Highlights The pillars of dollar support continue to fall, but the missing catalyst is visibility on the trajectory of global growth. For now, we remain constructive on the DXY short term, but bearish longer term. Market internals…

Highlights Policy Responses: The COVID-19 pandemic has become a full-blown global crisis and recession. Governments and central bankers worldwide are now responding with aggressive monetary easing and fiscal stimulus. Markets will not…

The Bank of England followed on the path of the Fed and executed a 50bps inter-meeting interest rate cut. Markets did not feel relieved. Instead, they sold off, a move that continued after the WHO declared COVID-19 a pandemic…

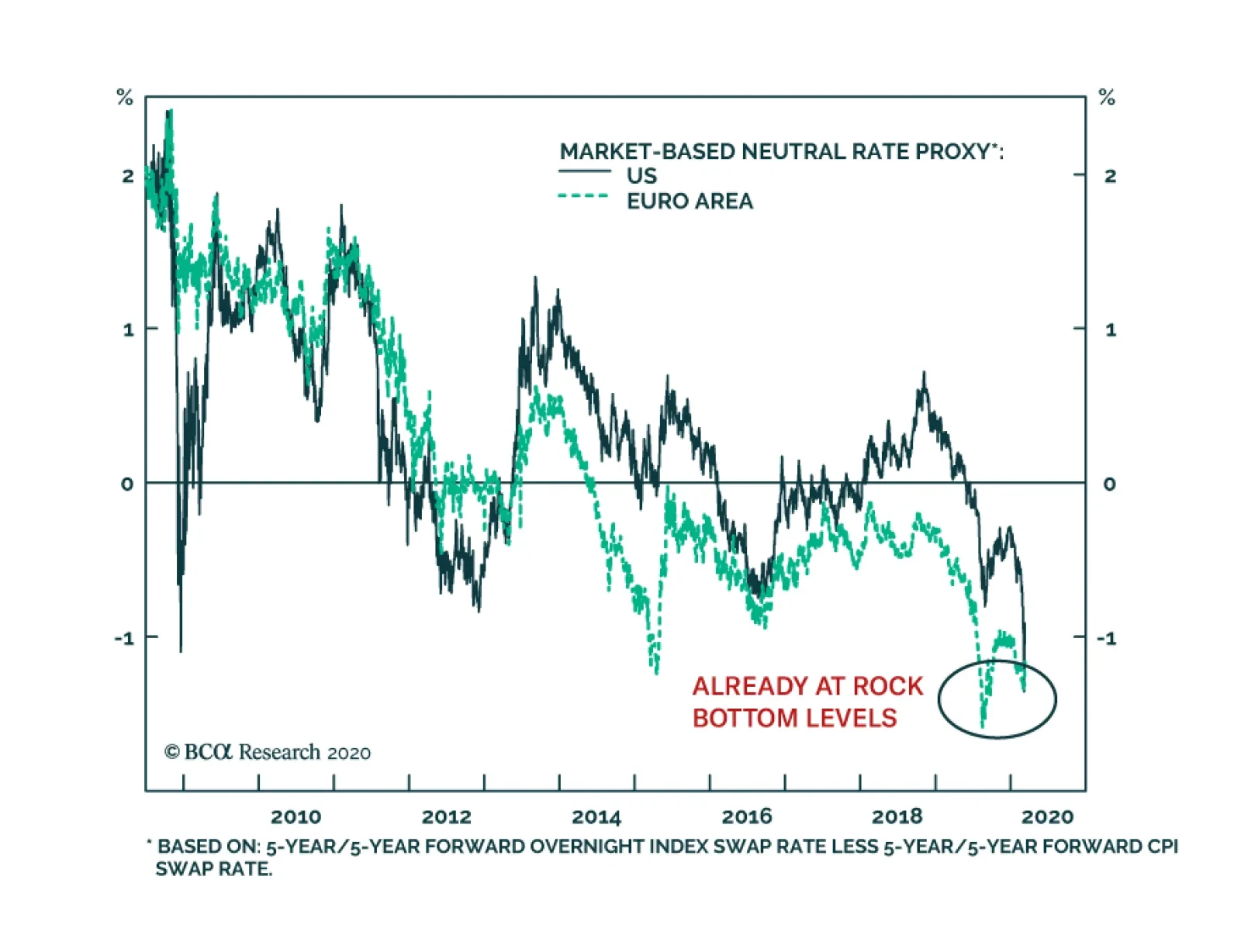

Highlights Uncertainty & Yields: Global bond yields, driven to all-time lows as investors seek safety amid rioting markets, now discount a multi-year period of very weak global growth and inflation. Bond Portfolio Strategy:…

