Highlights We conservatively estimate lost output from shutdowns and social distancing will equal $10 trillion, and we expect the jobs market to be permanently scarred. Inflation, even at 2 percent, is a pipe dream, which leads to…

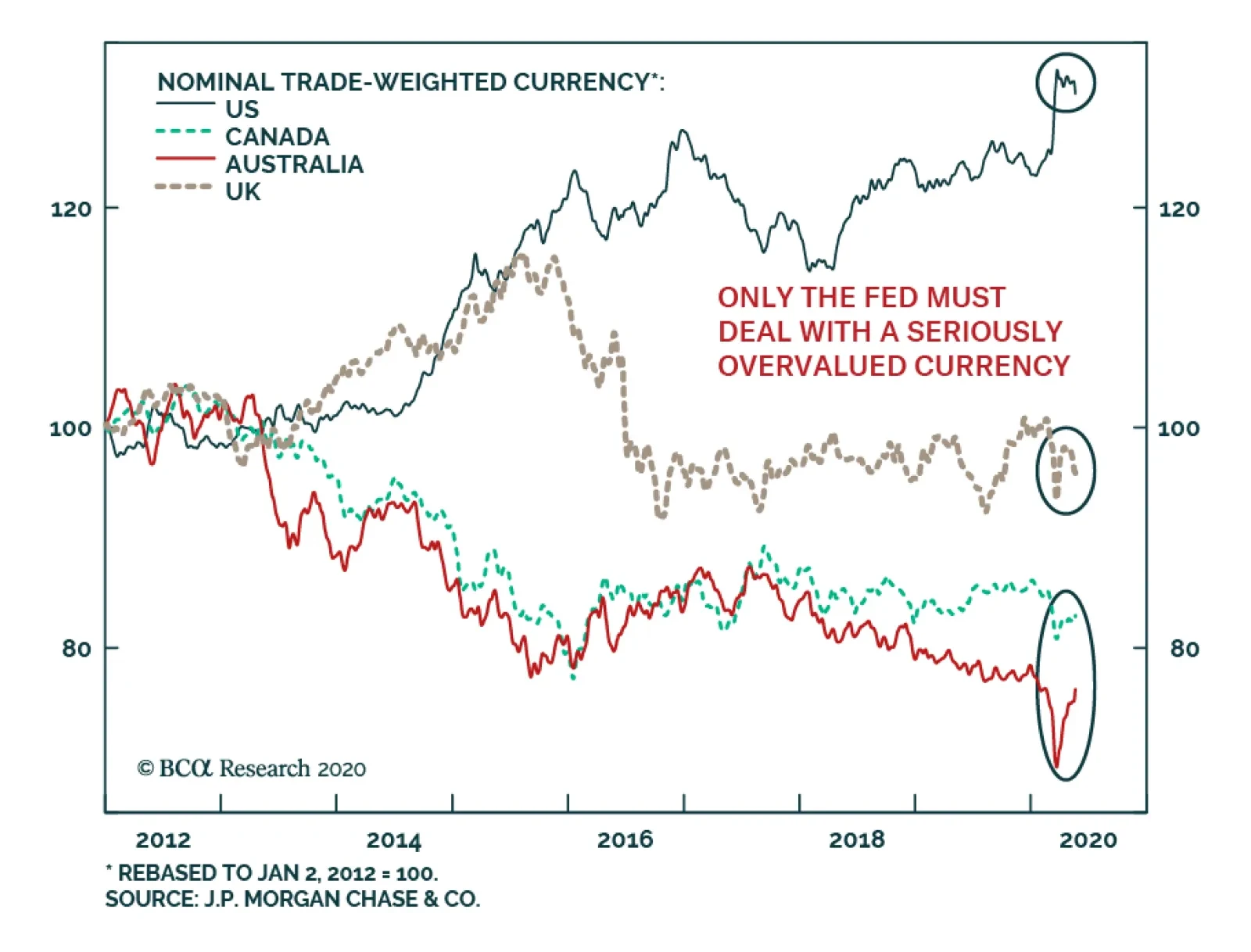

Highlights The dollar is likely to churn on recent weakness before a cyclical bear market fully unfolds. The reason is that the economic landscape remains fraught with uncertainty, both politically and economically. We continue to…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating the need for continued easy global monetary policy to help mitigate the…

