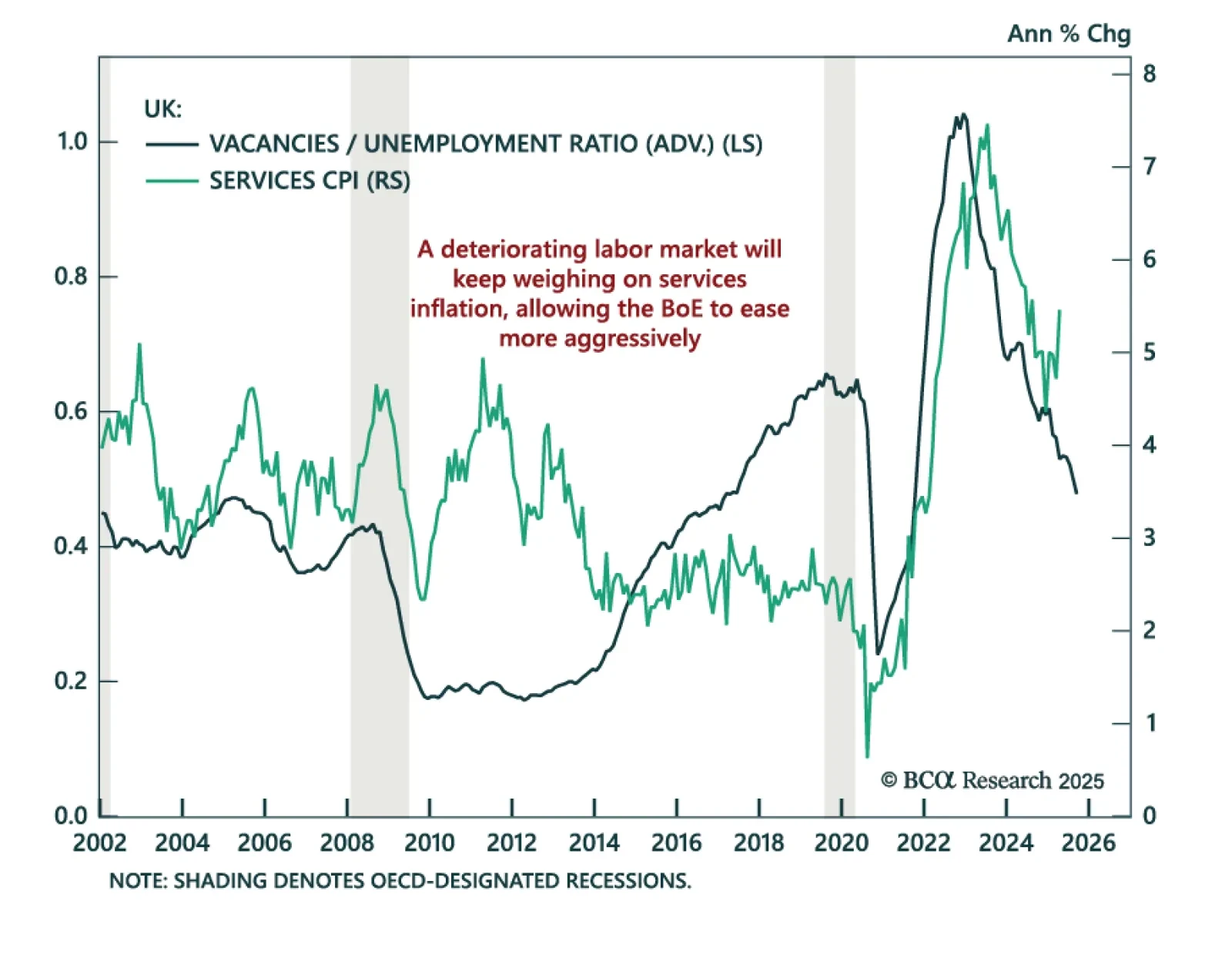

UK disinflation and labor market softening support our overweight in Gilts and short GBP trade. UK CPI came in slightly hotter than expected in May, with headline inflation at 3.4% y/y (vs. 3.5% in April) and core CPI meeting…

