Yesterday, the Bank of England slightly upgraded its economic forecasts when compared to the spring Inflation Report. While the BoE guided for no policy tightening for an extended period of time, it threw a cold shower on traders…

Highlights Global Bond Yields: The growing divide between falling negative real bond yields and rising inflation expectations in the US and other major developed economies may be a sign of investors pricing in slower long-run potential…

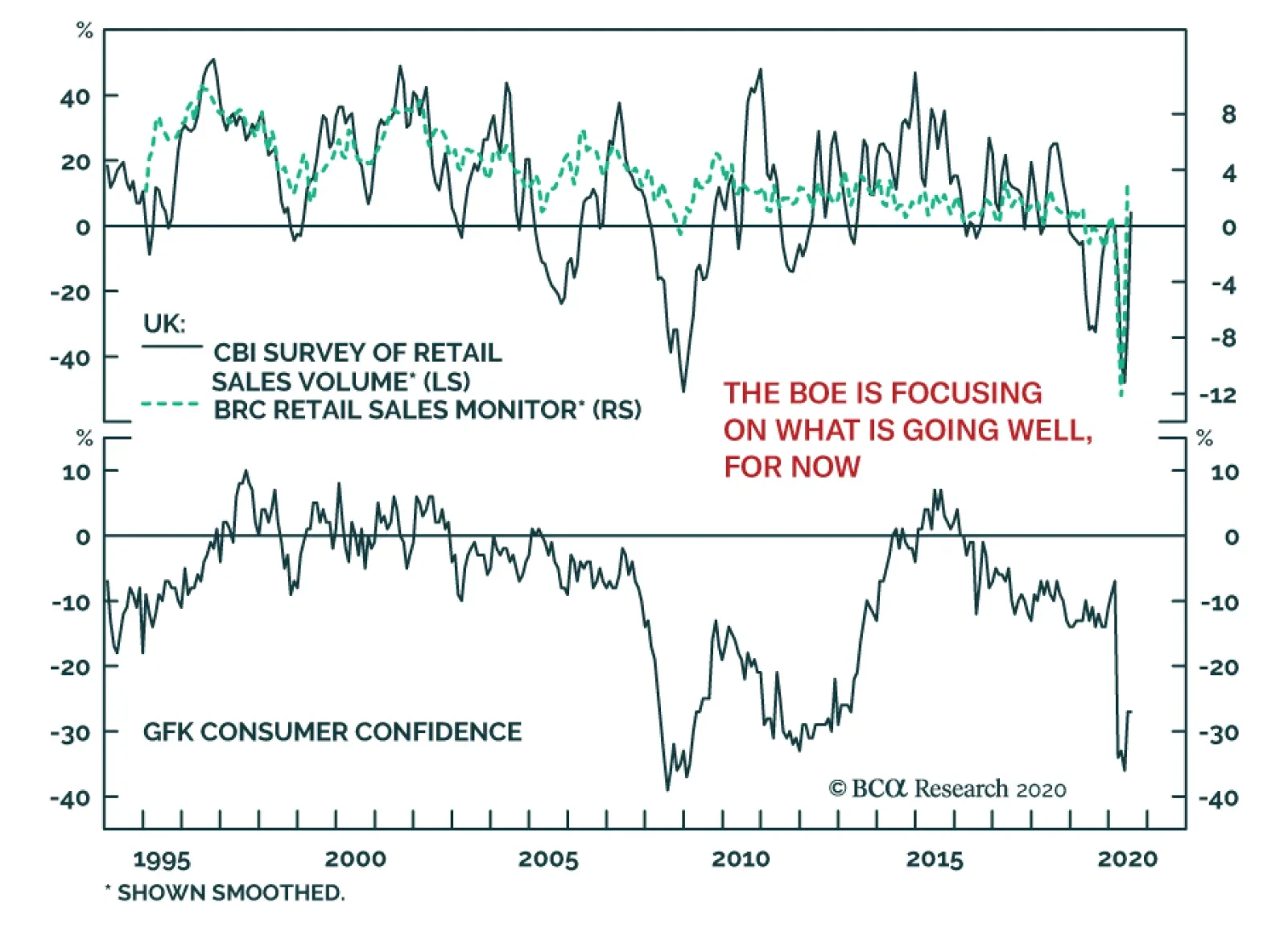

Highlights The tech sector faces mounting domestic political and geopolitical risks. We fully expected stimulus hiccups but believe they will give way to large new fiscal support, given that COVID-19 is weighing on consumer confidence…

Highlights Butterflies & Yield Curve Models: With bond market volatility now back to the subdued levels seen prior to the COVID-19 market turbulence earlier in 2020, it is a good time to update our global yield curve valuation…