Highlights The elevated uncertainty about global growth stemming from the COVID-19 virus in China has not only made investors more anxious, but central bankers as well. This means that, only six weeks into the year, policymakers may…

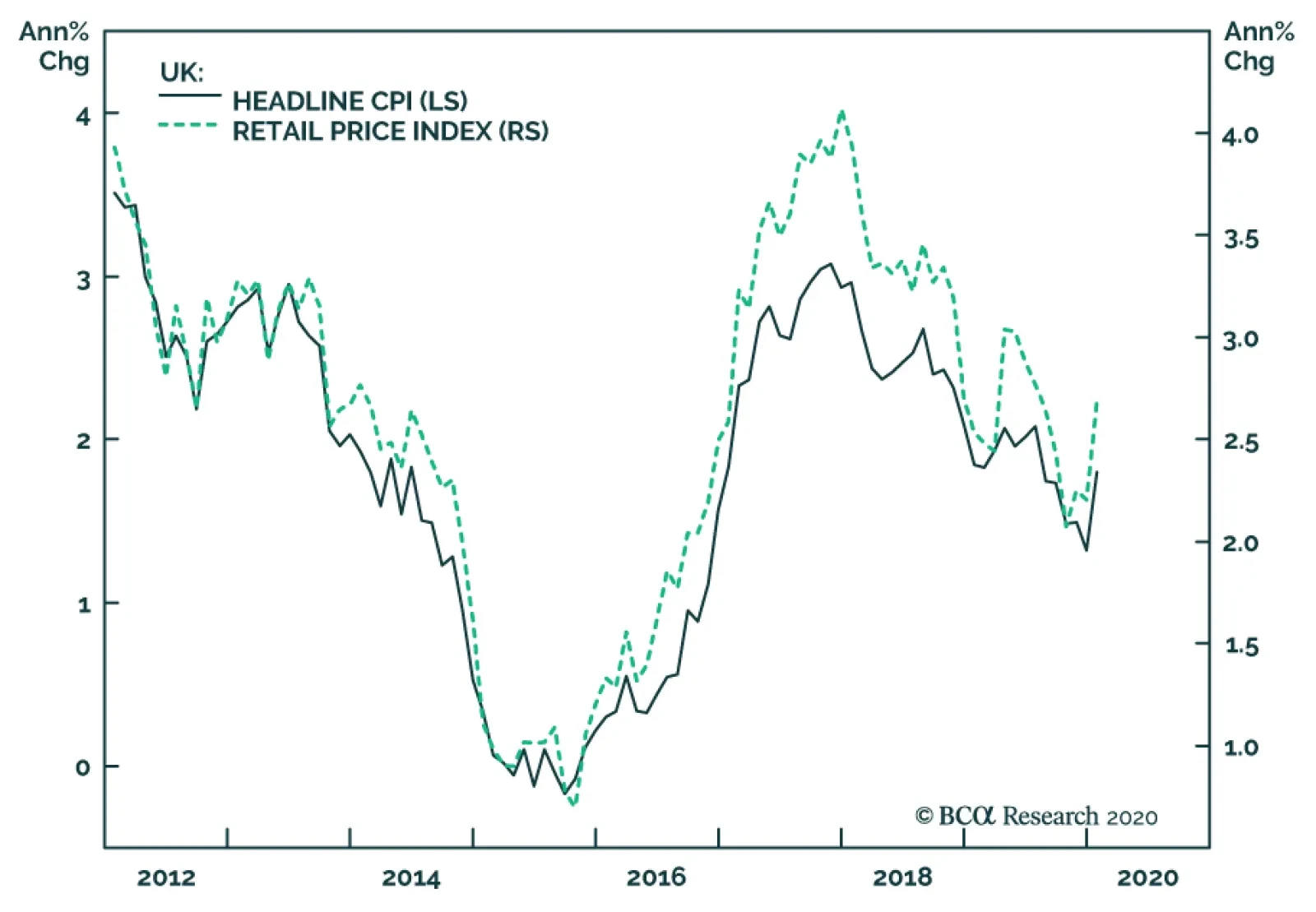

Inflation is perking up in the UK. Headline CPI jumped from 1.3% to 1.8% in January, while the more volatile retail price index surged from 2.2% to 2.7%. This follows a relatively robust labor market report for December that saw…