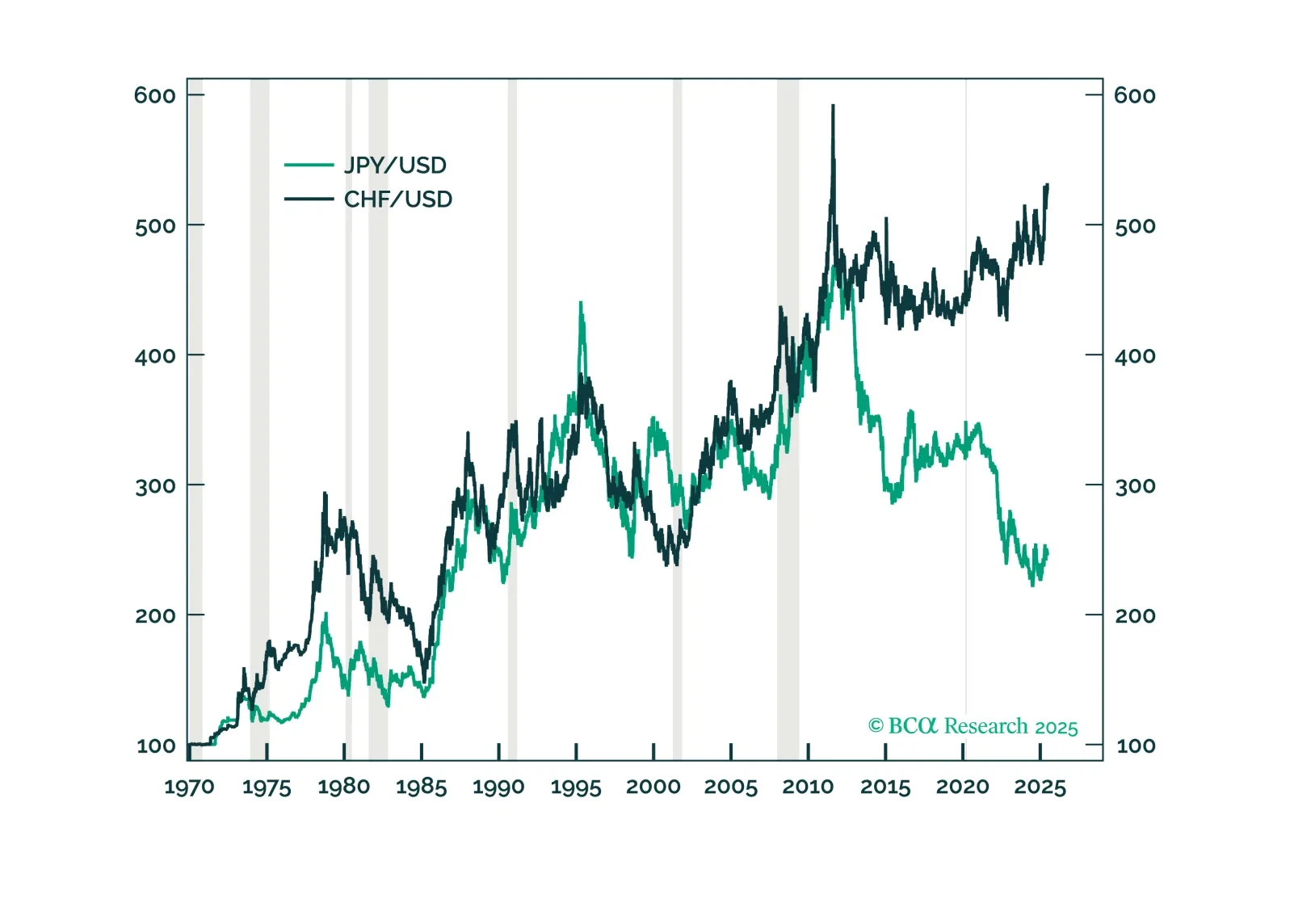

In this FX note, we provide a rationale for why it is important to pay attention to technical indicators, while still keeping your eyeball on the structural factors that drive currencies. This report answers the following questions:…

UK labor market deterioration reinforces our overweight on Gilts and dovish BoE policy trades. Payrolls fell by 109k in May, an acceleration from the 55k revised decline for April (originally reported as -33k), and job vacancies…