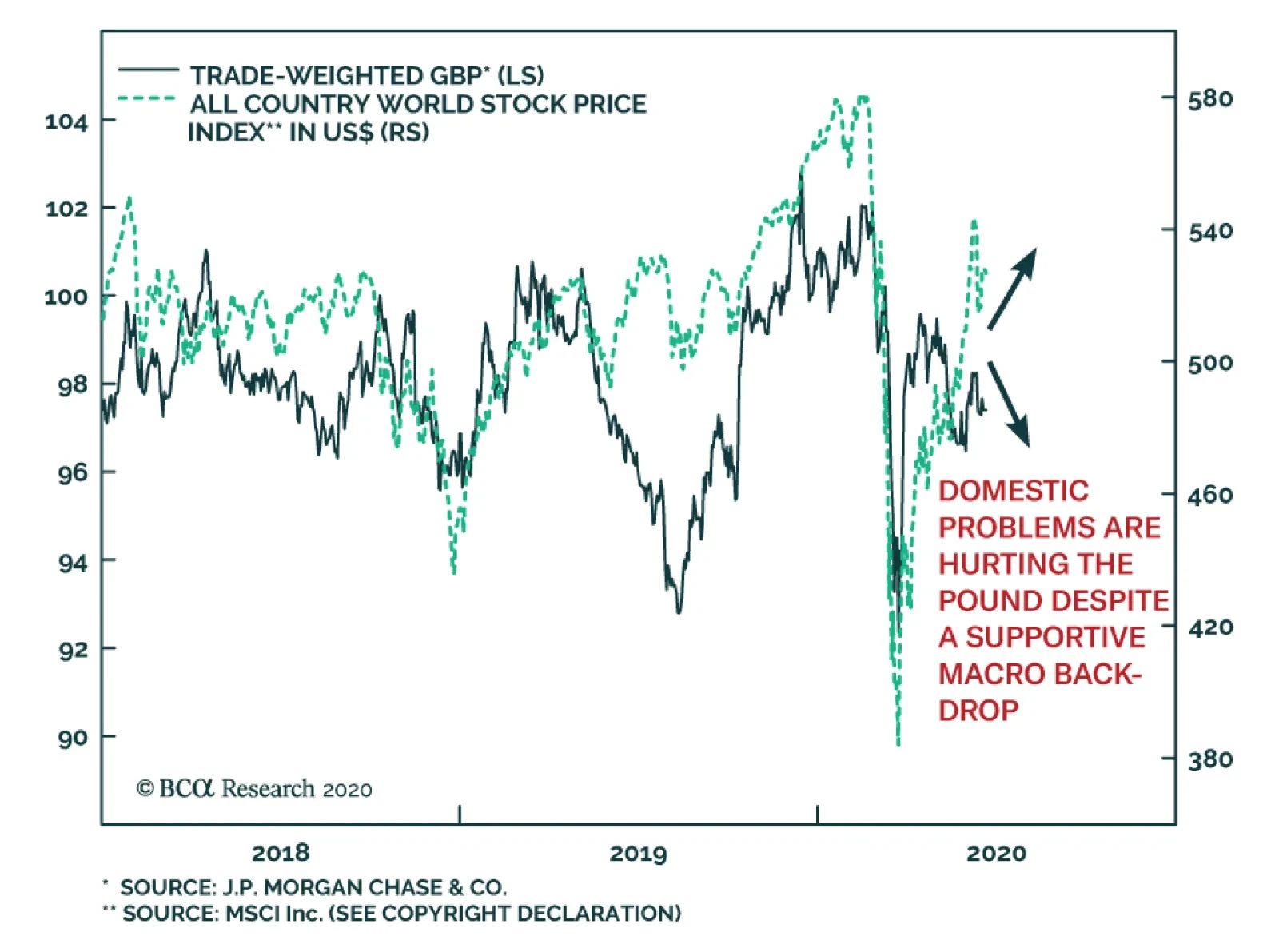

Highlights Our intermediate-term timing models suggest the US dollar is broadly overvalued. We are maintaining a modest procyclical currency stance (long NOK, GBP and SEK), but also have a portfolio hedge (short USD/JPY). Go…

Highlights The cyclical rally in stocks is not over, but the S&P 500 will churn between 2800 and 3200 this summer. Supportive policy, robust household balance sheets and budding economic growth have put a floor under global…

The pound historically is a pro-cyclical currency. The UK sports a current account deficit of 3.74% of GDP. Funding such a large deficit is easier when global liquidity is plentiful, when global growth is strong, and when risk…