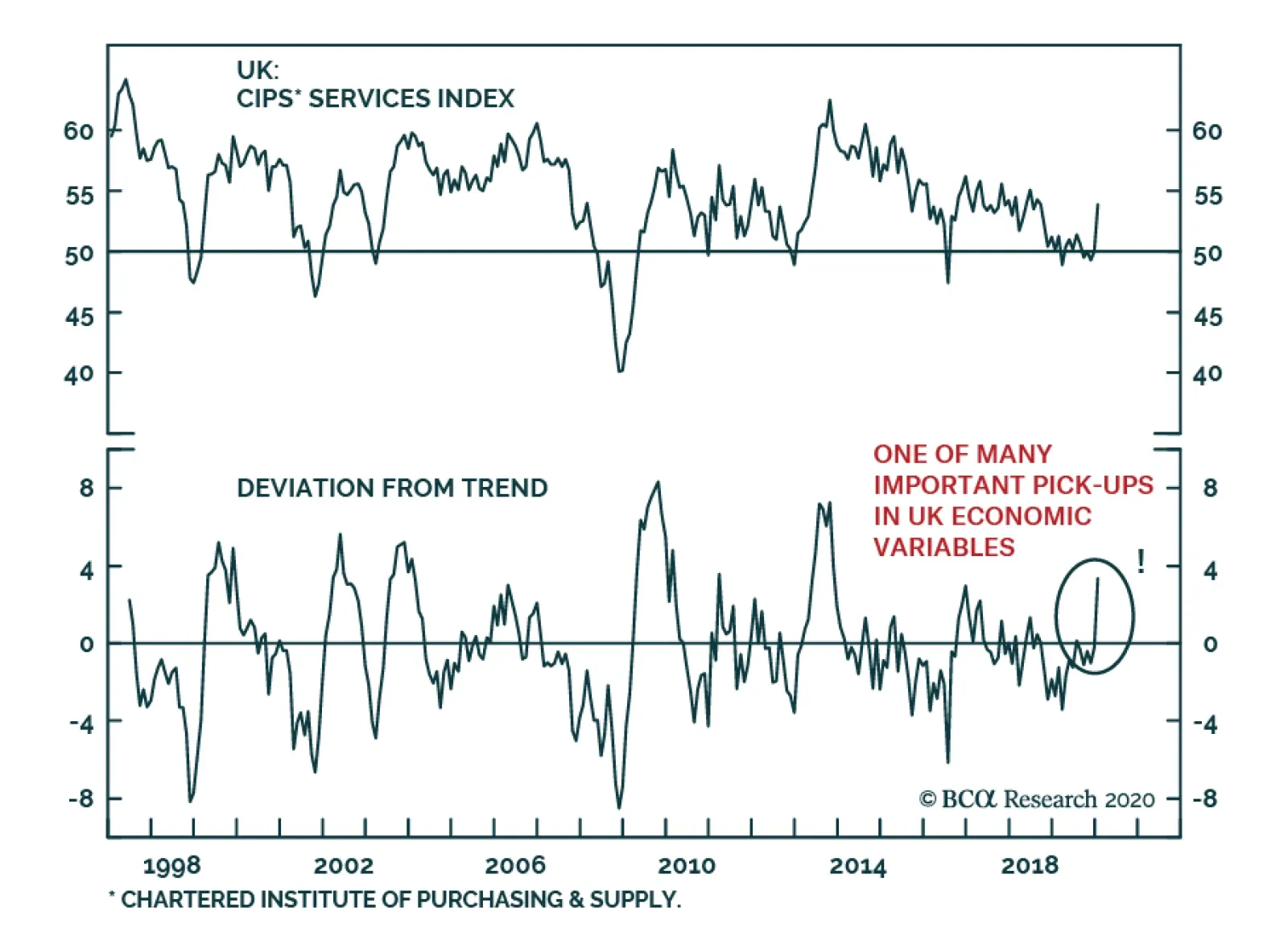

The UK’s service sector is showing signs of revival as the services PMI is rebounding significantly. This improvement is not an isolated phenomenon. Since the December election, consumer confidence, business optimism and…

Highlights China’s economic rebound in Q1 will be delayed due to the coronavirus, which will have a larger negative hit than SARS. New stimulus measures will assist a rebound in demand later this year. Europe remains a…

Highlights The coronavirus scare is the catalyst for the recent correction, not the cause. The true cause is that the stock market had reached a point of groupthink-triggered instability and therefore needed the slightest catalyst to…