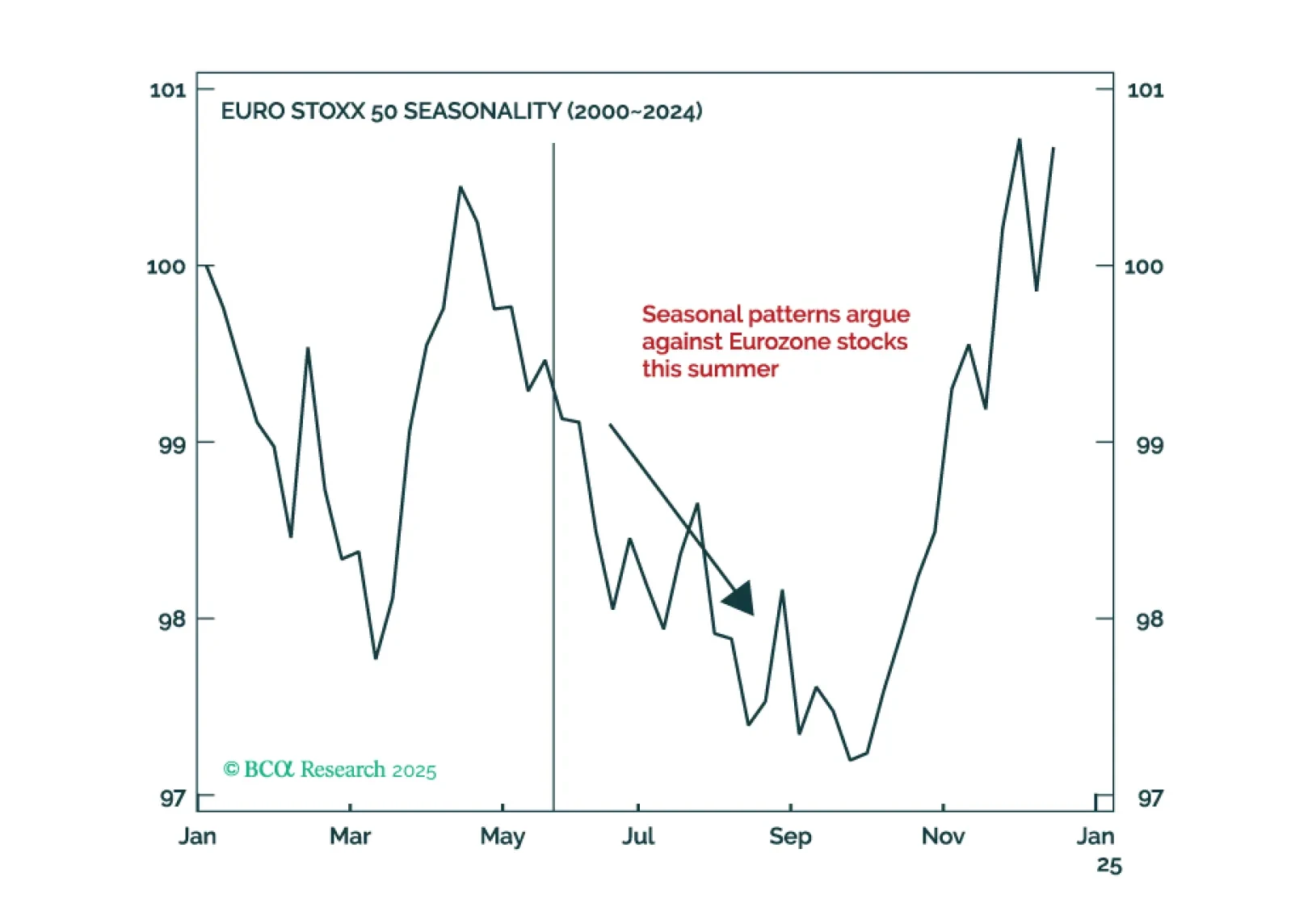

European equities will face a clash of powerful forces this summer. Expect sharp swings and false breaks, creating an ideal terrain for nimble traders but a minefield for buy-and-hold investors seeking steady gains.Within this backdrop,…