Highlights Investment Grade Sector Valuation: Our investment grade corporate bond sector valuation models for the US, euro area, UK, Canada and Australia show some common messages, as markets have adjusted to a virus-stricken world.…

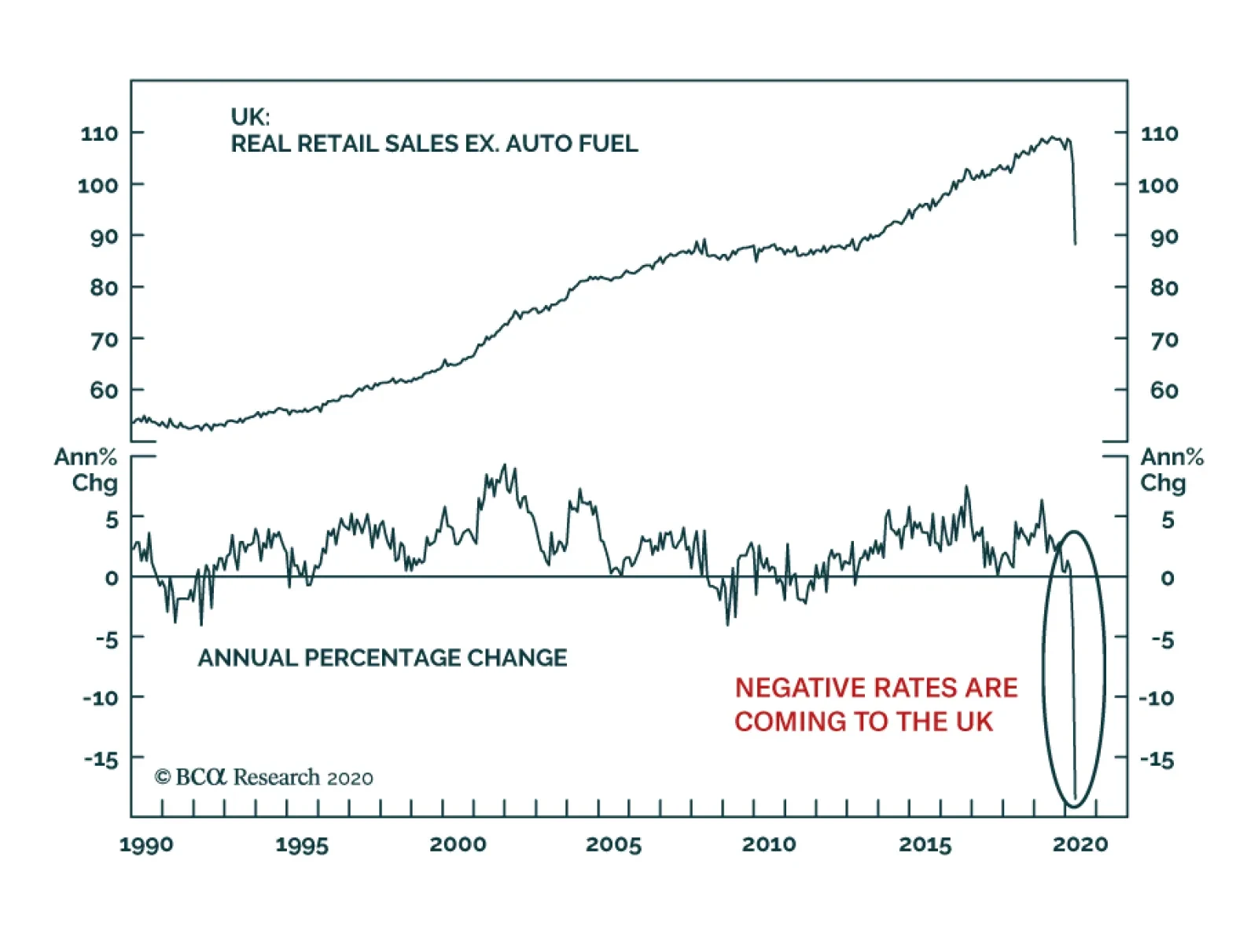

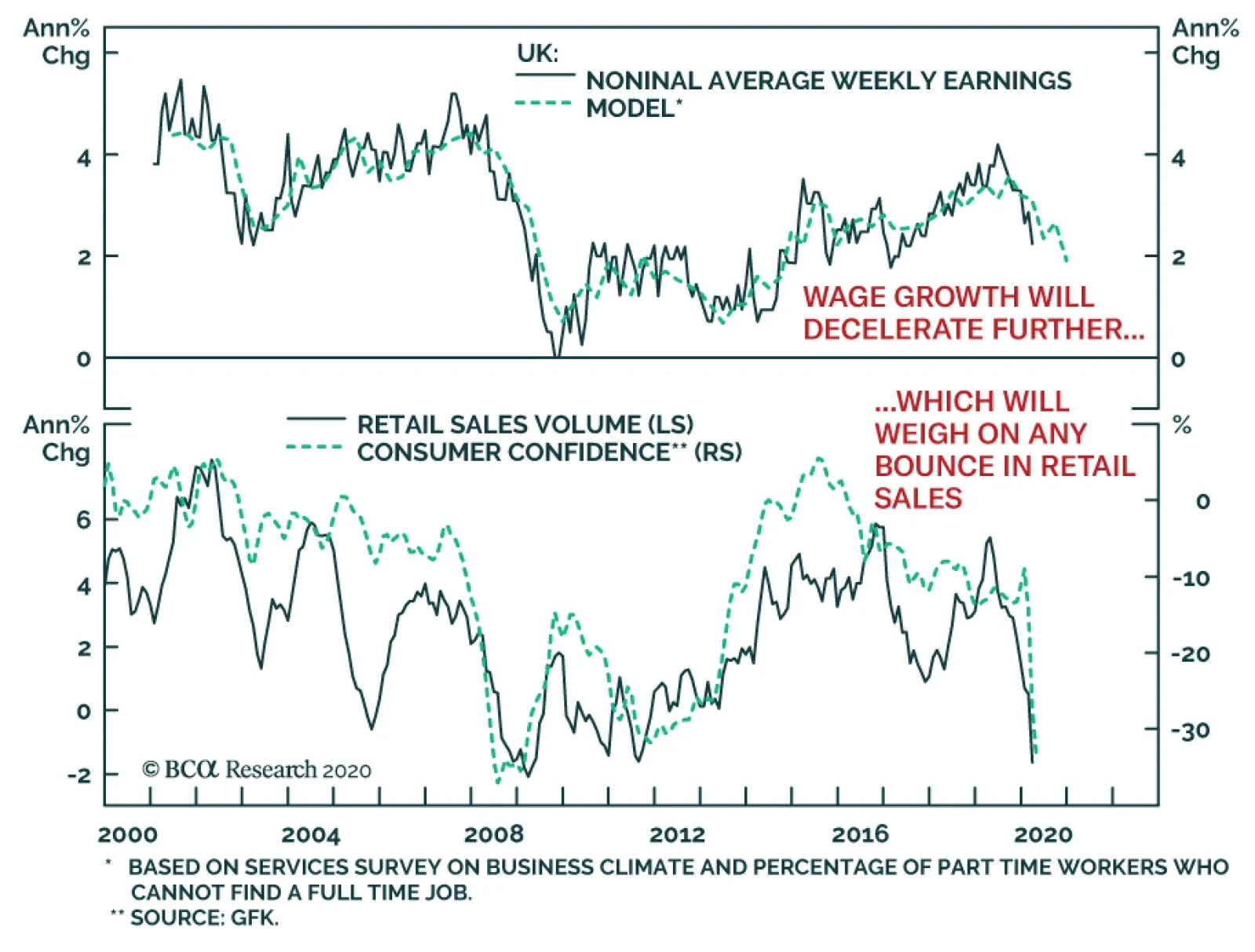

British retail sales excluding auto fuel collapsed 18.4% in April compared to last year, resulting in the worst contraction on record. This poor number comes on the heels of dismal consumer confidence, inflation, and employment…

Dear client, In lieu of our regular weekly report next week, we will hold a webcast on Thursday at 10:00 am ET discussing both tactical and strategic currency considerations. The format will be a short presentation, followed by a Q&…

Yesterday, BCA Research's Global Fixed Income Strategy service concluded that among the major countries without negative interest rates (the US, UK, Canada, and Australia), longer-term borrowing rates do not need to fall…

The UK labor market has been hit by a 2% contraction in the GDP in Q1. The claimant count rose by 856 thousand individuals and the claimant count rate rose to 5.8%. Moreover, weekly wage growth continues to weaken, which is a…

Highlights Inflation-Linked Bonds: The plunging price of oil has put renewed downward pressure on global bond yields via lower inflation expectations. With oil prices set to recover over the next 6-12 months as the global economy…