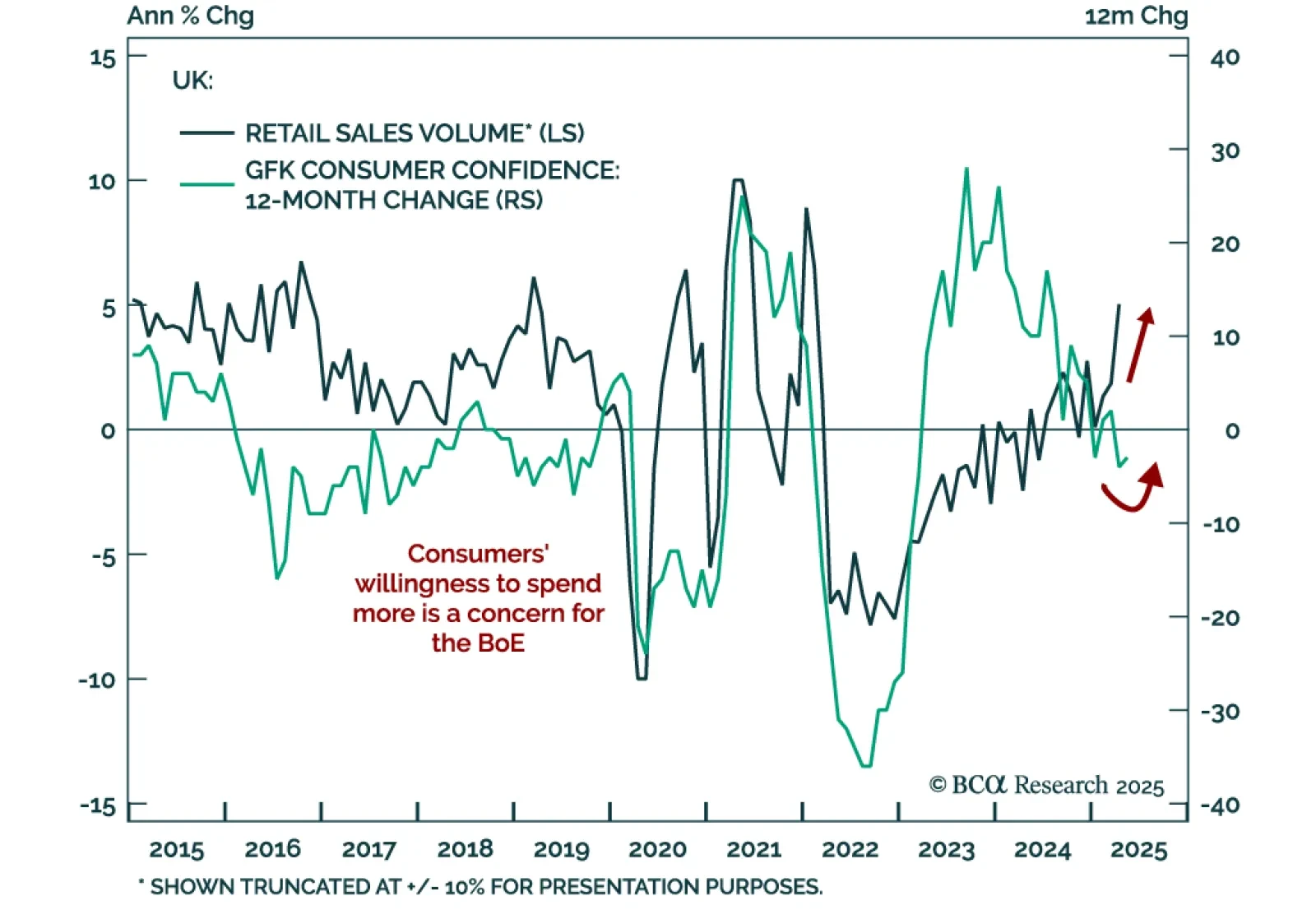

The rebound in UK retail sales and consumer confidence surprised to the upside, and suggests that the re-acceleration in inflation observed earlier this week may not be transitory. UK retail sales rose 1.2% m/m in April…